Business

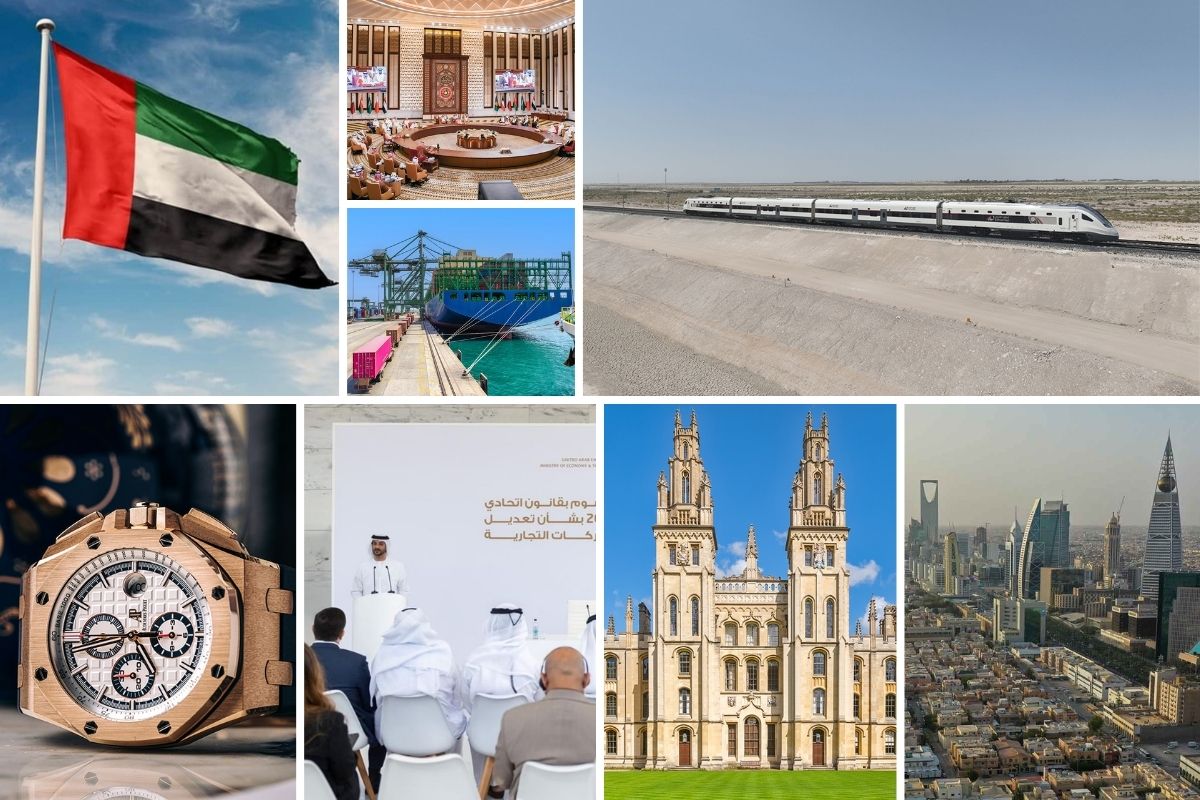

UAE rail plans revealed, Saudi markets open up and Dubai property holds firm – 10 things you missed this week

Across the UAE and Saudi Arabia, governments moved decisively on rail, real estate, capital markets and corporate regulation. Exclusive interviews and data-led reports also shed light on shifting investment trends, from luxury watches to property and ports.

Catch up on 10 of the biggest stories this week as selected by Arabian Business editors.

UAE passenger rail network: Etihad Rail reveals full national system connecting 11 cities ahead of 2026 launch

The project will deliver the UAE’s first fully integrated national passenger rail system, connecting 11 cities and regions through strategically located stations. The network is designed to strengthen connectivity across the Emirates and provide safe, reliable mobility services for citizens, residents and visitors.

In early 2025, Etihad Rail announced the first four passenger stations in Abu Dhabi, Dubai, Sharjah and Fujairah. The company has now confirmed the remaining planned stations in Al Sila’, Al Dhannah, Al Mirfa, Madinat Zayed, Mezaira’a, Al Faya and Al Dhaid. These stations will become operational in phases.

EXCLUSIVE: Saudi Global Ports unveils $933m expansion to challenge UAE transshipment dominance

The operator of Dammam port is ploughing funds into container terminals, multi-purpose facilities and a new integrated logistics zone to exploit geographic advantages over Emirati rivals as the kingdom’s non-oil economy expands.

Chief executive Rob Harrison told Arabian Business the investment represents phase three in the company’s evolution from port operator to ecosystem developer, positioning Saudi Global Ports to serve the kingdom’s 36 million consumers more directly than transshipment-focused competitors.

Saudi Arabia to officially open property market to foreigners as long-awaited law takes effect this month

Saudi Arabia will this month formally open parts of its real estate market to foreign buyers, bringing into force a long-awaited law that allows non-Saudis to own property in designated areas of the Kingdom.

The new Law on Non-Saudis’ Ownership of Real Estate, approved by royal decree last year and published in the official gazette in July 2025, came into effect on January 21 following a six-month transition period. This marks one of the most significant structural shifts in the Kingdom’s property market in decades and is closely aligned with the government’s broader economic diversification agenda under Vision 2030.

For months before the law was formally approved, developers, investors and advisers had been closely tracking its progress, with expectations building that Saudi Arabia would eventually follow other Gulf markets in easing restrictions on foreign ownership. While foreign investment in Saudi real estate has been permitted in limited forms since 2000, the new legislation replaces that older framework with clearer rules, wider eligibility and stricter enforcement.

Dubai real estate holds firm in 2025 as prices, rents and ROI climb: top areas revealed

The Dubai real estate sector remained firmly on a growth trajectory in 2025, supported by steady demand and expanding supply, according to the Annual Dubai Property Market Report released by dubizzle.

The report points to sustained transactional activity and overall stability across key segments, including ready properties, off-plan sales and short-term rentals, reinforcing confidence across Dubai’s residential market.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and dubizzle and CEO of Dubizzle Group MENA, said: “Dubai’s real estate market kept up its momentum throughout the year, with steady demand across the board. We’ve also seen the industry evolve, supported by stronger regulation, new partnerships and emerging innovations like real estate tokenisation, which are adding more confidence and depth to the market.”

UAE holidays 2026: How to get 45 days off with just 17 of annual leave, expected Eid dates revealed

The UAE started 2026 with an official holiday for the public and private sector on Thursday, January 1.

The Gregorian New Year is just one of many official public holidays legislated in Cabinet Resolution No. (27) of 2024 Concerning the Public Holidays in the State in the UAE. The ruling identifies the official UAE holidays observed across the country every year.

The UAE has announced prospective holiday dates for occasions such as Eid Al Fitr, Eid Al Adha, the Islamic New Year and National Day in 2026. By booking annual leave strategically, it will be possible to have 45 days off and multiple full weeks of vacation for just a few days of annual leave.

UAE overhauls Commercial Companies Law with new ownership and transfer rules

The UAE Ministry of Economy and Tourism has outlined major amendments to the country’s Commercial Companies Law, introducing far-reaching reforms aimed at strengthening business flexibility, reducing costs and enhancing the country’s investment appeal.

At a media briefing reviewing Federal Decree-Law No. 20 of 2025, which amends Federal Decree-Law No. 32 of 2021, officials confirmed that the changes span 15 articles and introduce a new provision regulating the transfer of a company’s registration in the commercial register while preserving its legal identity.

Abdulla bin Touq Al Marri, Minister of Economy and Tourism said the UAE continues to pursue a long-term, forward-looking vision to build an advanced and pioneering business environment for companies of all sizes, aligned with global best practices and guided by the country’s leadership.

Saudi Arabia opens capital market fully to foreign investors from February 2026

The move removes long-standing restrictions on non-resident participation and is designed to deepen liquidity and attract additional international capital. The announcement was made by the Capital Market Authority (CMA) following approval by the CMA Board of a new regulatory framework governing foreign investment in the Main Market.

Under the new framework, the Saudi capital market will be accessible to all categories of foreign investors for direct participation across all its segments, effective from February 1, 2026.

EXCLUSIVE: Watches are not a ‘get-rich-quick’ investment but can be ‘better than gold or cash’ in 2026

The global luxury watch market stands at an inflection point as 2026 begins. After three years of corrections following the post-pandemic speculative peak, the industry is showing early signs of stabilisation yet the investment landscape for watches has shifted significantly.

“Think of watches less like stocks and more like portable wealth. They work best as a store of value with the potential to appreciate over time, not as a get-rich-quick investment,” Robertino Altiero, CEO of WatchGuys.com, said in an exclusive interview with Arabian Business.

According to experts, the market now rewards selectivity over speculation and heritage over hype. For investors in the Gulf region where discretion and long-term wealth preservation has trumped short-term gains, the current environment presents challenges and opportunities.

UAE restricts scholarships for citizens studying at British universities amid radicalisation fears

In June, the UAE’s higher education ministry published a list of global universities for which scholarships would be approved and qualifications certified, as part of reforms limiting funding to top-performing institutions. The list included universities in the US, Australia, Israel and France, but excluded the UK, home to many of the world’s leading academic institutions.

The exclusion is linked to UAE concerns over what it perceives as the risk of Islamist radicalisation on UK campuses, according to three people familiar with the matter cited by the FT.

A new Gulf order? What December’s Bahrain summit tells us about the future of the GCC

On the surface, the Bahrain summit looked like any other Gulf gathering. A familiar family photograph. Ornate reception halls. A final communiqué thick with references to brotherly relations and shared destiny. Yet behind the choreography, something more serious was going on.

For the first time in years, all the moving parts of Gulf integration – customs, aviation, rail, security, even real estate regulation – were pulled in one direction and given deadlines. Piece by piece, the summit revealed a bloc finding its full rhythm – not by proclamation, but through the steady, technical discipline of shared systems. The Supreme Council’s statement on December 3 was unequivocal on one point. The security of the GCC states is “indivisible” and “any aggression against any one of them is an aggression against all of them.”

It explicitly linked this to the joint defence agreement and King Salman’s long-running vision to move the bloc from loose cooperation towards something closer to a union. It also pushed ministers to complete the remaining steps of economic unity, from the customs union to a common market for services, and to report back on a “defined timetable”.