Business

UK Online Casinos Face Further Increased Costs

Recently published figures for Q3 of the 2025-26 financial year revealed gross gambling yield (GGY) for UK online casinos of £1.5 billion. Will they be able to continue posting such results amid rising costs in the coming months?

The cost of a UK Gambling Commission (UKGC) licence is likely to be increased later this year. It’s the latest piece of bad financial news for UK online casinos. Although the online gambling industry continues to post impressive results, there are also concerns about the dangers of addiction.

Last year saw a new mandatory levy come into force. UK gambling sites reviewed by Dailystoke.com had been making voluntary payments with funds going towards researching gambling harm and treatment of those who have been affected. However, the government felt not all companies were making an equal contribution and introduced a mandatory levy. This is aimed at raising £100 million a year with some of the funds going to the NHS.

Then came the Autumn Budget which included details of a rise in Remote Gaming Duty. A rise had been considered long overdue but companies were shocked when the rate went up from 21% to 40%. This will come into force in April of this year. A further rise in sports betting tax rates will take place next year.

There has been stricter regulation introduced in the past year and more is likely to come into force in the future. One major rule change last year saw maximum stakes for online slots introduced and this year, action has been taken against the bonuses UK online casinos offer.

Financial results published since the maximum stakes for online slots were introduced haven’t been bad news for online casinos. Slots provide a large proportion of GGY for sites and for Q3 the figure was £788 million 10% higher than recorded in the same period 12 months ago.

The average length of sessions for players has fallen from 18 minutes to 16 minutes but sites will be relieved to see the high GGY figure. The overall GGY of £1.5 billion was up from the £1.42 recorded in Q2. However, compared to Q3 of the previous financial year, there was a 2% fall.

Last month saw a consultation period begin regarding a rise in the cost of a UKGC licence. These are required for a company to legally operate in the UK. As you will read, there are many companies who are unlicensed and causing serious problems for the Treasury, legal operators and gamblers.

The UKGC has a tough task regulating the gambling industry and regularly investigates companies who may have committed regulatory breaches. This has seen several companies issued with fines when breaches have been confirmed. With the UKGC also looking to deal with the problems being caused by illegal sites, their costs have been steadily increasing and not been matched by their level of funding, hence the existence of a shortfall that needs to be closed.

That is why they are calling for a rise of an average 30% but there are other options currently being discussed in the consultation period. Other options are a 20% increase and the one that the government prefers. That would see a 30% rise in licence fees but only 20% would be used for commission-related costs with the remaining 10% ring-fenced and only used for specific regulatory priorities. These would include strengthening their enforcement capabilities and taking action against illegal operators.

The UKGC say that if the increase was to be only 20%, this would lead to savings of £15.8 million needing to be made and possibly a 10% cut in staffing levels by 2030-31. They would find it difficult to be able to carry on their current level of investigating suspected regulatory breaches.

How would UK online casinos be affected by a further rise in costs on top of the mandatory levy and tax increases? Stricter regulation is driving players to the black market and that is a worrying problem for the legal sites. It’s not good news for players either as the levels of customer protection are not as high as they do not need to adhere to the new rules. The Treasury does not receive any mandatory levy or tax contributions so a strong UKGC is needed to lead the fight against the illegal operators.

Top companies such as bet365, Flutter Entertainment and Entain are global businesses. If the levels of regulation continue to increase as well as the higher costs, they may be forced to make cuts in the UK and concentrate more on overseas interests in South America, the USA and Asia.

Business

Supreme Court tariff ruling could allow over $160B in tariff rebates for firms

The Big Money Show panel breaks down the Supreme Court’s 6-3 decision striking down President Donald Trump’s sweeping tariffs, what it means for billions in potential refunds and how the administration’s Plan B could reshape the trade fight.

The Supreme Court on Friday struck down a significant portion of the Trump administration’s tariffs that the justices found the tariffs were imposed illegally under an emergency economic powers law.

The Court issued a 6-3 ruling that held President Donald Trump’s use of the International Emergency Economic Powers Act (IEEPA) was illegal as the law “does not authorize the President to impose tariffs. The cases – Learning Resources Inc. v. Trump and Trump v. V.O.S. Selections – were brought by a pair of small businesses: an educational toy manufacturer and a family-owned wine and spirits importer.

Chief Justice John Roberts authored the majority opinion, which did not discuss the issue of tariff refunds. Justice Brett Kavanaugh, one of the three dissenters, noted in his dissent that the issue of distributing tariff refunds was described during oral arguments as “likely to be a ‘mess’.”

“The United States may be required to refund billions of dollars to importers who paid the IEEPA tariffs, even though some importers may have already passed on costs to consumers or others” Kavanaugh wrote. “Refunds of billions of dollars would have significant consequences for the U.S. Treasury. The Court says nothing today about whether, and if so how, the Government should go about returning the billions of dollars that it has collected from importers.”

SUPREME COURT DEALS BLOW TO TRUMP’S TRADE AGENDA IN LANDMARK TARIFF CASE

The Supreme Court’s ruling didn’t outline a process for how tariff refunds may proceed. (Sam Wolfe/Bloomberg via Getty Images / Getty Images)

While the Court’s ruling doesn’t explicitly outline a process for refunds and the Trump administration hasn’t specified how it would handle refunds, importers who paid IEEPA tariffs will be able to bring litigation to pursue those refunds.

That could play out through claims made via the U.S. Court of International Trade or through appeals made to Customs and Border Protection, which collects tariffs and duties on behalf of the Department of Homeland Security and remits them to the Treasury Department. Importers typically have 180 days after goods are “liquidated” to file a protest and request refunds from CBP, which could factor into what importers are eligible to receive refunds.

KEVIN HASSETT SAYS FED ECONOMISTS SHOULD BE ‘DISCIPLINED’ OVER TARIFF STUDY

The nonpartisan Penn-Wharton Budget Model estimated that the reversal of the IEEPA tariffs will generate up to $175 billion in refunds.

A similar analysis by the nonpartisan Tax Foundation estimated that more than $160 billion of tariffs were illegally collected under IEEPA through Feb. 20 of this year. It said that, “If the IEEPA tariffs are fully refunded to U.S. importers, it would erase nearly three-fourths of the new revenues from President Trump’s tariffs. The U.S. government should make the process for importers to receive their refunds as simple and transparent as possible.”

President Donald Trump said the issue of tariff refunds will play out in court. (Denis Balibouse/Reuters)

What the Trump admin is saying about tariff refunds

Trump said at a press conference that the ruling was “deeply disappointing” and that he is “ashamed of certain members of the Court” for “not having the courage to do what’s right for our country.”

The president went on to criticize the Supreme Court for not addressing tariff refunds in the decision and said that the issue will play out in court, and declined to say whether the administration would provide refunds.

“I guess it has to get litigated for the next two years. So they write this terrible defective decision, totally defective. It’s almost like not written by smart people. And what they do, they don’t even talk about that,” Trump said.

BATTLEGROUND STATES SHOULDER BURDEN OF TRUMP’S TARIFFS AS MIDTERM MESSAGING RAMPS UP

Treasury Secretary Scott Bessent said in a January interview with Reuters that, “It won’t be a problem if we have to do it, but I can tell you that if it happens – which I don’t think it’s going to – it’s just a corporate boondoggle. Costco, who’s suing the U.S. government, are they going to give the money back to their clients?”

Bessent added that the process for issuing tariff refunds could take a significant amount of time, saying that, “We’re not talking about the money all goes out in a day. Probably over weeks, months, may take over a year, right?”

Treasury Secretary Scott Bessent said last month that the Treasury has the funds to issue tariff refunds, but warned the process may be time-consuming. (John Lamparski/Getty Images)

What experts are saying

Tim Brightbill, co-chair of Wiley International Trade Practice Group, said that the Supreme Court ruling “could lead to the refund of hundreds of billions of dollars in tariff revenue – so the question of whether there will be a refund process and what it will look like is extremely important.”

“More than 1,000 lawsuits have already been filed at the U.S. Court of International Trade in an effort to secure tariff refunds in the event of a Supreme Court decision against the IEEPA tariffs,” Brightbill noted.

David McGarry, research director at the Taxpayers Protection Alliance, said that the decision “does not make clear how this money will be returned to its rightful owners, but litigation on behalf of many illegally tariffed businesses is already commencing.”

“The Supreme Court has ruled, and it is now the obligation of the Trump administration to ensure that this process carries on at minimal cost to American businesses – especially small businesses. Uncertainty is anathema to economic growth. Businesses ought to be confident that the money they were improperly compelled to hand over to the federal government will soon be returned,” McGarry added.

TARIFFS MAY HAVE COST US ECONOMY THOUSANDS OF JOBS MONTHLY, FED ANALYSIS FINDS

Trump’s IEEPA tariffs were ruled illegal, as the underlying law doesn’t authorize the president to impose tariffs. (Chip Somodevilla/Getty Images)

Scott Lincicome, vice president of general economics at the Cato Institute’s Herbert A. Stiefel Center for Trade Policy Studies, said that, “Most immediately, the federal government must refund the tens of billions of dollars in customs duties that it illegally collected from American companies pursuant to an ‘IEEPA tariff authority’ it never actually had.”

“That refund process could be easy, but it appears more likely that more litigation and paperwork will be required – a particularly unfair burden for smaller importers that lack the resources to litigate tariff refund claims yet never did anything wrong,” Lincicome added.

US BUSINESSES SHIFT AWAY FROM CHINA UNDER TRUMP TARIFFS

Nixon Peabody partner Joseph Maher, who served as the principal deputy general counsel of the Department of Homeland Security between 2011 and 2024, said that “there will be further litigation in the Court of International Trade to determine the remedies available for tariffs already paid,” adding that “U.S. importers should be vigilant to protect their interests in the payments demanded over the past year.”

JPMorgan chief economist Michael Feroli said that tariff rebates could pose an upside risk to the economy, though he noted “we won’t know the full amount or timing of any such rebates.”

“While the official data from CBP is a bit stale, we estimate the amount at stake to be around $150-200 billion. If the rebates were passed on to consumers, the boost to activity would be significant. In the more likely event that businesses keep the cash, the boost to activity would be smaller, as estimates of the fiscal multiplier from windfall transfers to businesses are usually quite small,” Feroli wrote.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Heather Long, chief economist at Navy Federal Credit Union, noted that “small firms may struggle to get any money back from the U.S. Treasury,” and said that it’s “likely the White House will fight against issuing refunds at all.”

Business

AppLovin shares pare gains as SEC confirms active probe

AppLovin shares pare gains as SEC confirms active probe

Business

Simple Mills earns Non-UPF Verified Standard certification

Twenty products meet the new standards.

Business

(VIDEO) Supreme Court Strikes Down Trump’s Sweeping Tariffs in 6-3 Ruling

The U.S. Supreme Court on Friday struck down President Donald Trump’s expansive tariffs imposed on imports from nearly every trading partner, ruling that he exceeded his authority under a 1977 law meant for national emergencies.

AFP

In a 6-3 decision, the justices held that the International Emergency Economic Powers Act (IEEPA) does not authorize the president to unilaterally impose tariffs. Chief Justice John Roberts wrote the majority opinion, joined by Justices Sonia Sotomayor, Elena Kagan, Neil Gorsuch, Amy Coney Barrett and Ketanji Brown Jackson. Justices Clarence Thomas, Samuel Alito and Brett Kavanaugh dissented.

The ruling invalidates a core pillar of Trump’s economic policy, including the widely publicized “Liberation Day” tariffs — a 10% across-the-board duty on imports from most countries, with higher rates on key partners like Canada (up to 35%), Mexico (25%), China, the European Union, Japan and South Korea. These measures, enacted via executive orders citing foreign economic threats as a national emergency, have generated more than $130 billion to $200 billion in revenue since implementation, according to estimates from the Tax Foundation and other analyses.

Roberts emphasized the limits of executive power in his opinion. “Based on two words separated by 16 others in … IEEPA—’regulate’ and ‘importation’—the President asserts the independent power to impose tariffs on imports from any country, of any product, at any rate, for any amount of time,” he wrote. The court agreed with challengers, including businesses and states like California, that such broad authority requires explicit congressional approval, not emergency declarations.

The decision affirms lower court rulings and sends related cases back to the U.S. Court of International Trade to address remedies, including potential refunds to importers who paid the duties. Those costs were largely passed on to consumers and businesses through higher prices, with studies estimating an average household impact of around $1,751 last year in states like California.

The ruling marks a rare instance where the conservative-led court has curbed Trump’s use of executive authority, echoing prior decisions limiting broad presidential actions. It does not affect all tariffs — those imposed under other statutes, such as Section 232 national security tariffs or Section 301 unfair trade practices, remain intact — but it wipes out the sweeping IEEPA-based ones central to Trump’s “America First” trade strategy.

The White House reacted swiftly. President Trump reportedly called the decision a “disgrace” in private, according to sources cited by multiple outlets. Aides indicated plans to invoke alternative trade authorities to reimpose similar measures quickly, potentially through existing laws allowing targeted tariffs. Trump is scheduled to hold a news conference Friday afternoon to address the ruling directly.

Market reaction was positive in the immediate aftermath, with U.S. stocks rising as investors welcomed reduced uncertainty over broad trade disruptions. Economists noted that removing the tariffs could shield the economy from further inflationary pressures and protect taxpayers, though uncertainty lingers over potential replacements. The Committee for a Responsible Federal Budget estimated that, absent new actions, the ruling could increase projected deficits by about $2 trillion over the next decade by eliminating tariff revenue.

The tariffs stemmed from Trump’s long-standing view that unfair trade practices by foreign nations justified aggressive countermeasures. Supporters argued they protected domestic industries, boosted manufacturing and forced better trade deals. Critics, including affected businesses, importers and some allies, contended they functioned as a tax on Americans, raised costs for goods and strained international relations.

States like California, which filed lawsuits challenging the tariffs, hailed the decision. Gov. Gavin Newsom called for immediate refund checks — with interest — to families and businesses, arguing the duties illegally raised costs passed on to consumers. Ports in Los Angeles and other hubs had seen shifts in import patterns due to the duties.

The case consolidated challenges, including Learning Resources Inc. v. Trump and V.O.S. Selections v. United States, highlighting how the tariffs affected everyday products from toys to wine. Importers argued the emergency declaration stretched IEEPA beyond its intent, originally designed for sanctions against hostile foreign actors rather than broad trade policy.

Dissenters, led by conservative justices, warned of practical fallout. Kavanaugh suggested the ruling might create a “mess” requiring billions in refunds while not permanently limiting future presidential tariff authority under other laws.

The decision arrives amid ongoing global trade tensions and domestic economic debates. It underscores congressional primacy in taxation and commerce, as Article I of the Constitution grants Congress the power to lay and collect duties.

For now, the ruling halts the most sweeping elements of Trump’s tariff regime, forcing the administration to pivot. Whether new measures emerge — and how trading partners respond — will shape U.S. trade policy in the coming months.

As the administration weighs next steps, businesses and consumers await clarity on import costs and supply chains. The court’s message was clear: emergency powers have limits, even for a president pursuing signature priorities.

Business

Philippine Central Bank Delivers Another Rate Cut as Economy Slows

The Philippine central bank cut rates at its first meeting of the year, a widely expected move as weak growth underlines the need for more economic support.

Bangko Sentral ng Pilipinas lowered its benchmark overnight reverse repurchase rate by 25 basis points to 4.25% from 4.50% on Thursday, delivering a sixth straight round of easing. It reduced its benchmark lending rate to 4.75% from 5.00%.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Strawberry Fields REIT, Inc. 2025 Q4 – Results – Earnings Call Presentation (NYSE:STRW) 2026-02-20

Q4: 2026-02-19 Earnings Summary

EPS of $0.15 beats by $0.02

| Revenue of $40.10M (31.51% Y/Y) misses by $203.00K

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

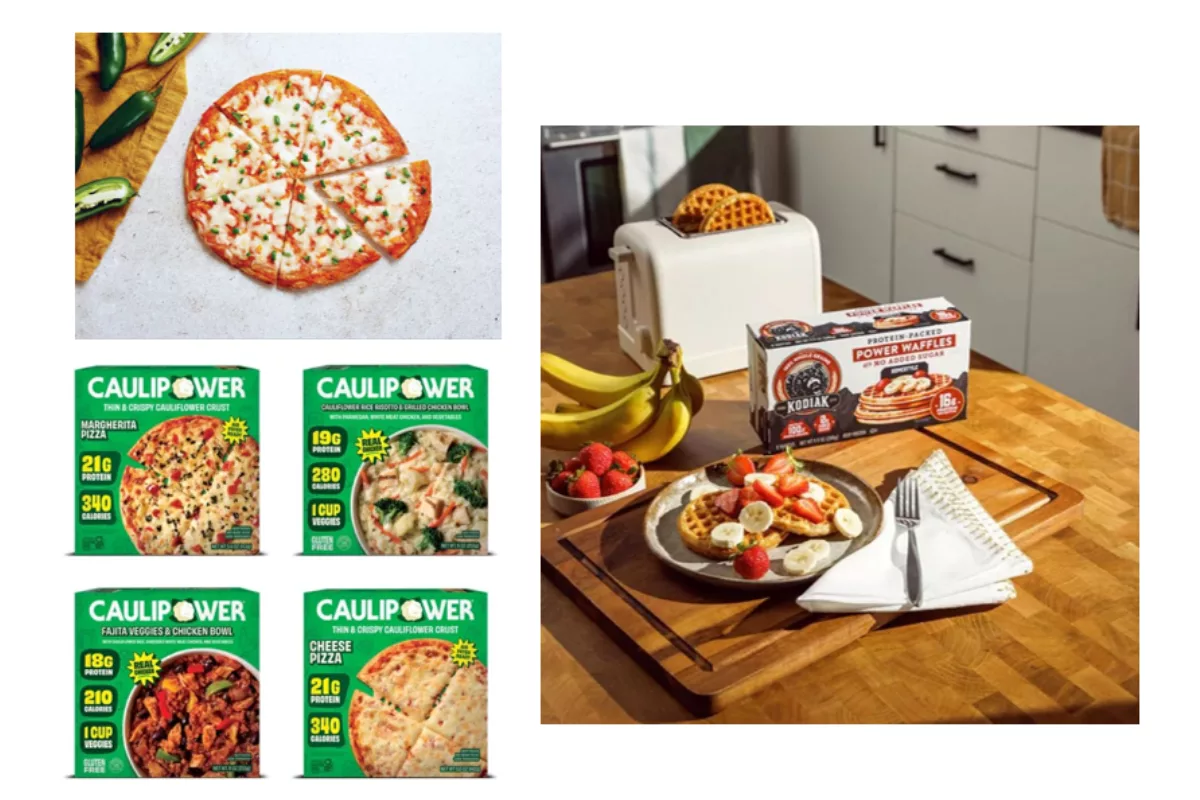

Slideshow: New products from Tattooed Chef, Kodiak and Caulipower

New food items are freezing over into retailers.

Business

JPMorgan taps CHIPS, defense officials for $1.5 trillion security initiative push, memo says

JPMorgan taps CHIPS, defense officials for $1.5 trillion security initiative push, memo says

Business

Form 8K SRX Health Solutions Inc For: 20 February

Form 8K SRX Health Solutions Inc For: 20 February

Business

MYR Group stock hits all-time high at 283.87 USD

MYR Group stock hits all-time high at 283.87 USD

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video18 hours ago

Video18 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World22 hours ago

Crypto World22 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics3 days ago

Politics3 days agoEurovision Announces UK Act For 2026 Song Contest