Business

Treasury implementing Trump’s car loan interest tax break, Bessent says

FOX Business’ Max Gorden joins ‘Varney & Co.’ to break down President Donald Trump’s push for tiny Kei cars to be built in America and whether U.S. drivers are ready to downsize.

The Treasury Department is implementing President Donald Trump’s No Tax on Car Loan Interest policy, a measure designed to lower costs for American families, Treasury Secretary Scott Bessent said Wednesday.

The policy, enacted as part of Trump’s “big, beautiful bill,” allows eligible taxpayers to deduct up to $10,000 a year in car loan interest on new, U.S.-assembled vehicles purchased between 2025 and 2028.

“Treasury is implementing President Trump’s No Tax on American Car Loan Interest, putting money back in the pockets of working and middle-class families,” Bessent wrote on X.

“For new U.S.-assembled vehicles purchased in 2025-2028, eligible taxpayers can deduct up to $10,000 per year in auto loan interest, whether they itemize or take the standard deduction.”

THE “BIG, BEAUTIFUL, BILL” INCLUDES A CAR LOAN INTEREST TAX DEDUCTION. DO YOU QUALIFY?

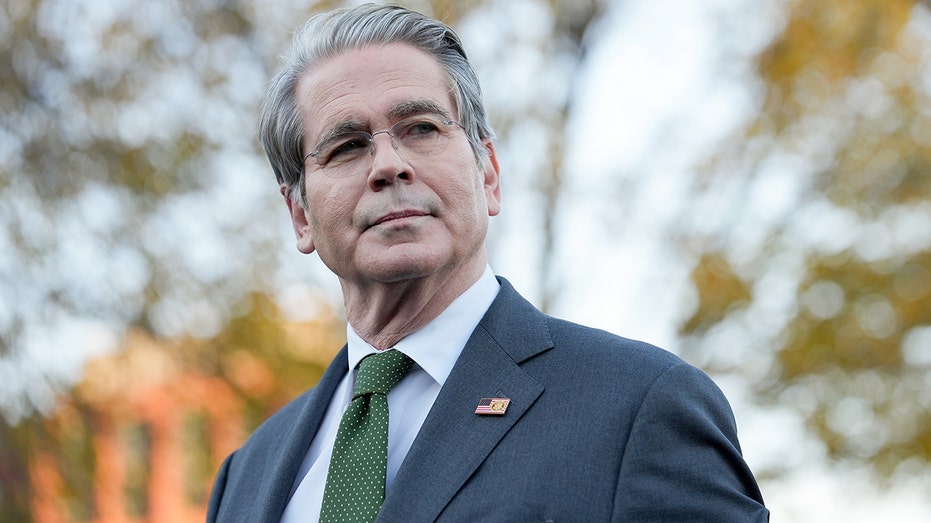

Treasury Secretary Scott Bessent said Wednesday he is implementing President Donald Trump’s No Tax on Car Loan Interest policy. (Eric Lee/Bloomberg via Getty Images / Getty Images)

Bessent said the Treasury Department and the IRS are rolling out clear guidance so taxpayers “know exactly how the deduction works.”

“For millions of Americans, a car isn’t a luxury, it’s how you get to work, school, and childcare,” Bessent said. “This deduction helps lower monthly costs and makes car ownership more affordable when families need it most.”

The tax break applies exclusively to vehicles assembled in the U.S., which Bessent said is intended to support American workers.

“The tax cut also supports American workers by applying solely to U.S.-assembled vehicles, strengthening domestic manufacturing,” he said.

AUTO LOAN INTEREST DEDUCTION IN ‘BIG, BEAUTIFUL BILL’

The tax break applies exclusively to vehicles assembled in the U.S. (iStock / iStock)

Signed into law July 4, the One Big Beautiful Bill Act includes several requirements for the auto loan interest deduction. It applies only to new cars, SUVs, vans, pickup trucks and motorcycles weighing under 14,000 pounds. Used vehicles are not eligible.

To qualify, the vehicle must be purchased for personal use — not business or commercial purposes — and its final assembly must be done in the U.S.

Final assembly refers to a process by which the major components of a vehicle — engine, transmission, body and chassis — are fully integrated, and the vehicle is completed at a U.S.-based manufacturing plant, automotive expert Lauren Fix previously told FOX Business.

Buyers must also be the vehicle’s first owner, and the loan must be secured by a lien against it, according to Kelley Blue Book.

AMERICANS WILL GET ‘GIGANTIC’ TAX REFUND NEXT YEAR, TREASURY SECRETARY SAYS

The policy was enacted as part of Trump’s “big, beautiful bill.” (Yuri Gripas/Abaca/Bloomberg via Getty Images / Getty Images)

The deduction shrinks for higher earners, phasing out for individuals making more than $100,000 a year and joint filers earning more than $200,000.

The IRS has not yet released an official list of qualifying vehicles and models.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“I will make interest on car loans fully tax-deductible,” Trump said at a North Carolina campaign rally in October 2024, according to Reuters.

“I am only going to do it if they build that particular product — namely an automobile — in the United States.”

The Treasury Department and IRS did not immediately respond to FOX Business’ request for comment.