Crypto World

Altcoins That Can Benefit If Bitcoin Crashes Below $70,000

Bitcoin has slipped nearly 7% in the past 24 hours and is now drifting closer to the critical $70,000 mark, a psychological level that could deepen fear across the broader crypto market if it breaks. As traders prepare for a possible downturn, attention is shifting toward specific altcoins that can benefit. Ones that may stay resilient if Bitcoin crashes below $70,000.

While most tokens tend to fall alongside BTC during major sell-offs, BeInCrypto analysts have identified three cryptocurrencies that are showing strong negative correlation, healthier chart structures, and improving capital flows. These signals suggest they could possibly outperform during market stress, making them potential opportunities even in a risk-off environment.

The White Whale (WHITEWHALE)

The White Whale (WHITEWHALE) is emerging as one of the few altcoins that can benefit if Bitcoin crashes under $70,000. All thanks to its growing independence from broader market trends. While most tokens have followed Bitcoin lower, the Solana-based WHITEWHALE has remained resilient.

Sponsored

Sponsored

It gained nearly 17% over the past seven days and rose close to 20% in the past 24 hours. This relative strength suggests that traders are possibly rotating into the token despite wider market weakness.

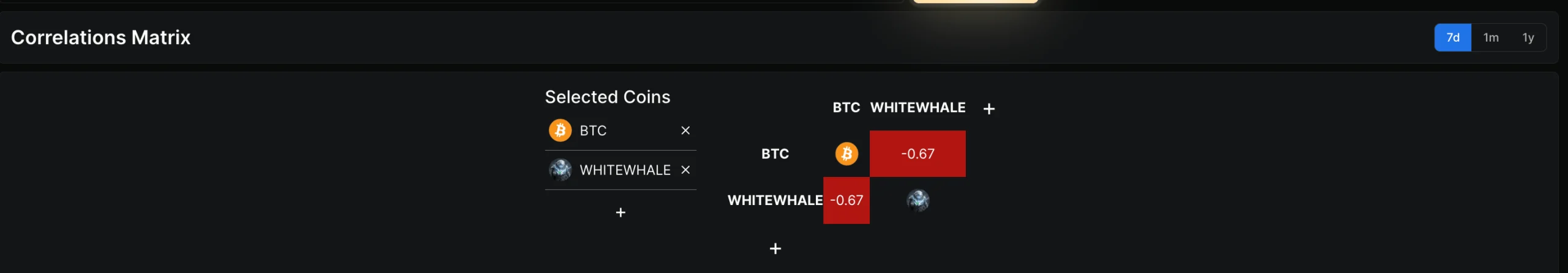

Over the last week, The White Whale has posted a strong negative correlation of –0.67 with Bitcoin. This means it has often moved in the opposite direction. This decoupling is important in a risk-off environment.

If Bitcoin crashes below $70,000, assets with low or negative correlation tend to attract speculative capital. And that makes WHITEWHALE one of the altcoins that can benefit from such a move. At the same time, the token is trading inside a bullish ascending channel on the 4-hour chart.

From a technical view, resistance sits near $0.127 and $0.143. A sustained move above this zone would confirm a breakout and open the path toward $0.226, implying upside of nearly 58% and a potential move into price discovery. On the downside, support lies at $0.098, with a deeper invalidation below $0.087. A break under these levels would weaken the bullish case and expose the price to a pullback toward $0.070.

Overall, The White Whale’s negative correlation, strong short-term performance, and bullish chart structure position it as a high-risk, high-reward candidate if Bitcoin enters a deeper correction.

Sponsored

Sponsored

Bitcoin Cash (BCH)

Bitcoin Cash is emerging as one of the altcoins that can benefit if Bitcoin crashes below $70,000, especially as it continues to show relative strength during broader market weakness. While the wider crypto market has slipped nearly 7% in recent sessions, BCH is down just over 1%, highlighting early signs of resilience. Over the past three months, it has also been up nearly 8%, making it one of the few large-cap altcoins still holding gains on a medium-term basis.

On-chain data supports this defensive setup. The Spent Coins Age Band metric, which tracks how many previously dormant coins are being moved, shows a sharp decline in activity.

Since early February, this figure has fallen from around 18,900 coins to roughly 8,278, a drop of nearly 56% in just a few days. This means far fewer long-held BCH tokens are being sold, even as prices remain under pressure. When coins stay inactive during market stress, it often reflects growing holder confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Chaikin Money Flow (CMF) indicator, which measures whether large capital is entering or leaving an asset using price and volume, has risen steadily between January 29 and February 5. CMF has climbed back toward, and briefly above, the zero line, showing that large buyers are quietly increasing exposure despite weak sentiment elsewhere.

Sponsored

Sponsored

From a technical perspective, BCH needs to hold above $523 to maintain this structure. A daily close above $558 would strengthen the bullish case and open the path toward $615 and $655, with $707 as an extended target if conditions improve.

However, failure to reclaim $523 could expose the price to a deeper pullback toward $466.

Hyperliquid (HYPE)

Hyperliquid’s native token, HYPE, stands out as one of the altcoins that can benefit if Bitcoin crashes below $70,000. It is mainly because it has been moving in the opposite direction to BTC. Over the past month, HYPE is up nearly 28%, while Bitcoin has dropped around 24%.

Sponsored

Sponsored

During the same period, its correlation with BTC stands at –0.71, showing a strong inverse relationship. This means that when Bitcoin weakens, HYPE has recently tended to rise, making it a candidate for traders looking for relative strength during market stress.

The HYPE price chart supports this divergence. After rallying toward the $38.43 zone earlier, HYPE entered a consolidation phase that now resembles a bullish flag-and-pole pattern. This structure usually forms when an asset pauses after a strong rally before attempting another upward move. If the upper trendline breaks, the pattern projects a potential upside of around 87%.

Capital flow data also remains supportive. The Chaikin Money Flow (CMF) is still positive, showing that large buyers are active. However, CMF is moving below a descending trendline, meaning stronger inflows are still needed to confirm a new flag breakout.

For bullish confirmation, HYPE needs a clean daily close above $34.87. Clearing this level would open the path toward $38.43 first, and potentially toward the $65.70 zone if momentum builds. On the downside, weakness below $28.21 would damage the setup, while a fall under $23.82 would invalidate the bullish structure.

If Bitcoin crashes under $70,000 and HYPE maintains its negative correlation, strong structure, and inflow support, it remains one of the altcoins that can benefit from market stress rather than suffer from it.

Crypto World

WLFI to Offer More Incentives for Token Holders Who Use USD1

Trump family-backed crypto venture World Liberty Financial (WLFI) has proposed new measures to boost participation in governance through a staking system and incentivize the use of its stablecoin USD1.

In its latest proposal on Wednesday, the team suggested governance votes should require holders to stake their tokens for at least 180 days to ensure “voting power is held by participants with long-term alignment to the protocol,” instead of “short-term holders or speculators.”

Stakers would earn an annual percentage rate of 2% provided they participate in at least two governance votes during the lock-up period. Governance power would be based on the amount staked and the time left in the lock-up. Users with locked tokens can continue to vote as usual.

Incentives for USD1 usage on the table too

WLFI has been trying to increase USD1 adoption since it launched through rewards programs and partnerships with institutional platforms and other protocols.

As part of the staking system, the WLFI team said users who stake their tokens would also gain “additional benefits for USD1 usage,” with USD1 deposits made on the trading and lending platform WLFI Markets attracting unspecified “incentives” from the DeFi protocol Dolomite.

At the same time, “Nodes,” holders with at least 10 million WLFI tokens, will gain access to providers who offer conversion of other stablecoins like USDC (USDC) and USDt (USDT) into USD1 at a 1:1 rate and can provide an off-ramp directly to fiat.

“Super Nodes,” or holders with more than 50 million WLFI tokens, will also have access to the feature.

For the vote to be valid, the WLFI team has set the bar at one billion voting tokens participating, with a majority voting in favor required for it to pass. CoinGecko lists over 27 billion WLFI tokens in circulation.

If approved, the rollout will be in three phases: starting with staking rewards and USD1 deposit incentives, followed by the 1:1 conversion feature and lastly partnership access and a revenue-sharing framework for “Super Nodes.”

Related: Trump crypto company says ‘coordinated attack‘ on stablecoin failed

Stablecoin market dominated by USDC and USDT

The total market capitalization for stablecoins is over $309 billion as of Thursday, according to DeFi aggregator DefiLlama. USDT has the largest market cap with over $183 billion and a market dominance of 59%.

Circle’s USDC is the second-largest stablecoin by market cap, with $75 billion. WLFI’s USD1 is the fifth-largest stablecoin with a $4.7 billion market cap.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Tap to Earn Game Development Guide 2026: Strategy & Growth

Tap to Earn is no longer a novelty mechanic. In 2026, it has matured into a scalable user acquisition & token distribution model built around frictionless onboarding, micro-interactions, and viral network effects, especially within the TON ecosystem and Telegram infrastructure.

Unlike traditional Web3 games that demand high production budgets and long development cycles, Tap to Earn games optimize for speed, distribution, and engagement density. However, while they may appear simple on the surface, building a sustainable Tap to Earn ecosystem on TON requires strategic architecture, disciplined tokenomics, backend scalability, and strong anti-fraud design.

This Tap to Earn game development 2026 guide explores the structural foundation on TON and what it takes to build for long-term growth.

What Is Tap to Earn in 2026?

Tap to Earn in 2026 is not just about tapping a screen to collect tokens. It represents a behavioral reward engine designed around micro-engagement cycles. At its core, Tap to Earn is built on three mechanics:

- Ultra-simple interaction loops

- Instant reward feedback

- Referral-amplified growth

However, what makes it powerful today is not the tap, it is the ecosystem design. Modern Tap to Earn systems integrate:

- On-chain reward validation

- Token-based incentive layers

- Community leaderboard gamification

- Progressive unlock systems

- Hybrid off-chain performance optimization

The reason this model works so effectively on TON is that Telegram removes the largest friction point in gaming that is app installation. Users need not download and they need not register. They simply click and start interacting. This instant participation layer plays a significant role in dramatically improving early retention metrics. In 2026, Tap to Earn is less about “earn by tapping” and more about “engage and amplify within an ecosystem.”

Reason Behind the Explosion of Tap to Earn in 2024–2026

The growth of Tap to Earn is not accidental. It is structurally aligned with current user behavior and Web3 distribution dynamics. Typically, there are four primary reasons for its rapid adoption.

1. Distribution Without Friction

Telegram provides a ready-made network. Every user is already authenticated. Wallet integrations through TON helps reduce onboarding complexity further. No app store policies applicable, no 30% deduction in revenue, and no installation barrier.

2. Viral Referral Loops

Tap to Earn thrives on referral multipliers. Most games are architected to incentivize inviting friends. Every new user increases reward potential for existing participants, which, in turn, creates network compounding effects.

3. Micro-Session Behavior

Modern users prefer short engagement bursts. Tap to Earn sessions often last seconds or minutes, making them highly repeatable. This helps increase daily active usage frequency.

4. Tokenized Incentives

Unlike Web2 games, Tap to Earn integrates token ownership. This adds speculative and financial motivation layered on top of gameplay.

However, growth alone does not guarantee sustainability. Many projects in 2024 collapsed because they were optimized for viral spikes rather than focusing on economic durability.

Tap to Earn vs Play to Earn: Structural Differences

A number of new entrants in the field of gaming tend to get confused between Tap to Earn and Play to Earn model. While both Tap to Earn and Play to Earn fall under the category of Web3 gaming, they are fundamentally different in architecture, user behavior, and scalability potential. Understanding the difference between Tap to Earn and Play to Earn helps businesses and decision-makers choose the right model for their Web3 gaming strategy.

| Factor | Tap to Earn Games | Play to Earn Games |

|---|---|---|

| Core Interaction Model | Built around simple micro-interactions such as tapping, claiming rewards, or completing lightweight tasks. Designed for rapid engagement cycles. | Built around deeper gameplay mechanics such as battles, quests, strategy, or asset management requiring longer sessions. |

| User Onboarding | Extremely low friction. Users can start instantly through Telegram Mini Apps or bots without downloads or complex registration. | Typically requires wallet setup, NFT purchases, or platform onboarding before meaningful participation begins. |

| Development Complexity | Focuses on scalable backend systems, referral engines, and reward validation logic rather than complex gameplay mechanics. | Requires complex gameplay systems, NFT logic, multiplayer infrastructure, and advanced in-game mechanics. |

| Infrastructure Requirements | Lightweight frontend but strong backend validation systems to support large user volumes and prevent bot abuse. | Heavy infrastructure requirements due to complex gameplay, marketplace interactions, and asset ownership tracking. |

| Economic Structure | Growth-driven economies that depend on network expansion and controlled reward distribution. | Asset-driven economies focused on NFT ownership and in-game asset value appreciation. |

| Entry Barrier for Users | Usually free-to-start, allowing rapid user acquisition and viral growth. | Often requires upfront investment in NFTs or tokens to participate meaningfully. |

| User Session Length | Short sessions lasting seconds or minutes, encouraging frequent return visits throughout the day. | Longer sessions require dedicated gameplay time and higher user commitment. |

| Scalability Potential | Highly scalable due to lightweight interaction design and Telegram-based distribution. Can reach millions of users quickly. | Scaling requires significant infrastructure investment and longer development cycles. |

| Primary Growth Driver | Viral distribution and referral mechanics integrated into Telegram ecosystems. | Gameplay quality, asset value, and long-term player engagement. |

| Sustainability Challenges | Requires strong anti-bot protection and controlled token emissions to maintain ecosystem stability. | Requires balanced tokenomics and consistent player demand to prevent economic collapse. |

Strategic Takeaway

Tap to Earn is optimized for speed & distribution, while Play to Earn is optimized for depth and long-term gameplay value.

For projects launching within the TON ecosystem, Tap to Earn models often provide a faster path to user acquisition and ecosystem expansion. Play to Earn models, on the other hand, require significantly higher investment and longer development timelines but can support deeper gaming experiences.

Want to Build Your Viral Tap to Earn Game on TON?

Why TON Became the Default Ecosystem for Tap to Earn

TON particularly favors Tap to Earn due to its messaging-based ecosystem. Its technical architecture complements Tap to Earn mechanics exceptionally well, thereby making it ideal for Tap to Earn game development.

1. Native Telegram Integration

TON is embedded within Telegram’s infrastructure. This means wallet setup, notifications, and user verification happen inside the same ecosystem.

2. Transaction Efficiency

Low gas fees make micro-reward distribution economically viable. High gas environments would render Tap to Earn unsustainable.

3. Scalability

TON supports high transaction throughput. Viral Tap to Earn games may experience explosive user growth; infrastructure must support it.

4. Community Alignment

Telegram’s user base is already crypto-aware, which reduces user education barriers.

However, simply launching on TON does not guarantee success. Smart contract design, backend validation, and anti-bot systems remain critical.

Technical Architecture of TON Tap to Earn Games

Although Tap to Earn games appear simple to users, production-ready TON Tap to Earn game development relies on a multi-layered technical architecture. Each layer plays a critical role in ensuring scalability, reward validation, and long-term stability. Behind the simplicity lies layered engineering.

| Architecture Layer | Components | Purpose | Why It Matters |

|---|---|---|---|

| User Interaction Layer | Telegram Mini Apps, Bot Interfaces, Lightweight UI Components, Instant Feedback Systems | Provides a frictionless gameplay experience directly inside Telegram without requiring downloads or account creation | Fast and responsive interaction directly affects retention and engagement. Even small delays reduce daily active usage. |

| Application Logic Layer | Game logic engines, Reward calculation modules, Progress tracking systems, Leaderboards | Processes gameplay actions and determines how rewards are generated and distributed. | Ensures fair reward distribution and consistent user progression without manipulation. |

| Backend Infrastructure Layer | User databases, Referral tracking engines, Activity logging systems, API services | Stores player activity, validates interactions, and maintains the state of the game ecosystem. | Without robust backend infrastructure, viral growth can cause system instability and downtime. |

| Reward Validation Layer | Anti-bot detection systems, Rate-limiting controls, Behavioral analysis tools, Fraud monitoring systems | Detects suspicious activity and prevents automated reward farming or exploit attempts. | Tap to Earn ecosystems attract bots quickly. Without protection, token pools can be drained within weeks. |

| Blockchain Integration Layer | TON smart contracts, Token reward logic, Wallet connectivity, On-chain verification | Handles token distribution, asset ownership, and secure blockchain-based validation. | Ensures transparency and trust while keeping transaction costs low enough for micro-rewards. |

| Wallet & Identity Layer | TON Wallet integration, User identity mapping, Secure session handling | Connects players to blockchain assets and enables secure reward distribution. | Seamless wallet interaction reduces onboarding friction and improves user retention. |

| Analytics & Optimization Layer | Player behavior tracking, Retention analytics, Economy monitoring dashboards | Provides data-driven insights into user behavior and token circulation. | Enables continuous optimization and prevents economic imbalance over time. |

| Administration Layer | Admin dashboards, Economy controls, Reward adjustment tools, and User management panels | Allows operators to manage rewards, monitor activity, and maintain system stability. | Without administrative control, adjusting reward systems after launch becomes difficult. |

Architectural Insight

Most failed Tap to Earn projects underestimate the backend and validation layers. The visible interface may be simple, but scalable TON Tap to Earn game development requires disciplined engineering across multiple layers.

Successful projects typically implement hybrid architectures where:

- Frequent user actions are processed off-chain for speed

- Final reward distribution happens on-chain for transparency

- Smart contracts handle ownership and token logic

- Backend systems protect against exploitation

This hybrid model is considered best practice for TON Tap to Earn game development in 2026.

Monetization & Sustainability in Tap to Earn

Monetization models must go beyond token distribution. Sustainable Tap to Earn models integrate:

- Token sinks (upgrades, boosts, access rights)

- NFT premium layers

- Sponsored reward campaigns

- Marketplace transaction fees

- Tier-based reward multipliers

The biggest mistake projects make is treating token emission as marketing rather than economic policy. Economic modeling should actually account for:

- User growth velocity

- Token circulation rate

- Secondary market liquidity

- Inflation control mechanisms

Without this, reward dilution erodes value quickly.

Risks & Common Reasons for Failure

The majority of failed Tap to Earn projects tend to share similar weaknesses.

1. Bot Exploitation

If reward validation is shallow, automated systems drain tokens rapidly.

2. Backend Instability

Sudden user spikes overwhelm weak infrastructure.

3. Poor Token Design

High emission with low utility leads to rapid devaluation.

4. Short-Term Hype Mentality

Projects focused solely on viral marketing rarely sustain engagement beyond initial weeks.

Proper engineering and long-term modeling mitigate these risks. This is exactly where the role of the best Tap to Earn game development company comes into play.

Choosing the Best Tap to Earn Game Development Company

Selecting the best Tap to Earn game development company requires evaluating more than just portfolio aesthetics. Key evaluation criteria include:

- TON smart contract expertise

- Proven anti-bot engineering capability

- Backend scalability experience

- Tokenomics advisory understanding

- Telegram Mini App specialization

Antier, as a professional Tap to Earn game development company, understands both blockchain and high-scale backend systems to approach your project as an ecosystem, not just a bot.

Strategic Outlook for 2026 and Beyond

Tap to Earn game development is evolving into:

- AI-personalized reward loops

- Dynamic token emission adjustments

- Cross-chain integration models

- Community governance overlays

- Hybrid Web2-Web3 reward systems

The projects that will dominate are those that appropriately integrate growth mechanics, secure architecture, sustainable economic design, and continuous iteration. Tap to Earn is not here to disappear. It is here to mature. Those who engineer for sustainability rather than hype will certainly capture long-term value.

Frequently Asked Questions

01. What is Tap to Earn in 2026?

Tap to Earn in 2026 is a behavioral reward engine focused on micro-engagement cycles, featuring ultra-simple interaction loops, instant reward feedback, and referral-amplified growth, all designed to enhance user acquisition and token distribution.

02. How does Tap to Earn leverage the TON ecosystem?

Tap to Earn leverages the TON ecosystem by utilizing Telegram’s infrastructure to eliminate friction points like app installation, allowing users to engage instantly without downloads or registrations, which significantly improves early retention metrics.

03. What are the key components of a successful Tap to Earn ecosystem?

A successful Tap to Earn ecosystem includes on-chain reward validation, token-based incentive layers, community leaderboard gamification, progressive unlock systems, and hybrid off-chain performance optimization, all contributing to sustainable growth.

Crypto World

$75 turns into $200,000 jackpot for lucky BTC miner

Talk about winning the lottery. A solo miner walked away with over $200,000 in bitcoin while renting just $75 of hash power.

A solo miner validated block 938,092 around 8:04 a.m. UTC on Tuesday, earning the full 3.125 BTC block reward using hashrate rented through on-demand cloud services, according to blockchain data from Mempool.space.

The miner spent roughly 119,000 satoshis, about $75, to rent 1 petahash per second of computing power and used CKPool, a service that lets individual miners work independently while relying on a pool server to broadcast and submit solutions.

The math on that return is absurd. It’s a 2,600x payoff on what amounts to a lottery ticket with better odds than most actual lotteries.

Bitcoin’s network processes transactions by bundling them into blocks, which are added to the blockchain roughly every 10 minutes. Miners compete to solve a cryptographic puzzle for the right to add each block, and the winner collects the reward.

The competition is measured in hashrate, the amount of computing power a miner throws at the puzzle. More hashrate means more guesses per second and better odds.

Statistically rare

A solo miner renting 1 petahash is like bringing a slingshot to a gunfight. The odds of that single petahash solving a block before the industrial operations do are vanishingly small, roughly equivalent to finding one specific grain of sand on a beach.

But someone has to win each block, and probability doesn’t care about scale. As such, while solo-mined blocks remain statistically rare, they’re not as rare as they used to be.

Data from solo mining aggregator Bennet shows 21 individual miners have successfully validated blocks over the past year, earning a combined 66 BTC worth $4.1 million at current prices. That’s a 17% increase in solo blocks found year-over-year, with one landing roughly every 17 days on average.

The rise of on-demand hashrate rental has lowered the barrier to entry.

Miners no longer need to own physical hardware to take a shot. Cloud-based services let anyone rent computing power for as little as a few dollars, turning solo mining from an infrastructure-heavy operation into something closer to a scratch-off card with transparent odds.

Meanwhile, the lucky block landed during an interesting moment for bitcoin mining economics.

Network difficulty just climbed to 144.4 trillion after the latest adjustment, a 15% increase that reversed an 11% drop caused by severe U.S. winter storms earlier this month. The climb means miners now need on the order of 144.4 trillion hash attempts, on average, to find a valid block, compared with the very first blocks in 2009.

That storm-driven decline was the sharpest hashrate drop since China’s 2021 mining ban, temporarily making blocks easier to find before the network recalibrated.

And for one miner with $75 and good timing, the window was enough.

Crypto World

Uniswap’s UNI jumps 15% as governance vote to expand fee switch gains momentum

UNI climbed roughly 15% over the past 24 hours, outperforming bitcoin’s 4.7% gain and ether’s 8.5% rise, as investors reacted to a Uniswap governance vote aimed at broadening the protocol’s revenue capture across multiple layer-2 networks.

If approved, the proposal would expand the so-called fee switch to eight additional chains and replace the current pool-by-pool model with a tier-based v3 system that activates fees across all liquidity pools by default.

Fee switch is the mechanism that redirects a portion of the platform trading fees to the protocol treasury itself from liquidity providers. This captured fee revenue is then used for UNI token buybacks, burns and treasury growth, establishing a direct link between the platform’s trading volume and UNI’s market value.

A single governance decision is about to add $27M in annualized revenue to Uniswap.

Since the first UNIfication proposal passed, collected protocol fees have already enabled $5.5M+ in UNI burns ($34M annualized). So, what kind of impact could expanding this to eight additional… pic.twitter.com/GjEJbJ0S8b

— Entropy Advisors (@EntropyAdvisors) February 25, 2026

Some estimates suggest the change could add roughly $27 Million in annualized revenue on top of the approximately $34 Million already being generated and used to burn UNI, marking one of the most significant shifts in Uniswap’s token economics since fees were reintroduced late last year.

The governance proposal, split into two onchain votes due to transaction limits, would turn on protocol fees across multiple blockchains. It also introduces a new v3OpenFeeAdapter that applies protocol fees uniformly across liquidity pools based on their fee tier, rather than requiring governance to activate pools individually.

The change would make protocol fee capture automatic for all new v3 pools, reducing manual intervention and potentially broadening revenue collection across long-tail trading pairs.

Since the first phase of the fee switch rollout late last year, Uniswap has already burned more than $5.5 Million worth of UNI, implying an annualized pace of roughly $34 Million at current levels.

The rally comes as crypto markets broadly rebound, with bitcoin up around 4–5% and ether gaining roughly 8% over the same period.

Still, the long-term impact will hinge on whether higher protocol fee capture affects Uniswap’s competitiveness for liquidity on layer-2 networks, where fee-sensitive traders and market makers can migrate to alternative venues.

After years of generating trading volume without meaningful token-holder income, recent quarters show the protocol beginning to retain revenue.

In Q1 2026, Uniswap recorded roughly $3.12 million in gross profit, according to DeFi Llama data, compared with effectively zero in prior periods.

The change follows the gradual activation of the fee switch late last year, which redirected a portion of trading fees toward UNI burns.

If passed, the vote would cement Uniswap’s transition into a cross-chain revenue-generating protocol, with UNI burns increasingly tied to aggregate trading activity beyond Ethereum.

Crypto World

Bitcoin at $68,000 as majors see strongest bounce in weeks

Bitcoin came within touching distance of $70,000 on Wednesday before pulling back to around $68,300 in Thursday morning trading, a nearly 5% swing from the session high to the overnight low of $67,700.

The move marks the strongest attempt to reclaim the $70,000 level since the Feb. 5 crash but stopped short of a clean breakout.

The more interesting story was underneath. Altcoins outperformed across the board, with ether up 8.5%, solana gaining 6.9%, cardano surging 10.8%, and dogecoin adding 8.3%. Bitcoin’s 4.3% gain was among the smallest in the top 10.

That kind of divergence typically signals risk appetite returning to the edges of the market, where traders chase higher-beta moves once they believe the worst of the selling is done.

“The wave of forced selling is starting to clear out,” said Daniel Reis-Faria, CEO of ZeroStack, in an email. “Altcoins are outperforming again, and more of them are ahead of bitcoin. That tells me we’re seeing a rotation.”

The bounce arrived alongside a muted reaction to Nvidia’s quarterly earnings, which beat estimates but failed to sustain a rally. Nasdaq 100 futures slipped 0.3% after the report, and Nvidia shares erased most of their post-earnings gains to edge up just 0.2% in extended trading.

The world’s most valuable company signaled concerns about an overheated AI economy, tempering what had been a multi-day recovery in tech stocks.

Meanwhile, the macro backdrop remains fragile for a continued movement in crypto markets. Market maker Wintermute noted that cryptocurrencies have been losing ground alongside tech stocks as capital rotates into defensive and tangible assets.

Crypto finance platform Matrixport flagged stagnation in stablecoin supply as a “significant obstacle” for bitcoin, and onchain data firm Glassnode expects broader liquidity to recover in six months at the earliest.

The near-term risk is straightforward. Cryptoquant data shows selling has slowed on Binance, which supports the case for a short-term bounce. Elsewhere, crypto exchange Bitrue warned that a break below $60,000 could open up a move toward $50,000-$55,000 or even $47,000 if cascading liquidations accelerate.

The gap between the short-term bounce and the medium-term trend remains wide — and Wednesday’s rejection at $70,000 did nothing to close it.

Crypto World

What Are Whales Doing Now?

Ethereum (ETH) is seeing renewed buying interest amid its latest recovery rally, which has pushed the price back above $2000.

On-chain data shows whales accumulating the second-largest cryptocurrency. At the same time, the Coinbase Premium Index has moved above zero for the first time since early January.

Ethereum Reclaims $2000 as Crypto Market Extends Midweek Rally

The crypto market extended its gains today, continuing the upward trajectory that began on Wednesday. Ethereum’s price has risen about 8% during the same period. At press time, the altcoin was trading at $2054.

On-chain analytics platform Santiment noted that the 30-day Market Value to Realized Value (MVRV) ratio for large-cap cryptocurrencies shifted significantly following the rally, suggesting the market is rebalancing after a period of undervaluation.

The MVRV metric compares market capitalization with realized capitalization, providing insight into average holder profitability. Ethereum, in particular, has moved from a strongly undervalued position to a mildly undervalued zone, with its MVRV ratio currently at -5.5%.

ETH Surge Triggers Major Whale Buys

The recovery has been accompanied by notable whale activity. Blockchain analytics firm Lookonchain documented that whale address 0xAb59 invested $14.57 million to acquire 7,008 ETH at an average price of $2,079.

In addition, whale address 0x166f withdrew 20,000 ETH worth $38.25 million from Binance and Deribit within a two-hour window. The large-scale exchange withdrawal involved five transfers, with the largest being 8,000 ETH from a Binance hot wallet.

US investor demand is also showing signs of improvement. According to CryptoQuant data, the Ethereum Coinbase Premium Index has moved over zero.

Throughout much of January and early February 2026, the index, which measures the price difference between Ethereum on Coinbase and Binance, remained firmly negative. This typically signals weaker buying pressure from US-based investors during periods of price softness.

The current reading shows ETH trading at a slight premium on Coinbase. This typically reflects stronger buying pressure from US-based investors, including institutional participants, compared to offshore markets.

“Most of the moments when the ETH Coinbase premium turned positive were followed by an upward trend. And now, the Coinbase premium has risen to 0. We’ve reached a critical turning point,” an analyst wrote.

Meanwhile, some derivatives traders have also benefited from ETH’s rise. Data shared by OnchainLens shows that trader Machi’s leveraged 25x long on ETH has swung back into profit, now up more than $760,000.

Separately, the whale known as “pension-usdt.eth” has closed both ETH and BTC long positions, realizing approximately $1.16 million in gains.

For now, momentum appears positive, but whether it can be sustained in the coming weeks remains to be seen.

Crypto World

Sam Bankman-Fried’s social media campaign fails to sway Trump on pardon

The White House has reaffirmed that former FTX CEO Sam Bankman-Fried will not receive a presidential pardon, even as the disgraced crypto founder publicly courts President Donald Trump through a sustained social media campaign.

Summary

- The White House reaffirmed that Sam Bankman-Fried will not receive a presidential pardon, despite his recent public appeals directed at Donald Trump.

- Bankman-Fried has used social media to criticize the Justice Department and align himself with Trump’s rhetoric, in what observers see as a bid for clemency.

- Trump has previously stated he has no intention of pardoning the former FTX CEO, even as he has shown clemency toward other high-profile figures.

Sam Bankman-Fried’s Trump appeals fall flat

A White House spokesperson reiterated to media that Trump has no plans to grant clemency to Bankman-Fried, revealing the president’s stance.

Bankman-Fried, serving a 25-year sentence for fraud and conspiracy related to the collapse of his cryptocurrency exchange FTX, has in recent weeks taken to platforms like X to align himself with Trump’s policies, criticize the judge who sentenced him, and lash out at his legal foes.

The messaging, widely interpreted as an attempt to influence Trump’s pardon calculus, also includes praise for conservative causes and disparagement of the Biden administration.

Despite these efforts, Trump’s position remains firm. In January, the president declared that Bankman-Fried was not among the individuals he intended to pardon — a list that also excludes other high-profile figures such as former New Jersey senator Robert Menendez and Venezuela’s Nicolás Maduro.

The White House statement reiterated this stance and suggested that the FTX founder’s public overtures have not altered Trump’s approach to clemency.

Bankman-Fried’s pivot toward Trump contrasts sharply with his earlier role as a major Democratic donor before FTX’s collapse. The shift in tone has been accompanied by amplification across various accounts on social media, with critics dismissing the campaign as ineffective “sock-puppet” activity.

The president has granted pardons to several figures associated with the cryptocurrency world, including Binance founder Changpeng Zhao and BitMEX’s leadership. Still, advisers and political observers view Bankman-Fried’s bid as unlikely to succeed, given his controversial reputation and the severity of his crimes.

Crypto World

Buterin outlines 4-year roadmap to faster, quantum-resistant Ethereum

Ethereum (CRYPTO: ETH) co-founder Vitalik Buterin has expanded on a four-year roadmap designed to dramatically accelerate block production and transaction confirmations. The Strawmap, a visual plan released by the Ethereum Foundation’s Protocol team, frames the network’s next phase as a sequence of incremental steps intended to make the blockchain feel more live and responsive rather than a system where users wait for each new block to arrive.

In a Thursday update, Buterin added detail to the Strawmap, noting that “fast slots” sit in their own lane within the plan and do not connect directly to the rest of the roadmap, which remains largely independent of the slot time. The core objective is to shrink the current 12-second block cadence toward as low as 2 seconds over time, enabling swifter confirmations and a more immediate user experience.

The roadmap outlines a measured path: 12 seconds down to 8, then 6, 4, and ultimately 2 seconds per slot, with each step pursued incrementally to minimize disruption while preserving security and network reliability. This approach is designed to avoid the complexity and risk of implementing sweeping changes all at once, favoring controlled, bite-sized upgrades that can be deployed with fewer unintended consequences.

The Strawmap also highlights improvements to peer-to-peer communication among Ethereum nodes. By refining how blocks and data are shared—reducing duplicated data transfers and accelerating how quickly nodes achieve consensus—the network can sustain shorter slot times without compromising security. Buterin described these P2P enhancements as essential to making shorter slots viable while preserving the network’s integrity.

Finality from minutes to seconds

The second major thrust in the Strawmap is finality—the point at which a transaction is mathematically irreversible. Today, finality sits around 16 minutes, but the roadmap envisages a target window of roughly 6 to 16 seconds, achieved by replacing the current, more complex confirmation regime with a simpler, cleaner model that is also designed to be quantum-resistant.

“The goal is to decouple slots and finality, to allow us to reason about both separately,” Buterin explained. He described this as an invasive set of changes, prompting the team to bundle the most significant upgrade with a cryptographic switch—specifically a move to post-quantum hash-based signatures—to minimize risk and complexity across forks.

The push toward quantum resistance is anchored in a staged approach: slots would become quantum-resistant earlier than finality, a decision that could see the chain continue to function even if distant quantum threats emerged before full post-quantum finality is achieved. “One interesting consequence of the incremental approach is that there is a pathway to making the slots quantum-resistant much sooner than making the finality quantum-resistant,” Buterin noted. In practical terms, the network might quickly reach a regime where, if quantum computers materialize, the finality guarantee could be suspended temporarily, yet the chain would continue to operate.

Guardrails aside, the overarching plan is to pursue a component-by-component replacement of Ethereum’s slot structure and consensus, yielding a cleaner, simpler, quantum-resistant, prover-friendly, end-to-end formally verified framework. The four-year horizon envisages seven forks, roughly every six months, with Glamsterdam and Hegotá already confirmed for later this year.

The Strawmap is the Ethereum Foundation’s attempt to visualize a long view for Ethereum’s evolution beyond today’s constraints, balancing speed, security, and future-proof cryptography.

Key takeaways

- Current block time sits around 12 seconds, with the roadmap aiming for a path down to 2 seconds per slot in incremental steps.

- Improvements to peer-to-peer data sharing are designed to reduce block propagation time without sacrificing security.

- Finality is targeted to move from minutes (roughly 16) toward seconds (6–16) through a simpler, quantum-resistant approach to confirmations.

- The plan calls for seven forks over four years, with Glamsterdam and Hegotá already confirmed for later this year.

- Cryptography changes are paired with the upgrade path, including a shift to post-quantum hash-based signatures to support long-term security.

Tickers mentioned: $ETH

Sentiment: Neutral

Market context: The drive to accelerate Ethereum’s block production and simplify finality sits within broader industry efforts to improve L1 throughput while preparing for future cryptographic threats, all against a backdrop of growing demand for faster, more scalable blockchain services and ongoing debates about post-quantum readiness.

Why it matters

The Strawmap represents a fundamental rethinking of how Ethereum validates transactions and finalizes states. By decoupling slot timing from finality, the network aims to create a more modular upgrade path. This modularity could allow developers to test and deploy changes in smaller, safer increments, reducing the risk of destabilizing the network during major upgrades.

From a user and developer perspective, shorter slot times could translate into faster inclusion of transactions and more responsive DeFi and smart contract interactions. For validators and node operators, the proposed P2P optimizations and cryptographic shifts are expected to lessen the burden of processing large data loads and maintaining security in the face of emerging quantum-era threats, respectively.

Yet the changes are not trivial. The shift to a new cryptographic regime and the introduction of a simplified finality mechanism will require careful implementation across forks, with substantial testing to prevent disruption. The four-year horizon and seven forks underscore the breadth of coordination required among developers, researchers, and the wider ecosystem to ensure a smooth transition.

What to watch next

- The first of the planned forks under the Strawmap timeline, Glamsterdam, and Hegotá, slated for later this year, and their specific upgrade goals.

- Ongoing work on node communication protocols and data sharing improvements to reduce block propagation times.

- The cryptography switch to post-quantum signatures and the associated testing cycles across testnets and mainnet participants.

- Public updates from the Ethereum Foundation’s Protocol team on fork schedules and implementation milestones.

Sources & verification

What Strawmap changes for Ethereum’s block production and finality

Ethereum’s roadmap, as articulated by Vitalik Buterin and the Ethereum Foundation, centers on a deliberate, phased approach to transforming how blocks are produced and how state changes become final. At the heart of the plan is the intent to shrink the slot time—a metric that dictates how quickly new blocks are produced—from the current roughly 12 seconds toward a target as low as 2 seconds. The progression is designed to be gradual: 12 → 8 → 6 → 4 → 2 seconds, with each step evaluated for security and performance before advancing. This geometric, square-root-inspired trajectory is intended to preserve the network’s integrity while delivering tangible increases in transaction throughput and responsiveness.

Parallel to slot-time optimization, the Strawmap emphasizes improvements to how Ethereum nodes communicate with one another. By enhancing the efficiency of block propagation—reducing redundant data, and optimizing the sharing of new blocks and related information—it’s possible to support shorter slots without broadening attack surfaces or creating bottlenecks. Buterin has underscored that these improvements should not come at the expense of security, arguing that better messaging and data handling can unlock faster consensus without inviting new risks.

The roadmap’s second major thrust—finality—targets a dramatic reduction in the time required to irreversibly confirm a transaction. Where today finality hinges on a multi-layer, often lengthy confirmation process, the plan envisions a streamlined mechanism that can achieve finality within a window of about 6 to 16 seconds. A key part of this redesign is the switch to a more straightforward cryptographic architecture designed to be post-quantum resistant. This aligns with Ethereum Foundation materials that stress quantum readiness and the need to secure long-term security guarantees as the ecosystem scales.

To manage the scope and risk of such a sweeping overhaul, the strategy involves a decoupled approach to slots and finality. By treating these components as separable concerns, the network can be reasoned about more clearly, with targeted upgrades deployed in discrete forks. Buterin described the changes as highly invasive, necessitating a coordinated move that bundles the most significant cryptographic shift with the upgrade to a new, post-quantum hashing regime. This pairing aims to minimize disruption while laying the groundwork for future-proof security in a post-quantum era.

A notable implication of this incremental path is a staged advancement toward quantum resistance for slots ahead of finality. If quantum hardware were suddenly to arrive, there could be a temporary loss of finality guarantees; however, the chain would continue to operate, preserving usability and security in parallel. The overall trajectory anticipates ongoing, progressive reductions in both slot time and finality time, with a long horizon that envisions seven forks over four years and periodic, well-communicated upgrades designed to minimize risk for users and operators alike.

Crypto World

China holiday spending sends a strong signal on consumer stimulus plans

People watch performances to welcome the ‘God of Wealth’ during Lunar New Year festivities at Qianmen Street in Beijing, China, on February 21, 2026.

Nurphoto | Nurphoto | Getty Images

BEIJING — China’s consumer market is recovering — just enough that policymakers likely won’t need to roll out the large-scale stimulus that investors have long hoped for.

The nine-day Lunar New Year, which ended Monday, saw a steady rise in spending across the country, from hotel bookings to duty-free shopping. Rail travel hit a record of over 18.7 million passengers in a single day.

The better-than-expected data suggest that Beijing’s recent support measures are effective, while underscoring a broader consumer trend: spending on experiences such as travel and entertainment is still picking up faster than traditional goods, CCB International Securities said in a report Tuesday.

China’s retail sales have remained sluggish since the pandemic. Unlike the U.S., which handed out cash to consumers, Beijing has instead offered trade-in programs and vouchers. Chinese authorities have increasingly emphasized the need to boost consumers’ incomes, but have yet to release details.

That’s not likely to change soon.

“Policymakers are likely to build on the positive [holiday] momentum and introduce targeted, incremental easing around the March Two Sessions to stabilize expectations and sustain the recovery,” the CCB analysts said, referring to the annual parliamentary meetings that kicks off next week.

Chinese Premier Li Qiang is set to announce the year’s economic targets and policy priorities on March 5.

Still price-conscious

Despite the travel rebound, consumers remained price sensitive. Nationwide, tourism trips per day grew by 5.7% on average from a year ago, in line with 2025, according to official holiday figures released late Tuesday. Even though spending climbed by 5.5%, it slowed from 7% in 2025.

“Such trends reflect better sentiment from a longer holiday, but consumers remained budget cautious in general,” Morgan Stanley Equity Analyst Lillian Lou said in a report Wednesday.

In a sign of persistent deflationary pressure, the holiday recorded a 0.2% drop in average spend per tourist trip compared with a year ago, according to CNBC’s analysis of official data.

To boost consumer spending, China extended the official holiday period by one day compared with last year. Many people also took personal leave around the holiday, suggesting the official figures may not capture the entire spending picture.

“The extended holiday encouraged families to travel together,” Jihong He, chief strategy officer at H World Group, one of China’s largest hotel operators, said in a statement.

“That shift is driving demand for larger rooms and family-friendly configurations designed for shared experiences,” He said.

H World operates more than 12,000 hotels across over 30 brands in mainland China. For the Lunar New Year, the company said the top 10 destinations, with hotel occupancy rates of 90% or higher, were all located in southern or coastal cities, including Sanya in the tropical island province of Hainan.

China in December expanded a zero-tariff policy for the island to encourage duty-free luxury goods purchases within the mainland. Official figures showed Hainan’s holiday-period duty-free sales rose 30.8% from a year ago to 2.72 billion yuan ($400 million).

Alibaba-owned travel booking platform Fliggy said bookings for hotel and theme park packages during the holiday season more than doubled from last year. More remote, scenic destinations such as Altay in Xinjiang and Pu’er in Yunnan also saw bookings more than double, the company said.

Government support

China has sought to promote its growing services sector. This month, the National Bureau of Statistics disclosed that it was giving more weight to services in its consumer price index than in the previous base period in 2020.

Even consumer goods in China are increasingly oriented towards dining and social activities, Bruce Pang, adjunct associate professor at CUHK Business School, said in Chinese remarks translated by CNBC.

The key to consumption recovery is confidence in income and employment prospects, he said, rather than shopping promotions. Policymakers should place greater emphasis on those long-term issues, Pang added.

In the fall, China’s top leaders pledged to boost consumption over the next five years, and have subsequently said the country will prioritize domestic demand.

Local governments in China issued more than 2.05 billion yuan in consumption vouchers and subsidies ahead of the holiday, CCB analysts said, “effectively putting a floor under demand.”

However, prioritizing consumption does not necessarily signal sweeping stimulus, said Liqian Ren, director of Modern Alpha at U.S.-based fund manager WisdomTree.

Instead, Beijing appears focused on preventing consumption growth from slipping below a certain level, Ren noted, indicating sector growth of roughly 2% to 3%.

Crypto World

Can bulls break $2 as Bitcoin reclaims $65K?

XRP price is back in focus as Bitcoin stages a sharp 24-hour rebound, reclaiming the $65,000 level after dipping to roughly $62,800 earlier this week.

Summary

- Bitcoin has rebounded to $65,000 after defending the $62,800 support zone, shifting short-term momentum back to buyers.

- XRP is consolidating near $1.36, with resistance at $1.45 and $1.60, while $2 remains a distant macro target.

- The XRP/BTC pair remains in a broader downtrend, suggesting XRP is still underperforming Bitcoin despite improving momentum indicators.

Can XRP price follow Bitcoin’s $65K rebound?

The Bitcoin (BTC) price chart shows a strong impulsive bounce, with BTC climbing back above short-term consolidation levels and attempting to stabilize after the heavy sell-off on Feb. 23–24.

The recovery suggests buyers are defending the mid-$62K region, turning it into near-term support, while $66,000–$67,000 now stands as immediate resistance.

Against this backdrop, the Ripple token (XRP) is trading near $1.36 on the daily chart, consolidating after a prolonged downtrend from above $2.20 in January. Price action shows XRP holding above the $1.30 support zone, with stronger structural support sitting near $1.20, the level that triggered the early-February bounce.

On the upside, XRP faces layered resistance at $1.45 and $1.60. A break above $1.60 would open the path toward $1.80, but bulls would still need a sustained breakout above that level before $2.00 comes into focus. At present, the $2 mark remains a distant macro resistance rather than an immediate target.

Indicators show tentative improvement. Balance of Power has flipped positive at 0.28, suggesting buyers are regaining short-term control, while the Chaikin Money Flow (CMF) has turned slightly positive at 0.03 — signaling mild capital inflows.

However, neither indicator reflects strong bullish momentum yet.

Meanwhile, the XRP/BTC pair remains in a broader downtrend, hovering around 0.0000209 BTC, indicating XRP is still underperforming Bitcoin. For a credible move toward $2, XRP would likely need not just Bitcoin stability above $65K, but also renewed relative strength against BTC.

For now, XRP’s outlook improves if $1.30 holds, but a decisive breakout above $1.60 is the real trigger bulls must clear before $2 enters the conversation. At current momentum, a move to $2 would likely require a broader market breakout led by Bitcoin clearing $67K.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business4 days ago

Business4 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business4 days ago

Business4 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat7 hours ago

NewsBeat7 hours agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat5 hours ago

NewsBeat5 hours agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech4 days ago

Tech4 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics4 days ago

Politics4 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat1 day ago

NewsBeat1 day agoPolice latest as search for missing woman enters day nine

-

Crypto World1 day ago

Crypto World1 day agoEntering new markets without increasing payment costs

-

Sports3 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market