Crypto World

70% UAE firms plan AI-driven SOCs

Editor’s note: AI in security operations is rapidly changing how organizations detect and respond to threats. A global Kaspersky study indicates near-universal intent to integrate AI into SOCs, yet organizations still confront data quality issues, talent shortages and mounting costs. In the UAE, 70% of firms say they will probably adopt AI-driven SOCs, while concerns about data, skills and integration underscore the gap between ambition and execution. This editorial offers context on what to watch as AI becomes a core SOC capability and how to approach implementation responsibly.

Key points

- 99% of respondents plan to incorporate AI into their security operations.

- In the UAE, 70% say they will probably adopt AI in SOCs, with 30% stating they will definitely do so.

- Top use cases: automated analysis for threat detection (58%), and automated incident response (46%).

- Major challenges include data quality, shortage of AI experts, new AI-related threats, and high costs.

Why this matters

AI adoption in security operations is advancing, but the move from experimentation to real SOC impact remains challenging. Talent shortages and evolving AI threats complicate deployment. As providers roll out AI-powered features, organizations should couple technology with data governance and skilled teams to unlock meaningful improvements in threat detection and response.

What to watch next

- Progress on data quality and availability for AI training and deployment.

- Adoption of AI-powered features across SOC tools and platforms.

- Investment in AI talent and integration of SOC processes with AI capabilities.

- Updates to Kaspersky’s AI-powered offerings and threat intelligence capabilities.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Kaspersky study: 70% of UAE Firms Plan AI-Driven SOCs—But Talent and Data Gaps Stall Progress

February 20, 2026

Almost all companies planning to establish a Security Operations Center (SOC) regard artificial intelligence (AI) as a must-have component. However, despite high expectations, organizations face significant challenges in deploying and operationalizing AI effectively. These include a lack of high-quality training data, a shortage of AI-skilled personnel, substantial integration costs and emerging AI-related threats.

To explore how companies build and maintain processes in SOCs, Kaspersky conducted a comprehensive global study which highlights, among other things, priorities, expectations and challenges associated with leveraging AI to elevate SOC performance[1]. The findings reveal that an overwhelming 99% of respondents plan to incorporate AI into their security operations. Among them, nearly three quarters (70%) in the UAE say they will probably do so and nearly a third (30%) state they will definitely do so. This underscores the widespread perception of AI as a vital driver for enhancing threat detection, accelerating investigation processes and boosting overall SOC efficiency.

When it comes to practical use cases, organizations in the UAE primarily expect AI to strengthen threat detection capabilities through automated analysis of data to identify anomalies and suspicious activities (58%) and to facilitate response automation, enabling rapid execution of predefined incident response scenarios (46%). These expectations align closely with the top motivations driving AI adoption in SOCs: improving overall threat detection effectiveness (46%), automating routine tasks (39%) and increasing accuracy while reducing false positives (52%). Large enterprises consistently report broader and more ambitious plans for applying AI across multiple SOC functions.

However, a clear execution gap appears when it comes to AI implementation, characterized by several critical and widespread challenges. Foremost is the lack of high-quality training data, a barrier cited by 32% of organizations in the UAE as a fundamental obstacle that hampers the accuracy and relevance of AI models. This issue is further compounded by other critical concerns: a shortage of qualified AI experts within internal team (43%), the emergence of new threats and vulnerabilities related to AI usage (27%) and the high costs associated with developing and maintaining AI-driven solutions (32%). Together, these factors create a barrier that prevents organizations from turning their AI strategy into operational success, underscoring the necessity for a structured and well-supported approach.

“Organizations clearly recognize the value AI can bring to SOCs but the transition from experimentation to real SOC impact still remains challenging. Given the cybersecurity talent shortages—and AI talent being scarce as well—introducing in-house AI capabilities in a SOC remains a coveted but hard-to-achieve goal. This is why cybersecurity companies are investing in AI-powered features across their leading products. Over the past year, Kaspersky has introduced a comprehensive suite of AI-powered tools across its B2B portfolio to meet the rising demand for timely detection of more advanced threats, while also making our solutions more efficient and user-friendly,” says Anton Ivanov, Chief Technology Officer at Kaspersky.

To build and operate a successful and reliable SOC, Kaspersky recommends the following:

- Engage with Kaspersky SOC Consulting during the initial setup or when enhancing your existing security operations. Our comprehensive consulting services are designed to help companies build a robust SOC and streamline its processes.

- Boost your security performance with Kaspersky SIEM, powered by advanced AI capabilities. This solution aggregates, analyzes and stores log data across your entire IT infrastructure, providing contextual enrichment and actionable threat intelligence insights. Recently, this solution was empowered by AI capability to identify signs of dynamic link library (DLL) hijacking.

- Protect your company against a wide range of threats with solutions from the Kaspersky Next product line that provide real-time protection, threat visibility and AI-driven investigation and response capabilities of EDR and XDR for organizations of any size and industry.

- Equip your cybersecurity team with in-depth visibility into cyber threats targeting your organization. The latest Kaspersky Threat Intelligence delivers rich, contextual insights throughout the entire incident management cycle, enabling timely identification of cyber risks. Recently, it was strengthened by AI-enhanced open-source intelligence search, enhancing your team’s ability to uncover and respond to emerging threats with greater precision.

To explore more of Kaspersky’s solutions and services for building and enhancing your SOC, please follow this link.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.

- The survey was conducted by Kaspersky’s internal market research center and involved senior IT security professionals, managers, and directors from organizations with 500 or more employees, and focused on companies that do not yet have a Security Operations Center (SOC) but plan to establish one in the near future. The respondents in this study come from 16 countries, including Germany, Spain, Italy, Brazil, Mexico, Colombia, Singapore, Vietnam, China, India, Indonesia, Saudi Arabia, Turkey, Egypt, the United Arab Emirates, and Russia.

Crypto World

Bitcoin price slips after Trump hikes worldwide tariff to 15% from 10% despite Supreme Court decision

The price of bitcoin fell slightly on Saturday after U.S. President Donald Trump announced an additional increase to global tariffs, despite a U.S. Supreme Court decision that invalidated earlier trade actions under the International Emergency Economic Powers Act (IEEPA).

In a post on Truth Social, Trump called the court’s decision “anti-American” and declared that, effective immediately, he was raising the previously announced worldwide tariff to 15%.

“During the next short number of months, the Trump Administration will determine and issue the new and legally permissible Tariffs,” the president added.

The price of bitcoin reacted quickly to the post, seeing an initial uptick of around 0.5% before losing nearly 1% of its value, reacting to the development. BTC is now trading at $68,000. Ether is down 0.45% since the announcement to $1,980.

The tariff hike comes just after the U.S. Supreme Court decided that Trump didn’t have the power to impose tariffs as he did earlier in the year. Reacting to that decision, Trump announced he was ordering a neew 10% global tariff, which is now being hiked to 15%.

Read more: U.S. Supreme Court’s decision on Trump’s tariffs may not rock crypto — yet

Crypto World

Which Alt Is More Undervalued and Has the Biggest Upside?

The conclusion was derived from the 30-day MVRV of each of those altcoins (and bitcoin).

The cryptocurrency market is far from its best shape, with most assets trading 50% or more from their peaks recorded at some point last year. Some of the largest from this cohort, such as BTC, ETH, XRP, LINK, and ADA could provide proper entry opportunities at this point, but a few of them are believed to be more undervalued, according to data from Santiment.

Basing their findings on each asset’s Market Value to Realized Value (MVRV) metric, the analysts determined the following:

📊 According to the 30-day MVRV’s of crypto’s large caps, which identifies overvalued and undervalued assets based on average trader returns, here are where things stand:

Undervalued:

📌 Ethereum $ETH: -14.3%Slightly Undervalued:

📌 Bitcoin $BTC: -6.9%

📌 Chainlink $LINK:… pic.twitter.com/Qu08RBaw1S— Santiment (@santimentfeed) February 20, 2026

Ethereum stands out as the king of undervaluation, with -14.3%. The largest altcoin peaked last year at just under $5,000, which was inches above its previous all-time high. However, it has been mostly downhill since then, currently struggling to reclaim the $2,000 resistance.

This means that although its network capabilities have expanded, the underlying asset now trades 60% away from its peak.

Bitcoin was second in line, with an undervaluation score of -6.9%. The largest digital asset shot up to several new all-time highs last year, the latest being in early October of over $126,000. It now sits at $68,000 or 46% lower than its ATH.

LINK is third in Santiment’s ranking, with an undervaluation score of -5.1%. Chainlink’s native token was among the few that failed to mark new peaks in 2025. It trades at $8.88 as of press time, which puts it at a whopping 83% distance from its 2021 all-time high of $52.70.

You may also like:

XRP and ADA complete Santiment’s top five, with percentages of -4.1% and -2.0%, respectively. XRP rocketed to a fresh peak of $3.65 in July last year, but now sits 60% lower at $1.45.

It’s worth noting that ADA is arguably the poorest performer from this list. It also couldn’t come anywhere near its 2021 all-time high of over $3.00 last year. Moreover, its current price tag of $0.28 puts it at a 91% discount since those levels from four and a half years ago.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BNP Paribas Brings Money Market Fund to Ethereum

BNP Paribas has launched a tokenized share class of a French-domiciled money market fund on the public Ethereum blockchain. The firm is the largest bank in Europe, with over $3 trillion in assets.

This marks another significant step in traditional finance’s gradual migration to distributed ledger technology.

Ethereum RWA Market Tops $15 Billion as BNP Paribas Joins Tokenization Push

The pilot project, executed through the bank’s AssetFoundry platform, allows BNP Paribas to test the integration of public blockchains into heavily regulated fund structures.

However, the bank is maintaining strict control over the digital assets.

The tokenized shares utilize a permissioned access model, meaning holdings and transfers are cryptographically restricted to a whitelist of authorized participants who meet stringent compliance standards.

“The initiative was conducted as a one‑off, limited intra‑group experiment, enabling BNP Paribas to test new end‑to‑end processes, from issuance and transfer agency to tokenisation and public blockchain connectivity, within a controlled and regulated framework,” the bank explained.

This walled-garden approach reflects a growing consensus among institutional asset managers. They clearly want to utilize the underlying settlement infrastructure of public networks like Ethereum.

However, these firms still demand the strict access controls inherent to traditional financial systems.

Notably, the initiative follows a previous BNP Paribas pilot that utilized a private blockchain in Luxembourg. This pivot signals a cautious institutional shift toward public networks to capture broader future interoperability.

Money market funds have emerged as the primary testing ground for Wall Street’s blockchain ambitions. For institutional investors, tokenizing these funds offers a regulated, yield-bearing alternative to fiat-backed stablecoins.

Furthermore, traditional fund processing relies on slow, batch-based settlement systems that can trap capital. Tokenization introduces the possibility of atomic, nearly instantaneous settlement, vastly improving capital efficiency.

“This second issuance of tokenized money market funds, this time using public blockchain infrastructure, supports our ongoing efforts to explore how tokenization can contribute to greater operational efficiency and security within a regulated framework,” Edouard Legrand, chief digital and data officer at BNP Paribas Asset Management, said in a statement.

Meanwhile, BNP Paribas joins a crowded field of incumbent heavyweights, including BlackRock, JPMorgan Chase & Co., and Fidelity Investments, all of which have deployed tokenized money market funds on Ethereum.

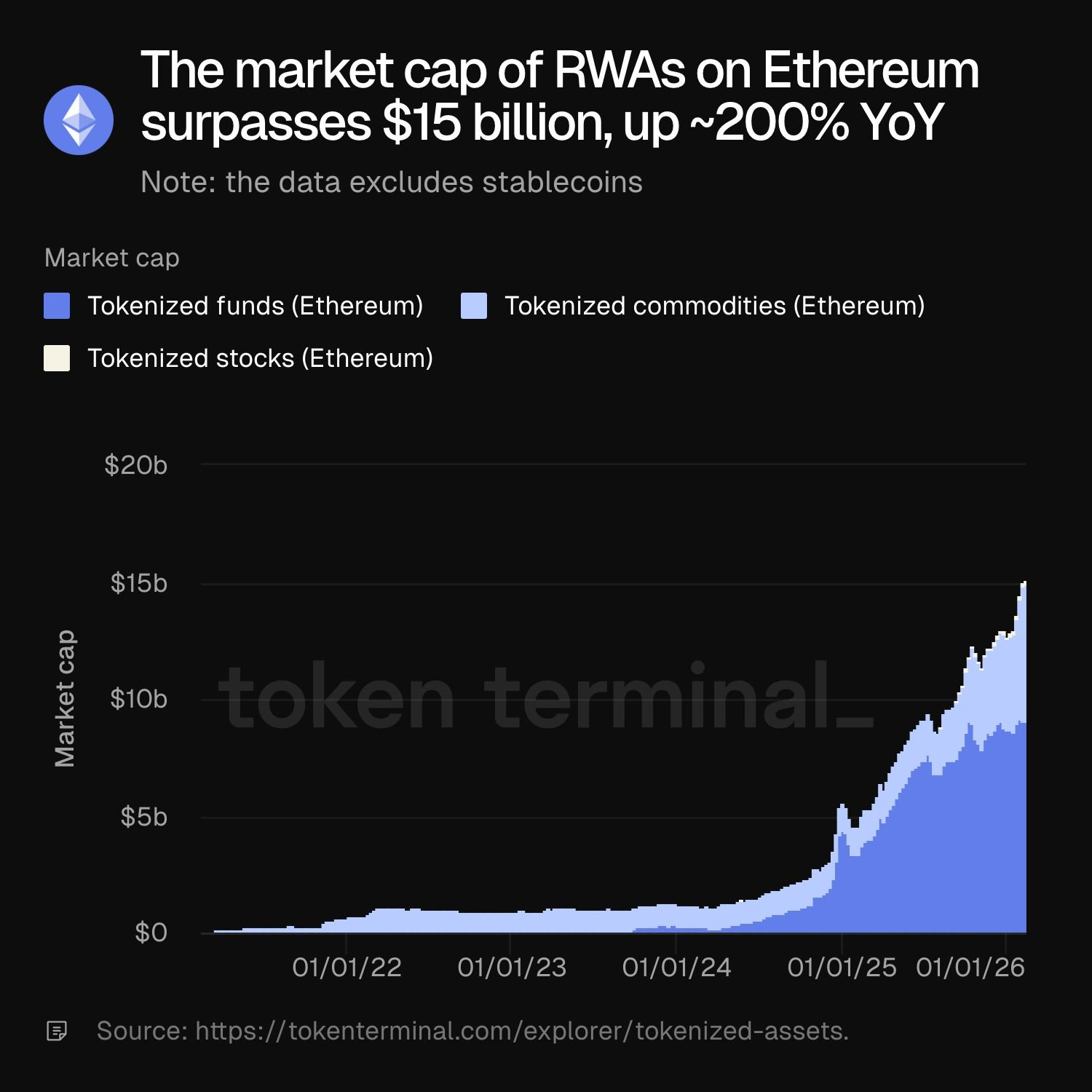

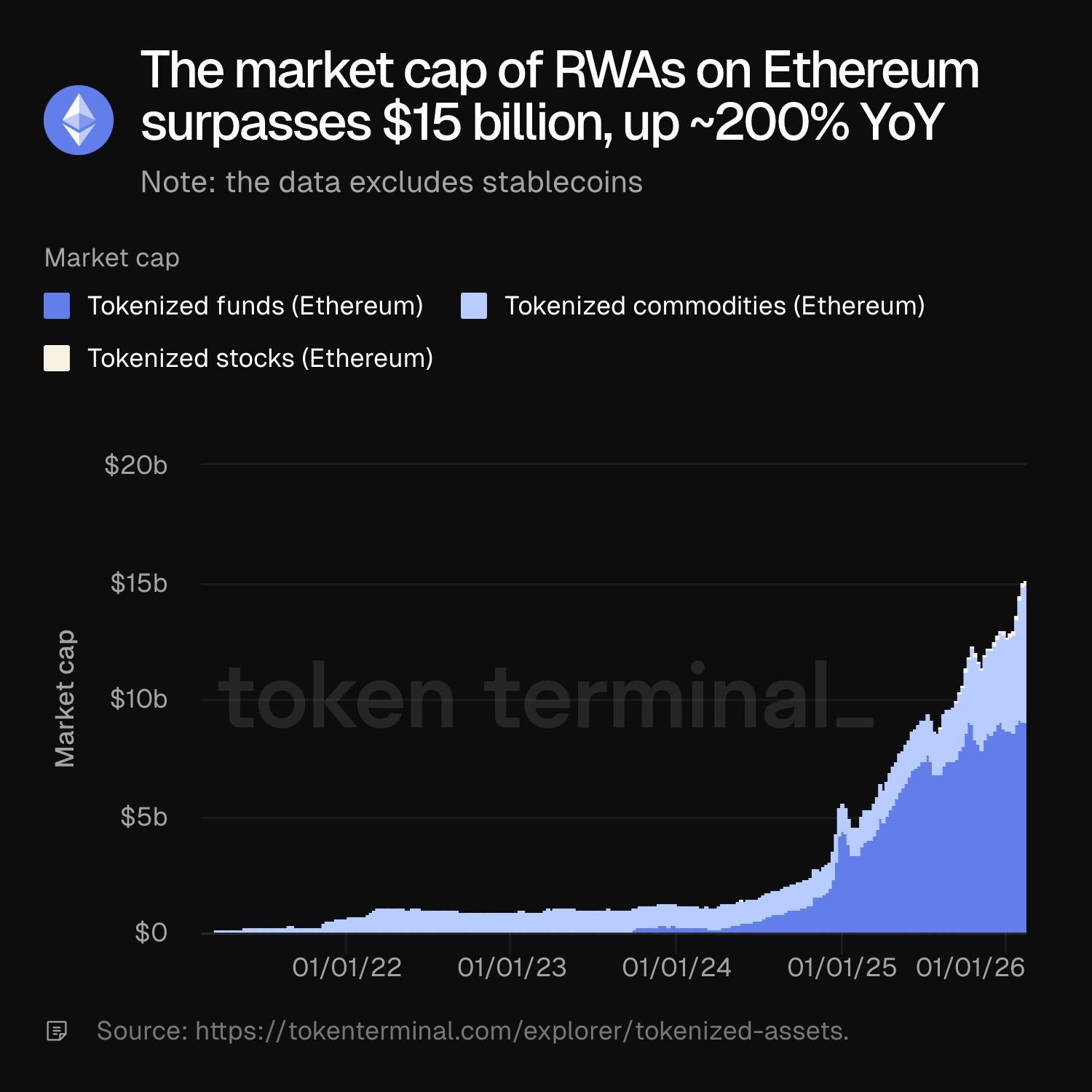

According to Token Terminal data, Ethereum currently dominates the tokenized asset market, leading in stablecoins, commodities, and tokenized funds.

The total market capitalization of real-world assets on the Ethereum ecosystem, excluding stablecoins, recently surpassed $15 billion, up roughly 200% year over year.

Crypto World

Market volatility trap? This investment strategy may hurt investors

The market volatility may be leading retail investors astray.

According to Kathmere Capital Management’s Nick Ryder, they shouldn’t use the current backdrop as an excuse to dive into defensive trades — including dividend-paying stocks and bonds.

“Oftentimes, we just see too often people taking an income-focused approach, and it leaves a lot on the table,” the firm’s chief investment officer told CNBC’s “ETF Edge” this week. “We generally just advise for all of our clients to take a total return-oriented approach … that’s going to apply across stocks, bonds and everything in between within a portfolio.”

Ryder, whose firm has $3.5 billion in assets under management, warns against so-called “yield-chasing.”

“Within fixed income, it could be yield-chasing in terms of moving further out interest rate risk, taking greater amounts of duration and portfolio, [and] moving from investment grade to high-yield bonds —which have dramatically different risk and return expectations,” he added.

Ryder contends income shouldn’t be the foundation of long-term portfolios. He indicates investors are better served starting with goals and risk tolerance, then adding income, because pullbacks are part of long-term investing. An income-first approach, he cautions, can quietly push portfolios into unintended bets.

He’s also optimistic about the macro backdrop.

“Overall, the economy has been pretty darn resilient,” added Ryder. “You’ve seen corporate profitability be very resilient.”

That total-return approach is also why Amplify ETFs’ Christian Magoon is urging investors not to let the distribution number drive the decisions.

“We think being smart about yield means balancing attractive yield with upside or long-term capital appreciation … not just going for a maximum possible yield,” the firm’s CEO said in the same interview. “We think that’s a yield trap.”

Crypto World

BlockDAG Reaches 35,000 Airdrops! Will its Beat LTC and BCH After the March 4 Trading Launch?

The digital currency space is full of activity as top crypto gainers show fresh strength. Litecoin price today is hinting at a bounce over $56, with the $57 mark being a vital spot for the trend to keep moving up. Bitcoin Cash price stays firm around $559.70, keeping its main floor and showing a careful push from buyers.

Past these known names, BlockDAG (BDAG) is winning interest before its official start. With the Mainnet active and the TGE finished, people have already taken over 35,000 airdrops. The project is getting ready for a huge world release on exchanges in the USA and Europe on March 4th. Final Genesis coins are still open at $0.000125, making a fast path for those who want to join before the public markets take control.

With high interest before the start and a possible 400x listing jump, BlockDAG (BDAG) is showing up as a major path, ready to race against other top crypto gainers once the world trade begins.

Litecoin Price Today Points Toward a Positive Turn

Litecoin price today shows signs of moving up as a strong daily candle forms by the $56 floor. The $57 pivot point is very important for proving the short-term trend stays alive, and the Litecoin price today could find more strength if this spot is kept. Daily charts show that people are protecting the mid $50s, which suggests a careful move toward the green.

How it looks next to Bitcoin will guide the next steps for Litecoin, and moving over the downward line of lower highs could clear a way to $68. Main walls at $57 and $64 will set how fast any relief climb goes. Litecoin price today stays tight near its floor, showing a chance for a big move if those buying stay in charge. Small jumps on the short charts offer paths for quick trades.

Bitcoin Cash Price Stays on Floor and Seeks a Move Up

Bitcoin cash price is sitting at $559.70 after a week with small shifts. BCH has kept above the MA 20 ($535.41) but is still below the MA 50 ($579.75) and MA 200 ($561.20), which shows short term strength hitting long term walls. Weekly views show different signs: MACD and ADX show selling power, while RSI and the CCI look more neutral or positive.

The main floor is at the Ichimoku Kijun near $513.50, with a wall at the MA 50. It will likely stay between $513.50 and $561.00 this week. A jump over $561.00 could start a new climb, while a slide under the floor might lead to a quick dip. Bitcoin cash price stays tight near the moving lines, showing a careful positive stance as people watch for breaks or drops.

BDAG Hits 35,000 Airdrop Milestone Prior to Launch

The waiting period is finished and BDAG is truly set to join the open market. Since the Mainnet is active and the TGE is finished, the work has shifted from planning to real movement. World trading starts on March 4 through USA and European platforms, and a large list of extra CEX spots will be shared near the start date. The creation stage is over and the market stage is where the real speed begins.

Last Genesis coins are still out there at $0.000125, giving people a final opening to get ready before market trends take charge. More than 35,000 airdrop claims are already done, which proves there is high early interest. The smart plan for the rollout and the chance for a 400x listing jump have made things move faster for those wanting to get coins at the last set rate.

These points help turn BDAG into one of the top crypto gainers right now. Its mix of a planned world exchange start, active airdrops, and last pre-market rates makes a strong space for those who join early. When trading starts on March 4, the amount of coins, the need for them, and the speed will set the path, helping those who got in during this last opening.

Closing Summary

The digital coin space is showing careful hope as the Litecoin price today stays firm over $56, which hints at possible quick wins, while the Bitcoin Cash price stays close to $559.70, keeping its base but meeting some push back.

Both of these coins show steady speed among top crypto gainers, but those watching the market stay careful about key points for proof. At the same time, BlockDAG (BDAG) is setting itself up as a big new name. With its Mainnet running, 35,000 airdrops taken, and a last Genesis rate of $0.000125, the work is set for a big March 4th start in the USA and Europe.

As world trading and DEX entry start, the smart exchange plan and high early need for BDAG show a strong chance for quick market results, giving a high growth path next to known coins.

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

What’s next for Europe’s crypto after Lagarde steps down

European Central Bank President Christine Lagarde is set to step down sometime before the next French presidential election, a timeline that market observers say could influence how Europe steers crypto policy and digital money initiatives. Lagarde’s tenure saw the EU push forward on the Markets in Crypto Assets regime, known as MiCA, and launch work on a digital euro designed to complement the bloc’s payments ecosystem. Yet policy gaps remain: DeFi remains خارج the regulatory scope of MiCA, and the final shape of the digital euro is still under debate. As observers weigh potential successors, questions arise about whether Europe’s cautious stance on crypto will endure or shift under new leadership.

Key takeaways

- Lagarde’s looming departure timing could affect the tempo and tone of Europe’s crypto regulation, including MiCA’s implementation and post- MiCA adjustments.

- MiCA has advanced but currently does not regulate decentralized finance (DeFi); policy gaps persist even as the bloc pursues a comprehensive framework for crypto assets.

- The digital euro project has progressed from investigation to preparation for issuance, reflecting Europe’s bid to offer a secure, Europe-based digital money option while addressing privacy and offline operation concerns.

- European officials continue to advocate for strict stablecoin regulation and global standards, emphasizing safeguards and equivalence with foreign issuers to prevent systemic risks.

- Potential successors to Lagarde, such as Pablo Hernández de Cos and Klaas Knot, are expected to uphold a prudent regulatory posture toward crypto, signaling continuity rather than a dramatic policy pivot.

Sentiment: Neutral

Market context: The EU has moved ahead on a crypto framework with MiCA, while the digital euro program marches through defined phases. Investigation into the digital euro began in October 2021, and in October 2025 the ECB signaled it would begin preparation for issuance. The policy path sits within a broader global debate about stablecoins, cross-border payments, and central bank digital currencies as regulators weigh consumer protection, financial stability, and monetary sovereignty against innovation.

Why it matters

The trajectory of European crypto policy matters for users, investors, and developers alike. MiCA’s existence signals a long-awaited regulatory foothold for digital assets in a major economy, a framework that aims to reduce regulatory ambiguity while anchoring crypto markets in a single, coherent set of rules across 27 member states. Lagarde’s skepticism toward crypto—captured most famously in a 2022 remark where she described crypto as “worth nothing” for its lack of intrinsic backing—set a cautious tone. Even as the ECB advised, observed, and offered comments during the MiCA process, the central bank’s stance remained one of measured restraint rather than open endorsement.

“It is based on nothing … There is no underlying asset to act as an anchor of safety.”

That posture has shaped how Europe approaches crypto policy, emphasizing the need for robust consumer protections and safeguards against investor misperceptions. Even as MiCA became law, Lagarde continued to push for international alignment on stablecoins and for safeguards that would prevent the kind of market stress seen in times of stablecoin runs. In 2025, she urged lawmakers to ensure that stablecoins operate within a framework that includes robust equivalence regimes and safeguards governing transfers between the EU and non-EU entities. The aim is not merely domestic regulation but a coordinated, cross-border standard that could reduce regulatory arbitrage and systemic risk.

Beyond MiCA, the digital euro represents a strategic bet on Europe’s monetary sovereignty in a digital era. The project has long faced criticism over privacy, offline operability, and the central bank’s ability to monitor or control spending. The ECB has defended the digital euro as privacy-protective and cash-like in its benefits, while acknowledging the need to adapt payment systems to a digital economy. The move to prepare for issuance in 2025-2026 reflects a belief that a European-issued digital cash tool could reduce costs for merchants, improve resilience in payment networks, and provide a platform for private-sector financial innovation to scale within a regulated environment.

Public remarks from Lagarde and her colleagues signal a cautious but constructive approach to the digital euro. ECB executive board member Piero Cipollone emphasized that the digital euro would preserve the advantages of cash while reinforcing the resilience of Europe’s payments landscape. The project is framed as a response to consumer demand for digital options, articulated by Lagarde as early as 2021 when she acknowledged an appetite for digital currencies if backed by secure, European infrastructure. The emphasis has consistently been on a solution that is secure, accessible, and fit for the future—without compromising financial stability or privacy.

As Europe debates the digital euro and a more comprehensive crypto framework, the identity of Lagarde’s successor could influence the emphasis placed on crypto innovation versus caution. The field remains skeptical about rapid, unbridled adoption, and the leading candidates discussed in financial circles—Pablo Hernández de Cos, former Spanish central bank governor, and Klaas Knot, former Dutch central bank governor—bring a similar prudential lens to crypto policy. Hernández de Cos, for example, warned that crypto assets can pose “highly significant risks that are hard to understand and measure,” calling for a robust regulatory transition from fiction to a more orderly framework. Knot, too, has been measured, recognizing potential benefits of blockchain while insisting on the primacy of stability and supervisory oversight.

The EU’s measured pace has been noted in contrast to the regulatory maturation observed in the United States and other jurisdictions. While the region’s path may appear deliberate, it has produced a comprehensive framework that integrates monetary policy considerations, payments regulation, and financial stability concerns. The collaboration between the ECB, European Parliament, and member states has yielded a crypto policy architecture that aspires to be risk-aware, globally harmonized, and technologically forward-looking without giving up the core public interest in stable and interoperable financial systems. In parallel, the ongoing dialogue around stablecoins—balancing innovation with safeguards—reflects a broader global debate about how to reconcile private money issuance with public monetary policy and consumer protections.

Ultimately, the leadership transition at the ECB arrives at a moment when Europe is weighing how far to push centralizing control versus encouraging private-sector innovation in digital money. Lagarde’s legacy will be judged, in part, by how seamlessly MiCA’s, and the digital euro’s, developments continue under a new president. The fact that the EU proceeded with a regulated framework—rather than a laissez-faire path—before some other major jurisdictions illustrates a distinctive approach: prioritizing a well-defined supervisory environment that can accommodate innovation while reducing systemic risk.

As these conversations unfold, market participants will be watching for explicit signals on how a new ECB president will balance the competing imperatives of financial stability, monetary policy autonomy, and the potential for Europe to become a hub for compliant crypto activity. The coming months are likely to see tighter discussions around DeFi and cross-border payments, the refinement of MiCA provisions, and continued debates about the digital euro’s privacy guarantees and offline capabilities. The overarching narrative remains: Europe intends to shape, not simply follow, the global trajectory of digital money, with leadership choices that will echo through regulatory decisions, technology deployments, and the ongoing evolution of the crypto economy.

What to watch next

- The selection process for a new ECB president—and whether Paris signals its preferred candidate—may influence the tone toward crypto policy and MiCA adjustments.

- Key milestones in MiCA implementation, including any refinement of DeFi provisions or updates to stablecoin regulations.

- Further communications from the ECB about the digital euro timeline, privacy safeguards, and offline functionality tests.

- Continued international coordination on crypto standards, including discussions around equivalence regimes for foreign issuers.

- Public speeches or BIS remarks from potential successors outlining their views on crypto regulation and financial stability.

Sources & verification

- ECB public statements and press materials on MiCA and the digital euro rollout timeline.

- Reuters coverage of Lagarde’s potential departure and the names of frontrunners to replace her.

- BIS remarks and speeches by Pablo Hernández de Cos and Klaas Knot addressing crypto risks and regulatory frameworks.

- Reports on Europe’s plan to close stablecoin loopholes and to align international standards, as referenced in contemporary coverage.

ECB leadership transition and Europe’s crypto policy trajectory

European Central Bank President Christine Lagarde is nearing the end of her tenure, with her exit anticipated before the next French presidential election. Her time at the helm has been marked by decisive moves to formalize Europe’s crypto regime through MiCA and to advance the digital euro initiative, a bid to provide a secure, European-based digital alternative to cash. In public remarks and behind-the-scenes deliberations, Lagarde has consistently urged a cautious, tightly regulated approach to crypto, underscoring the need to protect investors and preserve financial stability while still enabling innovation within a well-defined framework.

Her most public stance on crypto crystallized in a 2022 interview in which she described crypto as “worth nothing,” a sentiment anchored in the perception that many digital assets lack intrinsic value or a reliable anchor. The accompanying skepticism was not merely rhetorical; it shaped the ECB’s approach to MiCA as a mechanism to bring order to a volatile landscape. Lagarde and her colleagues argued that regulation should be robust enough to reduce risk, while not stifling legitimate use cases that could emerge from compliant, Europe-based crypto activity. The ECB did not legislate, but it played a central advisory and supervisory role, shaping the contours of MiCA through ongoing dialogue with lawmakers and industry participants.

As MiCA moved toward final enactment, Lagarde also pressed for international cooperation on stablecoins and cross-border standards. She warned that European legislation must deter the operation of stablecoin schemes without robust equivalence regimes and safeguards for transfers between the EU and non-EU entities. The aim was to prevent regulatory arbitrage and ensure that Europe remains part of a global financial system that is resilient to the rapid evolution of digital money. A recurring theme across her public statements has been the imperative to protect the public interest and avoid a future where private-sector control of a money-like instrument could undermine monetary sovereignty.

The digital euro remains at the heart of Europe’s forward-looking money agenda. The project has faced criticism—particularly around privacy, offline operability, and the potential surveillance capabilities of digital cash. Yet the ECB has consistently asserted that the digital euro would be privacy-preserving and would replicate, in digital form, the advantages of cash. The bank has argued that such a currency could enhance payment resilience, reduce merchant costs, and provide a platform for private-sector innovation to flourish within a safe, regulated framework. The October 2025 decision to begin preparation for issuance signaled a concrete step toward realizing these ambitions, even as the detailed design and governance structures continue to be debated among policymakers.

Under discussion are also the personalities who might succeed Lagarde. The Financial Times has highlighted Pablo Hernández de Cos and Klaas Knot as prominent contenders, each with a record of cautious, risk-aware governance. Hernández de Cos, speaking at BIS events in 2022, warned of crypto’s potential risks and urged a transition from fiction to a more orderly, regulated ecosystem. Knot has similarly urged prudence, acknowledging potential benefits of distributed ledger technologies but emphasizing the need to preserve financial stability and maintain robust supervisory oversight. If Paris signals a preferred candidate, it could reinforce a policy posture that favors measured innovation with a strong emphasis on consumer protection and systemic resilience.

Ultimately, Europe’s crypto policy course appears to favor a steady, standards-driven path. While critics may argue that the approach stifles innovation, supporters contend that a predictable, well-regulated environment is essential for sustainable growth in digital money markets. The EU’s progress—often completed with more deliberation than in other regions—reflects a willingness to balance the benefits of financial innovation with the need to maintain trust in the financial system. As the leadership transition unfolds, market participants will be watching not only who rises to the ECB presidency but how new leadership weighs MiCA updates, the digital euro’s rollout, and Europe’s role in shaping global standards for crypto and digital payments. The coming months will reveal whether Europe can sustain its measured but forward-looking approach in a rapidly changing crypto landscape.

Crypto World

Top 3 reasons why the Ethereum price may crash to $1,500 soon

Ethereum price continued its strong downward trend on Friday as geopolitical risks rose and demand for cryptocurrencies waned.

Summary

- Ethereum price may continue the downward trend this year.

- Technical analysis shows that it has invalidated the inverted head-and-shoulders pattern.

- The upcoming Donald Trump attack on Iran may push prices lower.

Ethereum (ETH) token dropped to $1,937, down sharply from the all-time high of $4,943, and key factors suggest that it has more downside, potentially to the key support level at $1,500.

Ethereum price technical points to more downside

The weekly timeframe chart shows that the ETH price has remained under pressure in the past few months. It has dropped in the last five consecutive weeks, and is hovering near its lowest level since May last year.

The coin has dropped below the key support level at $2,145, invalidating the inverted head-and-shoulders pattern, a common bullish reversal sign in technical analysis.

Ethereum has dropped below the 50-week and 200-week Weighted Moving Averages. It has also moved below the Supertrend indicator, a sign that bears remain in control.

The Relative Strength Index has moved to the oversold level of 30. Therefore, the most likely scenario is where it continues falling so that the RSI can become extremely oversold, which will then lead to a rebound.

Ethereum institutional demand is waning

The other main bearish catalyst for Ethereum is that demand from institutional investors has waned in the past few months.

One sign for this is the fact that demand for spot Ethereum ETFs has waned. These funds shed over $130 million in assets on Thursday, bringing the monthly outflow to over $450 million. They have suffered outflows in the last four consecutive months.

Another sign of waning demand is that the futures open interest has continued falling in the past few months and now stands at $23 billion, down from the year-to-date high of $41 billion.

Donald Trump is locked and loaded on an Iran attack

Geopolitics may also contribute to the Ethereum price crash as cryptocurrencies are no longer safe-haven assets.

All indications are that Donald Trump will attack Iran, as the US has accumulated a large armada in the region. In a statement on Thursday, he warned Iran of an attack that may happen in the next 10 to 15 days.

An Iranian attack would have a major impact on financial assets. For example, it would lead to higher crude oil prices, which may lead to higher inflation. This is important as this week’s Federal Reserve minutes showed that some Fed officials are considering rate hikes if inflation remains at an elevated level.

Still, on the positive side, Ethereum has some potential bullish catalysts, including soaring transactions, active addresses, and fees. Also, key metrics in its ecosystem, like the DeFi total value locked has jumped to a record high in ETH terms. Also, its staking queue continues rising, while its market share in the real-world asset tokenization industry is soaring.

Crypto World

Making cloud mining the preferred channel for ordinary people to steadily enjoy crypto dividends

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As 2026 nears, FT Mining’s zero-threshold cloud model is reshaping global crypto participation trends.

Summary

- FT Mining introduces zero-cost, flexible cloud mining, widening global crypto access.

- As 2026 volatility looms, FT Mining’s compliant cloud model offers steady, low-barrier digital income.

- With “after-sleep income” rising, FT Mining redefines mining through accessible computing power allocation.

As a new round of transformation in the cryptocurrency market approaches in 2026, a “lightweight” participation method is quietly emerging worldwide. Cloud mining platform FT Mining, with its disruptive “zero equipment, zero threshold” model, is rapidly becoming a convenient new channel for ordinary people to share in crypto dividends.

With its stable profit model, the platform has even been praised by French media as a “mining dark horse earning $2,000 per day.” This article will deeply analyze the wealth logic behind this phenomenon.

Why FT Mining is becoming the first cloud mining choice

Founded in 2021 and headquartered in the United Kingdom, FT Mining has, after five years of development, rapidly risen to become a leader in the global cloud mining industry. FT Mining currently has more than 5 million registered users, operates over 100 large-scale mining farms worldwide, and contributes more than 3% of the total computing power of the global Bitcoin network.

Core platform highlights

Green Intelligent Mining:

All data centers are powered by clean energy and introduce AI algorithms to optimize the energy consumption-to-output ratio, taking into account both profitability and sustainability.

Top-Tier Hardware Guarantee:

Fully equipped with the latest cutting-edge mining machines to ensure industry-leading computing power output.

Compliant and Legal Operations:

Strictly complies with UK and EU regulations, possessing complete business registration and compliance qualifications, which can be traced and verified by users worldwide.

24/7 Customer Support:

A 7×24-hour online customer service team responds in real time to any questions users encounter during the mining process.

Flexible Multi-Currency Deposits and Withdrawals:

The platform supports LTC, BTC, ETC, DOGE, USDT, USDC, SOL, XRP, and other mainstream and stable cryptocurrencies, making asset management more convenient.

Extremely Beginner-Friendly:

A simple and intuitive operating interface allows users with no technical background to complete the entire process from registration to earning within three minutes.

Daily Earnings Credited:

Mining output is automatically settled every 24 hours, and earnings are credited directly to users’ accounts, with support for withdrawal or reinvestment at any time.

Dual Referral Rewards:

Successfully inviting friends to register and invest allows users to enjoy a permanent 5% investment rebate; they can also participate in the affiliate program, with up to $10,000 in additional rewards.

Start the FT Mining wealth journey in three steps

Registration Bonus:

Create an account and immediately receive a $15–$100 registration reward. At the same time, the platform will activate a free computing power contract to help someone steadily earn $1 per day and verify the mining process at zero cost.

Flexible Contract Selection:

FT Mining provides multiple computing power packages with different durations, ranging from short-term experiences to long-term compound interest, meeting the needs of investors with different capital scales.

Enjoy Daily Passive Income:

After the contract takes effect, the platform’s professional technical team will fully handle the operation and maintenance of mining machines. Log in to the account daily to view and withdraw continuously growing mining earnings.

Selected computing power contracts

Beginner Entry [Basic Contract]:

Investment: 100 USDT | Term: 2 days | Daily Earnings: 4 USDT | Total Return: 108 USDT

Steady Progress [Classic Contract]:

Investment: 1,080 USDT | Term: 10 days | Daily Earnings: 15.66 USDT | Total Return: 1,236.6 USDT

Advanced Option [Classic Contract]:

Investment: 4,800 USDT | Term: 20 days | Daily Earnings: 76.8 USDT | Total Return: 6,336 USDT

High Return [Premium Contract]:

Investment: 28,000 USDT | Term: 32 days | Daily Earnings: 490 USDT | Total Return: 43,680 USDT

Flagship Exclusive [Super Contract]:

Investment: 130,000 USDT | Term: 42 days | Daily Earnings: 3,250 USDT | Total Return: 266,500 USDT

(For more details, please visit the official website.)

Security and compliance: The cornerstone of building user trust

In the field of crypto assets, security is the prerequisite for earnings. FT Mining always places compliance and risk control in the first position:

Global Regulatory Endorsement:

The platform holds a license issued by the UK Financial Conduct Authority (FCA) and U.S. MSB compliance certification. User funds are placed under institutional-level custody by HSBC, and asset security is protected by the laws of multiple countries.

Cold Wallet Asset Isolation:

95% of user funds are stored in offline cold wallets and protected by Fireblocks bank-level encryption technology, maintaining a “zero security incident” record for two consecutive years.

Multi-Currency Hedging Strategy:

Users can independently choose to settle earnings into stablecoins such as USDT to lock in profits or obtain long-term compound returns through XRP staking services, effectively hedging against the market volatility risk of a single cryptocurrency.

Conclusion

FT Mining is reshaping the rules of cryptocurrency mining with the new concept of “zero-cost participation, high flexibility, and strong compliance protection,” opening up an accessible and stable wealth channel for ordinary investors worldwide.

As 2026 approaches and short-term market fluctuations become difficult to predict, choose to let assets sleep in a wallet, or embrace the “after-sleep income” revolution brought by cloud mining? The answer may lie in how someone wants to allocate their first portion of computing power.

Visit the official website www.ftmining.com or download the official App to claim a $15–$100 registration reward and begin thejourney of steady daily income growth.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Zcash price slumps as Ethereum plans stealth addresses and ZK privacy features

Zcash price has crashed this year, erasing most of the gains made last year as profit-taking continued and as competition fears rise.

Summary

- Zcash price has slumped by 66% from its highest level in November last year.

- Ethereum plans to launch stealth addresses, while Cardano is working on Midnight.

- ZEC has moved to the distribution phase of the Wyckoff Theory.

Zcash (ZEC) token dropped to a low of $250 on Friday, down by 66% from its highest level in November last year. This crash has brought its market capitalization from nearly $12 billion to the current $4.21 billion.

The ongoing Zcash price crash aligns with the broader crypto market plunge that has affected Bitcoin and other top altcoins like Ethereum and Cardano.

At the same time, there are concerns that competition is rising in the privacy industry. The biggest competition will come from Ethereum, which plans to launch stealth addresses as part of the ERC-5565.

Stealth addresses aim to solve a key challenge that has existed for many years, where Ethereum transactions are public. As a result, sender and receiver data will now become private, a strategy that emulates Zcash’s shielded addresses.

Ethereum is also working on a strategy to implement zero-knowledge proofs in the layer-1 network, which will improve its privacy features

Cardano, on the other hand, is working on Midnight, a zero-knowledge proof-based sidechain that will have advanced features. The mainnet launch will happen in March this year.

Meanwhile, data compiled by CoinGlass shows that Zcash’s futures open interest has dropped in the past few months, a sign that its demand has waned. It has dropped to $377 million from last year’s high of over $1.38 billion.

Zcash price technical analysis

The weekly chart shows that the Zcash price remained in a narrow range between the key support and resistance levels at $15 and $85, respectively. This consolidation was part of the accumulation phase of the Wyckoff Theory.

It then surged and moved to a high of $745 as part of the mark-up phase. Therefore, the ongoing retreat is part of the markdown and distribution of the Wyckoff Theory.

It has now moved below the key support level at $385, its highest level in May 2021. Also, it has moved below the 50-week and 100-week Exponential Moving Averages.

ZEC price is also forming a bearish pennant pattern, a popular continuation sign in technical analysis. Therefore, the most likely scenario is where it continues falling, potentially to the next key support level at $200.

Crypto World

How AI is helping retail traders exploit prediction market ‘glitches’ to make easy money

A fully automated trading bot executed 8,894 trades on short-term crypto prediction contracts and reportedly generated nearly $150,000 without human intervention.

The strategy, described in a recent post circulating on X, exploited brief moments when the combined price of “Yes” and “No” contracts on five-minute bitcoin and ether markets dipped below $1. In theory, those two outcomes should always add up to $1. If they don’t, say they trade at a combined $0.97, a trader can buy both sides and lock in a three-cent profit when the market settles.

That works out to roughly $16.80 in profit per trade — thin enough to be invisible on any single execution, but meaningful at scale. If the bot was deploying around $1,000 per round-trip and clipping a 1.5-to-3% edge each time, it becomes the kind of return profile that looks boring on a per-trade basis but impressive in aggregate. Machines don’t need excitement. They need repeatability.

It sounds like free money. In practice, such gaps tend to be fleeting, often lasting milliseconds. But the episode highlights something bigger than a single glitch: crypto’s prediction markets are increasingly becoming arenas for automated, algorithmic trading strategies, and an emerging AI-driven arms race.

As such, typical five-minute bitcoin prediction contracts on Polymarket carry order-book depth of roughly $5,000 to $15,000 per side during active sessions, data shows. That’s several orders of magnitude thinner than a BTC perpetual swap book on major exchanges such as Binance or Bybit.

A desk trying to deploy even $100,000 per trade would blow through available liquidity and wipe out whatever edge existed in the spread. The game, for now, belongs to traders comfortable sizing in the low four figures.

When $1 isn’t $1

Prediction markets like Polymarket allow users to trade contracts tied to real-world outcomes, from election results to the price of bitcoin in the next five minutes. Each contract typically settles at either $1 (if the event happens) or $0 (if it doesn’t).

In a perfectly efficient market, the price of “Yes” plus the price of “No” should equal exactly $1 at all times. If “Yes” trades at 48 cents, “No” should trade at 52 cents.

But markets are rarely perfect. Thin liquidity, fast-moving prices in the underlying asset and order-book imbalances can create temporary dislocations. Market makers may pull quotes during volatility. Retail traders may aggressively hit one side of the book. For a split second, the combined price might fall below $1.

For a sufficiently fast system, that’s enough.

These kinds of micro-inefficiencies are not new. Similar short-duration “up/down” contracts were popular on derivatives exchange BitMEX in the late 2010s, before the venue eventually pulled some of them after traders found ways to systematically extract small edges. What’s changed is the tooling.

Early on, retail traders treated these BitMEX contracts as directional punts. But a small cohort of quantitative traders quickly realized the contracts were systematically mispriced relative to the options market — and began extracting edge with automated strategies that the venue’s infrastructure wasn’t built to defend against.

BitMEX eventually delisted several of the products. The official reasoning was low demand, but traders at the time widely attributed it to the contracts becoming uneconomical for the house once the arb crowd moved in.

Today, much of that activity can be automated and increasingly optimized by AI systems.

Beyond glitches: Extracting probability

The sub-$1 arbitrage is the simplest example. More sophisticated strategies go further, comparing pricing across different markets to identify inconsistencies.

Options markets, for instance, effectively encode traders’ collective expectations about where an asset might trade in the future. The prices of call and put options at various strike prices can be used to derive an implied probability distribution, a market-based estimate of the likelihood of different outcomes.

In simple terms, options markets act as giant probability machines.

If options pricing implies, say, a 62% probability that bitcoin will close above a certain level over a short time window, but a prediction market contract tied to the same outcome suggests only a 55% probability, a discrepancy emerges. One of the markets may be underpricing risk.

Automated traders can monitor both venues simultaneously, compare implied probabilities and buy whichever side appears mispriced.

Such gaps are rarely dramatic. They may amount to a few percentage points, sometimes less. But for algorithmic traders operating at high frequency, small edges can compound over thousands of trades.

The process doesn’t require human intuition once it’s built. Systems can continuously ingest price feeds, recalculate implied probabilities and adjust positions in real time.

Enter the AI agents

What distinguishes today’s trading environment from prior crypto cycles is the growing accessibility of AI tools.

Traders no longer need to hand-code every rule or manually refine parameters. Machine learning systems can be tasked with testing variations of strategies, optimizing thresholds and adjusting to changing volatility regimes. Some setups involve multiple agents that monitor different markets, rebalance exposure and shut down automatically if performance deteriorates.

In theory, a trader might allocate $10,000 to an automated strategy, allowing AI-driven systems to scan exchanges, compare prediction market prices with derivatives data, and execute trades when statistical discrepancies exceed a predefined threshold.

In practice, profitability depends heavily on market conditions and on speed.

Once an inefficiency becomes widely known, competition intensifies. More bots chase the same edge. Spreads tighten. Latency becomes decisive. Eventually, the opportunity shrinks or disappears.

The larger question isn’t whether bots can make money on prediction markets. They clearly can, at least until competition erodes the edge. But what happens to the markets themselves is the point.

If a growing share of volume comes from systems that don’t hold a view on the outcome — that are simply arbitraging one venue against another — prediction markets risk becoming mirrors of the derivatives market rather than independent signals.

Why big firms aren’t swarming

If prediction markets contain exploitable inefficiencies, why aren’t major trading firms dominating them?

Liquidity is one constraint. Many short-duration prediction contracts remain relatively shallow compared with large crypto derivatives venues. Attempting to deploy significant capital can move prices against the trader, eroding theoretical profits through slippage.

There is also operational complexity. Prediction markets often run on blockchain infrastructure, introducing transaction costs and settlement mechanisms that differ from those of centralized exchanges. For high-frequency strategies, even small frictions matter.

As a result, some of the activity appears concentrated among smaller, nimble traders who can deploy modest size, perhaps $10,000 per trade, without materially moving the market.

That dynamic may not last. If liquidity deepens and venues mature, larger firms could become more active. For now, prediction markets occupy an in-between state: sophisticated enough to attract quant-style strategies, but thin enough to prevent large-scale deployment.

A structural shift

At their core, prediction markets are designed to aggregate beliefs to produce crowd-sourced probabilities about future events.

But as automation increases, a growing share of trading volume may be driven less by human conviction and more by cross-market arbitrage and statistical models.

That doesn’t necessarily undermine their usefulness. Arbitrageurs can improve pricing efficiency by closing gaps and aligning odds across venues. Yet it does change the market’s character.

What begins as a venue for expressing views on an election or a price move can evolve into a battleground for latency and microstructure advantages.

In crypto, such evolution tends to be rapid. Inefficiencies are discovered, exploited and competed away. Edges that once yielded consistent returns fade as faster systems emerge.

The reported $150,000 bot haul may represent a clever exploitation of a temporary pricing flaw. It may also signal something broader: prediction markets are no longer just digital betting parlors. They are becoming another frontier for algorithmic finance.

And in an environment where milliseconds matter, the fastest machine usually wins.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech7 days ago

Tech7 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion22 hours ago

Fashion22 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat1 day ago

NewsBeat1 day agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody