Crypto World

Asia Market Open: Bitcoin Slips 3% To $76K As Asian Stocks Track US Tech-Led Selloff

Bitcoin slipped 3% on Wednesday to $76,000 as investors carried a sour mood into the Asia session after a tech-led sell-off hit US benchmarks and encouraged a shift toward more economically sensitive industries.

In early trade, Japan and Australia opened lower, and futures pointed to losses in Hong Kong.

Market snapshot

- Bitcoin: $78,719, up 2%

- Ether: $2,334, up 1.8%

- XRP: $1.61, up 0.5%

- Total crypto market cap: $2.72 trillion, up 2.6%

Software Rout Drags US Indexes Lower As Rotation Away From Big Tech Deepens

Overnight, falling software names pulled down the S&P 500 and the Nasdaq 100, even as most stocks in the S&P 500 finished higher and value shares continued to outpace growth in 2026 amid a broader rotation away from the “Magnificent Seven”.

The damage started with legal software and data services. Experian, London Stock Exchange Group and Thomson Reuters tumbled, and the selling spread across the wider software sector, sending the iShares Expanded Tech-Software Sector ETF down about 4.5%.

The slide picked up pace late in the session after Advanced Micro Devices sank in after-hours trade on a disappointing sales forecast. Traders also stayed cautious ahead of earnings from Alphabet and Amazon later this week, as investors demanded clearer payoffs from costly AI spending.

Crypto Markets Mirror Global Risk Aversion As Bitcoin Slips

Crypto traders watched the same risk-off undercurrent spill into digital assets. Bitcoin fell for a second day and extended an almost four-month slide, and investor Michael Burry warned that a drop through key thresholds could trigger cascading liquidations and wipe out value.

Tony Severino, market analyst at YouHodler, said Bitcoin remains locked in a tightening range, and he pointed to a signal building on longer timeframes.

“Bollinger Bands on the monthly chart are the tightest they have ever been, reflecting an extreme level of volatility compression,” he said. “At the same time, Bitcoin continues to trade below the monthly basis line, with only days left before a monthly close that would confirm acceptance beneath it.”

Across markets, the shared theme this week looks less about direction and more about pressure building under the surface. Currency volatility has risen. The dollar has softened.

Software Stocks Slide As AI Competition Spurs Fresh Investor Jitters

Metals have held extreme levels without a clear break, and Bitcoin has stayed stuck in one of the tightest volatility regimes in its history, conditions that tend to frustrate short-term traders while signalling markets are working off time rather than trend, he said.

On Wall Street, the focus tightened on software makers seen as vulnerable to AI-driven competition after Anthropic rolled out a legal tool for its Claude chatbot. Nvidia and Microsoft each fell almost 3% as the S&P 500 software and services index slid 3.8% for a fifth straight session.

Away from tech, pockets of the market showed more resilience. FedEx extended a record-breaking rally, and Walmart pushed past $1 trillion in market value. Palantir jumped almost 7% after strong quarterly results, while PepsiCo gained 4.9% after announcing price cuts on core brands like Lay’s and Doritos.

In other moves, oil climbed after the US Navy shot down an Iranian drone heading toward an aircraft carrier in the Arabian Sea.

Federal Reserve officials kept the rate outlook in play. Tom Barkin said policy easing has bolstered the jobs market as officials turn back to getting inflation to target, and Stephen Miran said the absence of strong price pressures means rates need to be lowered again this year.

The post Asia Market Open: Bitcoin Slips 3% To $76K As Asian Stocks Track US Tech-Led Selloff appeared first on Cryptonews.

Crypto World

Why Bitcoin’s Next Big Move Hinges on $60K and $82K According to Coinbase Institutional’s GEX Report

TLDR:

- Coinbase Institutional’s GEX report identifies $60,000 as the thickest BTC support zone in current market structure.

- Negative gamma between $60K and $70K could accelerate Bitcoin’s downside beyond what discretionary buyers anticipate.

- Positive gamma from $85K to $90K points to a slow, choppy grind rather than a sharp breakout for Bitcoin.

- The report favors call spreads over outright calls above $82K, reducing theta bleed during uncertain market conditions.

Gamma Exposure (GEX) is now part of Coinbase Institutional’s latest Bitcoin analysis report. The report combines options market data with key support and resistance levels. It identifies $60,000 and $82,000 as critical price zones for BTC.

The findings suggest that negative gamma could accelerate downside moves, while positive gamma above $85,000 may slow upside momentum. Traders are urged to adjust their strategies based on these dynamics.

Negative Gamma Raises Downside Risk Below $70K

Coinbase Institutional’s report introduces GEX as a tool that turns the options market into a hidden liquidity layer. It helps traders decide between range trades and breakout strategies. The metric tracks how options dealers hedge their positions when Bitcoin’s price shifts.

Gamma measures how quickly an option’s price sensitivity changes as BTC moves. When dealers are short gamma, they tend to buy as prices rise and sell as prices fall. This behavior can turn small price moves into sharper, faster trends.

The report shows a pronounced negative gamma band concentrated between $60,000 and $70,000. That setup means any move toward $60,000 could accelerate beyond what typical buyers expect. Liquidation-style cascades become more likely in this zone.

Support near $60,000 remains the thickest demand cluster in the current price structure. However, the GEX data advises against buying the initial selloff. Traders are better positioned to enter only after a confirmed reclaim of that level.

Positive Gamma Between $85K and $90K Signals a Slow Grind

Above $82,000, the gamma picture shifts toward stabilization. A breach and hold above $82,000 would suggest that supply at that level has been absorbed. From there, BTC would likely move toward the next liquidity bands higher up.

The $85,000 to $90,000 range carries meaningful positive gamma. In positive gamma zones, dealers sell into strength and buy into weakness. That pattern tends to reduce volatility and create a slow, choppy upward grind.

Because of this chop risk, the report favors call spreads over outright calls in an $82,000 breakout scenario. Call spreads retain convexity while cutting theta bleed during a grind. That trade structure fits an environment where the macro catalyst remains unclear.

For traders managing existing long portfolios, protective put spreads offer a cleaner hedge if $60,000 fails. Bear put spreads are preferred over outright short positions, given the elevated risk of sharp reversals.

The report concludes that the $82,000 level remains the key gate that must open before any sustained upside becomes probable.

Crypto World

Bitcoin Rises as Markets Price State of the Union Trump Address

Bitcoin (BTC) surged more than $2,000 to reclaim the $66,000 level Tuesday evening, driven by risk-on positioning ahead of the State of the Union address by President Donald Trump.

While the asset has since retraced slightly to trade near $65,500, according to CoinGecko, the move signals a potential localized bottom as traders digest the administration’s economic messaging amidst a broader equity rally.

Key Takeaways

- The Catalyst: Trump’s claims of “plummeting inflation” and economic turnaround fueled a 3.5% relief rally across risk assets.

- The Level: Bitcoin rejected immediate resistance at $66,000 but held support above $64,500, creating a tight consolidation range.

- The Setup: Traders are eyeing Nvidia earnings Wednesday as the critical volume trigger to confirm or invalidate the bounce.

Trump Address Fuels Risk-On Rotation into Bitcoin

The immediate catalyst for the price action was the State of the Union address, where President Trump framed his first year back in office as an economic “turnaround for the ages.”

By highlighting falling mortgage rates and a 1.7% decline in core inflation over the last three months of 2025, the address provided a macro tailwind for risk assets that had been battered by regulatory uncertainty.

Markets reacted favorably to the pledge that the U.S. economy would “never go back” to previous policies, spurring a relief bounce that saw Bitcoin climb from approximately $64,000 to peak at $66,000 just before the 9 pm ET speech.

This reaction starkly contrasts with earlier volatility, where Bitcoin price fell below $65k on Trump tariff risk-off fears, highlighting the market’s extreme sensitivity to fiscal signaling.

Post-Trump Address: Can Bitcoin Bulls Defend $64,500?

Bitcoin’s rejection at $66,000 has left price action in a precarious consolidation zone. The asset is currently trading up about 3.7% on the day, but the inability to close a 4-hour candle above $66,500 suggests buy-side exhaustion is still present.

Support is forming firmly at $64,500. If that slips, it gives weight to claims by Polymarket and CryptoQuant that $55,000 may be the next local bottom.

Recent data shows that $370M in liquidations were required to defend the $60k level earlier this week, indicating that deep support exists lower down, but bulls cannot afford another tests of those lows if the recovery narrative is to hold.

Three metrics are currently flashing capitulation-level readings, with Bitcoin still down nearly 50% from its October 2025 ATH. While short-term engagement has increased, the lack of follow-through volume at $66,000 remains a concern for technical traders looking for a trend reversal.

Discover: Best meme coins To Buy Now

Risk Sentiment and Nvidia Correlation

The broader market context suggests Bitcoin is once again trading in high correlation with equities. Asian stocks rallied overnight, and markets are optimistic ahead of Nvidia’s earnings report due Wednesday.

This tech-led optimism has spilled over into crypto, specifically benefiting altcoins a little more than Bitcoin, like Solana, which is up 8% in the last 24 hours, and Chainlink, which rose 5% in the same period.

However, institutional flows tell a more cautious story. Recent ETF outflows signal institutional caution, with smart money hesitating to deploy capital aggressively until a clear break above structural resistance occurs.

If Nvidia earnings disappoint, the risk-off rotation could drag Bitcoin back toward the $63,000 range regardless of Trump’s fiscal promises.

Discover: Top crypto for portfolio diversification

What Happens Next?

Traders must watch two specific levels in the next 24 hours. For the bullish rebound to sustain, Bitcoin needs to reclaim $67,500 to confirm a break from the local downtrend. A close above this level opens the path to $70,000.

Conversely, a breakdown below $64,000 invalidates the post-speech bounce. Market sentiment remains fragile; currently, Polymarket odds show traders pricing in a potential drop to $55k if macro headwinds persist. Until $67,500 is reclaimed, the trend favors the bears.

The post Bitcoin Rises as Markets Price State of the Union Trump Address appeared first on Cryptonews.

Crypto World

Jane Street Sued Over Alleged Role in Terra-Luna’s $40B Collapse in 2022

TLDR:

- Terraform Labs’ bankruptcy administrator filed a lawsuit against Jane Street in Manhattan in February 2026.

- Jane Street allegedly dumped 85M UST minutes after Terraform pulled 150M UST liquidity from Curve Finance.

- A private chat called “Bryce’s Secret” allegedly gave Jane Street insider knowledge before the Terra-Luna collapse.

- Jane Street reportedly avoided over $200M in losses while retail investors suffered catastrophic and unrecoverable financial damage.

Jane Street, the prominent trading firm, faces a lawsuit filed by Terraform Labs’ bankruptcy administrator in Manhattan.

The February 2026 complaint accuses Jane Street of orchestrating the collapse of TerraUSD (UST) and LUNA in May 2022.

The event wiped out approximately $40 billion within days. It also triggered a broader crypto market downturn lasting well into 2023. Jane Street has denied all allegations, calling the lawsuit “baseless.”

The Alleged Timeline Behind the Terra Collapse

The lawsuit outlines a specific sequence of events from May 2022. According to the complaint, Terraform quietly withdrew 150 million UST from the Curve liquidity pool.

Minutes after that withdrawal, Jane Street allegedly dumped 85 million UST into the market. That move reportedly triggered immediate panic among investors and traders across the ecosystem.

The panic then accelerated UST’s loss of its one-dollar peg. Once UST depegged, LUNA’s mint-and-burn mechanism caused it to hyperinflate rapidly and uncontrollably.

This is how the $40 billion wipeout unfolded within just a few days. The lawsuit argues the sequence was not coincidental but rather a coordinated effort.

The complaint further claims Jane Street had access to insider information before the event. A former Terraform intern, who later joined Jane Street as a trader, allegedly shared critical details.

This exchange reportedly occurred through a private group chat named “Bryce’s Secret.” This alleged insider access forms a central pillar of the legal argument presented.

Because of this reported advance knowledge, Jane Street allegedly positioned itself ahead of the collapse. The firm is accused of avoiding over $200 million in losses as a result.

Additionally, the complaint claims Jane Street profited during the meltdown. Meanwhile, retail investors absorbed devastating and largely unrecoverable losses.

Broader Market Fallout and New Questions Raised

The Terra collapse did not remain isolated to LUNA and UST alone. The event created a domino effect that spread rapidly across the broader crypto market.

Several major firms with exposure to Terra faced severe liquidity crises shortly after. This chain reaction contributed directly to what became known as the 2022 crypto winter.

The lawsuit has also reignited ongoing debates about institutional manipulation in crypto markets. Analysts and observers began drawing comparisons to other unexplained market events.

Some pointed specifically to the October 10 crash, questioning whether similar tactics were deployed then. The complaint, however, does not formally allege Jane Street’s involvement in that separate event.

Jane Street has responded firmly, publicly denying every allegation contained in the lawsuit. The firm has not addressed specific claims surrounding “Bryce’s Secret” or the insider trading accusations.

Legal proceedings are currently active in Manhattan federal court. The outcome could establish an important precedent for institutional accountability in crypto.

This lawsuit stands as one of the most serious legal actions linked to the 2022 Terra collapse. It places direct scrutiny on institutional trading conduct during periods of extreme crypto market volatility. The case is expected to progress through federal court in the coming months.

Crypto World

Bitcoin falls from $66k to $65k after Trump ignores crypto in state of the union address

Bitcoin dropped about 1.5% in hours after Trump skipped Bitcoin, validating Schiff’s selloff warning.

Summary

- Bitcoin climbed toward ~$66k before Trump’s State of the Union on expectations he’d mention crypto, then slid back near ~$65k after no reference.

- Schiff warned of selling pressure whether or not Trump mentioned BTC, citing “buy the rumor, sell the news” dynamics and potential insider profit-taking.

- Schiff called BTC’s multi‑year rally a bubble, saying price could eventually sink toward ~$40k despite only a modest pullback after the speech.

Gold advocate and Bitcoin (BTC) critic Peter Schiff predicted a sell-off in Bitcoin prices regardless of whether U.S. President Donald Trump mentioned the cryptocurrency in his State of the Union address, according to statements posted on social media.

Schiff stated that the recent recovery in Bitcoin stemmed from market expectations that Trump would mention the cryptocurrency in his speech. The gold advocate predicted that if the President made no mention of Bitcoin in the address, selling pressure would occur.

Schiff further stated that even if Trump mentioned Bitcoin, a decline would still be expected, arguing that expectations were already priced into the market and the speech could trigger profit-taking, leading to a price drop. The analyst suggested that individuals close to Trump who purchased Bitcoin in anticipation of the announcement might sell following any mention.

President Trump delivered his State of the Union address without directly mentioning Bitcoin, causing short-term fluctuations in the cryptocurrency market, according to market data.

The address covered topics including tariff policy, tax cuts, the response to the Iran nuclear issue, and approval of a defense budget. No mention of cryptocurrencies, including Bitcoin, was made during the speech.

Bitcoin had risen to higher levels before the speech, in line with market expectations based on Trump’s previous statements supporting cryptocurrency. Following the speech, profit-taking led to selling and the price declined, though the drop was smaller than Schiff had anticipated, according to market observers.

In a separate social media post, Schiff described Bitcoin’s multi-year price increase as a bursting bubble and stated the cryptocurrency’s price could fall significantly.

Crypto World

North Carolina DOJ Seizes $61 Million in USDT Tied to Pig Butchering Scam

The U.S. Attorney’s Office for the Eastern District of North Carolina seized more than $61 million in Tether (USDT) linked to money laundering from crypto “pig butchering” investment scams.

Why it matters:

- Victims of pig butchering scams lose funds to fraudulent platforms showing fake returns, then face demands for “taxes” or “fees” to withdraw. This is a cycle designed to repeatedly extract money.

- The $61 million seizure ranks among the largest single USDT confiscations tied to romance-based crypto fraud in U.S. history.

- The case signals direct DOJ and Homeland Security Investigations (HSI) coordination with Tether to freeze and transfer illicit stablecoin holdings.

The details:

- The U.S. Attorney’s Office for the Eastern District of North Carolina announced the seizure, with the DOJ and HSI leading the operation.

- Investigators traced the USDT to wallet addresses linked to money laundering tied to crypto investment fraud.

- Pig butchering scams involve criminals building fake romantic relationships online before steering victims toward fraudulent trading platforms.

- Tether assisted the DOJ and HSI in facilitating the transfer of the $61 million in seized assets.

The big picture:

- Pig butchering scams generated billions in global losses in recent years, with U.S. authorities accelerating seizures as stablecoins become the preferred settlement layer for organized fraud networks.

- The case adds to the DOJ’s growing track record of recovering crypto assets linked to transnational fraud.

The post North Carolina DOJ Seizes $61 Million in USDT Tied to Pig Butchering Scam appeared first on BeInCrypto.

Crypto World

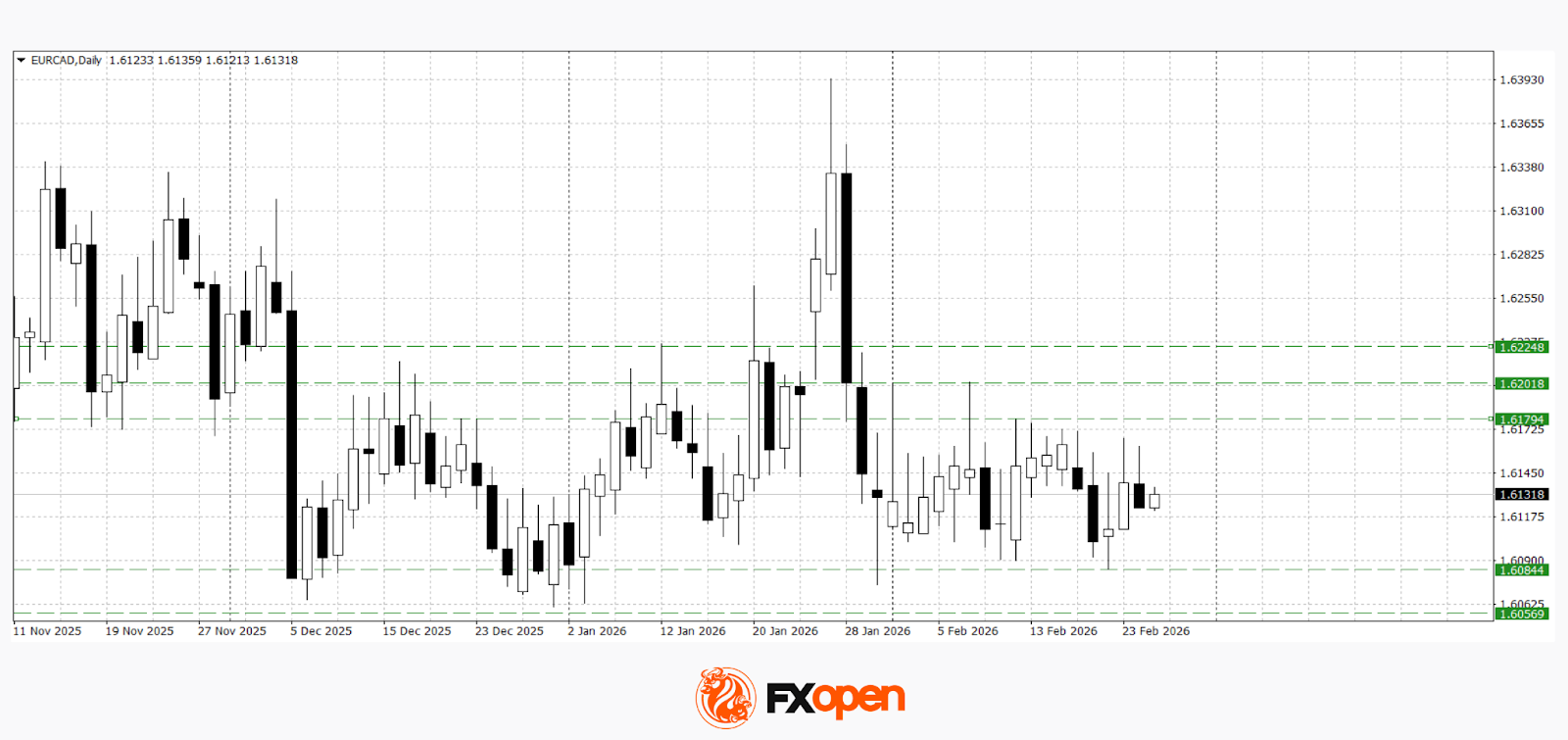

Euro Consolidates After the Impulse: Market Awaits Macro Data

The euro has moved into a phase of correction and consolidation ahead of key macroeconomic releases. In EUR/USD, a technical pullback is unfolding following the previous decline, while EUR/CAD continues a more extended corrective move within its medium-term structure. Market activity is easing as traders await important data from the euro area, the United States and Canada, which could determine the next directional move.

In the euro area, the focus is on Germany’s GDP figures, the GfK consumer climate index and business activity indicators. These releases will help assess the resilience of the region’s largest economy amid a slowdown in the manufacturing sector. Weak data would increase pressure on the euro, while more solid readings could support attempts at stabilisation.

In the United States, investors are monitoring developments in the mortgage market, upcoming comments from Federal Reserve officials and oil inventory data. Trade policy also remains a source of uncertainty. President Donald Trump announced the introduction of a temporary global tariff of 10% for 150 days, with the administration not ruling out a further increase to 15%. The postponement of harsher measures has slightly eased tensions, yet ongoing trade risks continue to influence currency markets, including the euro and commodity-linked currencies.

EUR/USD

After the resumption of the downward move in EUR/USD last week, buyers managed to find support near 1.1740. A retest of this level and a rebound towards 1.1840 helped establish the boundaries of the current sideways range. Technical analysis points to consolidative trading conditions. A sustained move above 1.1840 could pave the way for gains towards 1.1900–1.1920. A break below 1.1740 may trigger a fresh bearish impulse.

Key events for EUR/USD:

– today at 09:00 (GMT+2): Germany GDP;

– today at 09:00 (GMT+2): Germany GfK Consumer Climate Index;

– today at 16:30 (GMT+2): speech by FOMC member Thomas Barkin.

EUR/CAD

EUR/CAD has been trading sideways for more than a month. The pair is testing 1.6180 as resistance and 1.6080 as support. A break above the upper boundary could lead to further gains towards 1.6200–1.6230. Conversely, a move below 1.6080 may open the way for a retest of the psychological 1.6000 level.

Key events for EUR/CAD:

– today at 15:30 (GMT+2): Canadian corporate profits;

– today at 17:30 (GMT+2): US crude oil inventories;

– tomorrow at 15:30 (GMT+2): Canadian wholesale sales.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

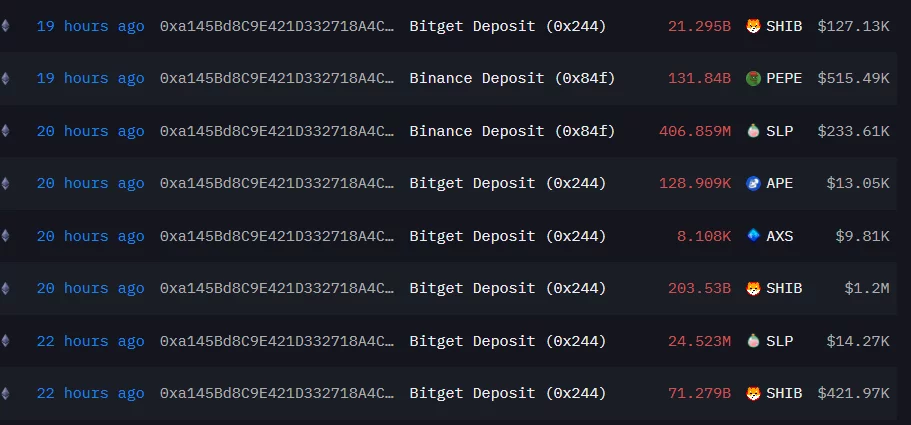

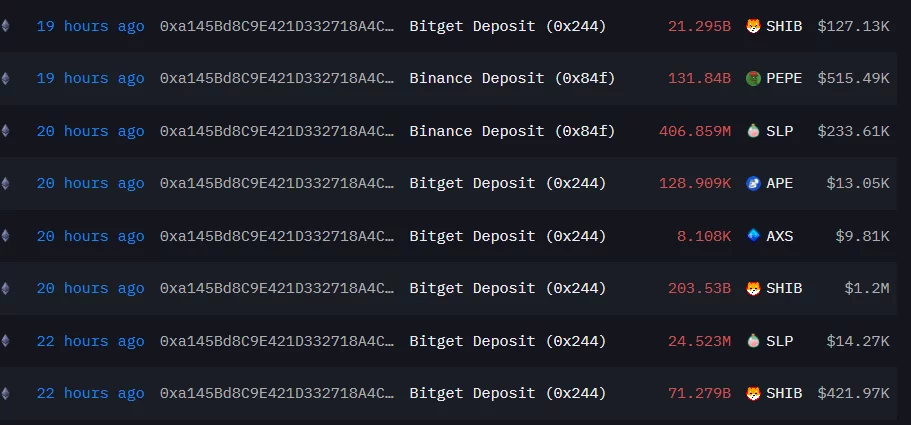

Will Shiba Inu price drop as whale transfers 370B SHIB to exchange?

Shiba Inu is back in focus after on-chain data showed a large holder moving hundreds of billions of tokens to a centralized exchange, raising fresh concerns about potential sell pressure.

Summary

- On-chain data from Arkham shows a whale transferred roughly 370 billion SHIB to Binance and Bitget deposit addresses, raising concerns about potential sell pressure.

- SHIB is trading near $0.00000601, holding short-term support at $0.00000580–$0.00000590, with resistance at $0.00000640 and $0.00000700.

- Indicators remain cautious: the Awesome Oscillator is still negative but weakening, while the MFI around 44 signals limited buying momentum.

According to data from Arkham Intelligence, a whale address deposited roughly 370 billion SHIB to exchange wallets in a series of transactions over the past 24 hours. The transfers, routed to both Binance and Bitget deposit addresses, totaled several million dollars in value.

Large exchange inflows are often interpreted as a sign that a holder may be preparing to sell, as tokens moved off self-custody and onto trading platforms increase immediate circulating supply.

While it is not yet confirmed whether the whale intends to liquidate, the timing comes as SHIB continues to trade in a broader downtrend, adding weight to bearish sentiment.

Shiba Inu price action and key levels

On the daily chart, SHIB is currently trading near $0.00000601, consolidating after a prolonged slide from January highs near the $0.00000900 region.

Price recently bounced from the $0.00000580–$0.00000590 support zone, which has acted as a short-term floor. A decisive breakdown below this region could expose the next psychological support around $0.00000550, followed by deeper support near $0.00000500.

On the upside, immediate resistance sits near $0.00000640, where recent daily highs were rejected. Above that, stronger resistance is clustered around $0.00000700, a level that capped the mid-February rebound.

Bulls would need a sustained move above $0.00000700 to shift short-term structure back in their favor.

Momentum indicators show tentative stabilization but no strong bullish reversal yet. The Awesome Oscillator (AO) remains slightly negative, though red histogram bars are shrinking, suggesting bearish momentum is weakening but not fully reversed.

The Money Flow Index (MFI 14) sits around 44, below the neutral 50 mark, indicating modest capital outflows and a lack of strong buying pressure.

Together, the indicators point to consolidation rather than immediate breakdown but they also fail to confirm a bullish shift.

If the 370B SHIB deposit translates into aggressive selling, pressure on the $0.00000580 support zone could intensify. A breakdown would likely accelerate downside momentum. However, if support holds and exchange inflows do not materialize into sustained sell volume, SHIB could remain range-bound between $0.00000580 and $0.00000640 in the near term.

For now, whale activity adds uncertainty but the chart suggests bears still hold the broader structural advantage unless key resistance levels are reclaimed.

Crypto World

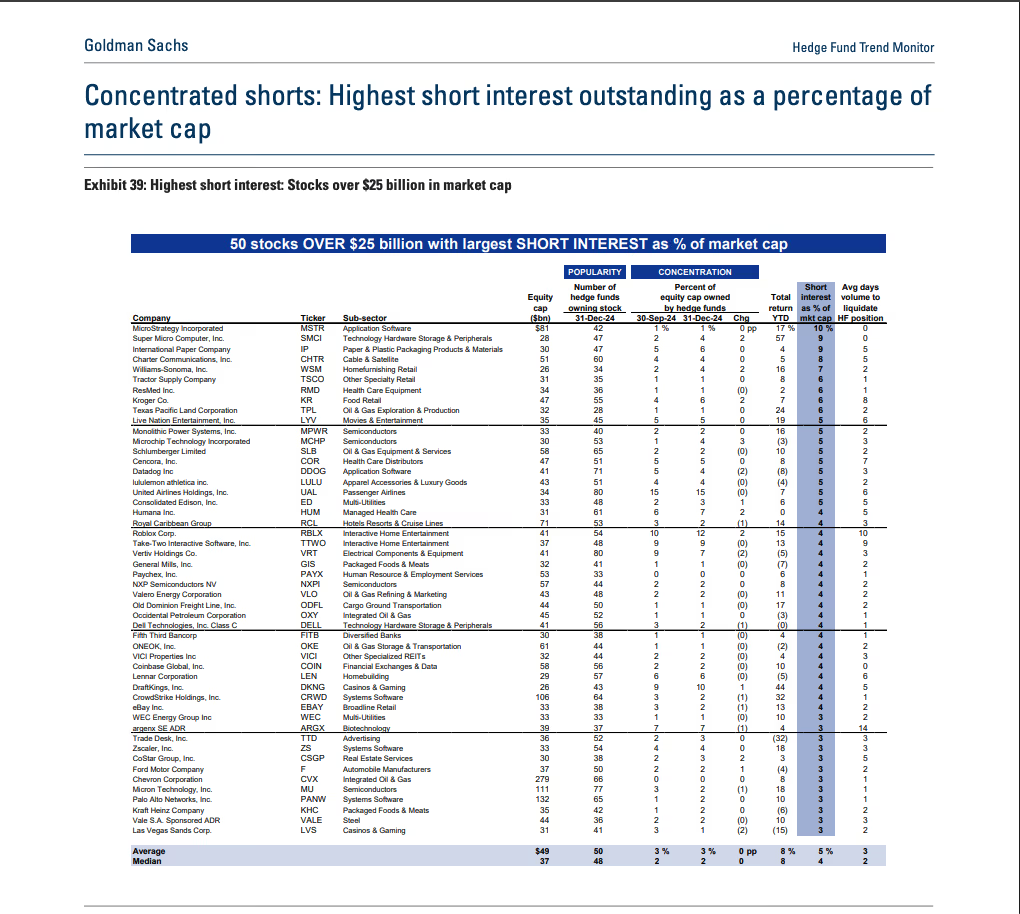

MSTR tops list of most heavily shorted stocks, but don’t assume pure bearishness

The market for Bitcoin-holder Strategy (MSTR) shares is among the most “heavily shorted,” a market slang term for dominance of bearish plays, according to FactSet and Goldman Sachs data. Yet the positioning may not reflect investor bias toward a continued price crash, per some observers.

According to the report released last week, bearish short bets on Strategy (MSTR) equaled 14% of its market capitalization of $34 billion at the time, making it the most shorted stock by that measure. Cryptocurrency exchange Coinbase (COIN) ranked fourth at 11% of its market cap. The report tracked positioning in stocks with market capitalization of over $25 billion.

This comes as Strategy is sitting on roughly a $7 billion unrealized loss on its bitcoin holdings. That figure, however, has no impact on the stock in the near term. Strategy began adding BTC to its balance sheet in 2020 and has since gobbled up 717,722 BTC, worth $47 billion. As of writing, its market cap stood closer at $42 billion, despite the stock falling 20% year-to-date.

One explanation for the elevated short interest offered by analysts is the basis trade – a strategy that seeks to profit from the price difference between two related markets. In this context, traders may bought bitcoin spot ETFs, like BlackRock’s IBIT, while simultaneously shorting the MSTR stock. to profit from a narrowing of MSTR’s premium to its BTC holdings narrows, plus any funding from paired futures if layered on, while staying market neutral.

“I suspect a lot of this short interest is still MSTR / BTC basis trade. Jane Street, in particular, has recently acquired a conspicuously large IBIT position,” Brian Brookshire, specialist in bitcoin treasury companies, said.

According to recent 13F filings, Jane Street purchased more than 7 million shares of BlackRock’s iShares Bitcoin Trust. It also held a large position in MSTR.

If Brookshire’s instincts hold, Jane Street’s purchases of IBIT could be a part of the carry/basis trade, paired with short positions in MSTR.

So far this year, that trade would have not worked. The MSTR-to-IBIT ratio is up about 12%, meaning MSTR has outperformed IBIT on the downside. MSTR is down 20% year to date, while IBIT has fallen 27%.

Crypto World

Institutional ETF Flows Tilt Toward This Altcoin in February

Solana exchange-traded funds (ETFs) are diverging from broader crypto ETF trends this month. While demand for Bitcoin and Ethereum products has shown signs of cooling, Solana-linked funds have maintained steady inflows.

The shift comes amid heightened volatility in digital asset markets. With macro uncertainty weighing on investor sentiment, ETF flows may be offering a signal of where institutional capital is positioning in the short term.

Solana ETF Streak Stands Out in Volatile Crypto Market

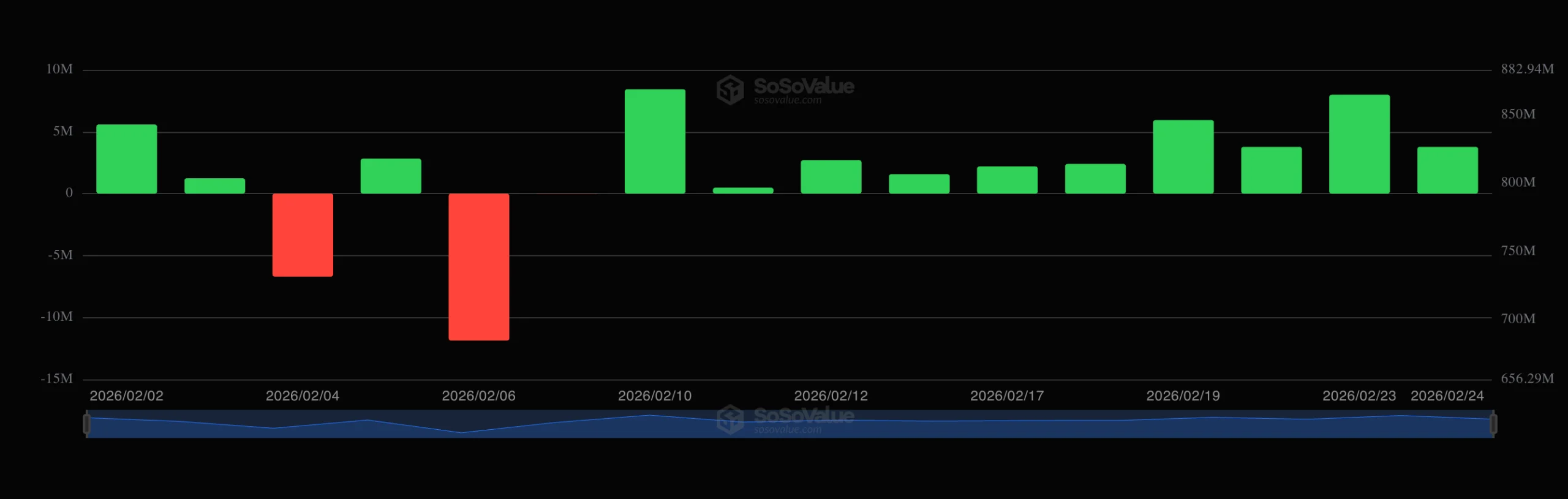

According to data from SoSoValue, Solana ETFs have recorded consecutive inflows since February 10. As of February 24, the products have logged only three red days this month. Overall, the ETFs have pulled in $30.33 million.

The streak stands out against the more uneven performance seen in larger crypto ETFs during the same period.

Bitcoin ETFs have posted mixed results in February. Inflows were recorded on seven trading days this month. Ethereum ETFs have followed a similar pattern, reflecting inconsistent demand rather than sustained accumulation.

Despite those positive sessions, cumulative flows remain deeply negative. So far this month, Bitcoin ETFs’ net outflows stand at $939.94 million. In addition, Ethereum ETFs recorded outflows of $490.58 million.

When compared to other altcoin products, Solana’s performance also appears relatively stronger. XRP-linked ETFs have experienced outflows on three trading sessions this month while recording zero flows on four days.

Although the number of positive sessions is comparable, the consistency of Solana’s streak since mid-February remains notable.

Nonetheless, it is important to contextualize the data. In absolute dollar terms, inflows into Solana ETFs remain smaller than those seen in Bitcoin products.

Bitcoin and Ethereum ETFs continue to command the majority of institutional crypto exposure and overall capital allocation. However, consistency in flows can indicate relative resilience in demand during periods of broader uncertainty.

The steady inflows into Solana products suggest that some investors are maintaining or selectively increasing exposure to higher-beta assets, even as flagship crypto ETFs experience uneven demand. Still, the divergence may reflect short-term capital rotation rather than a structural shift in institutional positioning.

SOL Price Remains Under Pressure

Despite the ETF inflows, Solana’s price performance has continued to reflect broader market weakness. Like most major digital assets, SOL has trended downward over the past month, declining 32.8%.

The altcoin saw a modest recovery today, rising more than 7% as total crypto market capitalization expanded by approximately $32 billion. At press time, SOL was trading at $82.15.

However, technical analysts remain cautious on the asset’s near-term outlook. Market commentator Alejandro suggested that Solana’s next downside target could be $45.

Whale Factor described the token as entering a high-probability “make or break” zone on the 4-hour chart. According to the analysis, SOL’s wedge formation is “reaching maximum exhaustion,” signaling a potential volatility squeeze at a critical inflection point.

The analyst outlined two possible scenarios:

“Bull Case: Clean break and retest of $82 targets the $97-100 macro resistance. Bear Case: Failure to hold the $78 support level opens the door for a retest of $68.”

Whether Solana will extend its recovery or face renewed downside pressure remains to be seen.

Crypto World

Bitcoin Rebounds as Traders Debate Jane Street “10am Price Slam”

Bitcoin (BTC) sought to reclaim $65,000 as support into Wednesday’s Wall Street open as rumors swirled around US institutional pressure.

Key points:

-

Bitcoin bounces 2.5% as talk turns to alleged selling pressure from Wall Street trading company Jane Street.

-

Jane Street rebuts claims of crypto market manipulation during the 2022 bear market.

-

“Razor thin” order books boost BTC price volatility.

Bitcoiners debate Jane Street “10am price slam”

Data from TradingView tracked a BTC price rebound, taking BTC/USD to $66,300 on Bitstamp before the pair consolidated.

Daily price gains remained at more than 2% at the time of writing, while crypto market participants became increasingly interested in potential deliberate BTC price suppression.

A theory circulating on social media revolved around secretive quantitative investment firm Jane Street, now subject to legal action by defunct crypto company Terraform Labs.

Coordinated algorithmic selling of Bitcoin at 10am Eastern time daily, it alleged, provided the main impetus for months of BTC price downside beginning in October 2025.

What Happened Today:

>Jane Street was exposed for massive manipulation of the crypto market and for being behind the TerraLuna collapse.

>An insider leaked that they were forced to shut down their trading algos.

> no 10am price slam for the first time.

>8pm, Bitcoin…

— AMCrypto (@AMCryptoAlex) February 25, 2026

Amid the ongoing legal proceedings, Jane Street may have been forced to suspend its trading strategy, leaving the market to adjust higher.

The Terraform Labs complaint makes specific reference to “market manipulation” that impacted crypto throughout 2022, the year in which Bitcoin put in its last bear market bottom of $15,600 in Q4.

Jane Street told Cointelegraph that the accusations were “baseless, opportunistic claims.”

The 10am argument, meanwhile, failed to convince many. Crypto YouTuber Wise Advice was among them, suggesting that the theory was too simplistic to be valid.

🚨 Everyone on CT right now:

“Jane Street got sued.”

“10AM manipulation stopped.”

“ $BTC finally free.”Do you really think they’re that stupid?

You’re talking about Jane Street.

A top quant firm.

And they supposedly:• Ran a visible daily pattern

• Let everyone track it…— Wise Advice (@wiseadvicesumit) February 25, 2026

BTC price versus “razor thin” liquidity

Commenting on the latest BTC price move, traders remained cautious.

Related: Bitcoin ETF sell-off is ‘purification’ of bull case, investor says

“$BTC is facing major resistance at $66k – from both the local range lows and the 4h trend,” trader Jelle wrote in his latest analysis on X.

“Flipping that could spark short-term relief, but until that happens, the trend is clear. Don’t fight it.”

Keith Alan, cofounder of trading resource Material Indicators, said that a “razor thin order book” on exchanges had contributed to the price rebound.

Overhead sell liquidity, he told X followers, had been pulled in advance of US President Donald Trump’s State of the Union address.

Looks like we got a roof pull just before Trump’s State of the Union Address, and $BTC price ripped through a razor thin order book. pic.twitter.com/bgBtwg6aaZ

— Keith Alan (@KAProductions) February 25, 2026

The 24-hour crypto liquidations totaled $333 million at the time of writing, per data from CoinGlass, with shorts accounting for $213 million of that figure.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World1 day ago

Crypto World1 day agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Tech17 hours ago

Tech17 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Crypto World7 days ago

Crypto World7 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat12 hours ago

NewsBeat12 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

Eric Trump says Bitcoin will reach $1 million.

Eric Trump says Bitcoin will reach $1 million.