Crypto World

$2.9B Bitcoin ETF Outflow, Bearish Futures Data Project More BTC Downside

Key takeaways:

-

Heavy outflows from Bitcoin exchange-traded funds and massive liquidations show that the market is purging highly leveraged buyers.

-

Bitcoin options metrics reveal that pro traders are hedging for further price drops amid a tech stock sell-off.

Bitcoin (BTC) slid below $73,000 on Wednesday after briefly retesting the $79,500 level on Tuesday. This downturn mirrored a decline in the tech-heavy Nasdaq Index, driven by a weak sales outlook from chipmaker AMD (AMD US) and disappointing United States employment data.

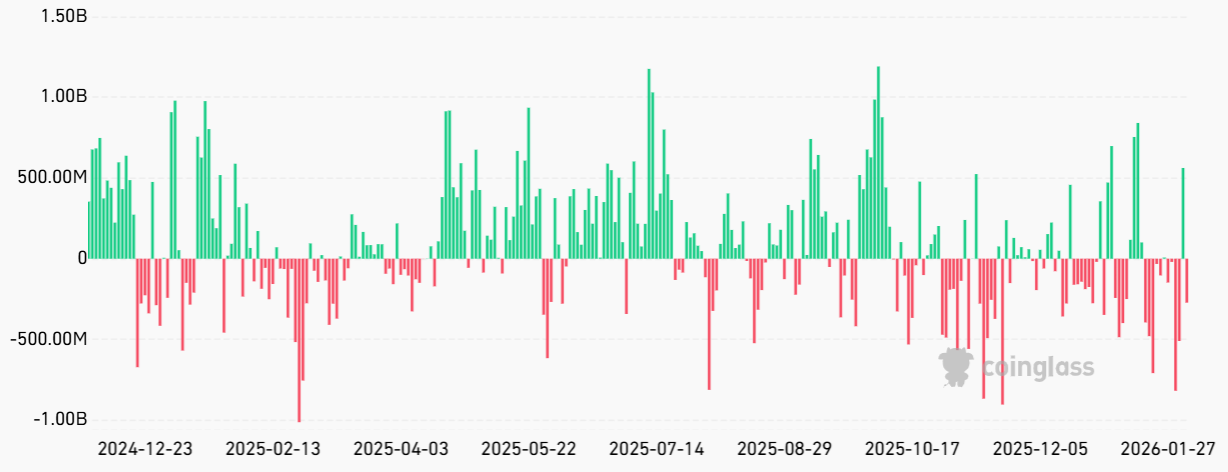

Traders now fear further Bitcoin price pressure as spot exchange-traded funds (ETFs) recorded over $2.9 billion in outflows across twelve trading days.

The average $243 million daily net outflow from the US-listed Bitcoin ETFs since Jan. 16 nearly coincides with Bitcoin’s rejection at $98,000 on Jan. 14. The subsequent 26% correction over three weeks triggered $3.25 billion in liquidations for leveraged long BTC futures. Unless buyers deposited additional margin, any leverage exceeding 4x has already been wiped out.

Some market participants blamed the recent crash on the lingering aftermath of the $19 billion liquidation on Oct. 10, 2025. That incident was reportedly triggered by a performance glitch in database queries at Binance exchange, resulting in delayed transfers and incorrect data feeds. The exchange admitted fault and disbursed over $283 million in compensation to affected users.

According to Haseeb Qureshi, managing partner at Dragonfly, huge liquidations at Binance “could not get filled, but liquidation engines keep firing regardless. This caused market makers to get wiped out, and they were unable to pick up the pieces.” Qureshi added that the October 2025 crash did not permanently “break the market,” but noted that market makers “will need time to recover.”

The analysis suggests that cryptocurrency exchanges’ liquidation mechanisms “are not designed to be self-stabilizing the way that TradFi mechanisms are (circuit breakers, etc.)” and instead focus solely on minimizing insolvency risks. Qureshi notes that cryptocurrencies are a “long series” of “bad things” happening, but historically, the market eventually recovers.

BTC options skew signals traders doubt $72,100 bottom

To determine if professional traders flipped bearish after the crash, one should assess BTC options markets. During periods of stress, demand for put (sell) instruments surges, pushing the delta skew metric above the 6% neutral threshold. Excess demand for downside protection typically signals a lack of confidence from bulls.

The BTC options delta skew reached 13% on Wednesday, a clear indication that professional traders are not convinced Bitcoin’s price has found a bottom at $72,100. This skepticism stems partly from fears that the tech sector could suffer from increased competition as Google (GOOG US) and AMD roll out proprietary artificial intelligence chips.

Related: Bitcoin open interest falls by $55B in 30 days–What’s next for BTC price?

Another source of discomfort for Bitcoin holders involves two unrelated and unfounded rumors. First, a $9 billion Bitcoin sale by a Galaxy Digital customer in 2025 was previously attributed to quantum computing risks. However, Alex Thorn, Galaxy’s head of research, denied those rumors in an X post on Tuesday.

The second speculation involves Binance’s solvency, which gained traction after the exchange faced technical issues that temporarily halted withdrawals on Tuesday. Current onchain metrics suggest that Bitcoin deposits at Binance remain relatively stable.

Given the current uncertainty in macroeconomic trends, many traders have opted to exit cryptocurrency markets. This shift makes it difficult to predict whether Bitcoin spot ETF outflows will continue to apply downward pressure on the price.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Tokenized US Treasury Market Surges by $1B Since Beginning of Year

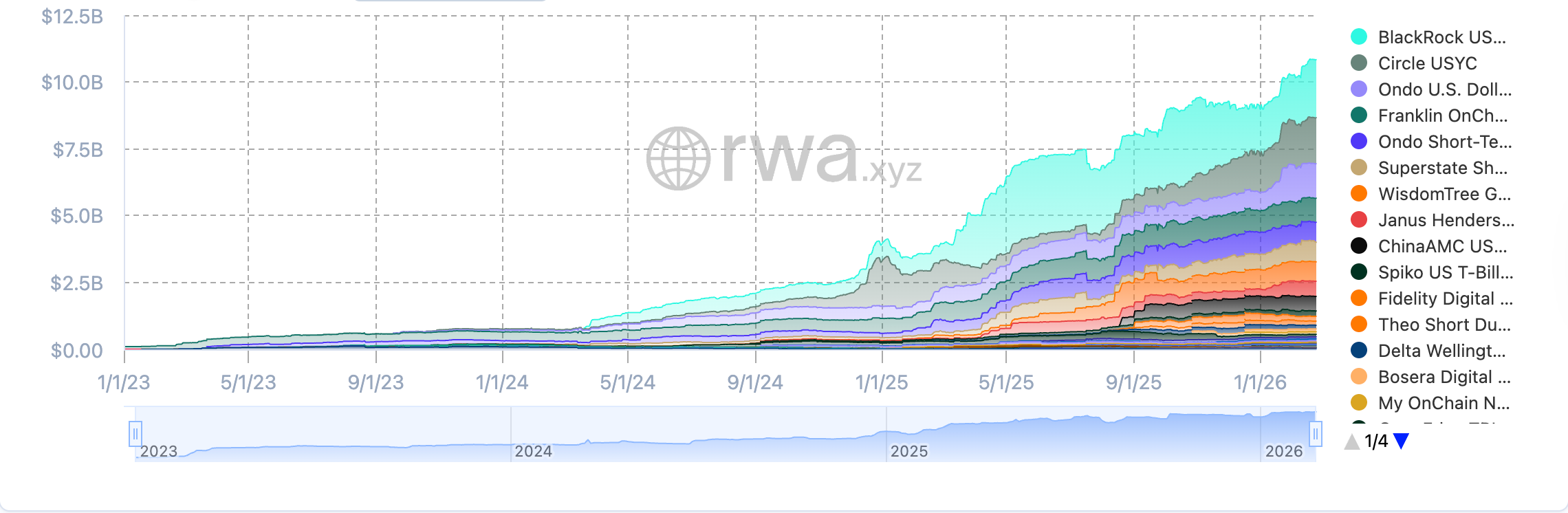

The tokenized US Treasury market has surged by over $1 billion since the beginning of 2026, despite macroeconomic uncertainty and concerns over the US government’s growing national debt.

Tokenized US Treasurys are government debt instruments that are a form of real-world assets (RWAs) represented onchain by a token.

The market capitalization of tokenized Treasurys climbed to more than $10.8 billion at the time of writing from $8.9 billion on Jan. 1, according to data from RWA.xyz.

The tokenized US Treasury market has surged 50x since 2024, according to data from Token Terminal, aided by the March 2024 debut of asset manager BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which now has a market cap of more than $1.2 billion.

Tokenized US Treasurys continued to surge despite a broad crypto market downturn that began in October 2025, rising US government debt levels and investor uncertainty about the macroeconomic outlook in 2026.

Related: Tokenized RWAs climb 13.5% despite $1T crypto market drawdown

The Depository Trust and Clearing Corporation to launch US Treasury tokenization service

The Depository Trust and Clearing Corporation (DTCC), which provides clearing and settlement services for global financial markets, announced plans in December 2025 to launch an asset tokenization service, beginning with US Treasurys.

DTCC will eventually expand the service to include a “broad spectrum” of assets, according CEO Frank La Salla.

“Following the tokenization of US Treasurys on the Canton network, DTCC anticipates that exchange-traded funds (ETFs) and equities will come shortly thereafter,” La Salla said.

The DTCC is the largest clearinghouse in the world and settled $3.7 quadrillion in transaction volume in 2024, according to the company.

US Treasurys are considered the backbone of global and corporate finance due to the deep liquidity of the US Treasury market.

Corporations and institutional investors use short-term Treasurys, with a duration of one-year or less, as a proxy for physical cash.

The surge in tokenized US Treasurys and other US government debt could bring an influx of revenue to the blockchain networks where tokenized assets are minted, supporters of the technology say.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside story

Crypto World

Bitcoin’s Dry Powder Myth Busted: Outflows – Not Buyers

Bitcoin’s Stablecoin Supply Ratio has fallen to 9.36, a level often viewed as sidelined buying power ready to deploy.

Bitcoin’s Stablecoin Supply Ratio (SSR) has dropped to 9.36, a level historically associated with significant buying power waiting on the sidelines, but on-chain data shows this metric is flashing a false signal.

According to analyst Axel Adler Jr., the decline is being driven by capital leaving the ecosystem rather than stablecoin accumulation, which fundamentally alters how investors interpret this classic bullish indicator.

Liquidity Drain, Not Dry Powder

The SSR measures Bitcoin’s market capitalization against total stablecoin supply, with lower readings traditionally suggesting ample stablecoin liquidity available to purchase BTC. However, current conditions tell a different story.

In a February 25 brief, Adler pointed out that USDT capitalization peaked at $187.2 billion on December 30, 2025, and has since contracted to $183.6 billion, a $3.6 billion outflow over 60 days. Additionally, the 30-day change has remained negative for 34 consecutive days, now sitting at -$3.08 billion.

This matters because SSR’s mathematical decline stems from both components weakening simultaneously. Bitcoin’s market cap has dropped roughly 27% during this period, while stablecoin supply also contracted.

“Technically SSR falls mathematically because BTC market cap has collapsed, but the simultaneous contraction of USDT strips this signal of any bullish potential,” Adler explained.

The Estimated Leverage Ratio confirms the structural weakness, remaining flat around 0.219 across all exchanges for 90 days despite Bitcoin’s sharp correction. This plateau indicates speculative capital isn’t adding new risk, but crucially, isn’t shedding old risk either, thus creating potential for cascading liquidations on further downside.

Aged Supply, Absent Buyers

Bitcoin’s recent price action reflects the fragility described above, with the asset briefly falling below $63,000 on February 24 before recovering to current levels around $65,400. This price represents a dip of more than 25% across the last 30 days and nearly 27% over one year.

You may also like:

HODL Waves data published recently also revealed a defensive market structure beneath the price action. Coins last moved 3 to 6 months ago now comprise approximately 26% of the circulating supply, up from 19% earlier this month.

These correspond to purchases near the November 2025 peak above $120,000, now held at a loss. Meanwhile, the 6 to 12 month cohort has grown to about 20%, while coins moved within the past month account for less than 10% of supply.

Furthermore, the Realized Cap Net Position Change confirms capital exiting the network, standing at -2.26% over 30 days with $33 billion in value compression since late November.

The distinction between SSR decline through outflow versus accumulation carries real implications. According to Adler, for a genuine trend reversal, two things must happen at the same time: the 30-day USDT change returning to sustained positive territory (confirming fresh capital inflow) and ELR beginning to rise during price stabilization. Until then, the analyst says Bitcoin’s low SSR represents not opportunity, but the mathematical residue of capital departure.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Tether Invests $200 Million in Whop to Expand Stablecoin Payments

The investment will bring Tether’s wallet tools to millions of users.

Stablecoin issuer Tether has made a $200 million strategic investment in Whop, an online marketplace, as it looks to expand stablecoin payments into more real-world use cases.

Tether’s USDT stablecoin currently has a market cap of about $183 billion, according to DeFiLlama data, making it the largest circulating stablecoin worldwide.

Whop co-founder Steven Schwartz said in a post on X that Tether’s investment pushed the company’s valuation to $1.6 billion. As part of the deal, Whop will integrate Tether’s Wallet Development Kit (WDK), allowing users to send and receive payments in stablecoins like USDT.

“In partnership with Tether, we will be scaling infrastructure in real-time for new business models as they emerge across the globe,” Schwartz said on X. “The job is just getting started.”

The deal is part of Tether’s broader push to expand beyond crypto trading and into everyday finance. Specifically, Tether will gain exposure to a platform with over 18 million users and about $3 billion in yearly payouts. Moreover, Whop’s transaction volume has been growing around 25% month over month, according to an official announcement.

“Stablecoins and wallets become most powerful when they are embedded directly into people’s lives, supporting their businesses, activities, families, and individual stories,” Tether CEO Paolo Ardoino said, per the announcement. “Our investment in Whop proudly reflects Tether’s focus on supporting real economic activity by providing efficient digital dollar and wallet infrastructure that can scale to billions of people, across every continent.”

The new funding will help Whop expand into Latin America, Europe, and the Asia-Pacific region, while also developing new financial tools and AI features for its users. The investment also builds on Tether’s recent expansion efforts, including the launch of its regulated U.S. stablecoin USAT last month.

Crypto World

3 DeFi Altcoins Explode After BlackRock and Wall Street Deals

Three major DeFi tokens — Morpho (MORPHO), Uniswap (UNI), and Jupiter (JUP) — rallied sharply over the past week after Wall Street firms Apollo Global Management, BlackRock, and ParaFi Capital struck landmark deals to acquire direct stakes in onchain financial infrastructure.

The moves signal a structural shift, as traditional asset managers move beyond crypto exposure and begin acquiring governance and economic ownership in decentralized trading and lending rails.

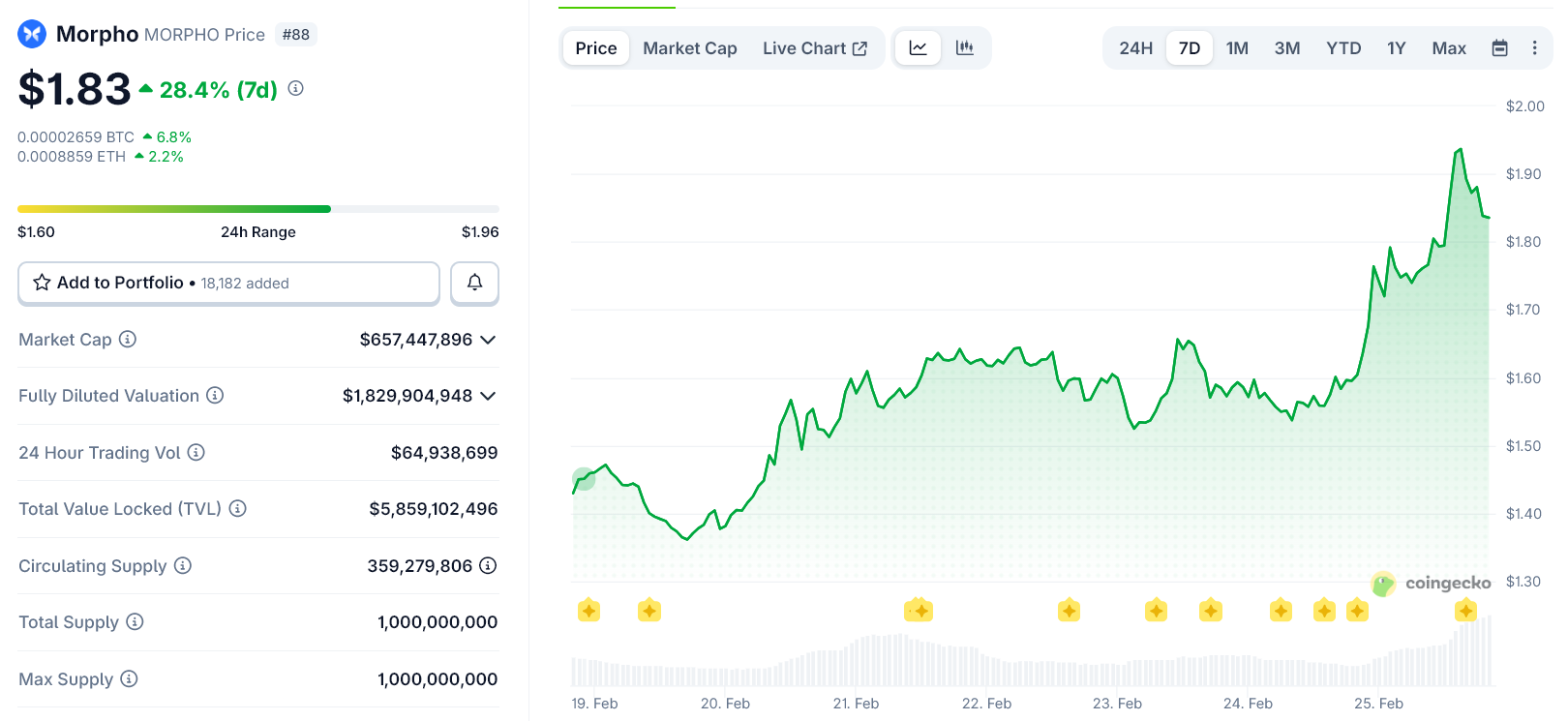

Morpho Surges after Apollo Agrees to Acquire 90 Million Tokens

Morpho posted the strongest rally after Apollo Global Management announced a cooperation agreement to acquire up to 90 million MORPHO tokens over four years. The purchase represents roughly 9% of total supply.

The deal gives Apollo governance exposure and positions the firm to support lending markets built on Morpho’s infrastructure.

Morpho currently secures about $5.8 billion in total value locked, making it one of the largest onchain lending platforms.

Investors responded quickly. MORPHO is up nearly 30% in a week.

Uniswap Jumps as BlackRock buys UNI and Integrates Tokenized Fund

Uniswap rallied after BlackRock confirmed it purchased UNI tokens alongside integrating its $2 billion tokenized Treasury fund, BUIDL, onto Uniswap’s institutional trading infrastructure.

The integration allows institutional investors to trade tokenized Treasury exposure using Uniswap’s decentralized exchange rails.

Meanwhile, BlackRock’s UNI purchase gives the asset manager governance influence over the protocol that now hosts its fund.

UNI surged sharply late in the week, rallying nearly 20%.

ParaFi Invests $35 Million directly Into JUP

Jupiter also rallied after ParaFi Capital invested $35 million directly into the protocol’s JUP token.

Unlike typical venture deals, ParaFi purchased tokens at market price with lockups and warrants for future purchases.

The deal marks Jupiter’s first institutional investment and aligns ParaFi with the platform’s expansion into lending, stablecoins, and institutional trading infrastructure.

JUP rose from approximately $0.144 to $0.163 during the week.

Together, the deals highlight a broader trend. Instead of simply buying crypto assets, Wall Street firms are acquiring governance stakes in core DeFi protocols.

This transition signals growing institutional confidence in onchain financial rails and helps explain the strong price reactions across lending and trading infrastructure tokens.

Crypto World

Bitcoin Surges to $69.5K on ETF Inflows, US Macroeconomic Boost

Bitcoin (BTC) rallied to a weekly high of $69,500 on Wednesday, surging from lows near $62,400 in less than 24 hours. The rebound aligned with a renewed spot Bitcoin exchange-traded fund (ETF) inflows and firmer macroeconomic sentiment after the recent US policy signals helped steady broader risk markets.

Derivatives data shows that BTC’s open interest is falling and funding rates are staying relatively contained, indicating the move was largely driven by spot demand rather than a buildup of leveraged positioning.

Bitcoin receives a macro boost and a positive ETF flip

US President Donald Trump’s State of the Union address on Tuesday evening framed the first 12-months of his leadership as an “economic turnaround for the ages,” highlighting falling mortgage rates and a 1.7% decline in core inflation over the final three months of 2025.

Markets interpreted the remarks as a sign of reduced near-term policy uncertainty following tariff and Supreme Court volatility, lifting the risk appetite across equities and crypto.

The US spot Bitcoin ETFs recorded $257.7 million in net inflows on Feb. 24, ending five consecutive weeks of redemptions totaling $3.8 billion. Fidelity drew roughly $83 million, and BlackRock’s iShares Bitcoin Trust added close to $79 million.

Related: Bitcoin daily gains near 5% as analysis eyes bullish ‘rotation’ from gold

Bitcoin futures data clears excess downside risk

As Bitcoin trades above $69,000, futures data shows that its aggregated open interest has stabilized around 235,167 BTC, after previously reaching levels above 240,000 BTC earlier in the week.

The drop in open interest suggests that the excess leveraged positioning has already been flushed out during the recent volatility.

At the same time, aggregated funding rates remain slightly negative at -0.0037%. Negative funding indicates that short positions are still paying longs, signaling that traders are not aggressively chasing upside exposure despite the price rally.

This combination of cooling open interest and negative-to-neutral funding points to a market that has reset leverage rather than overheated. The rally toward $69,000 appears to be occurring without an aggressive buildup of long positioning.

The cumulative volume delta (CVD) has edged higher, showing that spot buyers are stepping in and are one of the primary drivers of this rally.

Market analyst BackQuant noted that derivatives activity is still playing a large role, and options data shows that dealers, the firms that sell options and hedge their exposure, are holding what’s known as positive gamma.

When gamma is positive, dealers tend to buy as the price falls and sell as the price rises to stay hedged. That behavior can smooth out volatility and slow sharp breakouts in either direction.

Likewise, trader LP also pointed to BTC’s order book dynamics around the $60,000–$63,000 region, where strong bid pressure previously absorbed selling. Since tapping that zone, the price has expanded roughly 8% to the upside.

The trader added that if sell pressure builds again at these levels, it may signal a slowdown in buy-side aggression and trigger another lower reversal.

Related: Anchorage buys STRC as Wall Street shorts mount against Saylor’s Bitcoin proxy

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Aptos price jumps 20% as altcoins rally: more gains ahead?

- Aptos price jumped more than 20% to break above $1 on Wednesday.

- The altcoin’s rally followed a sharp bounce for Bitcoin, which rose to above $69,000.

- Risk assets gained ahead of Nvidia earnings.

Aptos (APT) is trading around $1.02 amid a broader altcoin uptick, with the token posting a notable 20% surge on February 25, 2026.

The uptick puts APT on the cusp of a breakout above the psychological level and aligns with positive signals from major altcoins. Intraday volume jumped 54% to over $105 million as bulls extended gains from the all-time lows of $0.79 reached on February 23, 2026.

Aptos price surges as Bitcoin storms to $69,000

A look at the broader market suggests momentum during US trading hours came amid sharp gains for the bellwether digital asset Bitcoin.

The surge to above $69,400, with BTC up nearly 8% in the past 24 hours, came as stocks rose ahead of Nvidia’s earnings. Cryptocurrencies also rose as markets reacted to US President Donald Trump’s State of the Union address.

As Bitcoin registered its biggest intraday jump since Feb. 6, Ethereum rose 11% to above $2,064. Polkadot, Avalanche, Uniswap and Litecoin posted double-digit gains.

📈 Following @realDonaldTrump‘s State of the Union, crypto markets have SKYROCKETED to their best daily collective jumps of the year. The altcoin charge breakout is being led by notables like $DOT (+23%), $UNI (+19%), $AVAX (+17%), $LINK (+15%), $NEAR (+15%), & $LTC (+14%). pic.twitter.com/NlHMjtHzQu

— Santiment (@santimentfeed) February 25, 2026

Traders remained cautious, though, with analysts at Glassnode noting that the market awaits conviction.

“$BTC is range-bound between key valuation anchors, with $60k–$69k absorbing sell pressure.

Profitability and breadth are fading, spot and ETF flows stay negative, and leverage has reset,” the platform posted on X.

But gains for BTC and ETH seem to have buoyed Aptos, whose price momentum is strengthened by recent ecosystem growth.

Other than an uptick in daily transactions, the blockchain platform is among 30 chains to go live on Bitwise’s staking solution.

Interest in real-world assets (RWA) and stablecoin adoption is also key to Aptos’ growth.

Prices are up amid these factors.

Aptos price analysis

Technical indicators show Aptos price off oversold territory, with RSI near 46 to signal potential for a relief rally toward the $1.20-$1.45 resistance levels.

The MACD indicator also signals upside momentum, and rising volume suggests bulls could sustain a breakout above $1.

However, the token’s position below key moving averages means bearish sentiment remains.

On the daily chart, APT is below 50-day SMA at $1.33 while the 100 SMA offers short-term resistance around $1.62.

A sustained move above $1 would invalidate the seller dominance trend. Buyers will also benefit if BTC extends gains to $70k or higher.

However, if downside pressure resumes, with the top digital asset giving up gains, Aptos could drop to recent lows around $0.80. Likely to come into view could also be October 2025 lows of $0.74.

Crypto World

Largest BNB treasury crashes 95%, blames CZ family office

The world’s largest BNB treasury company has crashed 95% from its high last year and is blaming the family office of Binance founder Changpeng Zhao (CZ) for a “secret side agreement.”

On Tuesday, it issued a press release demanding that CZ’s YZi Labs disclose a confidentiality provision between his family office and 10X Capital Asset Management LLC, the lead party in the company’s July 2025 PIPE transaction that coincided with its 52-week and multi-year high of $82.88 per share.

Shares of CEA Industries, which changed Nasdaq ticker symbols from VAPE to BNC — an attempt to pivot the company’s brand to a BNB Network Company — now trade at $3.88 after losing 95% of their value over the past seven months.

Before becoming a BNB treasury company during the height of the digital asset treasury (DAT) mania in the summer of 2025, CEA Industries was operating Canadian vape retailers.

That business model, as well as several business models and pivots including a previous ticker change from CEAD to VAPE, failed to reverse a multi-year decline in its common stock from a $873 peak in 2018 to under $8 by the time of its acquisition of 33 Canadian vape locations.

By July 2025, the company had yet again began looking for a new trend.

It found a suitor in Cantor Fitzgerald, founded by US Commerce Secretary and Jeffrey Epstein’s former neighbor Howard Lutnick, who acted as the lead financial advisor to 10X Capital and sole placement agent to CEA Industries.

Read more: Binance demands the Wall Street Journal remove ‘damaging’ article

Another Cantor Fitzgerald-advised treasury flop

Cantor Fitzgerald helped raise capital for other DATs like Twenty One, Bitcoin Standard Treasury Company, and Nakamoto.

In fact, the same 10X Capital that led CEA Industries’ $500 million PIPE also served as financial advisor to Nakamoto, which has declined 99% in value from its May 2025 peak. Twenty One is down 89% since May, and Bitcoin Standard Treasury Company is down 37% since July.

Despite its financial devastation, CEA Industries’ 95% decline is somewhat unremarkable among DATs.

10X Capital acted as CEA Industries’ BNB asset manager “with the support of YZi Labs.” According to CEA Industries, that support is potentially problematic, and it wants to force disclosure of how, exactly, CZ’s family office “supported” 10X Capital’s management of BNB.

10X Capital’s Chief Investment Officer (CIO) Russell Read became CIO of CEA Industries shortly after the PIPE closed.

By September, the company had relegated him to a non-executive position and by the end of the year, he’d resigned entirely.

Almost everyone lost in BNB treasury debut

Some of the biggest crypto funds invested in CEA Industries via the PIPE, including Pantera Capital, GSR, Arrington Capital, Borderless, Blockchain.com, Arche Capital, Hypersphere Capital, Kenetic, and the founders of BitFury.

There are two sides to every story.

For its part, YZi Labs has contested CEA Industries’ characterization of the “secret side agreement” as recently as this week.

YZi Labs wants CEA Industries to retract what it calls false claims about that agreement, and it’s requested directors Hans Thomas and David Namdar recuse themselves from asset management discussions.

It also wants to solicit stockholder written consents for board changes.

Amid the infighting, CEA’s common stock has fallen 41% year to date, 67% over the past 12 months, 95% from its 52-week high, and 98% over the past five years.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

3 AI Stocks That Can Outperform Nvidia in March

NVIDIA dominates the AI chip market. But dominance doesn’t always mean the best risk-reward. With institutional money flow turning cautious, tariff headwinds on Taiwan-made chips, and a valuation demanding 60%+ sustained growth — smart money is looking at other AI stocks.

Here are three AI stocks that could offer a sharper setup, both technical and fundamental, heading into March 2026. And watch out for a high risk, honorary pick, right at the end.

How is Nvidia (NVDA) Looking?

NVIDIA, the largest holding in the Technology sector (XLK) at 15.79% weightage at press time, reports its Q4 FY2026 earnings on February 25, post-market close.

Wall Street expects high numbers, but recent history shows that hasn’t been enough. After Q3’s $57 billion beat, the stock barely moved and has traded sideways since.

Despite being up over 50% year-on-year, NVIDIA’s chart has been trading inside a descending channel since late October. At press time, the price appears to be breaking out of this channel — but the breakout needs confirmation.

A sustained hold above $195, followed by a move through $203 and $212, would flip the structure bullish.

However, if the breakout fails, the $190 and $179 zones have acted as near-term support, with deeper downside risk below that.

The Chaikin Money Flow (CMF) — which tracks whether institutional money is flowing into or out of a stock — remains a concern.

The Chaikin Money Flow (CMF) indicator has remained below the zero line since mid-January, indicating net money continues to leave despite the price recovery.

If CMF fails to flip positive (like mid-January), the price recovery loses its institutional backing, and the descending channel could reassert itself.

On the fundamental side, NVIDIA manufactures 100% of its GPUs through TSMC in Taiwan. This fully exposes it to Section 232 semiconductor import tariffs, raising chip costs.

China’s revenue has collapsed under US export restrictions, cutting off the world’s second-largest AI market.

And at 35x EV/EBITDA (a measure of how expensive a stock is relative to its earnings power), NVIDIA needs 60%+ sustained growth just to justify its current price. With these risks in play, three other AI stocks may offer a sharper setup into March.

Taiwan Semiconductor (TSM)

TSMC (TSM), the first stock on the list, is up nearly 100% year-on-year. That outpaces even NVIDIA’s 50% gain and the reason is straightforward. TSMC manufactures over 90% of the world’s most advanced chips.

Every NVIDIA GPU, Broadcom ASIC, and AMD processor runs on TSMC fabrication. It doesn’t matter who wins the AI chip race. TSMC builds for all of them.

Here’s what most investors miss. TSMC controls NVIDIA’s cost structure. It raised prices 10-20% on advanced chips recently. Customers paid without hesitation as no alternative exists.

Intel is generations behind, and Samsung has yield problems. When TSMC raises prices, its margins expand. When NVIDIA pays those prices, its margins shrink.

And unlike NVIDIA, TSMC doesn’t pay import tariffs. Tariffs hit the importer, not the exporter. TSMC exports. NVIDIA imports. Plus, TSMC’s new Arizona fabs produce US-made chips — completely tariff-free.

At 18x EV/EBITDA — a measure of price relative to core earnings — TSMC costs nearly half of NVIDIA’s 35x. Last quarter, 1,945 institutions opened new positions, worth $49 billion, one of the highest inflows among AI stocks.

On the chart, TSM trades inside an ascending channel since mid-December. A breakout, which is almost there, could target $470 — over 20% upside, starting in March itself.

CMF reads 0.21, above zero, confirming steady institutional inflow. A push past 0.28 would strengthen the breakout signal.

On the downside, $386 is critical support. A correction, likely triggered by the Taiwan-specific geopolitical tensions, could test $362 or $346. Only a sustained break below $346 turns the structure neutral.

Alphabet (GOOGL)

This AI stock might throw a surprise. On the daily chart, Alphabet looks weak. It’s mostly flat year-to-date. Down 7% over the past month. The price is forming a head and shoulders pattern with a downward sloping neckline. But here’s the interesting part.

Since hitting the right shoulder on February 23, the price has tried to rebound. It now sits near the right shoulder level. A break above $319 would weaken the bearish pattern. It turns the structure neutral.

Above $349, the short-term bearish thesis gets completely invalidated.

The CMF tells a different story than the price. While NVIDIA’s CMF remains negative — showing institutional money leaving — Alphabet’s CMF has turned positive at 0.09.

Similar to TSM, money is flowing in despite the weak price action. A sustained move above 0.19 would confirm institutional accumulation is carrying into Q1 2026.

Even in the last quarter, 520 institutions opened new positions averaging $74 million each.

The fundamental edge is unique. Google doesn’t just use AI — it sells cheaper AI infrastructure to NVIDIA’s own customers. Its Ironwood TPUs cost roughly $15,000. NVIDIA’s GPUs cost $30,000-$40,000.

Google Cloud grew 48% last quarter. Operating margin jumped from 17.5% to 30.1% in one year.

And as a software and services company, Alphabet has zero tariff exposure — unlike NVIDIA’s 100%.

If the price breaks below $286, the bearish pattern confirms. That could push prices toward $276 and lower levels — likely triggered by broader tech selling or disappointing Cloud growth guidance.

But the CMF divergence and institutional flows suggest smart money is positioning for a reversal, not a breakdown.

Last on the list but not the least. This AI stock is up 64% year-on-year but flat over the last seven days.

An inverse head and shoulders pattern is forming now. This is a classic reversal structure, which can change the short-term weakness. The AVGO price is now moving toward the neckline at $350.

A breakout above that level opens the path for a near 20% move — potentially pushing AVGO close to $420. That breakout window aligns with early March, right around its Q1 FY2026 earnings on March 4. A beat-and-raise on March 4 could be the trigger that cracks the neckline of the bullish pattern.

Here’s what makes Broadcom a direct NVIDIA challenger. AI is shifting from the training phase to inference — running models at scale for millions of users. NVIDIA GPUs dominate training. But for inference, custom ASICs are 3-5x more energy-efficient and cost way less.

Broadcom designs these ASICs for Google, Meta, ByteDance, and now OpenAI. As inference scales, Broadcom is positioned for the bigger phase ahead, courtesy of this AI shift.

The Money Flow Index (MFI) — which measures buying and selling pressure using both price and volume — confirms accumulation on dips.

Since February 10, while prices trended lower, MFI has trended higher. And that’s a bullish divergence. MFI currently sits around 67, still below the overheated 80 threshold. Room to run. This means, possibly retail is picking up AVGO shares at a clip.

On the downside, $314 is critical. A break below would weaken the bullish setup. Under $295, the inverse head and shoulders invalidates entirely. A broader AI spending slowdown or weaker-than-expected March 4 guidance could trigger that scenario.

Honorable Mention: Palantir Technologies (PLTR) — The Risky Bet

Palantir didn’t make the main list of AI stocks, courtesy of the high valuation risk.

But the chart is flashing reversal signals worth watching. Between February 5 and 24, the price made a lower low, yet the relative strength index (RSI), a momentum indicator, made a higher low. That’s a classic bullish divergence.

The CMF confirms it. Between February 9 and 25, prices trended down while CMF trended up. Two separate indicators pointing toward bullishness.

If $126 holds as a base, the first target is $143. Beyond that, $170 — a strong resistance from early January — becomes the key level.

Fundamentally, Palantir is one of the few AI companies turning AI into real revenue. Last quarter delivered $1.41 billion — up 70% year-on-year. It carries zero debt, $4 billion in cash, and like the three main picks, zero tariff exposure. Pure software.

Here’s the catch. PLTR trades at over 200x P/E — meaning investors are paying $200 for every $1 the company earns. That’s a price tag that assumes everything goes perfectly.

Any stumble in growth, and the stock could fall hard. Moreover, losing $126 invalidates the entire setup.

Crypto World

Is The Bull Market Back?

Key points:

-

Bitcoin bulls have pushed the price above $69,000, signaling solid dip buying at lower levels.

-

Several major altcoins have turned up sharply, suggesting that selling pressure is reducing.

Bitcoin (BTC) bulls purchased Tuesday’s dip and are attempting to sustain the price above $69,000 on Wednesday. According to SoSoValue data, BTC exchange-traded funds recorded net inflows of $257.7 million on Tuesday, the largest inflows since Feb. 6. That suggests investors are viewing the dips near $60,000 as a buying opportunity.

Santiment said in a post on X that BTC’s correlation with stocks has broken down in the past six months. The S&P 500 rose 7% during the period, while BTC fell 43%. However, the on-chain data provider added that the disconnection is unlikely to stay forever. If BTC follows its historical pattern of tracking equities during economic expansions, then “it may have significant room to catch up.”

Not everyone is bullish on BTC’s prospects in the short term. Glassnode said in a post on X that BTC’s realized profit/loss ratio (90-day moving average) slipped below 1. Historically, breaks below 1 have resulted in at least six months of loss realization before the level was reclaimed.

Could BTC and select major altcoins break above their overhead resistance levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC has risen sharply from the $62,510 level on Tuesday, indicating that the bulls are vigorously defending the $60,000 level.

Buyers will attempt to thrust the Bitcoin price above the 20-day exponential moving average ($69,375). If they succeed, the BTC/USDT pair may rally to the breakdown level of $74,508, where the bears are again expected to mount a strong defense.

Sellers will have to successfully defend the 20-day EMA if they want to retain the advantage. If the price turns down sharply from the 20-day EMA, the $60,000 support may be at risk of breaking down. If that happens, the pair may plummet to $52,500.

Ether price prediction

Ether (ETH) turned up from the $1,800 level on Tuesday, indicating that the bulls are attempting to retain the price inside the $1,750 to $2,111 range.

The relief rally is expected to face selling at the $2,111 level. If the Ether price turns down sharply from $2,111, the ETH/USDT pair may extend its stay inside the range for a few more days.

Alternatively, if buyers propel the price above the $2,111 level, it suggests that the bears are losing their grip. The pair may then surge to the 50-day SMA ($2,540), where the bears are again expected to step in.

XRP price prediction

XRP (XRP) turned up sharply and has reached the 20-day EMA ($1.46), indicating that the bulls are attempting a comeback.

If the XRP price closes above the 20-day EMA, the XRP/USDT pair may rally to the 50-day SMA ($1.70) and eventually to the downtrend line. Buyers will have to clear the hurdle at the downtrend line to signal a potential trend change.

Sellers are likely to have other plans. They will attempt to defend the moving averages and pull the price below the support line. If they can pull it off, the pair may nosedive to the Feb. 6 low of $1.11 and then $1.

BNB price prediction

BNB (BNB) has risen sharply from $577, indicating that the bulls are aggressively defending the $570 level.

Buyers will have to swiftly drive the price above the 20-day EMA ($641) to strengthen their position. If they manage to do that, the BNB/USDT pair may rise to $669 and eventually to $730.

Contrary to this assumption, if the BNB price turns down and breaks below $570, it indicates that the bears are in control. The pair may then resume the downtrend toward the psychological level at $500.

Solana price prediction

Solana (SOL) dipped below the $76 support on Tuesday, but the bears could not maintain the lower levels.

The SOL/USDT pair is attempting a recovery, which is expected to face selling at the 20-day EMA ($87). If the price turns down sharply from the 20-day EMA, the possibility of a break below the $76 level increases. The Solana price may then tumble to the Feb. 6 low of $67.

Instead, if bulls push the price above the 20-day EMA, the relief rally may reach the $95 level. This is a crucial level to watch out for, as a close above $95 suggests that the bulls are back in the game. The pair may then rally toward $117.

Dogecoin price prediction

Dogecoin (DOGE) turned up sharply from the $0.09 level, and the bulls are attempting to drive the price above the 20-day EMA ($0.10).

Sellers are unlikely to give up easily and will strive to defend the 20-day EMA. If the Dogecoin price turns down from the 20-day EMA, it increases the likelihood of a drop to the $0.08 support. Buyers are expected to fiercely defend the $0.08 level, as a close below it may start the next leg of the downtrend to the $0.06 level.

Buyers will have to maintain the price above the 20-day EMA to indicate that the bears are losing their grip. The DOGE/USDT pair may then march toward the breakdown level of $0.12.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) turned down sharply from the 50-day SMA ($564) and fell below the $500 support on Monday.

The 20-day EMA has started to turn down, and the RSI is in the negative territory, indicating an advantage to the bears. That suggests the relief rally to the 20-day EMA is likely to be sold into. If the Bitcoin Cash price turns down from the 20-day EMA, the possibility of a drop to the $443 level increases.

The first sign of strength will be a close above the moving averages. The BCH/USDT pair may then rise to $580 and subsequently to $600.

Related: Bitcoin price climbs 3% as gold divergence signals ‘significant upside’

Hyperliquid price prediction

Hyperliquid (HYPE) fell below the 50-day SMA ($28.10) on Monday, indicating that the bears are attempting to take charge.

Buyers are striving to push the price back above the moving averages but are likely to face stiff resistance from the bears. If the Hyperliquid price turns down from the moving averages, the HYPE/USDT pair may drop to the solid support at $20.82.

Contrarily, if the price closes above the 20-day EMA ($29.31), it suggests buying at lower levels. The pair may then ascend to $32.50 and later to the stiff resistance at $36.77. The next trending move is expected to begin on a close above $36.77 or below $20.82.

Cardano price prediction

The bears failed to pull Cardano (ADA) to the support line of the descending channel pattern, indicating a lack of selling at lower levels.

The buyers are attempting to make a comeback by sustaining the Cardano price above the 20-day EMA ($0.28). If they manage to do that, the ADA/USDT pair might rally to the downtrend line.

If the price turns down sharply from the downtrend line and breaks below the 20-day EMA, it suggests that the pair may remain inside the channel for a while. The bulls will have to secure a close above the downtrend line to gain the upper hand.

Monero price prediction

Monero (XMR) fell below the immediate support at $309 on Monday, but the bears could not sustain the lower levels.

The bulls are attempting a relief rally, which is expected to face selling at the 20-day EMA ($346) and then at the breakdown level of $360. If the Monero price turns down from the overhead resistance, it suggests a range-bound action between $360 and $300 for some time.

The advantage will tilt in favor of the bulls if they push and maintain the XMR/USDT pair above the $360 level. If they do that, the pair may surge toward the 50-day SMA ($435).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Blockfills co-founder and CEO Nicholas Hammer has stepped down

Nicholas Hammer, co-founder and CEO of crypto lender Blockfills, has stepped down from his leadership role, according to a person with direct knowledge of the matter.

The firm’s website now lists Joseph Perry as the interim CEO. A company spokesperson confirmed that Hammer was CEO until July 2025.

The change of leadership comes as the firm has suffered losses of around $75 million and suspended client deposits and withdrawals earlier this month.

Blockfills is also said to have urged some clients to withdraw their crypto assets before the platform halted deposits and withdrawals on Feb. 11, the person said, who spoke on condition of anonymity as the matter is private. Customer deposits remain suspended as of publication time.

CoinDesk reported last week that the Chicago-based firm was seeking a buyer after the losses.

Hammer did not respond to a request for comment by the publication time. His LinkedIn profile, as of 5.58 pm UTC on Feb. 25, still lists him as CEO of Blockfills.

The firm said in the Feb. 11 press release that it was working with investors and clients to reach a swift resolution and restore liquidity to the platform.

“Clients have been able to continue trading with BlockFills for the purpose of opening and closing positions in spot and derivatives trading and select other circumstances,” the company said at the time.

Blockfills’ abrupt halt to withdrawals revives memories of the 2022 crypto winter, when firms including Celsius, BlockFi and Genesis froze customer accounts as markets unraveled.

The market has struggled to regain traction in early 2026, with major tokens well below recent highs amid cautious sentiment. Bitcoin has remained below $70,000 after a sharp pullback from its late-2025 all-time high, while ether (ETH) trades around $2,000 amid weakness across the digital asset market.

The company said it handled more than $60 billion in trading volume in 2025, up 28% from a year earlier, and ranks among the most active institutional crypto lending and borrowing desks. It serves roughly 2,000 institutional clients, including hedge funds, asset managers and mining firms.

Blockfills is backed by investors including Susquehanna Private Equity Investments, CME Ventures, Simplex Ventures, C6E and Nexo. The company raised $37 million in a January 2022 Series A funding round.

Read more: Susquehanna-backed Blockfills up for sale after $75 million lending loss

UPDATE (Feb. 25, 6 pm UTC): Updates story with the company’s comment on the CEO’s departure.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat23 hours ago

NewsBeat23 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World23 hours ago

Crypto World23 hours agoEntering new markets without increasing payment costs

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection