Crypto World

3 Altcoins That Could Hit New All-Time Highs In February 2026

The crypto market is entering February with several altcoins showing early signs of trend shifts after weeks of volatility. Investor sentiment remains selective, with capital rotating toward projects backed by clear development roadmaps, improving on-chain metrics, or strong narratives such as privacy and decentralized infrastructure.

BeInCrypto has analysed three such altcoins that fit into these parameters and could form new all-time highs in February 2026.

Sponsored

Sponsored

Midnight (NIGHT)

NIGHT launched strongly in December 2025 but quickly lost momentum as early investors took profits. The sell-off weighed on the price through January. Conditions heading into February appear more constructive, however. Upcoming network developments and improving capital flow signals suggest downside pressure may be easing.

Two factors support a potential shift in trend. Midnight’s roadmap shows Q1 2026 centered on the Kūkolu phase, delivering a stable mainnet with trusted validators and privacy-first applications. At the same time, the Chaikin Money Flow is rising, signaling that outflows are shrinking and inflows may follow.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If inflows strengthen, NIGHT could rebound from the $0.053 level. Sustained buying would open a path toward the $0.120 all-time high, a 126% upside. Charles Hoskinson’s involvement adds credibility. Failure to sustain momentum, however, could send NIGHT lower toward $0.039.

Sponsored

Sponsored

Hyperliquid (HYPE)

HYPE currently trades near $29 and requires a 98% rally to revisit its $59 all-time high. Recent data shows a shift in investor behavior. The Chaikin Money Flow has moved above the zero line, signaling that inflows now dominate. Such transitions often mark early recovery phases, as buyers absorb supply and stabilize price action.

Correlation data adds further support to a bullish outlook. HYPE shows a -0.22 correlation with Bitcoin, indicating independent price behavior. Demand has also strengthened sharply. Hyperliquid’s HIP-3 open interest surged to $793 million on January 26–27, 2026, from $260 million a month earlier. This growth reflects rising interest in decentralized commodities trading and alternative market structures.

If momentum holds, HYPE could break above the $38 resistance and advance toward $47. Turning that level into support would confirm a recovery path toward $59. However, failure to sustain inflows would shift risk lower. Under renewed selling pressure, HYPE could slide toward $23 or even $20, invalidating the bullish thesis.

Monero (XMR) – MFI

Another one of the altcoins that could hit new all-time highs is Monero, which is trading near $437 after breaking below the $450 support level. The privacy coin has dropped about 30% over the past 11 days. Despite the decline, the Money Flow Index suggests selling pressure is approaching saturation, indicating that downside momentum may be weakening.

Although the MFI has not entered oversold territory, it reflects similar exhaustion conditions. If buying pressure improves from current levels, XMR could stage a rebound. With privacy coins gaining renewed attention, Monero may benefit from narrative-driven demand and reclaim levels above $500 by February 2026.

A sustained recovery could push XMR toward $600 and $679. Securing those levels would open a path toward $800, representing an 83% upside. However, if the privacy narrative fails to deliver strong inflows, Monero may consolidate below $500 while holding support above $417.

Crypto World

Binance Alpha adds support for Ondo tokenized stocks

Binance has added support for tokenized U.S. stocks and exchange-traded funds on its Alpha trading platform, giving users new ways to access traditional assets through blockchain-based products.

Summary

- Binance Alpha listed Ondo tokenized securities on its platform.

- The launch includes 10 major U.S. stocks and ETFs with low or zero trading fees.

- The move marks Binance’s return to tokenized equities under clearer regulations.

The update allows users to trade tokenized securities directly using funds held on Binance Exchange, without moving assets to external wallets. Trading is available through the Alpha section of the platform.

The initial rollout includes 10 products, covering major technology stocks and the Nasdaq-100 ETF. At launch, supported assets include tokenized versions of Apple, Tesla, Nvidia, Amazon, Meta, Microsoft, Alphabet, and the Invesco QQQ ETF.

Regulated structure and trading features

Binance said the tokenized securities are classified as structured products under regulations issued by the Financial Services Regulatory Authority in Abu Dhabi’s Abu Dhabi Global Market. Under this framework, the products are offered in approved jurisdictions and are not available to users in the United States.

Each token is designed to reflect the market price of its underlying stock or ETF. While holders gain exposure to price movements, they do not receive voting rights or other shareholder privileges.

The exchange said users can place both market and limit orders through the Alpha interface. Trading fees may fall to 0%, and gas fees for placing and canceling orders are being waived for a limited period.

Binance also introduced a rewards system tied to the new listings. By trading or holding tokenized securities, users can accrue Alpha Points, which can then be redeemed for token sales, promotions, and airdrops.

Ondo Global Markets has reported a total value locked of more than $550 million since its launch last year. The company has focused on developing compliant infrastructure for tokenized stocks and ETFs.

Return to tokenized equities and market impact

After closing a similar product in 2021 due to regulatory pressure, Binance is making a comeback to tokenized stocks with this listing. Since then, the exchange has adopted a more cautious stance, emphasizing regional approvals and regulated structures.

Binance can now re-enter the market while lowering legal risk thanks to the partnership with Ondo. For users outside the U.S., the products offer access to popular equities that may otherwise be difficult to trade directly.

The integration has also drawn attention to Ondo’s wider plans, including its work on a dedicated blockchain for institutional real-world assets and its expansion into derivatives and structured finance products.

Following the announcement, Ondo (ONDO) token gained about 5% as trading activity surged. Market observers say the move reflects rising demand for regulated ways to trade traditional assets through crypto platforms.

Binance stated that it may expand its tokenized securities lineup in the future, depending on user demand and regulatory developments.

Crypto World

Crypto exchange giant Binance revives tokenized stocks trading with Ondo Finance

Binance, the world’s largest crypto exchange by trading volume, is returning to offer tokenized stocks nearly five years after shelving a similar product under regulatory pressure.

The exchange has teamed up with tokenization specialist Ondo Finance to list 10 tokenized U.S. stocks, ETFs and commodity-linked products on the Binance Alpha platform, the companies said in a Tuesday press release.

Binance Alpha is a platform within Binance Wallet, the exchange’s crypto wallet service, that allows users to trade early-stage, riskier crypto projects before listing them on the centralized spot marketplace.

The lineup includes blockchain-based token versions of Apple, Google, Tesla and Nvidia shares, along with the Invesco’s Nasdaq-tracking QQQ ETF.

The tokenized stocks are not available to users in the United States.

“Our users now have even more convenient ways to explore and trade tokenized securities, in line with our mission to offer innovative and accessible trading opportunities,” Jeff Li, Binance’s vice president of product, said in a statement.

The move marks a comeback for Binance, having offered tokenized stocks in April 2021 with Tesla and later added Coinbase, Strategy, Microsoft and Apple, before shutting the service after scrutiny from the U.K.’s Financial Conduct Authority and Germany’s BaFin.

Last month, Binance said it was weighing a fresh push into tokenized equities. Listing the Ondo-issued tokens on the platform now puts that plan into action.

Tokenized stocks have gained traction across crypto and traditional finance, with sector’s total value is approaching $1 billion, led by Ondo’s more than $550 million in locked value and $11 billion in cumulative trading volume since September 2025.

Trading venues such as Kraken, Bybit and Gemini and brokerages like Robinhood rolled out their versions of tokenized equities trading. Wall Street exchanges such as Nasdaq and the New York Stock Exchange (NYSE) also laid out plans to offer trading with stocks tokens.

Blockchain-based stocks can widen investor access, especially to retail users in developing countries without easy access to brokerage accounts offering U.S. stocks, proponents say. The tokens can also serve as collateral for borrowing in decentralized finance (DeFi).

Read more: NYSE’s 24/7 plan could fix key problem for stock tokens, Ondo’s de Bode says

Crypto World

MoonPay launches non-custodial wallets for AI agents

Crypto payments platform MoonPay has introduced a new product designed to give artificial intelligence systems direct access to digital wallets and on-chain transactions.

Summary

- MoonPay launched MoonPay Agents on to support non-custodial AI wallets.

- The platform enables automated trading, funding, and machine-to-machine payments.

- The product targets developers building large-scale autonomous financial systems.

MoonPay Agents, a non-custodial software layer that enables AI agents to create wallets, manage funds, and trade on behalf of verified users, was officially launched by the company on Feb. 24.

The system is built on MoonPay’s command-line interface and is aimed at developers building automated programs that need to move money without relying on centralized custody. Once a user completes identity checks and funds a wallet, an AI agent can trade, swap, and transfer assets independently.

Connecting AI systems to digital money

MoonPay said the product supports the full financial cycle, including fiat-to-crypto funding, portfolio tracking, and conversion back to traditional currencies. Users can also receive funds through virtual accounts or payment services such as Apple Pay, PayPal, and Venmo.

“AI agents can reason, but they cannot act economically without capital infrastructure,” said Ivan Soto-Wright, the company’s chief executive officer. He said the goal is to make crypto the default financial layer for autonomous systems.

According to MoonPay, users can set up a working wallet and agent connection in minutes, allowing automated systems to begin executing strategies almost immediately.

MoonPay Agents includes tools such as recurring purchases, real-time cross-chain swaps, machine-to-machine payments, and automated fiat funding via on-ramps. These features are designed to ensure that agents always have access to liquidity when operating.

Additionally, the platform supports portfolio monitoring, token discovery, and basic risk analysis, enabling developers to incorporate financial management straight into their apps. Wallets are stored on users’ own devices, giving them direct control over private keys.

The product is built to scale from single-user setups to networks of thousands of agents. It runs on the same infrastructure that supports nearly 500 enterprise customers and more than 30 million users across 180 countries.

Part of a the growing “agent economy” trend

The launch comes amid growing interest in so-called “agentic” systems that can plan and act without continuous human oversight. Industry forecasts suggest the autonomous agent economy could reach $30 trillion by 2030, with AI systems managing a large share of routine financial decisions.

In crypto markets, this shift is already underway. AI-powered wallets are being used for trading, DeFi activity, and machine-to-machine payments. At ETHDenver 2026, developers showcased blockchain-based identity tools, automated treasuries, and agent-led trading systems, highlighting the rapid growth of this trend.

According to company executives, MoonPay Agents will serve as a default financial rail for developers building trading bots, gaming platforms, and automated payment systems. With AI systems increasingly taking on financial tasks, MoonPay is positioning its infrastructure as a foundation for this emerging market.

Crypto World

PayPal pops nearly 7% on report Stripe is weighing an acquisition

Thomas Fuller | SOPA Images | Lightrocket | Getty Images

PayPal‘s stock surged nearly 7% on Tuesday following a report that fintech startup Stripe is weighing buying the payments platform.

Bloomberg reported the news, citing people familiar with the matter, and said the discussions are in early stages. The report said Stripe is considering buying all or some segments of PayPal’s business.

The news comes a day after reports that buyer interest has picked up in the company following its recent stock slump.

PayPal and Stripe declined to comment on the report.

PayPal, which is grappling with slowing growth in an increasingly competitive financial payments industry, has plummeted more than 19% since the start of the year. The company shed nearly a third of its value in 2025.

Earlier this month, the stock plunged on lackluster profit guidance and its board appointed HP’s Enrique Lores as its new CEO to start at the beginning of March.

Meanwhile, fintech startup Stripe hit a $159 billion valuation on Tuesday following a secondary stock sale for employees and shareholders.

That’s up from the $91.5 billion a year ago. Stripe said in a business update that its revenue suite is slated to reach an annual run rate of $1 billion this year.

Stripe, which ranked 10th on CNBC’s Disruptor 50 list last year, has transformed into one of the most valuable private companies yet and recently acquired billing startup Metronome in January.

Stripe co-founder and president John Collison told CNBC’s Andrew Ross Sorkin on Tuesday that the company isn’t yet aiming for an IPO, which would sidetrack its current product and business growth.

Read the full Bloomberg article here.

Crypto World

Why Bitcoin’s Rising HODL Cohorts Are a Bearish Signal This Time

Short-term coin activity remains near historic lows, highlighting weak participation from new buyers across the network.

Bitcoin faced renewed sell pressure on Tuesday, briefly dragging the price down to $62,700 after a 5% decline, as macro concerns continued to weigh on investor sentiment.

New data suggest that BTC remains in a defensive phase as capital continues to exit the network and supply ages steadily without signs of renewed accumulation.

Peak Buyers Now Frozen

Realized Cap, which measures the aggregate value of all coins at the price they last moved, has declined for a second consecutive month. According to the latest analysis by Axel Adler Junior, this indicates that capital continues to exit the network rather than flow into it.

The 30-day Realized Cap Net Position Change currently stands at -2.26% and has remained negative for several weeks, which means that coins are either being transferred below their cost basis or that incoming capital is insufficient to offset ongoing outflows. Realized Cap peaked on November 26, 2025, at approximately $1.127 trillion and has since fallen to around $1.094 trillion – a compression of roughly $33 billion.

Daily net position changes continue to hover around zero or remain negative, amidst the absence of new capital entering the market. As long as the 30-day Realized Cap metric stays below zero, the network remains in net outflow mode. A move back into positive territory is the first condition required for a shift toward accumulation.

In addition, HODL Waves data revealed a sharp structural change in coin age distribution that is consistent with this defensive regime. Coins that last moved 3-6 months ago now make up about 26% of Bitcoin’s supply, up from 19% earlier this month. These coins were mostly bought near the last market peak and haven’t moved since.

The share of Bitcoin held for 6-12 months has grown to just over 20%, while coins moved within the past month account for less than 10% of the supply. This shows that few new buyers are entering the market, as per Adler Junior. Most circulating coins were bought at higher prices and are now sitting at a loss, which has left holders reluctant to sell and effectively locking supply in place.

You may also like:

The growth of older cohorts does not represent strategic accumulation but rather forced holding due to unfavorable price conditions. The structure would only see a meaningful change if coins in the 3-6 month band begin migrating into longer-term cohorts without triggering renewed selling pressure, alongside a measurable return of short-term activity.

Familiar Bear Signal Is Back

Against the backdrop of bleeding capital, an important technical signal that has appeared near the end of past Bitcoin bear markets is starting to form again. According to analyst Ali Martinez, a potential death cross on Bitcoin’s three-day chart is projected to occur in late February.

In previous cycles, this signal consistently showed up just before the final major drop. With the crypto asset still 50% below its October 2025 peak, Martinez warned that a similar setup could open the door to further downside.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Mark Zuckerberg’s Meta is planning stablecoin comeback in the second half amid U.S. regulatory shift

Meta, the U.S. tech giant helmed by Facebook creator Mark Zuckerberg, is aiming to enter the stablecoin space later this year, pending successful integration with a third-party firm to facilitate payments using the dollar-pegged token technology, according to three people familiar with the plans.

The tech giant, which owns Facebook, WhatsApp and Instagram and has more than 3 billion users, wants to begin its stablecoin integration early in the second half of this year, said one of the people, who spoke on condition of anonymity because the plans are not public. Meta is planning to integrate a vendor to help administer stablecoin-backed payments and implement a new wallet, the person said.

A second person said that Meta has sent out a request for product (RFP) to third-party firms and mentioned Stripe as a likely candidate for piloting Meta’s stablecoin.

Stripe, which acquired stablecoin specialist Bridge last year, is a long-time partner of Meta, and Stripe CEO Patrick Collison joined Meta’s board of directors in April 2025.

Meta, Stripe, and Bridge were approached for comment, but none responded by the time of publication.

Meta introducing stablecoins would let it open payment rails to its massive user base while bypassing expensive traditional banking fees, and potentially position it as a global leader in “social commerce” and cross-border remittances.

The move would also put the tech giant in direct competition with the likes of Elon Musk’s social media platform X as well as messaging platform Telegram, both of which are aiming to bring payments in-house by becoming “super apps.” This was one of the original goals for the planned Libra project — allowing the social media company to tap its vast networks, including WhatsApp’s peer-to-peer messaging service and Facebook and Instagram’s network and commerce tools, for payments.

Regulatory shift

Meta famously tried to introduce the Libra stablecoin, later renamed Diem, in 2019, only to face strong headwinds due to a less favorable regulatory climate than today’s and a lingering reputational hit from the Cambridge Analytica scandal.

In the face of a pushback against the project by U.S. lawmakers, the Libra Association, as it was then called, scaled back its ambitions in 2020, pivoting to the development of a number of stablecoins pegged to different currencies, as opposed to the original plan of a global digital currency backed by a basket of national currencies.

In the end, Meta’s stablecoin never formally launched, and the project was shut down and its assets sold off in early 2022.

The regulatory climate in the U.S. today is quite different. There are several crypto regulatory regimes underway, including President Donald Trump’s GENIUS Act, which, for the first time, established a legal foundation for U.S. stablecoin issuers and opened the floodgates for market entrants with new tokens. However, U.S. regulators are still only in the early stages of drafting the regulations governing issuers.

That said, the whole Libra/Diem experience has led Meta to prefer relying on a third-party stablecoin payments provider this time around, according to one of the sources.

“They want to do this, but at arm’s length,” said the source.

Crypto World

Global M&A stays strong in 2026 despite tightest capital squeeze in 30 years

A Goldman Sachs logo is displayed on the floor of the New York Stock Exchange in New York City, on Wednesday, August 11, 2010.

Ramin Talaie | Corbis Historical | Getty Images

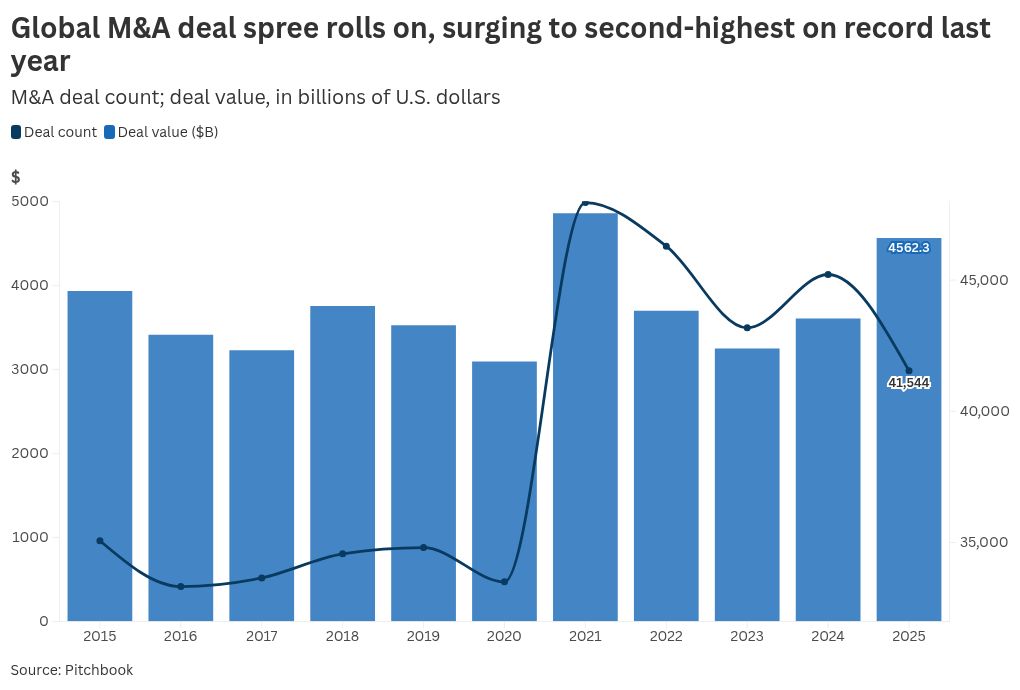

The global mergers and acquisitions boom that defined 2025 is carrying into 2026, as companies reassess their portfolios and artificial intelligence-led demand fuels large-scale transactions. However, a tightening capital pool is forcing executives to be more selective than ever.

Despite a sluggish start as Trump’s sweeping tariffs early last year briefly scuttled acquisitions and new public listings, the total value of deal-making activity surged 40% to $4.9 trillion in 2025, according to Bain & Company’s annual M&A report.

That marked the second-highest level on record, trailing only the $5.6 trillion peak in 2021, when low borrowing costs and buoyant equity markets propelled a historic dealmaking frenzy.

Dealmaking activity last year rebounded as central banks cut interest rates, valuations improved and companies increased spending on artificial intelligence.

Markets are betting that the surge will continue, as Wall Street regains its appetite for large deals amid the prospect of lower borrowing costs.

A Bain survey of 300 M&A executives found that 80% expect to sustain or increase deal activity this year, citing improved macroeconomic conditions and a growing backlog of private equity and venture capital assets awaiting exit.

As abrupt shifts in trade policies settled into a pattern of less threatening change, relief turned into confidence and then a fear of missing out.

Jake Henry

Global co-leader, McKinsey’s M&A Practice.

Goldman Sachs, drawing on its own poll of 600 corporate and financial sponsor clients, found that 57% believe scale and strategic growth will be the primary driver of deal decisions this year.

“As abrupt shifts in trade policies settled into a pattern of less threatening change, relief turned into confidence and then a fear of missing out,” said Jake Henry, global coleader of McKinsey’s M&A Practice.

Central to the shift is a decisive push by companies to reassess their portfolios, as geopolitical risks, economic fragmentation and uneven global growth force boards to reconsider where they operate and the risks they are willing to take.

“Leaders across industries recognize that many traditional business models have reached the limits of their historical growth engines,” said Suzanne Kumar, executive vice president of Bain’s global M&A and divestiture practice.

“Companies urgently need to reinvent themselves to get out ahead of the big forces of technology disruption, a post-globalization economy, and shifting profit pools,” Kumar added.

Goldman topped the global M&A ranking last year, advising on nearly 40 deals worth $1.48 trillion in total volume. It marked the strongest period for mega-deals by volume, according to Reuters, citing LSEG records dating back to 1980.

Still, companies remain cautious. Boston Consulting Group’s M&A sentiment index rebounded to 75 from its low in late 2022 — but still remained well below the long-term average of 100, reflecting “an improving but cautious stance.” A higher value than the prior month indicates that M&A market momentum is accelerating, while a lower value suggests a deceleration.

Tightest funding squeeze in decades

While the appetite for deals remains strong, the pool of discretionary capital to fund them is historically thin, forcing executives to pursue only transactions that deliver clear returns.

The proportion of capital allocated to M&A hit a 30-year low in 2025, according to Bain, as companies directed more cash towards dividends, buybacks, capital expenditures as well as research and development.

“Executives must pressure test whether M&A pathways and specific deals will help the company better compete in the most attractive markets … rethink portfolio boundaries, and make bigger, bolder decisions about what capabilities they must own vs. access,” said Kumar.

“As competing demands for capital raise the bar for deals, disciplined reinvention and value creation are essential,” she added.

The funding crunch has pushed private capital to the center of dealmaking. Private equity firms are seeking to deploy idle cash, borrowers are turning to private credit funds for flexibility, and sovereign wealth funds are increasingly acting as lead investors rather than passive backers.

Private equity now accounts for roughly 40% of global M&A activity, according to Goldman. Despite signs of stress in the private credit market — now valued at roughly $2.1 trillion — Goldman expects the asset class to more than double by 2030, broadening the pool of capital available to fund large transactions.

AI capital expenditure ‘supercycle’

Blockbuster deals are fueling the resurgence in M&A, powered by AI-related demand, according to industry reports.

Mega-deals valued at greater than $5 billion accounted for more than 73% of the increase in deal value in 2025, according to Bain.

The number of deals exceeding the $10 billion threshold swelled to 60 last year, the highest level since 2021, said McKinsey’s Henry.

“We expect more big deals in 2026, with continued consolidation and geographic expansion,” Henry said, with AI-related service providers fueling “big-deal fever” this year.

However, the heavy capital spending in AI could constrain M&A activity in the near term, Brian Levy, global deals industries leader at PwC, said.

As AI adoption accelerates, demand for computing power has surged across digital infrastructure, energy, semiconductors, and hardware optimization. In response, many companies are opting to acquire rather than build across the technology stack.

Between the first quarter of 2024 and the third quarter of last year, U.S. hyperscalers’ capital expenditures averaged $760 million per day, according to Goldman Sachs.

The Wall Street bank estimates that by 2030, another 65 gigawatts of data center capacity will come online — more than double the amount added from 2019 to 2024.

“Investment in AI is being directed towards data centres, energy, and other infrastructure as well as technology development and customisation,” Levy said.

“In the near term, the scale of this multitrillion-dollar investment may divert capital and temper M&A activity.”

Crypto World

Meta Plans Stablecoin Return With Third-Party Partner

TLDR

- Meta plans to reenter the stablecoin market in the second half of 2026 through a third-party partnership.

- The company has issued a request for product to select a vendor for stablecoin payments integration.

- Stripe has emerged as a likely candidate to pilot the stablecoin payment system.

- Meta intends to integrate a new wallet to support dollar-pegged stablecoin transactions.

- The renewed effort follows the shutdown of the Libra and Diem projects in 2022.

Meta is preparing to reenter the stablecoin market later this year through a third-party partnership. The company aims to integrate a dollar-pegged token for payments across its platforms. Sources said the rollout could begin early in the second half of 2026, pending vendor selection.

Meta Revives Stablecoin Strategy With External Partner

Meta has sent a request for product to several payment firms, according to two people familiar with the process. One source said the company prefers a third-party issuer instead of launching its own token.

The source said Meta plans to integrate a vendor to manage stablecoin-backed payments and a new wallet. The person added that the company wants operational readiness before the second half launch window.

Stripe has emerged as a likely pilot partner, according to a second person. Stripe acquired stablecoin firm Bridge last year and maintains a long partnership with Meta.

Patrick Collison joined Meta’s board in April 2025, strengthening ties between the companies. However, Meta, Stripe, and Bridge did not respond to requests for comment.

Meta owns Facebook, Instagram, and WhatsApp, which together serve more than three billion users. The company aims to use stablecoin rails to reduce payment processing costs and expand digital transactions.

Sources said the integration would support cross-border transfers and in-app purchases. However, Meta has not disclosed technical specifications or launch markets.

Regulatory Shift Shapes Meta’s Renewed Effort

Meta attempted to launch Libra in 2019 but faced regulatory resistance in the United States and Europe. Lawmakers criticized the project and raised concerns about financial stability and data privacy.

The Libra Association later rebranded the project as Diem and narrowed its scope. It shifted from a global basket-backed currency to individual currency-pegged stablecoins.

Meta shut down the Diem project in early 2022 and sold its assets. The company has since avoided direct issuance of digital currencies.

The current regulatory landscape in the United States has evolved. President Donald Trump’s GENIUS Act established a legal framework for stablecoin issuers.

Regulators are still drafting detailed compliance rules for token providers. However, the new law has encouraged more companies to explore stablecoin services.

One source said the Libra experience shaped Meta’s new approach. The person stated that Meta now prefers to rely on an established stablecoin issuer.

The company aims to integrate payments without assuming direct regulatory responsibility for issuance. Sources said Meta continues internal planning while it evaluates vendor proposals.

Crypto World

Crypto’s biggest exchange fights back against allegations of moving billions of Iran-linked money

Crypto exchange Binance accused The Wall Street Journal Tuesday of publishing “false information” in a Monday article about the exchange allegedly firing employees investigating funds moving through the exchange to sanctioned entities.

Richard Teng, Binance co-CEO, accused the WSJ of “inaccurate reporting about our compliance program” in an X post. He included a letter to the news organization from the crypto exchange’s counsel in New York City, which said “The Wall Street Journal published defamatory claims,” despite the exchange’s attempts to “set the record straight.” The letter is similar to one Binance directed to Fortune last week over a similar article which said the exchange fired investigators who reported sanctions concerns.

The Journal’s article on Monday said the crypto exchanged fired staff investigators who identified $1 billion that moved to “a network funding Iran-backed terror groups.”. The report claimed to have Binance documents and statements from people familiar with Binance operations, saying that the crypto exchange dismantled the staff investigation into the $1 billion..

Binance claims staff were disciplined

The Journal article includes a statement from a Binance spokeswoman saying the investigators resigned and denied they were fired or suspended for raising compliance concerns.

“Documents, foreign law-enforcement officials and the people familiar with Binance’s operations said the same conduct that broke the sanctions and anti-money-laundering laws has persisted at the exchange,” the Journal article said, referring to Binance’s 2023 settlement with the U.S. Department of Justice and other authorities, in which the exchange and founder Changpeng “CZ” Zhao admitted to violating federal money laundering statutes..

The news report also mentions $1.7 billion more in 2024 and 2025 that were transferred from Binance-registered Chinese clients to Iran-backed groups, including Yemen’s Houthi militants. The New York Times’ article also published on Feb. 23 alleges the same information.

Both influential U.S. newspapers said the four individuals “fired” by Binance, who worked in compliance and market oversight roles, were dismissed after the crypto exchange concluded they had failed to adequately escalate red flags related to suspicious trading activity and potential policy violations.

A Binance spokesperson told CoinDesk the exchange conducted an “internal review and did not find evidence of violations of applicable sanctions laws or regulations related to the transactions described.”

However, the spokesperson, who stated no investigator was dismissed for raising compliance or potential sanctions issues, said suspicious activity was detected and reported, which is “evidence that our controls are working, not the opposite.”

Rachel Conlan, another spokesperson, told the Times, there is an ongoing investigation and that a full report will be sent to the U.S. Justice Department on Feb. 25.

Binance said in a blog post on Sunday that its “sanctions-related exposure is minimal.”

“Recent reporting on our top-tier compliance is, at best, inaccurate. It presents a distorted, jumbled account that relies on false claims by disgruntled former employees. This incomplete and flawed viewpoint reflects a lack of understanding of general compliance control processes for crypto exchanges,” the blog post, which was published prior to the Wall Street Journal’s report.

Crypto World

New Data Reveals Which Wall Street Firms Sold Bitcoin ETFs

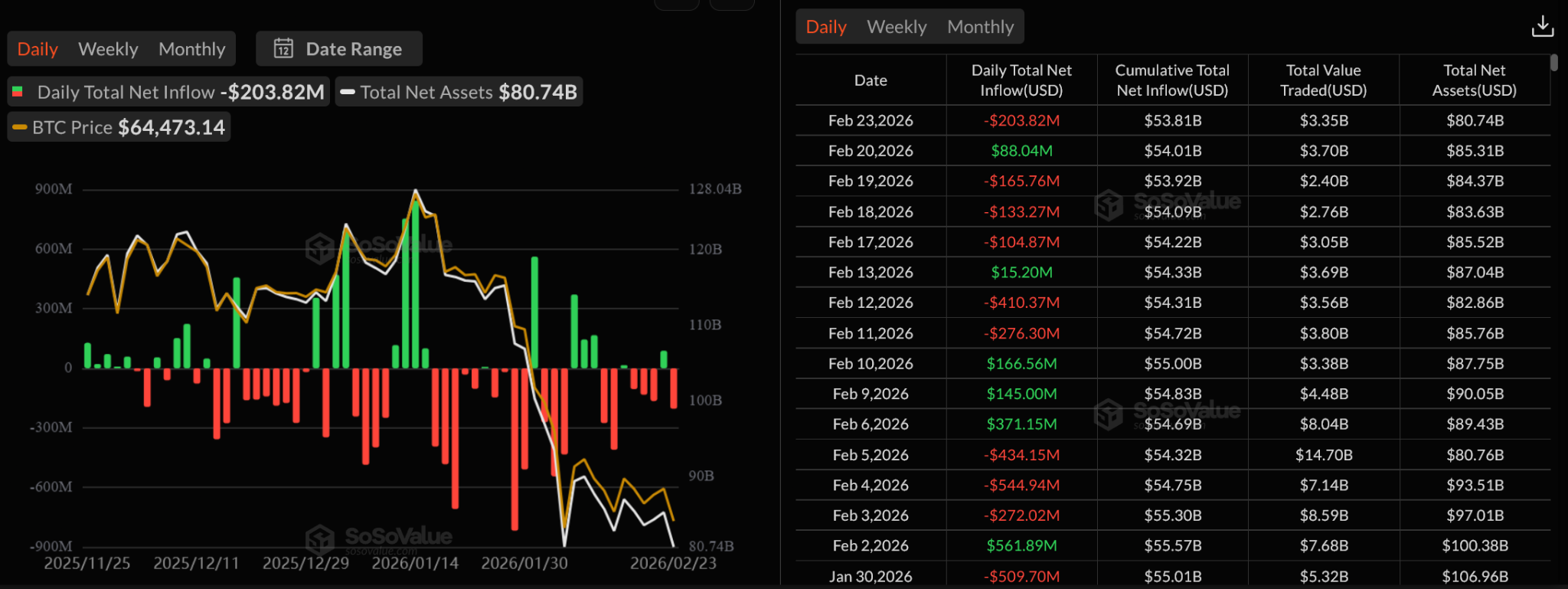

Large US investors reduced their Bitcoin ETF holdings in late 2025, and new breakdowns show the selling came mainly from a few specific groups rather than the entire market.

Bloomberg Intelligence data shared by analysts shows that 13F filers — large institutions that report quarterly holdings to the US SEC — were net sellers of Bitcoin ETFs in Q4 2025, cutting exposure by nearly $1.6 billion.

The biggest reductions came from investment advisors and hedge funds, the two largest holder categories.

13F Filers Sold Their Bitcoin Shares

A 13F filer is a large US money manager (usually with over $100 million in qualifying assets) that must report its holdings every quarter. These filings show a snapshot of positions at quarter-end.

These firm’s reported Bitcoin ETF holdings were lower in Q4 than in Q3. In other words, they reduced ETF shares, not necessarily that they sold physical Bitcoin directly on exchanges.

That helps explain why Bitcoin has remained under pressure even during short-term rebounds. ETF flow data shows repeated daily outflows in recent weeks, including several large red days in February.

Who Sold the Most

The category-level data shows the largest net reductions came from:

- Investment Advisors: about -21,831 BTC

- Hedge Fund Managers: about -7,694 BTC

Other categories, such as brokerages and banks also reduced exposure.

However, some groups increased holdings, including holding companies and government-related entities.

This does not mean “all institutions turned bearish.” Many firms use Bitcoin ETFs for hedging, arbitrage, or short-term trading, not just long-term bets.

However, the broader signal is clear. Big-money positioning weakened, and that matches the recent ETF outflow trend.

Until daily ETF flows stabilize and turn positive for more than a few sessions, Bitcoin may remain in a fragile, relief-rally phase rather than a full recovery.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World19 hours ago

Crypto World19 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech9 hours ago

Tech9 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 hours ago

NewsBeat4 hours agoPolice latest as search for missing woman enters day nine