Crypto World

Aave Shuts Down Avara Brand and Family Crypto Wallet

Aave Labs is consolidating its branding around core decentralized finance offerings, signaling a shift away from its umbrella project Avara. The reorganization follows a string of moves intended to streamline product focus and accelerate mainstream adoption of Aave’s DeFi stack. In a post on X, founder and CEO Stani Kulechov explained that Avara—an umbrella for projects including the Family crypto wallet and Lens-related initiatives—will be deprecated as the team doubles down on bringing Aave to a wider audience. The announcement underscores a broader theme in the ecosystem: simplifying user experiences to drive mass adoption rather than expanding brand reach through ancillary products.

Key takeaways

- Aave Labs replaces Avara as the central branding home for current and future products, including Aave App, Aave Pro, and Aave Kit.

- The Family wallet on iOS is winding down, with onboarding of new users halted and a slated wind-down over the next year.

- Lens governance has shifted away from Aave, with stewardship handed to Mask Network and Aave taking on a primarily advisory role for Lens-related work.

- The change is part of a broader strategic refocus on DeFi product development and ecosystem integration rather than broad branding expansion.

- Aave remains the dominant DeFi protocol by total value locked (TVL), hovering around $30 billion, well ahead of competitors.

Tickers mentioned: $AAVE

Price impact: Negative. The AAVE price recently declined about 0.7% in the last 24 hours, trading around $127.40.

Market context: The move comes as the DeFi sector consolidates leadership around core lending and borrowing protocols. With Aave at the forefront of TVL—roughly $30 billion, according to DefiLlama—the branding simplification may help streamline user onboarding and product development amid fluctuating risk sentiment and regulatory scrutiny that has grown tighter around decentralized finance offerings.

Why it matters

The decision to sunset Avara and consolidate into Aave Labs signals a strategic bet on a more focused, product-led growth path. By winding down the Family wallet and relegating Lens governance to a governance partner, Aave appears to be prioritizing a seamless end-user experience and clear product ownership. For investors and developers, the move provides a more direct line of accountability for delivering DeFi features that scale: a more cohesive roadmap, clearer product boundaries, and less fragmentation across brands.

On the user experience front, the Family wallet’s wind-down represents a realignment of resources toward experiences that encourage sustained engagement, such as savings-oriented features rather than open-ended wallet functionality. While the wallet’s iOS app will be phased out over the coming year, existing users will still be able to access their funds via Aave’s web interfaces through at least 2027. This keeps funds secure and accessible while the underlying infrastructure continues to support Aave Labs’ broader product ecosystem.

The Lens protocol transition, previously under Aave stewardship, to Mask Network, underscores a broader industry trend: governance and development responsibilities are increasingly distributed to specialized teams. While Aave maintains an advisory role, the strategic emphasis remains on preserving protocol integrity and enabling DeFi deployment at scale. This alignment could help reduce overlaps and accelerate deployment timelines for core Aave products in areas like lending, borrowing, and asset management, reinforcing the network’s competitive position in a crowded DeFi landscape.

In formal terms, Aave Labs will house all current and future offerings, including the Aave App, Aave Pro, and Aave Kit. The branding simplification aims to minimize confusion for users navigating a growing suite of tools and services. By concentrating branding under a single umbrella, the company aims to deliver a more coherent user journey—from onboarding to advanced use cases—without sacrificing the security and reliability that have underpinned its market leadership.

From a market perspective, Aave’s status as the largest DeFi protocol by total value locked provides a cushion against volatility in the broader crypto markets. With TVL around $30 billion and Lido’s staking protocol trailing at roughly $21.7 billion, the competitive landscape remains robust. The price action of AAVE—which traded around $127.40 after a 0.7% daily dip—reflects the typical sensitivity of blue-chip DeFi tokens to broader liquidity and regulatory dynamics, even as the core product suite continues to evolve in line with the company’s strategic reorientation.

What to watch next

- April 1: No new users will be onboarded to the iOS Family Wallet, marking a hard stop for new installations.

- April 1, 2027: Existing Family Wallet users retain access to their funds via Aave’s web interfaces; iOS app access ends, completing the wind-down.

- Updates on Aave App, Aave Pro, and Aave Kit within Aave Labs, including roadmap milestones and governance developments.

- Lens protocol governance and collaboration with Mask Network—monitor any public governance proposals or technical integrations.

Sources & verification

- Stani Kulechov’s X post announcing the sunset of Avara and the move to focus on bringing Aave to the masses.

- Avara blog post detailing that current and future products will operate under Aave Labs and the wind-down of the Family wallet on iOS.

- DefiLlama TVL data confirming Aave as the largest DeFi protocol with approximately $30 billion in total value locked.

- CoinGecko price data showing AAVE trading around $127.40 with a ~0.7% daily decline.

Why it matters

The branding consolidation is a signal of maturity for Aave as it increasingly treats DeFi tooling as an integrated ecosystem rather than a set of standalone products. By aligning development under Aave Labs, the project can allocate resources more efficiently, reduce friction for users, and accelerate delivery of core DeFi capabilities that have driven adoption since the early days of the protocol.

For builders, the move clarifies accountability and ownership for each product, potentially speeding up integration work and reuse of components across the Aave ecosystem. For users, a streamlined brand can translate into a simpler onboarding flow, more consistent user interfaces, and fewer disruptions caused by shifting project scope. Regulators, too, may appreciate a well-defined product suite with centralized governance and clearer risk management practices across Aave’s core offerings.

In the broader crypto market, the emphasis on DeFi-focused growth comes at a time when liquidity and risk appetite remain uneven. However, as institutional and retail demand for scalable, compliant, and user-friendly DeFi tools persists, Aave’s renewed focus could bolster confidence in its trajectory and reinforce its position as a leading provider of decentralized financial primitives.

What to watch next

- Roadmap updates for Aave App, Aave Pro, and Aave Kit under Aave Labs in the coming quarters.

- Any governance proposals related to Lens or other partnerships tied to the Lens ecosystem.

- Evolving product onboarding experiences aimed at broad user segments, including savings-focused features.

Crypto World

Shiba Inu price outlook: analysts project a potential 400% surge

- Shiba Inu (SHIB) faces short-term pressure from large exchange inflows.

- The key support lies at $0.0000060, while the immediate resistance lies near $0.0000066.

- Long-term forecasts project potential gains up to 400%.

Shiba Inu (SHIB) price has seen an uptick, trading at around $0.0000064 after gaining over 7% in 24 hours.

Despite this movement, short-term dynamics suggest caution.

A significant portion of SHIB tokens, totalling hundreds of billions, has recently flowed into centralised exchanges.

Such large inflows often indicate potential selling pressure.

This means the market could see a downward push if buyers do not absorb the increased supply.

Adding to the caution, technical indicators point to weakening momentum.

SHIB recently formed a death cross on shorter timeframes, where a faster-moving average crossed below a slower one.

This pattern historically signals bearish pressure in the short term.

The support near $0.0000060 has become a key pivot point.

If this level holds, SHIB may stabilise, but a breach could trigger further declines toward $0.0000057 or lower.

Resistance remains at around $0.0000066, a level that must be cleared for buyers to regain control.

On-chain trends and market sentiment

Beyond price action, on-chain data shows a growing number of tokens being held on exchanges.

This indicates that many holders are prepared to sell, adding to market uncertainty.

At the same time, the market has shown resilience.

Small rallies have occurred even as selling pressure builds, suggesting that some investors remain confident.

Liquidity is limited, however, which can exaggerate price swings in either direction.

The short-term picture remains fragile, and momentum is likely to be influenced by market sentiment and broader cryptocurrency trends.

Long-term Shiba Inu price projections

Looking beyond the immediate fluctuations, analysts remain optimistic about SHIB’s potential.

JAVO MARKS projects that the meme coin could rise as high as $0.00005 by late 2026, which represents an increase of more than 400% from current levels.

With $SHIB‘s RSI making Higher Lows and its prices making Lower Lows, this is considered a regular bullish divergence in technical analysis and suggests a strong possibility for a bullish reversal!

A reversal can result in Shiba Inu recovering over 400% into the $0.000035 areas! pic.twitter.com/mzD0SFX2m2

— JAVON⚡️MARKS (@JavonTM1) February 16, 2026

Several factors could contribute to this bullish outlook.

One of those factors could be a broader crypto market upswing, which could lift altcoins and memecoins like SHIB.

Regulatory clarity and adoption of cryptocurrencies by institutions may also provide a boost.

These catalysts, combined with continued community support, create a framework for long-term growth.

Despite this, experts caution that short-term technical weaknesses could limit immediate gains.

Price stability and strong support at key levels will be crucial for sustaining any rally.

The token’s speculative nature and its dependence on market cycles mean that volatility is likely to continue.

If the bullish catalysts materialise, SHIB could deliver substantial gains, but the path may be uneven.

For now, the market will likely navigate a mix of uncertainty and opportunity, reflecting the unique position Shiba Inu holds in the crypto space.

Crypto World

Billionaire Alan Howard’s crypto incubator WebN closes down

WebN Group, the blockchain and Web3 incubator backed by billionaire Alan Howard, is closing its doors after seeding a clutch of digital infrastructure startups over the past several years, according to a person familiar with the matter.

Most recently, the venture studio backed tokenization specialist Libre (now called KAIO), crypto staking shop Twinstake, blockchain infrastructure firm TruFin and zero-knowledge proofs startup Geometry.

In addition to Howard, WebN also received an undisclosed investment from Japanese bank Nomura’s crypto partnership, Laser Digital, back in 2023.

The incubator was described as having “successfully completed its mission” the person said. Some of the staff who worked at WebN moved across to work at Brevan Howard, the hedge fund founded by Howard, they said.

The decision to close down the WebN incubator has no bearing on Howard’s digital asset aspirations, said the person, who is close to the situation at WebN.

“Those who know Alan, know that he has long been convinced that blockchain technology would be used in traditional markets,” the person said.

The last 12 months have been a challenging time for crypto-exposed firms. Brevan Howard’s digital asset fund lost almost 30% last year, according to a report in the Financial Times. This follows gains of 52% in 2024 and 43% the year before.

Like many other hedge funds, Brevan Howard has trimmed its bitcoin ETF positions, cutting holdings of BlackRock’s iShares Bitcoin Trust by some 85%, according to data from Bloomberg and CF Benchmarks.

2025 also saw the departure of BH Digital CEO Gautam Sharma, who had been overseeing crypto investing at the firm for a few years. Brevan Howard also decided to spin out Nova, a hedge fund run by former Dragonfly investor Kevin Hu, who joined the firm with his own money pool in 2023 as part of an acquisition.

“Brevan Howard isn’t scared off by temporary volatility, remains bullish on digital assets and has a huge VC business focused on the broad opportunity set,” said the source.

WebN Group did not respond to requests for comment. Brevan Howard declined to comment.

Crypto World

Ethereum Foundation’s Justin Drake Unveils “Strawmap” Roadmap With Seven Forks Planned Through 2029

TLDR:

- Ethereum Foundation researcher Justin Drake proposed roughly seven protocol forks through 2029 on a six-month cadence.

- The EF protocol team targets 1 gigagas/sec L1 throughput via zkEVMs, equating to approximately 10,000 transactions per second.

- High-throughput L2 via data availability sampling aims to support up to 10 million transactions per second across Layer 2 networks.

- The strawmap introduces post-quantum cryptography and native privacy-preserving ETH transfers as long-term first-class protocol goals.

Ethereum Foundation researcher Justin Drake has released a protocol document called the “strawmap,” proposed by the EF protocol team.

The plan outlines roughly seven forks through 2029, operating on a cadence of one upgrade every six months. Five long-term goals anchor the roadmap: faster L1 finality, 1 gigagas/sec throughput, high-throughput L2, post-quantum cryptography, and native privacy-preserving ETH transfers.

Drake Proposes a Six-Month Fork Cadence Through the End of the Decade

Justin Drake, a researcher at the Ethereum Foundation, put forward the strawmap as a technical coordination tool for the EF protocol team.

The document covers seven planned forks stretching from the present through 2029. It was originally drafted during an internal EF workshop held in January 2026 before being shared publicly.

Drake introduced the document on social media, writing that the strawmap is “an invitation to view L1 protocol upgrades through a holistic lens.”

By placing all proposals on a single visual, the EF protocol team aimed to present a unified perspective on Ethereum’s long-term ambitions. The time horizon extends well beyond what All Core Devs typically covers in its near-term planning cycles.

The six-month fork cadence is central to how the EF protocol team structured the strawmap. Each fork is limited to one consensus headliner and one execution headliner to keep the pace manageable.

For example, the upcoming Glamsterdam fork features ePBS and BALs as its two headliners across the respective layers.

Fork names follow a star-based naming convention on the consensus layer, with letters incrementing from Altair onward.

Upcoming forks like Glamsterdam and Hegotá carry confirmed names, while others such as I* and J* remain placeholders.

The roadmap is publicly accessible at strawmap.org and will receive at least quarterly updates as the protocol evolves.

Five Long-Term Goals Shape the EF Protocol Team’s Technical Vision

The five north stars proposed by the EF protocol team define the technical direction through the end of the decade.

Drake described them clearly: faster L1 targeting finality in seconds, 1 gigagas/sec throughput via zkEVMs, high-throughput L2 via data availability sampling, post-quantum cryptography through hash-based schemes, and native privacy-preserving ETH transfers via shielded transactions.

Each goal connects directly to specific upgrade tracks mapped across the consensus, data, and execution layers. The gigagas target of 1 gigagas/sec translates to roughly 10,000 transactions per second on L1.

The teragas L2 goal targets 1 gigabyte per second, supporting approximately 10 million transactions per second across Layer 2 networks.

Post-quantum cryptography addresses the long-term durability of Ethereum’s security model. Hash-based cryptographic schemes are the proposed mechanism for protecting the network against future quantum computing threats. This upgrade track reflects the EF protocol team’s focus on securing Ethereum well beyond the current decade.

Native privacy through shielded ETH transfers rounds out the five goals. The strawmap treats privacy as a first-class protocol feature rather than an application-layer concern.

Drake described the document as a work-in-progress living document, not a formal prediction, but a structured path proposed by the EF protocol team for advancing Ethereum’s core infrastructure.

Crypto World

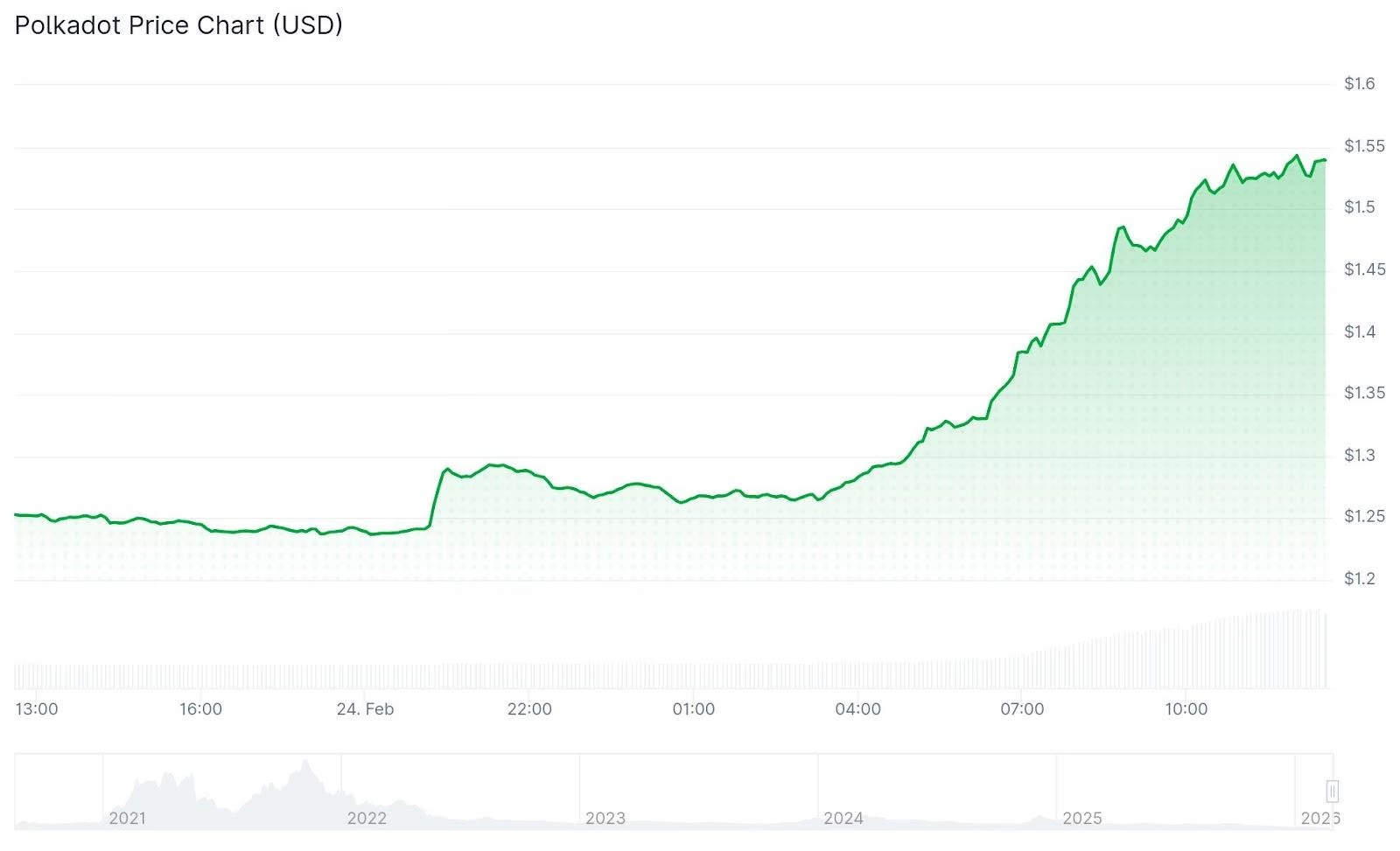

Polkadot Jumps Ahead of Halving Event

DOT rises as investors look toward a coming supply cut, though analysts say the move may be driven by market sentiment.

Polkadot’s native token DOT soared on Wednesday, Feb. 25, making it the top performer among large-cap cryptocurrencies just weeks before the network’s planned supply halving.

DOT is currently trading at $1.54, up about 23% over the past 24 hours, according to CoinGecko. The token’s market cap is near $2.6 billion, while daily trading volume has climbed above $420 million.

The rally comes as Polkadot approaches a major tokenomics change scheduled for March 14. The network plans to cut annual token issuance in half and cap the total supply at about 2.1 billion DOT. The move aims to lower inflation and make the token more scarce over time.

This upcoming change, called a “halving,” may be one reason the market is paying more attention to DOT. However, other analysts say the timing of the rally suggests it may be driven more by market sentiment than by Polkadot itself.

“We’re seeing double-digit green candles across the altcoin space. DOT just happens to be one of today’s leaders,” said Danny Nelson, a research analyst at Bitwise. “Nothing’s changed about Polkadot, its users, or its usefulness. There’s no new ‘news’ to catalyze a DOT repricing. I chalk DOT’s 20%+ surge up to market-wide speculation.”

Nelson added that investors are speculating that Bitcoin has reached its bottom. “If that’s so, then you’d certainly expect altcoins to rally, too,” he said. “You can see some positive indicators in Bitcoin’s 24-hour chart.”

Meanwhile, Brian Huang, co-founder of Glider, pointed out that trading activity has also spiked, but the reason for the move remains unclear. “The odd part is there is no clear catalyst for DOT surging today,” He said. “Because of this surge, both spot and perp volume are at their highest levels in the last three months.”

Huang added that while the supply change is important, it doesn’t take effect until mid-March, “so today’s timing feels unrelated.”

Crypto World

The Bank of England’s plan to cap stablecoin holdings is sparking an industry revolt

The U.K.’s Financial Conduct Authority (FCA) picked Revolut, Monee Financial Technologies, ReStabilise, and VVTX to test stablecoin issuance in its Regulatory Sandbox as regulators move toward a full rulebook.

The FCA said the cohort will trial stablecoin products in real-world conditions, with safeguards in place. The regulator plans to focus on issuance and review use cases that include payments, wholesale settlement and crypto trading. Testing begins in the first quarter of 2026, and the FCA said the results will feed into final stablecoin rules later in 2026.

“We are supporting U.K. stablecoin issuers to ensure they can be trusted for payments, settlement and trading,” said Matthew Long, director of payments and digital assets at the FCA. “It will benefit consumers and financial transactions and help to deliver the FCA’s strategy and the Government’s National Payments Vision.”

Industry pushes back

However, industry leaders have pushed back against the Bank of England’s (BoE) stablecoin caps, saying they limit innovation and prevent the U.K. from becoming the global hub it aims to be.

The BoE published a paper on Nov. 10, 2025, announcing stablecoin caps of between £5,000 and £20,000 for individuals and £1 million to £10 million for businesses. Armstrong asked U.K. users to sign a petition to Parliament for these caps to be reconsidered. The petition has 81,909 of the 100,000 required signatures.

“Stablecoin rules in the U.K. are being finalized, and are at risk of preventing the U.K. from being globally competitive in the digital economy,” Brian Armstrong, CEO and co-founder at Coinbase, wrote on X on Tuesday. He cited a Bank of England proposal to cap stablecoin holdings.

The government has repeatedly pledged to position London as a center for global digital asset activity. However, comprehensive legislation governing stablecoins and wider crypto activity is expected to be approved by parliament only later this year and won’t come into force until 2027.

The regulatory timeline contradicts U.K.’s goal of remaining globally competitive within the industry, Andrew MacKenzie, CEO of sterling stablecoin developer Agant, told CoinDesk in a recent interview at Consensus Hong Kong. He said the introduction of rules is not moving fast enough to support the aspirations of the global crypto hub.

“The U.K. has a long history of being a financial hub,” said Armstrong. “Embracing and encouraging innovation, especially when other countries are moving fast here, is important for maintaining that.”

Crypto World

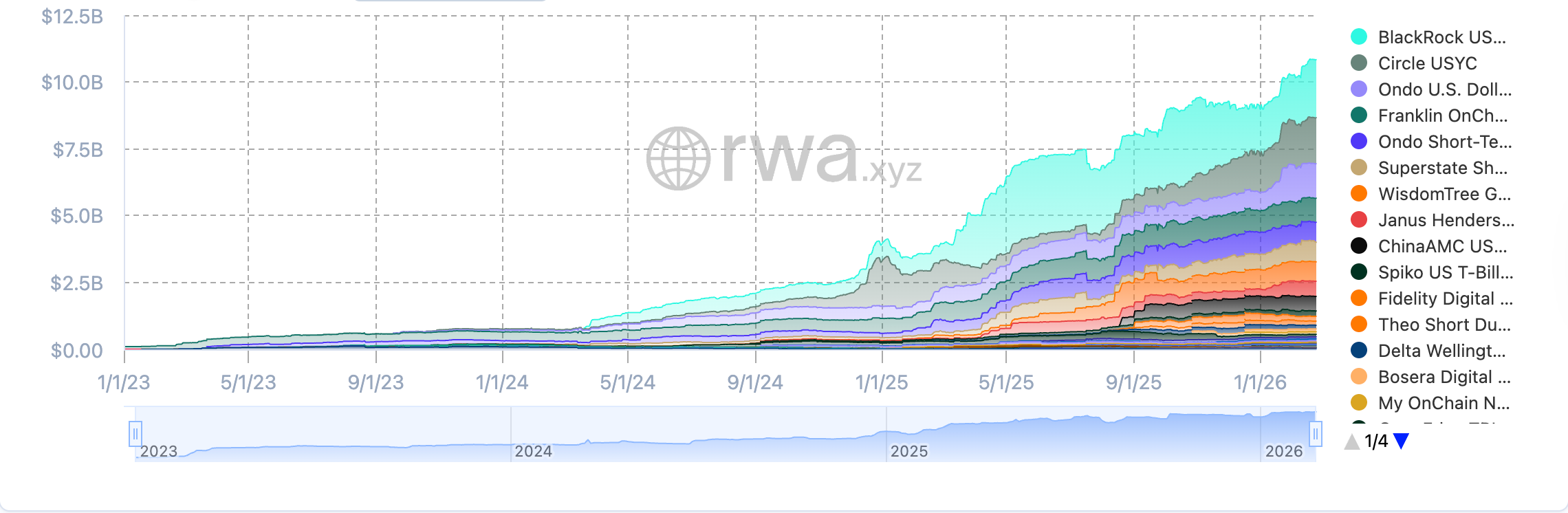

Tokenized US Treasury Market Surges by $1B Since Beginning of Year

The tokenized US Treasury market has surged by over $1 billion since the beginning of 2026, despite macroeconomic uncertainty and concerns over the US government’s growing national debt.

Tokenized US Treasurys are government debt instruments that are a form of real-world assets (RWAs) represented onchain by a token.

The market capitalization of tokenized Treasurys climbed to more than $10.8 billion at the time of writing from $8.9 billion on Jan. 1, according to data from RWA.xyz.

The tokenized US Treasury market has surged 50x since 2024, according to data from Token Terminal, aided by the March 2024 debut of asset manager BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which now has a market cap of more than $1.2 billion.

Tokenized US Treasurys continued to surge despite a broad crypto market downturn that began in October 2025, rising US government debt levels and investor uncertainty about the macroeconomic outlook in 2026.

Related: Tokenized RWAs climb 13.5% despite $1T crypto market drawdown

The Depository Trust and Clearing Corporation to launch US Treasury tokenization service

The Depository Trust and Clearing Corporation (DTCC), which provides clearing and settlement services for global financial markets, announced plans in December 2025 to launch an asset tokenization service, beginning with US Treasurys.

DTCC will eventually expand the service to include a “broad spectrum” of assets, according CEO Frank La Salla.

“Following the tokenization of US Treasurys on the Canton network, DTCC anticipates that exchange-traded funds (ETFs) and equities will come shortly thereafter,” La Salla said.

The DTCC is the largest clearinghouse in the world and settled $3.7 quadrillion in transaction volume in 2024, according to the company.

US Treasurys are considered the backbone of global and corporate finance due to the deep liquidity of the US Treasury market.

Corporations and institutional investors use short-term Treasurys, with a duration of one-year or less, as a proxy for physical cash.

The surge in tokenized US Treasurys and other US government debt could bring an influx of revenue to the blockchain networks where tokenized assets are minted, supporters of the technology say.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside story

Crypto World

Bitcoin’s Dry Powder Myth Busted: Outflows – Not Buyers

Bitcoin’s Stablecoin Supply Ratio has fallen to 9.36, a level often viewed as sidelined buying power ready to deploy.

Bitcoin’s Stablecoin Supply Ratio (SSR) has dropped to 9.36, a level historically associated with significant buying power waiting on the sidelines, but on-chain data shows this metric is flashing a false signal.

According to analyst Axel Adler Jr., the decline is being driven by capital leaving the ecosystem rather than stablecoin accumulation, which fundamentally alters how investors interpret this classic bullish indicator.

Liquidity Drain, Not Dry Powder

The SSR measures Bitcoin’s market capitalization against total stablecoin supply, with lower readings traditionally suggesting ample stablecoin liquidity available to purchase BTC. However, current conditions tell a different story.

In a February 25 brief, Adler pointed out that USDT capitalization peaked at $187.2 billion on December 30, 2025, and has since contracted to $183.6 billion, a $3.6 billion outflow over 60 days. Additionally, the 30-day change has remained negative for 34 consecutive days, now sitting at -$3.08 billion.

This matters because SSR’s mathematical decline stems from both components weakening simultaneously. Bitcoin’s market cap has dropped roughly 27% during this period, while stablecoin supply also contracted.

“Technically SSR falls mathematically because BTC market cap has collapsed, but the simultaneous contraction of USDT strips this signal of any bullish potential,” Adler explained.

The Estimated Leverage Ratio confirms the structural weakness, remaining flat around 0.219 across all exchanges for 90 days despite Bitcoin’s sharp correction. This plateau indicates speculative capital isn’t adding new risk, but crucially, isn’t shedding old risk either, thus creating potential for cascading liquidations on further downside.

Aged Supply, Absent Buyers

Bitcoin’s recent price action reflects the fragility described above, with the asset briefly falling below $63,000 on February 24 before recovering to current levels around $65,400. This price represents a dip of more than 25% across the last 30 days and nearly 27% over one year.

You may also like:

HODL Waves data published recently also revealed a defensive market structure beneath the price action. Coins last moved 3 to 6 months ago now comprise approximately 26% of the circulating supply, up from 19% earlier this month.

These correspond to purchases near the November 2025 peak above $120,000, now held at a loss. Meanwhile, the 6 to 12 month cohort has grown to about 20%, while coins moved within the past month account for less than 10% of supply.

Furthermore, the Realized Cap Net Position Change confirms capital exiting the network, standing at -2.26% over 30 days with $33 billion in value compression since late November.

The distinction between SSR decline through outflow versus accumulation carries real implications. According to Adler, for a genuine trend reversal, two things must happen at the same time: the 30-day USDT change returning to sustained positive territory (confirming fresh capital inflow) and ELR beginning to rise during price stabilization. Until then, the analyst says Bitcoin’s low SSR represents not opportunity, but the mathematical residue of capital departure.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Tether Invests $200 Million in Whop to Expand Stablecoin Payments

The investment will bring Tether’s wallet tools to millions of users.

Stablecoin issuer Tether has made a $200 million strategic investment in Whop, an online marketplace, as it looks to expand stablecoin payments into more real-world use cases.

Tether’s USDT stablecoin currently has a market cap of about $183 billion, according to DeFiLlama data, making it the largest circulating stablecoin worldwide.

Whop co-founder Steven Schwartz said in a post on X that Tether’s investment pushed the company’s valuation to $1.6 billion. As part of the deal, Whop will integrate Tether’s Wallet Development Kit (WDK), allowing users to send and receive payments in stablecoins like USDT.

“In partnership with Tether, we will be scaling infrastructure in real-time for new business models as they emerge across the globe,” Schwartz said on X. “The job is just getting started.”

The deal is part of Tether’s broader push to expand beyond crypto trading and into everyday finance. Specifically, Tether will gain exposure to a platform with over 18 million users and about $3 billion in yearly payouts. Moreover, Whop’s transaction volume has been growing around 25% month over month, according to an official announcement.

“Stablecoins and wallets become most powerful when they are embedded directly into people’s lives, supporting their businesses, activities, families, and individual stories,” Tether CEO Paolo Ardoino said, per the announcement. “Our investment in Whop proudly reflects Tether’s focus on supporting real economic activity by providing efficient digital dollar and wallet infrastructure that can scale to billions of people, across every continent.”

The new funding will help Whop expand into Latin America, Europe, and the Asia-Pacific region, while also developing new financial tools and AI features for its users. The investment also builds on Tether’s recent expansion efforts, including the launch of its regulated U.S. stablecoin USAT last month.

Crypto World

3 DeFi Altcoins Explode After BlackRock and Wall Street Deals

Three major DeFi tokens — Morpho (MORPHO), Uniswap (UNI), and Jupiter (JUP) — rallied sharply over the past week after Wall Street firms Apollo Global Management, BlackRock, and ParaFi Capital struck landmark deals to acquire direct stakes in onchain financial infrastructure.

The moves signal a structural shift, as traditional asset managers move beyond crypto exposure and begin acquiring governance and economic ownership in decentralized trading and lending rails.

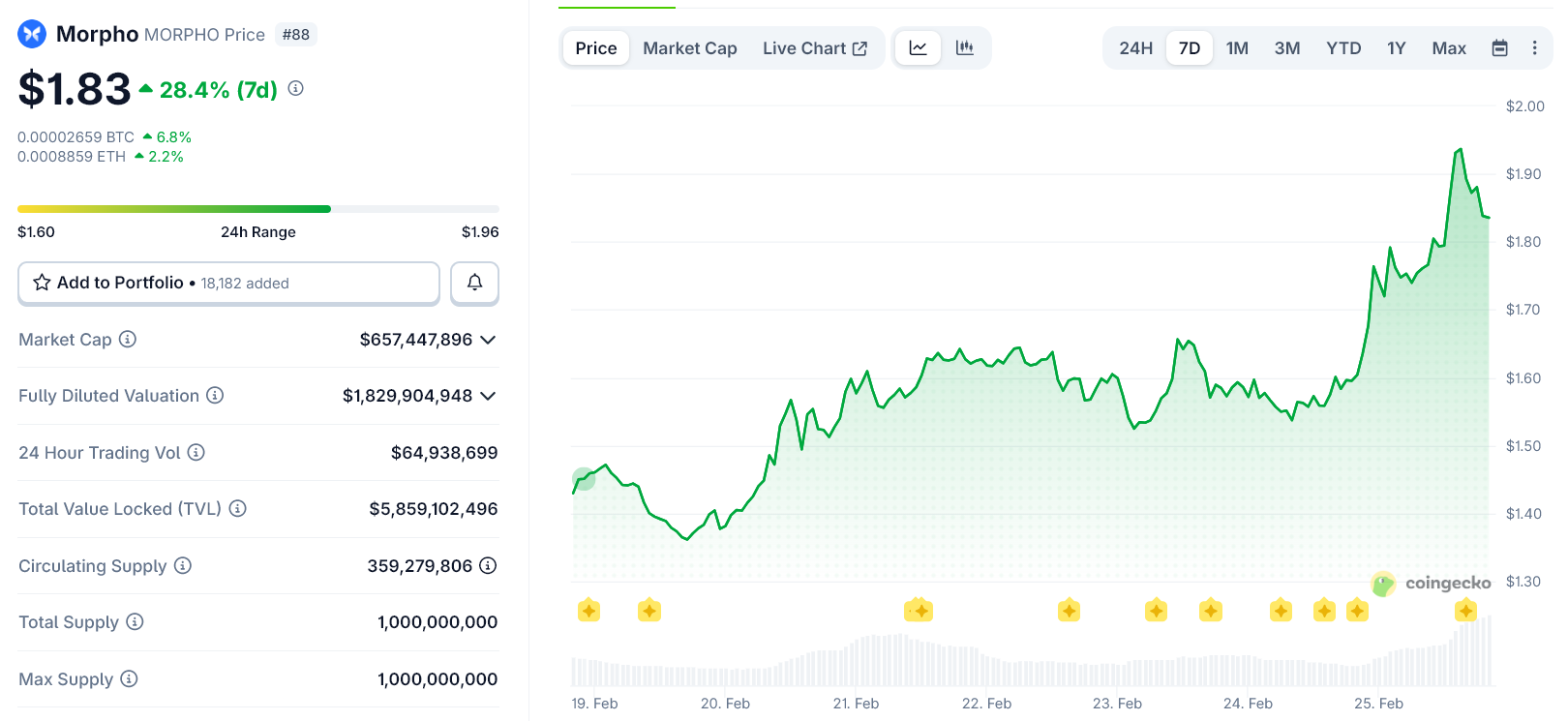

Morpho Surges after Apollo Agrees to Acquire 90 Million Tokens

Morpho posted the strongest rally after Apollo Global Management announced a cooperation agreement to acquire up to 90 million MORPHO tokens over four years. The purchase represents roughly 9% of total supply.

The deal gives Apollo governance exposure and positions the firm to support lending markets built on Morpho’s infrastructure.

Morpho currently secures about $5.8 billion in total value locked, making it one of the largest onchain lending platforms.

Investors responded quickly. MORPHO is up nearly 30% in a week.

Uniswap Jumps as BlackRock buys UNI and Integrates Tokenized Fund

Uniswap rallied after BlackRock confirmed it purchased UNI tokens alongside integrating its $2 billion tokenized Treasury fund, BUIDL, onto Uniswap’s institutional trading infrastructure.

The integration allows institutional investors to trade tokenized Treasury exposure using Uniswap’s decentralized exchange rails.

Meanwhile, BlackRock’s UNI purchase gives the asset manager governance influence over the protocol that now hosts its fund.

UNI surged sharply late in the week, rallying nearly 20%.

ParaFi Invests $35 Million directly Into JUP

Jupiter also rallied after ParaFi Capital invested $35 million directly into the protocol’s JUP token.

Unlike typical venture deals, ParaFi purchased tokens at market price with lockups and warrants for future purchases.

The deal marks Jupiter’s first institutional investment and aligns ParaFi with the platform’s expansion into lending, stablecoins, and institutional trading infrastructure.

JUP rose from approximately $0.144 to $0.163 during the week.

Together, the deals highlight a broader trend. Instead of simply buying crypto assets, Wall Street firms are acquiring governance stakes in core DeFi protocols.

This transition signals growing institutional confidence in onchain financial rails and helps explain the strong price reactions across lending and trading infrastructure tokens.

Crypto World

Bitcoin Surges to $69.5K on ETF Inflows, US Macroeconomic Boost

Bitcoin (BTC) rallied to a weekly high of $69,500 on Wednesday, surging from lows near $62,400 in less than 24 hours. The rebound aligned with a renewed spot Bitcoin exchange-traded fund (ETF) inflows and firmer macroeconomic sentiment after the recent US policy signals helped steady broader risk markets.

Derivatives data shows that BTC’s open interest is falling and funding rates are staying relatively contained, indicating the move was largely driven by spot demand rather than a buildup of leveraged positioning.

Bitcoin receives a macro boost and a positive ETF flip

US President Donald Trump’s State of the Union address on Tuesday evening framed the first 12-months of his leadership as an “economic turnaround for the ages,” highlighting falling mortgage rates and a 1.7% decline in core inflation over the final three months of 2025.

Markets interpreted the remarks as a sign of reduced near-term policy uncertainty following tariff and Supreme Court volatility, lifting the risk appetite across equities and crypto.

The US spot Bitcoin ETFs recorded $257.7 million in net inflows on Feb. 24, ending five consecutive weeks of redemptions totaling $3.8 billion. Fidelity drew roughly $83 million, and BlackRock’s iShares Bitcoin Trust added close to $79 million.

Related: Bitcoin daily gains near 5% as analysis eyes bullish ‘rotation’ from gold

Bitcoin futures data clears excess downside risk

As Bitcoin trades above $69,000, futures data shows that its aggregated open interest has stabilized around 235,167 BTC, after previously reaching levels above 240,000 BTC earlier in the week.

The drop in open interest suggests that the excess leveraged positioning has already been flushed out during the recent volatility.

At the same time, aggregated funding rates remain slightly negative at -0.0037%. Negative funding indicates that short positions are still paying longs, signaling that traders are not aggressively chasing upside exposure despite the price rally.

This combination of cooling open interest and negative-to-neutral funding points to a market that has reset leverage rather than overheated. The rally toward $69,000 appears to be occurring without an aggressive buildup of long positioning.

The cumulative volume delta (CVD) has edged higher, showing that spot buyers are stepping in and are one of the primary drivers of this rally.

Market analyst BackQuant noted that derivatives activity is still playing a large role, and options data shows that dealers, the firms that sell options and hedge their exposure, are holding what’s known as positive gamma.

When gamma is positive, dealers tend to buy as the price falls and sell as the price rises to stay hedged. That behavior can smooth out volatility and slow sharp breakouts in either direction.

Likewise, trader LP also pointed to BTC’s order book dynamics around the $60,000–$63,000 region, where strong bid pressure previously absorbed selling. Since tapping that zone, the price has expanded roughly 8% to the upside.

The trader added that if sell pressure builds again at these levels, it may signal a slowdown in buy-side aggression and trigger another lower reversal.

Related: Anchorage buys STRC as Wall Street shorts mount against Saylor’s Bitcoin proxy

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat23 hours ago

NewsBeat23 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World23 hours ago

Crypto World23 hours agoEntering new markets without increasing payment costs

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection