Donald Trump’s call for a new oil boom will be thwarted by Wall Street’s reluctance to approve another drilling binge, shale bosses have warned.

Total US oil output in Trump’s second term will rise by less than 1.3mn barrels a day, said Rystad Energy and Wood Mackenzie, well below the 1.9mn b/d rise achieved under Joe Biden and much less than in the shale bonanza years in the previous decade.

Executives said investor pressure on companies and the economic realities of a sector always beholden to oil prices would be obstacles to Trump’s quest to launch an era of “American energy dominance”.

“The incentive, if you will, to just drill, baby, drill . . . I just don’t believe that companies are going to do that,” said Wil VanLoh, chief executive of private equity group Quantum Energy Partners, one of the shale sector’s biggest investors.

“Wall Street will dictate here — and you know what? They don’t have a political agenda. They have a financial agenda . . . They have zero incentive to basically tell the management teams running these businesses to go and drill more wells,” VanLoh said.

The reality on the ground could be a disappointment for Trump, who is betting that a big jump in oil supply can beat back US inflation by making goods and fuel cheaper.

“We will bring prices down . . . We will be a rich nation again, and it is that liquid gold under our feet that will help to do it,” the president said in his inauguration speech on Monday.

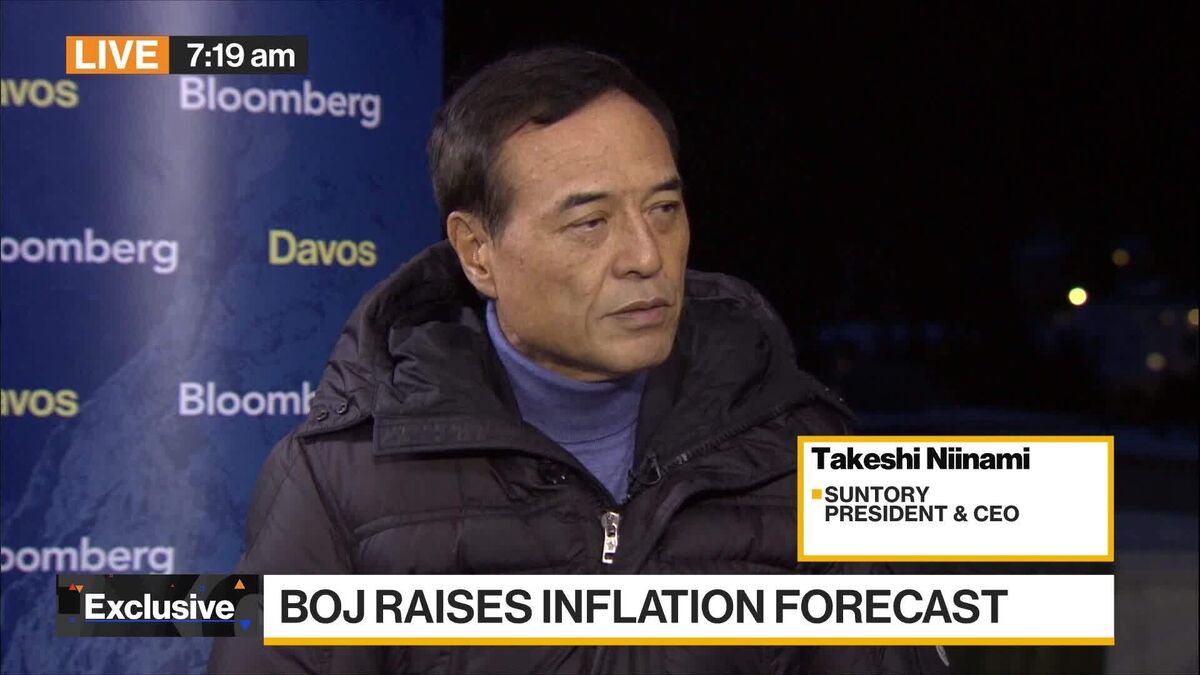

In Davos on Thursday he also called on the Opec cartel to slash oil prices, suggesting this would allow central banks to cut interest rates around the world “immediately”.

But lower oil and gas prices would make shale companies less profitable — and less likely to follow Trump’s command to “drill, baby, drill”, executives warned.

“Prices will be a bigger signal than politics,” said Ben Dell, managing partner at Kimmeridge, an energy investment firm that owns shale assets including in Texas’s Permian Basin, the world’s most prolific oilfield.

After US oil production hit a record high last year, the Energy Information Administration expects output will grow just 2.6 per cent to 13.6mn b/d in 2025 before rising by less than 1 per cent in 2026 due to price pressures.

Some shale producers are also concerned that the best locations have been tapped after more than a decade of breakneck exploration across states such as Texas and North Dakota.

After his swearing-in ceremony this week, Trump signed executive orders to “unleash” new oil and gas supplies and declare a “national energy emergency”. He has also moved to eliminate Biden-era regulations that drillers say increased their costs and restricted activity.

But executives warned that even Trump’s full-throated support for fossil fuels and deregulation could have limited impact.

“As much as the incoming administration is very favourable around energy and power . . . we don’t see a significant change in activity levels going forward,” said David Schorlemer, chief financial officer of ProPetro, an oilfield services company in the Permian.

Producers’ reluctance comes after two decades of soaring growth — and sometimes punishing oil price volatility.

US oil and gas production exploded in the past 15 years as drillers found ways to unlock vast deposits locked in shale rocks. Wall Street funded a headlong drilling race that made the US the world’s biggest oil and gas producer.

But brutal price crashes in 2014 and 2020 triggered widespread bankruptcies, a more cautious approach from investors and a change in producers’ behaviour — especially in the face of softer crude prices.

A recent Kansas City Federal Reserve survey found the average US oil price needed for a substantial increase in drilling was $84 a barrel, versus about $74 a barrel today.

JPMorgan predicts that US oil prices will drift down to $64 per barrel by the end of this year and shale activity will “slow to a crawl” in 2026.

“If prices are anaemic, you can remove all the red tape you want. It’s not going to move the needle on production,” said Hassan Eltorie, director of companies and transaction research at S&P Global Commodity Insights.

America’s second-biggest oil producer Chevron — a huge shale investor — plans to cut spending this year for the first time since the pandemic oil crash, budgeting $14.5bn-$15.5bn for 2025, down from $15.5bn-$16.5bn last year. Exxon, by comparison, will raise its capex in the coming years.

ConocoPhillips expects to lower spending by $500mn from last year, and Occidental Petroleum and EOG Resources are to hold activity levels roughly flat — decisions designed to please Wall Street.

“The shareholders of these energy stocks . . . if you do more [capital spending] than they would allow, they will scream bloody murder and sell your stock,” said Cole Smead, chief executive of Smead Capital Management, which invests in a handful of oil companies, including Chevron and Occidental Petroleum.

You must be logged in to post a comment Login