Business

The Ultimate Guide to Calculating Real Influencer Campaign ROI

If you have ever tried to defend creator spend in front of a CFO, you know the problem. The campaign can look busy on the surface. Views are high, comments are positive, and the creators are asking when the next deal is coming.

Then the CFO asks one question: what did we get back in revenue, and how do you know it came from this spend? When the answer leans on Earned Media Value (EMV) only, engagement rate, or brand awareness, the conversation usually ends with budget pressure.

In 2026, that standard is changing. Vanity metrics might help you improve creativity, but they do not justify investment. What wins the budget is attribution to Net Revenue and profit, plus clear math that ties spend to Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), and conversion. CFOs in particular and brands in general need performance-based influencer marketing.

This guide shows how to calculate influencer marketing ROI using the same financial logic you would use for any growth channel. We will also separate Return on Ad Spend (ROAS) from profit based ROI, and walk through creator campaign attribution models and the tracking stack needed to connect an influencer post to a closed deal.

Key Takeaways

- Move beyond EMV to Hard Revenue.

- Include all costs (agency, product, shipping) in the formula.

- Use U-Shaped or Linear attribution to see the full picture.

- Automate tracking with UTMs and pixels.

ROI vs. ROAS vs. EMV: Defining Financial Success

Marketers often mix these metrics in the same report. A CFO will not. If you want influencer spend to be treated like a real growth investment, you need to be precise about what each metric measures, what it ignores, and what question it answers.

Earned Media Value (EMV)

- What it is: A dollar estimate assigned to impressions, views, likes, or engagement by comparing them to what you might have paid for similar reach in ads.

- What it answers: “How much would this exposure have cost if we bought it?”

- Why it fails in the boardroom: EMV is built on vanity metrics. It has no direct link to net revenue, profit, or even verified customer actions. Two campaigns can have the same EMV while one drives sales and the other drives nothing but attention. EMV can be useful for creative benchmarking, but it is not a financial result.

Return on Ad Spend (ROAS)

- What it is: A revenue efficiency metric.

- Formula: ROAS = Gross Revenue / Ad Spend

- What it answers: “How much gross revenue did we generate per dollar spent?”

- Why it matters: ROAS is a clean way to compare channel efficiency when your goal is revenue generation. It forces you to connect spend to revenue. But ROAS is not profitable. It does not subtract costs like Cost of Goods Sold (COGS), shipping, discounts, refunds, or agency fees. A campaign can look strong on ROAS and still lose money.

Influencer Marketing ROI

- What it is: A profitability metric for creator investment, and the primary financial KPI if you need CFO level approval.

- Core logic: profit compared to Total Investment.

- What it answers: “Did we make money after all costs, and how much profit did this Investment produce?”

- Why it matters: ROI is what finance teams use to decide whether to scale, hold, or cut spend. It forces you to define total investment properly and connect it to profit, not just revenue.

Comparison table: EMV vs. ROAS vs. ROI

| Metric | What it measures | Core inputs | Best use | Main weakness |

| EMV | Estimated value of exposure | Vanity metrics like views, impressions, engagement, plus assumed media rates | Creative comparison, top of funnel reporting | Not tied to net revenue, profit, or verified outcomes |

| ROAS | Revenue efficiency | Gross revenue, ad spend | Comparing efficiency across paid and creator programs | Ignores costs, so it can overstate success |

| ROI | Profitability | Net profit, total investment | Budget justification and scale decisions | Requires clean cost accounting and attribution |

The math difference that matters

- ROAS uses Revenue, not profit:

- ROAS = Gross Revenue / Ad Spend

- Useful when you need to show Revenue per dollar, but it does not tell you if the campaign was profitable.

- ROI uses profit and full Investment:

- ROI is built on Profit compared to Total Investment, not just the creator fee.

- Finance cares about Profit, because Profit is what remains after costs.

If you want a creator report to survive a CFO review, treat EMV as supporting context, not the headline. Lead with investment, revenue, and profit. Then back it up with transparent assumptions and a repeatable tracking method. For more on this, see metrics that matter.

The Exact Formulas to Calculate Creator ROI in 2026

1. ROI

Start with the only ROI formula a CFO will accept. Influencer marketing ROI is a profitability metric, not a feelings metric. The standard formula is:

ROI (%) = (Net Profit – Total Cost) / Total Cost x 100

This is the formula you should use when you want to claim a creator campaign “paid back” the budget.

2. Total Cost

Define Total Cost correctly, or your ROI will be wrong. Most influencer reports quietly treat the influencer fee as the whole cost. That is the fastest way to lose credibility with finance. Total Cost must include every real expense required to produce and fulfill the sale.

Include in Total Cost:

- Creator fees (and usage rights if paid separately)

- Agency fees or internal labor allocation (if you report that way)

- Product seeding costs (free product sent to creators)

- Cost of Goods Sold (COGS) for units sold

- Shipping and handling

- Payment processing fees and platform fees

- Returns, refunds, chargebacks (treat as revenue reduction or as cost consistently)

- Discounts and coupons (again, handle consistently)

If you leave out COGS and shipping, you can show a positive ROI on paper while the business loses money on every order.

3. Net Profit

Calculate Net Profit the same way your finance team does. Net Profit is what remains after costs. A simple way to structure it for creator campaigns is:

Net Profit = Net Revenue – Total Cost

Where Net Revenue is revenue after refunds, returns, and any adjustments your finance team uses. This is why Net Revenue matters more than top line gross sales when you are trying to prove real ROI.

4. Break-even Revenue

Know your break-even point before you scale. Before you ask for more spend, you should know the Break-even Point, meaning the minimum revenue you must generate to avoid losing money.

Break-even Revenue = Total Cost / Gross Margin %

Example:

- Total Cost of the influencer program this month: $50,000

- Your gross margin is 60% (0.60)

- Break-even Revenue = $50,000 / 0.60 = $83,333.33

If your attributed revenue is below $83,333.33, you are not breaking even yet. If it is above it, you have room to scale, assuming the attribution is credible.

5. CAC

Calculate Customer Acquisition Cost (CAC) for creator campaigns. ROI tells you profitability. CAC tells you efficiency of acquiring new customers, which is often how senior teams compare channels.

Influencer CAC = Total Spend / New Customers

Important details:

- Total Spend should match your Total Cost logic, not just creator fees.

- New Customers must be net new customers, not all purchases. Otherwise CAC looks artificially low.

Example:

- Total Cost: $50,000

- New customers attributed to creators: 250

- CAC = $50,000 / 250 = $200

If your blended CAC target is $150, creator CAC at $200 might still be acceptable if it brings higher CLV, stronger retention, or higher average order value. For a deeper breakdown, see calculating CAC: /marketing-efficiency-ratio.

6. CLV

Bring in Customer Lifetime Value (CLV) to judge payback, not just first purchase. Influencers often drive higher trust and higher intent, which can affect retention. That is why CLV matters, especially for subscriptions, high ticket items, or products with repeat purchase behavior.

A simple CLV model:

CLV = Average Order Value x Purchase Frequency x Gross Margin x Average Customer Lifespan

Then compare CLV to CAC:

- If CLV / CAC is healthy (many teams target 3x or more), the channel can be worth scaling even if first purchase ROI looks modest.

- If CLV is unknown, at least estimate the payback period: how long it takes gross profit to recover CAC.

7. What about brand awareness campaigns?

Use cost efficiency, not fake ROI. If the campaign truly has no conversion event to measure, you do not calculate financial ROI honestly. You measure cost efficiency for awareness outcomes, and you keep it separate from performance claims.

Practical options:

- Brand lift studies (awareness, consideration)

- Share of voice or search lift

- Cost per qualified visit, cost per email signup, or cost per lead, as a proxy when you are building the funnel

The key is consistency. If you want to say influencer marketing ROI improved, you must anchor it to profit math and full cost accounting, and then validate the attribution method you used to assign revenue and customers to influencers.

Attribution Models: Tracking the Invisible Touchpoints

If your influencer marketing ROI looks weaker than Facebook or Google, there is a good chance the campaign is not actually underperforming. You are likely seeing an attribution problem, not a performance problem. Influencer campaigns often create demand at the top of the funnel, while paid search, retargeting, or email captures the final click that converts. If you rely on Last-Click Attribution, creators will look expensive even when they are the reason the customer entered your world in the first place.

Below are the attribution models you can use to assign credit across touchpoints. The goal is not to “make influencers look good.” The goal is to assign credit in a way that reflects how people actually buy in 2026.

Last-Click Attribution

- What it does: Gives 100% credit to the final touchpoint before purchase.

- Why it breaks influencer campaign attribution: An influencer post might drive the first site visit, the email signup, or the app install. Then the customer returns later through Google search, a retargeting ad, or a branded direct visit. Last click gives all credit to the closer and none to the introducer.

- When it is acceptable: Rarely. It can work for impulse purchases with one session conversion, but most creator driven journeys are not one session.

First-Touch Attribution

- What it does: Gives 100% credit to the first recorded touchpoint.

- Why it helps: It credits discovery, which is often the influencer’s true role. It is useful when your objective is growing new demand and you need to prove the creator’s “opening” value.

- What it misses: It can undervalue the channels that do the heavy lifting in the middle and at close, like retargeting, email, sales, or affiliates.

Linear Attribution

- What it does: Splits credit equally across every touchpoint in the journey.

- Why it helps: It prevents one channel from stealing all credit and gives creditors a fair share when they are part of a longer path.

- What it misses: Not all touchpoints are equally important. Some are decisive. Some are noisy.

U-Shaped Attribution

- What it does: Assigns more credit to the first touchpoint and the last touchpoint, with the remaining credit spread across the middle touches. The model in this brief is: 40% First, 40% Last, 20% Middle.

- Why it is often best for creator campaigns: It matches how many influencer paths work. Influencers introduce the brand and frame the intent. Retargeting or search closes the deal. The middle touches still matter, but they should not erase discovery.

- How to use it in reporting: Treat the creator as the 40% opener when they are the first recorded touchpoint, or when they are the first meaningful engagement that can be verified (click, signup, install, or survey confirmed source).

Multi-Touch Attribution as the Umbrella Concept

- Multi-Touch Attribution is any approach that assigns credit across multiple touchpoints instead of one. First touch, linear, and U shaped are common “rules based” versions. More advanced versions use data driven weighting, but the principle is the same: share credit across the journey.

Why your influencer ROI can look lower than Facebook ads ROI

In many stacks, Facebook is the closest because it retargets the people who first visited from creators. If your reporting uses last click, Facebook appears to generate the sale “cheaply,” and creators appear to “not convert.” That is an attribution error. The sale was assisted by creators, but the credit was not assigned.

Visual description for a U-Shaped model diagram

Imagine a path that goes left to right with five boxes:

- Influencer Post

- Website Visit

- Email Signup

- Retargeting Ad

- Purchase

Above each box is a percentage.

- The Influencer Post box has 40% credit

- The Purchase box, labeled Retargeting Ad as the last touch, has 40% credit

- The three middle boxes share the remaining 20% credit equally, so each middle box gets about 6.7%

The diagram makes one point clear: the model gives real credit to both introduction and close, instead of letting Last-Click Attribution erase the first touchpoint.

The Tech Stack: Automating the Tracking Loop

A strong attribution model only works if you can capture the right data. The goal is simple: every creator touchpoint should leave a measurable trail that can be tied to a user, a lead, and eventually net revenue in your reporting. You do not need a perfect setup to start, but you do need a consistent one.

UTM Parameters for every single creator link

Create UTM Parameters for each influencer, each platform, and ideally each post.

Minimum fields to standardize:

- utm_source (influencer name or handle)

- utm_medium (influencer)

- utm_campaign (campaign name)

- utm_content (platform or post identifier)

UTMs make the first click traceable, which protects Creator Campaign Attribution from being erased by Last-Click Attribution in your analytics.

Promo codes to track conversions that happen without a click

Not every customer clicks a link. Some see a post and search your brand later, or share it in a chat. This is dark social, and it is common for influencer driven demand.

Promo codes give you a second line of tracking when link data is missing.

Best practice:

- Unique code per creator for clean attribution.

- A consistent code structure (for example INFLUENCER10 or BRAND CREATOR).

- A defined policy for discounting so codes do not destroy profit while chasing revenue.

Attribution pixels and conversion events

Use attribution pixels (your ad platform pixel or a server side event) to capture key actions:

- View content

- Add to cart

- Lead form submit

- Purchase or subscription start

Pixels let you build remarketing audiences and connect creator driven traffic to later conversions. They also help you see assisted conversions inside multi-touch views.

CRM integration from click to closed won

If you sell B2B, high ticket, or anything with a sales cycle, you cannot stop at checkout tracking. You need CRM Integration so each lead keeps its original source through the pipeline. Tools that are commonly used are HubSpot, Salesforce, and the like.

Minimum setup:

- Capture UTMs on the first visit and store them in hidden form fields.

- Push those fields into the CRM as lead properties.

- Maintain the original source through deal stages, not just last activity.

This is where creator programs become CFO friendly, because you can show an influenced pipeline, closed won revenue, and payback timing.

Post purchase surveys to fill attribution gaps

- A simple “How did you hear about us?” questions at checkout can catch what UTMs miss.

- Offer structured answers that include top influencers or “Creator on TikTok” or “YouTuber.”

- This is not perfect data, but it is often the only way to capture dark social influence when links are not clicked.

A practical reporting view that finance can trust

Build a weekly or monthly report that includes:

- Total Investment by influencer and by platform

- Attributed Net Revenue by model (first touch, U-shaped, or linear)

- Profit and Influencer Marketing ROI

- Creator CAC and payback period where possible

The point is to show the same language finance uses: Investment, Revenue, Profit, and time to recover spend.

The ROI Tracking Setup Checklist

- UTMs on every creator link, standardized naming convention

- Promo codes, ideally unique per creator

- Attribution pixels with key conversion events configured

- CRM Integration that stores original source and ties leads to closed won revenue

- A post checkout or post signup survey to capture dark social touchpoints

- A consistent attribution rule (often U shaped or linear) applied across reports

Conclusion

Influencer programs do not fail in finance reviews because creators “do not convert.” They fail because the measurement is incomplete. If you report EMV, views, or engagement as the headline, you are asking a CFO to fund feelings. In 2026, budget is won with revenue attribution, transparent cost accounting, and a repeatable method for assigning credit across touchpoints.

The fastest path to credible influencer marketing ROI is simple: pick an attribution model that reflects how people buy, and build a tech stack that captures the data consistently. For most teams, that means moving away from Last-Click Attribution, applying a U-Shaped or Linear approach for influencer campaign attribution, and enforcing tracking hygiene with UTMs, pixels, and CRM fields that survive the full journey to closed won.

If you want more budget next year, audit your current campaigns this month. Replace vanity reporting with Net Revenue, profit, CAC, and payback. Then you will have numbers that hold up in the boardroom.

Business

Earnings call transcript: Medifast Q4 2025 shows significant EPS miss

Earnings call transcript: Medifast Q4 2025 shows significant EPS miss

Business

Humble Growth acquires minority stake in SimplyFuel

Startup manufactures protein balls and snacks.

Business

Sysco Corporation (SYY) Presents at Consumer Analyst Group of New York Conference 2026 Transcript

Unknown Analyst

Good afternoon. Welcome back from the break. It’s now my pleasure to introduce Sysco Corporation. The leading global distributor of fresh food and related products to the food-away-from-home industry.

Sysco generated about $81 billion in sales in fiscal ’25 and serves roughly 730,000 customer locations with a business that is well balanced across customers and geographies. Many of us know Sysco best from seeing their trucks outside our favorite local restaurants, which make up 60% of sales, while the other 40% is built around recession-resistant categories, including government, education, health care and large campuses and office complexes, where Sysco also enjoys leading share positions.

I’m excited to turn the conference over to Kevin Hourican, President, CEO and Chairman; and Kenny Cheung, CFO, to dive deeper into the story and discuss the company’s specific initiatives that are driving structural improvements currently unlocking durable and compounding performance and supporting the company’s commitment to a steady return of capital to shareholders.

Before turning it over to Kevin, please join me in thanking Sysco for sponsoring dinner tonight. Kevin, thanks again, and over to you.

Kevin Hourican

CEO & Chairman

Thank you, everyone. It’s great to be back at CAGNY. We have the pleasure of being able to update you on our Sysco story, and it’s also our pleasure to be able to host you all for dinner tonight. I really do hope you have a chance to come join us. Our Sysco chefs will be here in force delivering the best of Buckhead Meat, FreshPoint produce, our Italian cuisine business, our Asian foods business and

Business

M4-Powered iPad Air Expected ‘In the Coming Weeks’ Amid Inventory Shortages

Apple is poised to launch an updated iPad Air featuring the M4 chip in the coming weeks, according to Bloomberg’s Mark Gurman, as retail stock shortages signal an imminent refresh for the mid-range tablet.

The report, published Feb. 12, 2026, cites declining inventory of the current M3 iPad Air models and the iPhone 16e, a pattern Gurman says typically precedes new product announcements. “Apple retail employees say that inventory of the iPhone 16e has basically dried out and the iPad Air is seeing shortages as well,” Gurman wrote in his Power On newsletter. “I’ve been expecting new versions of both (iPhone 17e and M4 iPad Air) in the coming weeks.”

The next-generation iPad Air — likely designated as the eighth-generation model — is anticipated to upgrade from the M3 processor introduced in March 2025 to the more powerful M4 chip, which debuted in the iPad Pro lineup in 2024 and later in MacBooks. Industry analysts expect the M4 to deliver roughly 20-30% gains in CPU and GPU performance over the M3, enhancing tasks such as video editing, graphic design and AI-driven features under Apple Intelligence.

Additional rumored enhancements include Apple’s custom N1 wireless chip for improved Wi-Fi connectivity, potentially supporting Wi-Fi 7 standards, and faster 5G capabilities via an updated modem. However, major design changes appear unlikely: the device is expected to retain the same slim aluminum chassis, Liquid Retina display (without ProMotion 120Hz refresh rate or OLED), camera setup and RAM configuration as the current models.

The refresh aligns with Apple’s historical spring timing for iPad Air updates. The M3 version arrived in March 2025 alongside a redesigned lineup, while prior generations often launched in March or April. Some reports suggest a possible March 2026 announcement, potentially tied to an Apple event on March 4 in New York City, London and Shanghai — though Apple has not confirmed the event’s focus. That date has fueled speculation about bundled reveals, including the iPhone 17e, entry-level Mac updates or other hardware.

Alongside the iPad Air, Apple is reportedly preparing a 12th-generation base iPad with the A18 chip (up from A16), enabling Apple Intelligence support for the first time on the entry-level model. The iPad mini is slated for a more substantial upgrade later in 2026, including an OLED display.

Pricing for the M4 iPad Air remains unconfirmed, but analysts anticipate a possible modest increase due to component costs and the chip upgrade, starting around the current model’s $599 for the 11-inch version. No official details on storage tiers, colors or accessory compatibility have surfaced.

Fan and consumer reactions on platforms like Reddit and X highlight mixed sentiment: excitement over the performance boost and better future-proofing for AI features, tempered by disappointment that the Air won’t receive the Pro-level display or design innovations. Many current M3 owners question whether the incremental upgrade justifies waiting or upgrading immediately.

Apple has not commented on the rumors or announced any launch plans. The company typically reveals new iPads through press releases or virtual events rather than full-stage keynotes for minor refreshes.

With shortages already reported and Gurman’s timeline pointing to late February or March 2026, potential buyers weighing an M3 iPad Air purchase may benefit from monitoring official channels closely in the coming days.

Business

Austin population grows 51% in households from 2014-2024 census data

Texas REALTORS Chairman of the Board Jennifer Wauhob speaks to Fox News Digital about the Lone Star State’s recent wealth and population boom that’s ‘creating good things for Texas.’

The Austin, Texas, region has seen its population grow rapidly over the last decade, with new data showing it added households at about four-times the pace of the nation as a whole.

Data from the National Association of Realtors showed that the metropolitan area encompassing Austin, Round Rock and San Marcos saw the number of households grow roughly 51% from 2014 to 2024.

The Austin region gained 357,000 households from 2014 to 2024, which brought the number of households in the region from 703,976 to 1,061,155 in that time. Over that same period, the number of households in the U.S. as a whole grew at a rate of about 13%.

NAR’s analysis found that household growth in the Austin metro area was driven across younger and older age groups.

ABBOTT UNVEILS 5-POINT PLAN TO OVERHAUL TEXAS PROPERTY TAXES, TARGETING RELIEF FOR HOMEOWNERS

The Austin area added households at roughly four-times the national rate over the 2014 to 2024 period. (iStock)

The data showed that the share of households in Austin, Round Rock and San Marcos led by those under the age of 25 grew from 5.1% to 5.9% from 2014 to 2024. Among those between the ages of 25 and 34, the proportion rose from 21.1% to 21.7%.

“Households headed by people in their late 20s and 30s grew significantly,” wrote NAR senior economist and director of real estate research Nadia Evangelou. “Those are the classic years for household formation. That’s when people move for jobs, form families, and step into the housing market for the first time.”

She said that growth in those age groups can spur demand for rentals and starter homes, keeping entry-level housing demand very strong and competitive, while eventually boosting demand for move-up properties.

MCMANSIONS BECOME FINANCIAL ‘LIABILITY’ AS BUYERS DITCH OVERSIZED HOMES

Austin saw strong demand for different classes of housing that met the needs of different age groups. (Mark Felix/Bloomberg via Getty Images)

The youngest age cohort of those under 25 in particular played a role in driving an influx of new apartment buildings, which helped lower rental prices in the area.

Older age groups also saw their share of the Austin area household mix rise, with the share of those led by people aged 65 to 74 rising from 9.5% to 10.7% from 2014 to 2025, while those over the age of 75 rose from 5.6% to 7% in that period.

“The number of households headed by those 65 and older increased significantly over the decade, and their share of total households rose,” Evangelou said. “That tells us Austin isn’t just attracting younger workers, it’s also keeping residents as they age.”

HOUSING MARKET COOLS AS PRICE GROWTH HITS SLOWEST PACE SINCE GREAT RECESSION RECOVERY

The Austin region’s growth kept demand strong for a variety of types of homes. (Matthew Busch/Bloomberg/Getty Images)

“That kind of growth creates steady demand for different types of housing: single-level homes, properties with less maintenance, and communities that allow people to age in place,” she explained.

With the growth in younger and older households, other age cohorts declined slightly. The share of households led by those between 35 and 44 was little changed, dipping slightly from 22.9% to 22.7%. Those between the ages of 45 and 54 fell from 19.2% to 17.7%, while the 55 to 64 age group declined from 16.6% to 14.2%.

The growth seen in Austin, Round Rock and San Marcos across different age groups helped keep demand strong for a variety of housing categories that cater to the needs of the disparate groups.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“When only one age group drives the market, demand tends to be concentrated in a single segment, demand tends to be concentrated in a single segment. But when young adults, families, and older households are all growing that the same time, housing demand becomes stronger across multiple price points and housing types,” Evangelou explained.

“Here is why: Starter homes remain in demand. Move-up homes stay competitive. Downsizing options matter more,” she added.

Business

How waste cooking oil collection benefits hospitality businesses

Most business owners view waste disposal as a necessary cost. You generate rubbish, you pay someone to take it away, and that is the end of the transaction.

However, one waste stream works differently: used cooking oil. Restaurants, hotels, and food manufacturers produce oil that can be collected through structured channels and handled responsibly, yet many businesses still follow traditional disposal methods.

Over the past decade, demand for biodiesel and sustainable aviation fuel (SAF) has increased as renewable energy targets have tightened. Used vegetable oil has become an established feedstock. Some businesses are still operating under older assumptions, not fully aware that professional collection provides an efficient and compliant solution for this type of waste.

How waste cooking oil collection works in practice

High-volume food businesses naturally generate significant quantities of used cooking oil. A busy restaurant or a larger hotel kitchen can produce hundreds of litres monthly. Using professional waste cooking oil collection services ensures this oil is handled safely and in line with environmental regulations.

Exact arrangements vary depending on volumes and service agreements, but the principle is consistent: used cooking oil is collected by licensed operators and businesses receive payment based on the quantity and quality of the oil. At the same time, kitchens avoid the risks associated with informal disposal methods. Companies such as Quatra provide compliant, licensed collection without adding operational complexity for kitchen staff.

Practical benefits for all businesses

Even small operations benefit from structured oil collection because it removes the need to manage disposal informally and reduces compliance risks. Proper collection supports reporting requirements for corporate clients and public sector tenders and demonstrates that a business is managing waste responsibly.

Environmental responsibility has become increasingly important to customers and business partners. Demonstrating that waste oil is collected and converted into renewable energy reinforces sustainability credentials. Combined with financial compensation, this adds measurable operational value without changing day-to-day kitchen routines.

Making the switch to structured collection

Transitioning to professional waste cooking oil collection is straightforward. Licensed collectors provide storage containers, manage logistics, and handle all compliance documentation. Staff procedures require minimal adjustment because the main change is storing oil for a licensed collector.

When choosing a provider, it is advisable to compare terms, check licensing credentials, and ensure that collection frequency and procedures meet operational needs. Reliable providers maintain clear and transparent arrangements so that the collection process is simple and effective.

Most UK businesses with commercial kitchens are still using outdated approaches for used cooking oil. Structured collection services now offer a balanced combination of regulatory compliance, environmental responsibility, and financial return.The infrastructure exists, the process is efficient, and businesses benefit from compliance and operational simplicity. This is one of those cases where environmental care and smooth business operations align naturally.

Business

Samsung Galaxy Buds4, Buds4 Pro Renders Revealed Ahead of Launch

The Samsung Galaxy Unpacked event is expected to take place next week, with several new products on the line. One of them is the upcoming wireless earbuds.

According to the latest rumors, the early renders of the Buds 4 and Galaxy Buds 4 Pro have been revealed, and here’s what they look like ahead of the most anticipated Samsung event.

Refined Design and Upgraded Charging Case

In an X post by reputable leaker Mohammed Khatri, the leaked images suggest Samsung is introducing subtle yet meaningful design refinements across both models. The Galaxy Buds4 and Buds4 Pro reportedly feature similarly styled charging cases with a sleek transparent lid, showcasing the earbuds positioned horizontally inside. The visual refresh gives the lineup a more modern and premium aesthetic.

Galaxy Buds 4 & Buds 4 Pro Renders Leaked 🔥

Entire design, box content, Buds shape, case lid and form factor revealed ✨️ First detailed look from all angles‼️

Both should be available in Black & White ⚫️⚪️

Follow for more 💬#GalaxyBuds4 #Samsung pic.twitter.com/dASG5bpmWN

— Mohammed Khatri (@Mohammed_K_2010) February 16, 2026

The earbuds themselves, however, take distinct approaches. The Galaxy Buds4 appear to adopt a semi-in-ear design without silicone tips, catering to users who prefer a lighter, more breathable fit for extended listening sessions.

Meanwhile, the Buds4 Pro retains a full in-ear design with silicone ear tips, offering improved passive noise isolation and a more secure seal during movement.

Samsung has also reportedly redesigned the stem with a flat outer surface, refining ergonomics while giving the earbuds a cleaner, more contemporary look.

Battery Capacity Differences

Battery life could be one of the key differentiators between the two models. Reports indicate that the Galaxy Buds4 Pro may feature a 57mAh battery per earbud, while the standard Galaxy Buds4 could include a smaller 42mAh cell.

Although official playback estimates have yet to be confirmed, the larger battery in the Pro model suggests extended listening time, particularly when using advanced features like active noise cancellation.

In terms of box contents, both versions are expected to ship with a charging cable. However, only the Buds4 Pro is rumored to include additional silicone ear tips, reinforcing its premium positioning.

Smarter Controls and New Software Features

Beyond hardware refinements, the Galaxy Buds4 lineup may introduce new software-driven capabilities. Rumors point to a pinch-and-hold gesture control system, enhancing intuitive navigation for music playback and calls.

GSM Arena also reported that an innovative Interpreter mode is also expected, and this potentially offers real-time language support through Samsung’s ecosystem. If integrated effectively, this feature could position the Buds4 series as more than just audio accessories, expanding their appeal for travelers and professionals.

How Much Are the Galaxy Buds4 and Buds 4 Pro

Audophiles can expect an approximate pricing of around €179 ($212) for the Galaxy Buds4, while the Galaxy Buds4 Pro may reach around €249 ($295). If the leaks prove accurate, Samsung’s next-generation earbuds could emerge as one of the standout audio releases of the year.

Originally published on Tech Times

Business

Thailand’s Department of Health Lowers “Normal Sweetness” Standard to 50%

Thailand’s Department of Health has redefined “normal sweetness” in beverages, reducing it from 100% to 50% to promote healthier choices, lower sugar intake, and reduce risks of health issues like obesity and diabetes.

Key Points

- Thailand’s Department of Health has revised the “normal sweetness” standard for beverages from 100% to 50% to promote healthier consumption and mitigate health risks associated with high sugar intake. This change, effective February 11, 2026, aims to lower the likelihood of overweight conditions and non-communicable diseases.

- The department highlights the benefits of reduced sugar intake, including improved skin health, stable blood sugar levels, and decreased abdominal fat. Lower sweetness levels also help restore taste sensitivity, making less-sweet foods more enjoyable.

- Taste receptors renew approximately every 14 days; initial dissatisfaction may occur but sticking to reduced sweetness for over 10 days can promote healthier eating habits and support overall well-being by easing the strain on the liver and pancreas.

Thailand’s Department of Health Redefines “Normal Sweetness” Standard to 50 Percent

The Department of Health has introduced a new standard for “normal sweetness,” reducing it from 100 percent to 50 percent to promote healthier beverage choices and reduce the risks associated with excessive sugar consumption.

On February 11, 2026, the Department of Health announced that the updated guideline aims to improve public health by halving the sugar content of beverages. This change is designed to reduce the risk of overweight conditions and non-communicable diseases (NCDs).

The Department also noted that reducing sugar intake benefits both skin and overall physical health. Choosing 50 percent sweetness can slow premature skin aging, support stable blood sugar for better concentration and reduced fatigue, and help decrease abdominal fat and water retention.

The Department added that reducing sweetness restores natural taste sensitivity, making less-sweet foods more enjoyable. Lower sugar intake also reduces strain on the liver and pancreas, supporting metabolism and lowering future risks of fatty liver disease and diabetes.

The Department explained that taste receptors for sweetness renew in about 14 days. It is normal to feel less satisfied at first, but maintaining reduced sweetness for over 10 days can make healthier choices easier to sustain.

Source : Thailand’s Department of Health Redefines “Normal Sweetness” Standard to 50 Percent

Other People are Reading

Business

Budget sees largest ever personal allowance rise

Treasury Minister Chris Thomas’s budget sees the tax-free allowance rise by £2,250 to £17,000.

Business

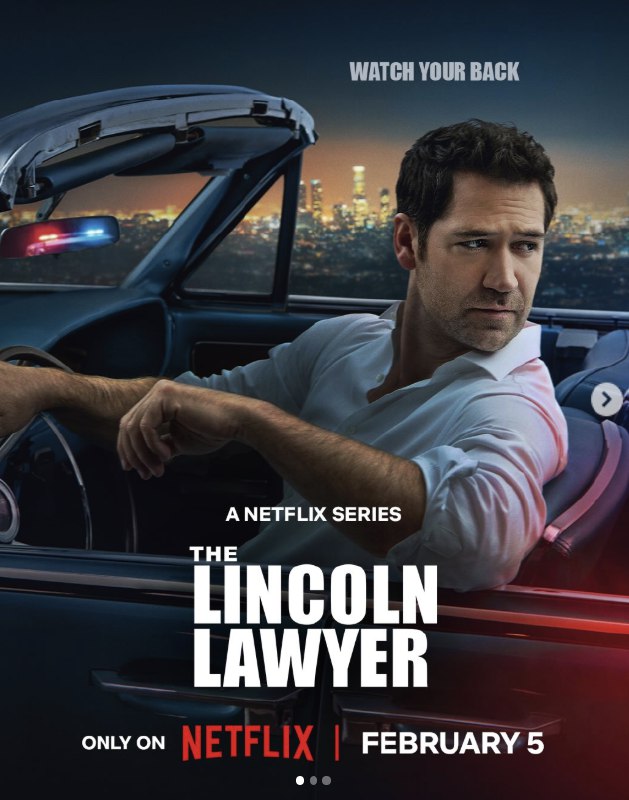

‘The Lincoln Lawyer’ Season 4 Delivers High-Stakes Drama as Mickey Haller Defends Himself in Murder Trial

Netflix’s hit legal thriller “The Lincoln Lawyer” returned Feb. 5, 2026, with its fourth season, thrusting charismatic defense attorney Mickey Haller into the role of defendant as he fights murder charges in a gripping adaptation of Michael Connelly’s novel “The Law of Innocence.”

The 10-episode season, which dropped all at once on the streaming platform, picks up directly from the shocking Season 3 finale where police discovered the body of former client Sam Scales in the trunk of Mickey’s signature Lincoln Continental. Framed for the killing, Mickey (Manuel Garcia-Rulfo) must navigate a relentless prosecution led by a tough district attorney while his team — including ex-wife Maggie McPherson (Neve Campbell), investigator Cisco (Angus Sampson), legal secretary Lorna Crane (Becki Newton) and driver Izzy Letts (Jazz Raycole) — works to uncover the truth from the outside.

The season marks a tonal shift, described by co-showrunner Ted Humphrey as the “most emotional” yet, blending intense courtroom battles, personal stakes and character-driven moments. Mickey’s trial tests his legal prowess from behind bars, forcing him to confront his own vulnerabilities. A major subplot involves the death of his mentor Legal Siegel (Elliott Gould), adding layers of grief and motivation. New cast members Cobie Smulders, Sasha Alexander and Constance Zimmer bring fresh dynamics, with Smulders and Alexander appearing in key supporting roles that heighten the intrigue.

Early viewership figures show strong performance: The season debuted with 9 million views in its first four days, securing the No. 2 spot on Netflix’s English TV list for the week of Feb. 5. Fan reception has been enthusiastic, with praise for Garcia-Rulfo’s performance in his most challenging arc yet. Garcia-Rulfo himself called Season 4 his favorite, highlighting the emotional depth and personal stakes for Mickey.

The trailer, released mid-January 2026, teased the high-tension premise: “On trial for a murder he didn’t commit, Mickey must face a relentless DA as he fights to prove his innocence, expose the real killer and save his firm.” A sneak peek of the first six minutes, shared Feb. 2, showed Mickey adjusting to life in prison while his allies rally.

The series, created by Ted Humphrey and David E. Kelley, continues to film primarily in Los Angeles, employing thousands of local cast and crew across its run. Production for Seasons 1-4 spanned 359 days and involved over 4,300 personnel, underscoring its economic impact in the region.

Netflix has already greenlit a fifth season, ensuring more cases for Mickey Haller. While plot details for future installments remain under wraps, the renewal signals strong confidence in the show’s enduring appeal.

Viewers can stream all 10 episodes of Season 4 exclusively on Netflix. Critical consensus on Rotten Tomatoes stands at 100% fresh based on early reviews, with audiences giving it a 77% Popcornmeter score.

As Mickey’s journey continues to captivate, “The Lincoln Lawyer” solidifies its place as one of Netflix’s premier legal dramas, blending procedural thrills with deep character exploration.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech18 hours ago

Tech18 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video13 hours ago

Video13 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World13 hours ago

Crypto World13 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports19 hours ago

Sports19 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery