Crypto World

Analysts Explain Why BTC Just Crashed to $65K and Where the Bottom Lies

Meanwhile, XRP continues to be the poorest performing altcoin today.

Bitcoin has officially wiped out all gains registered after the reelection of Donald Trump to step back in the White House at the end of 2024. The cryptocurrency plummeted to just over $65,000 minutes ago, which actually puts it in a minor loss since the presidential elections.

Moreover, this means that it has lost almost $25,000 since last Wednesday. It has also shed nearly 50% of its value since the all-time high marked in early October 2025.

Naturally, investors tend to ask themselves what the most probable reason is behind this crash. As with all previous declines from the past several weeks, it doesn’t seem to be aligned with problematic fundamentals within the BTC ecosystem as a whole.

Analysts from the Kobeissi Letter indicated that the actual reason behind the consecutive price dumps is “emotional” selling. Riskier assets, such as BTC, tend to move frequently due to investor sentiment, and the current bearish trend appears to be driven by a mass exodus without any fundamental basis.

BREAKING: Bitcoin falls below $66,000 for the first time since October 2024, now down -$11,000 this week alone.

This is beginning to feel like “emotional” selling. pic.twitter.com/SMUczlcNzo

— The Kobeissi Letter (@KobeissiLetter) February 5, 2026

Doctor Profit, an analyst known for their rather bearish calls who has been predicting a substantial crash for months, noted that they have placed “big buy” orders at around $57,000-$60,000, which could be the current trend’s bottom.

The analyst added that they plan to hold for 2-3 months, and they are not interested in buying higher than that.

You may also like:

“I consider $57k-$60k as a great entry to make money for the short term and gain some serious % before we continue going down.”

On the other hand, MMCrypto said he believes BTC is indeed in a bear market, but it’s almost over time-wise.

I think this Bitcoin Bear Market is almost over (time wise).

We are in the last capitulation move, which may continue for a bit. Once we have MAX PAIN, it’s over, soon!

I am getting ready NOW already.

MONEY MAKING TIME IS APPROACHING! 🚀

— MMCrypto (@MMCrypto) February 4, 2026

Elsewhere, the altcoins are getting obliterated as well, and XRP is the poorest performer for some reason. The token has plummeted by almost 20% in just 24 hours and now struggles below $1.25.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Buterin Targets Ethereum’s Core Bottlenecks with Bold Overhaul

Vitalik Buterin is shifting the Ethereum scaling conversation away from Layer 2 (L2) and back to the protocol’s core.

The Russo-Canadian innovator argues that Ethereum’s biggest long-term constraints are not rollups or blob capacity, but deeper architectural bottlenecks inside the network’s state tree and virtual machine.

Vitalik Buterin Proposes Deep Ethereum Overhaul Targeting State Tree and Virtual Machine Bottlenecks

According to Buterin, two components — the network’s state tree and virtual machine — account for more than 80% of the proving costs. This, he says, is a critical issue as zero-knowledge (ZK) technology becomes central to Ethereum’s roadmap.

“Today I’ll focus on two big things: state tree changes, and VM changes,” Buterin wrote, adding that both are “the big bottlenecks that we have to address if we want efficient proving.”

A Binary Tree Overhaul

At the heart of the proposal is EIP-7864, which would replace Ethereum’s current hexary Merkle Patricia tree with a binary tree design.

The change may sound subtle, but its implications are significant. Binary trees would produce Merkle proofs roughly 4 times shorter than the current structure, dramatically reducing verification bandwidth requirements.

That makes lightweight clients and privacy-preserving applications cheaper and more viable.

The new structure would also group storage slots into “pages,” allowing applications that load related data to do so more efficiently.

Many decentralized applications (dApps) repeatedly access adjacent storage slots. This means the upgrade could save more than 10,000 gas per transaction in some cases.

Buterin also suggested pairing the tree change with more efficient hash functions, potentially delivering further gains in proof generation speed.

More importantly, the redesign would make Ethereum’s base layer more “prover-friendly,” allowing ZK applications to integrate directly with Ethereum’s state instead of building parallel systems.

Zooming out, the binary tree proposal aims to consolidate a decade of lessons on state management into a cleaner, future-proof structure.

A Future Beyond the EVM?

Even more ambitious is Buterin’s long-term vision for Ethereum’s execution engine. He floated the idea of eventually moving beyond the Ethereum Virtual Machine (EVM) toward a RISC-V–based architecture.

RISC-V is a widely used open instruction set that could offer greater efficiency and simplicity.

Buterin argued that Ethereum’s increasing reliance on special-case precompiles reflects a deeper discomfort with the EVM itself.

If Ethereum’s core promise is general-purpose programmability, he suggested, then the VM should fully support that vision without excessive workarounds. A RISC-V-based VM could:

- Reduce complexity

- Improve raw execution efficiency, and

- Better align with modern zero-knowledge proving systems, many of which already use RISC-V environments internally.

In the near term, Buterin proposed a “vectorized math precompile,” described as a “GPU for the EVM.” This could significantly accelerate cryptographic operations.

Longer term, he outlined a phased transition in which RISC-V would first power precompiles, then support user-deployed contracts, and eventually absorb the EVM itself as a compatibility layer.

Debate Over Complexity

However, not everyone is convinced Ethereum needs more deep-layer changes. Analyst DBCrypto criticized what he described as growing abstraction across the Ethereum roadmap, including new frameworks aimed at addressing rollup fragmentation.

Each additional layer, he argued, increases complexity, introduces trust assumptions, and creates additional potential attack surfaces.

The tension reflects a broader debate over whether Ethereum should continue layering solutions on top of its existing design or rework its foundation.

However, according to Vitalik Buterin, Ethereum’s architecture must evolve and adapt as zero-knowledge proofs move from a niche to a necessity.

The next phase of scaling, he suggests, may not occur on Layer 2 but rather deep within Ethereum’s core.

Crypto World

Altcoin Season Index Is Rising While Bitcoin Remains Under Pressure: Here is Why

TLDR:

- The Altcoin Season Index shows 24 out of 55 altcoins outperforming Bitcoin on a rolling 60-day basis.

- Altcoin bear markets historically last 7 to 11 months, while Bitcoin bear markets typically run closer to 12 months.

- Many altcoins have already dropped 80% to 90% from cycle highs, leaving less room to set new lows.

- The index measures relative performance, meaning altcoins are falling less than Bitcoin, not necessarily recovering yet.

The Altcoin Season Index is rising, and the numbers behind it tell a specific story. At 24 out of 55 altcoins outperforming Bitcoin over a rolling 60-day period, the index sits just below the midpoint between Bitcoin season and altcoin season.

The direction from its recent low is upward. Understanding what the index actually measures helps explain why this reading matters in the current market environment.

What the Index Measures and Why the Current Reading Stands Out

The Altcoin Season Index tracks relative performance, not absolute price movement. When more altcoins outperform Bitcoin over a 60-day window, the index rises.

That does not mean altcoins are going up in price. It means they are falling less than Bitcoin during the same period.

This distinction is critical for reading the current data correctly. Crypto markets remain under broad pressure, with fear at historically high levels. Yet the index has been climbing from its recent trough.

That combination points to altcoins holding ground better than Bitcoin, not staging independent recoveries.

Analyst Joao Wedson addressed this pattern directly in a recent post. He noted that altcoin bear markets historically last between 7 and 11 months, while Bitcoin bear markets run closer to 12 months.

That shorter cycle duration means a portion of the altcoin market can complete its bear phase while Bitcoin is still declining. The index rising during Bitcoin weakness is consistent with that historical pattern.

The chart history of the index shows it can move from the neutral zone into altcoin season territory quickly. It can also reverse just as fast. The current reading reflects what is happening across the altcoin market right now, not what comes next.

The Floor Dynamic Behind the Data

A second factor helps explain the index behavior. Many altcoins have already declined 80% to 90% or more from their cycle highs.

Assets that have fallen that far carry less downside risk in percentage terms, even if Bitcoin drops further. That arithmetic shapes how the index moves.

Wedson noted that two thirds of altcoins may not set new lows even if Bitcoin makes fresh cycle lows. That observation is not a bullish call.

It reflects the reality that deeply discounted assets have proportionally less room to fall further. The index rising during this period is partly a result of that floor dynamic playing out across the altcoin market.

During the middle phase of Bitcoin bear markets, history shows that many altcoins rally and outperform BTC. That mid-cycle divergence is visible in the current data.

The index moving upward while Bitcoin remains under pressure aligns with how this phase has unfolded in previous cycles.

Wedson also noted that altcoins can serve as a vehicle to accumulate more Bitcoin in this environment. Rotating through discounted altcoins that outperform Bitcoin can grow BTC holdings over time.

He acknowledged the strategy carries complexity for most investors, but the data behind the index supports the broader market dynamic he describes.

Crypto World

Kalshi founder updates on Iran’s Khamenei market carveout

Prediction-market operator Kalshi voided certain contracts tied to the death of Iran’s top leader after his passing was confirmed, saying it designed safeguards to prevent profits from outcomes involving death. The death, reported by Iranian state media early Sunday after an attack by Israel and the United States, prompted traders to move into markets such as “Ali Khamenei out as Supreme Leader.” Co-founder Tarek Mansour explained on X that the platform does not list markets directly connected to death and that the rules were applied to prevent profit from such outcomes. Kalshi has since reimbursed fees for the affected market and set settlements according to the last-traded price prior to the death event.

In the platform’s own words, the policy is clear and longstanding: death-related markets are not listed, and mechanisms exist to deter profit from catastrophic events. Kalshi reiterated this stance on Saturday, stressing that the death carveout was embedded in the market’s rules. Still, the decision generated backlash online, with users arguing that the platform was curbing potential profits. The linked market for the event—“Ali Khamenei out as Supreme Leader”—remains available only under the clarified rules, and the refunds reflect Kalshi’s effort to close the episode with financial fairness for participants who were in before and after the event.

The exchange said it would reimburse all fees for participants in the death-market and would settle traders who held bets based on the last-traded price before the death. Those who opened positions after the death were also reimbursed, with the difference between the entry price and the last-traded price returned. The policy has become a focal point for debates about how prediction markets should respond to geopolitical turnarounds and sensitive events, highlighting tensions between user expectations and platform safety nets.

The broader conversation around political and geopolitical markets extended beyond Kalshi. Earlier coverage highlighted a related issue on rival platforms, where questions about insider trading and the surfacing of sensitive information prompted scrutiny. For instance, a February episode on Polymarket drew attention after six traders netted about $1 million on bets about a U.S. strike on Iran, with wallets created that month and some positions filled just hours before explosions in Tehran, according to Bloomberg. Among other threads, the narrative tied into comments from political figures who criticized information handling and raised questions about the integrity of event-driven markets.

Kalshi’s position underscores a recurring tension in prediction markets: the desire for liquidity and profitability versus safeguards that prevent exploitation of real-world events. The company’s co-founder, in his post on X, framed the approach as a principled stance to prevent profit from death, a line that some traders interpret as protective discipline and others as a restraint on market opportunities. The platform’s ongoing emphasis on rule-based conduct suggests a continued commitment to transparency around how markets are structured and settled, including how post-event price dynamics influence refunds and settlements.

In parallel coverage, a briefing about related insider-trading concerns on Polymarket signaled how geopolitical volatility can intensify debate around predictive trading. The February surge in bets around a potential strike on Iran, coupled with the rapid wallet activity observed by analysts, prompted calls for enhanced scrutiny of how information flows influence on-chain markets. While Kalshi’s policy remains explicit about death-related markets, the broader ecosystem continues to wrestle with questions about fairness, transparency, and the potential for speculative activity to intersect with real-world events in unpredictable ways. The discussions around those questions—spurred by both Kalshi’s decision and the Polymarket episode—reflect the evolving regulatory and community norms governing digital-age prediction platforms.

Key takeaways

- Kalshi voided the “Ali Khamenei out as Supreme Leader” market after confirmation of the death, applying rules designed to prevent profits tied to death-related outcomes.

- The platform reimbursed all fees for the affected market and settled positions using the last-traded price prior to the death event.

- Traders who opened positions after the death were refunded the difference between entry prices and the last-traded price, according to Kalshi’s announcements.

- The death-market policy is described as long-standing, with the rules clearly stated in the market’s framework, yet the decision drew online backlash from users who felt profits were being curtailed.

- Geopolitical event-driven markets on other platforms, such as Polymarket, have faced insider-trading scrutiny and rapid, market-driven activity around sensitive events, illustrating broader tensions in the space.

Sentiment: Neutral

Price impact: Neutral. The refunds and settlement mechanics aimed to neutralize profit opportunities tied to the event, with no evidence of material market disruption described in the sources.

Market context: The episode sits within a broader pattern of how prediction markets respond to geopolitical shocks, balancing user demand for tradable exposure with safeguards to deter exploitation of real-world events. As regulators and platforms scrutinize on-chain and event-based markets, governance decisions like Kalshi’s illustrate how policy design shapes liquidity, risk, and user trust across the ecosystem.

Why it matters

The decision to void a death-related market and refund participants highlights a core challenge for modern prediction platforms: protecting users while maintaining transparent, rule-based operations around volatile, high-stakes events. For traders, this episode reinforces that markets anchored to real-world outcomes can trigger rapid policy shifts, especially when outcomes touch sensitive or destabilizing events. The policy keeps the platform aligned with ethical considerations that discourage profiting from human tragedy, but it also raises questions about the breadth of such rules and how they apply to future situations.

From the builders’ perspective, Kalshi’s stance demonstrates how market design can embed safeguards that reduce mispricing risk and potential manipulation. The explicit rule set—paired with a clear post-event settlement framework—provides a reproducible approach for handling similar events in the future. For users, the episode underscores the importance of understanding the platform’s rules before placing bets, particularly in markets connected to political or humanitarian events that may spiral into unforeseen consequences.

For the broader crypto and on-chain ecosystem, the episode sits at the intersection of liquidity, risk sentiment, and regulatory scrutiny. It accents the ongoing debate about how decentralized or semi-decentralized prediction markets should operate when real-world events intersect with volatile capital flows. As the market landscape evolves, stakeholders will watch for how platforms balance openness and safety, how settlements are executed in edge cases, and how governance processes respond to investor expectations during periods of geopolitical flux.

What to watch next

- Kalshi’s continued enforcement and clarification of its death-market policy, including any updates to the market’s rules or post-event settlement practices.

- Regulatory or community responses to the incident, and whether other markets adjust their own death-related or sensitive-event rules in response.

- Ongoing scrutiny of insider-trading allegations on prediction markets, particularly around geopolitical events, and what disclosures or safeguards platforms adopt.

- Developments around the specific market page for this event (kxkhameneiout) and any subsequent disclosures from Kalshi about settlements or future similar markets.

- Further analysis or reports on how price discovery and liquidity behave in event-driven markets during geopolitical shocks, including comparisons with rival platforms.

Sources & verification

Kalshi’s death-market decision and its implications

Kalshi faced a moment of policy clarity as it acted to void a market tied to the death of a major political figure and to reorganize post-event settlements. The company’s leadership underscored that markets framing fatal outcomes were never intended to function as profit channels, reinforcing a boundary around event-driven contracts that hinge on real-world violence or loss. The decision to reimburse all fees for the affected market and to settle participants using the last-traded price prior to the event reflects a deliberate approach to minimize financial risk for users while upholding a principled rule set. In parallel, the company reaffirmed the rule that markets do not list death-related outcomes, a position that has implications for how the platform will handle similar events in the future and how users should approach these markets going forward.

From a governance perspective, the episode demonstrates the importance of transparent disclosures and timely communication with users. By publicizing the policy and the settlement approach, Kalshi aims to maintain trust and deter opportunistic trading around sensitive developments. For participants, the refunds and price-based settlements provide a defined path for recourse when the market design encounters unforeseen real-world triggers. For observers and analysts, the event serves as a case study in how prediction markets navigate the delicate balance between liquidity and ethical boundaries, and how this balance shapes the broader market’s resilience amid geopolitical tension.

Looking ahead, industry watchers will be watching for how Kalshi and other platforms articulate any updates to their market rules, how they monitor for potential rule violations in edge-case scenarios, and how regulators respond to the increasing convergence of finance with geopolitics in the digital trading space. The dialogue surrounding dead-man markets, insider trading concerns, and the integrity of price discovery in crisis moments is likely to intensify as platforms refine their policies and governance practices in the months ahead.

Crypto World

Solana Price Coils for Big Move After 4 Weeks of Consolidation

Solana price has remained rangebound for nearly four weeks, trading within a tight horizontal structure. The altcoin has repeatedly tested both support and resistance without establishing a decisive trend.

This prolonged consolidation has compressed volatility and placed investor behavior at the center of the next potential breakout.

Market conditions now present a two-sided scenario. A surge in demand could trigger a sharp upward move. Conversely, weakening conviction may push SOL toward lower support levels.

Solana Holders Need To Hold On

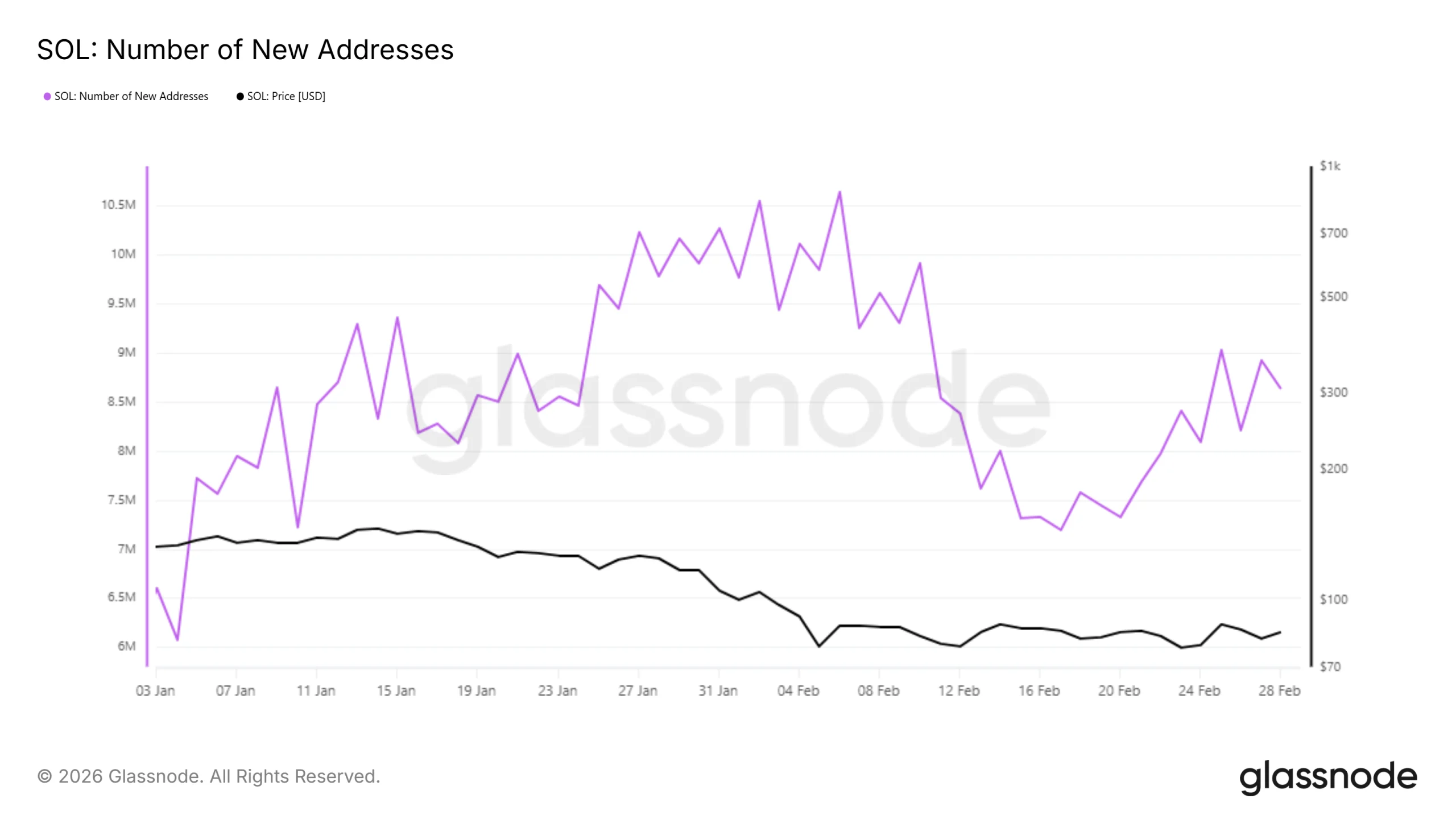

On-chain data shows that new Solana addresses are rising again. Increased network onboarding signals renewed interest in the ecosystem. Fresh participants typically introduce additional liquidity, which can support price stability and breakout attempts.

Over the past 12 days, daily new addresses have increased by 1.4 million, reaching 8.6 million. This expansion indicates improving engagement across the network. Growing user activity strengthens the fundamental case for Solana and could underpin a future price advance if sustained.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The HODLer net position change metric reveals continued resilience among long-term holders. While the pace of accumulation has slowed, the broader trend still reflects net positive positioning. Long-term conviction remains intact despite short-term volatility.

However, the moderation in buying momentum is notable. Persistent holding has helped keep the Solana price consolidated rather than declining sharply. If long-term holders shift from accumulation to distribution, downside pressure could intensify quickly and disrupt the current balance.

SOL Price Breakout On The Cards

Solana is trading at $85 at the time of writing, confined within a $77 to $88 range. Multiple breakout attempts have failed, reinforcing the strength of these boundaries. A decisive move beyond either level is likely to define short-term direction.

Bollinger Bands are converging, signaling a volatility squeeze. Such compression often precedes a significant price expansion. If bullish momentum aligns with the volatility release, SOL could breach $88 and target $97. A sustained move above $97 would place Solana back above $100, restoring broader optimism.

However, failure to attract sufficient buying pressure may result in continued range-bound movement. If long-term holders reduce exposure, the Solana price could revisit $77 support. A breakdown below that threshold would expose $67 as the next key level, invalidating the bullish thesis and reinforcing a bearish outlook.

Crypto World

Bitcoin logs third-worst Q1, Ethereum falls 32%

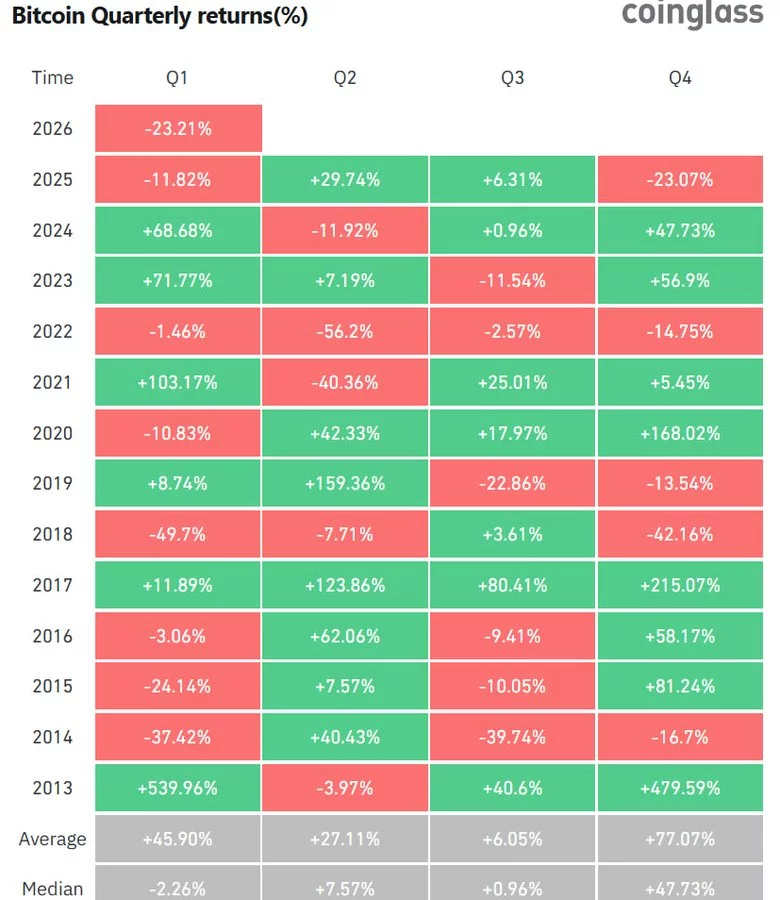

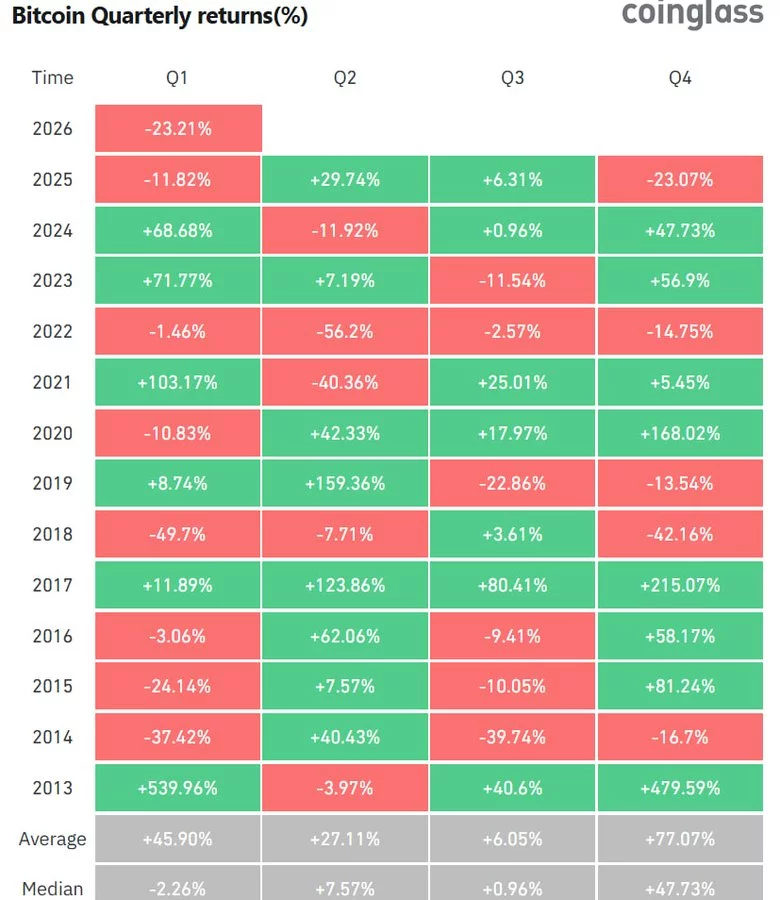

Bitcoin posted a -23.21% return in Q1 2026 and marked the third-worst first-quarter performance since 2013 according to CoinGlass data.

Summary

- Bitcoin fell 23% in Q1 2026, its third-worst first quarter on record.

- Ethereum dropped 32%, also marking its third-worst Q1 performance.

- Back-to-back quarterly losses follow the October 2025 market peak.

The loss falls far below Bitcoin’s (BTC) historical Q1 average of 45.90% and sits well below the median return of -2.26%.

Only two prior first quarters posted worse performance: Q1 2018 at -49.7% and Q1 2014 at -37.42%.

Ethereum fared worse with -32.17% in Q1 2026, also the third-worst since 2016, trailing its historical Q1 average of 66.45% and median return of 4.37%.

Bitcoin historical Q1 pattern shows mixed performance across years

Bitcoin’s quarterly returns since 2013 show no consistent first-quarter pattern. Strong Q1 gains in 2013 (+539.96%), 2021 (+103.17%), 2023 (+71.77%), and 2024 (+68.68%) contrast sharply with losses in 2014 (-37.42%), 2015 (-24.14%), 2018 (-49.7%), 2022 (-1.46%), 2025 (-11.82%), and 2026 (-23.21%).

The historical Q1 average of 45.90% gets pulled higher by extreme outliers like 2013’s +539.96% and 2021’s +103.17%.

The median Q1 return of -2.26% provides a more accurate picture, showing first quarters tend toward slight losses more often than gains.

Q4 historically posts the strongest performance with a 77.07% average and 47.73% median. Q2 averages 27.11% with a 7.57% median, while Q3 averages 6.05% with a 0.96% median.

Recent years show increasing volatility. 2024 posted strong gains across Q1 (+68.68%), Q3 (+0.96%), and Q4 (+47.73%) while Q2 dropped -11.92%. 2025 saw Q2 (+29.74%) and Q3 (+6.31%) gains offset by Q1 (-11.82%) and Q4 (-23.07%) losses.

2026 Q1 decline follows October liquidation event

The Q1 2026 loss follows Bitcoin’s October 2025 all-time high and the October 10 liquidation event that triggered $19 billion in market-wide liquidations.

Bitcoin fell from $126,080 to current levels around $66,000, a 48% decline from the peak.

Q1 2026’s -23.21% return exceeds Q4 2025’s -23.07% loss, creating back-to-back losing quarters.

The last time Bitcoin posted consecutive quarterly declines occurred in 2022, which saw losses across all four quarters: -1.46%, -56.2%, -2.57%, and -14.75%.

Crypto World

Stablecoins Challenge Traditional Banks as Yield Gap Widens and Regulatory Debate Intensifies

TLDR:

- Stablecoins like USDC and PYUSD now offer yields above 4%, far outpacing bank savings rates near 0.01%.

- The CLARITY Act missed its March 1, 2026 deadline amid heavy banking industry resistance in the Senate.

- Tokenized T-bills settle instantly and globally, cutting out SWIFT fees and traditional multi-day windows.

- JPMorgan analysts flagged CLARITY Act passage as a potential trigger for major crypto inflows in late 2026.

Stablecoins are reshaping how retail and institutional investors think about deposit alternatives. Digital dollar assets like USDC and PYUSD now offer yields above 4%, delivered through exchanges, wallets, and decentralized protocols.

Meanwhile, traditional savings accounts at major banks remain near 0.01%. The growing gap has sparked fierce debate in Washington, with the CLARITY Act stalling past its March 1, 2026 White House deadline amid continued banking industry resistance.

Yield Competition Puts Banks Under Pressure

Banks have long profited by collecting deposits at low rates and lending them out at 5–7%. That spread model is now facing a direct challenge from stablecoin issuers.

Treasury-bill reserves backing these digital assets generate 4–5% returns, which platforms pass along to holders through revenue-sharing programs.

Crypto analyst Adam Livingston argued on X that the banking sector is losing this battle by choice. He wrote that stablecoins offer “zero branches, zero tellers, and zero KYC theater for every transaction” while reserves sit in actual T-bills that return yield directly to users.

The cost structure difference between banks and stablecoin issuers is hard to ignore. Legacy systems, compliance teams, and physical infrastructure drive overhead costs for traditional banks. Stablecoin platforms, by contrast, operate with far leaner models and pass savings to users.

Regulatory Battles Reflect Industry Tensions

The GENIUS Act attempted to prevent stablecoin issuers from paying direct interest to holders. However, the market adapted quickly.

Exchanges and smart contracts now route Treasury returns to users without issuers paying interest directly.

The CLARITY Act, which would have established broader crypto market structure rules, missed its March 1 deadline. Banking lobbyists remain active in Senate Banking Committee discussions.

Critics say the industry is pushing for regulatory barriers rather than competing on product quality.

Livingston was pointed in his criticism, writing that banks “pressured the OCC into a 376-page rulemaking precisely to close loopholes” that allowed customers to earn market-rate yields. He suggested the banking lobby prefers legislative protection over innovation.

The Office of the Comptroller of the Currency rulemaking referenced in that critique targeted programs like Coinbase’s revenue-sharing model. Whether regulators will sustain that approach remains an open question as the debate continues in Congress.

Market Shifts Signal Long-Term Structural Change

Tokenized real-world assets are already settling on-chain at faster speeds and lower costs than traditional systems.

Products like tokenized T-bills allow investors to hold interest-bearing instruments globally without SWIFT fees or multi-day settlement windows. This represents a fundamental change in how capital moves.

JPMorgan’s internal analysts, according to Livingston, have quietly acknowledged that CLARITY Act passage could trigger significant crypto inflows in the second half of 2026.

Meanwhile, both retail and institutional money continues moving toward yield-bearing digital assets. The trend is gaining momentum regardless of legislative outcomes.

The Silicon Valley Bank collapse in 2023 added a new dimension to the stablecoin conversation. Fully reserved stablecoins carry a different risk profile than fractional-reserve bank deposits, and that distinction is drawing attention from investors who lived through recent bank failures.

The deposit flight narrative is no longer theoretical — it is showing up in capital flow data across the financial sector.

Crypto World

Handling $50M in ARC Perpetual Volume

Lighter reported that its upgraded liquidity pool system successfully limited ADL losses to a pre-determined threshold.

On February 26, Lighter, a decentralized crypto exchange, announced that its upgraded liquidity pool system successfully resisted a $50 million ARC perpetual long squeeze attempt.

This occurred after approximately 600 traders reversed a whale’s position, resulting in an $8.2 million loss, and the episode tested Lighter’s newly launched LLP Strategies, capping the downside risk for liquidity providers at just $75,000.

LLP Strategies Face First Stress Event

In a February 17 post on X, Lighter announced changes to its LLP infrastructure, splitting liquidity into separate strategies for different market types, including RWAs. Risk, liquidations, and auto-deleveraging are now handled at the strategy level rather than across the entire pool.

That structure faced what the platform called its “first battle test” on February 26. According to Lighter, a trader had built a large long position in ARC perpetuals over several days, with around 600 other traders and market makers taking the short side and pushing total open interest to $50 million.

ARC perp trading was assigned to Strategy #7, a high-risk strategy with about $75,000 in allocated USDC. Lighter said this meant only that portion of LLP deposits could be exposed if auto-deleveraging occurred.

As ARC’s price fell around 6 p.m. ET on February 26, the large long position was first liquidated on the order book for roughly $2 million. Lighter said LLP was initially in profit on the position, but further downside depleted Strategy #7, triggering another ADL at 0.071123. In the end, the whale lost about $8.2 million, LLP lost its capped $75,000 allocation, and short traders who held their positions were profitable.

ARC Price Collapse

The unwind left visible scars on the ARC price chart, with data from CoinGecko showing the token experienced a flash crash in the early hours of February 27, sliding from around $0.031 to $0.025 before recovering to $0.0348.

You may also like:

At the time of writing, ARC, which powers the Ryzome agentic AI “app store,” was down over 9% in 24 hours and nearly 59% across seven days. The token has also lost more than 63% of its value in the past two weeks, as well as falling 42% over 30 days. It currently sits 95% below its January 2025 all-time high of $0.62, having shed nearly 88% off its price in the past year.

This turbulence matches up with observations from crypto commentator Simon Dedic, who noted that ARC’s value had dipped overnight by about 80% on volumes approaching $400 million, which was nearly ten times its fully diluted valuation.

Dedic pointed out that before dumping, the token had been “massively outperforming” despite a weak market, even suggesting it had been “heavily manipulated.”

The concerns raised by Dedic echo a broader industry debate about market integrity. Just last month, Base co-founder Jesse Pollak rejected the idea of behind-the-scenes manipulation, stating his team won’t coordinate or deploy capital to influence prices because markets “deserve to be free, open, and fair.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

What the U.S. Treasury’s $745 Million TIPS Buyback Actually Means for the National Debt

TLDR:

- The U.S. Treasury confirmed a $745 million TIPS buyback on February 25, 2026, as part of routine debt management.

- The $2.7 billion weekly repurchase operation accounts for less than 0.008% of the total $35 trillion national debt.

- Treasury buybacks have been used since 2002 to improve bond market liquidity and manage maturity structure efficiently.

- The repurchase reshuffles existing debt obligations but does not cancel principal or alter the broader fiscal debt outlook.

U.S. Treasury buyback operations came into focus on February 25, 2026, as the government confirmed a $745 million repurchase of Treasury Inflation-Protected Securities (TIPS).

The transaction was part of a broader $2.7 billion repurchase program executed that same week. The bonds involved fall within a 2027–2036 maturity range.

While the action reflects active portfolio management, analysts note it does not reduce the national debt. The total U.S. debt currently exceeds $35 trillion.

Treasury Buyback Functions as a Routine Portfolio Management Tool

The U.S. Treasury buyback program has been in active use since 2002. Over recent years, the program has been expanded to meet growing bond market demands.

The primary goal is to enhance liquidity in older, less actively traded bond issues. These operations also help smooth refinancing cycles and manage interest rate exposure.

Paul White Gold Eagle noted on X that the $2.7 billion weekly operation represents less than 0.008% of total outstanding debt.

The $745 million TIPS repurchase amounts to roughly 0.00002% of the total federal debt load. These figures make clear that the buyback operates within a narrow financial scope. It does not translate into any measurable reduction in overall debt.

Treasury officials describe the buyback as a tool to improve functioning in bond markets. The operation also aims to maintain stability within secondary markets for government securities.

By targeting bonds in the 2027–2036 maturity range, the Treasury manages its future refinancing schedule. This approach is designed to reduce rollover risk over the medium term.

The buyback ultimately reshuffles existing obligations within the Treasury’s broader issuance strategy. It does not cancel debt or reduce the principal amount owed to bondholders.

Rather, it adjusts the composition of outstanding securities in circulation. This distinction matters when assessing the true fiscal result of such operations.

Structural Debt Concerns Stay Unchanged After the Repurchase

The broader debt picture remains a pressing concern for fiscal observers and analysts. The national debt now surpasses $35 trillion and continues on an upward path.

A $745 million repurchase barely registers against that scale of obligation. The gap between buyback size and total debt volume remains enormous.

Without long-term spending reform or meaningful revenue adjustments, the debt trajectory stays the same. Portfolio adjustments are not a substitute for genuine fiscal consolidation measures.

Treasury repurchase operations serve operational and technical goals, not fiscal reduction ones. Debt reduction requires legislative action and structural policy changes.

As Paul White Gold Eagle stated, this action “is not debt cancellation.” It remains a standard liquidity and portfolio management tool.

The buyback does improve technical efficiency within bond markets during periods of tighter financial conditions. However, it leaves the macro debt outlook fundamentally unchanged.

Market observers continue watching Treasury operations closely for signals of any broader fiscal strategy. For now, the $745 million repurchase remains a routine technical adjustment within existing programs.

It reflects the Treasury’s ongoing effort to manage the maturity structure of current obligations. The national debt trajectory, however, continues on its present course without alteration.

Crypto World

Kalshi Founder Outlines Next Steps for ‘Iran Leader Ousted By’ Market

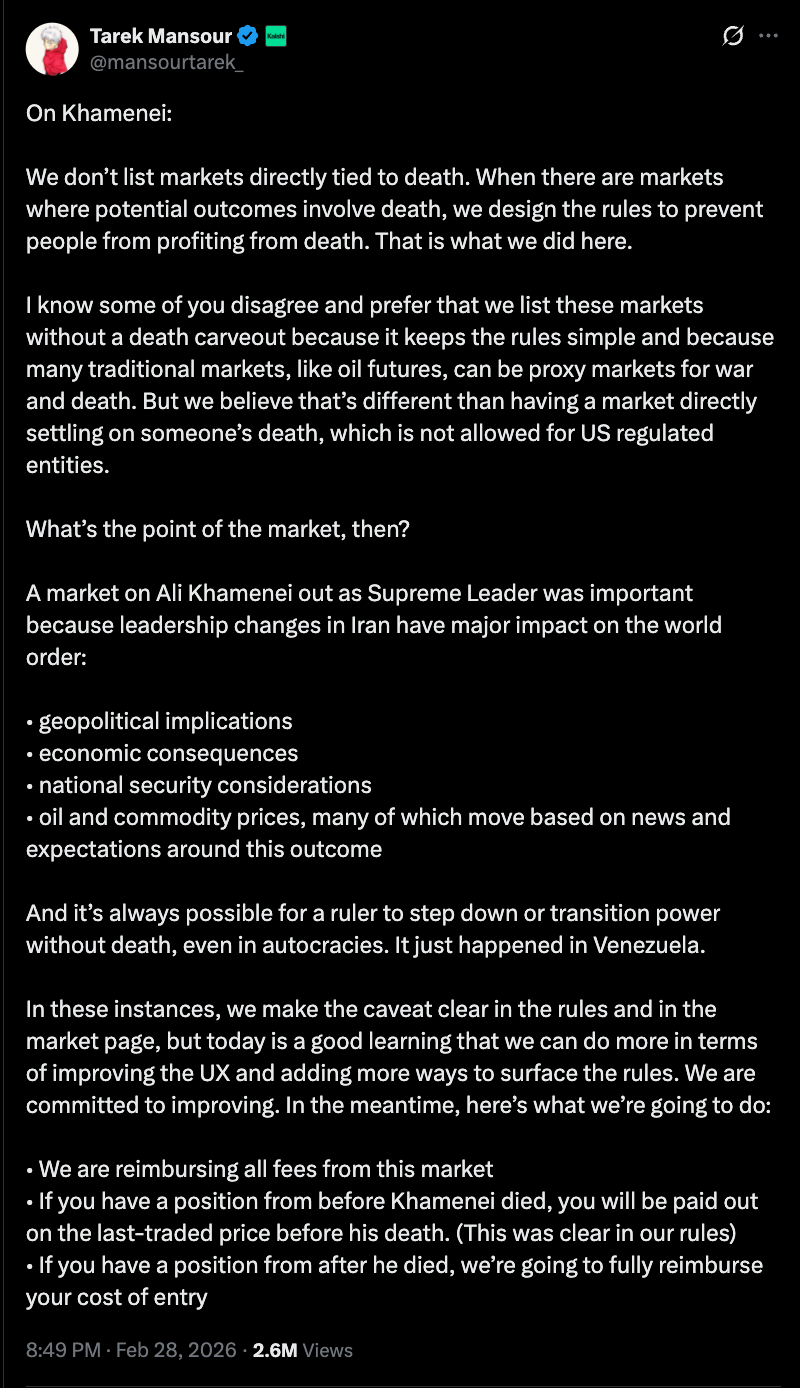

Tarek Mansour, the co-founder of prediction market Kalshi, provided an update, following the platform’s decision to void some positions that were opened after the death of Iran’s Supreme Leader Ayatollah Ali Khamenei was confirmed.

“We don’t list markets directly tied to death. When there are markets where potential outcomes involve death, we design the rules to prevent people from profiting from death. That is what we did here,” Mansour said in a post on X.

Iranian state media reported the death early Sunday, after an attack launched by Israel and the United States a day earlier.

Kalshi is reimbursing all fees from the “Ali Khamenei out as Supreme Leader” market, and will pay traders with positions open before Khamenei died according to the “last-traded price before his death,” Mansour said.

Additionally, users who opened positions after the death of Khamenei were reimbursed the difference between the higher price paid for entry and the last traded price.

A Kalshi spokesperson told Cointelegraph that the platform’s policy on not allowing “death markets” is clear and long-standing.

The platform reiterated the policy on Saturday, and Mansour said that the death carveout stipulations were clearly stated in the rules for the market. However, the decision sparked backlash from users online, who accused the platform of curtailing user profits.

Related: Kalshi bans US politician over alleged insider trading violation

Suspicions of insider trading activity on prediction market platforms rise amid geopolitical tensions

In February, six traders on rival prediction market Polymarket netted about $1 million betting that the US would initiate a strike on Iran before the end of the month.

All six wallets were created in February, mostly bet on markets related to a strike on Iran, and some of the positions were filled hours before the first explosions were heard over the Iranian capital of Tehran, according to Bloomberg.

The trading patterns raised suspicion of insider trading activity among onchain investigators and analysts.

In January, US President Donald Trump announced that the individual who leaked information tied to the raid and capture of former Venezuelan President Nicolás Maduro had been arrested by US law enforcement.

The comments fueled speculation from onchain analysis platform Lookonchain that the leaker Trump was referencing may have been linked to winning bets on Polymarket placed shortly before the US raid in Caracas.

Magazine: Astrology could make you a better crypto trader: It has been foretold

Crypto World

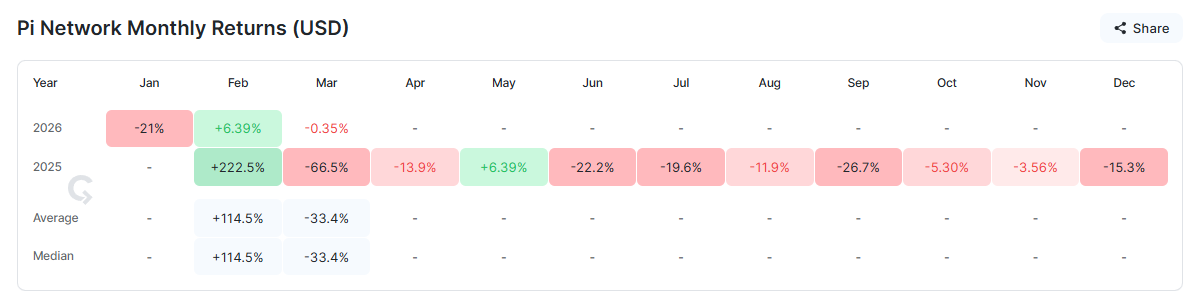

Pi Coin Price Prediction For March 2026

Pi Coin price is attempting to recover after forming a new all-time low earlier this month. The altcoin has shown modest strength in recent sessions, holding above key short-term support.

However, broader technical indicators and historical patterns suggest that Pi Coin’s price recovery may face significant resistance in March 2026.

While some investors anticipate stabilization, momentum indicators highlight persistent weakness. Past seasonal trends and current capital flows imply that Pi Coin could remain under pressure unless buying demand improves meaningfully.

Pi Coin’s Past Is Bleak

March has historically been volatile for Pi Coin. In March 2024, PI declined by 66.5%, marking its weakest monthly performance on record. That steep drop followed its initial launch phase, when early participants moved quickly to secure profits.

The sharp decline was largely driven by immediate post-launch distribution. Early miners and holders capitalized on newly available liquidity. Those specific launch-related dynamics do not fully apply today. However, the memory of extreme volatility still shapes investor caution entering March 2026.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

PI Holders Aren’t Too Supportive

The Money Flow Index now signals renewed selling pressure. MFI has slipped below the neutral 50 mark, reflecting capital outflows rather than sustained inflows. This shift often precedes extended corrective phases when buyer conviction weakens.

Historically, whenever MFI dropped below neutral for PI, the price tended to decline until buying momentum returned. Current readings suggest that sellers remain active. Unless the indicator rebounds above 50, downside risks may continue to outweigh short-term recovery attempts.

The Chaikin Money Flow indicator reinforces this cautious outlook. CMF has remained below the zero line for nearly three consecutive weeks. Persistent negative readings signal ongoing net outflows from Pi Coin.

These outflows indicate fading investor confidence. Reduced participation from new buyers compounds the issue. Without fresh capital entering the ecosystem, upward price movements may lack sustainability. Weak inflows often limit breakout potential and increase vulnerability to corrections.

PI Price May See a Reversal

Pi Coin price is trading at $0.1701 at the beginning of March, holding above an ascending trendline support. Immediate resistance sits at $0.1752. Despite this structure, technical indicators suggest that March may bring corrective pressure rather than sustained gains.

Quarterly performance adds another layer of concern. Following mixed results in January and February, Pi Coin is tracking a 16% loss for Q1 2026. Closing the quarter in negative territory could weigh on investor sentiment heading into Q2, especially if broader crypto market conditions remain cautious.

If selling pressure intensifies, Pi Coin may decline toward the $0.1597 support level. A breakdown below that threshold would likely expose $0.1502. Continued weakness could push the price closer to the all-time low of $0.1300, increasing downside risk in the near term.

The bearish thesis would be invalidated only if buyers regain control. A decisive breakout above $0.1752 would be the first signal of strength. Flipping $0.2002 into support would confirm renewed bullish momentum. Sustained inflows and improved sentiment would be required to support such a move and stabilize Pi Coin price action.

-

Sports6 days ago

Sports6 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Iris Top

-

Politics6 days ago

Politics6 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business5 days ago

Business5 days agoTrue Citrus debuts functional drink mix collection

-

Politics3 days ago

Politics3 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech18 hours ago

Tech18 hours agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Tech5 days ago

Tech5 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat1 day ago

NewsBeat1 day agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat1 day ago

NewsBeat1 day agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat8 hours ago

NewsBeat8 hours ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat6 days ago

NewsBeat6 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat1 day ago

NewsBeat1 day agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoPolice latest as search for missing woman enters day nine

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Sports6 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Business3 days ago

Business3 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality