What impact will Donald Trump’s second coming have upon the world? The world is unpredictable. Trump is also unpredictable. His first presidency transformed the US and the world. His second is likely to have a deeper impact.

“From this day on,” Trump said in his inaugural address, “the United States of America will be a free, sovereign and independent nation.” We are so used to such expressions of self-pity from him and those around him that they have (almost) ceased to startle. Yet he is speaking of the world’s most powerful country, which has been at the forefront of innovation for one and a half centuries, and has shaped the world we live in. What on earth has prevented the US from being a free, sovereign and independent nation? The answer, it seems, is self-imposed obligations and voluntarily accepted constraints on its own power. Now, he suggests, the US will do whatever it wants. The US ceases to have pretensions to moral leadership: it proclaims itself another great power under the old motto: “might makes right”.

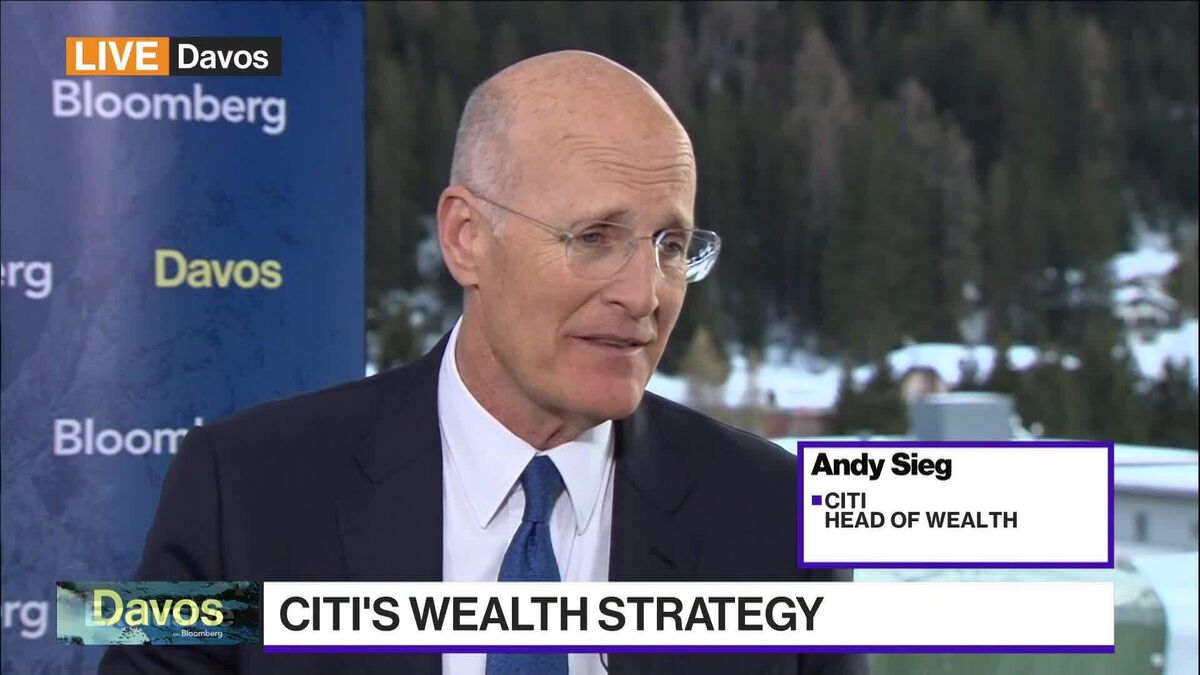

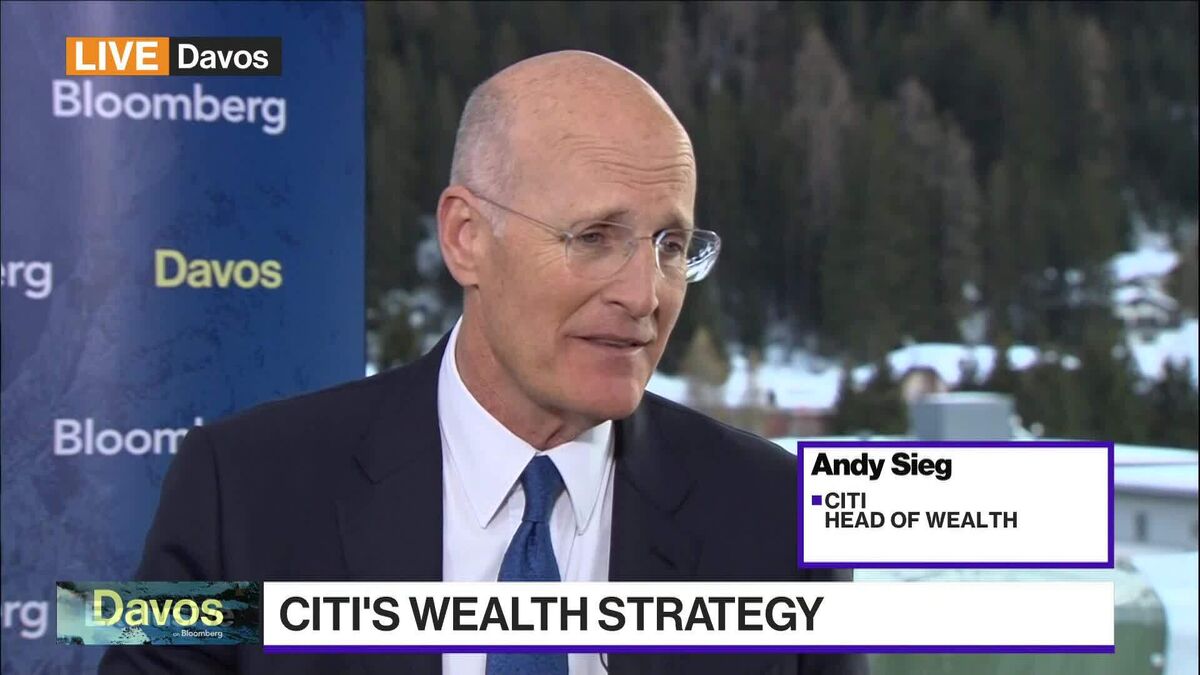

How does the world view this event? In “Alone in a Trumpian World”, the European Council on Foreign Relations has just published the results of surveys of public opinion across the world. They are fascinating. The people most disturbed by Trump’s second coming are citizens of its closest allies. Only 22 per cent of citizens of the EU, 15 per cent of the British and 11 per cent of South Koreans think his return is a good thing for their country. Meanwhile, 84 per cent of Indians, 61 per cent of the people of Saudi Arabia, 49 per cent of Russians and 46 per cent of the Chinese think it is good for their country. (See charts.)

This, suggests the report, signals “the publics’ embrace of a much more transactional world”. Yet, for close US allies it marks the end of the bonds of trust on which they rely. They can be free-riders on US power no longer. Maybe that serves them right. But this is about more than their mere dependence. Postwar Europeans really believed in the “liberal international order”. For them, its disappearance is a huge disappointment. The so-called “global south” mostly never did and so is more comfortable with Trump’s transactional approach.

In two important areas — trade and the global environment — Trump’s approach will create special challenges. In the former, there was indeed a liberal order, built around global institutions that promoted trade liberalisation and provided substantial stability to the trade policy environment. This was of particular importance to trade-dependent small economies. As a result, the ratio of trade in goods to world output rose from 5 per cent at the end of the second world war to 15 per cent at the end of the cold war and 25 per cent on the eve of the global financial crisis. Since then it has stagnated.

How much damage will the tariff wars launched by Trump do? Trade has collapsed before. Will it do so again? Trump has the idea (one of his many silly ones) that foreigners will pay his tariffs. In fact, Americans will: he is not just a bully, but a stupid one. Pity poor Canada and Mexico. How then should victims respond? Retaliation, argues Harvard’s Dani Rodrik, is costly to those who embrace it. So, be cautious.

A second crucial area is climate change. This, say Maga Republicans, is a hoax. So, Trump declares that “we will drill, baby, drill”. In 2024, according to Nasa, global temperatures were 1.28C above its 1951-80 baseline, the highest ever recorded. Atmospheric concentrations of CO₂ continue to rise. So, it is to be “burn, baby, burn”. This indifference to the fate of the planet could prove devastating. That, too, creates huge concerns for the rest of the world.

Meanwhile, will King Donald be able to bask in an American economic renaissance? It is unlikely, not least because the economy he has inherited is very far indeed from the disaster he ceaselessly proclaims it to be. On the contrary, the US economy has far outperformed its peers since the pandemic. In its January World Economic Outlook Update, the IMF states that “growth is projected to be at 2.7 per cent in 2025”. This is 0.5 percentage points higher than in its October forecast and a rate other high-income economies can only dream of. Trump should thank Joe Biden for this bequest.

Given how good things are, the easiest way from here is down. In the short to medium run, the combination of a persistently loose fiscal policy with wild deregulation, the tariffs and the mass expulsion of immigrants is likely to reignite inflation. That would then trigger a destabilising conflict between the president and the Federal Reserve. Combined with a new bout of financial deregulation, this could trigger another financial crisis. This, in turn, would cause the collapse of a historically highly valued stock market, the one metric Trump cares about. Moreover, Trump inherits a fiscal deficit forecast by the Congressional Budget Office at 6.2 per cent of GDP this year, with debt in the hands of the public at 100 per cent and rising sharply. This is an unsustainable path. The hope seems to be that massive spending cuts will close the gap. But these will not be big enough and would come at the expense of his political supporters. Perhaps, in his second term, he no longer cares. But they surely will.

Trump is unpredictable. Maybe, he will deliver a just peace in Ukraine and the Middle East. Maybe, he will put most of his threats and promises in the Oval Office waste paper basket, bask in his status and leave his country and the world in good shape. Substantial damage to the western alliance, world trade, the global environment, and US and global institutions seems more likely. Yet he proclaimed, in this speech, that: “My proudest legacy will be that of a peacemaker and unifier. That’s what I want to be.” It’s what we all want him to be, too.

You must be logged in to post a comment Login