Business

Rent prices see relief as growth hits slowest pace since 2020 nationwide

The Corcoran Group broker Noble Black joins Varney & Co. to discuss homebuilder confidence, mortgage rates and Congress actions to address the housing crisis.

Renters are expected to see some relief from rising prices this year, with the pace of rent growth expected to slow as the market stabilizes and a measure of affordability hits a four-year-high.

An analysis by Zillow projects that multifamily rental prices are expected to remain relatively flat through the end of 2026, declining slightly by 0.2%.

Single-family rents are expected to rise at an annual rate of 1.1% in December 2026, which the report says would represent a “sharp slowdown from the rapid increases of recent years” as higher vacancy rates and more newly-built apartments help keep rent growth subdued as renters’ bargaining positions improve. Single family rents were up 2.7% last month from a year ago.

Zillow found that the typical asking rent in January was $1,895, up just 0.1% from December and 2% year over year. That represents the slowest annual rent growth since December 2020, as the market has steadied after prices saw rapid increases during the pandemic.

TEXAS CAPITAL’S HOUSEHOLD GROWTH SURGES, FAR OUTPACING NATIONAL RATE

Rent growth has eased over the last year and the trend is expected to continue in 2026, according to an analysis by Zillow. (Michael Nagle/Bloomberg via Getty Images)

Rents for multifamily homes have grown at an even slower pace, rising just 1.4% from a year ago. Zillow’s projection that multifamily rents will decline slightly and remain essentially flat this year, indicates that further relief could be on the way.

Slowing rent growth has boosted an affordability measure that takes into account renters’ income levels. A median income household would now spend 24.3% of its income on typical apartment rent, which is down slightly from 25% in February 2020.

By another measure, the typical household is spending 26.4% of its income on rent, which is the lowest share since August 2021.

US HOME PRICES ARE RISING – BUT THESE FAST-GROWING MARKETS REMAIN AFFORDABLE

Austin, Texas, was one of the most affordable metro areas for renters in Zillow’s analysis. (iStock)

Metro areas where that figure is significantly higher than the national average include Miami (37.2%), New York City (36.9%) and Los Angeles (34%).

Notable metros with better affordability include St. Louis (19.7%), Minneapolis (19.4%), Denver (19.4%), Austin (17.9%) and Salt Lake City (17.9%).

“Renters are operating in a very different environment than they were just a few years ago,” said Orphe Dviounguy, senior economist at Zillow. “When supply expands and vacancies rise, property managers have to adjust on both price and terms. Concessions are near record highs, keeping rent growth modest and creating meaningful opportunities for renters.”

HOUSING MARKET COOLS AS PRICE GROWTH HITS SLOWEST PACE SINCE GREAT RECESSION RECOVERY

Los Angeles is among the metro areas facing affordability challenges for renters. (Patrick T. Fallon/AFP via Getty Images)

Zillow also noted that renters are getting more concessions in lease terms as they utilize their negotiating leverage in renewals and new leases.

It found that nearly 40% of rental listings on the Zillow platform in January had at least one concession, like a free month of rent or a reduced deposit.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

That’s slightly below the record high set last January, when 41.1% of listings had a concession, and the figure remains elevated compared to historical norms.

Business

Nestle USA adds prebiotic beverages

The sparkling water features 6 grams of fiber.

Business

Eight skiers confirmed dead in California avalanche, one still missing

Eight skiers confirmed dead in California avalanche, one still missing

Business

Kodiak adds reformulated frozen waffles

The waffles are free from added sugar.

Business

Mark Selles on Discipline and Design in Landscaping

Mark Selles is an award-winning landscape designer and Executive Director and Senior Landscape Designer at DeSignia Inc in Kannapolis, North Carolina. He has built his career on discipline, craftsmanship, and steady leadership in an industry often driven by trends.

From a young age, Selles was drawn to gardening, camping, fishing, and building mechanical devices. He enjoyed working with his hands and understanding how things functioned. That early interest in both nature and engineering shaped his professional path. Today, he blends practical design with creative vision.

Selles believes strong landscape design must reflect the architecture of a home and support how people use the space. He has written about the difference between style and fashion in landscaping, arguing that trends fade but disciplined design endures. His approach focuses on quality over quantity and careful attention to detail.

Much of his growth came through experience. Early career challenges became learning moments. He continues to submit himself to certification processes and ongoing education. He values humility and believes arrogance is a barrier to progress.

Beyond design, Selles is also an inventor. He holds a patent for a mower blade sharpener that sharpens three blades at once, reflecting his practical engineering mindset.

For Selles, leadership is rooted in character. Faith, accountability, and teamwork guide his decisions. He measures success simply: a completed landscape that works well, looks right, and leaves the client genuinely satisfied.

In Conversation with Mark Selles: Discipline, Design and Leadership

Q: Let’s start at the beginning. What first drew you to landscape design?

I have always loved the outdoors. As a child, I enjoyed gardening, camping, fishing, and spending time at the beach. I also liked building mechanical things. I was curious about how things worked. Landscape design felt like a natural blend of those interests. It allowed me to work outside while still thinking structurally and creatively.

Q: How did those early interests shape your career?

They gave me a practical mindset. I do not see landscaping as decoration. I see it as structure, movement, and function. A landscape must reflect the style of the home, but it must also work in real life. Walkways, elevations, plant placement — all of it has purpose.

Q: You have written about style and fashion in landscaping. What is the difference?

Fashion changes. Twenty-five years ago, everyone wanted Bradford Pear trees. Then Knock-out Roses became popular. Trends come and go. Style should be tied to the architecture of the home. If you design with discipline and follow a clear strategy, the result can outlast fashion.

Q: Were there defining challenges early in your career?

Certainly. Often, issues arose from lack of experience. Those moments forced me to learn. I developed better forms, stronger design strategies, and clearer processes. Failure has been a motivator for me. It pushes you to improve.

Q: How would you describe your leadership style at DeSignia Inc?

Quality over quantity. Attention to detail. I believe in providing the same level of work to everyone, regardless of status. I also rely on my team. When challenges arise, we talk through client needs and site conditions together.

Q: You also hold a patent. How did that come about?

I enjoy mechanical and prototype engineering. I designed a mower blade sharpener that sharpens three blades at once. It reflects how I think. I look for efficiency and improvement in systems, whether that is equipment or design.

Q: How do you stay current in the industry?

I submit to certification processes that require recertification and continuing education. That means seminars and personal study. One of the biggest risks in any field is arrogance. You must stay open to learning.

Q: What role does character play in your work?

Character defines everything. Work and personal life influence each other. If your character is weak, your work will reflect it. For me, faith is foundational. It shapes my work ethic and how I treat people.

Q: How do you measure success?

When I visit a completed site, and the client is happy, and the space looks right — that is success. The design must function well and age well. Landscaping is living art. It grows and evolves.

Q: What advice would you give someone entering the industry?

Stay teachable. Work hard. Pay attention to details. Do not chase trends without understanding structure. Develop discipline. Over time, that foundation will speak for itself.

Business

Why Diversified Sales Channels Are Now Critical for SME Resilience

You ever meet a business owner who says, “We’re fine, all our sales come from one platform,” and your stomach tightens a little? Not because they’re wrong today. But because you’ve seen how fast “fine” can flip.

Here’s the thing: single-channel success feels efficient right up until it becomes fragile. One algorithm tweak. One policy change. One shipping disruption. And suddenly revenue isn’t dipping — it’s gasping.

I’ve watched perfectly healthy SMEs wobble because their entire pipeline ran through one door. Diversification used to be a growth strategy. Now it’s resilience strategy.

The Hidden Fragility Of Single-Channel Success

A lot of founders mistake stability for safety. Sales look consistent. Costs are predictable. The platform works. Why complicate it?

But single-channel businesses are structurally exposed. If 80% of your revenue flows from one marketplace, ad platform, or distributor, you’re effectively renting your business model. And landlords change terms.

We’ve seen it repeatedly. Algorithm shifts that bury organic reach overnight. If you’ve ever searched how to relist on Poshmark just to get fresh eyes on a listing again, you already understand how quickly visibility can become something you have to fight for.

And the tricky part is that none of this is malicious. Platforms optimize for their ecosystem, not your balance sheet. SMEs caught in the middle feel it first.

Take a hypothetical example. A retailer driving 90% of sales through one marketplace sees a category rule change. Their product suddenly needs new compliance documentation. Sales pause for 30 days. That’s not an inconvenience. That’s payroll risk.

Diversification Isn’t Growth, It’s Insurance

Let’s be real: most founders don’t diversify because they’re bored. They diversify because concentration risk is terrifying once you see it clearly.

Multi-channel presence spreads exposure. When one stream slows, others stabilize cash flow. It’s not about chasing every shiny platform. It’s about building redundancy into your revenue system.

I’ve seen brands triple their engagement by layering channels intelligently instead of doubling down on one. Direct site, marketplace presence, wholesale relationships, social commerce — each behaves differently under pressure.

What’s interesting is the geographic side effect. Different channels reach different regions and demographics.

A downturn in one market doesn’t hit every stream equally. That diversification softens economic shocks in ways spreadsheets rarely predict upfront.

It depends on your category, of course. Physical goods behave differently from digital services. But concentration risk exists everywhere.

Growth Gets Messy Before It Gets Stable

Nobody tells founders this part loudly enough: multi-channel expansion is operationally awkward at first. Inventory coordination gets complicated.

Pricing parity becomes a puzzle. Manual processes start cracking under volume. And that friction scares people back into simplicity.

But the complexity isn’t a sign diversification is wrong. It’s a signal your systems need to evolve. Early-stage SMEs often run on heroic manual effort. Founders patch gaps personally. That works at one channel. It collapses at three.

You know what works? Treating operations like infrastructure, not an afterthought. Standardized processes. Shared data layers. Clear inventory logic. Once the backbone exists, adding channels stops feeling chaotic.

The tricky part is timing. Invest too early, and you overspend. Invest too late and growth chokes. Most resilient businesses upgrade systems right as pain appears, not years after.

Automation Is The Quiet Growth Engine

There’s a romantic myth about scrappy founders doing everything by hand. And sure, hustle matters early. But sustainable scale runs on automation.

Streamlined stock management prevents overselling. Automated order routing reduces human error. Integrated reporting replaces spreadsheet archaeology at midnight. Administrative overhead shrinks while output grows.

On top of that, automation gives founders back cognitive space. Instead of chasing logistics fires, they focus on strategy. Product expansion. Partnerships. Brand positioning. The work that actually compounds.

I’ve watched teams cut operational hours by 40% just by connecting systems properly. Same revenue. Less chaos. Higher margins because mistakes dropped.

And mistakes are expensive. Duplicate shipments. Missed invoices. Pricing inconsistencies. They look small individually. Together, they bleed profit invisibly.

Data Stops Being Noise And Starts Being Guidance

Multi-channel businesses generate more data than single-channel ones. At first, that feels overwhelming. Dashboards multiply. Metrics compete. Signals blur.

But when integrated properly, that data becomes a strategic asset.

Cross-channel performance reveals demand patterns you’d never see in isolation. One platform might spike on weekends. Another might peak midweek. Combined, they stabilize production forecasting.

What’s interesting is how margin optimization emerges from comparison. You spot where logistics costs creep. Which channel tolerates premium pricing? Where discounts actually drive volume versus cannibalize profit.

Smarter forecasting follows naturally. Inventory aligns with real behavior instead of guesswork. Cash flow smooths. Risk shrinks.

And yes, analytics takes discipline. Bad data pipelines create false confidence. But good data turns diversification into a measurable advantage instead of a juggling act.

Resilience Is Built Before Disruption Arrives

Economic shocks don’t announce themselves politely. Supply chain interruptions. Currency swings. Platform crackdowns. Consumer behavior shifts. They land suddenly.

Diversified SMEs absorb those shocks differently. Revenue doesn’t vanish all at once. It redistributes. Adaptive businesses pivot faster because their infrastructure already supports multiple pathways.

That’s the real competitive edge. Not just survival, but optionality.

Adaptive models let you test emerging channels without betting the company. Infrastructure becomes a buffer, not a bottleneck. When markets change — and they always do — diversified businesses adjust instead of freezing.

But here’s the nuance: diversification isn’t about chasing every trend. It’s intentional expansion aligned with capacity.

Too many channels without operational maturity create fragility of a different kind. Balance matters. Depth and breadth grow together.

The Uncomfortable Truth Founders Eventually Accept

Resilient SMEs look less elegant than single-channel darlings. More moving parts. More systems. More decisions. From the outside, it can seem messy.

But under the surface, that complexity distributes risk. It transforms dependency into flexibility. And flexibility is what keeps businesses alive through cycles nobody can predict.

The irony is that diversification feels inefficient in calm markets. Focus wins short-term. But resilience wins in the long term. And long-term is where real businesses live.

Here’s the thing: the goal isn’t to avoid disruption. That’s impossible. The goal is to design a business that bends instead of breaks. Diversified sales channels aren’t just a growth lever anymore. They’re structural insurance for the modern SME.

Business

OpenAI launches EVMbench to test AI agents on smart contract security

OpenAI launches EVMbench to test AI agents on smart contract security

Business

Merz to seek strategic partnerships with China amid US tariff push

Merz to seek strategic partnerships with China amid US tariff push

Business

Seattle Seahawks begin sale process after Super Bowl win

Dareke Young #83 of the Seattle Seahawks celebrates with teammates during the third quarter of the NFC Championship game against the Los Angeles Rams at Lumen Field on Jan. 25, 2026 in Seattle, Washington.

Jane Gershovich | Getty Images

The Seattle Seahawks are officially up for sale.

The NFL team, which defeated the New England Patriots in Super Bowl 60 earlier this month, announced on Wednesday that it has begun a process through which it could sell the franchise. The process, led by investment bank Allen & Company and law firm Latham & Watkins, is expected to continue through the 2026 off-season.

The Seahawks franchise is owned by the estate of Paul Allen, the Microsoft co-founder who helmed the Seahawks from 1997 until his death in 2018. His sister, Jody Allen, became executor of his estate after his death and took over the leadership of the franchise, overseeing the sale of his assets and donations to charity.

“The Estate of Paul G. Allen today announced it has commenced a formal sale process for the Seattle Seahawks NFL franchise, consistent with Allen’s directive to eventually sell his sports holdings and direct all Estate proceeds to philanthropy,” the franchise wrote on social media.

Prior to the Seahawks’ Super Bowl win, the Seattle team was valued at roughly $7 billion, according to CNBC’s official NFL valuations. In that range, the sale has the potential to become one of the biggest in NFL history, after the Washington Commanders sold for roughly $6 billion in 2023.

A sale would be finalized after NFL owners ratify a purchase agreement, according to the Seahawks.

Business

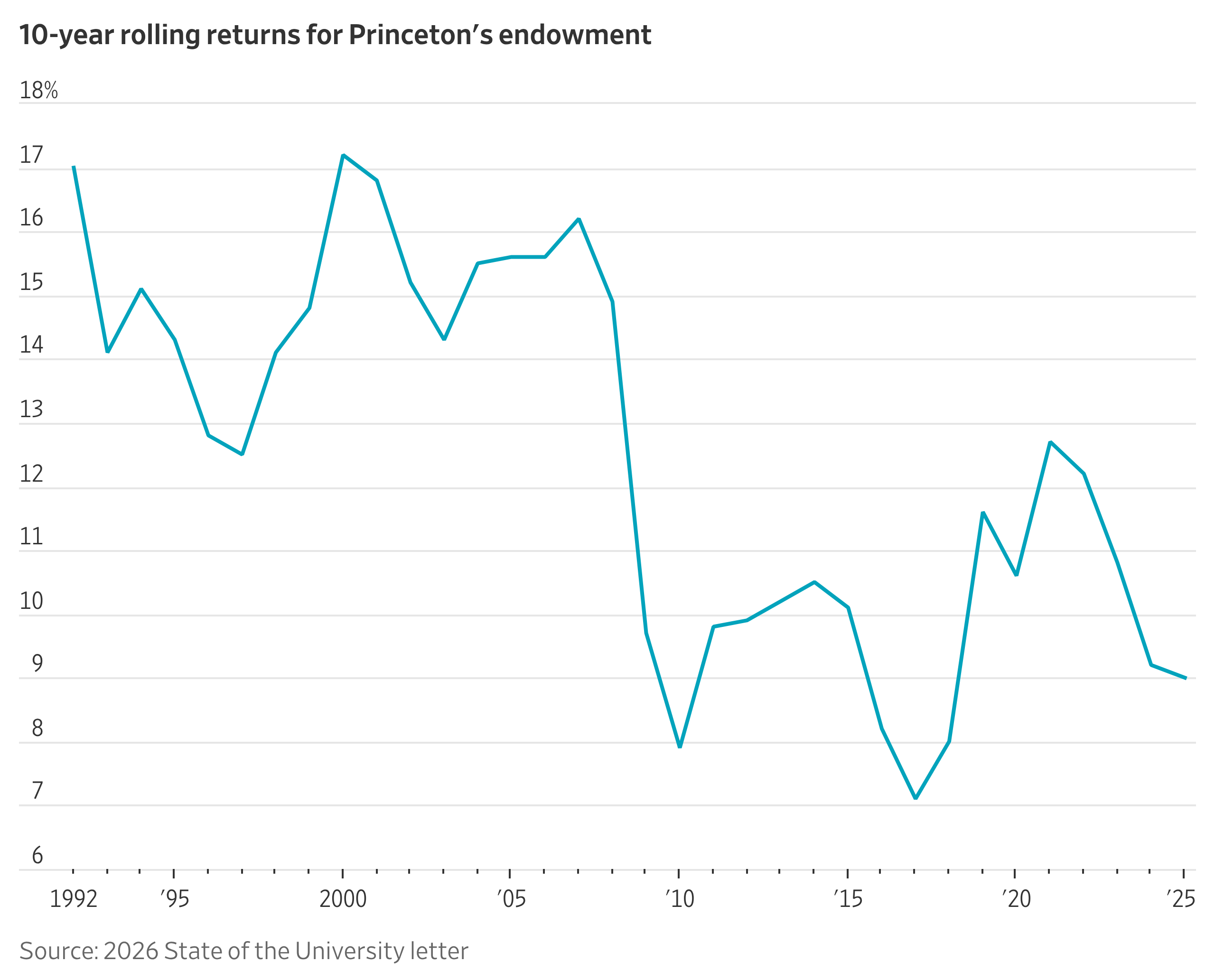

Why Are Ivy League Schools Revamping Their Investment Strategies?

Wealthy universities have been grappling with subpar returns on their private-capital investments, leading to second thoughts about where they put their money, says reporter Heather Gillers.

A: Private equity is on academic probation. Princeton University is lowering expectations for its endowment’s returns because its private-capital investments have disappointed. Yale trimmed its portfolio of leveraged buyouts for the first time in a decade. Harvard says cashing out of some private-market investments early is now part of a long-term strategy.

Private equity has long counted America’s wealthiest universities among its largest and most loyal clients. But the market for private-company investments has gotten crowded, and returns now struggle to match broader stock-market benchmarks.

Business

Bipartisan lawmakers introduce AI workforce training tax credit bill

Boosted.ai CEO and co-founder Josh Pantony joins ‘Mornings with Maria’ to discuss fears of AI-driven market disruption, the impact on white-collar jobs and whether artificial intelligence can truly predict the stock market.

House members from both parties joined to introduce legislation Wednesday aimed at incentivizing companies to train their employees to utilize artificial intelligence.

Rep. Josh Gottheimer, D-N.J., introduced the AI Workforce Training Act along with Rep. Mike Lawler, R-N.Y. If passed, the legislation would create a tax credit for companies who invest in AI trainings for their employees.

“If quantum computing and AI are the future, our workforce can’t be left behind. This workforce tax credit gives them the training they need to compete for the high-paying tech jobs of tomorrow, right here at home,” Lawler said in a statement.

According to the text of the bill, companies would be allowed to claim a tax credit equal to 30% of qualified expenses, up to $2,500 per employee per year, for costs related to teaching workers how to use, manage and build AI systems.

AI OUT OF CONTROL? HOW A SINGLE ARTICLE IS SENDING SHOCK WAVES WITH AN APOCALYPTIC WARNING

Rep. Mike Lawler leaves a meeting of the House Republican Conference in the U.S. Capitol on Wednesday. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

The legislation also directs the Departments of Treasury, Labor and Commerce to launch a public outreach campaign to make businesses aware of the tax credit.

“AI is already changing how we work and that transformation will keep getting faster, and we can’t let the American worker get left behind,” Gottheimer said in a statement. “Change is coming, and if we want America to continue to lead the world in AI innovation, we need to make sure American workers are ready for the jobs of the future.”

The legislation comes as members of Congress continue to debate how the country should address AI innovations.

SANDERS SAYS ‘SCIENCE-FICTION FEAR’ OF AI RUNNING THE WORLD ‘NOT QUITE SO OUTRAGEOUS’

Rep. Josh Gottheimer is pushing for Congress to address AI. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

Sen. Elizabeth Warren, D-Mass., told FOX Business last week that she is concerned about potential job losses.

“I am deeply concerned about AI and what it’s going to mean when people go out one day for lunch and come back and their jobs aren’t there anymore, and that happens to millions and millions of people. Now is the moment when we need to be preparing,” Warren told FOX Business.

Sen. Elizabeth Warren, D-Mass., says she is worried about AI costing jobs. (Michael A. McCoy/Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Pressed on what large-scale displacement could mean for the middle class, Warren – the ranking member of the Senate Banking Committee – issued a stark warning.

“We lost more than 100,000 manufacturing jobs last year,” she said. “If AI comes in on top of that and literally wipes out the income for millions of families we’re going to see a full-blown crisis right here in this country. If you know the bad weather is threatening out there, now’s the time to prepare for it.”

Read the full legislation below (App users click here)

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business20 hours ago

Business20 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment7 hours ago

Entertainment7 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech11 hours ago

Tech11 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business13 hours ago

Business13 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal