Business

What Is Risk? | Seeking Alpha

da-kuk/iStock via Getty Images

The risk that matters most is the risk of permanent loss [of capital]. – Howard Marks

The many varieties of risk

“Risk” is a funny word. In the context of investing, it is used constantly; however, if you ask somebody to define what he or she really means, you are likely to be met with plenty of hesitation. “Risk” is one of those words we all use every day without giving too much thought to what it actually means.

When I think about risk, though, one definition towers over and above all the other ones. To me, when investing, “risk” is mostly, but not exclusively, about the risk of permanently losing your capital. Whichever of those silos above you think offer the best description of risk, in almost all cases, the risk of a permanent loss of capital hovers above it. In the following, I will talk about how the risk of that can be minimised.

How to measure risk

When professional investors manage risk, two measures of risk tend to dominate:

- (equity) beta; and

- value at risk (VaR).

Allow me to spend a minute on how to define the two terms. Equity beta is a measure of the sensitivity of a stock (or portfolio) relative to movements in the equity market. If you assume the equity market is represented by S&P 500, an equity beta of 1 suggests the stock in question will move in line with S&P 500, whereas an equity beta suggests the stock in question is more (less) volatile than S&P 500.

The beta can be measured against other benchmarks as well – doesn’t have to be against the equity market. If, for example, you wish to measure the sensitivity to commodity prices, you calculate the commodity beta, etc, etc.

VaR is a bit more complicated. It is a measure of the maximum expected loss over a given time horizon and at a pre-defined confidence level (typically 97.5% or 99%) assuming normal market conditions . The latter is a very important assumption.

The primary problem with both of those measures is that they are akin to rear-mirror viewing. One cannot be sure that history will repeat itself, and both measures depend, to a significant degree, on historical patterns being repeated. That said, there isn’t much you can do to improve the analytical outcome. One option is to introduce a Month Carlo model when calculating the VaR, which will eliminate the dependence on history, but that won’t protect you against every possible outcome.

Every day, we calculate the equity beta on every single holding in our fund, and we calculate the portfolio VaR. In terms of the latter, we work with a self-imposed limit of 3%; i.e. we aim to keep the portfolio’s 97.5% 1-day VaR below 3%.

How you should manage risk

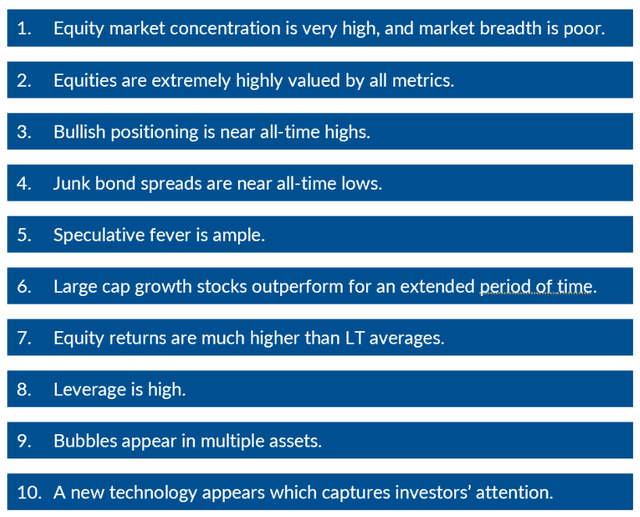

Most private investors don’t have the tools, nor the time, to spend hours every day on risk management, so a more pragmatic approach is warranted. I suggest the following approach: identify a handful or two of indicators which, historically, have led to the party coming to an abrupt end. To me, the ten most important ‘end of secular bull market’ indicators are listed in Exhibit 1 below.

Exhibit 1: End of secular bull market indicators

Sources: The Felder Report, Absolute Return Partners LLP

I work with these indicators in a rather simple way. Essentially, the more boxes I can tick, the more likely, I believe, it is for the secular bull market to come to an end rather soon. Now to the serious part: All ten boxes are currently ticked off! That tells me that the end might not be that far away. Three caveats:

1. Secular bull markets rarely end ‘just’ because equities are expensive. Some sort of catalyst shall be required.

2. When going through this exercise, you may end up with a different set of indicators than me but that matters less. Choose those that you are comfortable with and that have worked for you over the years.

3. Timing is the most difficult part of an exercise like this, and it is easy to be (too) early – in fact so early that it poses real career risk to professional investors, and that is probably why many prefer to stay on the train until it is too late to get off without an injury or two.

Re the last point, I learnt in 1990 when Tokyo Stock Exchange crashed, and again in 2000 when the same happened in New York, that most investors prefer to participate in the party to the very end, knowing very well that they may end up with plenty of (rotten) egg on their face.

Nothing has convinced me that investors have changed even the slightest. Momentum continues to drive markets forward, whatever asset class you look at, and the crowd mentality is stronger than ever. That is sort of a “if my neighbour got rich on gold, why shouldn’t I do the same?” mentality, which is very dangerous.

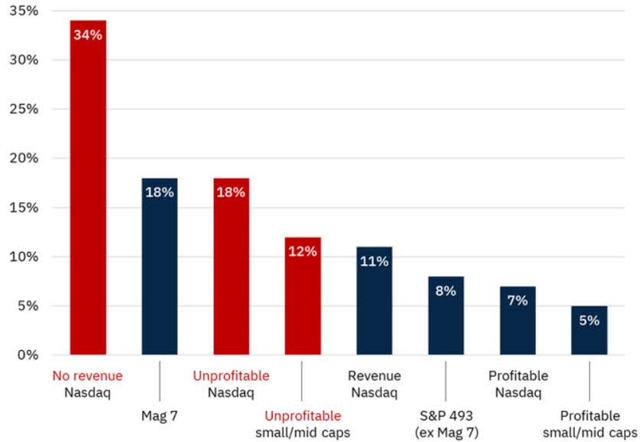

Allow me to finish this month’s Absolute Return Letter by sharing a chart from Goldman Sachs (GS) which shows how abundant speculative fever currently is (#5 on the list above). The chart was produced last October, i.e. it only provides 2025 data through September, but there is no reason to believe that anything happened in 4Q25 which would change the picture.

Exhibit 2: Price return on various US equities (Note: 2025 to 30 September)

Source: Goldman Sachs Global Investment Research

Now to my point: If Nasdaq stocks with no revenues delivered the highest return to US investors in Q1-Q3 last year, and if unprofitable Nasdaq stocks came joint second, isn’t that about as strong a signal you can get that speculative fever is ample?

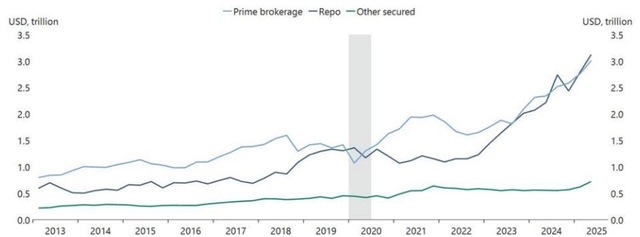

I could indeed provide plenty of other charts to support the issues I listed in Exhibit 1 but will only do one more – leverage is high (#8). Exhibit 3 below is testament to the fact that it is not only retail investors who get carried away from time to time. As you can see, in recent years when equity returns have been particularly strong, what have hedge funds done? Piling on ever more leverage, is the answer. This can only end in tears.

Line chart showing Hedge fund borrowings by source from 2013 to 2025.

Source: Apollo Global Management

Final few words

In the fund we manage, we are, at least to a degree, caught in the same dilemma. It is easy to see (many) equities are overvalued, but by going too conservative you risk missing out on returns. Consequently, we remain nearly fully invested but with a defensive twist. We hold large positions in low beta equities and in certain commodities which tend to do much better than equities when stocks decline. Most importantly, we hold plenty of gold.

Rather surprisingly, our ‘defensive’ approach still led to extraordinary returns in 2025. We finished the year delivering +29.24% net to USD investors. That is obviously very pleasing; however, at the same time, I find it uncharacteristically worrying. If you deliver almost 30% to your investors, do you in fact take more risk than you think you do? Finding the answer to that question has kept us very busy in January.

Niels

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Business

Can Omnitech IPO deliver long-term growth for investors?

The promoter group’s stake will fall to 74.2% after the IPO from 94.1%. The company has a loyal customer base with 97% of revenue coming from repeat business. With about 79% of its revenue coming from exports, including 58% from the US, the company faces geographical and tariff related risks. Additionally, It exhibited a longer working capital cycle and had negative cash flow from operations in FY25. Given these factors, investors may wait to see clarity in financials.

Business

Incorporated in 2006, Omnitech caters to customers across sectors such as energy, motion control and automation, industrial equipment systems, metal forming and others. It has three manufacturing units, all in Gujarat thereby creating geographic concentration risks. For instance, flooding from excessive rainfall in FY25 disrupted operations. It has a leased warehouse in Houston, USA. The company imports about 37% of its materials and uses hedging techniques to reduce currency risks.

Agencies

AgenciesWorld Matters Biz is growing at high-precision components maker, but co is exposed to tariff shifts and has longer working capital cycle

Financials

Between FY23 and FY25, revenue grew by 39.1% annually to ‘342.9 crore and net profit rose 16.5% to ‘43.9 crore. Around 30% revenue comes from top three customers. The company has a longer working capital cycle – net working capital days at 256 in the six months to September. This may increase working capital needs thereby raising interest outgo.

Cash flow from operating activities was ‘11.8 crore in the first half of FY26, but the company faced operating cash flow deficit of ’69 crore in FY25, dropping from positive cash flow of ‘39.4 crore in FY23. Though return on equity (ROE) dropped sharply to 21.6% in FY25 from 53.9% in FY23, it remains well above peer range of 6-13%. For the six months ended September 2025, the company’s revenue and net profit was ‘228.2 crore and ‘27.8 crore, respectively.

Valuation

Considering the post-IPO equity and annualised profit for FY26, the price-earnings (P/E) multiple is 50 compared with above 66 for peers including Azad Engineering, Unimech Aerospace and Manufacturing, and PTC Industries.

Business

Vedanta share price rise 5% as BofA upgrades stock to Buy, raises target price by 75%. Here’s why

The international brokerage cited a more constructive outlook for aluminium prices, supportive silver prices and an attractive dividend yield of over 6% estimated for FY27. It also highlighted that significant deleveraging at the parent level reduces the risk of any increase in brand-fee rates or inter-corporate loans.

BofA has raised its FY26E–FY28E EBITDA estimates for Vedanta by 16–21%, factoring in higher aluminium price assumptions, an increased fair value for Hindustan Zinc, depreciation in the USD-INR rate and a lower holding-company discount of 5%, compared with 15% earlier.

Vedanta Q3 snapshot

Vedanta reported a 61% year-on-year jump in consolidated profit to Rs 5,710 crore for the third quarter, with revenue rising 19% to Rs 45,899 crore. EBITDA climbed 34% year-on-year and 31% sequentially to a record Rs 15,171 crore, while margins expanded sharply to 41%, supported by higher metal prices, stronger premiums, improved volumes and cost efficiencies.

The aluminium business stood out operationally, with alumina production rising 57% year-on-year to a record 794 kilo tonnes, while aluminium cost of production declined 11% year-on-year to $1,674 per tonne, aiding margin expansion. Zinc India and international zinc operations also delivered strong growth on the back of favourable commodity prices and improved volumes.

The stronger operating performance translated into better capital efficiency, with return on capital employed improving to 27%, up nearly 300 basis points from a year ago.

Vedanta share price performance

Vedanta share price has been off to a strong start in 2026, rallying 20% on a year-to-date basis. The stock is up 60% in the last six months.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Form 144 AUTOLIV INC For: 25 February

Form 144 AUTOLIV INC For: 25 February

Business

Cognex head of corporate M&A sells $3.46 million in stock

Cognex head of corporate M&A sells $3.46 million in stock

Business

Piyush Pandey sees buying opportunity in IT stocks despite AI fears

According to Pandey, current valuations are “extremely comfortable” and most stocks are trading below their five-year averages. “As of now, it looks like most of the stocks are in oversold zone and I would say, the fears from the AI are overblown. And as most of these management we also believe that AI would provide more opportunities in the medium to long term. In fact, there can be some price deflation for certain legacy projects, but that should be more than compensated with increasing volume of IT projects,” he explained in an interview to ET Now.

Pandey emphasized that while the near-term impact might be temporary, IT companies are well-positioned for growth over the next one to two years.

When asked whether the AI disruption is materially different from previous technology shifts such as cloud and internet adoption, Pandey noted, “Even with this disruption, it is more about improvement in productivity. Revenue per employee would increase, headcount addition would be more measured, and some routine tasks can get automated. IT services companies are well entrenched in the entire IT ecosystem where they understand the client’s context and their tech journey over decades.”

He added that this productivity boost could make previously unviable legacy transformation projects feasible. “Near term we might see some disruption, but I remain positive and it looks like even for FY27 performance would be slightly better compared to what we had in FY26,” Pandey said.

Concerns over AI reducing man-hours and impacting revenue models were addressed as well. “In this AI age I believe it would shift from man-hour base to fixed price or outcome-based projects. There has been significant increase in productivity, especially in coding hours, but for clients who were previously unable to implement IT projects, now it becomes easier and more affordable,” he said.

On margin pressure, Pandey commented, “There would be some margin compression for legacy projects. But as IT companies move towards outcome-based billing, margins would be broadly protected. For global tech companies in the US, if they cannot monetize AI properly, their margins can take a hit. There is more of a bubble case in AI for US tech companies, but for Indian companies, the opportunities are just too huge.”From an investor’s perspective, Pandey recommends patience. “Let the price stabilise, maybe it can take a month or so. But at the current valuations, if somebody has a long-term horizon… and even Q4 would be reasonably good. So, if somebody has a longer term, one can add; otherwise, they can wait for the prices to stabilise.”

He advises a balanced approach between largecap and midcap IT names. “I would say mix of a largecap and Infosys and Coforge one can have 50-50,” he said, highlighting them as top picks.

Pandey also flagged key metrics to monitor in the AI-driven IT cycle: “Companies will start reporting on deal TCV, especially AI-led deal TCV, and one needs to track the pace at which AI-led deal TCV grows. Even Infosys reported around 5.5% revenue from AI-led services and TCS had a similar number at around 5.8%, that $1.8 billion. AI-led revenue, AI-led deal TCV, and how the mix is changing quarter to quarter needs to be tracked. Plus, headcount addition is still important to keep their employee pyramid intact.”

With measured optimism, Pandey believes the Indian IT sector is poised to navigate AI disruption while delivering value to long-term investors.

Business

HSBC ADR earnings beat by $0.03, revenue topped estimates

HSBC ADR earnings beat by $0.03, revenue topped estimates

Business

RealReal chief product officer sells $210k in stock

RealReal chief product officer sells $210k in stock

Business

Mortgage Rates Dip Under 6%. 3 Things Weighing on Housing Stocks.

Mortgage Rates Dip Under 6%. 3 Things Weighing on Housing Stocks.

Business

Everything you need to know about the new school uniform law

New guidelines have been issued by the Department of Education in the wake of law changes on uniforms.

Business

Virginia Governor Spanberger rips into Trump on economy, immigration

Virginia Governor Spanberger rips into Trump on economy, immigration

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World24 hours ago

Crypto World24 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World7 days ago

Crypto World7 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech13 hours ago

Tech13 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat9 hours ago

NewsBeat9 hours agoPolice latest as search for missing woman enters day nine