Crypto World

Are Solana’s 10 Million New Holders Enough to Move SOL Price?

Solana price action remains under pressure despite several attempted recoveries. The altcoin failed to sustain rebounds even after Telegram CEO Pavel Durov was released following his arrest. That development briefly lifted sentiment across related ecosystems.

However, SOL struggled to attract follow-through buying. Persistent weakness reflects broader market caution rather than project-specific concerns.

Solana Holders Are Increasing

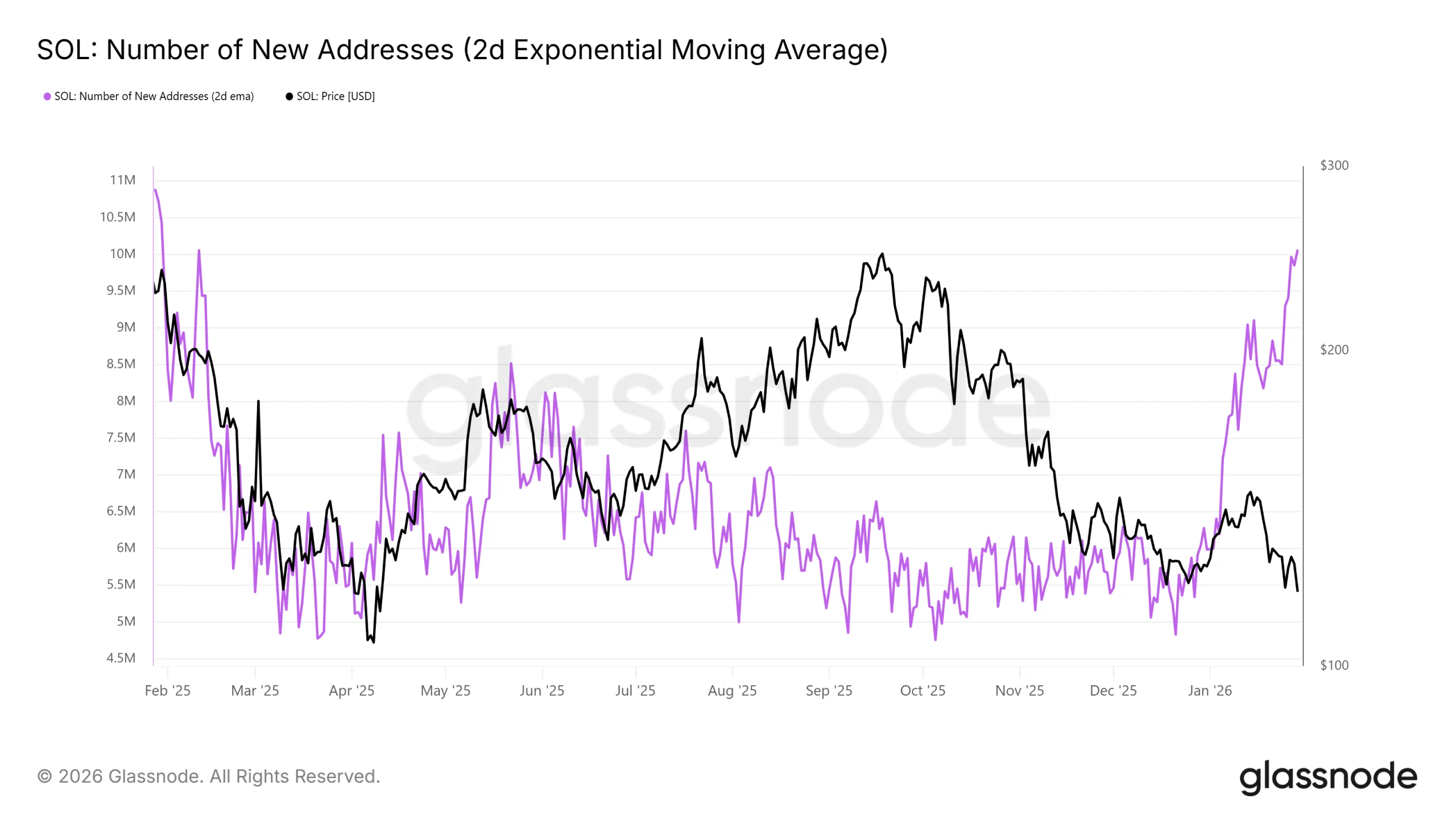

Network activity shows a notable rise in participation. Solana is now adding roughly 10.2 million new addresses on a daily basis. These addresses represent wallets that completed a transaction for the first time. Such growth often signals expanding adoption and fresh capital entering the ecosystem.

Sponsored

Sponsored

Historically, rising new addresses during bearish phases have supported price recoveries. New participants tend to absorb supply from short-term sellers. This dynamic has preceded rebounds in past Solana cycles. With current conditions matching those patterns, growing holder numbers could help stabilize SOL price over time.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Macro momentum, however, remains mixed. Spot Solana ETF flows turned negative for the first time after a week of trading sessions. On Thursday, ETFs recorded $2.2 million in outflows. This marked the first daily outflow in nearly two weeks.

ETF investors are typically considered more strategic and less reactive. The shift suggests emerging skepticism even among relatively bullish participants. Reduced ETF demand can limit upside momentum. As a result, SOL price may face headwinds until flows stabilize or reverse.

SOL Price Breakout Or Breakdown Ahead?

Solana price is trading near $115 at the time of writing. The token is holding above the $115 support level while moving inside a descending broadening wedge. This structure is generally viewed as a bullish pattern. Holding support keeps the upside scenario intact for now.

For confirmation, SOL must bounce from the lower trend line and clear $123. A decisive move above this level would mark a breakout. Under such conditions, price targets extend toward $132 and $136. These levels align with prior resistance zones and technical projections.

Failure to breach $123 could keep Solana range-bound within the pattern. Continued consolidation would delay any breakout attempt. If bearish signals outweigh bullish ones, downside risk increases. A drop below $115 could push SOL toward $110. Losing that support would invalidate the bullish thesis completely.

Crypto World

Upbit Will List 2 Altcoins Today: Here’s How Prices Reacted

Upbit, South Korea’s largest cryptocurrency exchange, has announced the listing of two new altcoins. The platform confirmed it will add spot trading support for Seeker (SKR) and Espresso (ESP).

In addition, Bithumb will also list ESP today. Following the listing announcements, both tokens recorded strong gains, with prices surging by double digits as trading interest accelerated.

Upbit and Bithumb Expand Offerings With New Token Listings

According to Upbit’s notice, SKR will be available to trade against three pairs: Korean Won (KRW), Bitcoin (BTC), and Tether (USDT). The exchange will open spot trading at 16:00 Korean Standard Time (KST) on February 24 and enable deposits and withdrawals within 90 minutes of the announcement.

“Deposits and withdrawals are supported only through the specified network (SKR-Solana). Please verify the network before making a deposit. The contract address for SKR supported by Upbit is: SKRbvo6Gf7GondiT3BbTfuRDPqLWei4j2Qy2NPGZhW3. Please confirm the contract address when depositing or withdrawing SKR,” the exchange added.

In a separate notice, Upbit announced support for ESP in the KRW, BTC, and USDT markets. Trading is scheduled to begin at 17:00 KST today.

Bithumb also announced the addition of ESP in its KRW market. The exchange stated that deposits and withdrawals will open within two hours of the announcement, with trading scheduled for 17:00 KST on February 24. The exchange set the reference price at 149 KRW.

Both exchanges outlined temporary restrictions designed to manage volatility during the initial trading period. Upbit will restrict buy orders for approximately five minutes after trading begins.

Sell orders priced 10% or more below the previous day’s closing price will also be restricted for about five minutes. Additionally, the exchange will permit only limit orders for approximately two hours after trading support begins.

Bithumb will similarly restrict buy orders for five minutes following the start of trading. During the same initial five-minute window, sell orders will be blocked if priced 10% or more below or 100% or more above the reference price. Like Upbit, Bithumb will allow only limit orders for roughly two hours after trading opens.

Exchange Listings Drive Sharp Moves in SKR and ESP

The listings triggered notable price movements in both tokens. Data shows that SKR, the native token of the Solana Mobile ecosystem, rose more than 62% following the announcement.

The daily trading volume increased by over 700%, with Bithumb accounting for approximately 33% of total activity, according to CoinGecko data. The figures suggest elevated trading interest from the South Korean market.

ESP also recorded significant gains, climbing more than 50% and reaching a new all-time high of $0.16. The token was launched earlier this month, making it a recent entrant to the market. ESP serves as the native token of the Espresso Network.

Espresso Network is a blockchain protocol that provides a shared sequencing and confirmation layer for rollups and other chains. It aims to improve scalability and interoperability by coordinating transaction ordering across multiple networks.

Crypto World

Who will ZachXBT expose as ‘insider traders’ on Thursday? Polymarket thinks these firms

Blockchain investigator ZachXBT hasn’t named the target yet. Polymarket bettors are already pricing it in.

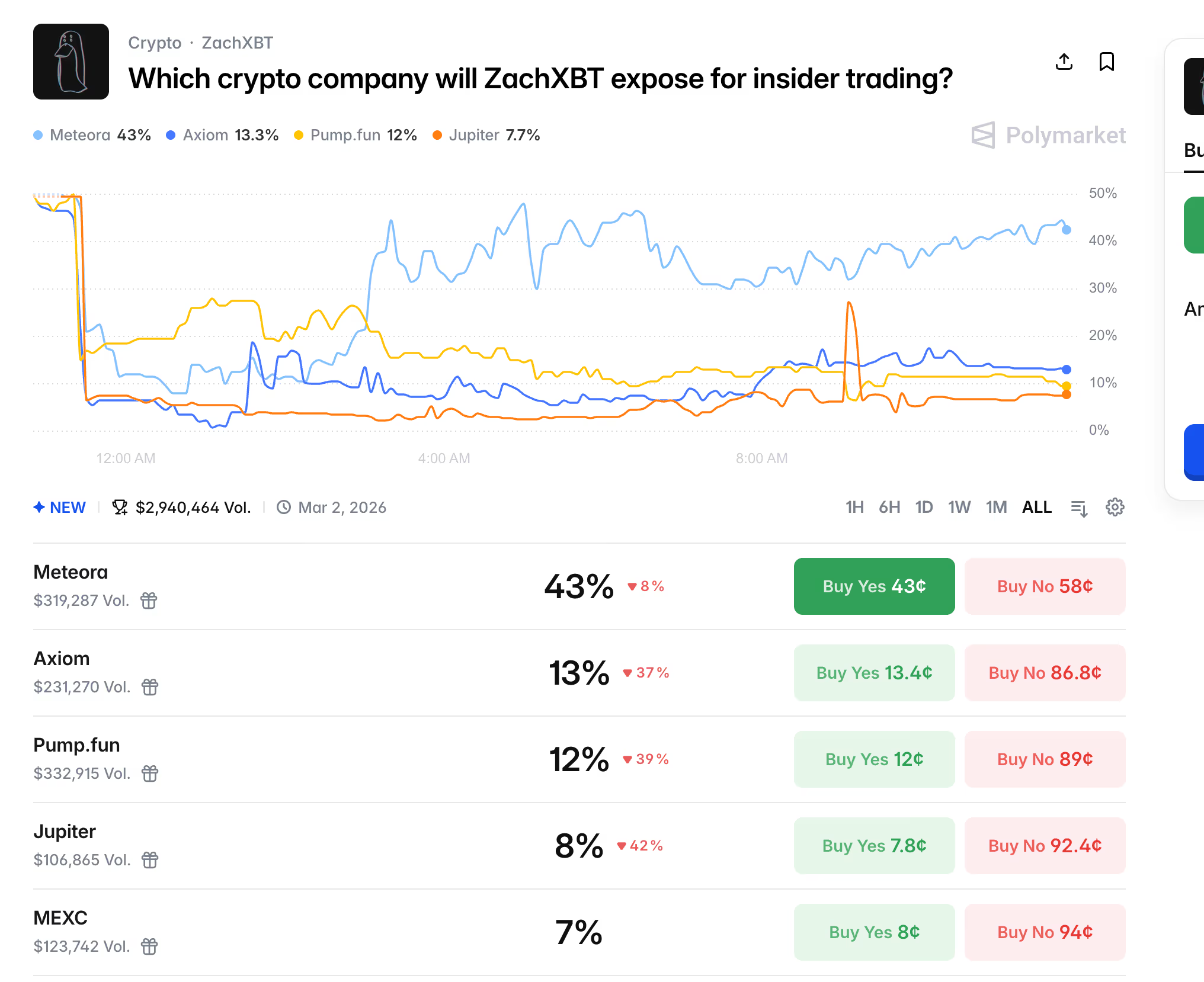

A prediction market asking which crypto company ZachXBT will expose for insider trading has drawn nearly $3 million in volume since the on-chain sleuth posted on X that a “major investigation” into one of crypto’s most profitable businesses would drop on February 26. He offered no specifics beyond alleging insider trading.

That was enough. Within hours, Polymarket traders began placing bets across several candidates, and the resulting odds function as a real-time map of where the market thinks the bodies are buried.

Polymarket is a blockchain-based prediction platform where users trade contracts on real-world outcomes using real money. The odds tend to reflect genuine conviction because bettors risk capital rather than just opinions. The platform gained mainstream credibility during the 2024 U.S. election cycle and has since become crypto’s de facto sentiment gauge for unresolved events.

As of Asian morning hours Tuesday, Meteora is the heavy favorite at 43%, with $319,000 in volume on that outcome alone. The Solana-based liquidity layer has been a recurring name in community discussions around meme coin market structure — particularly around how launch liquidity gets seeded and who ends up on the right side of early price moves.

Its proximity to politically linked token activity, including Trump-themed meme coins, has kept it in the spotlight.

Axiom sits at 13%, followed by Pump.fun at 12% with the highest single-outcome volume at $332,000 — suggesting heavy two-way action rather than consensus. Pump.fun’s inclusion tracks with months of scrutiny over early-wallet sniping on the platform, though the project has denied allegations of insider advantages.

Jupiter rounds out at 8% and MEXC at 7%. Jupiter’s presence reflects broader questions about Solana DeFi routing and fee extraction, while MEXC has faced persistent social media chatter about listing behavior and whale-friendly timing on meme coin markets.

The odds have shifted notably since the market opened. Axiom, Pump.fun, and Jupiter have all fallen 37-42% from their initial readings, while Meteora has consolidated its lead — a pattern that suggests early speculation has given way to more directional conviction as bettors parse ZachXBT’s prior work and posting patterns for clues.

None of this constitutes evidence, however. Prediction markets price belief, not fact, and Polymarket’s odds reflect the collective speculation of a few thousand traders rather than any inside knowledge of the investigation itself.

But the market is doing what prediction markets do best — forcing participants to put capital behind their hunches rather than just tweeting them.

The answer arrives in two days.

Crypto World

Bitcoin drops to $62,800 as tariffs, ETF outflows pressure crypto market

- Bitcoin price dipped to $62,800 amid the latest market weakness.

- Analysts say $60,000 is key to the bulls’ short-term picture.

- BTC could dip to $50,000 amid a bear cross pattern.

Bitcoin’s price slide gathered momentum on Tuesday, with fresh losses to under $63,000 as the cryptocurrency’s vulnerability to macroeconomic pressures and global uncertainties continued.

Trading volume surged 25% as investors reacted to a confluence of events, and top altcoins followed suit.

Bitcoin drops below $63,000

Bitcoin extended its losses to lows of $62,700 on Tuesday, bringing total declines to nearly 29% in the past month.

The benchmark digital asset’s latest dump comes amid mounting concerns over President Trump’s latest tariffs, with investor jitters rippling through the crypto market.

Analysts have noted that these trade policies heighten fears of inflation, trade instability, and reduced global liquidity.

Risk assets like cryptocurrencies are under pressure, and escalating geopolitical tensions surrounding potential US strikes on Iran add to this weakness.

BTC’s struggle mirrors traditional stock indices, which also tumbled after Citrini research sparked a sell out in companies that work in delivery and payments with software stocks also falling on Monday.

Meanwhile, on-chain data shows Bitcoin continues to confront huge ETF outflows, with investors pulling capital from investment products across the market.

According to Farside Investors’ data, Bitcoin ETFs saw $203.8 million worth of outflow on Monday.

These factors have outweighed Strategy’s 100th Bitcoin purchase and have failed to stem the downside.

BTC traded at $63,030 at the time of writing, down 2.4% in the past 24 hours.

The top cryptocurrency is down 7% from last week’s peak near $68k.

What’s next for Bitcoin price?

This dip thrusts the pivotal $60,000 support level into sharp focus.

Bears have already tested this psychological and technical floor, with BTC rebounding off the level following the February 5 crash.

Analysts warn that further short-term pain could allow for a potential revisit to $50,000.

If selling accelerates, lower support levels will come into play.

However, chart patterns suggest Bitcoin could find a bottom as the 50-week moving average crosses below the 100-week average. Price recovery has historically followed such patterns.

At the moment, the chart indicates no such cross has occurred, and prices will likely head lower.

However, extreme oversold conditions suggest a potential sharp rebound is next.

Bullish catalysts, including macro shifts and ETF inflows, can change the direction of Bitcoin.

The $70,000 mark remains key, with a breakout likely to accelerate short-term recovery.

“For a durable breakout to materialise, the market will require a clear resurgence in spot demand and stronger institutional participation; until then, Bitcoin is likely to remain range-bound within its established absorption zone,” analysts at Bitfinex wrote in a research note.

Crypto World

Crypto VC Backing a $500M DeFi Play

Framework Ventures has forged a strategic partnership with mortgage technology company Better to advance a $500 million credit facility into Sky’s decentralized stablecoin ecosystem. The collaboration aims to unlock the tokenization of real-world assets, beginning with mortgage-backed instruments that could generate yields for holders within a DeFi framework. The move signals a broader push by traditional finance and crypto-native firms to bridge tangible assets with scalable blockchain protocols, a trend that has gathered momentum as tokenization efforts spread from money-market funds to more complex asset classes.

Key takeaways

- Framework Ventures will extend up to $500 million in credit to Sky’s stablecoin ecosystem, enabling the launch of mortgage-backed tokens tied to Better’s assets.

- The initiative envisions tokens that represent mortgages, initially offered to accredited investors, with a long-term plan to broaden access to retail participants.

- Better is pursuing a stake in its own stock through Framework, with a reported 10% acquisition valued around a $45 million equity stake, alongside the tokenization push.

- The project sits within a wider wave of tokenization in traditional finance, including BlackRock’s exploration of tokenized instruments for money-market funds.

- Better’s leadership frames the effort as a means to cut intermediation and reduce costs for consumers, potentially enabling cheaper mortgage financing over time.

Tickers mentioned: $BETR

Market context: The plan arrives amid rising institutional interest in tokenized real-world assets and growing experimentation with DeFi-native structures that can support asset-backed tokens. It aligns with a broader move by asset managers toward tokenization as a way to broaden liquidity and potentially lower financing costs in traditional markets.

Why it matters

The collaboration highlights a convergence between crypto-native protocols and traditional mortgage finance. By channeling a sizable $500 million credit line into Sky’s stablecoin system, the initiative seeks to create a pipeline for mortgage-backed tokens that can be minted and traded within a decentralized framework. If successful, the approach could demonstrate a viable pathway to connect real-world debt—specifically conforming, government-backed mortgages—with blockchain rails, a pairing that proponents say can enhance efficiency, transparency, and liquidity.

Better’s leadership has framed the move as a broad effort to trim layers of intermediation and reduce operating costs. Vishal Garg, founder and CEO of Better, has argued that tokenization could lower overall financing costs, which, in turn, could translate into cheaper mortgage terms for consumers. While the precise mechanics and rate implications remain to be seen, the emphasis on cost reduction reflects a recurring theme in real-world asset tokenization: the potential for blockchain-enabled processes to streamline origination, underwriting, and settlement without sacrificing regulatory safeguards or consumer protections.

The strategic angle extends beyond just lending costs. By taking a stake in Better and pursuing mortgage-backed tokens, Framework and Better are testing whether a hybrid model—combining on-chain settlement with traditional mortgage assets—can deliver consistent yields to token holders while maintaining compliance and risk management. The initiative also underscores the appetite among some crypto investors for assets that can offer a bridge between digital liquidity and the stability of real-world collateral. In this sense, the project resonates with a wider industry trend toward tokenized assets that aim to preserve credit quality while expanding access to investors who are comfortable with DeFi governance and transparency standards.

The broader tokenization theme has gained notable attention from institutional players. For example, major asset managers have shown interest in tokenized versions of money-market funds, a development that could signal a future where high-quality, asset-backed tokens play a more prominent role in diversified portfolios. The industry’s trajectory toward tokenized real-world assets (RWAs) has been punctuated by regulatory scrutiny and the need to establish clear redemption, custody, and compliance frameworks. Even as investors weigh opportunities in these tokenized products, the emphasis remains on ensuring that tokenization scales without compromising investor protections.

The market backdrop includes public disclosures around Better’s equity positioning with Framework. Fortune reported that Framework would purchase about 10% of Better’s stock, which is currently valued at roughly $45 million, and that the tokenized mortgages could be made available initially only to accredited investors. Garg indicated the tokens would be issued first, with efforts to determine how those assets could reach everyday consumers, but specific launch dates were not disclosed. Market observers will be watching not only for token economics and compliance paths but also for how these mortgage-backed tokens would perform within Sky’s ecosystem and how collateralization, liquidity, and risk management would be structured in practice.

From a pricing perspective, Better’s stock BETR has experienced a challenging period since peaking near the $86 level in October. It was trading around $27 as of last close, reflecting ongoing volatility in the stock’s performance and investor sentiment amid broader market fluctuations. This backdrop adds another layer of complexity to any tokenization plan tied to a public equity component, highlighting the delicate balance between on-chain innovation and traditional market dynamics.

The motivation for the program rests partly on the belief that tokenization can unlock new efficiencies and access. Garg’s remarks suggest a long-term view where mortgage-backed tokens could reduce cost pressure on lenders and borrowers alike by removing redundant steps in the origination and settlement processes. The promise hinges on rigorous risk controls, credible asset backing, and a framework for on-chain governance that preserves the integrity of the underlying mortgage assets.

As the industry watches, a number of fundamental questions remain: How will the mortgage-backed tokens be structured in terms of collateralization and payment streams? What governance mechanisms will oversee the Sky ecosystem to ensure reliability and security? What regulatory approvals or safe harbors will be necessary to allow token holders to participate economically in mortgage yields without running afoul of securities or commodities rules? While these are not uniquely defined yet, the collaboration between Framework and Better signals a concerted effort to address these issues in a convergent manner—blending the best practices of traditional credit markets with the transparency and programmability of DeFi.

What to watch next

- Official rollout details for the $500 million credit facility to Sky and the timeline for token issuance.

- Detailed tokenomics for the mortgage-backed tokens, including yield structures, collateral requirements, and redemption mechanics.

- Regulatory filings or statements clarifying compliance pathways for accredited-investor tokens and eventual consumer access.

- Subsequent investor communications from Better and Framework regarding the equity stake and governance rights tied to the token program.

- Updates on Sky’s protocol integration, including security audits, collateral-custody arrangements, and on-chain settlement protocols.

Sources & verification

- Better and Framework Ventures press release announcing the strategic partnership to deploy $500MM into Better via Sky’s stablecoin ecosystem (BusinessWire).

- Fortune coverage of Framework’s investment in Better and the proposed “Home Token” mortgage-backed tokens, including the 10% stock acquisition and accreditation restrictions.

- Cointelegraph reporting on BlackRock’s exploration of tokenization for money-market funds as part of the broader tokenization trend.

- Cointelegraph explainer on tokenization, outlining the mechanics and opportunities of tokenizing traditional assets.

- BETR stock price context from Google Finance showing recent trading levels in Better’s public market.

Market reaction and key details

The partnership between Framework Ventures and Better marks a notable step in the ongoing experimentation with tokenized real-world assets. If the mortgage-backed token concept proves viable, it could provide a scalable model for aligning mortgage originators with DeFi liquidity, potentially lowering financing costs for borrowers while offering a novel yield channel for token holders. The approach emphasizes real-world asset backing, robust risk controls, and a governance framework designed to coexist with traditional financial oversight. Investors should monitor how the tokenization framework adapts to regulatory developments, how capital is deployed to Sky, and how consumer-ready token products are designed, tested, and rolled out in the months ahead.

What it means for users and builders

For users, the initiative could eventually translate into accessible, tokenized exposure to mortgage-originated yields—an option that sits at the intersection of DeFi and mainstream finance. For builders, the Sky ecosystem represents a testbed for on-chain loan structures, asset-backed collateral, and transparent settlement processes that can scale across asset classes. The collaboration also signals ongoing interest from institutional players in tokenized RWAs, a trend that could help drive liquidity, standardization, and better risk management practices within DeFi.

Crypto World

TRM Labs, Finray Launch Crypto and Fiat Monitoring

Blockchain intelligence platform TRM Labs has joined forces with banking infrastructure firm Finray Technologies to create a unified system that monitors both crypto and fiat transactions.

Finray’s compliance and decision engine, XZiel, has been integrated with TRM’s blockchain intelligence tools to enable real-time alert triaging, automated escalation, case management, and risk assessment across crypto and fiat transactions, the companies announced on Tuesday.

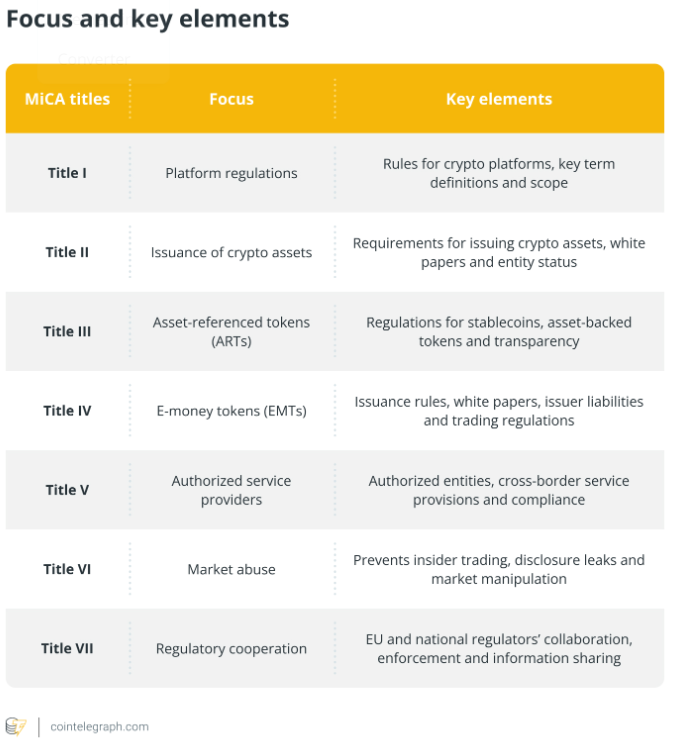

With stablecoin settlements and fiat payment flows becoming increasingly interconnected and with new regulations such as Europe’s Markets in Crypto-Assets (MiCA), institutions operating in both markets now require unified oversight, according to Finray Technologies and TRM Labs.

The system is designed to help institutions implement structured, auditable monitoring programs aligned with MiCA requirements and anti-money laundering obligations, streamlining market entry for regulated entities.

Bitcoin, Ethereum, and other blockchains covered

Key features of Finray and TRM Labs’ new system include real-time risk alerts for suspicious crypto transactions, using the same workflow as traditional payment monitoring. Blockchains covered include Bitcoin, Ethereum and Tron.

The system supports wallet screening during onboarding and ongoing monitoring, assessing the risk of wallet addresses across both on-chain and off-chain environments.

It also automatically records a detailed, time-stamped audit trail, documenting why an activity was flagged as risky, who reviewed it and what decision was made in the event of regulatory or audit reviews.

Aimed at banks expanding into crypto

Finray and TRM Labs’ system is aimed at exchanges, custodians serving institutional clients, corporate treasuries, banks, and electronic money institutions looking to expand their crypto offerings or enable crypto on- and off-ramp services, the firms said.

Related: TRM Labs completes $70M investment round at $1B, becomes crypto unicorn

“Compliance teams can’t manage fiat and crypto risk in separate systems anymore,” Oleksandr Potapenko, the CEO of Finray, said in a statement.

“Embedding TRM’s blockchain intelligence directly into XZiel gives our customers a single, auditable view of risk across both rails — where they can hold, clear, escalate, and document decisions within one environment. That is what operating under MiCA and evolving supervisory expectations actually demands,” he added.

A growing number of institutions are already expanding into crypto. More than half of the top US banks have started or announced plans to offer Bitcoin-related services, such as trading or custody Bitcoin financial services firm River said last month.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Bitcoin’s price discovery is moving to Chicago

Bitcoin , once hailed as an anti-establishment asset and antithesis to Wall Street, may now bend to sharp traders from those same floors.

Trading in the leading cryptocurrency is steadily shifting toward CME Group, and the exchange’s move to 24/7 derivatives later this year could cement its role as the dominant venue for institutional crypto risk.

The change removes one of the last advantages held by crypto exchanges: nonstop market access.

“You’ll see more traditional hedge fund managers getting more into the asset class, because they’ll be able to trade it on instruments they know, without having to upgrade their tech or move their signals,” Karl Naim, Chief Commercial Officer at XBTO, told CoinDesk. “Why would they want to take a counterparty risk of an entity they don’t know?”

CME already leads regulated bitcoin futures markets by open interest, and its contracts underpin much of the hedging activity tied to U.S. spot ETFs. Until now, however, trading paused over the weekend, producing the well-known “CME gaps” and leaving institutional investors unable to adjust positions while offshore exchanges continued operating.

Around-the-clock trading removes that constraint. Institutions that once relied solely on exchange-traded funds (ETFs) or avoided weekend exposure will be able to hedge continuously, tightening arbitrage windows between prices for regulated futures and offshore perpetual swaps.

As those gaps disappear, so too does the need for large allocators to maintain exposure on crypto exchanges simply for access. For institutions that prioritize regulatory clarity and established clearinghouses, CME begins to look less like an alternative and more like the default.

Even crypto exchange executives are aware of this. In January, OKX President Hong Fang wrote in a CoinDesk op-ed that crypto derivatives trading could one day rival or even surpass spot volumes on major global exchanges, making U.S. regulated volatility markets an even stronger anchor for bitcoin price discovery worldwide.

Institutions calling the shots

For Naim, the shift reflects a broader evolution in how capital enters bitcoin. What began as a grassroots activism by retail traders chasing BTC as an alternative to Wall Street has flipped upside down, with traditional institutions now calling the shots.

“Today we speak to a lot of the sovereigns, a lot of the institutions. They go for what they know,” he said, describing allocators that first accessed the asset through spot ETFs before considering more complex strategies.

With institutional positioning carrying more weight, bitcoin’s short-term direction increasingly reflects global risk sentiment.

“If [Trump attacks Iran], obviously what we’re going to see is that it’s going to be all risk off,” Naim said, referring to a potential forced regime change in Iran by the U.S. “Gold already started rallying. Equities will go down. Bitcoin will go down.”

In that framework, bitcoin behaves less like a standalone crypto trade and more like a macro instrument, priced alongside equities and commodities rather than apart from them.

Naim acknowledged the irony.

“Bitcoin was all about decentralization,” he said.

But as institutional capital scales and liquidity consolidates within regulated clearinghouses, the infrastructure surrounding the asset is becoming increasingly centralized — because institutional money chases risk assets, not risky platforms.

Crypto World

Cybersecurity Stocks Slump After Anthropic AI Launch

Shares in leading listed cybersecurity companies have fallen since Anthropic’s launch of Claude Code Security on Friday, an AI-powered code vulnerability scanner.

Anthropic launched Claude Code Security on Feb. 20 as a limited research preview.

Claude can reason like a skilled security researcher

According to the company website, Anthropic’s chatbot Claude “scans your entire codebase for vulnerabilities, validates each finding to minimize false positives, and suggests patches you can review and approve.”

Claude reasons through code “like a skilled security researcher,” it understands context, traces data flows, and “catches vulnerabilities that pattern-matching tools miss,” before proposing a fix.

Anthropic’s most advanced AI model, Claude Opus 4.6, has already found more than 500 high-severity vulnerabilities that have survived decades of expert review, VentureBeat reported on Monday.

ChatGPT maker OpenAI launched a new benchmark on Feb. 19 to evaluate how well different AI models detect, patch, and exploit security vulnerabilities in smart contracts. Claude Opus 4.6 came out on top.

Cybersecurity company shares decline

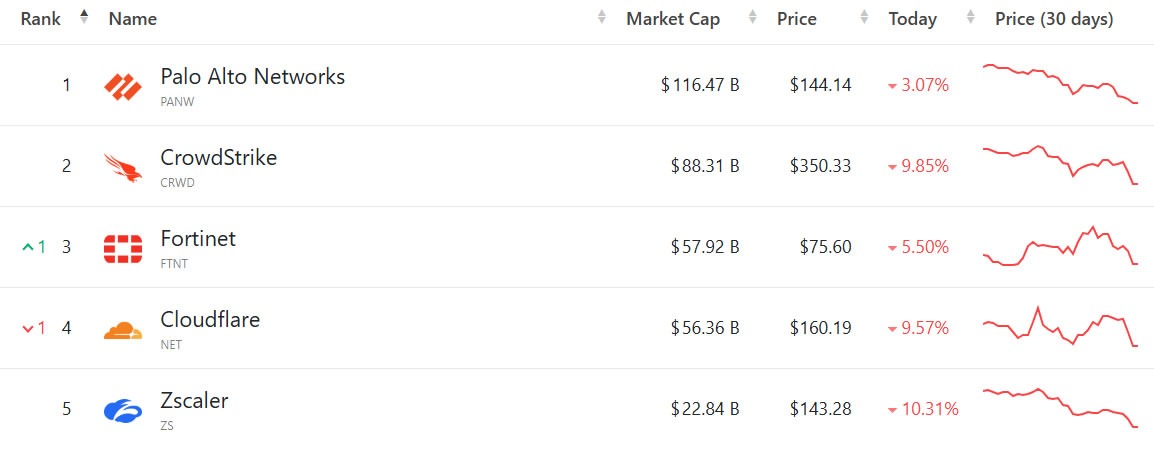

The top five US-listed information technology security companies by market capitalization have all seen heavy share price declines continue this week.

Palo Alto Networks, America’s largest cybersecurity company with a market capitalization of $116 billion, saw its stock (PANW) slide almost 9% since the launch.

CrowdStrike, which provides endpoint security, threat intelligence, and cyberattack response services, had an even greater loss with its share prices tanking 18% since Feb. 20, erasing $20 billion in market cap.

Meanwhile, California-based Fortinet, which develops and sells security products, lost 9% from its share price (FTNT) over the same period, according to Google Finance.

Other leading cybersecurity firms, such as Cloudflare and Zscaler, also saw their stocks slide amid the new AI competitor.

“What you’re seeing today is really the continuation of a panic-driven, narrative-led selloff,” Shrenik Kothari, security and infrastructure analyst at Robert W. Baird, told Reuters.

Market reactions are not irrational

“These reactions are not irrational,” noted the Kobeissi Letter in a lengthy post on the threat of AI taking over the IT workforce on Tuesday.

“When AI replicates what workers do, pricing power shifts to the buyer. That is the first-order impact, and it is very real.”

Related: Citrini’s AI doom report sees software, payment stocks tumble

Analysts at financial services firm Wedbush said the stock sell-off was due to “AI Ghost Trade fears.” They noted that Anthropic’s move into the market reinforces a broader view that cybersecurity will be a key beneficiary of the AI boom, reported Proactive on Tuesday.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

Framework Ventures to Help Better With DeFi Play

Crypto venture firm Framework Ventures has partnered with mortgage services company Better to help it launch a $500 million plan to integrate with the decentralized finance protocol Sky, formerly MakerDAO.

Better said on Monday that Framework would help it provide $500 million in credit to Sky’s stablecoin ecosystem, enabling it to launch tokens tied to mortgages that would generate yield.

Framework Ventures co-founder Vance Spencer said real-world assets are “one of the most important frontiers in decentralized finance, and government-backed conforming mortgages are one of the largest real-world asset classes in the world.”

The plan comes amid a broader interest in tokenization from traditional finance companies, with firms such as BlackRock dabbling in tokenization for money market funds.

Tokens only for accredited investors, but will expand

Fortune reported on Monday that Framework also struck a deal to buy 10% of Better’s stock, currently valued at about $45 million, and that the planned tokens would initially be available only to accredited investors.

Better founder and CEO Vishal Garg said that it would issue the tokens and then would be “figuring out how do we get this in the hands of consumers,” but did not say when the tokens would be launched.

Fortune reported that the retail-focused tokens would be named “Home Token,” citing a person familiar with the plans.

It comes as shares in the Nasdaq-listed Better (BETR) have struggled after hitting a peak of over $86 in late October.

Its stock has since sunk, ending trading on Monday at around $27, down nearly 17% so far this year.

Related: Backpack pledges 20% equity to token stakers amid IPO plans

Garg explained to Fortune that its push into crypto was driven by the promise of lower fees and operating costs, and that there are “so many different layers of intermediation that we’re going to be able to take out.”

“If we’re able to finance at a much lower cost than anyone else in the mortgage market, we’re going to be able to offer consumers a much cheaper mortgage than anybody else in the market,” he added.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation — Santiment founder

Crypto World

Crypto.com Secures Conditional OCC Trust Bank Approval

Crypto.com has secured conditional approval from the Office of the Comptroller of the Currency (OCC) to charter a national trust bank.

With this move, the cryptocurrency exchange and financial services platform joins a growing list of digital asset firms that received similar approvals last year.

As previously reported by BeInCrypto, Crypto.com applied for a national trust bank charter in October 2025. The OCC granted conditional approval in February 2026, marking a significant milestone for the company.

It’s worth noting that conditional approval represents a preliminary stage in the chartering process. The applicant must satisfy the OCC’s regulatory and operational requirements before obtaining full approval.

“Crypto.com today announced that it has received conditional approval from the Office of the Comptroller of the Currency (OCC) to charter Foris Dax National Trust Bank, d.b.a. Crypto.com National Trust Bank,” the announcement read.

Crypto.com emphasized that the approval does not affect the ongoing operations of Crypto.com Custody Trust Company. That entity will continue to operate as a qualified custodian regulated by the New Hampshire Banking Department as a non-depository trust company.

“This conditional approval is the latest testament to both our commitment to compliance and to providing customers trusted and secure services they expect from Crypto.com. This milestone brings us a major step closer to meeting leading institutions’ needs for a one-stop-shop qualified custodian under a gold standard of federal oversight,” said Kris Marszalek, Co-Founder and CEO of Crypto.com.

Firms such as Ripple, Circle, Paxos, and Fidelity Investments also received conditional approval for their national trust bank charter applications in December 2025. Meanwhile, BitGo went a step further, securing full approval from the OCC late last year to convert its state trust company into a national trust bank.

In addition, Trump-backed DeFi project World Liberty Financial’s subsidiary submitted its application to the OCC in January to establish World Liberty Trust Company, National Association (WLTC). The proposed institution would function as a national trust bank structured to facilitate stablecoin-focused activities.

The move by cryptocurrency firms into federally chartered banking structures reflects deeper integration of digital asset companies into the US financial regulatory framework. A national trust charter provides federal legal status, enhances custody capabilities, and may strengthen institutional credibility. Operating under OCC supervision centralizes oversight at the federal level.

However, this trend has also raised concerns. The American Bankers Association (ABA) and the Independent Community Bankers of America (ICBA) have pushed back against the OCC granting conditional approvals. They warn that broadening crypto charters may blur the boundaries of US banking and create new challenges.

Crypto World

Michael Saylor Weighs In on Quantum Threat to Bitcoin

Strategy (formerly MicroStrategy) co-founder and executive chairman Michael Saylor said he does not believe quantum computing represents Bitcoin’s (BTC) greatest security threat at the moment.

This statement comes as the quantum computing narrative continues to be a focus of debate among crypto circles. Some argue that it has already started to impact Bitcoin’s valuation and institutional exposure.

Michael Saylor Dismisses Quantum Threat to Bitcoin

During an appearance on Natalie Brunell’s Coin Stories podcast, Saylor weighed in on growing concerns over quantum computing. He said the broader cybersecurity community generally agrees that any meaningful quantum-related risk remains at least a decade away. Saylor added that it’s not a “this decade thing.”

“Whether or not there will be a quantum threat or a quantum risk is a question that is yet to be decided. But there’s certainly no consensus that there is any threat right now or that there will be a threat materializing anytime soon,” he commented. “I don’t actually think that the quantum, you know, narrative is the greatest security threat to Bitcoin right now. I don’t think it has been.”

He emphasized that major breakthrough quantum capabilities would not catch the industry off guard. If a quantum threat materialized, global banking systems, internet infrastructure, consumer devices, artificial intelligence (AI) networks, and crypto protocols, including Bitcoin, would coordinate software upgrades to quantum-resistant cryptography.

Previously, Saylor has suggested that Bitcoin’s greatest threat comes from ambitious opportunists pushing for changes to the protocol.

“The software does change. If you’ve got 30 versions of Bitcoin core in an asset which is 17 years old, do the math in your head and figure out how long it takes for versions of this stuff to roll out. The nodes will upgrade, the hardware will upgrade, the wallets will upgrade, the exchanges will upgrade. How will they upgrade? Well, wait 10 years. There will be global consensus about the best way to deal with it. There is no global consensus right now because there isn’t a credible threat right now,” he added.

Saylor also downplayed fears of Bitcoin facing isolated vulnerability. He noted that major corporations, financial institutions, and governments worldwide rely on digital systems that would face similar exposure in the event of a credible quantum breakthrough.

Companies such as Google, Microsoft, Apple, Coinbase, and BlackRock, alongside global governments and major banks, would all be confronting the same challenge.

“When and if it materializes, I expect that there will be some software or hardware or both reaction to it. The crypto community is actually the most sophisticated cybersecurity community,” he remarked. “So I think that the crypto security community will be the first, you know, to perceive the threat and to react to the threat, and they’ll be leading the way.”

From Wall Street to Core Devs: Crypto Braces for the Quantum Era

While the technical threat may be distant, institutional capital appears to be pricing in uncertainty. Shark Tank investor Kevin O’Leary recently stated that many institutions are capping their Bitcoin exposure due to concerns over quantum computing.

Christopher Wood, Global Head of Equity Strategy at Jefferies, has removed Bitcoin from his model portfolio over similar fears. Meanwhile, analysts including Willy Woo and Charles Edwards argue that quantum-related uncertainty could be contributing to Bitcoin’s relative underperformance against gold and weighing on its price.

As the debate intensifies, defensive measures are accelerating across the industry. Ethereum has incorporated post-quantum readiness into its planned 2026 protocol priorities update. Coinbase and Optimism are also actively planning post-quantum security enhancements.

On the Bitcoin side, developers have merged Bitcoin Improvement Proposal 360 (BIP 360) into the official BIP GitHub repository.

-

Crypto World7 days ago

Crypto World7 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video4 days ago

Video4 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports12 hours ago

Sports12 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics14 hours ago

Politics14 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business6 days ago

Business6 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video7 days ago

Video7 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment5 days ago

Entertainment5 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat21 hours ago

NewsBeat21 hours ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Politics7 days ago

Politics7 days agoEurovision Announces UK Act For 2026 Song Contest

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.