Business

Ripi elevating the ravioli experience at retail

Business

Noble Corp SVP Denton Blake sells $1m in shares

Noble Corp SVP Denton Blake sells $1m in shares

Business

Salmonella outbreak linked to moringa powder prompts massive recall

Check out what’s clicking on FoxBusiness.com.

Federal regulators warned Friday that a multistate outbreak of a highly drug-resistant salmonella infection has been linked to moringa powder, a nutrient-dense plant supplement that has recently surged in popularity as a trendy “superfood.”

The Food and Drug Administration (FDA) conducting a traceback investigation said the outbreak has been linked to certain Rosabella-brand capsules distributed nationwide by Ambrosia Brands LLC.

Moringa powder, used for medicinal and dietary purposes, is made from the dried leaves of the Moringa oleifera tree, which is native to India and often referred to as the “miracle tree.”

At least seven people across seven states were infected with the outbreak strain between Nov. 7 and Jan. 8, according to the Centers for Disease Control and Prevention (CDC). Regulators said cases were reported in Washington, Arizona, Iowa, Illinois, Indiana, Tennessee and Florida.

SALMON SOLD AT BJ’S WHOLESALE CLUB RECALLED OVER POTENTIAL LISTERIA CONTAMINATION

The moringa tree (Moringa oleifera) is cultivated in tropical and subtropical regions and is known as the ”miracle tree” or ”tree of life” due to its many medicinal uses. (Soumyabrata Roy/NurPhoto via Getty Images / Getty Images)

Three people were hospitalized, and no deaths have been reported.

The FDA said investigators have interviewed three infected individuals, all of whom reported consuming the capsules.

Regulators emphasized that the salmonella strain linked to the outbreak is resistant to all first-line and alternative antibiotics commonly used to treat salmonella infections.

The FDA also announced that Ambrosia Brands LLC has agreed to recall certain lots of Rosabella-brand moringa powder capsules from the market.

SOME GIFT CARDS SOLD AT COSTCO ARE NOW WORTHLESS

Rosabella recalls moringa powder products after regulators linked a salmonella outbreak to the green supplement. (FDA / Fox News)

The products were sold nationwide through Ambrosia Brands’ direct-to-consumer website, TikTok Shop and Amazon.

The company emphasized that none of the affected lots were sold by them on Amazon and that it does not have any authorized resellers on the platform.

They added that some unauthorized third-party sales to consumers may have occurred through eBay, Shein or other websites.

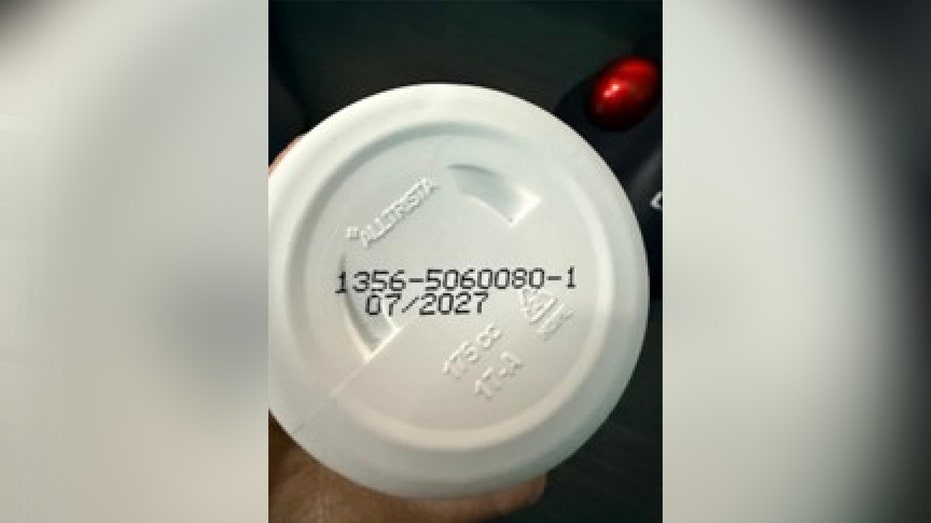

The recalled products are 60-count capsule bottles with expiration dates ranging from March 2027 to November 2027.

Lot codes include 5020591, 5020592, 5020593, 5020594, 5020595, 5020596, 5030246, 5030247, 5030248, 5030249, 5030250, 5030251, 5040270, 5040271, 5040272, 5040273, 5040274, 5040275, 5040276, 5040277, 5040278, 5040279, 5050053, 5050054, 5050055, 5050056, 5060069, 5060070, 5060071, 5060072, 5060073, 5060074, 5060075, 5060076, 5060077, 5060078, 5060079, 5060080, 5080084, 5080085, 5080086, 5090107, 5090108, 5090109, 5090113, 5090114, 5090115, 5090116, 5090117, 5090118, 5100039, and 5100048.

MORE THAN 191,000 AROEVE AIR PURIFIERS RECALLED OVER OVERHEATING, FIRE RISK

Three people have been hospitalized due to a moringa-linked salmonella outbreak. (Philip Dulian/picture alliance via Getty Images / Getty Images)

“We continue to diligently investigate, in collaboration with FDA, this possible link of the salmonella outbreak to Rosebella Moringa Capsule,” the company said in a statement. “We have discontinued use and purchase of all raw moringa leaf powder from the raw material supplier of the above referenced lots.”

“Ambrosia Brands is conducting this recall voluntarily and takes this matter very seriously,” it added. “We apologize for the inconvenience and concern this recall may cause our customers.”

The company advised that consumers who purchased the lots should dispose of the product and not consume, sell or distribute it.

Lot codes can be found at the bottom of the 60-capsule bottles. (FDA / Fox News)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Salmonella is an organism that can cause serious and sometimes fatal infections within 12 to 72 hours of ingesting in young children, elderly people and those with weakened immune systems.

Healthy people with the infection can often experience fever, diarrhea, nausea, vomiting and abdominal pain. In more serious and rare circumstances, the organism can get into the bloodstream and produce more severe illnesses such as arterial infections, endocarditis and arthritis.

Business

Noble Corp SVP Alting sells shares worth $182,902

Noble Corp SVP Alting sells shares worth $182,902

Business

Noble Corp SVP Howard sells $256k in shares

Noble Corp SVP Howard sells $256k in shares

Business

US Market | Berkshire Hathaway invests in New York Times, trims Apple

Shares of the Times rose 4% to $76.99 in after-hours trading.

In a filing with the U.S. Securities and Exchange Commission, Berkshire said it owned about 5.07 million Times shares worth $351.7 million at the end of 2025. Berkshire’s filing contained the Omaha, Nebraska-based company’s U.S.-listed stock holdings as of December 31, which comprise most of its equity portfolio.

Berkshire said that during the fourth quarter, it also sold 4% of its stake in iPhone maker Apple, still its largest equity holding at $62 billion, and 77% of its 10 million shares in online retailer Amazon.com.

The quarter marked the end of Buffett’s 60-year run leading Berkshire. Greg Abel succeeded him as chief executive on January 1, though Buffett remains chairman.

Berkshire’s filing does not say whether investments were directed by Buffett, Abel or portfolio manager Ted Weschler. Another portfolio manager, Todd Combs, left in December for JPMorgan Chase.

Stock prices routinely rise when Berkshire reveals new stakes, reflecting what investors view as a seal of approval from Buffett. It was unclear whether that will continue under Abel. Berkshire has not named a new chief investment officer to replace Buffett, or said how it will divvy up equity investments.

BUFFETT, FORMER PAPER CARRIER, CALLED THE TIMES A SURVIVOR

Buffett delivered newspapers as a teenager, and had long defended the industry before selling Berkshire’s newspaper business, including its hometown Omaha World-Herald, to Lee Enterprises for $140 million in 2020. Berkshire also became Lee’s only lender.

Loathe to sell entire businesses, Buffett told Berkshire shareholders in 2018 that only the Times, the Wall Street Journal and perhaps the Washington Post had digital models strong enough to offset declining print circulation and advertising revenue.

The Post, owned by Amazon founder Jeff Bezos, has since encountered its own struggles, and this month laid off approximately one-third of its employees.

During the fourth quarter, Berkshire also bought and sold several other stocks, adding to its holdings in Chevron and Chubb and selling some Aon and Bank of America stock.

More details about Berkshire’s investments may appear in the company’s annual report and Abel’s first shareholder letter on February 28.

Investors and analysts have said Berkshire has been cautious about valuations, having gone more than a year with no stock buybacks and a decade without a giant acquisition.

Berkshire also owns dozens of businesses including the BNSF railroad, Geico car insurance, energy and manufacturing companies, and retail brands such as Brooks, Dairy Queen, Fruit of the Loom and See’s.

Business

Positive Breakout: These 13 stocks cross above their 200 DMAs

In the Nifty500 pack, 13 stocks’ closing prices crossed above their 200 DMA (Daily Moving Averages) on February 17, 2026, according to stockedge.com’s technical scan data. The 200-day daily moving average (DMA) is used by traders as a key indicator for determining the overall trend in a particular stock. As long as the stock is priced above the 200-day SMA on the daily timeframe, it is generally considered to be in an overall uptrend. Take a look:

Business

OPEC+ Expected to Resume Output Increases, Kpler Says

1143 GMT – OPEC+ is forecast to resume oil output increases after pausing hikes in the first quarter, according to Kpler’s senior crude analyst Naveen Das. The alliance is expected to unwind the remaining portion of its 1.66 million barrels per day in voluntary cuts over six months. However, not all member countries can fully meet their quotas—Russia, for example, has limited capacity to increase output. As a result, Das doesn’t anticipate a major downside impact on Brent crude prices, which Kpler currently forecasts at an average of $65 a barrel this year. OPEC+ members are scheduled to meet virtually on March 1 to discuss production policy for the coming months. (giulia.petroni@wsj.com)

Oil Broadly Steady Ahead of U.S.-Iran Talks

0902 GMT – Oil prices are broadly steady ahead of a second round of talks between the U.S. and Iran this week. Brent crude rises 0.1% to $67.60 a barrel, while WTI is flat at $62.30 a barrel after posting weekly losses last week. “Absent any Middle East supply disruption, the scope for a sustained move above $70 appears limited, given continued emphasis on ample supply and indications that some OPEC members see room to resume output increases in April,” analysts at Saxo Bank say. Traders are also keeping a close eye on the U.S.-brokered talks between Russian and Ukrainian officials aimed at ending the four-year war. (giulia.petroni@wsj.com)

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Gold rises on dip-buying after more than 2% drop

FUNDAMENTALS

* Spot gold rose 0.2% to $4,886.69 per ounce by 0110 GMT, after declining more than 2% to a more than one-week low on Tuesday.

* U.S. gold futures for April delivery was steady at $4,904.50.

* The dollar held its ground on the day as geopolitical risks kept markets on edge and investors awaited minutes of the Federal Reserve‘s January meeting for cues into future rate cuts.

* A stronger dollar makes greenback-priced bullion more expensive for other currency holders.

* Mainland Chinese, Hong Kong, Singapore, Taiwan and South Korea markets are closed for the Lunar New Year holidays, which means low volumes and possibly volatile moves, traders said. * The Fed could approve “several more” rate cuts this year if inflation resumes a decline to the central bank’s 2% target, Chicago Fed President Austan Goolsbee said on Tuesday, downplaying a recent weak consumer price report as masking strong service price increases.

* Markets currently expect three 25-basis-point Fed rate cuts this year, per CME’s FedWatch Tool. * Non-yielding bullion tends to do well in low-interest-rate environments.

* Meanwhile, Iran and the U.S. reached an understanding on Tuesday on main “guiding principles” in talks aimed at resolving their longstanding nuclear dispute, but that does not mean a deal is imminent, Iranian Foreign Minister Abbas Araqchi said.

* Meanwhile, negotiators from Ukraine and Russia concluded the first of two days of U.S.-mediated peace talks in Geneva on Tuesday, with U.S. President Donald Trump pressing Kyiv to act fast to reach a deal to end the four-year conflict.

* Spot silver fell 0.8% to $72.86 per ounce after dropping over 4% in the last session.

* Spot platinum gained 0.9% to $2,025.80 per ounce, while palladium added 0.5% to $1,690.54.

DATA/EVENTS (GMT)

0700 UK Core CPI YY Jan 0700

UK CPI YY Jan 0700 UK CPI Services MM, YY Jan

0745 France CPI (EU Norm) Final MM, YY Jan

0745 France CPI MM, YY NSA Jan

1300 US Durable Goods Dec

1300 US Housing Starts Number Dec

1415 US Industrial Production MM Jan

1900 Federal Open Market Committee issues minutes from its meeting of January 27-28.

Business

Khara, Disc Medicine chief legal officer, sells $179k in shares

Khara, Disc Medicine chief legal officer, sells $179k in shares

Business

US Stocks Today |Equities close with slight gains as tech shares recover

After dropping as much as 1.5% at its lows of the session, the S&P 500 information technology sector erased declines to close up 0.5% as gains in Nvidia and Apple overcame declines in Microsoft and Oracle .

Worries about artificial intelligence disrupting business models had sparked a selloff in software firms, brokerages and trucking companies the previous week, leading to Wall Street’s three main indexes to record their biggest weekly decline since mid-November.

“There’s a lot of different trends going on in terms of where investors want to put money right now and you see that in this market where you just see spikes up and spikes down, on maybe not a daily basis, but on a regular basis,” said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York.

“The market is looking very short-term here and there will be a return to AI plays being very much in favor.” Potential risks from Chinese AI players exacerbated the uncertainty. On Monday, Alibaba unveiled a new AI model, Qwen 3.5, designed to independently execute complex tasks.

Even with the rebound in technology names, software stocks remained under pressure, with the S&P 500 software index ending down 1.6% with Intuit and Cadence Design the worst-performing in the index on the day with declines of more than 5%.

The Dow Jones Industrial Average rose 32.26 points, or 0.07%, to 49,533.19, the S&P 500 gained 7.05 points, or 0.10%, to 6,843.22 and the Nasdaq Composite gained 31.71 points, or 0.14%, to 22,578.38. The S&P 500 financials index was among the best-performing of the 11 major S&P sectors on the day. Gains in banks such as Goldman Sachs and JPMorgan Chase helped nudged the Dow into positive territory from a decline of 0.7% earlier in the session. Consumer staples, down 1.5%, was the worst-performing S&P 500 sector on the session, dragged lower by a 7% tumble in General Mills after the cereal maker cut its annual core sales and profit forecasts.

This week, the personal consumption expenditure report – the U.S. Federal Reserve’s preferred inflation gauge – will be in focus for insights into inflation and how it could impact the central bank’s rate-cut trajectory. The data follows cooler-than-expected consumer inflation data last week that slightly raised bets on interest-rate cuts this year.

Traders are pricing in a chance of roughly 63% for a rate cut of at least 25 basis points at the Fed’s June meeting, the first with odds above 50%. Chicago Fed President Austan Goolsbee said the Fed could approve “several more” interest-rate cuts this year if inflation resumes a decline to the central bank’s 2% target, while Governor Michael Barr said that another central bank interest rate cut could come somewhere well down the road amid ongoing risks to the U.S. inflation outlook. In addition, San Francisco Fed President Mary Daly said the central bank must do a deep dive into the data to determine whether AI is lifting productivity growth and in turn, economic growth, without rekindling inflation that would force tighter monetary policy. Norwegian Cruise Line shares rallied 12.1% as the best performer on the S&P 500, after activist investor Elliott said it had built a more than 10% stake in the cruise operator. Fiserv’s shares jumped 6.9% after the Wall Street Journal reported that activist investor Jana Partners had taken a stake in the payments company. Masimo shot up 34.2% after Danaher said it would acquire the pulse-oximeter maker for $9.9 billion, including debt, sending Danaher shares 2.9% lower.

Advancing issues outnumbered decliners by a 1.02-to-1 ratio on the NYSE while declining issues outnumbered advancers by a 1.07-to-1 ratio on the Nasdaq.

The S&P 500 posted 42 new 52-week highs and 10 new lows while the Nasdaq Composite recorded 81 new highs and 224 new lows.

Volume on U.S. exchanges was 17.76 billion shares, compared with the 20.7 billion average for the full session over the last 20 trading days.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech23 hours ago

Tech23 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 hours ago

Business3 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video18 hours ago

Video18 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World18 hours ago

Crypto World18 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

![WARNING: History Is Repeating! [Bitcoin Must Hold This Level]](https://wordupnews.com/wp-content/uploads/2026/02/1771385251_maxresdefault-80x80.jpg)