Stargate, a high-profile artificial intelligence infrastructure project trumpeted by Donald Trump this week, will exclusively serve ChatGPT maker OpenAI, according to people familiar with the matter.

The venture planned to spend $100bn on Big Tech infrastructure projects, with the figure rising to as much as $500bn over the next four years, OpenAI and SoftBank, Stargate’s two main backers, said on Tuesday. Oracle and Abu Dhabi state AI fund MGX are also founding partners.

Trump lauded the SoftBank-backed initiative on Tuesday at a White House event attended by OpenAI chief Sam Altman and other tech executives as “a resounding declaration of confidence in America’s potential under a new president.”

Despite the flashy announcement, Stargate has not yet secured the funding it requires, will receive no government financing and will only serve OpenAI once completed, the people familiar with the initiative have said.

“The intent is not to become a data centre provider for the world, it’s for OpenAI,” said one of the people.

Another person close to the project said it was far from a fully developed plan: “They haven’t figured out the structure, they haven’t figured out the financing, they don’t have the money committed.”

SoftBank and OpenAI intend to put forward more than $15bn each for the project. The companies hope to raise a combination of equity from their existing backers and debt, which will be used to fund Stargate. Tokyo-based SoftBank will also inject existing funds into Stargate, according to one of the people.

OpenAI and SoftBank declined to comment.

Altman has spent well over a year working on boosting OpenAI’s access to data and computing power, a bottleneck he argues must be overcome if the company is to achieve its goal of creating AI capable of surpassing humans across most cognitive skills, supplanting them in the workforce and pushing the boundaries of scientific research.

That has meant looking beyond OpenAI’s exclusive relationship with Microsoft. The group, which has invested $13bn into OpenAI and is entitled to almost half the profits from the start-up’s for-profit subsidiary, is providing technological support to Stargate, but not capital.

Microsoft launched its own $30bn AI infrastructure fund with fund manager BlackRock in September last year, and on Wednesday chief executive Satya Nadella said his company would spend $80bn on infrastructure this year, separate from Stargate.

Altman had been speaking to SoftBank chair Masayoshi Son for as long as two years about AI projects, including a new AI device, according to people familiar with the discussions.

SoftBank also invested in OpenAI during a $6.6bn fundraising round in October, which valued the start-up at $157bn, and the Financial Times reported the Japanese group planned to purchase an additional $1.5bn of stock in the company in November. Son and Altman began having detailed talks on Stargate in the months before this week’s announcement, according to two people with direct knowledge of the matter.

While Altman’s infrastructure plans had been in the works for well over a year, “the idea of announcing it at the White House was not in the works for [as long]”, according to one person with knowledge of the project.

“There’s a real intent to do this, but the details haven’t been fleshed out,” said another person involved in the project. “People want to do splashy things in the first week of Trump being in office.”

Stargate is incorporated in Delaware, with OpenAI, SoftBank, Oracle and MGX each taking stakes in the company. The group will appoint an independent chief executive and board, according to people with knowledge of the plans.

The company would be split into an operational unit, tasked with building and running the data centres and headed by OpenAI, and a unit responsible for raising capital, run by SoftBank, a person familiar with the project said.

Work is already under way on a first facility in Abilene, Texas.

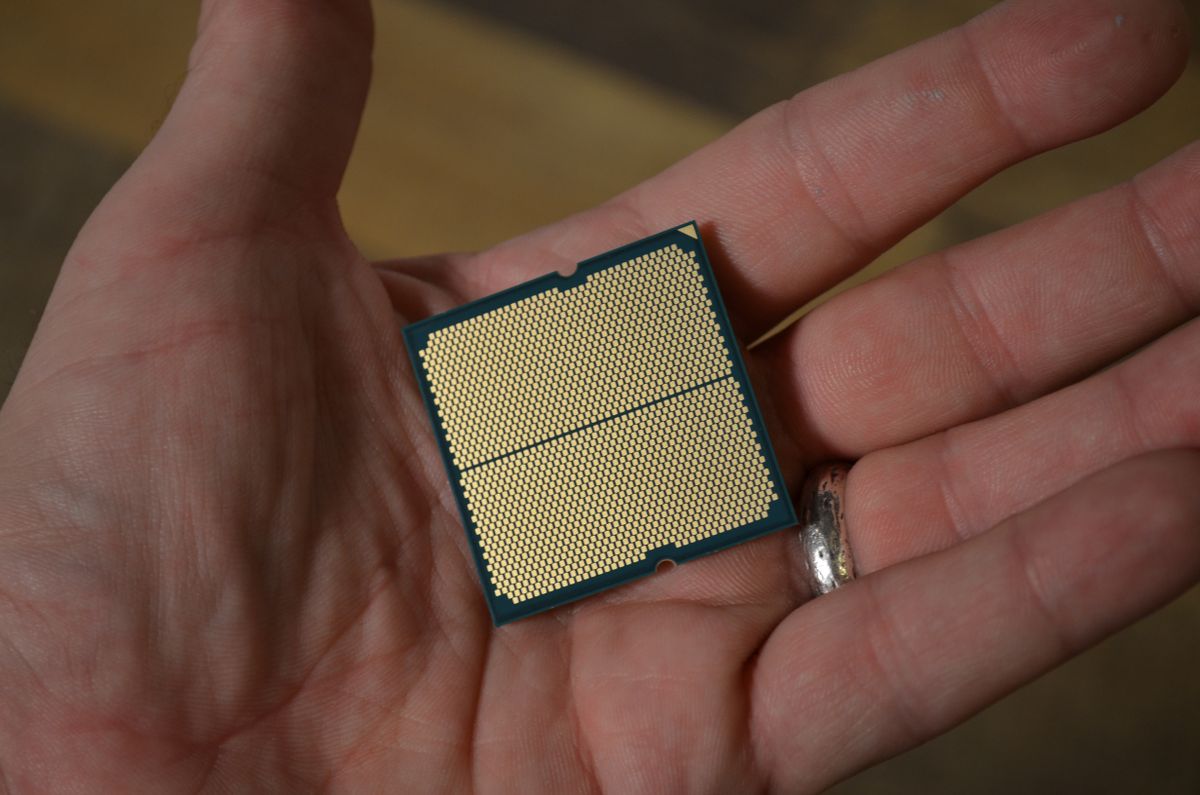

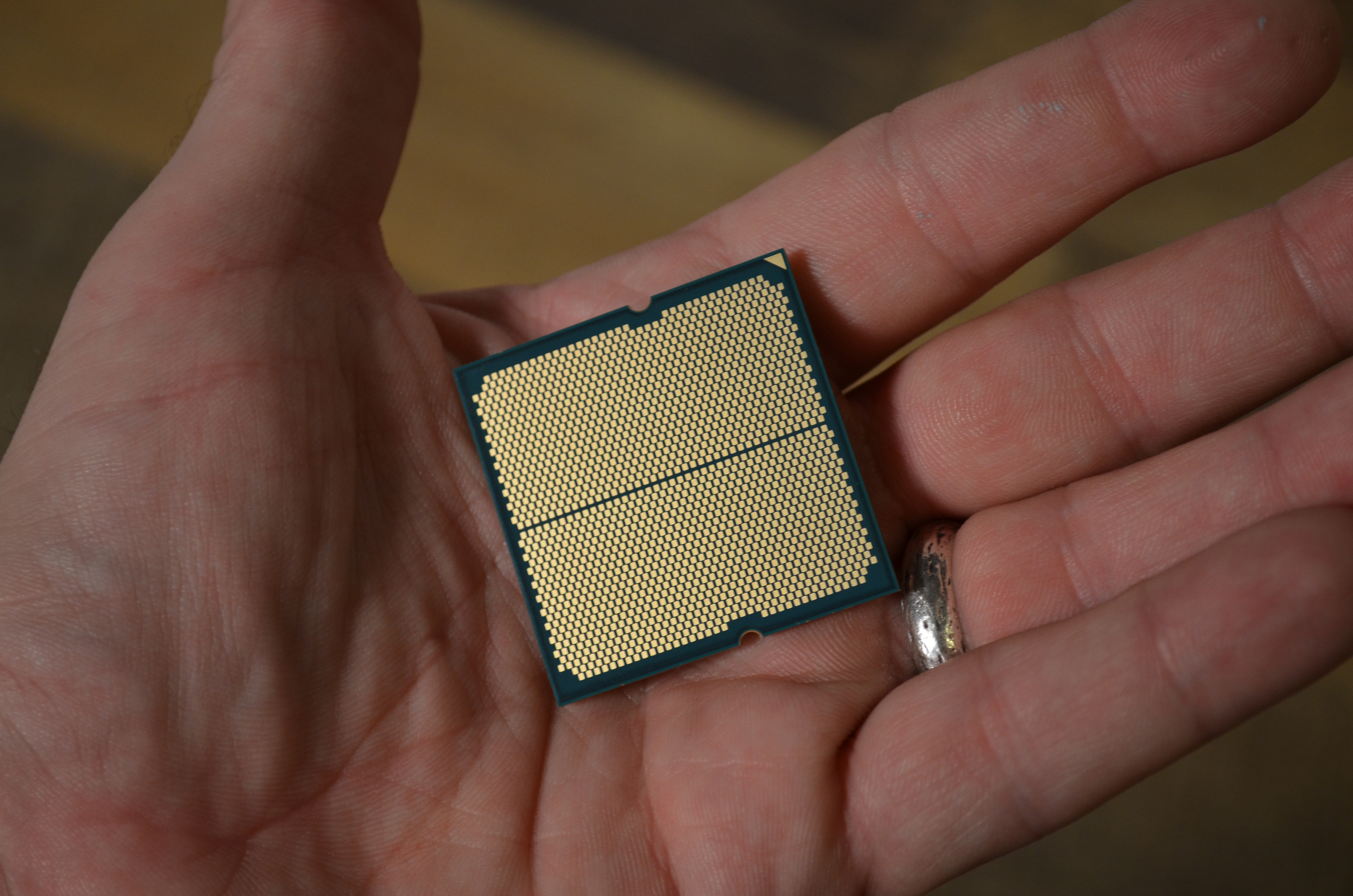

Data centre start-up Crusoe has been building that facility for Oracle since June 2023. Crusoe secured $3.4bn in financing from Blue Owl in October to help fund its development. Oracle is expected to buy about $7bn worth of chips to power the Texas site and will provide that computing power to Microsoft, which will use it to power OpenAI.

Additional reporting by David Keohane in Tokyo and Stephen Morris in Davos

You must be logged in to post a comment Login