Crypto World

Analytical Silver Price Forecasts for 2026 and Beyond

Silver continues to sit at the intersection of monetary confidence, industrial transformation, and geopolitical tension. Its price history shows repeated phases of sharp repricing followed by consolidation, reflecting shifts in macro conditions rather than steady progression.

Looking ahead, silver’s role in electrification, combined with fiscal and currency dynamics, keeps it firmly in focus for market participants. This article examines silver’s historical price behaviour and provides analysts’ silver price predictions for the next 5 years, placing recent developments within a broader market context.

Analytical Forecast Summary

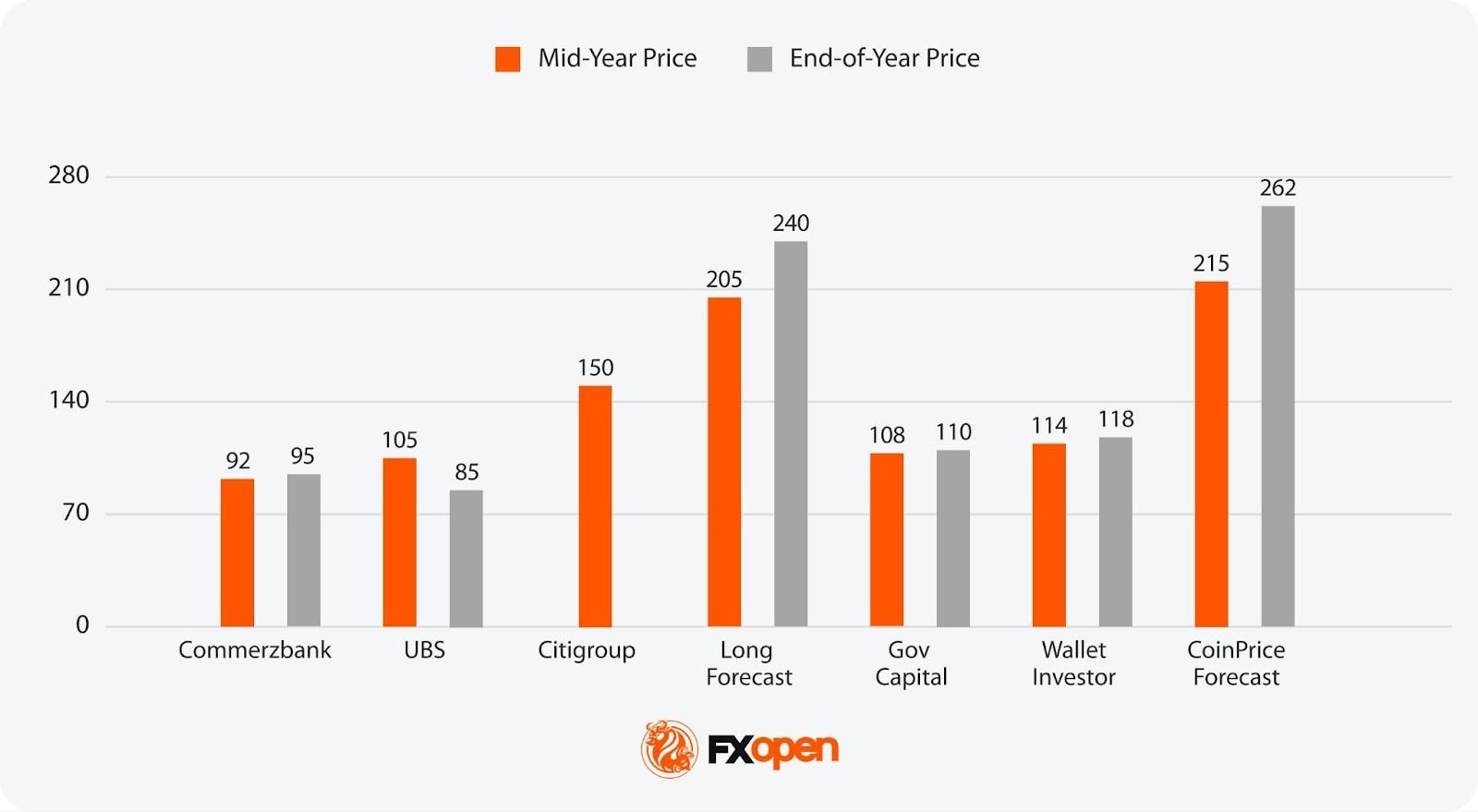

2026

For 2026, estimates span roughly $92 to $262, with bank views clustering around $100 while some retail-aggregator models extend far higher. The spread reflects uncertainty around real yields, dollar direction, and how long physical tightness persists after the January volatility spike.

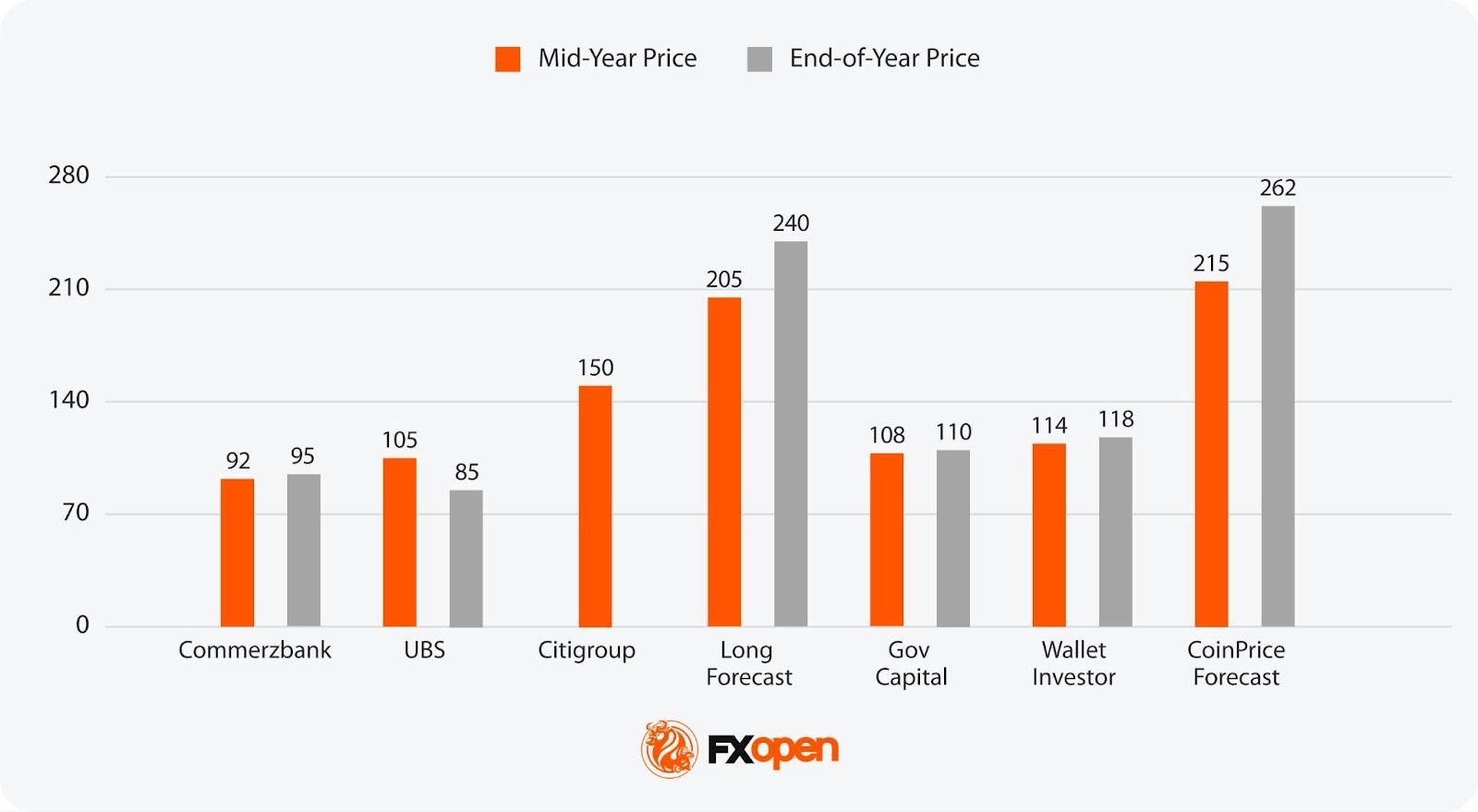

2027

In 2027, forecasts widen further, from about $112 to $374. Some views lean on a lower gold-silver ratio as a driver of relative upside, while others assume industrial thrifting and substitution cap follow-through after any sharp repricing

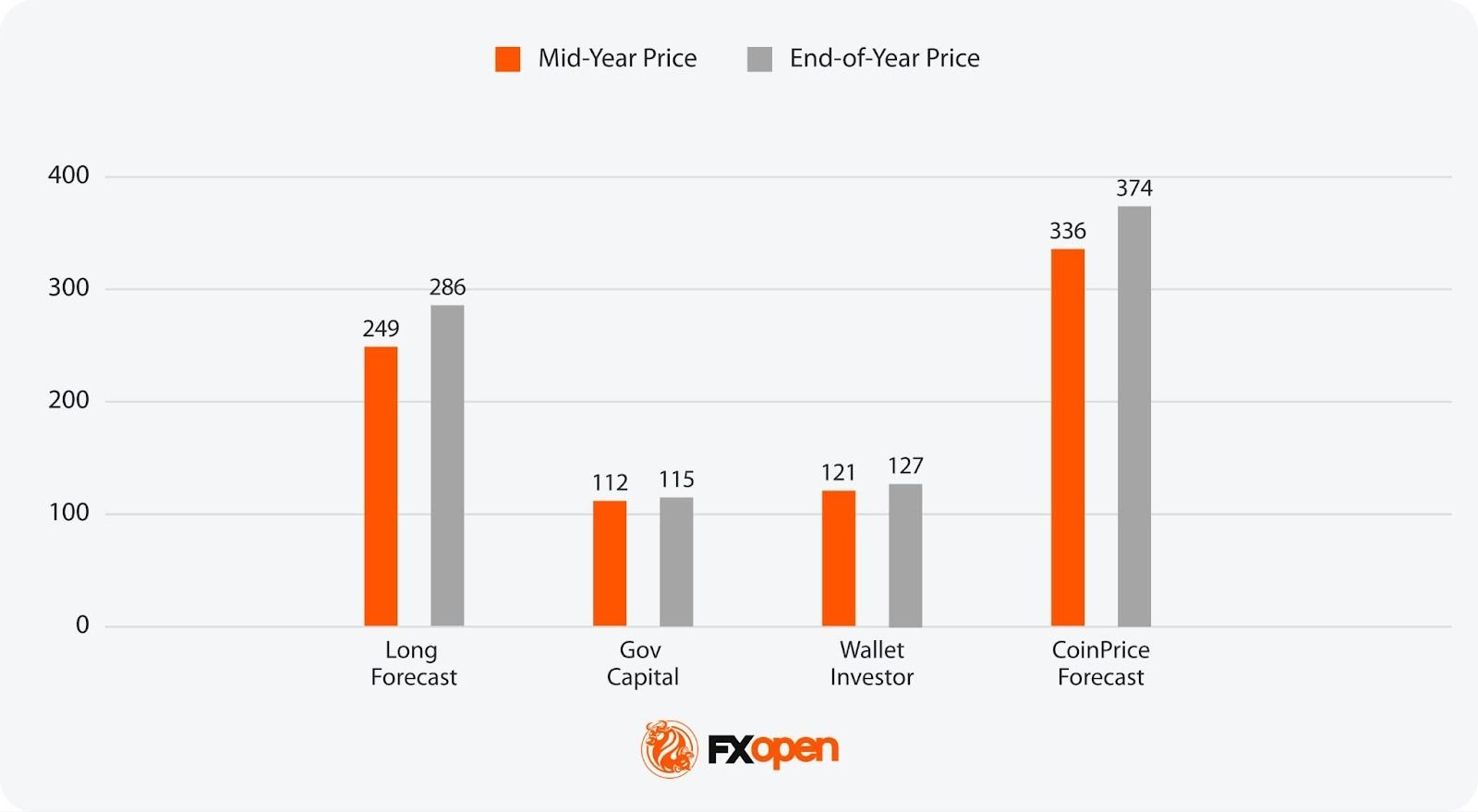

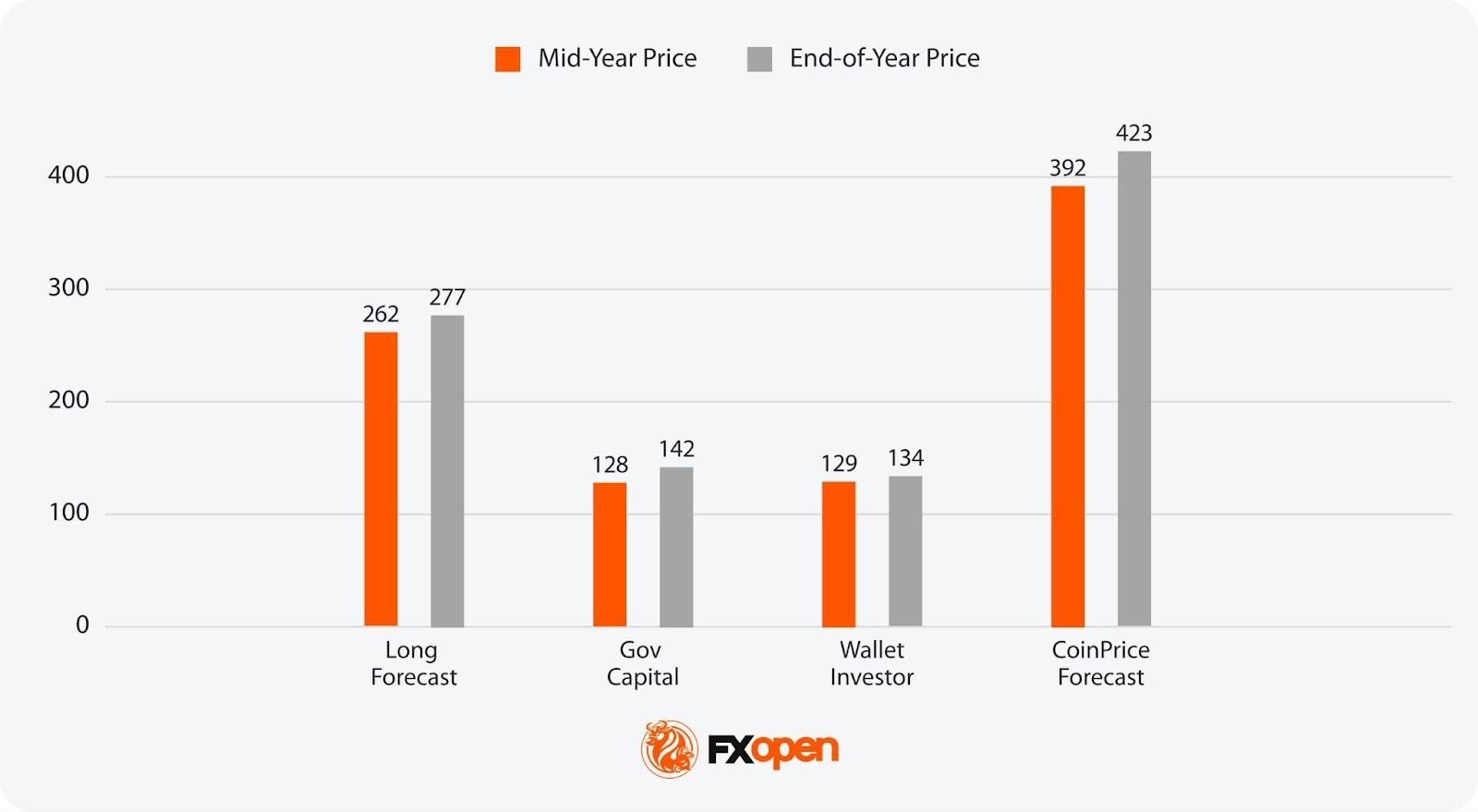

2028

Silver’s projected price in 2028 ranges from around $128 to $423. This gap largely comes down to how much PV and electrification demand offsets lower silver intensity per unit and whether supply response remains slow.

2029

2029 estimates run from roughly $136 to $443. Longer-range numbers diverge on whether investment demand remains episodic or returns in multi-quarter waves during macro stress.

2030

Forecasts for 2030 sit between about $143 and $499, implying continued volatility rather than a linear trend, with outcomes hinging on fiscal dynamics, monetary credibility, and the balance between demand growth and supply constraints.

Silver’s Price History

Silver’s price history is marked by dramatic fluctuations, reflecting the interplay of market forces, geopolitical events, and investor behaviour.

Silver Thursday (1980)

One of the most significant periods was in the late 1970s and early 1980s, notably during the Silver Thursday event of 1980. After the precious metal began climbing in the latter half of the 1970s, an attempt by the Hunt brothers to corner the market in January 1980 led to silver prices reaching an all-time high of $49.45 per troy ounce—from the 1979’s high of $28— before crashing to a low of $4.90 at the end of 1982.

The Early 21st Century (2000-2011)

Following the dot-com bubble burst in the early 2000s, silver and other precious metals began a bullish run as investors sought so-called safe-haven assets amidst economic uncertainty. However, after surging from a low of around $4.43 in November 2002 to a high of $15.23 in May 2006, prices stalled. It eventually rose again, driven by a combination of investment demand, industrial applications, and concerns over fiat currency devaluation in the run-up to the Great Financial Crisis of 2008.

While it dipped as the crisis unfolded, silver spiked in the following years, reaching an all-time high of roughly $50 in April 2011.

A Volatile Period in Silver’s History (2012-2026)

However, silver then reversed hard, ending 2011 near $27.80 and sliding again as tighter policy expectations built. The downswing carried into the mid-2010s, with a trough around $13.9 in late 2015/early 2016. For much of 2014-2019 it rotated in a $15-$20 band as US rates rose and the dollar firmed.

In March 2020, the COVID liquidity shock pushed silver below $12, then stimulus and reflation trades drove a fast rebound towards $29 by August 2020. A retail-driven “silver squeeze” wave in early 2021 lifted it to around $30 before momentum faded.

Fed tightening and a stronger dollar weighed again in 2022, taking prices back toward $18 before stabilising. A break higher gathered pace from May 2024 (moves through $32-$35 linked to tight physical conditions and strong solar-related demand signals), then 2025 accelerated: silver cleared the prior nominal record in October near $54.50 and pushed higher into year-end. In January 2026, price action became disorderly, with a spike to over $121 late in the month. At the time of writing on the 29th of January, silver stands at around $114.

Interested readers can head over to FXOpen’s TickTrader platform to explore silver price trends using our interactive XAG/USD charts.

Analytical Silver Prices Forecasts for 2026

Silver enters 2026 after a steep 2024–January 2026 run and a sharp volatility spike. The key issue for silver price predictions is whether the metal rises on strong fundamental factors, or corrects as the factors change.

Macro, Rates, and Debasement Concerns

Rate-path pricing and the US dollar remain central. If real yields drift lower and fiscal deficits stay elevated, concerns about currency depreciation may continue to influence investment flows into precious metals. Persistent budget imbalances, heavy Treasury issuance, and questions around long-term currency purchasing power remain a central part of the backdrop.

Industrial Demand and Manufacturing Thrift

Solar, electrification, and electronics demand stay in focus, but 2025 highlighted a clear constraint: higher prices encouraged reduced silver loadings in PV cells and components. If prices remain elevated, further thrifting and substitution may lower silver demand.

Supply, Inventories, and Physical Tightness

The silver market has recorded several annual deficits in recent years. Analysts note a decline in above-ground inventories and heightened sensitivity to regional physical flows. While recycling supply may rise in response to price incentives, primary mine output is likely to remain relatively inelastic given silver’s predominantly by-product production profile.

Volatility and Positioning

After the January spike, silver may trade in wide ranges driven by ETF flows, futures positioning, and liquidity conditions. The 2025 breakout zone around $28-$35 remains important; sustained trade below it could point to a deeper reset.

Analytical Silver Price Predictions for 2026

Silver price forecasts for 2026 reflect a market adjusting after sharp repricing, with views shaped by macro policy uncertainty, physical availability, and shifting investor positioning.

- Most Pessimistic Projection for Mid-Year 2026: $92 (Commerzbank)

- Most Optimistic Projection for Mid-Year 2026: $215 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2026: $85 (UBS)

- Most Optimistic Projection for End-of-Year 2026: $262 (CoinPriceForecast).

Citigroup outlines one of the most aggressive near-term outlooks, pointing to $150/oz by mid-2026. Commodities strategist Max Layton links this view to strong Chinese buying, supply constraints, and persistent structural imbalances. Citi characterises silver as behaving like “gold squared”, arguing the move may persist until valuations appear stretched relative to gold.

Commerzbank has lifted its expectations materially, now seeing $92/oz by mid-2026 and $95/oz by year-end, up sharply from late-2025 assumptions. Analyst Carsten Fritsch points to escalating geopolitical tensions, including unrest in Iran and the risk of wider confrontation, while cautioning that higher prices may accelerate industrial thrifting or substitution towards cheaper metals.

Analytical Silver Price Forecasts for 2027 and Beyond

Beyond 2026, silver price predictions become less about short-term positioning and more about structural forces shaping demand, supply, and capital allocation.

Structural Demand Versus Intensity Decline

Solar, grid expansion, EVs, and data infrastructure continue to absorb material volumes, but the focus shifts from headline installation growth to silver intensity per unit. PV manufacturers, battery systems, and electronics producers are expected to keep reducing silver loadings where technically feasible. This creates a tension: total volumes may rise, but marginal demand growth becomes more sensitive to price. Periods of elevated prices risk flattening fabrication demand.

Fiscal Dynamics and Monetary Credibility

Longer term, silver remains exposed to currency debasement narratives rather than cyclical rate expectations alone. Persistent fiscal deficits, rising sovereign debt servicing costs, and political resistance to austerity may keep precious metals embedded in asset-allocation discussions. Unlike 2024–2026, this influence is expected to express itself episodically rather than through sustained one-way moves.

Supply Response Lag

Mine supply response beyond 2027 remains constrained. Supply elasticity remains low: as most silver is mined as a by-product, production levels are often dictated by the economics of copper, lead, or zinc rather than silver market trends. Recycling growth faces natural limits after several years of elevated prices pulling forward scrap supply. This could keep the market sensitive to demand shocks.

Analytical Silver Price Predictions: 2027

The 2027 outlook points to a continuation of longer-cycle themes, with some analyses focusing on relative valuation against gold while others factor in demand moderation from industrial thrift.

- Most Pessimistic Projection for Mid-Year 2027: $112 (Gov Capital)

- Most Optimistic Projection for Mid-Year 2027: $336 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2027: $115 (Gov Capital)

- Most Optimistic Projection for End-of-Year 2027: $374 (CoinPriceForecast)

HSBC’s James Steel expects physical market tightness to ease gradually through 2027 as supply-side pressures resolve. The bank projects the global deficit narrowing further as industrial demand weakens, while mine output and recycling rise. Steel notes that elevated prices are encouraging “substitution, thrifting and design changes” across industrial applications, with jewellery demand “especially vulnerable.”

Oxford Economics, in a December 2025 report on behalf of the Silver Institute, projects that electric vehicles will overtake internal combustion engine (ICE) vehicles as the primary source of automotive silver demand by 2027. Electric vehicles consume, “on average, 67-79 percent more silver than ICE vehicles.”

Data centres powering AI systems represent another expanding offtake channel; as digitisation accelerates, demand for silver’s superior conductivity in servers and infrastructure is expected to rise in tandem. Oxford Economics characterises silver as a “next-generation metal,” concluding it will “remain an essential component across multiple high-growth sectors as industries race to embrace digital innovation and meet clean energy mandates.”

Analytical Silver Price Predictions: 2028

By 2028, projections diverge more clearly as assumptions vary around supply response timing, sustained electrification demand, and the durability of investment flows.

- Most Pessimistic Projection for Mid-Year 2028: $128 (Gov Capital)

- Most Optimistic Projection for Mid-Year 2028: $392 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2028: $142 (Gov Capital)

- Most Optimistic Projection for End-of-Year 2028: $423 (CoinPriceForecast)

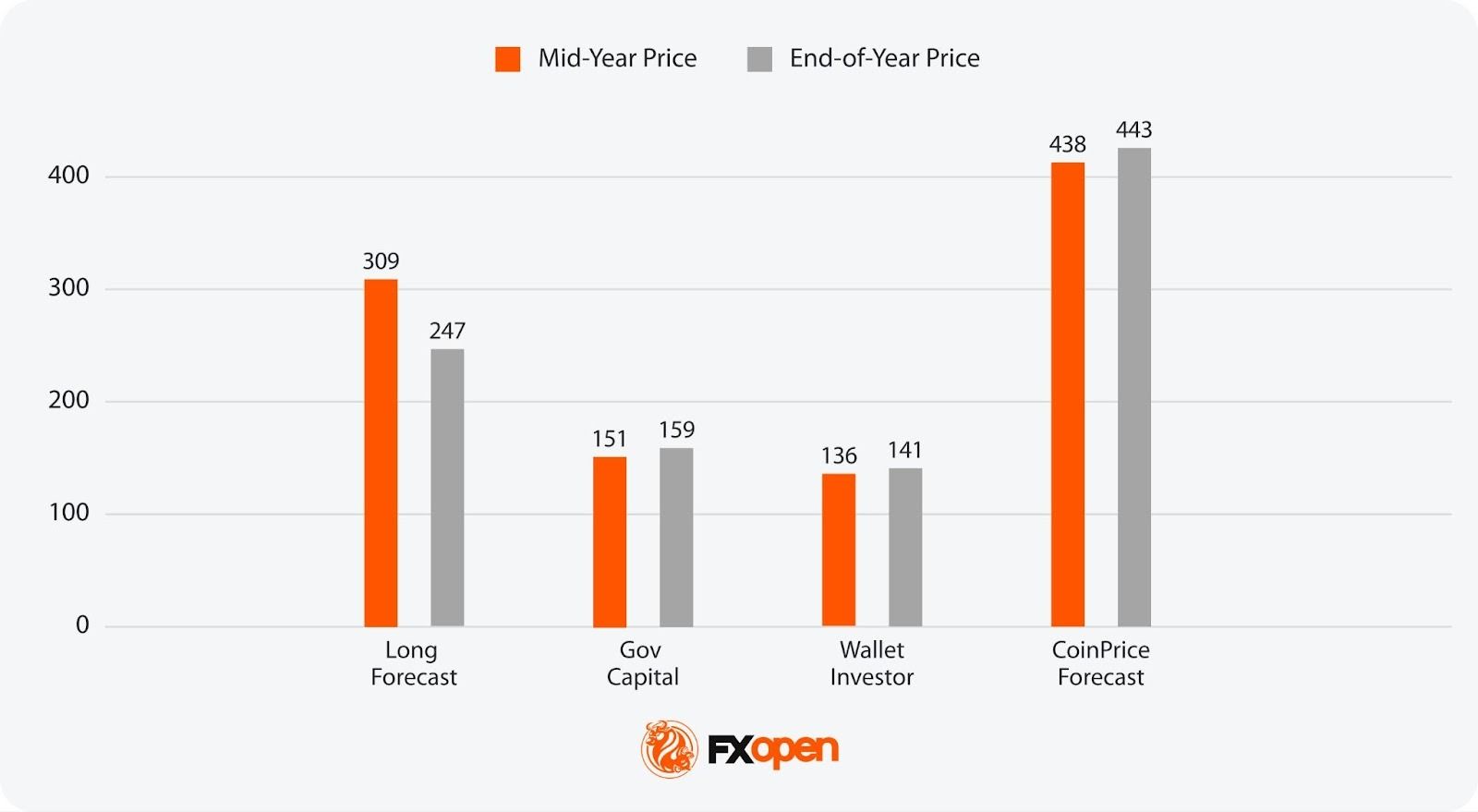

Analytical Silver Price Predictions: 2029

The 2029 outlook reflects growing uncertainty over macro structure rather than short-term cycles, with outcomes tied to fiscal dynamics, currency credibility, and episodic capital rotation.

- Most Pessimistic Projection for Mid-Year 2029: $136 (Wallet Investor)

- Most Optimistic Projection for Mid-Year 2029: $438 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2029: $141 (Wallet Investor)

- Most Optimistic Projection for End-of-Year 2029: $443 (CoinPriceForecast)

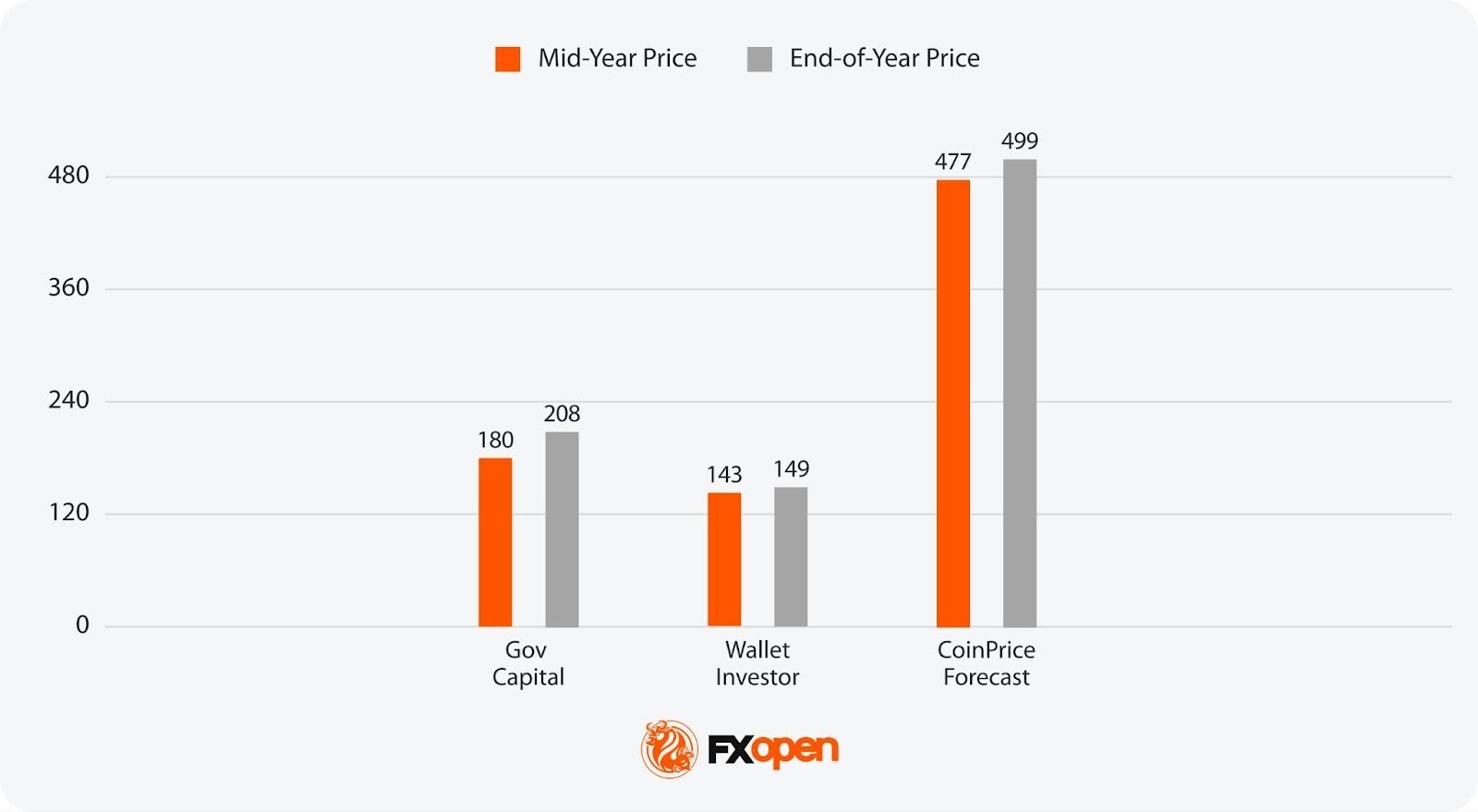

Analytical Silver Price Predictions: 2030

Looking at long-term silver price forecasts in 2030, estimates frame silver as a hybrid asset, where price behaviour depends on whether structural demand pressures outweigh gradual supply adaptation and periodic volatility.

- Most Pessimistic Projection for Mid-Year 2030: $143 (Wallet Investor)

- Most Optimistic Projection for Mid-Year 2030: $477 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2030: $149 (Wallet Investor)

- Most Optimistic Projection for End-of-Year 2030: $499 (CoinPriceForecast)

Factors That Might Affect the Silver’s Price

Silver prices are shaped by a dynamic blend of economic, geopolitical, and industrial factors, reflecting its dual role as both an investment and an industrial metal. Key factors going forward include:

- Industrial Demand: Silver’s extensive use in technologies like solar panels and electronics directly influences its price.

- Economic Conditions: Economic growth increases silver demand in manufacturing, while downturns often boost its appeal as a so-called safe-haven asset.

- Monetary Policy: Interest rate changes can shift investor preference between silver and yield-bearing assets.

- US Dollar Strength: An inverse relationship exists between XAG prices and the US dollar; a stronger dollar can suppress its price.

- Geopolitical Tensions: Conflicts and instability tend to increase investment in silver as a so-called protective measure.

- Gold/Silver Ratio: This indicator may help investors decide when to buy silver over gold, affecting demand and prices.

The Bottom Line

Silver’s outlook remains shaped by a mix of macro uncertainty, fiscal dynamics, and structural industrial demand. Price behaviour over the coming years is likely to reflect shifts in real yields, currency confidence, and supply constraints rather than linear trends, with volatility remaining a defining feature.

If you are looking to trade Silver via CFDs, you can consider opening an FXOpen account and get access to the advanced trading tools and more than 700 instruments.

FAQ

Will Silver Go Up in 2026?

Silver’s direction in 2026 depends on real yields, dollar trends, and physical market conditions. Some analysts point to support from tight supply and debasement concerns, while others highlight scope for consolidation after the January volatility spike.

Is Silver a Good Investment in 2026?

Silver is analysed as a hybrid asset with both industrial and monetary drivers. Its role in electrification and sensitivity to macro stress may support portfolio diversification, though price behaviour in 2026 is expected to remain uneven.

Will Silver Hit $200?

Some analyses outline scenarios above $200 based on historical gold-silver ratios compressing sharply. These outcomes assume sustained macro stress and strong investment flows, and sit well outside base-case assumptions from major banks.

What Will Silver Be Worth by 2030?

By 2030, analytical estimates range widely between $143 and almost $500, reflecting uncertainty around fiscal dynamics, supply response, and industrial demand intensity. Longer-range views agree that the future of silver prices will likely be volatile and shaped by macro structure and capital flows.

How Do Traders Trade Silver in Forex?

Silver cannot be traded on the forex market, as it is a currency market. However, it can be traded in the XAG/USD pair via CFDs. If you are interested in CFD trading, you can consider opening an FXOpen account and get access to over 700 instruments and 1,200 analytical tools.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

BTC Leads Recovery While Altcoin Indicators Hit Cycle Lows

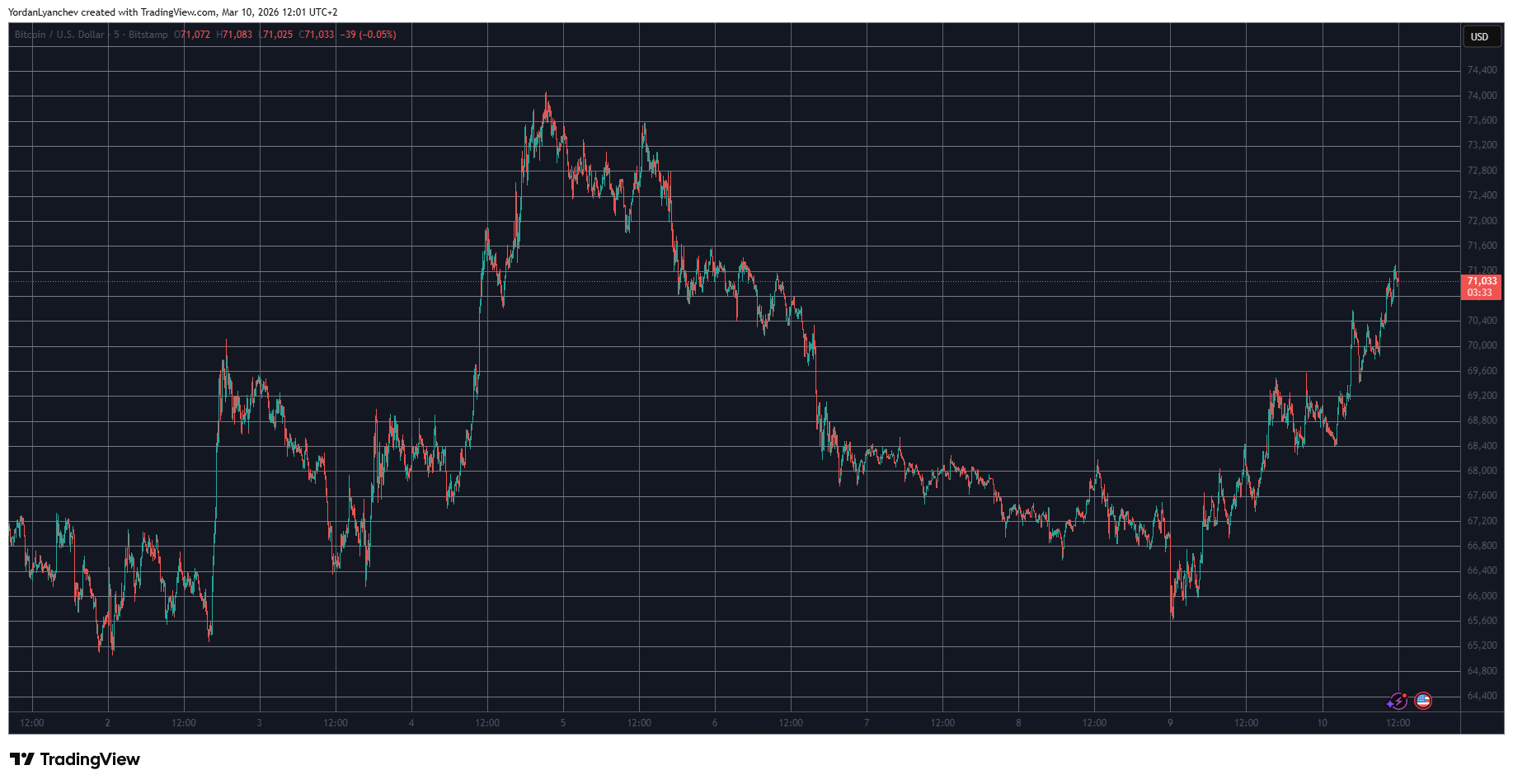

Bitcoin’s (BTC) recent recovery above $71,000 suggests that the price bottom is officially in, and bullish momentum can be seen across the crypto market. TOTAL2, which tracks the market cap of all crypto assets excluding Bitcoin, has held support at its 200-week moving average, but is an altcoin season in the making?

The divergence between Bitcoin’s rally and the muted altcoin price action is beginning to draw attention to altseason indicators, raising the question of whether the broader market may soon follow BTC’s lead.

TOTAL2 tests long-term support just below $1 trillion

The TOTAL2 market cap peaked near $1.7 trillion in October 2025 but currently sits at $970 billion, a drawdown of roughly 43%. The decline accelerated in January after the market cap broke a three-year ascending trendline near $1.15 trillion.

Market attention has now shifted to the higher-timeframe support. On the weekly chart, the TOTAL2 market cap trades close to its 200-week moving average near $900 billion, a level that held during market corrections in September 2024 and April 2025.

The daily chart shows consolidation beneath the former trendline and the $1.1 trillion to $1.25 trillion resistance band, a zone that previously held large liquidity clusters.

The altcoin positioning metrics align with the drop in TOTAL2. CryptoQuant data highlighted that 36.8% of altcoins are trading near their historical lows, excluding Bitcoin, Ether (ETH), and stablecoins.

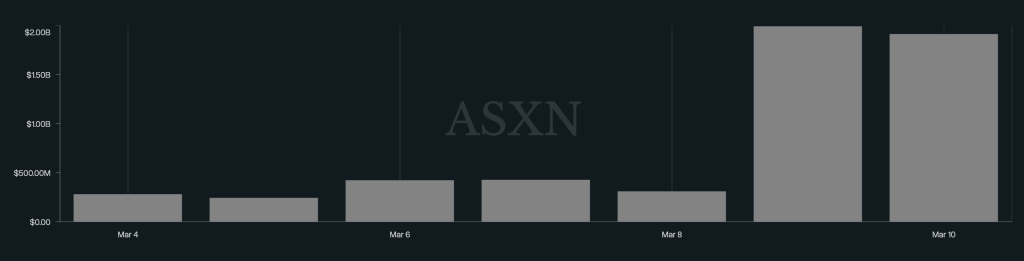

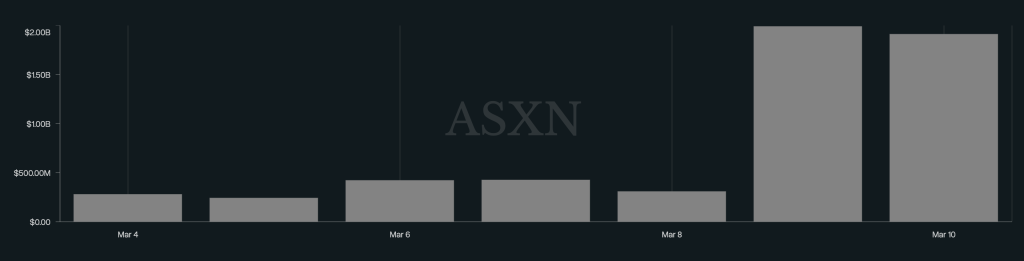

These elevated readings appear when capital concentrates in larger assets. XWIN Research said that spot Bitcoin ETF inflows and the growing number of tokens have intensified competition for liquidity across smaller assets over the past year.

Related: Hyperliquid’s HYPE price will hit $150 by August, predicts Arthur Hayes

Average altcoin performances near cycle lows

Data from CryptoQuant outlined how deeply altcoins have underperformed Bitcoin. The average altcoin trades 44.4% below its 200-day simple moving average (SMA), a level historically seen near bear-phase bottoms.

The exchange data shows similar weakness. Only 4.59% of Binance-listed altcoins trade above their 200-day SMA, confirming a strong Bitcoin-led phase.

The altcoin expansion typically begins with Ether’s (ETH) leadership. The ETH/BTC pair has not established an uptrend and continues to trade inside a descending channel on the weekly chart.

A move above 0.036 may mark the first break of the channel’s local resistance and signal improving relative strength for ETH. A stronger shift in capital rotation could emerge if the pair reclaims 0.043, a level that previously acted as resistance before the broader decline in 2025.

Until these levels are reclaimed, Bitcoin-led momentum continues to dominate the recovering crypto market.

Market analysts are also debating whether the next altcoin cycle will resemble past rallies. Bitwise Chief Investment Officer Matt Hougan recently said that future altcoin seasons may not lift the entire market equally, arguing that the capital will most likely be concentrated in projects with stronger adoption and real-world applications.

Related: Bitcoin vs gold: ETF flows point to early capital rotation signs

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

SEC Chair Calls for ‘Coordinated Oversight‘ Between US Financial Agencies

Paul Atkins, chair of the US Securities and Exchange Commission (SEC), said that an agreement with the Commodity Futures Trading Commission (CFTC) would lead to a new level of “coordination and collaboration,” including on enforcement.

In a Tuesday speech for the FIA Global Cleared Markets Conference in Florida, Atkins said that the SEC and CFTC were considering an updated memorandum of understanding on coordination between the two federal regulators. The SEC chair did not explicitly mention oversight of digital assets, but said “the regrettable era of duplicative enforcement actions and conflicting remedial obligations for the same conduct is over.”

“Conduct in a single operating environment means that the SEC and CFTC, within the bounds of their independent statutory authority and regulatory interests, should coordinate legal theories and remedial strategies,” said Atkins. “Fragmented, redundant enforcement does not increase deterrence—it only increases confusion.”

Atkins’s remarks followed similar statements from CFTC Chair Michael Selig striking a cooperative tone as US lawmakers worked to pass a comprehensive market structure bill expected to give the CFTC more authority in overseeing crypto. The bill, passed as the CLARITY Act in the US House of Representatives in July, has effectively been stalled in the Senate amid discussions on stablecoin yield, tokenized equities, and conflicts of interest.

Related: CFTC chair backs blockchain-based prediction markets as ‘truth machines’

The SEC, which oversees securities, and the CFTC, overseeing commodities, have sometimes overlapped in regulating cryptocurrencies that, according to many experts, do not clearly fall into a single agency’s purview. The SEC chair said the agency’s staff would be conducting joint meetings with CFTC officials on product applications, and launched a harmonization website for the two regulators.

“Firms should not be shuffled back and forth between regulators when a product touches elements of both regulatory frameworks,” said Atkins. “Nor should clarity depend on which agency happens to speak first. Where jurisdiction overlaps, the most effective response is a coordinated one.”

Leadership slots vacant after no nominations from Trump

As of Tuesday, the CFTC’s leadership consisted solely of Selig, whom the Senate confirmed in December. He replaced acting chair Caroline Pham, but remains the sole Republican-appointed commissioner in a leadership panel normally consisting of a bipartisan group of five people. Similarly, the SEC is being led by three Republican commissioners.

US President Donald Trump had not made any public statement as of Tuesday signaling that he plans to nominate additional commissioners to either agency.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

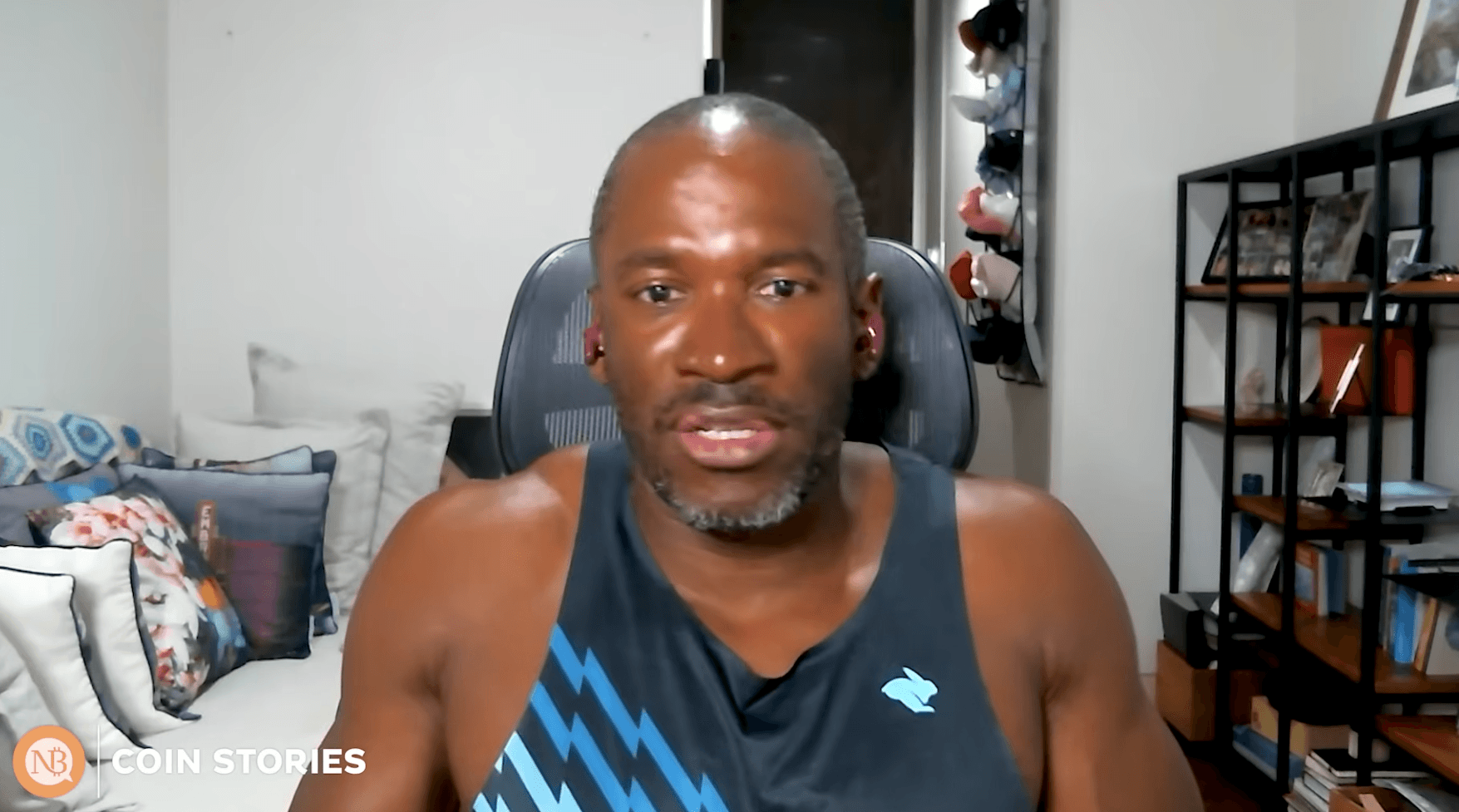

Arthur Hayes Wouldn’t Invest $1 In Bitcoin Right Now

BitMEX co-founder Arthur Hayes, who has projected Bitcoin to hit $250,000 this year, says he’d rather wait-and-see than invest in Bitcoin at the moment, holding off until the US Federal Reserve loosens its monetary policy.

“If I had $1 to invest right now, would I be putting it into Bitcoin? No. I would wait,” Hayes said on the Coin Stories podcast published to YouTube on Tuesday.

“The longer this conflict goes on, the higher the likelihood that the Fed has to print money to support the American war machine,” he said. Hayes said he will start buying when the Fed begins easing monetary policy:

“That’s when I’m going to buy Bitcoin when the central banks start printing money.”

Hayes said that while some argue “war is good for Bitcoin,” the more accurate view is that “money printing is good for Bitcoin.”

Hayes added he was unsure whether Bitcoin had reached its price bottom. Bitcoin is trading at $69,926 at the time of publication, down 45% from its October all-time high of $126,000, but Hayes warned that ongoing geopolitical tensions could push the price lower.

“[With] the unfortunate war between US and Iran, I think that there is a situation where the longer that this carries on, there could be a massive sell-off in equities and Bitcoin,” he said.

Hayes predicted $250,000 Bitcoin for 2026

Hayes explained that this may lead Bitcoin to fall below $60,000 and that “could be sort of a big cascading of liquidations down.” Bitcoin briefly touched the $60,000 level on Feb. 6 before edging into a mild uptrend.

Hayes usually shares strong convictions about Bitcoin and had held onto his $250,000 year-end prediction as late as October last year.

Related: Bitcoin leads, altcoin indicators drop to intriguing lows: Time for an altseason?

Other analysts are more confident about what will happen in the short term. Michaël van de Poppe recently pointed out the benefits for Bitcoin on the back of a “strong surge” in the Nasdaq.

“There are not many arguments left for uncertainty, and in that principle, I do think we’ll see way more upside into Bitcoin & Altcoins during the coming period,” van de Poppe said.

Meanwhile, Hayes said he doesn’t anticipate there being many more years when Bitcoin will be “sub 100,000.”

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Bitcoin Tops $71,000 as Oil Drops Under $80

Total crypto capitalization is up another 3% to $2.49 trillion.

Crypto markets rallied for a second day as fears of an oil supply shock eased after the International Energy Agency (IEA) convened an emergency meeting to discuss the potential release of emergency reserves.

Bitcoin (BTC) is trading at around $70,700, up 3.5% over the past 24 hours. The world’s largest cryptocurrency reached as high as $71,800 earlier in the day. Meanwhile, ETH climbed 2.5% to $2,070, SOL gained 4% to $88, and XRP is up 3.6% on the day.

The overall crypto market capitalization climbed 3% to $2.49 trillion, according to Coingecko.

Crude oil (WTI) briefly fell below $80 per barrel but has since erased its losses to trade around $84. The S&P 500 and the Nasdaq posted minor gains while gold and silver were mostly unchanged.

Almost all of the Top 100 digital assets posted gains over the last 24 hours.

Today’s top gainers are RENDER, which rallied 10%, followed by Bittensor (TAO) and SKY, which climbed 7%.

Memecore (M) and Midnight (NIGHT) are the biggest losers

Around 96,000 leveraged traders were liquidated for $377 million in the past 24 hours, according to CoinGlass. Bitcoin accounted for $138 million, while ETH positions made up $73 million.

Bitcoin exchange-traded funds (ETFs) recorded inflows of $167 million on Friday, according to SoSoValue, snapping a two-day losing streak.

Crypto World

Crypto market capitulation fades as Bitcoin losses shrink

The crypto market is showing early signs of stabilization after months of heavy selling, though the outlook remains uncertain.

Summary

- Crypto market losses are easing as Bitcoin realized losses narrow from February capitulation levels.

- Short-term holders now control about 22% of BTC supply, indicating active participation.

- Macro pressures and liquidity conditions may keep Bitcoin trading volatile in the near term.

With daily trading volume of about $121 billion, the global crypto market capitalization is close to $2.51 trillion, up roughly 2.5% over the previous day. Bitcoin (BTC) holds roughly 57% of the market, while Ethereum (ETH) accounts for about 10%.

Investor sentiment remains weak. The Crypto Fear & Greed Index has stayed in extreme fear, with readings between 14 and 19 in early March. Such levels often appear when markets are under pressure but can also precede sharp swings.

Bitcoin has just climbed above $71,000, helping push the market slightly higher. Some altcoins moved strongly as well. Flow posted gains of more than 36%. Even with the rebound, Bitcoin still trades about 42% below its all-time high.

Market losses begin to ease

A March 10 report from CryptoQuant analyst Darkfost shows that realized losses in the Bitcoin market are starting to slow after a period of capitulation.

Recent data shows $611 million in realized losses compared with $346 million in realized profit, leaving the market with a net weekly loss of about $264 million. Losses still dominate trading, but the gap has narrowed.

The situation looked very different a month ago. On Feb. 7, weekly losses were close to $2 billion as Bitcoin briefly fell below $60,000.

Short-term holders remain the most active participants. Their share of the Bitcoin supply has grown to about 22%, compared with 12% in early 2023. That increase suggests newer investors are still entering the market despite recent volatility.

Some signs of consolidation are also appearing. Analysts say investors have started holding or accumulating again as prices stabilize.

On Binance futures markets, Bitcoin trading volume has also moved ahead of altcoin volume. Similar shifts in the past often appeared near broader market bottoms.

Macro pressure still clouds outlook

The short-term outlook remains mixed. Liquidity in global markets is tightening, the U.S. dollar has strengthened, and bond yields are rising. These factors often weigh on risk assets, including crypto.

Because of that, Bitcoin may continue trading in a $60,000 to $70,000 range for now. Following the recent surge, short-term indicators have also moved higher, which may encourage profit-taking.

Future economic data could increase volatility. CPI reports and other inflation statistics may have an impact on interest rate expectations.

Despite the decline, some investors continue to see value. Pantera Capital’s Dan Morehead recently pointed out that cryptocurrency prices are significantly below long-term trend levels.

Other institutions share cautious optimism. Coinbase Institutional has pointed to improving regulation and deeper financial integration as supportive factors, while analysts at Bybit say options markets still price a small chance of Bitcoin reaching $150,000 this year.

For now, the market appears to be moving away from the most intense phase of selling. Whether the recovery continues will depend on Bitcoin’s ability to hold momentum in the weeks ahead.

Crypto World

Jito Foundation Acquires Solana News Outlet SolanaFloor

The foundation behind Solana liquid staking protocol Jito acquired SolanaFloor just two weeks after the media outlet announced it was shutting down.

The Jito Foundation has acquired SolanaFloor, a media outlet focused on the Solana ecosystem.

SolanaFloor reported the acquisition and that it’s resuming operations today, March 10, just over two weeks after the media outlet announced it was shutting down, “effective immediately.”

Jito Foundation develops Jito, the second-largest liquid staking protocol on Solana, per DefiLlama data. Jito Liquid Staking boasts a total value locked of $1.1 billion.

Per the announcement, SolanaFloor will retain editorial independence after the acquisition, clarifying that its “mission and editorial processes will remain unchanged under Jito Foundation’s stewardship.”

On the foundation’s motivations for the deal, Brian Smith, president of Jito Foundation, reiterated the foundation’s commitment to SolanaFloor’s editorial independence, explaining:

“Jito has a long-term stake in the health of the Solana ecosystem, and that means investing in the infrastructure and public goods that keeps the community informed.”

Second Acquisition

SolanaFloor was originally launched in 2021 with a focus on NFT analytics. The company was acquired by now defunct Solana DeFi portfolio management app Step Finance in 2022. SolanaFloor pivoted to become a Solana-focused news media outlet soon after, as the peak NFT frenzy and interest in the sector continued to wane.

Step Finanace suffered a major exploit in late January that resulted in the loss of nearly $30 million in SOL. Soon after, it announced that the platform was shutting down operations, along with the two companies it had acquired, SolanaFloor and Remora Markets.

Solana currently has a TVL of over $8 billion, down from nearly $14.5 billion in September, per DefiLlama.

The acquisition marks an important moment for crypto media, which has seen multiple outlets shutter their newsrooms in recent months.

This article was generated with the assistance of AI workflows.

Crypto World

Circle Launches Nanopayments on Testnet

Circle has launched Nanopayments on testnet, offering developers a new infrastructure layer for ultra-small, gas-free USDC transactions.

The product is built on Circle Gateway and designed to serve the emerging agentic economy, where AI agents and autonomous software need to make rapid, sub-cent payments for services such as pay-per-call APIs, usage-based billing, and machine-to-machine marketplaces.

The core challenge Nanopayments aims to solve is an economic one. Traditional payment rails carry fixed fees and overhead that make sub-cent transactions impractical, while even low-cost blockchain transactions can impose fees that dwarf the payment itself.

Circle’s approach sidesteps this by aggregating transactions off-chain and settling them on-chain in batches, effectively reducing the per-transaction gas cost to zero for developers, with Circle absorbing the settlement costs at the batch layer.

The system follows the x402 open standard, allowing any agent to pay any merchant without creating an account or adding a credit card. When an agent initiates a payment, it signs an authorization that’s validated by the Nanopayments API, the merchant gets instant confirmation, and actual on-chain settlement happens periodically in the background.

In a blog post, Circle highlighted an early proof of concept in which an autonomous robot dog used Nanopayments to pay for its own recharging in USDC, a glimpse at what fully autonomous economic actors might look like.

The testnet supports multiple blockchains, including Arbitrum, Base, Ethereum, Optimism, Polygon, and Sonic.

The launch comes amid explosive growth in the stablecoin sector, whose market capitalization now exceeds $314 billion, up 37% from $228 billion a year ago, according to DeFiLlama.

Circle’s USDC is the second-largest stablecoin with nearly $79 billion in circulation, according to Coingecko.

The company has been steadily building out its platform beyond USDC issuance. In spring 2025, it launched the Circle Payments Network, a platform for real-time, low-cost cross-border payments using stablecoins. It later unveiled Gateway, a chain abstraction tool that lets USDC holders access a unified balance across supported blockchains, and introduced Arc, a Layer-1 blockchain purpose-built for USDC transactions.

Crypto World

Starknet launches ERC-20 privacy layer for compliant DeFi

Starknet is returning privacy to the center of blockchain development as new tools attempt to balance confidentiality with regulatory oversight.

Summary

- Starknet introduced STRK20, adding private balances and transfers to ERC-20 tokens.

- The system allows selective disclosure for regulators, auditors, or compliance checks.

- The technology could enable private DeFi activity for assets like Bitcoin, ETH, and stablecoins.

On March 10, Starknet announced STRK20, a new privacy capability designed to give ERC‑20 tokens confidential balances and private transfers while keeping the option for regulatory disclosure when required.

The feature allows developers to deploy tokens on Starknet (STRK) with built-in privacy controls. Users can shield assets, hold balances privately, and transfer tokens without revealing transaction details on public block explorers.

At the same time, records can still be disclosed to auditors, regulators, or accountants if legally necessary.

Private balances and transfers for tokens

Blockchains such as Bitcoin and Ethereum operate with full transparency, meaning wallet balances and transactions can usually be viewed by anyone. While this design improves auditability, it can also limit institutional participation and certain financial use cases.

STRK20 attempts to address that issue. The system introduces what Starknet calls transaction-layer privacy, where asset ownership can remain hidden while the execution of transactions still occurs on a public network.

Once deployed, users can shield tokens into a private state, transfer them confidentially, or return them to a public state when needed. These functions remain tied to the same asset and liquidity pools, which avoids splitting tokens into separate public and private versions.

The first integrations are already planned within the Starknet ecosystem. Privacy-enabled swaps are expected to be available on Ekubo Protocol, while private staking options are also being explored for assets including Bitcoin and the Starknet token.

Privacy with compliance controls

The project also focuses on regulatory compatibility, an area that has historically limited privacy tools in crypto.

Instead of fully anonymous systems, STRK20 allows selective disclosure. Transaction details can be revealed to approved parties such as regulators or auditors when required. This approach attempts to give institutions privacy in daily activity while maintaining an audit trail for compliance purposes.

Starknet has already been experimenting with privacy-focused Bitcoin use cases. Earlier this year, the network introduced strkBTC, which allows optional shielding for Bitcoin balances while still enabling participation in decentralized finance applications.

Interest in privacy tools is growing in the crypto world. Every year, trillions of dollars move on public blockchains, but anyone can see transaction details and wallet balances.

Privacy tokens could let people pay, trade, and lend without exposing their financial activity. Starknet says this could make blockchain easier to use while still maintaining compliance.

Crypto World

Hyperliquid (HYPE) Rockets by Double Digits, Bitcoin (BTC) Tops $71K: Market Watch

The total crypto market cap added roughly $100 billion in a day.

After dumping to $65,500 on Monday morning, bitcoin reversed its trajectory and jumped by over five grand to tap $71,000 for the first time since last Friday.

Ethereum has reclaimed the coveted $2,000 level, while BNB is close to $650. XRP is above $1.40 despite continuous ETF outflows.

BTC Jumps to $71K

What a wild ride it has been in crypto, prompted by the quickly developing and escalating tension in the Middle East. It began with a nosedive to $63,000 for BTC on February 28, when the US and Israel attacked Iran, before the bulls took control and pushed the asset to a month-high of $74,000 by Wednesday.

The subsequent rejection was almost inevitable given the current market sentiment, and BTC began to lose value gradually. After dropping to and below $68,000 by the weekend, the bears drove it further south to $65,500 on Monday morning when the legacy financial futures markets opened.

However, bitcoin rebounded almost immediately and returned to $68,000. It even challenged the $70,000 level in the evening after Trump’s somewhat surprising remarks that the war with Iran is almost over. Although it failed there at first, it reclaimed that psychological line today, jumping to just over $71,000 minutes ago.

Its market capitalization has climbed to $1.420 trillion on CG, while its dominance over the alts is above 57%.

ETH Above $2K, HYPE Soars

Ethereum continues with its gradual ascent, jumping to over $2,050 as of press time after a 3% daily increase. A similar pump from BNB has driven the token to almost $650, while XRP is above $1.40, although the Ripple ETFs saw another major withdrawal yesterday. DOGE has gained 5% daily and now sits at $0.095.

HYPE has surged the most from the top 100 alts, pumping by 11% to nearly $35. XLM, SUI, ZEC, SHIB, AVAX, AAVE, and NEAR follow suit.

The cumulative market cap of all crypto assets has added $100 billion in a day and is close to $2.5 trillion on CG now.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Hyperliquid Jumps Following Margin Upgrade and 533% Oil Trading Surge

Hyperliquid (HYPE) token is suddenly on fire.

The token jumped to an intraday high near $35 as trading activity exploded on the platform. Volume on its oil perpetuals surged past $1.4 billion, driven by rising geopolitical tensions and wild moves in energy markets.

While most of the crypto market struggled, Hyperliquid actually benefited from the chaos. Traders piled into tokenized oil contracts, pushing daily volume close to $1.39 billion, second only to Bitcoin on the exchange.

At the same time, the platform rolled out a major upgrade to its margin system. The new portfolio margin feature is designed to make trading more capital efficient while reducing risk during extreme volatility.

Nansen analyst Nicolai Søndergaard said that dynamic scaling reduces systemic risk, making the platform safer for aggressive positioning on volatile assets.

The Levels That Change Everything for Hyperliquid (HYPE)

HYPE is still holding strong momentum. The token is up about 5% in the last 24 hours and roughly 120% over the past year. Even while much of the crypto market struggles, the chart continues printing higher lows, keeping the broader uptrend intact.

Right now, the level everyone is watching is $35.28. That recent intraday high is the key resistance. If HYPE manages to close above it on lower timeframes, the chart opens the door toward $38 and potentially the $40 psychological level.

On the downside, $32.50 is the main support. That area has acted as a launchpad during previous pullbacks. If it breaks, the next liquidity zone sits closer to $30. A deeper drop below $28.50 would be needed to truly damage the bullish structure.

Part of the strength comes from growing activity on the platform itself. Open interest has climbed to around $1.2 billion as traders increasingly use Hyperliquid to trade not just crypto, but also assets like oil during major global events.

As long as trading activity stays elevated, HYPE could keep moving independently from the broader crypto market. But if volume fades, the token may struggle to defend the $32.50 floor.

Discover: The best new crypto in the world

The post Hyperliquid Jumps Following Margin Upgrade and 533% Oil Trading Surge appeared first on Cryptonews.

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

Crypto World1 day ago

Crypto World1 day agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Business10 hours ago

Business10 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat1 day ago

NewsBeat1 day agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Business1 day ago

Business1 day agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat6 days ago

NewsBeat6 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show