Crypto World

Arthur Hayes Predicts AI Banking Crisis And Bitcoin Surge

The divergence between Bitcoin and tech stocks is a warning sign of a potential artificial intelligence-driven credit crisis that could lead to more central bank money printing, says Arthur Hayes.

“Bitcoin is the global fiat liquidity fire alarm. It is the most responsive freely traded asset to the fiat credit supply,” said the crypto entrepreneur in his latest blog post on Wednesday.

Hayes went on to caution that the recent divergence between Bitcoin (BTC) and the tech-heavy Nasdaq 100 Index “sounds the alarm that a massive credit destruction event is nigh.”

When these two previously correlated asset classes diverge, “it warrants further investigation into any trigger that could cause a destruction of fiat” — mostly dollars and credit, which is also known as deflation, he said.

Hayes believes that job losses due to AI adoption will have a major impact on consumer credit and mortgage debt “because of the inability of white-collar knowledge worker debt donkeys to meet their monthly payments.”

“That’s a bold statement to call for a financial crisis because of job losses caused by AI adoption.”

AI job losses could trigger another banking crisis

In 2025, companies cited AI when announcing 55,000 job cuts, more than 12 times the number of layoffs attributed to AI just two years earlier, reported CBS News in early February.

“This AI financial crisis will restart the money printing machine for realz,” said Hayes.

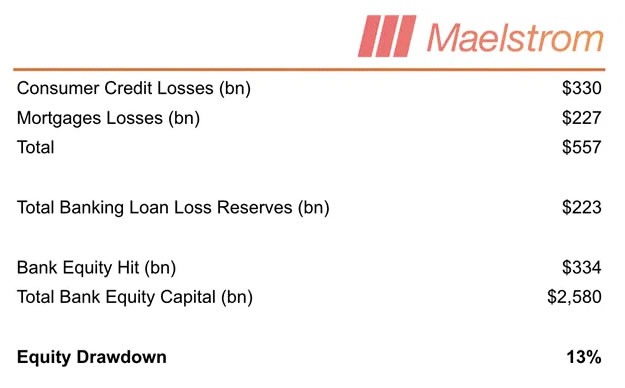

His loose model suggests that a 20% reduction in the 72 million “knowledge workers” in the US could produce around $557 billion in consumer credit and mortgage losses, representing a 13% write-down of US commercial bank equity.

Hayes speculates that weaker regional banks would buckle first, depositors would flee, and credit markets would seize. The Federal Reserve would eventually panic and start printing money.

“While the Fed is fighting windmills, AI-related job losses will destroy the balance sheets of American banks,” he said.

“Finally, the monetary mandarins panic and press that Brrrr button harder than I shred pow the morning after a one-meter dump.”

Related: 1 in 4 CEOs expect to sack staff due to AI this year

Hayes predicted that this surge in fiat credit creation would “pump Bitcoin decisively off its lows,” and that the future expectation of increased fiat creation to save the banking system would “propel Bitcoin to a new all-time high.”

In addition to Bitcoin, Hayes said there are two altcoins that his company, Maelstrom, will “deploy excess stables into once the Fed blinks.” Those coins are Zcash (ZEC) and Hyperliquid (HYPE).

More money-printing theories abound

However, this is not the first radical money-printing thesis Hayes has proposed.

In January, he said that the Federal Reserve would print money to alleviate the Japanese bond crisis.

In December 2025, he predicted that BTC would surge to $200,000 by March due to money printing through a new Fed liquidity tool called Reserve Management Purchases, which resembles quantitative easing.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Can Ethereum price rally continue above $2100 as BlackRock’s staked Ethereum ETF launches?

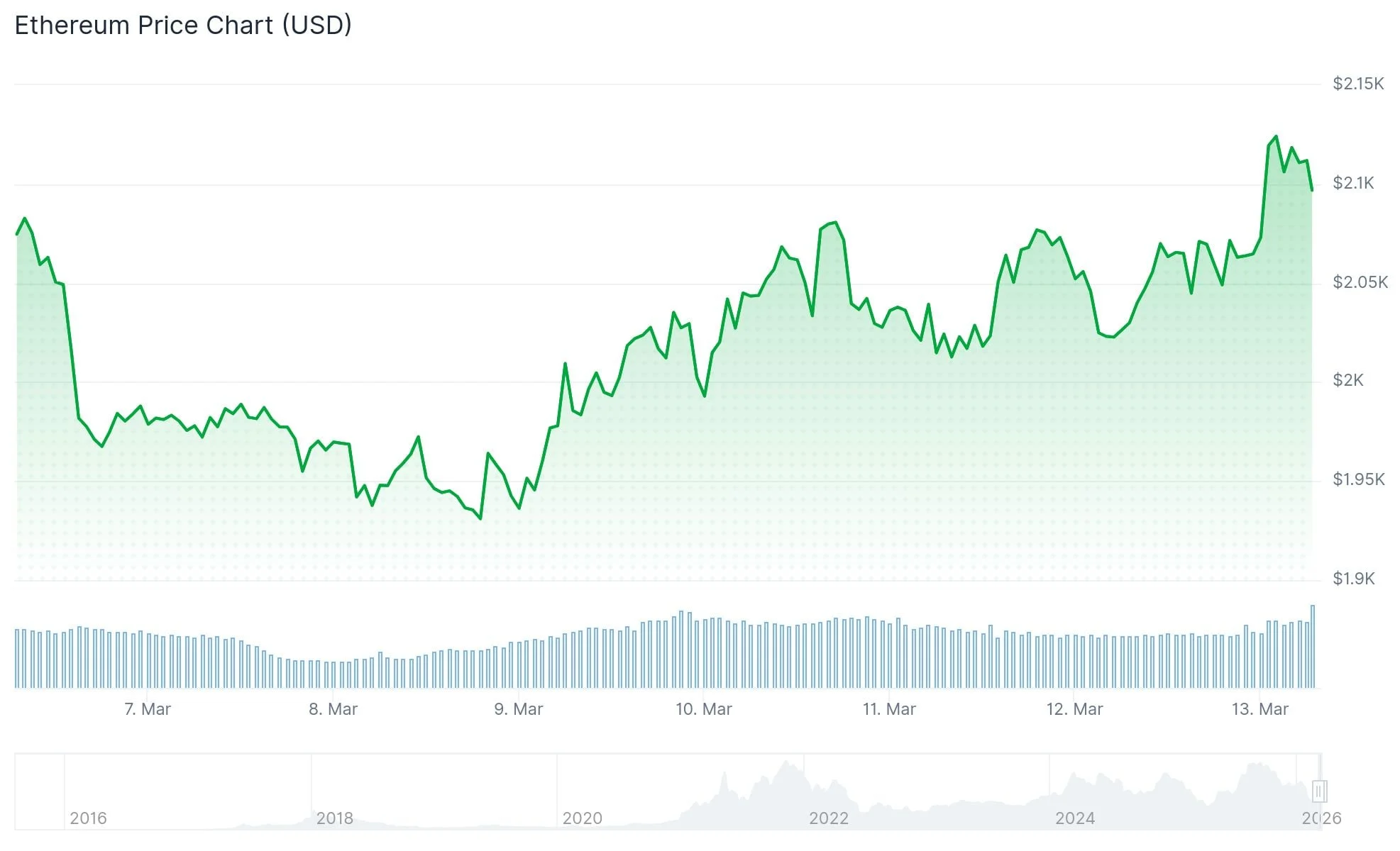

Ethereum’s price rallied to a weekly high of $2,144 on Friday following the strong debut of investment manager BlackRock’s staked Ethereum ETF.

Summary

- Ethereum price broke past the $2,100 resistance level on March 13.

- BlackRock’s staking ETF ETHB pulled in $15.5 million in trading volume on launch day.

- A bullish SMA crossover is close to confirmation on the daily chart.

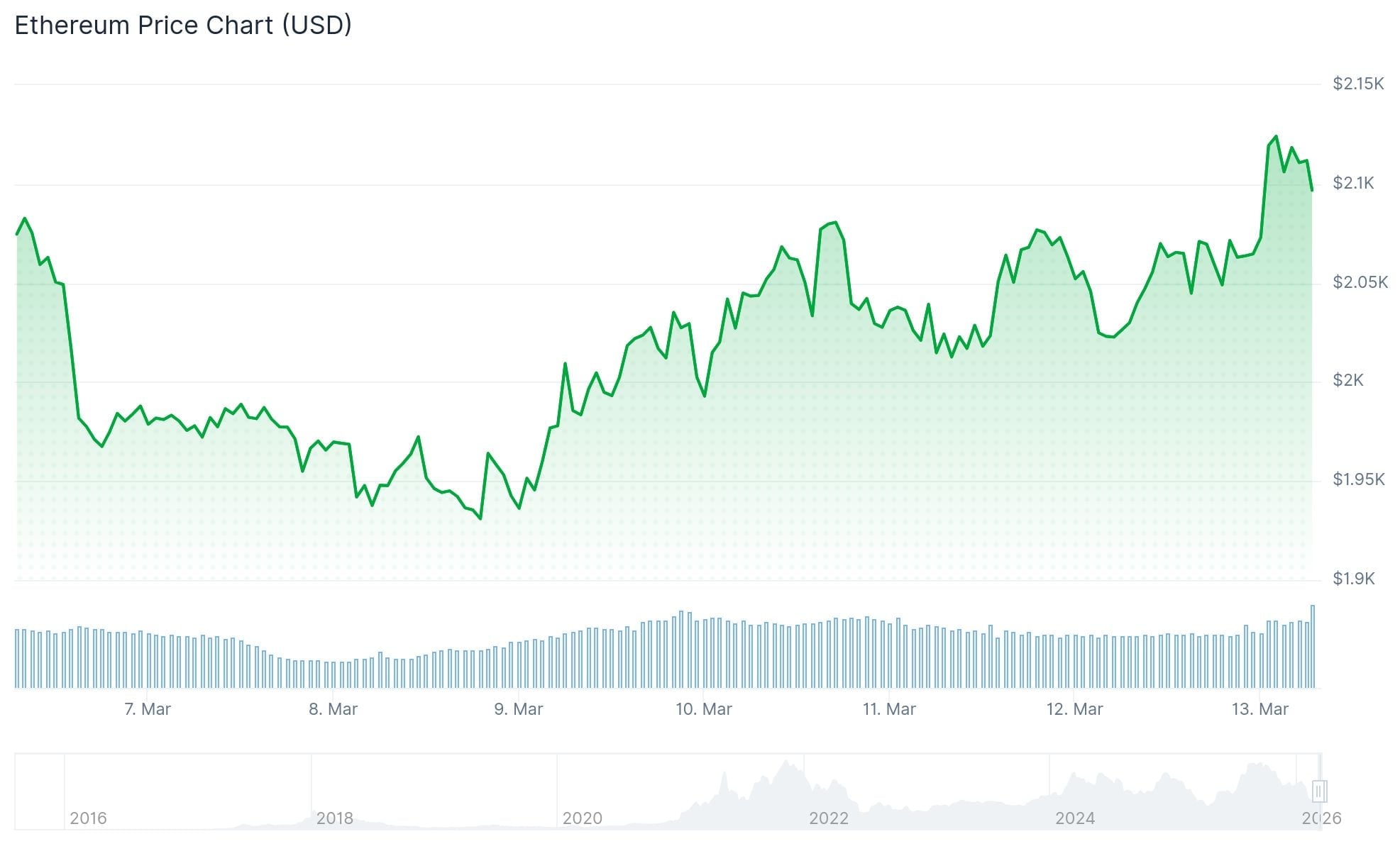

According to data from crypto.news, Ethereum (ETH) price shot up nearly 6% to $2,144 during Friday morning Asian time before stabilizing around $2,100 at the time of writing. At this valuation, the second-largest crypto asset by market cap sits 11% above its weekly low and over 18% from its lowest point in February.

The rally gained momentum after BlackRock recorded a very strong debut with its iShares Staked Ethereum ETF (ETHB) on Nasdaq. The first Ethereum ETF from the world’s largest asset manager to include staking pulled in around $15.5 million in trading volume on its first day.

For context, the iShares Staked Ethereum Trust (ETHB) operates by holding spot Ethereum and dynamically staking between 70% and 95% of its reserves directly on the Ethereum network. This structure allows investors to receive 82% of staking rewards through monthly distributions. This largely differs from existing Ethereum ETFs, where investors forego staking rewards, making those older products much less appealing.

As such, there is a strong possibility that investors could begin rotating their capital from other ETH ETFs, including BlackRock’s own ETHA, which offers no staking, into the new ETHB.

Investors who have previously stayed on the sidelines due to the lack of yield could now also enter the market while enjoying the added benefits of staking rewards. This shift, driven by those who finally see the ETF as a productive asset, could likely act as a fresh catalyst to sustain the current uptrend.

Meanwhile, besides the ETF news, a sharp drop in crude oil prices provided extra tailwinds. Brent crude dropped 7% today, renewing investor demand for risk assets, including Ethereum, as they rotate away from traditional safe-haven assets.

On the daily chart, technical indicators seem to suggest that Ethereum’s price could sustain its rally above $2,100 in the short term.

Notably, the 20-day moving average appears to be close to confirming a bullish crossover with the 50-day moving average. Meanwhile, the Aroon Up remains at 35.71%, which is comfortably above the Aroon Down at 7.14%. Ethereum’s RSI has also yet to enter the overbought area.

This suggests there is still room for the uptrend to continue before any potential exhaustion or reversal occurs.

For now, $2,200 could act as the immediate resistance that traders will be watching closely for signs of a breakout. A move above that level could act as a definitive confirmation of a positive shift in market sentiment.

A rally above that mark would also invalidate a major bearish pattern. As previously reported by analysts at crypto.news, the price has been forming a bearish flag pattern over multiple months.

Bearish flag patterns are considered some of the most bearish formations in technical analysis. If ETH falls towards $1800, it would confirm the pattern.

Crypto World

What Happens When You Ignore Slippage? One Trader Just Found Out With a $50M Swap

Despite clear warnings, a trader confirmed a massive $50M swap and received just 324 Aave tokens

A user attempted to purchase the AAVE token with $50 million worth of Tether through the Aave interface on March 12, but the trade executed poorly after the user accepted a warning about extreme slippage.

According to Aave Labs founder and CEO Stani Kulechov, the transaction involved a single order of significant size placed through the Aave interface, which integrates routing infrastructure provided by CoW Swap. Because of the unusually large order size, the interface displayed a warning about extraordinary slippage and required explicit confirmation before the swap could proceed.

$50M Trade Gone Wrong

The warning appeared as a confirmation checkbox, which the user had to manually accept before completing the transaction. Kulechov said the user confirmed the warning on a mobile device and chose to proceed with the trade despite the slippage notification. Due to the execution conditions and the liquidity available through the routing path, the user ultimately received only 324 AAVE tokens in return for the $50 million USDT order.

Kulechov stated that the transaction could not have moved forward without the user explicitly acknowledging the warning and confirming acceptance of the associated risks through the interface. He said the routing infrastructure functioned as designed and that the integration with CoW Swap followed standard practices commonly used across the DeFi sector.

However, the final execution was significantly worse than what would typically be expected in a more liquid market environment. Kulechov noted that events involving high slippage can occur in DeFi when users attempt to execute trades that are far larger than the liquidity available in the relevant markets, although he said the scale of this specific transaction was significantly larger than what is normally seen in the space.

In response to the incident, the exec said the Aave team sympathizes with the user and will attempt to establish contact with them. He added that the protocol plans to return approximately $600,000 in fees that were collected from the transaction. Kulechov said that while maintaining the permissionless nature of DeFi remains important, the industry can still build additional guardrails to help reduce the likelihood of similar incidents in the future.

User Freedom vs Protection

CoW Protocol, which is a DEX aggregator, took to X and explained that “preventing users from making trades removes choice and can lead to terrible outcomes in some situations.” It also added that trades like these demonstrate that “DeFi UX still isn’t where it needs to be to protect all users. As a team, we are now reviewing how we balance strong safeguards with preserving user autonomy.”

You may also like:

The platform asserted that it will refund any fees sent to CoW DAO.

The incident quickly drew reactions across the crypto community. A popular crypto analyst, Autism Capital, described the event as a “teachable moment about money.”

Meanwhile, another crypto commentator, KJ Crypto, questioned the motivation behind such a large purchase attempt and tweeted that it raises questions about why someone would want to acquire $50 million worth of Aave in a single transaction.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin Policy Institute to review Fed Basel proposal to ensure fair Bitcoin treatment

The Bitcoin Policy Institute said it plans to review and respond to an upcoming proposal from the Federal Reserve that could shape how U.S. banks treat Bitcoin under international banking standards.

Summary

- The Bitcoin Policy Institute plans to review and comment on an upcoming Federal Reserve proposal on Basel rules.

- The proposal will open a 90-day public comment period for industry feedback.

- Current Basel guidance assigns Bitcoin a 1250% risk weighting, discouraging banks from holding or servicing the asset.

Bitcoin Policy Institute to weigh in as Fed prepares Basel proposal for banks

According to Conner Brown, the Federal Reserve is expected to issue a public proposal next week outlining how American banks should implement risk-weighting guidance under the Basel Accords.

The proposal will apply to the largest U.S. banks and will open a 90-day public comment period, allowing industry participants, policy groups and financial institutions to submit feedback before the rules are finalized.

Brown said the institute intends to participate in the process to ensure regulators “get Bitcoin’s treatment right.”

Under the Basel framework, Bitcoin (BTC) is currently assigned a 1250% risk weighting, which effectively treats the cryptocurrency as a highly risky asset on bank balance sheets. Such a requirement forces banks to hold significantly higher levels of capital against Bitcoin exposure compared with most traditional assets.

Critics argue that this classification makes it difficult for banks to provide financial services to Bitcoin users and companies, as the capital requirements can discourage institutions from interacting with the sector.

“The Federal Reserve just announced that next week they will issue a public proposal for how banks should implement Basel risk weighting guidance,” Brown said in a post on X, adding that the think tank would review the document and submit a formal public comment.

The upcoming consultation comes as policymakers in the United States continue to debate how digital assets should fit within the global banking regulatory framework.

Industry advocates say the outcome of the Federal Reserve’s proposal could play a key role in determining whether traditional financial institutions expand or limit their engagement with Bitcoin-related services in the future.

Crypto World

Why Every Blockchain Suddenly Wants Its Own Perp Dex

In crypto’s latest infrastructure race, blockchains are competing to host perpetual futures exchanges. Many are now launching or incubating decentralized derivatives markets themselves, even as centralized platforms continue to dominate.

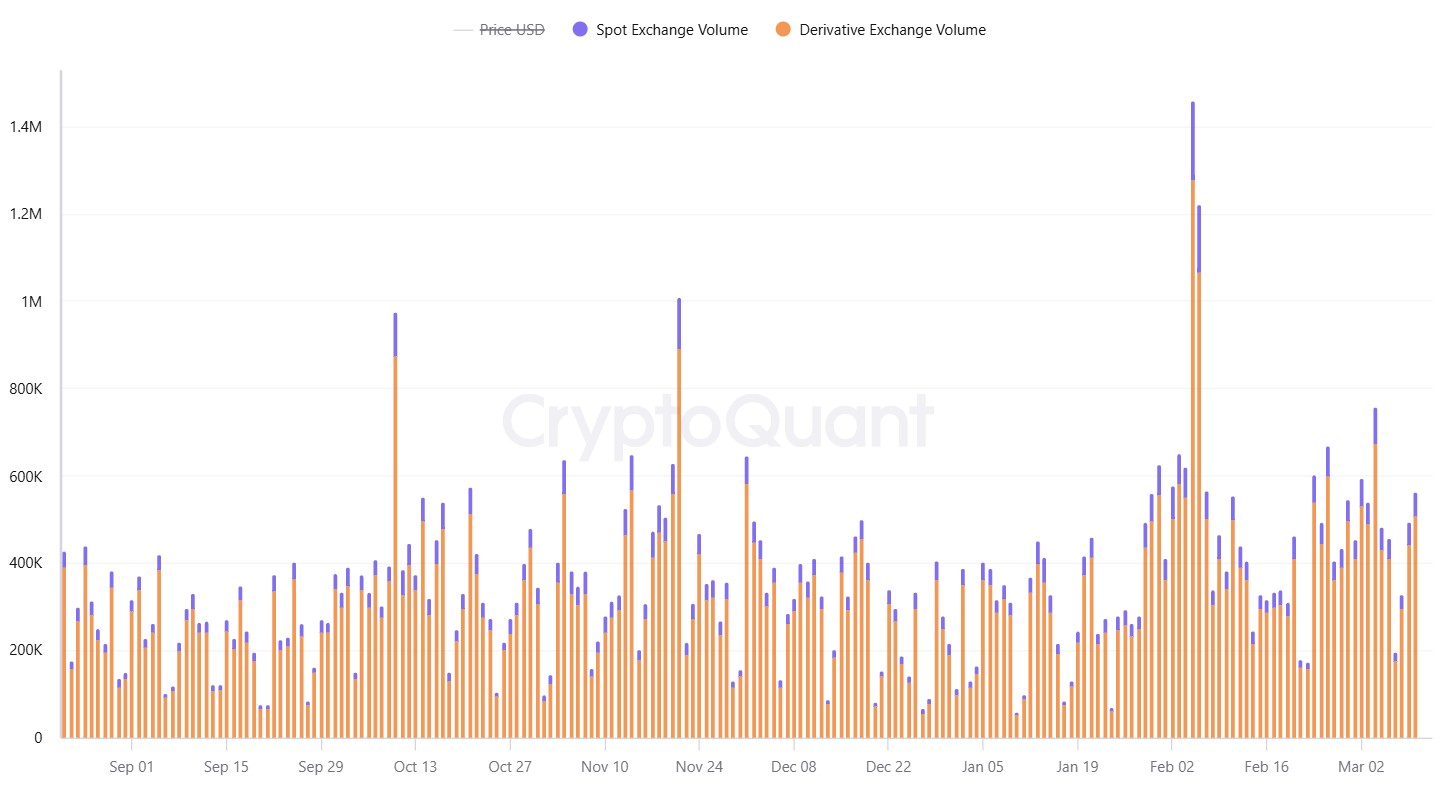

Derivatives make up most of today’s crypto trading activity, often accounting for the majority of total volume. On Tuesday, Bitcoin (BTC) spot trading volume across centralized exchanges reached about 55,230 BTC while derivatives volume totaled more than 506,600 BTC, according to CryptoQuant.

Perpetual decentralized exchanges, or perp DEXs, now act as core infrastructure as they give traders, market makers and institutional participants access to leveraged products, according to Nina Rong, executive director of growth at BNB Chain.

“When these players are active on a chain, they bring liquidity, hedging activity, and arbitrage flows, which significantly increase overall onchain volume and strengthen the ecosystem’s trading environment,” she told Cointelegraph.

While several blockchains are exploring their own derivatives venues, launching one does not automatically translate into meaningful or sustained trading activity. Derivatives liquidity has historically consolidated around a small number of dominant exchanges rather than spreading evenly across platforms.

Blockchains begin building or incubating their own perp DEXs

The logic is quite straightforward. If derivatives drive a large share of crypto trading volume, a perp DEX can help a blockchain attract more trading activity.

“In many ways, it has become a competitive race: the chains that host the largest number of successful derivatives platforms are more likely to attract and sustain higher trading volume within their ecosystem,” said Rong.

For BNB Chain, that platform is Aster. On Thursday, it had the second-highest open interest among perp DEXs, according to DefiLlama. Rong claimed that Aster’s rise has helped BNB’s ability to maintain its market share.

Some chains are actively incubating perp DEXs instead of waiting for an external team to select their network to build on. One such example is Decibel, which went live on the Aptos mainnet on Feb. 26.

“What you actually see in the crypto ecosystem as a whole is different L1s and different blockchains starting to think about what is actually going to use the block space,” Brylee Whatley, the head of Decibel Foundation, told Cointelegraph.

“A lot of L1 teams realize they are in the best position to understand the mechanics of their own chains and build applications on top of them,” he said.

Related: Aster delisting exposes DeFi’s growing integrity crisis

Whatley added that Decibel itself was not part of the recent rush by blockchains to build perp DEXs. Aptos has been incubating Decibel for about a year, many months before Hyperliquid, Aster and Lighter vied for market dominance.

Liquidity tends to consolidate around dominant venues

Launching a perp DEX will not guarantee a fountain of eternal liquidity. According to Stephan Lutz, CEO of BitMEX, derivatives trading has historically tended to cluster around a few platforms.

“All markets (derivatives and spot) rely heavily on market makers and strong risk management systems. These participants usually favor platforms that already have liquidity and a track record,” Lutz told Cointelegraph.

This means in the long run, it is inefficient to separate trading venues per chain or coin. Given that traders often trade across multiple chains and coins, we believe that consolidation is an almost natural process.”

A similar pattern has played out in traditional financial markets over the past three decades. The shift to electronic trading in the 1990s led to a wave of exchanges and alternative platforms entering the market. Over time, liquidity often reconsolidated around venues with deeper order books, lower spreads and more reliable infrastructure, according to research published by the Bank for International Settlements.

Chicago Mercantile Exchange (CME) dominates much of the US futures market in TradFi today. The Intercontinental Exchange leads in energy derivatives and Eurex Exchange is a major venue for European index futures.

In crypto, the majority of Bitcoin and Ether (ETH) derivatives trading has historically concentrated on a few exchanges like Binance, OKX, Bybit and Deribit. More recently, decentralized platforms such as Hyperliquid have emerged as significant players for perpetual futures activity.

Centralized exchanges still provide advantages such as order handling, risk management, liquidity and trading infrastructure, while fully onchain platforms are limited by block times, leading to delays and slippage, Sidrah Fariq, head of retail sales at Deribit, told Cointelegraph.

“In addition, centralized exchanges can offer greater privacy, which can be important for institutional traders,” she added.

Meanwhile, proponents of onchain exchanges argue that decentralization and composability allow derivatives liquidity to embed itself within specific ecosystems.

Related: Why institutions still prefer Ethereum despite faster blockchains

“Your order book is on the blockchain and verifiable, and order matching follows price-time priority set by the blockchain itself,” said Decibel’s Whatley.

“When you send an order you know exactly how it’s getting matched and that it’s entering the order book fairly instead of being routed somewhere else,” he said.

The “U” shape of derivatives markets

The long-term picture for derivatives may depend on whether perp DEXs differentiate themselves across networks or simply replicate the same products. Rong of BNB Chain said networks that offer distinct features may have an advantage.

“Chains win by offering unique yield opportunities or distinctive trading venues that are not available elsewhere,” she said. But if similar platforms emerge everywhere, “the result will likely be fragmentation across multiple ecosystems, rather than a single dominant hub.”

At the same time, market dynamics may eventually push liquidity back toward a smaller set of venues. Lutz from BitMEX said market makers and professional traders tend to cluster where they can deploy capital efficiently and manage risk across many assets without jumping between platforms.

“If liquidity is too spread out across several derivatives platforms, it often leads to wider spreads and more volatile markets,” he said.

That dynamic may produce what Lutz described as a cyclical pattern for ecosystems experimenting with their own derivative platforms.

“We expect a U-shaped technical liquidity development per ecosystem,” he said, where new venues initially see a surge of activity before momentum fades.

Perpetual futures markets now influence where liquidity forms, how traders hedge risk and which platforms dominate trading activity. As blockchains compete to host those markets, derivatives trading is increasingly becoming core infrastructure for crypto ecosystems.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Ethereum (ETH) Sees Major Whale Buying as BlackRock Launches Staked ETF Product

Quick Overview

- BlackRock’s iShares Staked Ethereum Trust (ETHB) entered the market with $15.5M first-day trading activity

- The new ETF began operations with $106.7M in net assets, charging a 0.25% fee (discounted to 0.12% during year one)

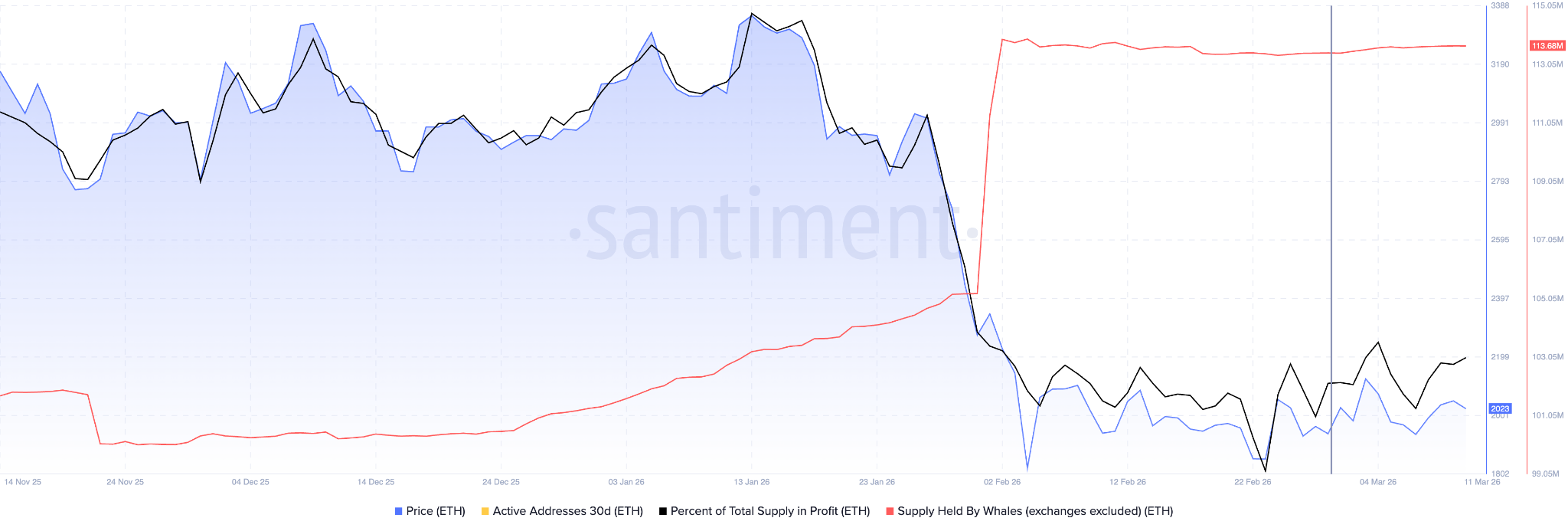

- Large Ethereum holders have accumulated approximately $480M in ETH throughout March, increasing profitable positions

- ETH maintains position above $2,080 with $2,000 serving as critical support

- Clearing $2,150 resistance could trigger an advance toward $2,800 price target

The world’s largest asset manager has introduced its staked Ethereum exchange-traded fund, expanding institutional crypto investment options. Simultaneously, significant accumulation by major holders and developing technical formations are capturing trader attention.

BlackRock introduced the iShares Staked Ethereum Trust (ETHB) on Nasdaq this Thursday. The investment vehicle generated

$15.5 million in first-day activity, with 592,804 shares traded. Bloomberg’s ETF specialist James Seyffart described the launch as exceptionally strong for an inaugural trading session.

The trading activity trailed behind two similar Solana-focused staking products. Bitwise’s Solana Staking ETF (BSOL) achieved $55.4 million during its October debut, while the REX-Osprey SOL + Staking ETF (SSK) generated $33.7 million at its July launch.

ETHB commenced operations holding $106.7 million in net assets secured through Coinbase custody. The product allocates 80% to staked Ether and 20% to unstaked Ether. It aims to deliver approximately 4% annual staking returns, with monthly reward distributions via validators operated by Figment, Galaxy Digital, and Attestant.

The fund implements a 0.25% annual fee, though this drops to 0.12% throughout the first year on initial assets up to $2.5 billion.

BlackRock Expands Digital Asset Offerings

ETHB represents another addition to BlackRock’s cryptocurrency portfolio. The firm’s iShares Bitcoin Trust ETF (IBIT) has accumulated more than $62.8 billion in investor capital since its 2024 debut. Meanwhile, the iShares Ethereum Trust ETF (ETHA) has gathered $11.9 billion during the same timeframe.

BlackRock is additionally developing a Bitcoin Premium Income ETF designed to generate returns through covered call options on Bitcoin futures contracts.

Ethereum Price Action and Large Holder Accumulation

Ethereum has declined approximately 3% across the previous seven days but maintained its position above the $2,000 threshold. For the year, ETH has dropped roughly 30%.

Blockchain analytics from Santiment reveal that major holders have acquired around 240,000 ETH tokens, valued near $480 million, since early March. During this accumulation period, the proportion of Ethereum tokens showing unrealized gains climbed from 39.8% to 42.3%.

Market volumes have contracted lately, which market observers suggest may signal diminishing selling momentum.

Ethereum currently changes hands above $2,080, positioned above its 100-hour Simple Moving Average. Initial resistance appears around $2,135, followed by $2,150. A decisive move past $2,150 could initiate momentum toward $2,220 and possibly $2,320.

Should the price slip below $2,050, support zones emerge at $2,000, followed by $1,950, with a critical foundation near $1,920.

A technical buy indication emerged on the hourly timeframe during Thursday’s U.S. trading hours, though market watchers emphasize that a validated breakout above key resistance would strengthen the signal before considering aggressive entries.

Crypto World

DeFi Disaster: How Ignoring Slippage Warnings Cost One Trader $50 Million on Aave

TLDR

- Extreme slippage on Aave led to a devastating loss of nearly $50 million for one cryptocurrency trader in a single swap transaction.

- The transaction converted $50.4 million into approximately 327 AAVE tokens valued at just $36,000.

- The trader acknowledged and bypassed several explicit slippage warnings on mobile before executing the trade.

- An MEV bot executed a sandwich attack on the same transaction, extracting close to $10 million in profits.

- The Aave protocol announced plans to refund approximately $600,000 in protocol fees to the impacted trader.

On Thursday, March 12, 2026, a cryptocurrency trader experienced one of the most devastating losses in DeFi history, losing approximately $50 million in just one transaction. The incident occurred while executing a token swap on Aave, a prominent decentralized finance platform.

The wallet in question, freshly funded via Binance, contained $50,432,688 worth of aEthUSDT. These interest-bearing tokens represent Tether’s USDT stablecoin deposited within the Aave lending ecosystem operating on Ethereum.

The trader initiated a swap to exchange the entire balance for aEthAAVE, the tokenized version of Aave’s governance token. This transaction was processed through CoW Protocol and executed on the SushiSwap decentralized exchange.

Due to the massive size of the order relative to available pool liquidity, the swap suffered catastrophic slippage exceeding 99%. The final result was a mere 327 AAVE tokens worth roughly $36,000.

Effectively, the trader paid approximately $154,000 for each AAVE token when the prevailing market rate stood at around $114.

What the Warnings Said

Stani Kulechov, founder of Aave, verified that the platform’s user interface had displayed prominent warnings before execution. In a post on X, he explained that the system alerted the user about “extraordinary slippage” resulting from the “unusually large size of the single order.”

The platform mandated that users check a confirmation box acknowledging the risk. The trader completed this step on a mobile device and moved forward with the transaction.

“The transaction could not be moved forward without the user explicitly accepting the risk,” Kulechov stated. He emphasized that the CoW Swap routing system functioned exactly as designed.

CoW DAO released its own statement, explaining that “no DEX, DEX aggregator, public liquidity pool, or private liquidity pool would have been able to fill this trade at anywhere near a reasonable price.”

The MEV Bot Attack

Compounding the slippage disaster, an MEV bot launched a sophisticated “sandwich attack” targeting this transaction.

MEV bots constantly scan pending blockchain transactions for profitable opportunities. This particular bot identified the massive incoming AAVE purchase and positioned itself to exploit it.

The bot secured a flash loan of $29 million in wrapped Ether from Morpho, deployed it to purchase AAVE on Bancor (artificially inflating the price), then sold directly into the trader’s order on SushiSwap. This strategy generated approximately $9.9 million in profits for the bot operator.

The manipulation drove AAVE’s price significantly higher immediately before the trader’s order executed, amplifying an already catastrophic outcome.

This incident followed closely after approximately $27 million in liquidations on Aave, which some observers suggested might have been connected to a temporary pricing anomaly affecting the wstETH token.

Kulechov expressed sympathy for the affected trader. The Aave protocol intends to contact the user and reimburse approximately $600,000 in fees collected during the transaction.

CoW DAO similarly committed to refunding any protocol fees associated with the trade.

Crypto World

AAVE Crypto Swap Costs Nearly $50M Lost: ETH MEV Pocketed $9.9M

When a trader wipes out $50M in seconds, the industry usually assumes a bridge hack or a sophisticated exploit. Late on Thursday (March 12), however, a crypto whale incinerated nearly their entire balance with a single click of AAVE crypto swap.

The user attempted to swap $50M worth of USDT for AAVE in a single on-chain transaction. Due to a complete lack of liquidity for an order of that magnitude, the trade suffered catastrophic slippage, returning just 324 AAVE crypto, worth roughly $50,000, for the $50M spent.

Data from the transaction shows the wallet interacted with the Aave interface via CoW Swap. According to Aave Labs founder Stani Kulechov, the interface explicitly “warned the user about extraordinary slippage and required confirmation via a checkbox.”

In a statement on X, CoW Swap confirmed that clear price-impact warnings were displayed and that the transaction followed the signed parameters. This comes down to user error and a lack of self-preservation in not using MEV bot protection.

How a Single Swap Cost One Whale $50M While Buying AAVE Crypto

The mechanics behind this loss are brutal but standard. Decentralized exchanges (DEXs) rely on liquidity pools. When a buy order exceeds the available liquidity at the current price, the automated market maker (AMM) moves the price up the curve to fill the order.

To fill the $50M order, the protocol had to buy available AAVE at astronomically higher prices, resulting in an average entry price that wiped out the capital immediately.

This highlights why institutional players typically break such trades into thousands of smaller chunks or use OTC (over-the-counter) desks.

While Ethereum is quickly cementing itself as the backbone of institutional settlement, this event shows that the user interface layer still allows for catastrophic human error. Smart contracts do not judge the wisdom of a trade; it only executes the parameters signed by the wallet.

DISCOVER: The 16 Best Meme Coins to Buy in March 2025

What This Reveals About DeFi Market Structure

This event exposes the dangerous reality of “fat finger” trades in DeFi, where human intervention or flagging systems would likely pause such an anomaly in traditional finance.

Current liquidity on Aave, or almost any single DEX pool, cannot absorb $50M in a single tick without massive price distortion.

Interestingly, the AAVE crypto token is up +5% over the past 24 hours, a price surge that may have been buoyed by an unfortunate user who bought $50,000 worth of the token for $50M.

We have seen similar risks highlighted recently, as just yesterday, the Bonk.fun website was hijacked leading to user funds being drained.

While that incident involved malicious actors, the AAVE swap shows that users can cause similar losses to themselves without a compromised platform.

What Happens Next for the Whale and How to Avoid Their Mistake

There is no reversal button on the blockchain. However, Kulechov noted that Aave Labs is attempting to contact the user to return approximately $600,000 in fees collected from the transaction.

While a sympathetic gesture, it represents slightly more than 1% of the lost funds. For the broader market, the lesson is stark: liquidity warnings are not suggestions.

If the interface warns of “Extraordinary Slippage,” take note. And even for smaller transactions, let alone five-figure ones, always enable MEV protection when executing trades, protecting users from sandwich attacks and being front-ran.

EXPLORE: Best Crypto Presales to Buy in 2026

The post AAVE Crypto Swap Costs Nearly $50M Lost: ETH MEV Pocketed $9.9M appeared first on Cryptonews.

Crypto World

US Midterms may Fuel Crypto, Stock Market Recovery: Binance Research

Update March 12, 1:21 pm UTC: This article has been updated to include comments from Gracy Chen, CEO of crypto exchange Bitget.

The US midterm elections may be the next catalyst to kickstart the crypto and stock market recovery, according to historical data shared by Binance Research.

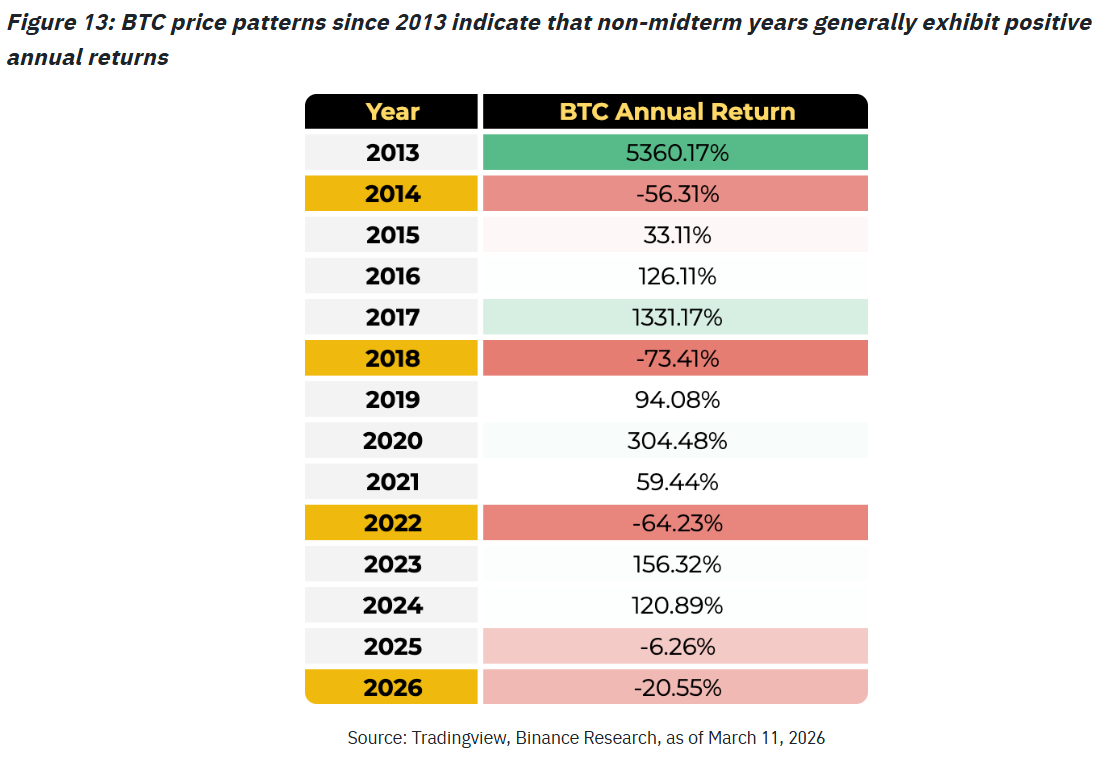

According to a Wednesday report from Binance Research, US midterm election cycles have historically been followed by strong rebounds in stocks and Bitcoin (BTC), potentially setting up a recovery window for risk assets after the 2026 vote.

The 12 months following US midterm elections have resulted in an average 19% rise in the S&P 500 and 54% rise for Bitcoin in the three post-midterm years on record.

Binance Research said the year following the US midterms may prove the “strongest window in the cycle,” arguing that markets have historically rallied after election outcomes remove a major source of political uncertainty.

“Once election outcomes are determined and uncertainty is resolved, markets have historically staged powerful rallies.”

Bitcoin logged negative returns during previous midterm years, including a 56% drawdown in 2014, 73% decline in 2018 and a 64% retracement in 2022, but historic patterns showed a rebound in the following years.

The report comes nearly eight months before the Nov. 3 US midterm elections, which will determine the makeup of the 120th Congress.

Binance said near-term market direction is more likely to be driven by the conflict involving the US, Israel and Iran, warning that further escalation could push oil prices higher and keep risk assets under pressure.

Related: Can US lawmakers pass crypto market structure before the midterms?

Oil spike adds to market stress

Crude oil price briefly surged to $95 per barrel on Thursday as the conflict entered its 13th day, according to data from Trading Economics.

The price surge followed reports of Iran stepping up its attacks against energy infrastructure, as two fuel tankers were scorched by explosive-laden Iranian boats, Reuters reported earlier on Thursday.

A spokesperson for Iran’s military command told the news outlet that the world should prepare for oil prices of $200 per barrel due to the instability caused by the US.

The jump came a day after the International Energy Agency said member countries would carry out a 400 million-barrel emergency stock release, the largest coordinated drawdown on record.

Gracy Chen, CEO of crypto exchange Bitget, said the crypto market’s recovery hinges on a resolution to the conflict, as continued oil supply disruptions may “position oil to outperform gold as a hedge.”

“In this environment, crypto’s higher-beta profile means its upside potential could still exceed traditional equities should liquidity conditions stabilize once political uncertainty clears,” she told Cointelegraph.

Related: US Senate bill targets prediction markets on war and assassinations

Global markets in “wait-and-see” phase amid geopolitical escalations

The ongoing developments in the Middle East remain the key driver for global risk sentiment, as uncertainty surrounding energy supply and military escalations left markets in a “wait-and-see phase where policy and geopolitical risks intersect,” analysts at crypto derivatives exchange Bitunix told Cointelegraph:

“Currently, BTC is fluctuating repeatedly below the $70,000 level, indicating that market activity remains dominated by liquidity sweeps both above and below.”

The market structure suggests that Bitcoin will remain bound to this range until “macro events provide clearer directional signals,” the analysts said.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

Crypto World

BlackRock Launches Staked Ethereum ETF Offering Yield

BlackRock is expanding its crypto investment lineup with a new Nasdaq-listed product tied to Ethereum staking.

BlackRock on Thursday introduced its iShares Staked Ethereum Trust ETF, or ETHB, describing it as an exchange-traded product (ETP) that combines spot Ether (ETH) exposure with “monthly income potential” by staking a portion of its ETH holdings.

The product expands BlackRock’s digital asset offerings, which include the iShares Bitcoin Trust ETF (IBIT) and the iShares Ethereum Trust ETF (ETHA). Both ETPs are the largest in their class, with more than $55 billion and $6.5 billion in assets under management, respectively.

“By bringing together spot ether exposure and staking rewards in an ETP, ETHB provides investors with an important new avenue to participate in the ecosystem’s evolution,” said Robert Mitchnick, BlackRock’s global head of digital assets.

ETHB will use Coinbase as custodian and staking provider

According to a prospectus with the Securities and Exchange Commission, BlackRock’s ETHB will use Coinbase as its custodian and staking provider.

The fund’s approved validators are currently limited to Figment, Galaxy Digital and Bitwise-owned Attestant.

Staking rewards are intended to be distributed monthly but “no less frequently than quarterly by the trust,” the filing notes.

Related: Vitalik Buterin envisions ‘one-click’ Ether staking for institutions

At launch, ETHB offers a 0.25% sponsor fee with a one-year waiver, reducing the fee to 0.12% on the first $2.5 billion assets under management.

Grayscale first to enable staking for Ether ETFs in the US

BlackRock’s Ether staking product arrives as several competitors have launched similar offerings.

Grayscale Investments, BlackRock’s largest crypto ETF competitor by assets under management, launched staking for the Grayscale Ethereum Trust ETF (ETHE) and the Grayscale Ethereum Mini Trust ETF (ETH) on Oct. 6, 2025, becoming the first US crypto issuer to do so.

The company also enabled staking on its Grayscale Solana Trust (GSOL), which began trading in late October. Additionally, Grayscale debuted the Grayscale Avalanche Staking ETF (GAVA) on Thursday.

Other issuers, including 21Shares and REX-Osprey, also support staking Ether ETFs. 21Shares in February announced its expected 2026 distribution dates for staking rewards from the 21Shares Ethereum ETF.

Magazine: 6 massive challenges Bitcoin faces on the road to quantum security

Crypto World

Offshore Crypto Exchanges Create Oversight Gaps, FATF Says

A new report from the Financial Action Task Force (FATF) warns that crypto service providers operating offshore pose risks of money laundering, sanctions evasion and other illicit financial activity.

In the report, titled “Understanding and Mitigating the Risks of Offshore Virtual Asset Service Providers (oVASPs),” the FATF said some offshore firms exploit gaps and differences in regulatory and supervisory coverage, making it harder for authorities to monitor activity and enforce Anti-Money Laundering (AML) and Counter-Terrorist Financing rules.

“As a result, effective international co-operation may not be possible, including with the relevant oVASP supervisor, thereby limiting the effectiveness of domestic risk-mitigation measures,” the report said.

The watchdog said the issue is particularly challenging because many offshore crypto firms operate across multiple jurisdictions. A company may be incorporated in one country, host infrastructure in another and serve customers worldwide through online platforms, leaving regulators uncertain about which authority has responsibility.

Related: Europe’s DeFi tax gap won’t last forever, says ex-OECD official

Regulators struggle to track offshore crypto

The FATF also said some countries struggle to identify offshore platforms providing services to local users. Without a local legal presence, authorities may have limited visibility into these businesses or the transactions they process.

To address the problem, FATF urged countries to strengthen oversight of crypto firms serving their markets, even if those companies are based abroad.

The organization recommended that governments require offshore VASPs to register or obtain licenses when offering services to domestic users. It also called for stronger cooperation between regulators and law enforcement agencies across borders.

Related: How Vietnam is using crypto to fix its FATF reputation

FATF flags P2P stablecoin transfers

The warning follows a separate FATF report last week on stablecoins and unhosted wallets, which said peer-to-peer transfers can weaken AML oversight when transactions occur without regulated intermediaries such as exchanges or custodians.

The FATF said this structure creates gaps in AML oversight as stablecoins expand into payments and cross-border transfers. The watchdog urged countries to assess the risks and introduce safeguards.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

-

Business7 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos4 days ago

News Videos4 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Ann Taylor

-

Crypto World4 days ago

Crypto World4 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech2 days ago

Tech2 days agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Tech3 days ago

Tech3 days agoChatGPT will now generate interactive visuals to help you with math and science concepts

-

Politics7 days ago

Politics7 days agoTop Mamdani aide takes progressive project to the UK

-

Business3 days ago

Business3 days agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Sports6 days ago

Sports6 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports5 days ago

Sports5 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat2 days ago

NewsBeat2 days agoResidents reaction as Shildon murder probe enters second day

-

Entertainment6 days ago

Entertainment6 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business5 days ago

Business5 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business2 days ago

Business2 days agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat3 days ago

NewsBeat3 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech4 days ago

Tech4 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business4 days ago

Business4 days agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat2 days ago

NewsBeat2 days agoI Entered The Manosphere. Nothing Could Prepare Me For What I Found.

-

Business6 days ago

Business6 days agoIran war enters second week as Trump demands ’unconditional surrender’

-

Sports4 days ago

Sports4 days agoSkateboarding World Championships: Britain’s Sky Brown wins park gold