Business

What are income tax rates and National Insurance thresholds?

Getty Images

Getty ImagesMany people will pay more tax after Chancellor Rachel Reeves announced in the Budget that tax thresholds will be frozen until 2031.

Thresholds set the point at which people have to start paying tax, or paying a higher rate. Income tax brackets used to rise every year in line with inflation.

What are income tax and NI thresholds and why do they matter?

The amount of money you can earn before paying various rates of income tax will not be increased in line with rising prices.

Instead the bands – known as tax thresholds – will stay frozen until 2031. That is three years longer than previously planned.

This means any kind of pay rise could drag you into a higher tax bracket, or see a greater proportion of your income taxed than would otherwise be expected.

We are “asking everyone to make a contribution”, Reeves said as she confirmed the move. “I know that maintaining these thresholds is a decision that will affect working people,” she said.

The previous Conservative government had already frozen the tax-free personal allowance and NI threshold at £12,570 until 2028. It also kept the higher-rate tax threshold at £50,270.

Freezing the thresholds means that any pay rise could move you into a higher tax bracket, or see a greater proportion of your income taxed.

Reeves’s further freeze means 780,000 more people will start paying income tax, according to the Office for Budget Responsibility (OBR).

It will also create 920,000 more higher-rate tax payers, and 4,000 more additional-rate income tax payers, it said.

Freezing thresholds will raise £8bn in 2029-30, it added.

What are the current income tax rates?

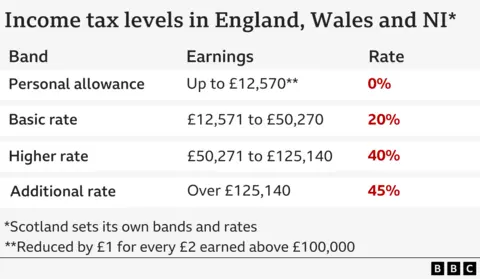

You have to pay income tax on your earnings from employment, or profits from self-employment, above the tax-free personal allowance of £12,570.

Income tax is also paid on some benefits and pensions, income from renting out property, and returns from savings and investments above certain limits.

The basic rate of 20% is paid on annual earnings between £12,571 and £50,270.

The higher rate of 40% is paid on earnings between £50,271 and £125,140.

Once you earn more than £100,000, you also start losing the £12,570 tax-free personal allowance. You lose £1 of your personal allowance for every £2 that your income goes above £100,000.

Anyone earning more than £125,140 a year no longer has any tax-free personal allowance.

They also pay an additional rate of income tax of 45% on all earnings above that amount.

These rates apply in England, Wales and Northern Ireland.

Some income tax rates are different in Scotland, where a new 45% band took effect in April 2024. At the same time the top rate also rose from 47% to 48%.

What is National Insurance and what does it pay for?

The government uses National Insurance to pay benefits and help fund the NHS.

It is paid by employees, employers and the self-employed across the UK. Those over the state pension age do not pay it, even if they are working.

Eligibility for some benefits, including the state pension, depends on the National Insurance contributions (NICs) you make across your working life.

It may be possible to make voluntary payments to fill gaps in your contribution history.

How much do employees currently pay in National Insurance?

The type and amount of NI you pay depends on your age, employment status and income.

Workers start paying NI when they turn 16 and earn more than £242 a week, or have self-employed profits of more than £12,570 a year.

The amount owed is usually deducted automatically from employees’ wages along with income tax.

The starting rate for NI for employees fell twice in 2024: from 12% to 10%, and then again to 8%. The previous Conservative government said these cuts were worth about £900 a year for a worker earning £35,000.

For the self-employed, the rate of NI paid on all earnings between £12,570 and £50,270 fell from 9% to 6%. This was said to be worth £350 to a self-employed person earning £28,200.

Most self-employed people pay their NICs through their self assessment tax return.

The NI rate on income and profits above £50,270 is 2% for all workers.

How much do employers currently pay in National Insurance?

Since April 2025, employers pay NI at 15% on most employees’ wages above £5,000. They previously paid 13.8% on salaries above £9,100.

This rate was frozen until £5,000 2027-28 and that has been extended for an additional three years until 2030-31 at this Budget.

Businesses also pay 15% NI on expenses and benefits they give to their staff – such as company cars or health insurance.

The employment allowance – the amount employers can claim back from their NI bill – rose from £5,000 to £10,500.