Crypto World

Adam Back says Liquid BTC is collateralized after dashboard problem

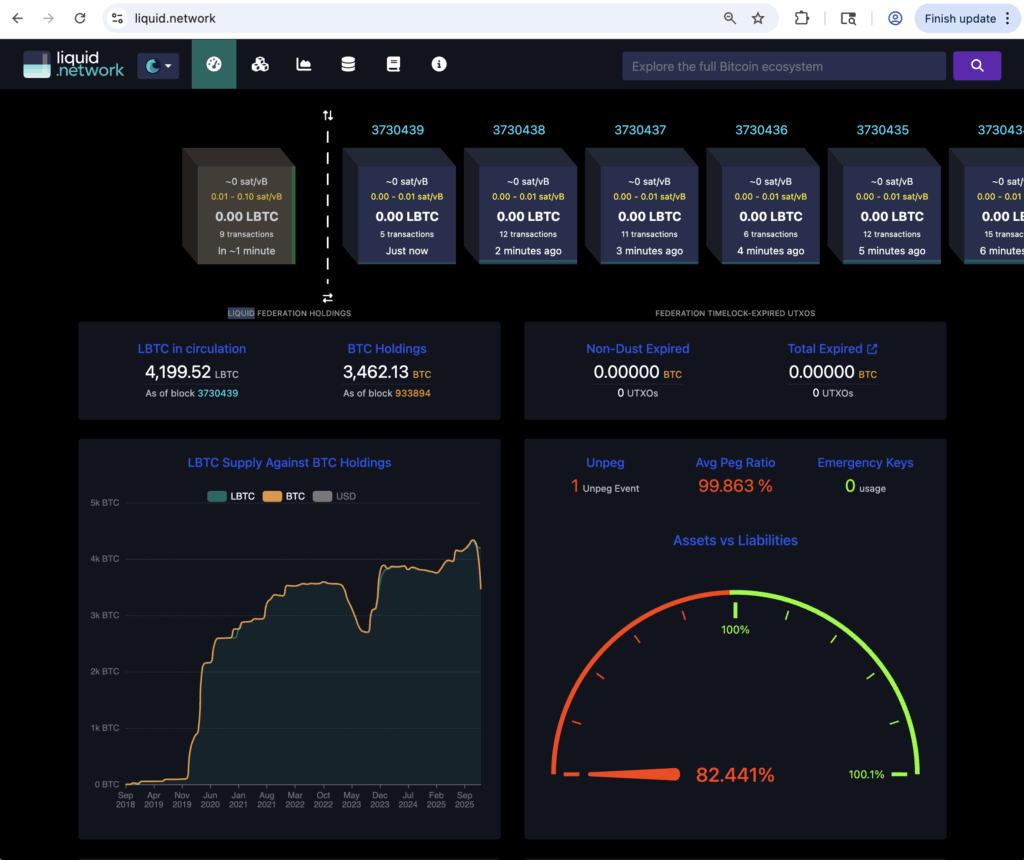

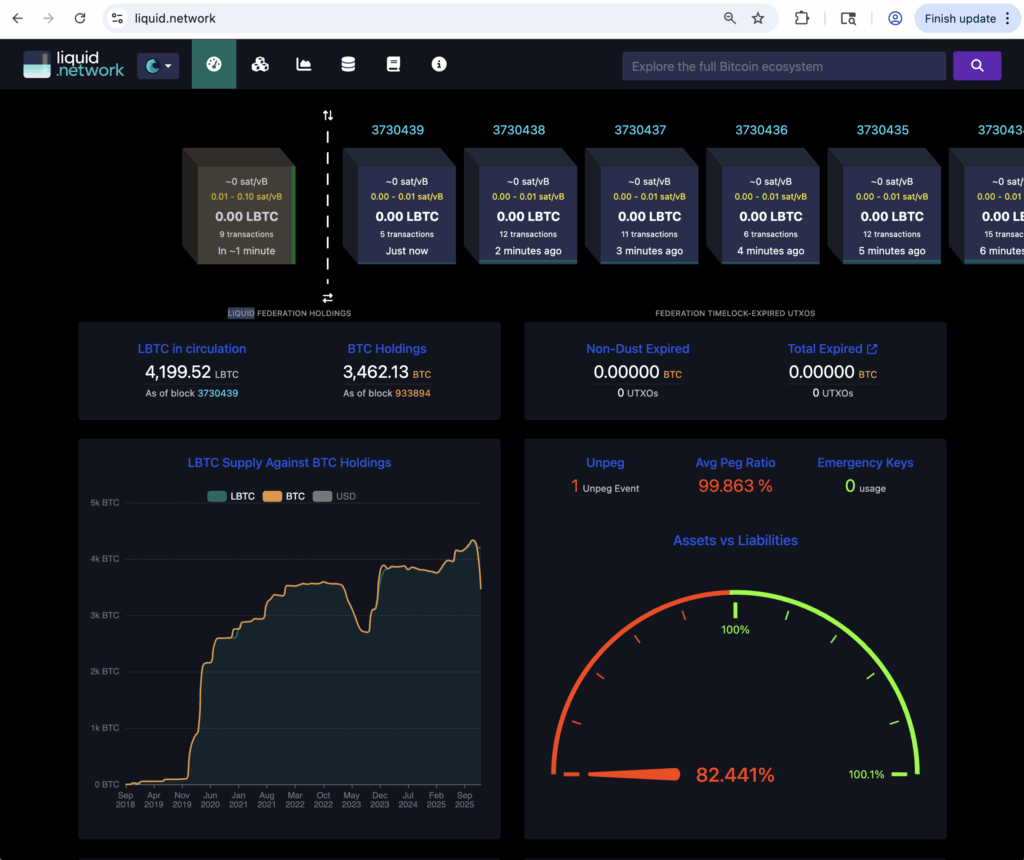

A lack of visibility and the counting of old addresses were to blame for a popular Liquid Network dashboard displaying just 82.4% assets backing the $350 million market capitalization of Liquid Bitcoin (LBTC) this week.

This is according to Adam Back, CEO of Blockstream, a founding member of the Liquid network and one of its 15 functionaries.

For a few confusing hours on Monday, Mempool.space’s monitoring system displayed less than 3,463 bitcoin (BTC) as the assets backing liabilities of 4,199 LBTC in circulation.

Shortly after, the website went mostly blank with a status message, “Indexing in progress.”

Read more: If BTC was really a rival to gold, it would be at $278K

Protos reached out to Blockstream for comment on the incident. According to Back, the error was the result of Mempool.space failing to track all federated wallets.

“Mempool.space the operators of liquid.network had not upgraded their node software following the most recent dynafed [Dynamic Federations] network upgrade. So they were looking at old addresses and not having visibility,” Back explained.

“They were notified, and promptly fixed that problem, and you can see on liquid.network that they are in the process of reindexing. The address they were missing is this one.”

At the same time, Blockstream’s independent dashboard showed 100% backing, with 4,199 BTC in federated wallets.

LBTC also held its 1:1 price parity with BTC during the time.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Almost 600,000 BTC snapped up between $60K and $70K in recent correction

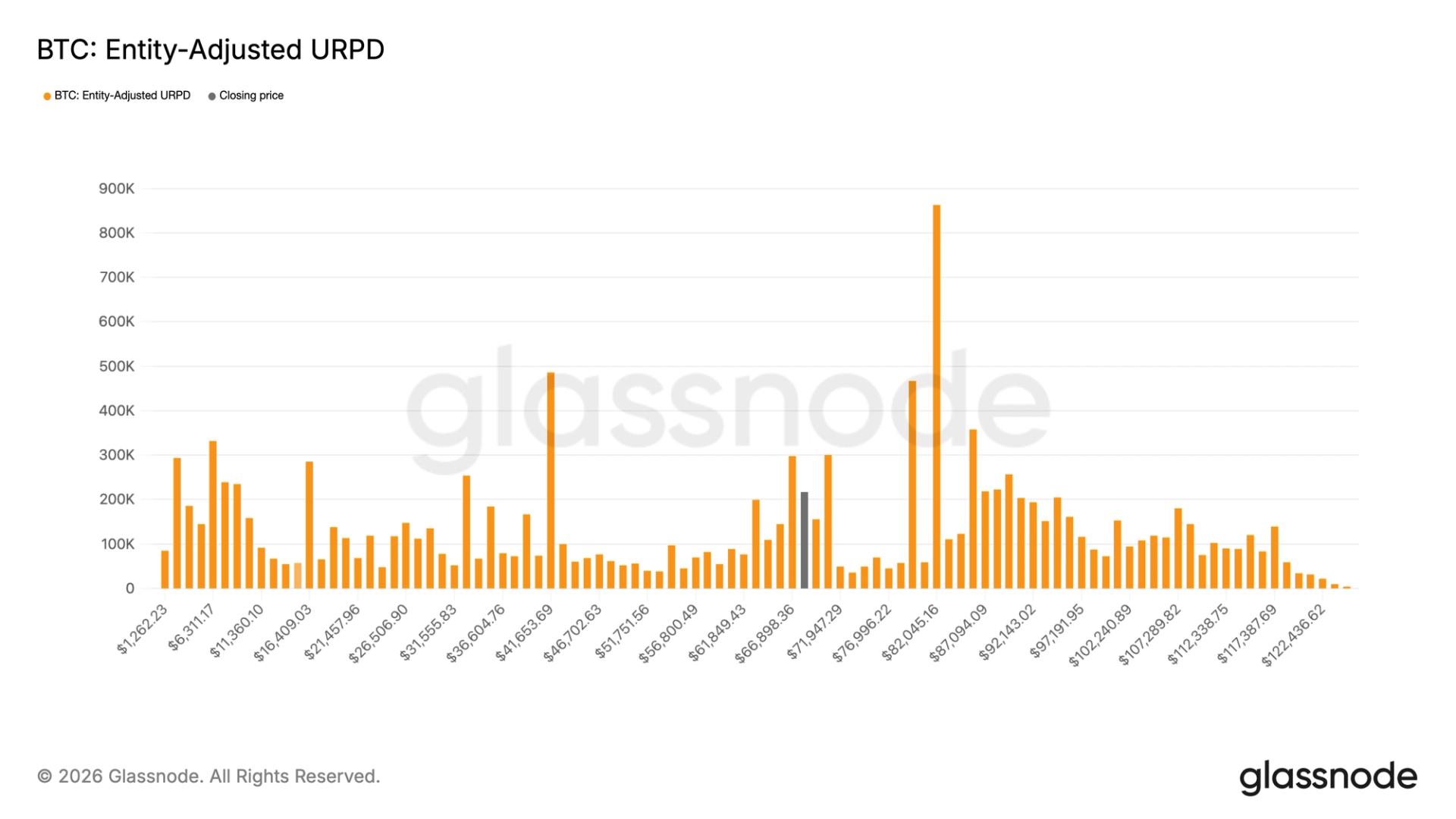

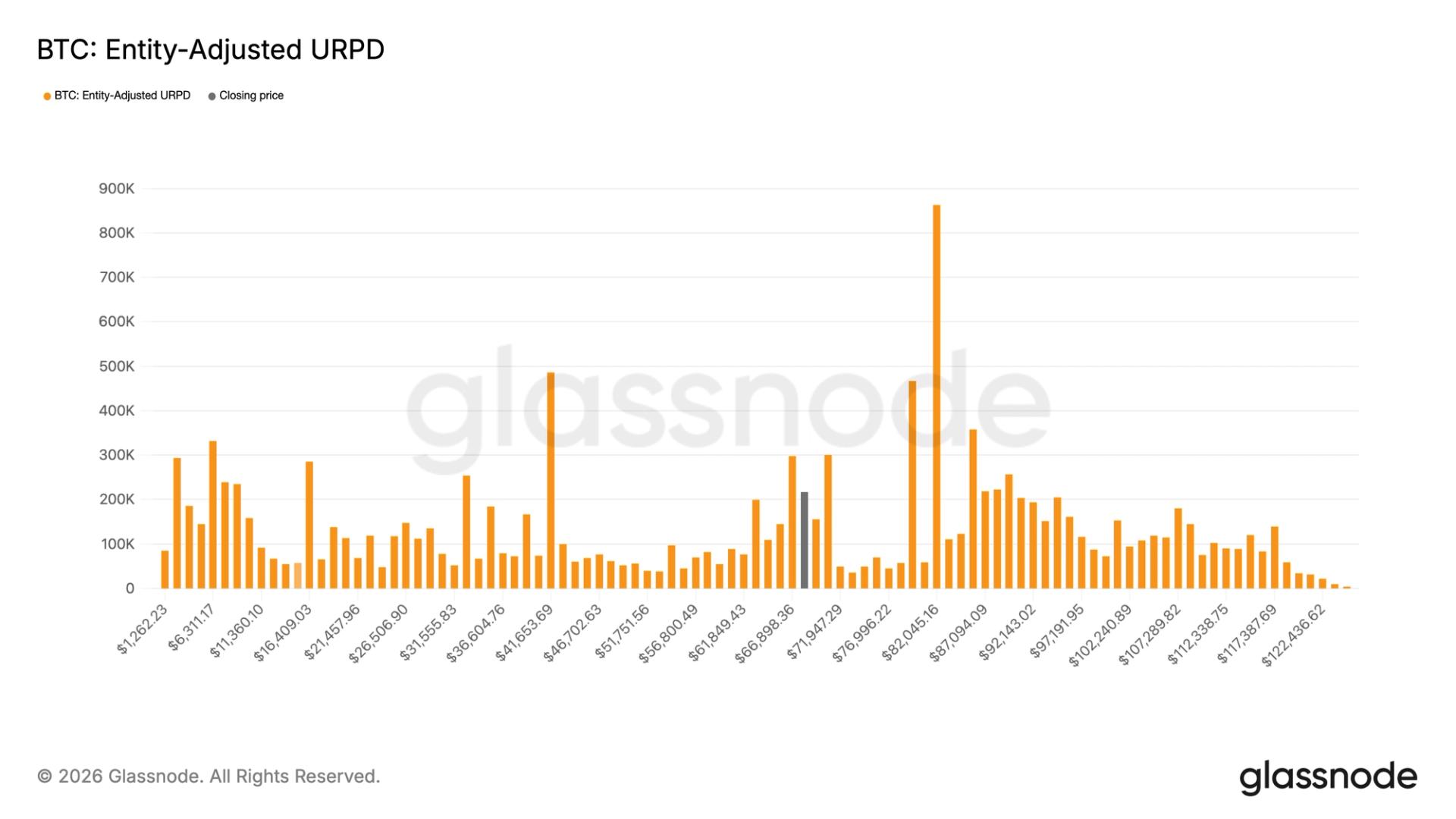

Bitcoin’s recent dip triggered heavy trading activity, with nearly 600,000 BTC changing hands in the $60,000–$70,000 range, according to blockchain data tracked by Glassnode.

In other words, traders went bargain hunting, snapping up nearly 600,000 BTC ($42.48 billion) in this price band during the correction. Of these, more than 200,000 BTC were accumulated in the past two weeks alone.

Note that at the start of the year, roughly 997,000 BTC had last moved within the $60,000–$70,000 range. Since bitcoin’s recent drop below $70,000, that number has jumped to 1.558 million BTC.

Taken together, it means that nearly 8% of the circulating supply is owned by people who bought their bitcoin in this range, creating a dense cluster of ownership. As such, the $60,000–$70,000 range could act as an important support level going forward.

At press time, bitcoin changed hands above $70,000, trading at levels, which have previously seen thin trading activity. CoinDesk Research has previously highlighted the “air gap” between $70,000 and $80,000, a range where relatively little supply changed hands.

Still, the market is at a point where things could spice up, because analysis by Checkonchain shows that around 40% of bitcoin holders have paid more than $70,000 for their coins.

Crypto World

Why FLOW price is up over 50% today after Upbit and Bithumb delisting announcement

- Legal injunction halts South Korean delistings of FLOW cryptocurrency.

- Altcoin rotation supports FLOW’s surge, outperforming broader crypto markets.

- Momentum indicators show FLOW in the overbought region, hinting at a possible pullback.

FLOW, the native token of the Flow blockchain, has seen a dramatic surge today, climbing over 53% in just 24 hours.

The jump comes despite recent announcements that major South Korean exchanges, including Upbit and Bithumb, planned to delist the token.

At first glance, delisting news might seem like a bearish trigger, but in FLOW’s case, the market response has been the opposite.

Here’s why the FLOW price is rising

The primary reason behind the surge is a legal move to suspend the delistings.

The Flow Foundation filed an injunction with the Seoul Central District Court to halt the planned March 16 delistings.

This move has reassured investors that the token will remain accessible on major South Korean platforms, removing a significant risk that had weighed on FLOW’s price for months.

In addition, Binance recently removed its monitoring tag for FLOW, signalling that previous technical issues have been resolved.

Together, these developments have alleviated fears about liquidity and safety, prompting a rush of capital back into the token.

Trading volumes have also spiked dramatically, indicating that both domestic and international traders are jumping in on the momentum.

Altcoin rotation strengthens the bullish momentum

Beyond the legal developments, FLOW’s rally has also benefited from a broader market trend.

Capital is currently rotating into altcoins, with investors seeking opportunities outside Bitcoin (BTC) and Ethereum (ETH).

This environment has amplified FLOW’s gains, as traders are looking for tokens with high growth potential and positive news catalysts.

FLOW’s performance today illustrates how market psychology and sector-wide trends can interact.

Even though BTC and the broader market have seen modest gains, FLOW’s price movement is clearly outpacing them due to its specific news-driven momentum.

This demonstrates how individual altcoins can decouple from broader market trends when there is a strong, token-specific catalyst.

FLOW price forecast

The pending court decision will remain the primary catalyst, as a favourable ruling could sustain momentum, while a rejection could trigger a swift correction.

Looking ahead, the immediate support is around $0.0481, which has acted as a pivot during the surge.

Holding above this level suggests that buyers remain in control and that the rally could continue toward the $0.07 area.

However, FLOW is currently in overbought territory, with momentum indicators like the RSI suggesting that a short-term pullback is possible.

If the price falls below the pivot, the token could retrace toward the 50-day moving average near $0.04743.

Crypto World

Stablecoin market expands, BTC price rallies as Iran war panic cools: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

The stablecoin market is expanding again, led by USDC, and bitcoin’s rally is gathering steam.

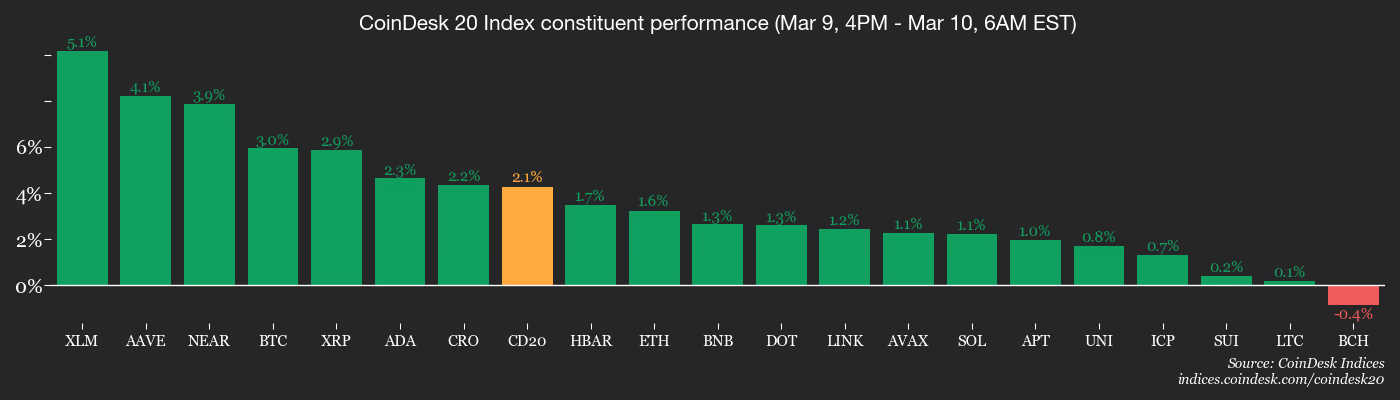

The panic over the Iran war has cooled in the past 24 hours after President Donald Trump said the conflict could be over soon. The result: Bitcoin, which held resilient through the turmoil, has rallied past $70,000, up over 4%. The CoinDesk 20 Index, ether (ETH), solana (SOL), and XRP (XRP) are up 3% to 5%, and smaller coins like HYPE, ZEC, and RENDER rallying 7% to 11%.

The market capitalization of USDC, the second-largest dollar-pegged cryptocurrency, is fast closing on the record high of $78.6 billion, extending a recovery from the late-January low of $70.9 billion. Stablecoin leader USDT’s supply has risen to $184 billion from the late-February low of $183.5 billion.

This upswing in supply of top coins pegged to the U.S. dollar indicates the dry powder sitting on the sidelines is increasing and could be deployed to fund new crypto purchases as the rally extends. ETF inflows are supportive of a continued bullish trend as well.

Some indicators, however, still call for caution. The Coinbase Premium Index, which measures the gap between bitcoin prices on the Nasdaq-listed Coinbase (COIN) exchange and offshore giant Binance, remains negative, a sign that demand from U.S. investors is still lagging. Historically, bull runs have seen sustained Coinbase premiums.

In traditional markets, oil has fallen back below $100, which supports continued stability in all risk assets, including cryptocurrencies. The dollar index and Treasury yields have also pulled back from recent highs. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- March 10, 9:00 a.m.: U.S. existing home sales for February est. 3.9M (Prev. 3.91M)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Aavegotchi DAO is conducting ballot 1and 2 of a multi-sig signer election, asking token holders to choose one signer from various nominees. Voting ends March 10.

- Ssv.network DAO is voting to cancel DIP-46 and reallocate the originally approved $15 million development budget, splitting it into $14.9 million for DVT and $100,000 as a retroactive research grant. Voting ends March 10.

- Realtoken Ecosystem Governance DAO is voting to temporarily pause interest rates on the RMM (Real Estate Monetary Fund) to zero for 15 days. Voting ends March 10.

- Unlocks

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 2.56% from 4 p.m. ET Monday at $70,734.01 (24hrs: +4.60%)

- ETH is up 1.68% at $2,061.24 (24hrs: +3.38%)

- CoinDesk 20 is up 2.02% at 2,015.27 (24hrs: +4.08%)

- Ether CESR Composite Staking Rate is up 17 bps at 2.81%

- BTC funding rate is at 0.0024% (2.6105% annualized) on Binance

- DXY is unchanged at 98.84

- Gold futures are up 2.02% at $5,194.10

- Silver futures are up 6.50% at $89.50

- Nikkei 225 closed up 2.88% at 54,248.39

- Hang Seng closed up 2.17% at 25,959.90

- FTSE 100 is up 1.84% at 10,437.86

- Euro Stoxx 50 is up 2.94% at 5,852.45

- DJIA closed on Monday up 0.50% at 47,740.80

- S&P 500 closed up 0.83% at 6,795.99

- Nasdaq Composite closed up 1.38% at 22,695.95

- S&P/TSX Composite closed up 0.32% at 33,189.30

- S&P 40 Latin America closed up 1.61% at 3.532,70

- U.S. 10-Year Treasury rate is unchanged at 4.14%

- E-mini S&P 500 futures are unchanged at 6,823.00

- E-mini Nasdaq-100 futures are unchanged at 25,100.25

- E-mini Dow Jones Industrial Average futures are unchanged at 47,948.00

Bitcoin Stats

- BTC Dominance: 59.53% (0.77%)

- Ether-bitcoin ratio: 0.02905 (-0.27%)

- Hashrate (seven-day moving average): 1,008 EH/s

- Hashprice (spot): $31.06

- Total fees: 2.52 BTC / $171,578

- CME Futures Open Interest: 103,205 BTC

- BTC priced in gold: 13.7 oz.

- BTC vs gold market cap: 4.76%

Technical Analysis

- The chart shows SOL’s daily price action in candlestick format since August last year.

- The token is again trapped in a back-and-forth trading range, this time between $75 and $90, mimicking the October and December-January pattern.

- The next move depends on the direction in which the range is ultimately resolved. A bullish resolution could bring a quick-fire rally above $100, while a breakdown would suggest continuation of the broader bearish trend.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $199.79 (+1.30%), +3.46% at $206.70 in pre-market

- Circle Internet Group (CRCL): closed at $111.84 (+9.74%), +2.18% at $114.28

- Galaxy Digital (GLXY): closed at $21.50 (+4.57%), +3.09% at $22.16

- MARA Holdings (MARA): closed at $8.66 (+8.11%), +2.31% at $8.86

- Riot Platforms (RIOT): closed at $14.70 (+3.78%), +2.52% at $15.07

- Core Scientific (CORZ): closed at $15.16 (+2.02%), +1.45% at $15.38

- CleanSpark (CLSK): closed at $9.61 (+4.34%), +2.29% at $9.83

- Exodus Movement (EXOD): closed at $10.83 (-0.64%)

- CoinShares Bitcoin Miners ETF (WGMI): closed at $37.33 (+3.49%)

- Bullish (BLSH): closed at $36.06 (+3.15%), +1.14% at $36.47

Crypto Treasury Companies

- Strategy (MSTR): closed at $138.95 (+4.06%), +3.25% at $143.46

- Strive Asset Management (ASST): closed at $8.51 (-2.18%), +4.58% at $8.90

- Sharplink (SBET): closed at $7.60 (+3.26%), +1.71% at $7.73

- Upexi (UPXI): closed at $0.97 (+7.78%), +6.19% at $1.03

- Lite Strategy (LITS): closed at $1.20 (+5.26%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $167.1 million

- Cumulative net flows: $55.52 billion

- Total BTC holdings ~ 1.28 million

Spot ETH ETFs

- Daily net flows: -$51.3 million

- Cumulative net flows: $11.61 billion

- Total ETH holdings ~ 5.73 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Massive leveraged bets show crypto traders are convinced this week’s rally is the real deal

Crypto traders on the perpetuals exchange Hyperliquid are placing increasingly aggressive leveraged bets that bitcoin will break above $75,000 after a sharp rally at the start of the week.

Bitcoin climbed to around $71,000 on Tuesday, up from roughly $65,000 when BTC futures opened on Sunday evening. The move has reignited calls for a retest of recent highs after being rejected near $74,000 last week.

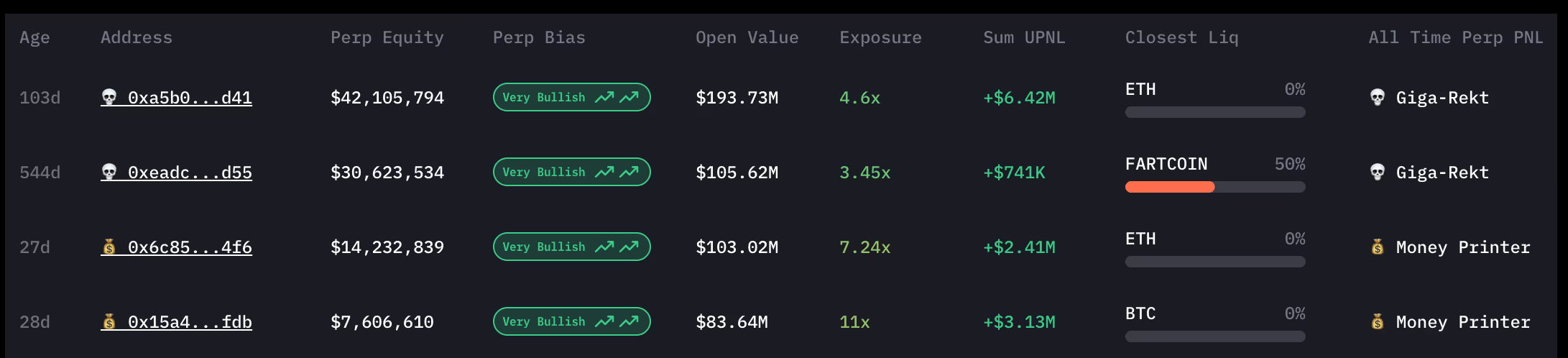

Onchain data shows several large traders — often referred to as “whales” — opening highly leveraged long positions on Hyperliquid as prices rise.

One trader is holding ether (ETH) and bitcoin long positions worth $194 million with unrealized profit and loss standing at around $6.5 million. Another account has $103 million worth of long positions across a multitude of trading pairs, betting on a broader crypto breakout as opposed to a major-dominated rally.

Positions on Hyperliquid are typically opened with leverage, allowing traders to amplify exposure. One wallet, for example, opened a series of trades using 20x leverage, meaning a $1 million account could control a $20 million bitcoin position. This trader opened 20x leveraged longs on 600 BTC worth about $42.5 million while simultaneously taking a 20x long position on 20,000 ETH valued at roughly $41.2 million.

The whale also appears to be accumulating ether in spot markets. Data shows the address spent $21 million in USDC to purchase 10,158 ETH at an average price of $2,067 shortly before opening the derivatives positions.

Other nine-figure long positions demonstrate one thing: Crypto traders are confident this breakout will stick and won’t be a bull trap like last week.

A separate wallet, 0x985f, is taking a different macro stance. The address deposited $9.5 million in USDC into Hyperliquid within a five-hour window before opening 20x leveraged short positions on oil futures, including roughly $8.17 million in crude oil (CL) contracts and $6.15 million in Brent oil.

The same trader also opened short positions across several crypto tokens, including HYPE, PUMP, XPL, APT and ASTER, suggesting a broader bearish stance on select altcoins while large traders concentrate bullish bets on bitcoin and ether.

The positioning highlights how decentralized derivatives platforms such as Hyperliquid have become a hub for large leveraged bets during periods of strong bitcoin momentum.

A break above $75,000 could force short sellers to cover and accelerate the rally, while a move lower would quickly test the conviction of traders piling into nine-figure leveraged longs.

Crypto World

Rising oil prices may wipe out effects of Trump’s ‘big beautiful bill’

Gas prices at a Shell Station located on Foothill Blvd.

Robert Gauthier | Los Angeles Times | Getty Images

Rising oil prices may not just be a headwind to President Donald Trump’s fight to lower inflation. They could also undermine his signature legislative achievement.

Almost all of the economic effect of the individual tax cuts in the “big beautiful bill” — from both smaller withholdings and sweetened tax refunds — could be erased if oil prices remain elevated by more than $20 compared to before the U.S.-Iran war, according to Raymond James.

“With the $25 move last week, if the oil price stays here, it essentially offsets the fiscal benefit from the OBBA,” wrote strategist Tavis McCourt in a note.

McCourt’s analysis relies on applying any increase in oil market prices to the more than $420 billion that consumers spent on gasoline in the fourth quarter of 2025. He told CNBC in an interview he accounted for both potential reduced demand due to higher prices and companies’ needs to pad margins in his calculations.

That leads him to conclude a $20 move in oil prices could mean consumers spending $150 billion more at the pump. The Tax Foundation estimates that the big beautiful bill’s individual tax cuts total $129 billion for 2025, with the overwhelming majority of it set to appear through tax refunds this filing season.

U.S. oil before the war on Feb. 27 closed at $67.02. As of Tuesday morning, after a major whiplash in prices on Monday, oil is still trading more than $20 a barrel higher at $88.20.

@CL.1 since Feb. 27 chart.

Stephanie Roth, chief economist at Wolfe Research, said in a Monday interview her estimations for the hit consumers could take with elevated oil prices are also similar to the elevated spending she projected from the tax law. Though Wolfe in a Tuesday note said oil prices would need to remain above $100 for some time for that to happen.

“In all these scenarios, it has to last longer than it is now,” Roth said. “The impact on gas prices so far has been short-lived, and modest compared to how it may ultimately play out.”

But it will take time for oil prices to come down even if an end to the war in Iran arrives, which Trump said in an interview with a CBS News reporter on Monday is “very complete,” didn’t give a timeline for the war’s end in a press conference that followed.

McCourt noted it took about six months for oil prices to get back to levels where they were before surges higher after the Gulf War in 1990 and the Russian invasion of Ukraine in 2022.

Consequences of weaker stimulus

Fiscal stimulus from the tax law was expected to boost the economy in 2026, with some economists predicting a reacceleration of U.S. growth partially thanks to it.

Now, an oil price shock is hitting right as consumers are set to get those tax refunds. Citadel Securities last week estimated that only 30% of refunds had been distributed by March 1, with the figure expected to rise to around 75% by May 1.

“The bottom line is that if we were expecting those tax refunds to lift consumer spending, these higher oil prices are just redirecting all that cash toward energy costs,” wrote Gabriel Shahin, CEO of Falcon Wealth Planning, in an email to CNBC. “It’s essentially voiding out the economic boost we were set to see.”

But Dan Niles, portfolio manager at Niles Investment Management, framed the situation as the refunds helping the economy weather higher oil prices.

He already has faith consumers can do that, pointing back to when oil hit similar prices in 2022 and 2023, all while Wall Street broadly predicted a recession on the horizon thanks to rising interest rates.

“You already had that stress tested a bit,” Niles said. “So if that’s the case back then, and coming off of inflation surging in 2021, and you still didn’t get a recession, why would you think inflation down at 3% and oil at $100 would cause a recession now?”

Many on Wall Street have drawn similarities between the surge in prices this time around to four years ago, when Russia invaded Ukraine.

Roth, though, cautioned investors against relying too much on that comparison.

“The economic backdrop is not a mirror image of where we are today,” she said. “Core inflation was running at 5.5% compared to 3% today. Job growth was running at around 500,000, now we’re at 37,000 over the past couple of months. So it’s just an entirely different backdrop.”

.GSPD vs. .SPX year-to-date chart.

McCourt added he thinks if the stimulus from the big beautiful bill isn’t as strong as originally thought, that likely won’t change too many outlooks for the year, particularly in stocks which he thinks never priced in a big surge in consumer spending. He noted that consumer discretionary stocks have underperformed the S&P 500 in 2026.

But he also had faith that the economy, not just the stock market, could weather oil prices and weaker-than-expected stimulus, so long as the labor market remains intact.

“We just have never had a sustained pullback in consumer spending without substantial job losses,” McCourt said. “We’ll have some shifts in spending… But it’s probably not going to impact the overall consumer spending levels.”

Crypto World

The ICT Silver Bullet Trading Strategy: Mechanics and Application

The ICT Silver Bullet strategy is a short-term trading approach derived from the Inner Circle Trader (ICT) methodology. It focuses on identifying high-probability price movements that tend to occur during specific intraday trading windows, particularly around the London and New York sessions.

Unlike many conventional forex trading strategies that rely primarily on indicators, the Silver Bullet strategy emphasises market structure, liquidity pools, and fair value gaps (FVGs) to identify potential entry points. By concentrating on defined time windows and liquidity-driven price movements, traders attempt to capture short-term market inefficiencies that may appear during periods of increased institutional activity.

In this article, we explain what the ICT Silver Bullet strategy is, how it works, and how traders analyse price action, liquidity, and fair value gaps when applying this method in forex markets.

Understanding the ICT Silver Bullet Strategy

What is a Silver Bullet in trading? The ICT Silver Bullet trading strategy is a sophisticated trading methodology developed by Michael J. Huddleston, known as the Inner Circle Trader, or ICT. This strategy is designed to take advantage of specific price movements that align with certain times throughout certain sessions, specifically the London and New York sessions.

Central to the ICT Silver Bullet strategy are two concepts: liquidity and fair value gaps. Liquidity in this context refers to places within the market where there is significant trading activity, often indicated by previous highs and lows of a trading session or historical price points that attract significant interest from traders.

Fair value gaps are price areas that were either skipped over quickly during rapid price moves or areas where the price has not returned for a significant period, reflecting a disparity between perceived value and market price.

The idea behind the strategy is based on executing trades during specific one-hour windows known as Silver Bullet times. By focusing on these concepts and timings, traders can more accurately analyse market movements and align their trades with the influxes of smart money, potentially improving their results by catching swift moves towards liquidity points.

Key Components of the Strategy

The Silver Bullet ICT strategy employs a detailed approach to trading that revolves around understanding market dynamics at critical times. Here are the main components that define this strategy:

Fair Value Gaps

A fair value gap (FVG) occurs when the price quickly moves away from a level without significant trading occurring at that price, leaving a “gap” that is likely to be tested again when the price returns to this point. In the context of the ICT Silver Bullet strategy, these gaps are targeted because they represent potential inefficiencies in the market where the price may return to balance or fill the gap. Traders using this strategy watch these gaps closely as they often present clear entry points when approached again.

Liquidity Targets

Liquidity targets are essentially areas where there is expected to be a significant volume of orders, which can lead to particular price movements when these levels are approached. These include:

- Previous session highs and lows: These are often areas where stop-loss orders accumulate, making them prime targets for liquidity-driven price moves.

- Swing points in the market: Reversal and continuation points that have historical significance.

- Psychological levels: These include round numbers or price levels ending in ’00’ or ’50’, which often act as focal points for trading activity.

Specific Silver Bullet Time

Unlike many strategies that align strictly with market opening times, the ICT Silver Bullet trading strategy utilises specific one-hour windows during the day when liquidity and volatility are expected to be high due to trader participation across the globe. These Silver Bullet hours are strategically chosen based on their potential to tap into significant market moves:

- London Open Silver Bullet: Occurs from 3:00 AM to 4:00 AM Eastern Standard Time (EST) in winter and from 2:00 AM to 3:00 AM in summer, which is 8:00 AM to 9:00 AM Greenwich Mean Time (GMT) in winter and 7:00 AM to 8:00 AM in summer.

- New York AM Session Silver Bullet: From 10:00 AM to 11:00 AM EST, translating to 3:00 PM to 4:00 PM GMT.

- New York PM Session Silver Bullet: From 2:00 PM to 3:00 PM EST or 7:00 PM to 8:00 PM GMT.

These time slots are selected based on historical data showing heightened trading activity and, therefore, increased probabilities to capture moves towards identified liquidity targets.

Implementing the ICT Silver Bullet Strategy

Traders utilising the ICT Silver Bullet strategy typically prepare by marking potential fair value gaps and liquidity targets before these key trading times. As these windows approach, they monitor price action closely for signs that the market is moving bullishly or bearishly toward these liquidity points, enabling them to search for an entry.

Is there a specific Silver Bullet time? This is an intraday strategy; therefore, ICT says it’s popular on a 15-minute timeframe or lower. Some traders use the 1-minute to 5-minute for the Silver Bullet setup, though those inexperienced with the strategy may prefer the 5-minute.

Traders can experiment with session timing and entry setups directly on FXOpen’s TickTrader platform, where real-time charts and over 1,200 tools support comprehensive analysis.

Here’s a breakdown of the Silver Bullet model:

Entry

- Market Direction and Liquidity Analysis: Before the designated Silver Bullet timeframes, traders perform a detailed assessment of the market direction on higher timeframes, such as the 15-minute to 4-hour charts. This initial analysis is crucial to align their strategies with the market’s overall momentum.

- Identifying Major Liquidity Points: Traders also mark significant liquidity targets during their analysis, such as previous session/day highs and lows. These points are expected to attract significant trading activity and thus are critical for planning entry points.

- Formation of Fair Value Gaps (FVG): During the Silver Bullet hours—specifically from 3:00 AM to 4:00 AM, 10:00 AM to 11:00 AM, and 2:00 PM to 3:00 PM EST—traders watch for the market to approach these liquidity points and leave behind a Fair Value Gap. This movement is essential as it indicates a potential inefficiency in price that the market may seek to correct.

- Setting Limit Orders at FVGs: Once an FVG is identified, traders set their limit orders at the boundary of the FVG closest to their intended trade direction. If aiming for a long position, the order is placed at the top of the FVG; for a short position, at the bottom. This method allows traders to potentially enter the market as it moves to ‘fill’ the gap, aligning with the initial momentum assessment and the subsequent market reaction to liquidity levels.

Stop Loss

- Initial Placement: Traders typically place stop-loss orders to potentially manage risk tightly with respect to the FVG’s structure. If trading long, the stop loss might be set just below the low of the candle that forms the FVG; if trading short, just above the high.

- Swing Points: Alternatively, stop losses might also be placed beyond recent swing highs or lows, providing a buffer against market volatility and minor fluctuations that do not affect the overall market trend.

Take Profit

- Targeting Liquidity Points: The common practice for setting take-profit points involves aiming for the next significant liquidity target identified during the preparatory phase.

- Risk-to-Reward Considerations: Many traders set their take-profit goals based on a calculated risk-to-reward ratio, often aiming for at least a 1:2 ratio. This means that for every unit of risk taken, two units of reward are targeted. In terms of pips, traders generally look for at least 15 pips when trading forex and 10 points in indices.

EUR/USD Example

Let’s consider the Silver Bullet in forex. In the provided EUR/USD chart example, a detailed analysis of higher timeframes has established a bearish outlook. Consequently, the focus is on identifying sell trading setups while disregarding potential long setups.

During the 8:00 AM to 9:00 AM GMT window, there’s a noticeable Fair Value Gap (FVG) that forms following a swift rejection from an upward move. This price action reflects a viable entry point for a short position. Traders could place a limit order at the bottom boundary of the candle that initiated the FVG, with a stop loss positioned just above the candle’s high or the nearby swing point high, depending on their risk tolerance. The target for this trade is set at the previous day’s low, which is reached and prompts a short-term reversal in price direction.

Later in the day, between 7:00 PM and 8:00 PM GMT, another FVG develops. Following the same principle, we can enter at the bottom of the FVG. Setting a stop loss above the swing high is considered more prudent than directly above the candle high, which in this case would likely lead to a stop-out due to the tightness of the entry. Since the previous day’s low has already been reached earlier, the next logical target is the low of the US session, aligning with the day’s bearish momentum.

The Bottom Line

The ICT Silver Bullet strategy offers traders a way to combine liquidity concepts, fair value gaps, and session timing into a clear trading framework. While no strategy guarantees results, applying this method with patience and proper risk control may help refine trade entries and improve market analysis.

Those looking to apply these principles in a robust trading environment, may consider opening an FXOpen account and access over 700 markets, low commissions, and tight spreads.

FAQs

What Is the Silver Bullet Strategy in Trading?

The ICT Silver Bullet strategy in trading is a specific, time-sensitive approach designed to capitalise on liquidity and fair value gaps that typically form during key periods of market volatility. Developed by Michael J. Huddleston, also known as ICT, it aims to take advantage of the movements that occur when the market reacts to these gaps during certain hours of the trading day.

What Time Is the Silver Bullet Strategy Valid?

The Silver Bullet strategy is executed during three distinct one-hour windows corresponding to heightened market activity periods. These are:

- London Open Silver Bullet: Occurs from 3:00 AM to 4:00 AM Eastern Standard Time (EST) in winter and from 2:00 AM to 3:00 AM in summer, which is 8:00 AM to 9:00 AM Greenwich Mean Time (GMT) in winter and 7:00 AM to 8:00 AM in summer.

- New York AM Session Silver Bullet: 10:00 AM to 11:00 AM EST (3:00 PM to 4:00 PM GMT).

- New York PM Session Silver Bullet: 2:00 PM to 3:00 PM EST (7:00 PM to 8:00 PM GMT).

How Long Does the Silver Bullet Strategy Last?

As an intraday trading strategy, the Silver Bullet targets quick, short-term trades within specific one-hour windows. The trades are typically intended to be closed by the end of the trading day, capitalising on rapid movements towards and away from liquidity points.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Vertex Pharmaceuticals (VRTX) Stock Surges 5% Following Positive Kidney Disease Trial Results

TLDR

- Shares of Vertex climbed approximately 5-7% following successful phase 3 trial results for povetacicept in treating IgA nephropathy.

- Trial participants experienced a 52% decrease in urine protein levels at 36 weeks, compared to only 4.3% in the placebo group.

- The treatment achieved a 79.3% reduction in harmful antibody levels and eliminated hematuria in more than 85% of participants.

- The company intends to submit for FDA accelerated approval before the end of March, utilizing a priority review voucher to shorten review duration to six months.

- Wall Street firms Cantor and Evercore upgraded their projections, setting price targets at $590 and $530 respectively.

Shares of Vertex Pharmaceuticals experienced a notable surge following impressive late-stage clinical trial outcomes for povetacicept, an investigational kidney disease therapy. The stock climbed as high as 7% during after-hours trading Monday, stabilizing near 5% gains in Tuesday’s premarket session.

Vertex Pharmaceuticals Incorporated, VRTX

Povetacicept targets IgA nephropathy, a chronic autoimmune condition that progressively damages kidney tissue. Medical research indicates that without intervention, a significant percentage of diagnosed patients may progress to kidney failure within two decades.

Trial participants receiving povetacicept demonstrated a 52% decrease in proteinuria levels following 36 weeks of treatment. In contrast, the placebo cohort showed merely a 4.3% reduction. Elevated protein in urine serves as a critical biomarker for ongoing kidney deterioration.

Additionally, the therapy reduced concentrations of a damaging antibody by 79.3%. More than 85% of treated patients experienced resolution of hematuria, significantly outperforming the placebo arm. According to Vertex, the medication, administered via injection monthly, exhibited a favorable safety profile with good tolerability.

The interim analysis encompassed 199 participants who had reached the 36-week milestone. The complete study enrolls 605 patients and extends over two years, with the primary objective of assessing whether povetacicept can decelerate progressive kidney function decline.

Vertex announced plans to file a comprehensive FDA submission by March’s conclusion. The company will leverage a priority review voucher, which compresses the typical 10-month regulatory evaluation period to just six months.

Wall Street Reacts

Investment analysts responded swiftly to the announcement. Evercore ISI’s Cory Kasimov characterized the outcomes as “pretty good validation” for Vertex’s $4.9 billion Alpine Immune Sciences acquisition in 2024, the source of povetacicept. His rating stands at Outperform with a $530 target price.

Carter Gould from Cantor described the data as “the first major step in unlocking the renal franchise,” projecting potential peak sales exceeding $10 billion. Gould maintains an Overweight rating with a $590 price objective.

Evan Seigerman from BMO Capital Markets stated the results “firmly places povetacicept as a clear competitor and potential leader” within the IgA nephropathy treatment landscape.

How It Stacks Up Against Rivals

According to Seigerman’s analysis, the trial outcomes compare advantageously to both Otsuka’s marketed therapy Voyxact and Vera Therapeutics’ investigational compound atacicept.

Vertex has historically been recognized for its dominant cystic fibrosis portfolio, which contributed to the company surpassing a $100 billion market capitalization. The IgA nephropathy initiative represents a strategic expansion into renal disease therapeutics.

Premarket trading Tuesday showed the stock at $485.10. Complete two-year trial results remain forthcoming.

Crypto World

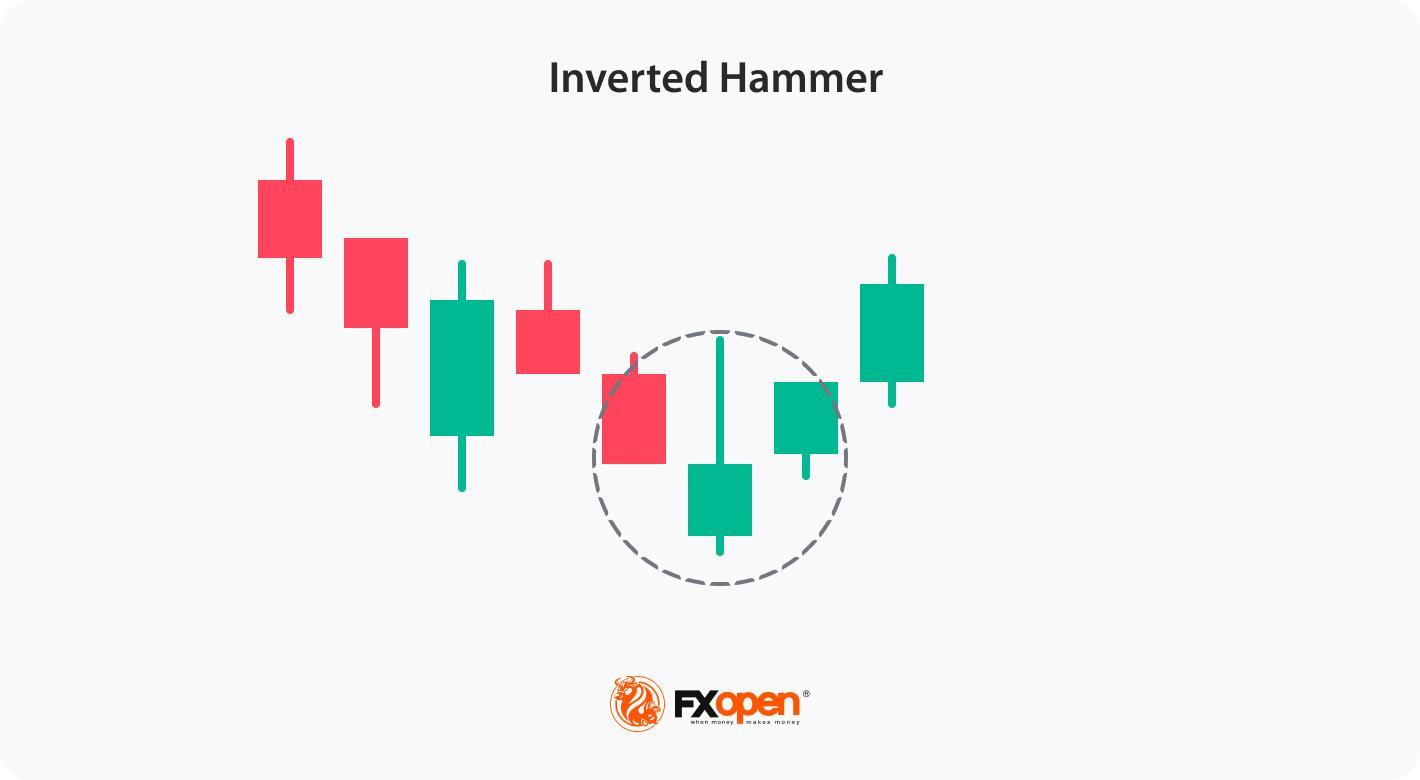

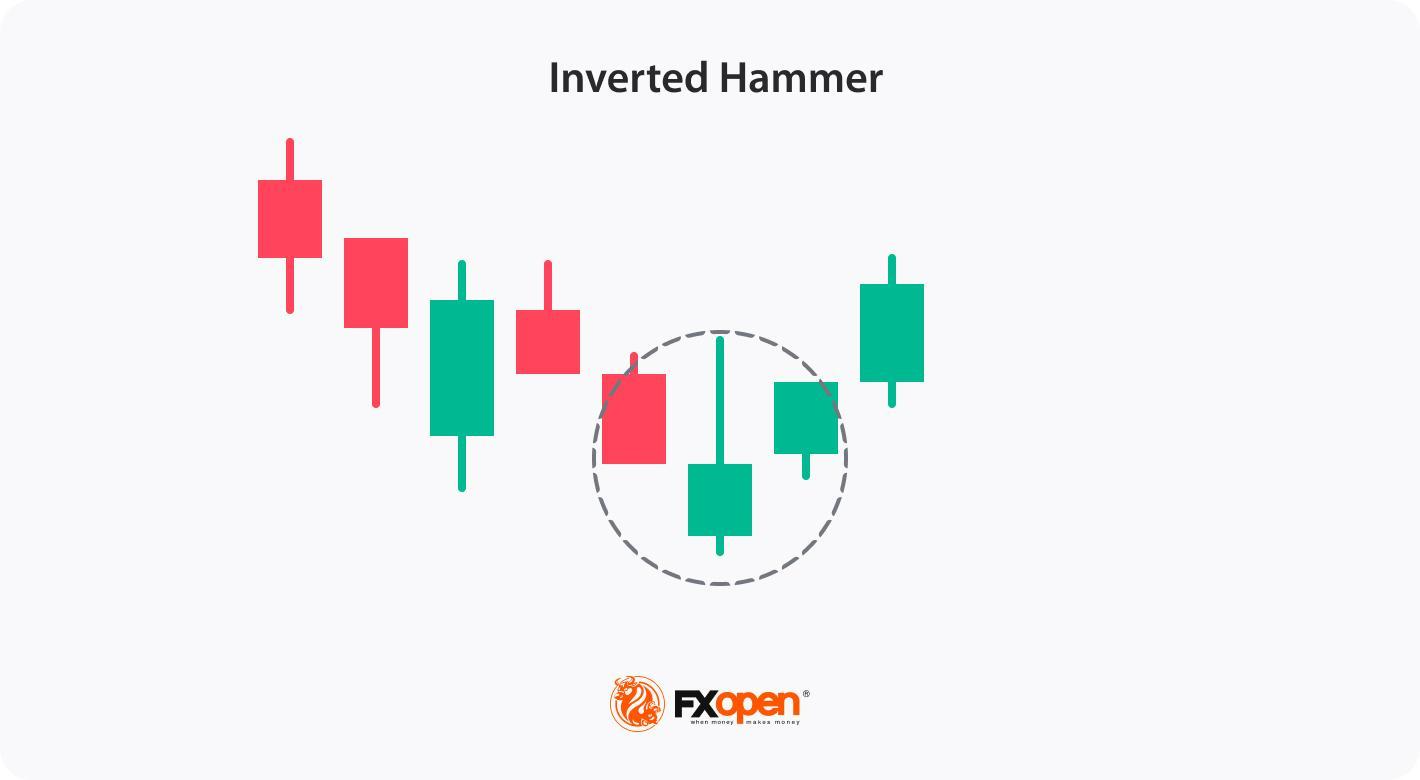

What Is an Inverted Hammer Candlestick Pattern in Trading?

Candlestick patterns are widely used in technical analysis to identify potential shifts in market sentiment and price momentum. One formation that traders frequently monitor during market declines is the inverted hammer candlestick pattern.

An inverted hammer is a single-candle formation characterised by a small real body near the lower end of the price range and a long upper shadow, typically at least twice the length of the body, with little or no lower shadow. It usually appears after a downtrend and may indicate that buyers attempted to push prices higher during the session, suggesting that selling pressure could be weakening.

In this article, we explain the meaning of the inverted hammer candlestick, examine its key characteristics, outline how traders identify it on charts, and discuss common ways it may be incorporated into technical analysis and trading strategies.

What Is an Inverted Hammer?

An inverted hammer is a candlestick pattern that appears at the end of a downtrend, typically signalling a potential bullish reversal. It has a distinct shape—a small body at the lower end of the candle and a long upper wick that is at least twice the size of the body. This structure suggests that although sellers initially dominated, buyers stepped in, pushing prices higher. While the inverted hammer alone does not confirm a reversal, it’s often considered a sign of a possible trend change when followed by a bullish move on subsequent candles.

The pattern can have any colour so that you can find a red inverted hammer candlestick or upside down green hammer. Although both will signal a bullish reversal, an inverted green hammer candle is believed to provide a stronger signal, reflecting the strength of bulls.

One of the unique features of this pattern is that traders may apply it to various financial instruments, such as stocks, cryptocurrencies*, ETFs, indices, and forex, across different timeframes. To test strategies with an inverted hammer formation, you may consider using FXOpen’s TickTrader trading platform, which provides access to over 700 markets.

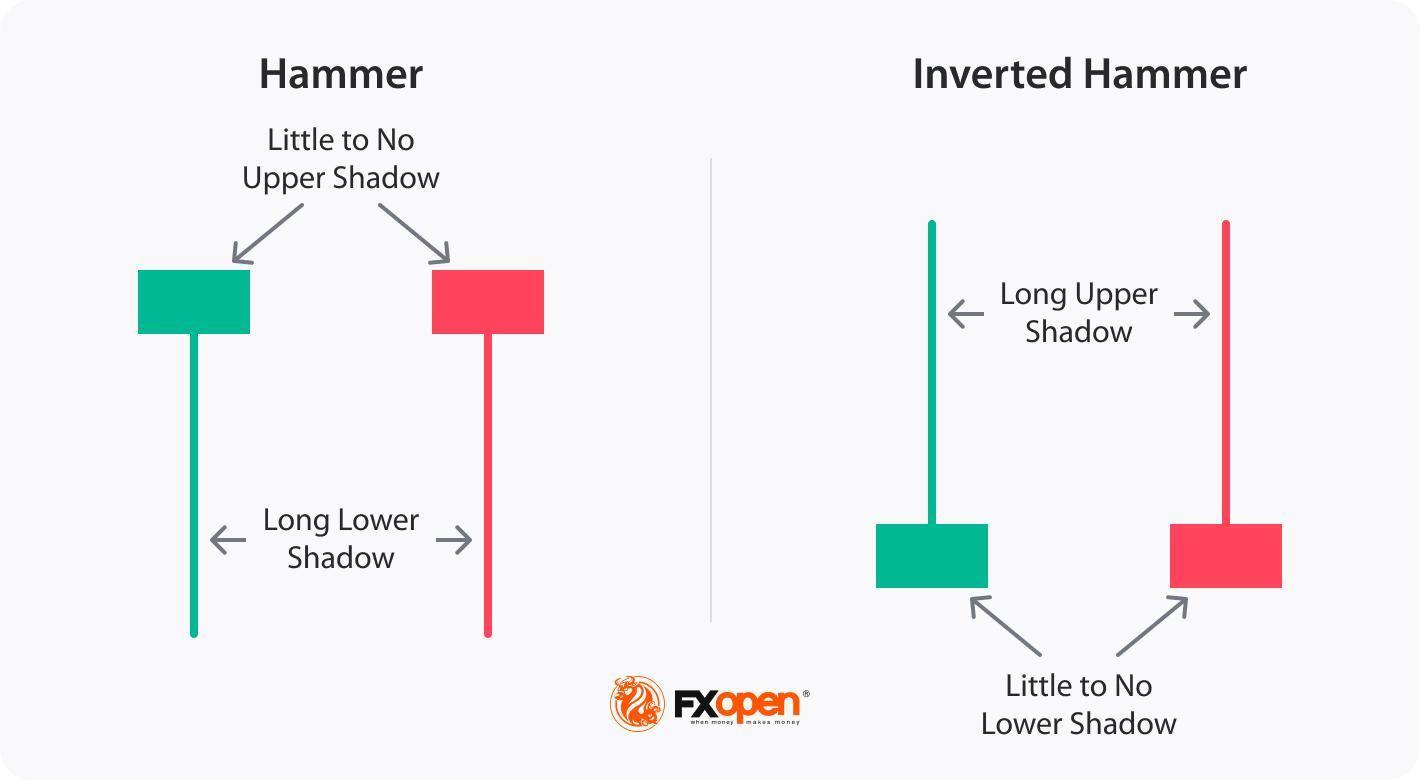

Hammer Candlestick vs Inverted Hammer

The hammer candlestick pattern and inverted hammer are both single-candle patterns that appear in downtrends and signal potential bullish reversals, but they have distinct formations and implications:

- Hammer: The reversal hammer candle has a small body at the top with a long lower wick, indicating that buyers pushed prices back up after a period of selling pressure. This bullish hammer pattern shows that sellers were initially strong, but buyers regained control, potentially signalling a reversal.

- Inverted Hammer: The inverted hammer, by contrast, has a small body at the bottom with a long upper wick. This structure indicates initial buying pressure, but sellers prevented a complete takeover. This pattern suggests that buyers may soon regain strength, hinting at a possible trend reversal.

Both patterns signal possible bullish sentiment, but while the green or red hammer candlestick focuses on buyer strength after selling, the inverted hammer suggests buyer interest in an overall bearish context, needing further confirmation for a trend shift.

How Traders Identify the Inverted Hammer Candlestick in Charts

Although the inverted hammer is a recognisable pattern, traders often apply additional rules to potentially strengthen the reversal signal it provides.

Step 1: Identify the Pattern in a Downtrend

- Traders ensure the market is in a downtrend, as the inverted hammer is only significant when it appears after a period of sustained selling pressure.

- Then, they look for a candlestick with a small body at the lower end and a long upper wick that’s at least twice the size of the body. This upper shadow shows initial buying pressure followed by selling, suggesting a potential reversal in sentiment.

Step 2: Choose Appropriate Timeframes

- The pattern can appear across various timeframes, but higher timeframe charts are more popular among traders, as shorter timeframes, like 5 or 15-minute charts, may provide false signals.

Step 3: Use Indicators to Strengthen Identification

- Volume: A rise in bullish trading volume after the inverted hammer can indicate stronger interest from buyers, increasing the likelihood of a trend reversal.

- Oscillators: Oscillators like Stochastic, Awesome Oscillator, or RSI showing an oversold reading alongside the candle can further suggest that the asset might be due for a reversal.

Step 4: Look for Confirmation Signals

- Gap-Up Opening: A gap-up opening in the next trading session indicates buyers stepping in, giving further weight to the bullish reversal.

- Bullish Candle: Following the inverted hammer with a strong bullish candle confirms that buying pressure has continued. This is a key signal that a trend reversal may be underway.

By following these steps and waiting for confirmation signals, traders might increase the reliability of the inverted hammer’s signals.

Trading the Inverted Hammer Candlestick Pattern: Real-Market Examples

Inverted hammer trading is based on a systematic approach to potential bullish reversals. Here are some steps traders may consider:

- Identify the Inverted Hammer: Spot the setup on a price chart by following the rules discussed earlier.

- Assess the Context: Analyse the broader market context and consider the pattern’s location within the prevailing trend. Look for support levels, trendlines, or other significant price areas that could strengthen the reversal signal.

- Set an Entry: Candlestick patterns don’t provide accurate entry and exit points as chart patterns or some indicators do. However, traders can consider some general rules. Usually, traders wait for at least several candles to be formed upwards after the pattern is formed.

- Set Stop Loss and Take Profit Levels: The theory states that traders use a stop-loss order to limit potential losses if the trade doesn’t go as anticipated. It may be placed below the low of the candlestick or based on a risk-reward ratio. The take-profit target might be placed at the next resistance level.

Inverted Hammer Candlestick: Live Market Example

The trader looks for a bullish inverted hammer on the USDJPY chart. After a subsequent downtrend, the inverted hammer appearing at a support level signals a potential trend reversal. They enter the market at the close of the inverted hammer candle and place a stop loss below the support level. Their take-profit target is at the next resistance level.

A trader could implement a more conservative approach and wait for at least a few candles to form in the uptrend direction. However, as the pattern was formed at the 5-minute chart, a trader could enter the market too late or with a poor risk-reward ratio.

Advantages and Limitations of the Inverted Hammer

The inverted hammer has its strengths and limitations. Here’s a closer look:

Advantages

- Recognisable: The pattern has a unique shape, making it accessible for traders at all experience levels.

- Can Be Spot in Different Markets: The candle can be found on charts of different assets across all timeframes.

- Clear Idea: When it appears on a chart, it reflects a trend reversal, allowing traders to incorporate it into broader trading strategies, especially when there are additional confirming signals.

Limitations

- Reliability Depends on Confirmation: The candle alone does not guarantee a market reversal; it requires confirmation from the next candlestick or other indicators. Without this, the reversal signal may be weak.

- Works Only in Strong Downtrends: The pattern might be more useful in strong downtrends; in ranging or weak trends, it generates less reliable signals.

- False Signals Can Occur: False signals are possible, especially in volatile markets. Over-reliance on this pattern without additional analysis may lead to poor trade outcomes.

Final Thoughts

While the inverted hammer can provide valuable insights into potential trend reversals, it should not be the sole basis for trading decisions. It is important to supplement analysis with other technical indicators and tools to strengthen the overall trading strategy. Also, risk management is crucial while trading this formation.

If you want to develop your own trading strategy, you may consider opening an FXOpen account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50.

FAQ

Is an Inverted Hammer Bullish?

Yes, it is considered a bullish reversal pattern. It indicates a potential shift from a downtrend to an uptrend in the market. While it may seem counterintuitive due to its name, the setup suggests that buying pressure has overcome selling pressure and that bulls are gaining strength.

How Can an Inverted Hammer Be Traded?

When using an inverted hammer, traders wait for confirmation in the next session, such as a gap-up or strong bullish candle. They usually open a buy position with a stop-loss below the low of the pattern to potentially manage risk and a take-profit level at the closest resistance level.

Is the Inverted Hammer a Trend Reversal Signal?

It is generally considered a potential trend reversal signal. An inverted hammer in a downtrend suggests a shift in market sentiment from bearish to bullish. An inverted hammer in an uptrend does not signify anything.

What Happens After a Reverse Hammer Candlestick?

After a reverse (or inverted) hammer candle, there may be a potential bullish reversal if confirmed by a strong bullish candle in the next session. However, without confirmation, the pattern alone does not guarantee a trend change.

Can an Inverted Hammer Candlestick Be Traded in an Uptrend?

In an uptrend, an inverted hammer isn’t generally considered significant because it’s primarily a reversal signal in a downtrend.

Are Inverted Hammer and Shooting Star the Same?

No, the inverted hammer and shooting star look similar but occur in opposite trends; the former appears in a downtrend as a bullish reversal signal, while the latter appears in an uptrend as a bearish reversal signal.

What Is the Difference Between a Hanging Man and an Inverted Hammer?

The hanging man and inverted hammer differ in both appearance and context. The former appears at the end of an uptrend as a bearish signal and has a small body and a long lower shadow, while the latter appears at the end of a downtrend as a bullish signal and has a small body and a long upper shadow.

What Is the Difference Between Red and Green Inverted Hammer Candlesticks?

A bullish (green) inverted hammer candlestick closes higher than its opening price, indicating a stronger bullish sentiment. A bearish (red) inverted hammer candlestick closes lower than its opening, which might indicate less buying strength, but both colours may signal a reversal if followed by confirmation.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Blockchain.com Enters Ghana: A Major Push into West African Crypto Markets

Key Highlights

- Blockchain.com officially enters Ghana to deliver regulated crypto solutions.

- Stablecoin USDT experiences explosive growth for remittances and inflation hedging.

- Bitcoin trading accelerates across Nigeria and Ghana for savings and payments.

- TRON emerges as popular choice for international transfers and e-commerce.

- Platform builds local infrastructure with dedicated teams and regulatory frameworks.

Blockchain.com has officially entered the Ghanaian market, marking a significant milestone in its West African expansion strategy. The crypto platform intends to deliver compliant and accessible digital asset solutions to users throughout the region. This move builds on successful operations in neighboring markets and demonstrates a sustained commitment to African crypto growth.

Stablecoin Demand Explodes Across Nigerian and Ghanaian Users

The demand for USDT has reached unprecedented levels on Blockchain.com’s platform in West Africa. Nigerian trading volumes have skyrocketed by more than 700% since retail services became available. Stablecoins serve critical functions in facilitating international payments and lowering transfer fees.

Users throughout the region increasingly turn to USDT as a hedge against local currency devaluation, while merchants integrate it into payment systems. Blockchain.com is building out its workforce with regional talent to enhance technical capabilities and service offerings. The platform maintains strict adherence to regulatory standards to guarantee safe and legitimate access to cryptocurrency products.

Even prior to official operations, Ghana demonstrated 140% expansion in platform participants. Rising stablecoin transaction activity reflects widespread appetite for blockchain-secured monetary alternatives. Blockchain.com focuses on delivering dependable, region-appropriate tools for West African financial needs.

Bitcoin Trading Reaches New Heights in West African Markets

Bitcoin continues to dominate trading activity on Blockchain.com’s Nigerian platform, generating unprecedented brokerage transaction volumes. The company indicates that BTC serves dual purposes as both an investment vehicle and remittance channel. Regional staffing expansions support operational scaling and enhanced customer service capabilities.

Nigeria’s smartphone-dominated population and unstable currency conditions fuel sustained Bitcoin engagement. Ghanaian market participants have similarly increased their Bitcoin trading frequency, revealing strong regional appetite. Blockchain.com combines Bitcoin services with complementary digital assets to broaden financial inclusion.

International fund transfers leverage Bitcoin’s deep liquidity pools, enabling rapid and cost-effective value movement. Blockchain.com systematically expands its technical infrastructure while maintaining rigorous security protocols. Regional programs emphasize user education, strategic partnerships, and market-specific crypto solutions.

TRON Network Gains Significant Momentum Throughout African Operations

TRON-based transactions have accelerated notably on Blockchain.com, especially within Nigerian markets. The platform observes expanding use cases spanning payments, wealth preservation, and online commerce applications. Blockchain.com bolsters technical resources to accommodate user requirements and evolving market dynamics.

The rise of TRX adoption aligns with the company’s strategic initiative to broaden its digital asset portfolio. Blockchain.com employs local market knowledge to refine service quality and regulatory compliance practices. Usage statistics confirm that TRON is becoming increasingly viable for remittances and business transactions.

Ghana displays promising early TRX trading activity despite awaiting complete platform activation. Blockchain.com’s emphasis on secure, user-friendly digital infrastructure cultivates confidence among participants. West African expansion enables the company to nurture developing cryptocurrency ecosystems throughout the continent.

Blockchain.com currently maintains operations across more than 70 international jurisdictions, having facilitated over $1.2 trillion in cryptocurrency transactions. The service has generated upwards of 90 million digital wallets and authenticated 40 million individual users. Ghana’s integration underscores Blockchain.com’s strategic vision for advancing financial services and cryptocurrency accessibility across the African continent.

Crypto World

Thailand crypto platforms freeze 10K accounts amid AML crackdown

Thailand’s crypto ecosystem is facing intensified scrutiny as authorities push a stricter regime on digital asset transactions. Operators in the country report that more than 10,000 accounts suspected of laundering funds have been frozen in the wake of tightened screening rules. The changes aim to slow dubious transfers and require additional Know Your Customer checks before higher-risk movements are completed, according to reporting from the Bangkok Post. The move marks a broadening effort by regulators and industry associations to curb illicit activity in a market that has seen a surge of compliance measures in recent years.

Key takeaways

- Thai licensed digital asset operators froze over 10,000 accounts identified as suspect mule accounts after the rollout of new screening measures and enhanced KYC checks for higher-risk transfers.

- The tightening builds on coordinated efforts by the Securities and Exchange Commission (SEC) of Thailand and the Thai Digital Asset Operators Trade Association (TDO), with support from the Bank of Thailand and various law enforcement agencies.

- Earlier in 2025, operators reportedly froze a much larger pool of mule accounts, with 47,692 identified in the period and handled within the Thai digital asset framework.

- Authorities have signaled a broader push to close money-laundering loopholes by enforcing the Travel Rule for digital asset transfers and enhancing data-sharing between crypto operators, banks, and law enforcement.

- Regulatory momentum in Thailand continues to unfold alongside actions against “gray money” in gold markets, reflecting a comprehensive tightening of financial oversight across asset classes.

Market context: The crackdown mirrors broader regional and global moves toward stricter AML/CFT standards for crypto activities. It comes as regulators push for clearer guidelines and cross-agency cooperation to curb illicit flows while balancing innovation and investor protection in Southeast Asia.

Why it matters

The Thai authorities’ approach signals a more disciplined regulatory environment for digital assets in Southeast Asia. By pairing tighter screening with explicit Know Your Customer procedures, officials aim to choke off the so-called mule accounts that move funds through multiple layers before reaching illicit destinations. For operators, the measures translate into deeper onboarding checks and stricter controls on high-risk transfers, potentially increasing compliance costs but also reducing reputational risk stemming from association with crime.

For investors and users, the evolving framework could bring greater transparency and predictability, albeit with heightened friction on some transactions. The Travel Rule enforcement adds another layer of customer-identification requirements, particularly for wallet-to-wallet transfers routed through exchanges. This aligns Thailand with a growing set of jurisdictions prioritizing traceability in digital-asset movements, even as the sector seeks to maintain smooth access to finance and capital markets for legitimate participants.

From a policy perspective, the collaboration between the SEC, the TDO, and federal and local enforcement bodies illustrates a mature, multi-agency approach to crypto regulation. The joint efforts to expand data-sharing, tighten screening, and standardize suspicious-activity responses demonstrate a willingness to move swiftly when red flags arise, while still engaging industry stakeholders in crafting practical safeguards.

What to watch next

- Outcomes from the February 2025 SEC–TDO workshop, including new guidelines for monitoring and investigating mule accounts and any published expedited measures.

- follow-up steps on expanded data-sharing between crypto operators, banks, and law enforcement to prevent transfers to suspected mule accounts.

- Any additional rounds of mule-account identification or freezes, and whether these actions target specific platforms or market segments.

- Regulatory guidance on broader digital-asset safeguards, including potential updates to the Travel Rule and related compliance requirements.

Sources & verification

- Bangkok Post: crypto-operators freeze 10,000 suspect accounts — https://www.bangkokpost.com/business/general/3213543/crypto-operators-freeze-10000-suspect-accounts

- SEC statement on collaboration with TDO and other agencies to tighten safeguards — https://www.sec.or.th/EN/Pages/News_Detail.aspx?SECID=11581&rand=113627

- Bangkok Post: SEC to expand digital asset framework — https://www.bangkokpost.com/business/investment/3180638/sec-to-expand-digital-asset-framework

- Pattaya Mail: Thai PM orders tighter oversight of gold and digital asset transactions to close financial loopholes — https://www.pattayamail.com/thailandnews/thai-pm-orders-tighter-oversight-of-gold-and-digital-asset-transactions-to-close-financial-loopholes-532051?utm_source=chatgpt.com

Thailand tightens mule accounts crackdown across digital assets

The Thai crypto ecosystem has entered a phase of heightened vigilance as regulators press for greater integrity in digital-asset markets. The most visible development so far is the publicized freeze of more than 10,000 accounts flagged as mule accounts—vehicles used to launder illicit funds or mask the origin of criminal proceeds. This action followed the implementation of stricter screening measures designed to slow down suspicious transfers and require additional Know Your Customer checks before completing higher-risk transactions. The Bangkok Post highlighted these changes, noting that operators have started to identify and freeze a substantial number of accounts as a consequence of the enhanced due-diligence regime.

Industry participants at the helm of Thailand’s digital-asset scene point to a broader, ongoing effort to curb illicit activity. Att Thongyai Asavanund, chief executive of KuCoin Thailand and chairman of the Thai Digital Asset Operators Trade Association (TDO), described the current phase as a direct response to evolving risk indicators. He said the tightened screening process enabled exchanges and brokers to identify and freeze more than 10,000 mule accounts, reflecting a concerted push by the sector to uphold compliance standards while continuing to serve legitimate traders and investors.

The collaboration between regulators and the industry has grown more structured over time. In February 2025, the SEC disclosed that it had worked with the TDO, the Bank of Thailand, the Cyber Crime Investigation Bureau, the Central Investigation Bureau, the Anti-Money Laundering Office, and the Thai Bankers’ Association to develop additional safeguards against mule accounts. This multi-agency effort underscores the Thai government’s intent to close gaps that criminals exploit—particularly as the country’s digital asset market expands and becomes increasingly integrated with traditional financial systems.

Earlier summaries from Thai authorities and media reported a broader, systemic approach to combatting mule accounts, with a sequence of enforcement actions that extended into 2025. Reports indicated 47,692 mule accounts had been frozen by Thai digital asset operators in 2025, signaling a sustained and data-driven approach to identifying risk and applying countermeasures. The TDO, which represents licensed digital-asset operators, continues to advocate for balanced governance that protects consumers while enabling legitimate innovation in the sector. As the sector broadens, exchanges and brokers alike are expected to tighten onboarding, enhance monitoring, and cooperate with law enforcement in real time.

The regulatory push also intersects with efforts to crack down on “gray money” flows in other asset classes. Thailand recently launched a comprehensive campaign aimed at closing money-laundering loopholes in both physical gold markets and crypto assets, emphasizing a holistic approach to financial crime prevention. In parallel, the government has pushed to strictly enforce the Travel Rule, requiring licensed crypto-asset service providers to collect and transmit identifying information about the sender and recipient of certain digital-asset transfers—particularly for wallet-to-wallet transfers facilitated via exchanges. This alignment between crypto, banking, and law-enforcement bodies marks a decisive step toward comprehensive oversight that aims to deter illicit activity while maintaining market resilience for compliant participants.

The evolving regulatory landscape in Thailand signals a broader shift in how Southeast Asian markets approach crypto compliance. With multiple agencies coordinating and industry groups actively participating in rule-making, the region appears to be moving toward more interoperable standards that can withstand the pressure of illicit finance while still accommodating legitimate innovation and investment.

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos1 day ago

News Videos1 day ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World20 hours ago

Crypto World20 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat11 hours ago

NewsBeat11 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech22 hours ago

Tech22 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business16 hours ago

Business16 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat5 days ago

NewsBeat5 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show

![Why Markets Are Going RISK OFF Overnight! [Urgent Update]](https://wordupnews.com/wp-content/uploads/2026/03/1773141138_maxresdefault-80x80.jpg)