Business

Silver Beech Capital Q3 2025 Investor Letter

Andreas Balg/iStock via Getty Images

Dear Fellow Investors and Friends,

The estimated year-to-date third quarter of 2025 and historical net performance for Silver Beech Capital, LP (“the Fund” or “Silver Beech”) are presented below.

Performance Summary*:

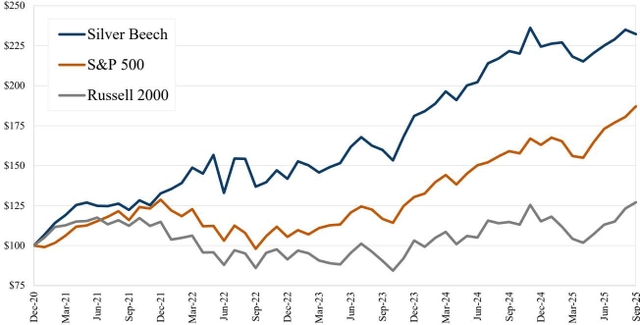

Performance Comparison: Value of $100 Invested at Inception*

Since track record inception, Silver Beech has generated 19.5% annualized returns, which equates to 5.3% annualized outperformance over the S&P 500. Through the third quarter of 2025, Silver Beech is up 3.5%, compared to the S&P 500’s 14.8% and the Russell 2000’s 10.4% year-to-date (YTD) gains.

The S&P 500 posted returns of +8.1% in the third quarter, extending its swift recovery following Liberation Day volatility. While the market’s multiple expansion has occurred against a backdrop of global monetary easing and resilient technology profitability, we believe current equity valuations have become broadly untethered from fundamentals.

Large-cap technology companies driving much of the S&P 500’s strong YTD returns possess outstanding legacy business models boasting strong growth and high returns-on-capital (ROC) that justify premium valuations, but the current price for “quality” and “predictability” is nonetheless steep. We also see a resurgence of speculative behavior reminiscent of 2021’s speculative bubble. This is most evident in the Russell 2000, which returned +12.4% in Q3. This performance was not driven by the profitable, heartland American companies historically associated with the index, but rather by speculative equities with low profits and, in some cases, non-existent revenue.

On average, the five largest companies in the Russell 2000 are up over 150% YTD, trade at over a 500x P/E ratio, and are dominated by unproven business models in speculative industries such as quantum computing and next generation defense.

In this environment, the market is rewarding accelerating revenue growth with little regard for underlying profitability, cash flow, or capital efficiency. Conversely, it shrugs off companies with modest, albeit durable, growth.

Against this backdrop and for the first time in the Fund’s track record history, we note that Silver Beech has trailed the S&P 500 through the first three quarters of 2025. While we do make mistakes and approach every period of underperformance with humility and rigorous self-review, we believe our deviation from the benchmark is a feature of our discipline, not a bug in our process. Preservation of capital and our orientation towards long-term outperformance require the discipline not to chase short-term returns.

We remain convinced that while the market may act as a voting machine in the short run (rewarding popularity and momentum), it functions as a weighing machine in the long run (rewarding free cash flow). Our confidence is grounded in our selective investment process and rigorous fundamental analysis, which have cumulatively resulted in a large comparative disparity between Silver Beech’s portfolio and the S&P 500: Silver Beech’s portfolio trades at over a 50% discount to the S&P 500’s price-earnings ratio and other valuation metrics, while possessing similar projected earnings-per-share growth and returns-on-capital. This valuation gap is our margin of safety and fuel for our future outperformance.

In this quarter’s letter, we provide investment updates on two companies that we believe provide excellent case studies on the outperformance that can be derived from our focused strategy of strong fundamental analysis applied to concentrated equity investing.

Portfolio Update: this quarter, we provide an update on our current investment in WillScot (WSC) and our recently realized investment in Dentalcorp (DNTL:CA).

WillScot (WSC)

At its current price, we believe WillScot represents the most asymmetric opportunity in the portfolio. Following a ~40% decline from our cost basis, the stock has derated significantly from a ~10x TEV/EBITDA (2024E) multiple to ~7.5x (2025E), and a ~7% free cash flow yield (2024E) to ~13% (2025E). At this valuation, the market is pricing WillScot as a business in secular decline. This stands in stark contrast to our view of WillScot as a compounding industrial services franchise with a dominant market position.

We approach this update with humility regarding our timing. In our Q1 2024 thesis, we posited that modular unit utilization1 was nearing a cyclical trough. We were too early in this prediction:

- Q1 2024 View: Utilization at 62.5% (96k units) was perceived as close to the floor.

- Current Reality: Utilization has drifted down to 59.3% (89k units).

While we misjudged the cycle’s depth, the resultant sell-off has created a disconnect between price and value that we find extremely compelling. At a 13% free cash flow yield, the upside is obvious, and we do not even need to time the exact bottom of the cycle to generate satisfactory returns; we simply need the business model to remain intact. The market has little idea what WillScot is worth: over the past three years the company’s stock price has oscillated dramatically between $15 and $53 per share.

Triggered by the stock’s selloff, and in accordance with our risk management protocol, we conducted a comprehensive re-underwriting of the business that centered around whether the decline in WillScot’s utilization is cyclical (macro-driven) rather than structural (competition-driven). This included channel checks with customers, competitors, lenders, and industry operators.

We believe our research confirms that the headwinds are cyclical, not structural:

- Historic Macro Headwinds: the decline in utilization correlates directly with the ISM Manufacturing Index, which has hovered in contraction territory (<50) for nearly 36 months. This duration of contraction has few historical precedents, comparable only to the 2000-2003 post-dot-com recession and the early 1980s.

- Enterprise Customer Growth : among enterprise customers (Fortune 500 companies, major government institutions, multinational firms, etc.) which are less economically sensitive due to better funding mechanisms and longer project timelines, WillScot continues to grow revenue in the mid-to-high single digits.

- Pricing Power : in a scenario where a company is losing market share to competitors, we would expect to see pricing deflation as they fight to retain volume. We see the opposite with modular unit pricing up 5%+ year-over-year in Q3 2025, and robust EBITDA margins at 40%+. We believe this shows WillScot is sacrificing volume to maintain price discipline, a hallmark trait of a rational market leader.

- Rational Oligopoly : WillScot’s well-funded competitors (United Rentals (URI), Sunbelt) are publicly traded entities targeting similar ROCs. These peers cannot undercut WillScot’s pricing while maintaining their own ROC targets. WillScot’s competition is disciplined.

- Temporary Distress : our interviews revealed that smaller private competitors are liquidating fleets or leasing them uneconomically. While this creates short-term pricing noise, it accelerates industry consolidation. WillScot, with its strong balance sheet, is positioned to capture this share as the cycle normalizes.

The market’s impatience with WillScot’s lack of immediate earnings visibility has created an opportunity to own a high-quality “tollbooth” on North American construction and infrastructure at an extremely attractive valuation. In addition to well-managed leverage, the company has multiple countercyclical levers to optimize free cash flow.

We are extremely supportive of the company’s share repurchase program which has seen the share count decline by 5%+ since the start of the year. We believe WillScot’s intrinsic value is $45+ per share (~12x TEV/EBITDA (2025E)), more than 100% higher than its current share price. Until the cycle turns, we are content as shareholders to collect a double-digit free cash flow yield on a dominant, essential business.

Realized Investment – Dentalcorp (TSX: “DNTL”) (OTCPK:DNTCF)

In the third quarter, we successfully realized our investment in Dentalcorp following its acquisition by GTCR. The transaction, priced at $11 per share, concludes our two-year holding period with a 44% gross IRR.

GTCR’s investment thesis appears to validate the specific attributes we identified in our initial underwriting (detailed in our Q3 2023 letter and Q1 2024 letter ): Dentalcorp is the partner of choice for Canadian dental practices, possesses a distinct scale advantage as the largest consolidator, an impressive service offering which results in acquisition synergies and strong same practice revenue growth, and enjoys a long runway for capital deployment. These attributes will be enhanced under the singular focus of private ownership.

While the take-private outcome appears deceptively obvious in hindsight, the path was decidedly non-linear. Dentalcorp frequently languished in the public markets, creating a disconnect between price and value that allowed us to exercise our (and GTCR’s) distinct advantage: patience and long-term time horizon.

Following its 2021 IPO at ~$14 per share (14x TEV/EBITDA), the stock fell more than 50% by Q3 2023. The market fixated on macroeconomic fears—specifically rising interest rates and leverage concerns—while ignoring the company’s utility-like cash flows and predictable margin expansion. We initiated our position during this period of pessimism at <$6 per share (~9x TEV/EBITDA).

Crucially, our involvement did not stop at the initial buy. We utilized subsequent volatility to our advantage. When the market overreacted to short-term noise in key performance indicators such as same practice revenue growth caused by post-COVID normalization of dental compliance or regulatory changes we pressure-tested our thesis. Finding no structural impairment to the business, we opportunistically increased our stake during drawdowns, most recently in March 2025 when shares fell over 20% in a few months and dipped below $8 per share.

GTCR’s acquisition price of $11 per share (~12x TEV/EBITDA) represents a meaningful re-rating and validates our view that the public markets were structurally undervaluing Dentalcorp’s leading position as the primary consolidator in the Canadian market. While this figure remains slightly below our internal intrinsic value estimate of ~$12.50 and we believe GTCR is buying the company cheap, the transaction unlocks immediate liquidity and secures an exceptional IRR on our equity investment.

The Dentalcorp investment serves as a timely reminder that the market often overfits temporary fluctuations in business fundamentals into grand narratives of growth or decline. While impatient capital fled the stock’s volatility, the business did not stop creating shareholder value. By distinguishing between price volatility and business risk, we were able to turn market capriciousness into a 44% IRR during our two-year hold period.

Conclusion: it is our great privilege to be your partner and manage your capital alongside our own. We thank you for your trust. We are always available to discuss our strategy and address your questions.

Sincerely,

James Hollier, Partner & Portfolio Manager

James Kovacs, Partner

Silver Beech Capital, LP

Silver Beech Capital, LP – Fund Summary as of September 30, 2025

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.