Crypto World

5 years after GameStop mania, retail investors are reshaping markets

Five years after a band of online traders sent GameStop skyrocketing and upended Wall Street’s assumptions about “dumb money,” the influence of retail investors has proven more durable and long-lasting than many expected.

What began as a dramatic short squeeze in early 2021 has evolved into a persistent force in equity markets, reshaping trading dynamics, pushing hedge funds to adapt and providing a steady source of dip-buying flows of cash that helped underpin one of the longest bull markets on record.

“Retail investors were signals,” said Tom Lee, head of research at Fundstrat, whose flagship exchange-traded fund exceeds $4 billion in assets. “When they were buying dips, I knew the bull market was healthy. The post-2020 world looks a lot like it did in the nineties to me, which is that retail investors actually are really good at fleshing out good growth stories, and then they can do it with size and conviction. They are difference makers.”

Before the pandemic, retail trading accounted for only a small fraction of daily equity volumes in the U.S. That changed as lockdown-era government stimulus payments, zero-commission trading and social media-fueled coordination pulled millions of new investors into markets.

“People had assumed that once Covid cleared up, and everybody went back to their daily lives in whatever form that is, that this retail participation would secede and go back down,” said Steve Quirk, chief brokerage officer at Robinhood Markets. “What surprised me a little bit is how strongly it’s continued.”

On average, individual investor participation in U.S. equities has risen to nearly 20% of daily trading volume, up from low single digits before Covid, according to Jeff Shen, co-chief investment officer and co-head of systematic active equities at BlackRock.

“There is certainly a social aspect of it that is quite foreign to a classic hedge fund where there’s a lot of independence,” Shen said. “The social aspect makes this type of flow very correlated” among varying types of Main Street investor.

Quirk noted that on high-volume days, retail participation in equities could shoot up to close to 40% and, on the options side, as high as 50% of volume.

During the meme stock frenzy, traders flocked to online forums such as Reddit’s WallStreetBets, where ideas spread at a rapid pace and unprecedented scale. Figures like Keith Gill, known online as Roaring Kitty, emerged as focal points for a loosely coordinated community that shared research, trading strategies and a deep skepticism of Wall Street orthodoxy. The GameStop saga also left a mark on popular culture, inspiring the 2023 film “Dumb Money,” starring Paul Dano and Seth Rogen.

A scene from the trailer for the film “Dumb Money” starring Paul Dano.

Courtesy: Sony Pictures Entertainment

Far from being wiped out after the meme stock boom faded, retail investors have continued to deploy capital — propelling retail flows to fresh records in 2025, according to JPMorgan. The bank found inflows jumped nearly 60% from the prior year and were about 17% higher than the previous peak set in 2021, when meme stock trading was at its height.

“This is a new retail investor that is much more informed, much more engaged, has many more tools,” said Devin Ryan, senior analyst at Citizens JMP. “It’s not just democratization of access to the markets, but also of information.”

A drop in trading commissions in 2019, and the rise of fractional trading also helped open up markets ahead of Covid. A few decades ago, trading commissions were close to $100. By 2020, most brokerage firms had also added the ability to trade “fractions” of a share. That meant you could buy in dollar amounts versus needing to have thousands to get access to your favorite tech stock. And there were largely no account minimums.

Respect from institutions

Hedge funds and short sellers learned a painful lesson. Crowded bearish positions now carry greater risk in an era where retail traders can quickly mobilize capital and amplify moves.

“It’s just so great to see that dumb money moniker go away, and then to get respect from the institutions,” said JJ Kinahan, head of retail expansion and alternative investment products at Cboe Global Markets. “Professionals learned a lesson from the tenaciousness of the retail investors who believe in companies and continue to buy them.”

Many hedge funds have scaled back short exposure, diversified portfolios and invested heavily in tracking retail sentiment to avoid becoming targets of coordinated buying.

“To many professional investors, retail traders have become that annoying TV-series villain who never quite gets written out,” said Ivan Ćosović, founder of Breakout Point, a firm that tracks retail trader activity on discussion boards. “Now, five years in, it’s basically the fifth season of the show, and somehow they’re still in the cast.”

Retail investors’ dip-buying during key drawdowns like the tariff-induced sell-off in early April — along with the rush into the SPDR Gold Shares (GLD) — last year resulted in bumper returns that left Wall Street taking note.

In 2026, everyday investors have turned their attention to energy stocks following the U.S. strike on Venezuela and silver amid the metal’s monster run. Silver passed the $100 per ounce mark for the first time last week.

“They’re really, really savvy,” said Quirk of Robinhood Markets. “They bailed out the market during Covid, and they bailed it out again during the tariffs, they were aggressive buyers.”

SPDR Gold Trust over one year

To be sure, other volatile investing opportunities have popped up in the void left by pandemic-era short squeezes of stocks like GameStop and AMC. Demand for options and leveraged funds have boomed in recent years, while a new class of meme stocks including Opendoor and Kohl’s sprouted up in 2025.

But at exchange-traded fund manager Direxion, retail investors are using their high-risk levered instruments wisely, according to CEO Douglas Yones. Firm research shows mom-and-pop investors are typically devoting only a small portion of their overall portfolios to these speculative plays, while keeping most of their money in more traditional investments.

“The markets are playing into the hands of retail,” said Yones, a former executive at the New York Stock Exchange. “The volatility has been incredibly good for end investors.”

Wealth transfer

Retail’s influence is being reinforced by a favorable backdrop of rising stocks and a looming generational wealth transfer from baby boomers, a shift that is gradually putting more capital in the hands of investors comfortable with digital-first trading.

Household investors collectively control more wealth than institutional investors, Fundstrat’s Lee said, with roughly 76% of household wealth held by people over the age of 60, a demographic that has traditionally been less active in trading but increasingly influential as assets shift hands.

Lee added that about $120 trillion will be inherited by millennials and Gen Z over the next 20 years.

“Retail participation could get much, much bigger,” Lee said. “That’s four times the size of the U.S. economy. It’s more wealth than the entire net worth of China.”

Brokerage firms are starting to build tools to cater to these younger investors. They’ve overwhelmingly moved toward 24/7 trading, a hallmark of cryptocurrency markets which trade on nights and weekends. More firms are offering access to cryptocurrencies and crypto ETFs, while prediction markets are booming. There’s also been a rise in private-market offerings for average investors.

‘The greatest thing since sliced bread’

Already, data shows how much more skin young people have in the game. JPMorgan found 37% of 25-year-olds in 2024 moved “significant” sums from checking to investment accounts in recent years — a sharp increase from the 6% recorded doing the same in 2015.

Nick Wyatt, a 27-year-old auditor, is one of those Covid-era traders. With extra downtime during the pandemic, the Michigan resident researched and consulted a friend on how best to grow his spare cash saved from a part-time job in the market. Wyatt briefly tried day trading stocks as he began investing, but quickly decided to instead use a conservative, long-term strategy that includes funding a Roth individual retirement account.

“It’s the best decision I ever made,” said Wyatt, who has since gotten his fiancé into investing and used profits for a down payment on a home. “Compounding interest is the greatest thing since sliced bread. You can’t beat it.”

Correction: This story has been updated to correct quotes from Steve Quirk of Robinhood Markets and Tom Lee of Fundstrat.

Crypto World

HBAR price risks correction to $0.07 as structure shifts

HBAR price faces downside risk after losing key support at $0.09, with bearish intraday structure increasing the probability of a corrective move toward $0.07.

Summary

- $0.09 support flipped into resistance confirms bearish structure

- Loss of point of control could accelerate downside momentum

- $0.07 high-timeframe support becomes next downside target

Hedera (HBAR) price action is showing early signs of structural weakness following a decisive loss of high-timeframe support near the $0.09 level. What previously acted as a strong demand zone has now transitioned into resistance, marking an important shift in market structure.

This transition is technically significant. When former support flips into resistance, it often signals a change in market control from buyers to sellers. Recent price movements suggest that HBAR is now undergoing a bearish retest of this level, a common market behavior that frequently precedes continuation to the downside.

As long as HBAR trades below $0.09, the broader technical outlook favors further corrective movement, with the next major support region located near $0.07 coming into focus.

HBAR price key technical points

- $0.09 support flipped into resistance: Structural breakdown confirms bearish shift

- Point of control under threat: Loss of key volume support could accelerate downside momentum

- $0.07 high-timeframe support targeted: Next major demand zone within current range

HBAR’s recent price action has been technically constructive in defining market direction. The confirmed loss of the $0.09 level represents a major structural development. Markets often respect these transitions strongly, as participants who previously bought at support may begin selling when price retests the level from below.

The current bounce toward resistance appears corrective rather than impulsive. Instead of establishing higher highs, price is forming a potential lower high within the intraday structure. This behavior aligns with a bearish retest scenario, where temporary upward movement allows sellers to re-enter positions before continuation lower.

From a market structure perspective, maintaining acceptance below $0.09 keeps sellers firmly in control. Until this level is reclaimed, bullish continuation remains unlikely in the short term.

Point of control becomes critical volume support

Another important level to monitor is the point of control (POC), which represents the area of highest traded volume within the broader range. The POC often acts as a final area of equilibrium before price transitions into expansion.

If HBAR loses acceptance around this level, it would signal that the market has abandoned its last major volume-based support. This development could significantly increase downside momentum.Below the POC lies a region of relatively thin volume, meaning fewer historical transactions exist to slow price movement. When markets enter low-volume zones, price tends to move quickly as liquidity gaps allow accelerated rotations toward lower value areas.

This technical dynamic strengthens the probability of a move toward the value area low and ultimately the $0.07 high-timeframe support.

Bearish retest suggests lower high formation

From a price action standpoint, the current local bounce appears to be a bearish retest rather than a trend reversal. Intraday structure continues to favor lower highs and weakening momentum, suggesting that the market is preparing for another rotational move downward.

Bearish retests typically occur after structural breakdowns, allowing price to revisit former support levels before sellers resume control. HBAR’s inability to reclaim resistance supports this interpretation.

If price forms a confirmed lower high beneath $0.09, it would further validate the bearish continuation thesis. This setup increases the likelihood that HBAR rotates toward deeper support levels as part of a broader corrective phase.

What to expect in the coming price action

From a technical, price action, and market structure perspective, HBAR remains vulnerable while trading below the $0.09 resistance. The current rebound appears corrective within a bearish intraday trend. A loss of the point of control could trigger accelerated downside movement toward the $0.07 high-timeframe support.

Unless buyers reclaim higher value and invalidate the lower-high structure, the probability favors continued downside rotation in the near term.

Crypto World

Price Falls While Network Activity Surges

XRP Ledger recorded multiple breakthrough metrics in February. These figures reflect Ripple’s effectiveness in attracting attention and accelerating adoption on its underlying blockchain.

However, XRP’s price remained stuck below $1.4 during the final week of February, despite several positive signals that predicted an upcoming recovery.

Activity on XRP Ledger Increased in February After Upgrades

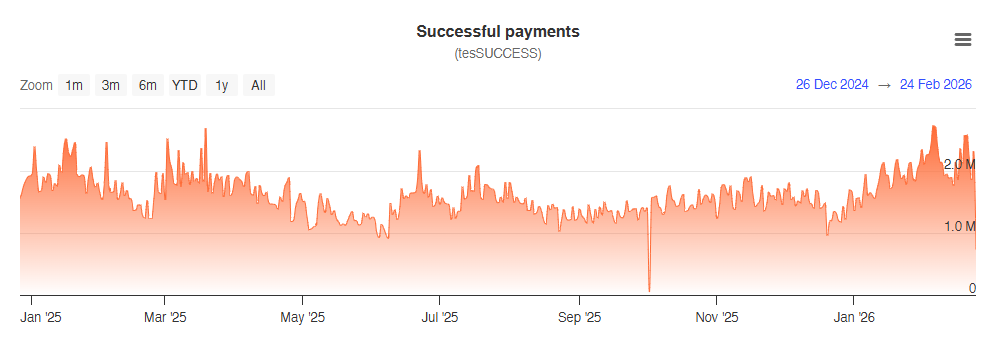

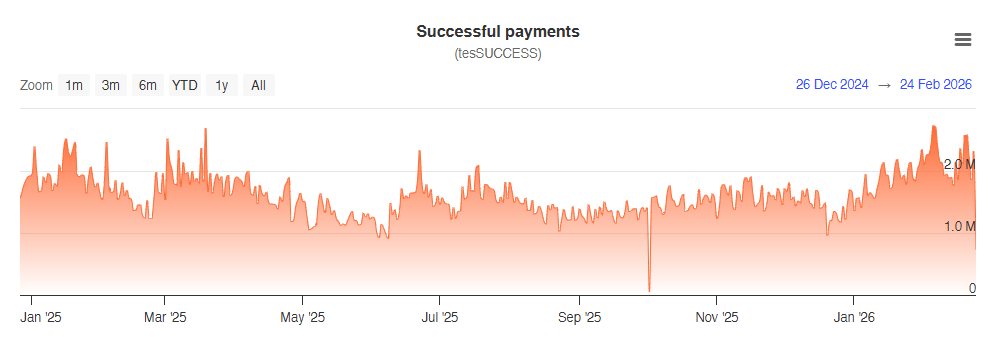

Data from XRPscan shows that the number of successful payments on the XRP Ledger has continuously increased over the past month. The figure rose from a low of 1 million payments at the end of December last year to more than 2.7 million in February. This marks the highest level in 12 months.

On the XRP Ledger, a successful payment is a transaction that validators have confirmed and recorded on the distributed ledger.

Therefore, this increase reflects the growing vibrancy of the XRP Ledger. A higher number of successful transactions proves that users genuinely use the network for payments, transfers, DeFi, or other applications.

“XRP network activity stays strong. Around 2M transactions per day and roughly 40K active addresses. That is real usage. While most chains chase narratives, XRPL keeps moving value. Payments. Settlements. This kind of consistency is what institutions look for,” crypto investor CryptoSensei said.

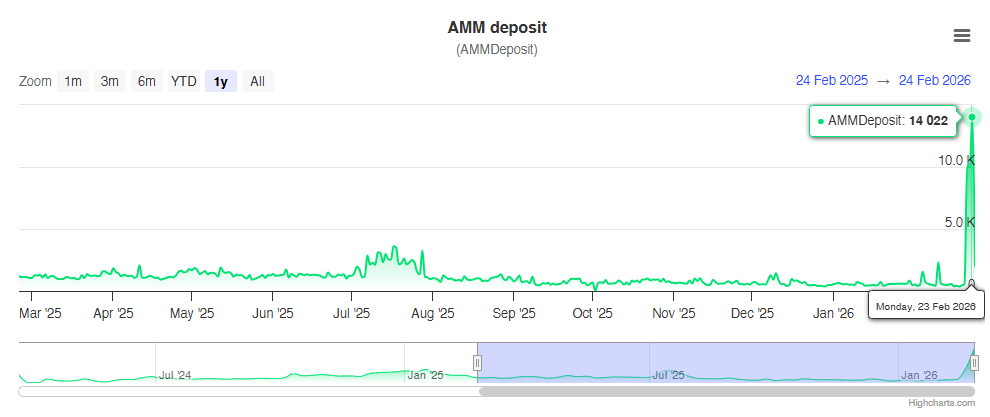

In addition, the Automated Market Maker (AMM) on the XRPL DEX showed signs of a breakout, with more than 14,000 deposits. This development provides XRPL with additional decentralized liquidity and reduces trading slippage.

Notably, AMM activity has never been this before. This breakout occurred after the Permissioned Domains upgrade was activated in early February. The network enabled the Permissioned DEX two weeks later.

Investors expect the Permissioned DEX to pave the way for banks, payment providers, and financial institutions to trade within a controlled liquidity environment on XRP Ledger.

Despite these positive signs, XRP’s price continued into its fifth consecutive month of decline, and the final week of February closed in the red. At the time of writing, XRP is trading at $1.33, down 45% from its early-year high.

A recent report from BeInCrypto shows that rising whale inflows to exchanges continue to create selling pressure. Realized losses have reached their highest level since 2022.

However, historical signals also suggest that such extreme negativity often precedes a price bottom and a strong recovery. The latest analysis from BeInCrypto clarifies that XRP now needs confirmation through a breakout above the $1.47 resistance level.

Crypto World

Nansen to Set up Bhutan Entity in Gelephu Mindfulness City

Blockchain analytics company Nansen will establish a local entity and build a Bhutan-based team in Gelephu Mindfulness City (GMC), expanding into the kingdom as its Special Administrative Region advances its digital asset strategy.

According to a joint announcement shared with Cointelegraph, Nansen plans to incorporate within GMC and develop on-the-ground analytics capabilities to provide blockchain data and market intelligence to industry participants operating in the region.

GMC is a purpose-built Special Administrative Region in southern Bhutan focused on long-term economic development. The region has previously announced digital asset initiatives spanning custody infrastructure, tokenization, institutional liquidity and regulatory frameworks.

The move does not replace Nansen’s existing operations in Singapore, CEO Alex Svanevik told Cointelegraph, but adds an additional entity within GMC, saying that the company “chose GMC because of the vision behind it.”

Svanevik added that Bhutan stood out because digital assets are being integrated into the region’s economic framework from the outset. He said:

Most crypto-friendly jurisdictions are optimizing for what exists today. Bhutan is building something fundamentally different — a values-driven economic zone with digital assets baked into the foundation, not bolted on as an afterthought. GMC has crypto in its strategic reserves, a progressive regulatory framework, and genuine sovereign conviction behind it. That’s rare. We want to be pioneers in that ecosystem.

Nansen plans to hire locally as part of the expansion. While the company did not disclose specific staffing targets, Svanevik said the intention is to build a “meaningful local team,” with details on roles and office setup expected in the coming months.

Nansen describes itself as an AI-native onchain analytics platform tracking more than 500 million labeled blockchain addresses and providing real-time data tools across major blockchain networks.

Related: Bhutan migrates its national ID system to Ethereum

Bhutan positions Gelephu Mindfulness City at the center of its digital asset strategy

Announced in 2023, Gelephu Mindfulness City is a special administrative region designed as a new economic hub to create high-value local jobs and attract businesses across sectors including finance, green energy, technology, healthcare and agriculture, while offering regulatory flexibility for crypto and fintech companies.

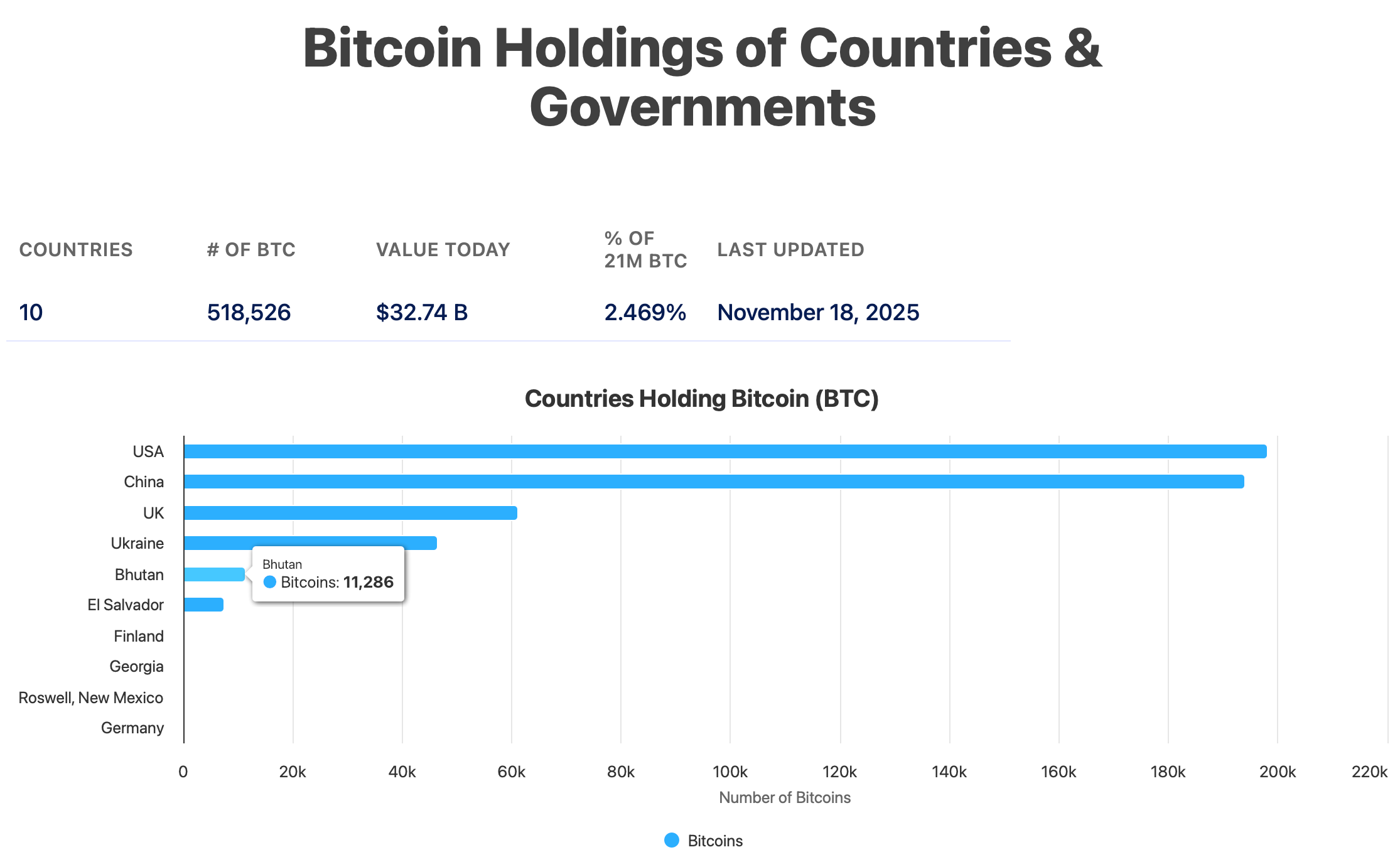

In December, the government said it would allocate up to 10,000 Bitcoin (BTC) from its national holdings to support the city’s development. Officials said they were evaluating treasury and risk-managed yield strategies for the Bitcoin holdings, alongside long-term plans aimed at preserving value while supporting stable and sustainable growth.

Nansen is not the first digital asset company to enter the region. Also in December, Crypto market maker Cumberland DRW signed a multi-year memorandum of understanding to help develop digital asset infrastructure in GMC, including financial frameworks, sustainable mining and AI compute, yield strategies and stablecoin infrastructure.

Bhutan holds the world’s fifth-largest national Bitcoin reserve, with Bitbo estimating its holdings at 11,286 BTC, as of Nov. 18.

The country’s crypto strategy is spearheaded by Druk Holding and Investments (DHI), the commercial arm of the royal government.

In an April 2025 interview with Reuters, DHI CEO Ujjwal Deep Dahal said the fund began accumulating cryptocurrencies in 2019 to convert surplus hydropower into foreign-currency liquidity, and senior officials in the capital of Thimphu have said some profits have helped support government salary payments over the past two years.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

ZachXBT Insider Trading Report Targets Major Crypto Firm in 2 Days

A major shake up could be coming as on chain investigator ZachXBT says he will publish a full insider trading exposé on February 26, targeting what he calls a major industry player tied to systemic market abuse.

Traders are not waiting. Prediction market volume around the target’s identity has surged toward $3M as participants hedge for potential fallout.

Right now, odds point toward names like Solana based liquidity protocol Meteora and the Trump backed World Liberty Financial as leading suspects.

Key Takeaways

- $6 Million Prediction Market Volume: Trading activity on the ZachXBT investigation market has surpassed $5.6 million as speculators attempt to price in the target’s identity.

- Meteora at 43% Odds: The Solana-based liquidity layer is currently the betting favorite to be named in the report, followed by infrastructure provider Axiom.

- Systemic MNPI Abuse: The investigation alleges that multiple employees exploited Material Non-Public Information to execute profitable trades over a prolonged period.

What Is the ZachXBT MNPI Investigation?

ZachXBT, known for tracing illicit crypto flows, says a major report is coming on February 26. The target is described as one of the industry’s most profitable firms, with allegations that insiders traded on material non public information to front run announcements.

The case reportedly began with a January Telegram exchange where wallet addresses tied to a firm’s treasury were shared, showing accumulation before public news. That kind of on chain trail can be hard to dismiss and often draws regulatory attention.

ZachXBT’s track record adds weight. Past investigations have led to frozen funds and law enforcement action. That is why traders see February 26 as a binary event. Either the evidence is strong enough to trigger serious fallout, or the accused project walks away under heavy scrutiny.

Prediction Markets Hit $3M as ZachXBT Odds Shift to Meteora

Speculators are already trading on the rumor. On Polymarket, volume on the “Which crypto company will ZachXBT expose?” contract is nearing $6M. Meteora leads with around 42% odds, followed by Axiom at 15% and Pump.fun near 9%.

The sharp jump in Meteora’s probability, while others like Jupiter and MEXC lag in single digits, shows concentrated conviction. Big names like Tether, Binance, and Coinbase are listed, but with low odds.

Still, prediction markets price belief, not proof. They reflect positioning and sentiment ahead of confirmation.

Why Meteora Is the Leading Suspect in the MNPI Probe

Meteora has emerged as the top suspect because it fits the profile of a highly profitable Solana based liquidity protocol with access to sensitive incentive data.

Onchain analysts have flagged wallet clusters interacting with its pools that appear to position ahead of yield adjustments, fueling speculation of potential MNPI abuse.

If confirmed, the fallout could ripple across the Solana ecosystem, especially if aggregators and routing platforms distance themselves quickly.

WLFI remains a lower probability but higher impact scenario. Its political ties raise the stakes, and any confirmed insider trading linked to a Trump affiliated project would likely draw immediate regulatory scrutiny. While markets see Meteora as the base case, WLFI represents a volatile tail risk.

If ZachXBT’s report delivers clear wallet attribution, the targeted token could see a sharp downside within minutes. Until then, prediction market volume reflects positioning, not proof.

Discover: Here are the crypto likely to explode!

The post ZachXBT Insider Trading Report Targets Major Crypto Firm in 2 Days appeared first on Cryptonews.

Crypto World

Fed’s Goolsbee calls for a hold on cuts as current rate of inflation is ‘not good enough’

Austan Goolsbee, president and chief executive officer of the Federal Reserve Bank of Chicago, speaks during the National Association of Business Economics (NABE) economic policy conference in Washington, DC, US, on Tuesday, Feb. 24, 2026.

Graeme Sloane | Bloomberg | Getty Images

Chicago Federal Reserve President Austan Goolsbee said Tuesday that interest rate cuts aren’t appropriate until there’s more evidence that inflation is on its way down.

With recent indicators showing that inflation well off its highs but still above the Fed’s 2% target, Goolsbee noted that policymakers “have been burned by assuming transitory inflation” in the past and shouldn’t make the same mistake again.

“I feel that front-loading too many rate cuts is not prudent in that circumstance,” he said in remarks before the National Association for Business Economics at its annual gathering in Washington, D.C. “People express that prices are one of their most pressing concerns. Let’s pay attention. Before we cut rates more to stimulate the economy, let’s be sure inflation is heading back to 2%.”

The most recent inflation data, for December, showed core inflation, which excludes volatile food and energy prices, running at 3%, as measured by the consumption expenditures price index, the Fed’s primary forecasting gauge. That was up 0.2 percentage point from November and came somewhat due to tariffs, which are viewed as temporary, but also from underlying pressures in the service sector and areas not directly impacted by the duties.

Specifically, Goolsbee said stubbornly high housing inflation isn’t tariff driven, emphasizing the need for the Fed to be “vigilant.”

Goolsbee noted that a 3% inflation rate “is not good enough — and it’s not what we promised when the Federal Reserve committed to the 2% target. Stalling out at 3% is not a safe place to be for a myriad of reasons we know all too well.” He has said previously that he thinks the Fed will be able to cut later in the year.

The remarks come with markets expecting the Federal Open Market Committee, of which Goolsbee is a voter this year, to stay on hold until at least June and probably July. Futures traders are placing about a 50-50 chance of a cut in June and about a 71% probability of a July cut, according to the CME Group’s FedWatch gauge. The Fed enacted three quarter-percentage-point cuts in the latter part of 2025.

Fed Governor Christopher Waller, who has been an advocate for lower rates, took a more measured approach Monday while also speaking to the NABE conference.

Though Waller said he thinks policymakers should “look through” tariff impacts, he said recent data show the labor market may be in better shape than previously indicated, mitigating the need for further cuts. If the jobs picture continues to improve, that would further lessen the case for cuts, though he said he isn’t convinced that the January nonfarm payrolls data wasn’t “more noise than signal.”

Tuesday will be an active day Fed speakers, with Governor Lisa Cook also due to present to the NABE later in the morning.

Crypto World

What Past Cycles Say Happens Before the Bottom

Bitcoin price dropped 25% in 2022 and 50% in 2018 after similar on-chain loss signals, a warning sign for BTC’s next move.

Bitcoin (BTC) traders are selling at a loss for the first time since 2022, raising odds that the biggest cryptocurrency’s ongoing price correction may deepen in the coming weeks.

Key takeaways:

-

Bitcoin is witnessing loss-driven selling that has historically lasted six months or more.

-

These signals surfaced during previous bear markets, preceding sharp downtrends each time.

BTC capitulation may last for another six months

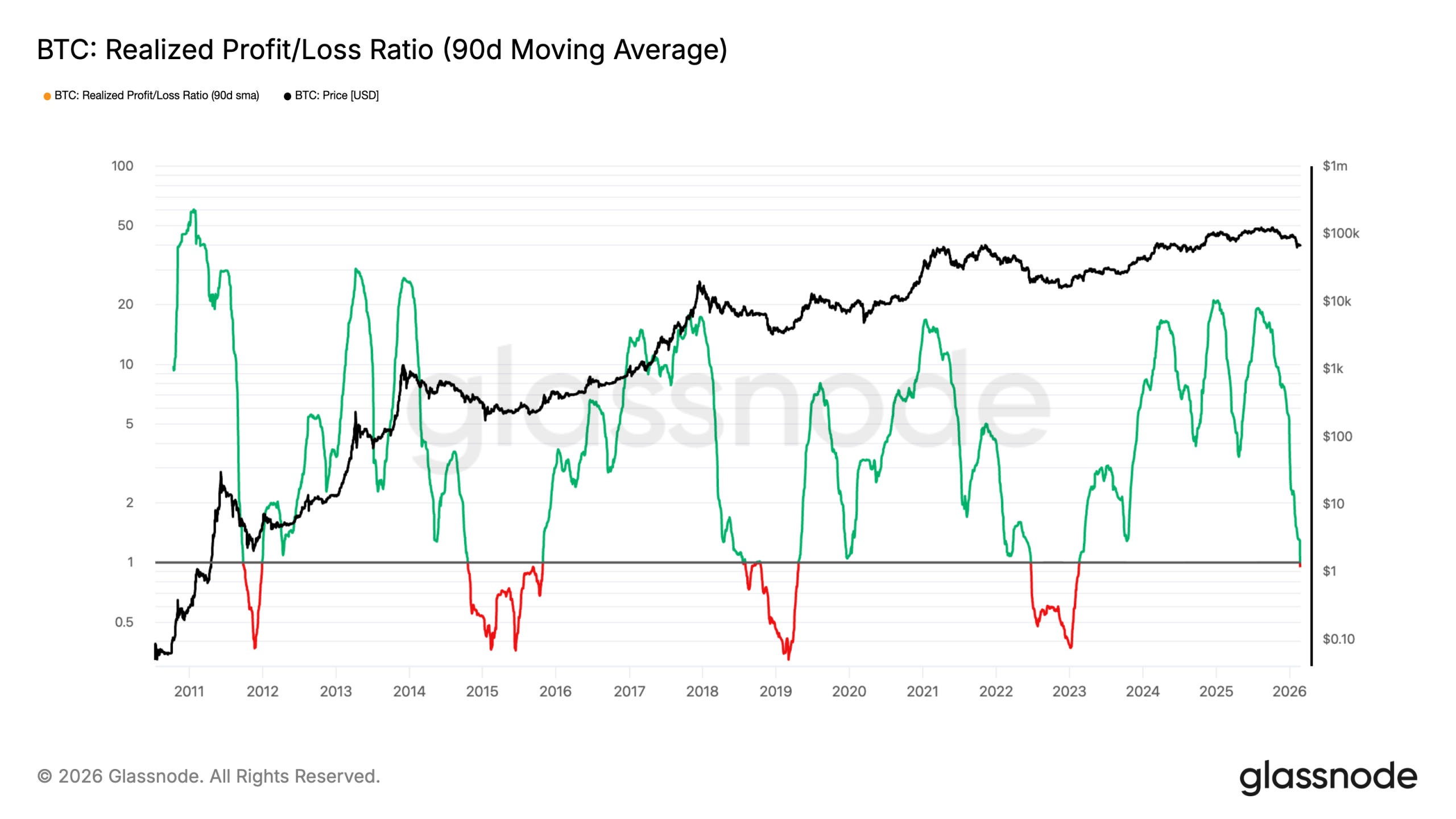

On Monday, Bitcoin’s realized profit/loss ratio (90-day moving average) slipped below 1.

The drop indicated that traders were dumping their BTC holdings at a loss, which is often linked to panic selling, margin pressure, or broader risk-off conditions.

Historically, breaks below 1 preceded at least six months of loss realization, according to on-chain data resource Glassnode. Meanwhile, a move back above 1 usually suggests that selling pressure is easing.

Traders often sell at a loss when they expect the downtrend to continue. In prior bear markets, loss-taking typically accelerated midway through the cycle, followed by more downside in Bitcoin’s price.

During the 2022 bear market, for instance, BTC declined 25% six months after its realized profit/loss ratio dropped below 1. In 2018, it plunged by over 50% in five months under similar conditions, as shown below.

The BTC price may continue its downtrend for another five months or more if history repeats. That will confirm “a full transition into an excess loss-realization regime,” Glassnode wrote.

Bitcoin price may bottom around $44,000

Bitcoin’s rising loss-realization may, therefore, drag the BTC price into its “extreme low” valuation zones.

These lows exist within the MVRV Pricing Bands metric, which maps where Bitcoin reaches extreme unrealized profit or loss zones. Historically, its lowest band (the blue line) has coincided with Bitcoin bear market bottoms.

As of February, the extreme low was around $43,760, a potential downside target by August if BTC’s price decline continue further.

Related: Bitcoin’s Mayer Multiple hits 2022 levels: Where is BTC price bottom?

The level also sits within the broader $40,000–$50,000 bottom range flagged by multiple analysts as a potential late-2026 target.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Kraken brings crypto-style, 24/7 perpetuals trading for tokenized U.S. stocks

Crypto exchange Kraken is launching what it calls the first regulated perpetual futures contracts based on tokenized stocks, the firm told CoinDesk.

The products, available to eligible non-U.S. users in more than 110 countries, track digital versions of major U.S. stocks, indices and a gold ETF, building on the tokenized equities offering of xStocks that Kraken acquired in December.

Initial listings include tokenized versions of the S&P 500, the Nasdaq 100, Apple, Nvidia, Tesla and SPDR’s gold ETF (GLD), the firm said.

Kraken’s launch matters because perpetuals trading has enjoyed a rapid growth, dominating crypto derivatives trading. Blockchain-based decentralized exchanges processed over $600 billion in perps trading volume in January, with Hyperliquid claiming the biggest market share with $200 billion monthly volume, data by The Block shows.

Unlike traditional futures contracts, perps do not expire and trade 24/7 and allow users to trade with high leverage. Investors favor them for continuous access, capital efficiency and the ability to take long or short positions at any time.

With Kraken’s move, that structure now is expanded to other asset classes like equities. The underlying xStocks tokens are fully collateralized and backed 1:1 by the referenced assets, according to the company. That provides a pricing anchor even when U.S. exchanges are closed. The tokenized stocks trade around the clock and support leverage of up to 20x.

“This is what it looks like when traditional markets are rebuilt for a crypto-native, always-on world, not a moment too soon given the volatility that all markets are exhibiting,” Mark Greenberg, Kraken’s global head of consumer, said in a statement.

“Regulated tokenized equities as perpetual futures represent a new chapter for global capital markets, one where equities, indices, and commodities trade with the same speed, accessibility, and flexibility as crypto via tokenization, delivering a more robust risk management experience,” he added.

Kraken said it plans to expand the lineup with more tokenized stocks and ETFs in the coming months.

Rival tokenization firm Ondo Finance earlier this month also announced plans to launch perps trading with its tokenized stocks.

Read more: Kraken’s co-CEO could trust AI with 100% of his crypto — Dragonfly’s Haseeb Qureshi isn’t convinced

Crypto World

Tether-Backed Oobit Adds Crypto-to-Bank Transfers

Crypto payment provider Oobit has launched crypto-to-bank transfers that settle into bank accounts via local payment rails, expanding its app beyond in-store spending and peer-to-peer (P2P) transfers.

In an announcement shared with Cointelegraph, Oobit said users could send supported digital assets from self-custody wallets and have funds deposited into bank accounts through networks including the Single Euro Payments Area (SEPA) in Europe, the Automated Clearing House (ACH) in the United States and Mexico’s Sistema de Pagos Electrónicos Interbancarios (SPEI).

Settlement currencies include US dollars, euros, Mexican pesos and Philippine pesos, while supported assets include Bitcoin (BTC), Ether (ETH) and a range of stablecoins such as Tether (USDT), USDC (USDC), EURC and EURR, along with other tokens including XRP (XRP), BNB (BNB), Solana (SOL), Cardano (ADA) and Dogecoin (DOGE).

Related: VCI Global unveils crypto treasury plan, backs Tether’s payments arm OOBIT

Oobit said that users could see the crypto amount leaving their wallet and the fiat equivalent arriving in the recipient’s account before confirming the transactions.

It described the system as routing transactions through local payment rails instead of traditional correspondent banking channels.

Unlike checkout-based providers that redirect users to third-party interfaces, Oobit said the transfer flow is embedded natively inside its app, without redirecting users to an external off-ramp provider.

Crypto off-ramps heating up

The rollout highlights growing competition in crypto off-ramping, where exchanges and fintech companies allow users to convert digital assets into fiat deposits.

Oobit’s stated differentiator is its focus on self-custody wallets, positioning the app as a payments layer that connects onchain assets to bank accounts without requiring users to hold funds on a centralized exchange.

DTR tie-up and Bakkt acquisition

Oobit says that the feature is powered by infrastructure from Distributed Technologies Research (DTR), which connects Oobit’s wallet interface to domestic payment networks.

DTR recently entered into an agreement to be acquired by Bakkt, a US-listed digital asset platform launched by the Intercontinental Exchange (ICE) in 2018.

Akshay Naheta, DTR founder and CEO of Bakkt, said in the release that infrastructure connecting digital asset platforms with traditional financial systems was “foundational to broader adoption.”

Amram Adar, co-founder and CEO of Oobit, told Cointelegraph the company’s model differs from traditional off-ramp providers in both custody structure and user flow. “The end-user relationship, wallet custody and transaction experience remain entirely within Oobit,” Adar said.

According to Adar, user funds are initially held within Oobit’s wallet infrastructure. When a bank transfer is initiated, funds are debited and transferred to DTR strictly for payout execution. DTR forwards the funds to the recipient bank account and does not hold funds for investment or discretionary purposes.

Oobit performs the initial crypto-to-USD conversion, after which the USD-equivalent value is transferred in USDT to DTR. DTR then executes the foreign exchange conversion into local fiat currency before settlement into the designated bank account, Adar said.

Oobit has previously disclosed backing from Tether, the issuer of USDT, linking the app to the largest stablecoin operator by market capitalization.

Related: Bybit to launch retail bank accounts with personal IBANs in February

Fees, limits and expanding infrastructure

Adar said the service is fully live across all countries supported by DTR, with no pilot corridors currently in place. US dollar transfers are limited to domestic US flows.

Minimum transfers range from a roughly 10 euro ($11.70) to $100 equivalent, depending on the corridor, while maximum limits can reach about a $50,000 equivalent.

Total fees consist of components charged by both Oobit and DTR. Oobit applies the greater of a fixed fee, currently contemplated at $1, or a 1% transaction fee, along with an estimated 0.5% spread on crypto-to-USD conversions.

DTR applies either a fixed fee, generally between about 0.65 cents and 2 euro depending on the currency, or a percentage-based fee ranging from about 0.65% to 1%, according to the company.

The integration comes as banks and fintech firms deepen efforts to embed blockchain-based assets into regulated payment systems.

Major payment players like Visa have rolled out USDC-based settlement and stablecoin payouts for financial institutions, and Crypto.com has used Circle’s application programming interfaces (APIs) to support dollar bank transfers to and from USDC wallets.

On Monday, digital asset infrastructure company Stablecore joined the Jack Henry Fintech Integration Network, enabling more than 1,600 US banks and credit unions to add stablecoin services through existing core banking platforms.

On the same day, TRM Labs announced a partnership with Finray Technologies to unify crypto and fiat transaction monitoring for institutions operating under Europe’s Markets in Crypto-Assets (MiCA) regulation.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

Smarter Web Secures $30M Coinbase Credit to Speed BTC Buys After Fund

The Smarter Web Company PLC, a United Kingdom-listed Bitcoin treasury holder, has secured a $30 million Bitcoin-backed credit facility with Coinbase Credit. The move is designed to provide liquidity to accelerate Bitcoin purchases immediately after equity raises, reducing settlement timing risk in volatile markets. The company underscored that the facility is not intended to be a long-term debt instrument for ongoing BTC purchases. Smarter Web is publicly traded on the London Stock Exchange’s Main Market and also trades on the OTCQB Venture Market in the United States, with Bitcoin described as a core pillar of its treasury strategy and a stated goal to expand its digital asset holdings. The arrangement leverages Bitcoin held in custody with Coinbase as collateral, per a February 24, 2026 filing. See the attached document here: PDF.

The latest development sits within a broader context of digital asset treasuries (DATs), which posted multi-billion dollar net inflows late in 2025 and into January 2026 before cooling in February. Data tracked by DefiLlama show inflows of $4 billion in December, followed by $3.7 billion in January, and then a marked slowdown to $363 million by February 24, 2026, as risk sentiment evolved. This pattern reflects a climate in which corporate balance sheets continue to scrutinize liquidity tools tied to Bitcoin exposure, even as overall demand for DATs moderates in the short term. See DefiLlama’s digital asset treasuries page for the latest inflow readings: DefiLlama.

According to BitcoinTreasuries.net, Smarter Web’s Bitcoin holdings stood at 2,689 BTC, purchased at an average cost of $112,865 per coin. At current price levels, those holdings value roughly $170 million, implying an unrealized loss of about 44% against the reported cost basis. The company’s disclosures note that, as of September 12, 2025, Smarter Web owned 2,470 BTC and described itself as the UK’s largest corporate Bitcoin holder at that time, signaling ongoing intent to grow its digital asset position. The firm also signaled interest in acquiring competitors to broaden its treasury and to pursue a spot on the FTSE 100 index. The latest holdings data suggest continued accumulation since the September 2025 update. For reference, see BitcoinTreasuries.net’s entry on Smarter Web: Smarter Web Bitcoin treasury.

The financing arrangement is designed to enable Swifter Web to borrow against its existing Bitcoin holdings to move more rapidly after equity raises, with repayment tied to the successful settlement of fundraising proceeds. The structure highlights a trend toward liquidity-centric use of BTC-backed facilities among corporate treasuries, as opposed to financing the ongoing purchase of BTC with new debt. The broader market context includes examples of divergent corporate Bitcoin strategies, where some firms are expanding exposure while others are reducing or liquidating holdings in response to capital needs and strategic shifts. For instance, a recent article discusses Strategy’s continued accumulation, with a 100th BTC purchase bringing its total to 717,722 BTC, while Bitdeer announced the liquidation of its entire Bitcoin treasury in a separate move to raise capital via a convertible debt offering. See: Strategy’s BTC purchases and Bitdeer’s treasury sale.

Diverging corporate Bitcoin strategies

The Smarter Web facility arrives amid a spectrum of corporate approaches to Bitcoin exposure. Some companies continue to add BTC to their treasuries, while others take liquidity-focused steps that involve selling or retooling holdings to support capital raises or strategic initiatives. The broader narrative underscores how treasury management is evolving as firms weigh balance-sheet resilience against market volatility and regulatory considerations.

Why it matters

The move by Smarter Web underscores a practical use-case for BTC-backed debt facilities beyond mere investment. By tying a credit facility to Bitcoin held in custody, the company can fast-track deployment of capital in the wake of equity raises, potentially capturing favorable entry prices and decoupling settlement timing from volatile market conditions. This kind of liquidity tool can help a corporate treasury bridge the gap between fundraising and asset deployment, reducing the risk of price slippage or missed opportunities during short windows after a financing round.

From a market-wide perspective, the development reflects ongoing experimentation with Bitcoin as a corporate treasury instrument. The inflow data from DATs suggests sustained interest in BTC-backed liquidity strategies through late 2025 and early 2026, even as overall momentum moderated in February. As BTC remains a volatile asset class, facilities that offer rapid access to liquidity while preserving long-term exposure can alter how companies plan capital allocation, M&A, and strategic initiatives, especially for firms with large Bitcoin holdings and ambitious growth agendas.

For investors tracking corporate exposure to Bitcoin, Smarter Web’s approach adds to the evidence that Bitcoin is being treated less as a speculative bet and more as a strategic balance-sheet asset. The company’s stated intent to avoid long-term debt financing for BTC purchases aligns with an emphasis on risk management and disciplined capital structure. As more issuers experiment with credit facilities secured by Bitcoin, market participants will watch for how these tools affect debt covenants, impacts on earnings volatility, and the potential signaling effect on other treasuries considering similar structures.

What to watch next

- Smarter Web’s upcoming earnings updates or capital-raising rounds to disclose how the facility is used to accelerate BTC deployments.

- Any changes to the company’s BTC holdings, including new acquisitions or rebalancing that would adjust the cost basis and unrealized gains/losses.

- Regulatory or market developments that could influence the viability or cost of BTC-backed facilities for corporates.

- Further DAT inflow/outflow signals from DefiLlama to gauge ongoing demand for Bitcoin treasury strategies.

- Announcements from related corporate treasuries (e.g., additional purchases, sales, or new liquidity facilities) that could provide context for Smarter Web’s strategy.

Sources & verification

- The strategic credit facility document: https://www.smarterwebcompany.co.uk/smarterweb-co-uk/_img/pdf/news/2026-02-24-strategic-credit-facility.pdf

- Smarter Web Bitcoin treasury data on BitcoinTreasuries.net: https://bitcointreasuries.net/public-companies/the-smarter-web-company-plc

- DefiLlama digital asset treasuries inflow data: https://defillama.com/digital-asset-treasuries

- Strategy BTC purchases article: https://cointelegraph.com/news/strategy-100th-bitcoin-purchase-592-btc

- Bitdeer Bitcoin treasury sale article: https://cointelegraph.com/news/bitdeer-sells-bitcoin-treasury-zero-holdings

Smarter Web taps Coinbase-backed facility to accelerate BTC deployment

In a strategic move to bolster liquidity after equity raises, The Smarter Web Company PLC has secured a $30 million Bitcoin-backed credit facility with Coinbase Credit. The facility is secured against Bitcoin held in custody with Coinbase and enables the company to move capital into Bitcoin (CRYPTO: BTC) immediately when fundraising closes, while reducing settlement timing risk during volatile markets. The company reiterates that the facility is not intended to finance ongoing, long-term BTC purchases, but rather to bridge liquidity between fundraising and deployment. Smarter Web is listed on the London Stock Exchange’s Main Market and trades on the OTCQB Venture Market in the United States; the firm emphasizes Bitcoin as a core component of its treasury strategy and has signaled an ambition to grow its digital asset holdings. The facility is designed to allow borrowing against existing holdings to accelerate post-raise deployment and to repay when fundraising proceeds settle. The filing and related documentation are available here: PDF.

The broader context for this move includes a pattern of positive net inflows into DATs through late 2025 and early 2026, followed by a cooling period in February. DefiLlama’s chart of inflows shows $4 billion in December, $3.7 billion in January, and roughly $363 million through February 24, 2026, indicating a deceleration after a burst of interest. This backdrop helps explain why Smarter Web would pursue a credit facility that unlocks faster deployment in response to equity raises while preserving long-term capital discipline. See DefiLlama’s DAT data for the latest series on inflows: DefiLlama.

Smarter Web’s Bitcoin holdings, tracked by BitcoinTreasuries.net, stood at 2,689 BTC with an average cost of $112,865 per coin, placing the current implied value near $170 million and an approximate unrealized loss of 44%. The company had previously disclosed a September 12, 2025 position of 2,470 BTC and described itself as the UK’s largest corporate Bitcoin holder at the time, with ambitions to acquire rivals to expand its treasury and potentially join the FTSE 100. The latest data suggest continued accumulation since that update, reinforcing the narrative of an aggressively managed digital-asset treasury. See Smarter Web’s BTC page for reference: Smarter Web BTC.

The rationale behind the facility is straightforward: borrow against existing BTC to accelerate deployment after fundraising, and repay once cash from the equity raise settles. It reflects how public companies are testing liquidity rails that preserve Bitcoin exposure while managing timing risk and balance-sheet constraints. The broader corporate landscape shows a mix of strategies, with some firms continuing to add BTC to their treasuries while others pivot to capitalize on capital-raising opportunities or to de-risk their holdings in a dynamically shifting market environment.

Crypto World

Coinbase Stablecoin Revenue Hits $1.35B: Bloomberg Sees 7x Growth Potential

Bloomberg Intelligence forecasts that Coinbase’s stablecoin revenue could jump sevenfold from its current $1.35 billion annual run rate.

Analysts point to a structural shift where stablecoins move beyond crypto trading collateral to become a primary rail for mainstream global payments.

Key Takeaways

- Coinbase generated approximately $1.35 billion in stablecoin revenue last year, accounting for 19% of its total income.

- Bloomberg Intelligence projects a potential 7x surge in this figure as regulatory frameworks drive payment adoption.

- The expansion hinges on the codified GENIUS Act, merchant integration via Stripe, and volume growth on the Base network.

Why Bloomberg Sees a Sevenfold Surge in Coinbase Stablecoin Revenue

Bloomberg Intelligence analysts, including Paul Gulberg, argue that the market is underestimating the utility phase of the stablecoin lifecycle.

While Coinbase reported $1.35 billion in stablecoin revenue for 2025, roughly 19% of its total top line, Bloomberg models suggest this figure is merely a baseline.

The forecast arrives despite Coinbase noting a net loss of $667 million in Q4 2025. The exchange’s revenue share agreement with Circle, the issuer of USDC, remains a bright spot, generating $364 million in the fourth quarter alone.

Bloomberg’s 7x multiple assumes that as interest rates stabilize, the sheer velocity of payment transactions will eclipse interest income as the primary revenue driver.

This thesis aligns with broader market data showing stablecoin transaction volumes hitting $33 trillion in 2025.

With USDC accounting for $18.3 trillion of that flow, the asset has already begun to decouple from pure crypto trading volumes.

The scale is big enough that the traditional finance sector can no longer ignore the fee generation potential.

Discover: The best Solana meme coins

How the GENIUS Act Is Accelerating Stablecoin Mainstream Adoption

The regulatory landscape shifted dramatically with the signing of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act in July 2025.

By creating a federal regime for payment stablecoins, the legislation provided the legal certainty required for large-scale institutional participation.

The Act explicitly bars issuers like Circle from paying interest to holders, a move backed by the banking lobby to protect traditional deposits.

While the regulatory framework for digital assets remains complex, the GENIUS Act has effectively greenlit stablecoins for commercial usage.

This clarity allows Coinbase to market USDC settlements to Fortune 500 companies without the overhang of legal ambiguity that plagued the sector in previous years.

Stripe Integration and Base Network Expansion Drive Payment Ambitions

Operational catalysts are already live, fueling the Bloomberg projection. The integration of USDC into Stripe’s global payment rails has reopened crypto acceptance for millions of merchants, creating a direct funnel for transaction volume.

Simultaneously, Coinbase’s own Layer-2 blockchain, the Base network, is lowering the barrier to entry for micro-transactions.

Much like other scaling solutions, the Base network reduces gas fees to fractions of a cent, making dollar-denominated transfers economically viable for daily coffee purchases.

High-throughput networks are critical here, as the Bitcoin Lightning Network demonstrated with its $1 billion monthly volume milestones, low-fee environments rapidly attract payment liquidity.

By routing these payments through Base, Coinbase captures value twice: once through the underlying sequencer fees and again through its revenue share on the growing supply of USDC required to service this commerce.

Discover: The top crypto for portfolio diversification

What a 7x Revenue Jump Would Mean for the Stablecoin Market

If Bloomberg’s 7x scenario plays out, stablecoin revenue would arguably become Coinbase’s most valuable business line, overshadowing its volatile trading fees.

This shift would fundamentally re-rate the stock, moving it from a cyclical crypto exchange play to a steady fintech payments processor. However, risks remain substantial.

The banking lobby is currently pushing the CLARITY Act in the Senate to close loopholes that allow exchanges like Coinbase to pass rewards to customers.

If new language bars these rewards, consumer adoption could slow.

Analysts at Monness Crespi maintain a sell rating, warning that optimistic projections effectively ignore the political target painted on stablecoin yields.

So, for Bloomberg’s 7x to be possible, Coinbase must defend its rewards program while successfully migrating user activity from holding USDC to spending it.

The post Coinbase Stablecoin Revenue Hits $1.35B: Bloomberg Sees 7x Growth Potential appeared first on Cryptonews.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports21 hours ago

Sports21 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics22 hours ago

Politics22 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World8 hours ago

Crypto World8 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market