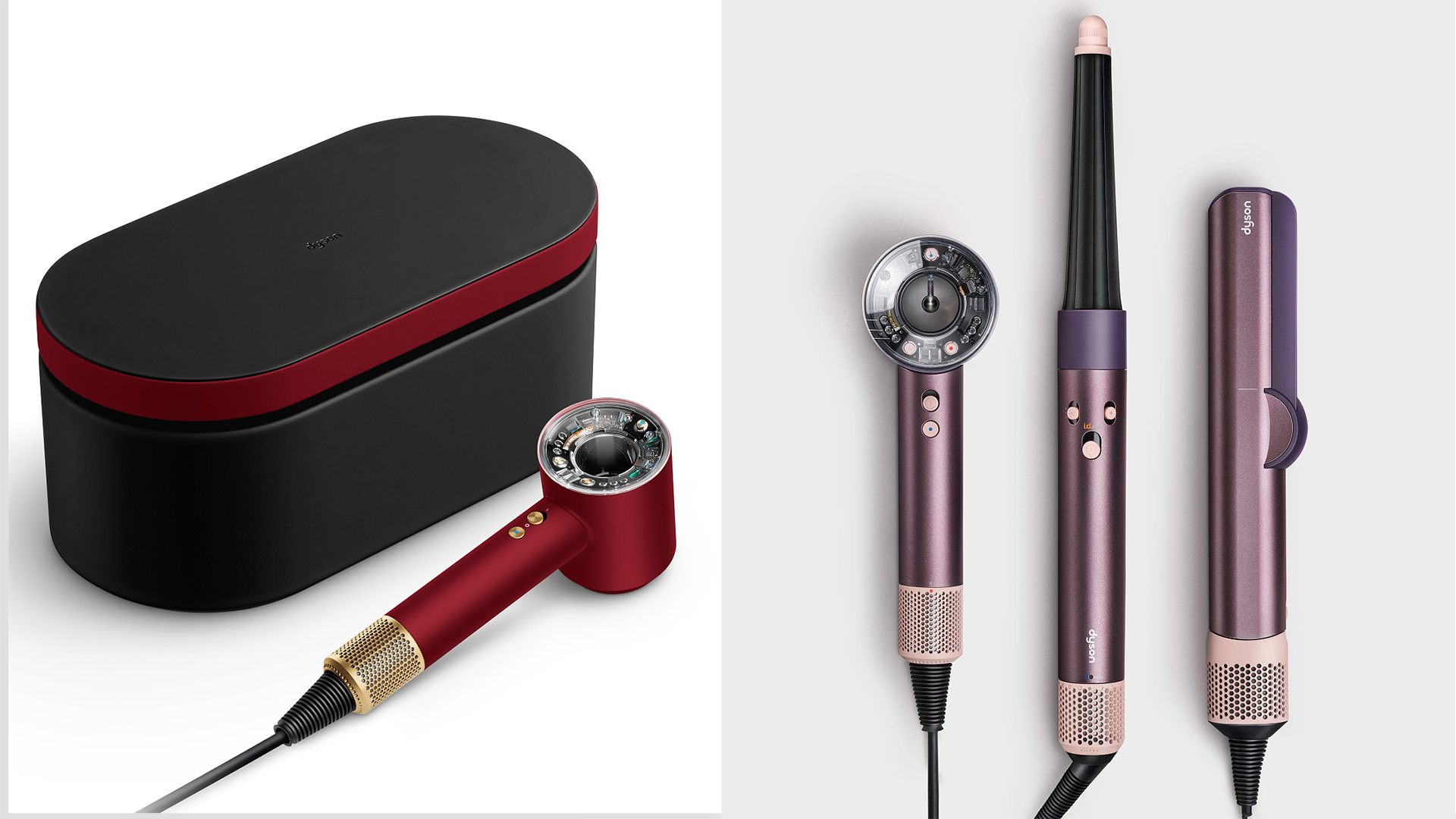

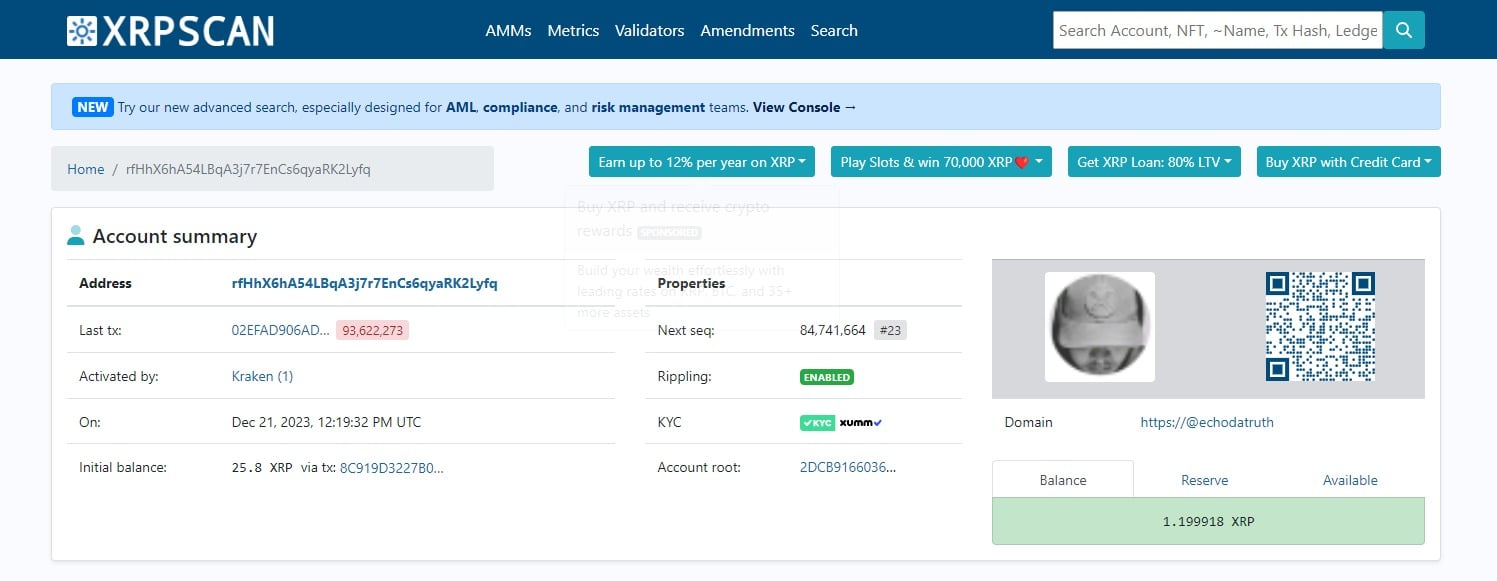

Dyson has just revealed two new special edition colorways for its popular hair styling tools, and I think I’m in love. They’re called ‘Jasper Plum’ and ‘Red Velvet & Gold’ and they’ll be available across the full haircare range, including the Airwrap i.d. multi-styler, the Supersonic dryer, and the Airstrait wet-to-straight styler.

While I don’t dislike the current purple-and-orange or turquoise options, they have more of a ‘Children’s TV presenter’ energy than I’d ideally want in a haircare tool that costs upwards of $400 / £350. These new options have a much more luxe feel that fits the premium price tag, and are perfect for a grown-up dressing table. I’ve been eyeing up an Airwrap for some time, and this might be the thing that makes me take the plunge.

The Jasper Plum colorway will be available to buy direct from Dyson UK from today (22 January), with the Red Velvet & Gold options joining in late February. There are no specifics on other territories yet, although a Dyson spokesperson told us the new-look tools “will become available at a later date” in the US and Australia.

Dyson says the new color options are “thoughtfully designed to celebrate love, individuality, and the small yet powerful moments of self-care”. The Jasper Plum option, which combines violet and plum with blush pink detailing, symbolizes “strength and self-discovery”. The Red Velvet & Gold model “embodies sophistication and modern beauty”.

I didn’t immediately get all that, but the new colors certainly do look very nice. And the Red Velvet version taps into the current obsession with burgundy that’s sweeping the fashion world.

We consistently rate Dyson’s styling gadgets among the best hair dryers and best hair styling tools you can buy. Having made its name in vacuum cleaners and fans, the brand gained prominence in the beauty market with its Supersonic hair dryer, which reimagined the traditional dryer shape to make it more streamlined and put the weight in the handle to make it easier to control. The current version – Dyson Supersonic Nural – adds some clever features to streamline the styling process.

That was followed by the Dyson Airwrap, an innovative gadget that harnesses the Coanda effect to shape hair into curls without the extreme heat of traditional curling tongs. More recently, the Dyson Airstrait – which again does away with the extreme temperatures of regular straightening irons and instead uses concentrated blades of air to smooth your tresses – has been gaining popularity. All of these options are available in the new colors.

You must be logged in to post a comment Login