Business

September figures deliver electric shock

The surge in electricity prices in the September quarter consumer price index pushed inflation above the Reserve Bank of Australia’s comfort zone.

The result dashed hopes of another interest rate cut this year, but that’s not the only part of the CPI figures posing a headache for the federal government.

It’s the latest in a series of foreboding signs for the government’s dream of Australia becoming a ‘green energy superpower’.

From 2.1 per cent in the June quarter and sitting comfortably near the bottom of the RBA’s 2-3 per cent target range, annual inflation jumped to 3.2 per cent.

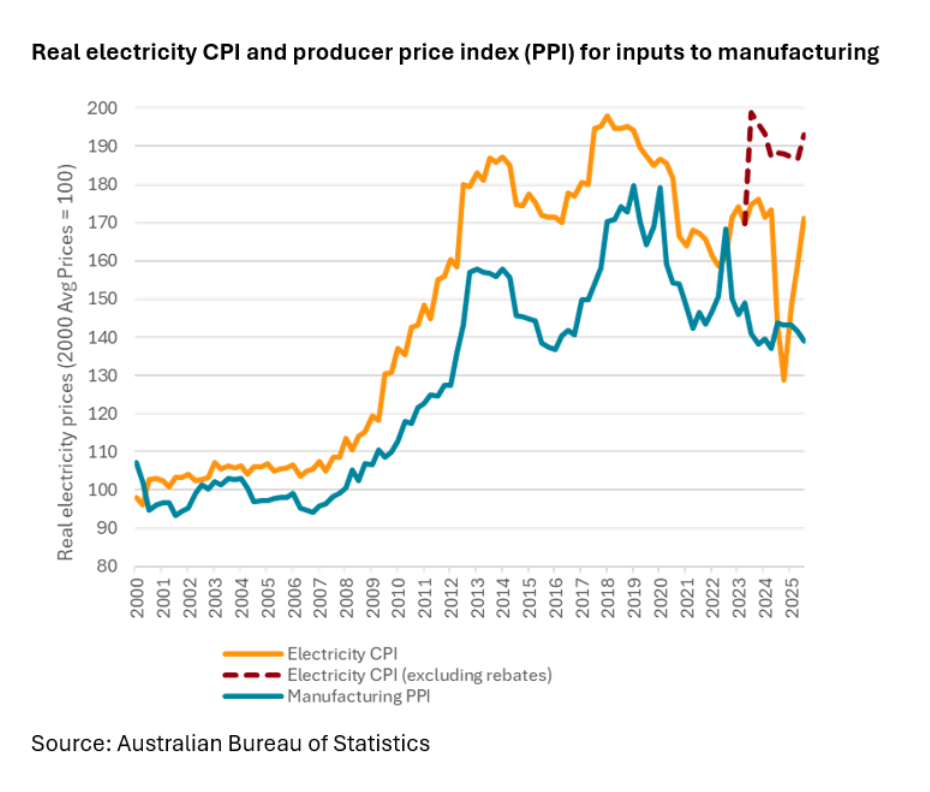

Electricity prices rose 9 per cent for the quarter, up 23.6 per cent over the year. Longer-term trends are just as concerning.

For Australian households, electricity prices have roughly doubled in real terms since 1980, with most of that rise in the 12 years from 2006 to 2018, when prices surged 90 per cent.

The renewable energy superpower vision is one where energy-intensive sectors such as manufacturing and AI data centres are knocking on the door to locate in Australia to take advantage of abundant, cheap and clean energy.

That includes downstream processing of critical minerals, and fabrication of the solar panels and wind components needed for a net-zero economy.

The vision rests on the belief that the shift to renewables will substantially reduce power prices. It’s hard to keep track of how many billions of dollars governments are investing in this transition, or the thousands of claimed jobs to be created.

Almost daily I receive updates from the Clean Energy Council and EcoGeneration hailing billions in new funding, investments and jobs in renewable energy.

Two hundred jobs from a wind farm Power Purchasing Agreement; $3.8 billion for the Capacity Investment Scheme; a multi-billion-dollar boost to landowners hosting renewables infrastructure; $1.8 billion and 1,600 workers building 1,000 transmission towers in NSW.

That’s a small sample from recent weeks’ emails.

These are touted as boosts to the economy but also represent a massive commitment of resources to renewable generation at a time when investment could be directed to many alternative uses.

Ultimately, all those costs end up on our power bills. The critical question is, when will we start to see the dividends in the form of falling energy prices?

The real price of electricity to producers has soared this century, along with the electricity CPI.

Government electricity credits have offered some temporary respite over the past couple of years, but support levels are declining.

Announcements of closures in mineral processing continue to mount, including Alcoa’s Kwinana alumina refinery.

Others, including the Tomago Aluminium smelter in NSW, and the Nyrstar and Whyalla steelworks in South Australia, have recently been placed on life support pending taxpayer-funded bailouts.

Climate Change and Energy Minister Chris Bowen is adamant that renewables are now the cheapest form of power, backed up by studies of the levelised cost of energy.

All of that remains academic until real electricity prices fall to levels once provided by fossil fuels, without the smokescreen of consumer rebates and producer subsidies.

The rhetoric of green-energy superpowers and ‘A Future Made in Australia’ will become harder to defend if power prices keep rising.

While the government watches the Coalition tie itself in knots over net-zero policy, it must be conscious it’s on borrowed time to convince voters that things will soon turn around.

• Professor Mike Dockery is principal research fellow at the Bankwest Curtin Economics Centre