What happens when a chemical engineer, who’s previously built a hydrogen-powered drone, becomes a venture capitalist? Energy Revolution Ventures, that’s what. The VC has now closed an $18 million Seed and Series A fund to invest in deeptech, such as energy storage, carbon capture, and, yes, hydrogen technologies.

Marcus Clover, Co-Founder and Partner at ERV told TechCrunch: “I studied at Cambridge, and thought I was going into oil and gas. I ended up getting hired as employee number one for an aerospace startup. We were building a hydrogen-powered drone for telecoms application.”

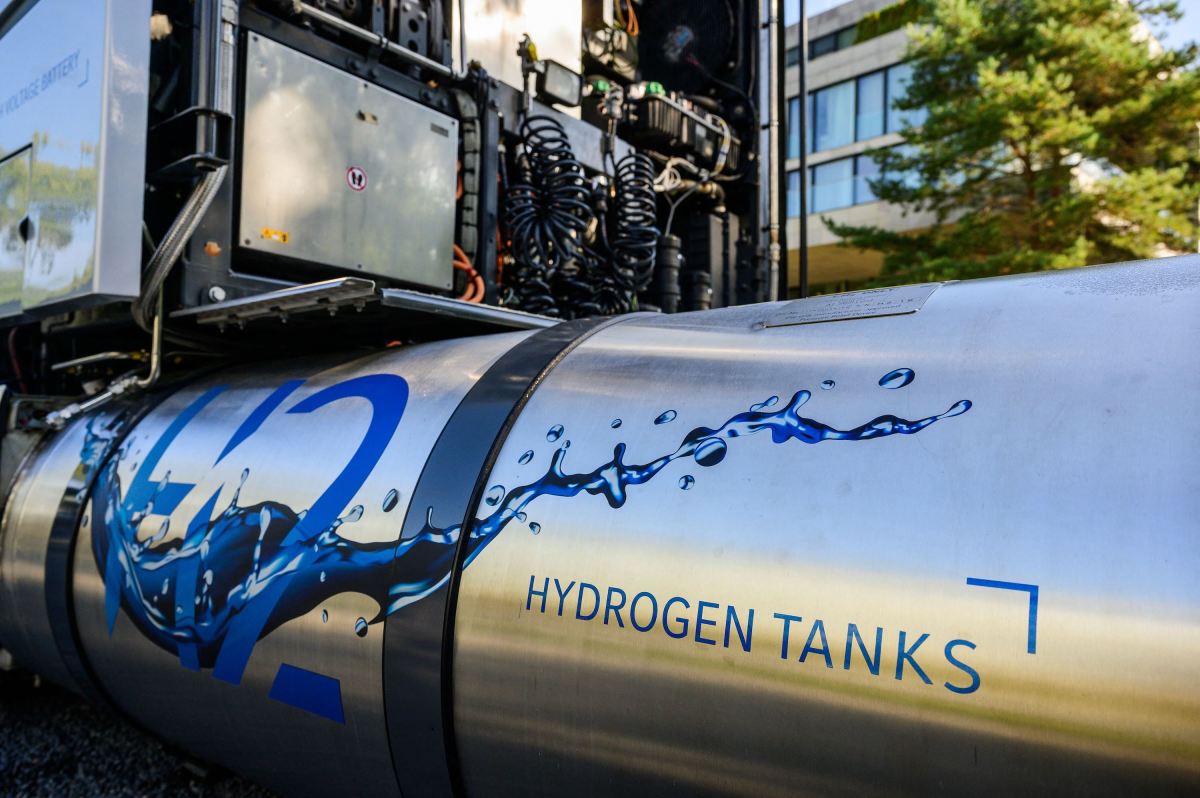

After doing that for five years he joined another firm putting hydrogen fuel cells in heavy-duty vehicles: “I saw firsthand, as an engineer working this space, how much innovation was happening in the energy sector. I realized I had to get into it from the investment side. That’s when I teamed up with two of my partners.”

The 2023 vintage fund includes LPs from family offices in the metals and energy sector, high-net-worth individuals, and Bidra Innovation Ventures, the corporate venture capital arm of Morocco’s OCP Group. ERV already has a portfolio of nine companies, including Green Li-ion (lithium-ion battery recycling), Anthro (structural, safe batteries), and Oort Energy (low-cost renewable H₂).

ERV has both a fund and a venture builder, dubbed Prosemino. The idea is that the fund can both invest in independent startups as well as spin up new ventures, based on its in-house technical expertise. It draws on a network of advisors, spread across the University of Oxford and University College London. It has also built some specialist laboratories to assist its startups.

“We have 4,000 square feet of wet chemistry and dry lab space here in London. We believe it’s the only lab of its kind outside of Europe, not related to a university,” said Clover.

ERV’s strategy is based on the idea that a lot of innovation is about to happen in chemistry, especially in the area of energy.

“When I was working hydrogen, back in 2015/2016, way before the latest hydrogen hype cycles, the most advanced tech was in the space sector. We were trying to repurpose it for aircraft. Doing that work teaches you a lot about how to redesign stuff from first principles and how to operate in small teams with tight budgets. So I can relate to a lot of the companies which we’ve now invested in,” said Clover.

He added that the firm’s thesis is not just about decarbonization, but also electrification: “It’s more than just electrical generation. You still need to store the power, transmit it to where it’s needed, and then electrify huge parts of the economy… We are literally rewiring the economy, and we need huge amounts of technology to do that. We saw how software made launching space rockets cheaper and better. I believe the same thing is going to happen with energy, and that’s the really exciting part of the story.”

TechCrunch has covered two of the investee companies in ERV’s portfolio, in the past. Anthro Energy had their $7.2m seed round partly led by ERV. Divigas, also covered by TechCrunch, is also in the portfolio.

He said that while some investors are focusing on decarbonization, the growth through electrification “is even more exciting from a market perspective.?”

To date ERV Fund 1 has made nine investments, including:

Blixt – Developers of software-enabled power electronics. The startup has been selected to join NATO’s Defence Innovation Accelerator for the North Atlantic (DIANA) program.

Ecolectro – Innovators of novel polymers designed for the next generation of electrolyzers in the hydrogen industry.

Immaterial – Creators of cheap and durable Metal-Organic Frameworks (MOFs) designed for carbon capture, gas separation, and purification purposes.

+ There are no comments

Add yours