Crypto World

AUD/USD and USD/CAD Test Key Levels Ahead of Central Bank Decisions

Commodity currencies have moved up to key levels after extending their recent gains, maintaining upward momentum. However, the next phase of price action will largely depend on fundamental drivers. For now, there are no clear signs of a slowdown, but proximity to important levels is increasing the market’s sensitivity to news.

Decisions from the Federal Reserve and the Bank of Canada, along with accompanying guidance from policymakers, could either confirm the strength of the current move or trigger a correction after the recent strong advance. Overall, the market remains directional, but it is approaching a point where fundamental signals become decisive.

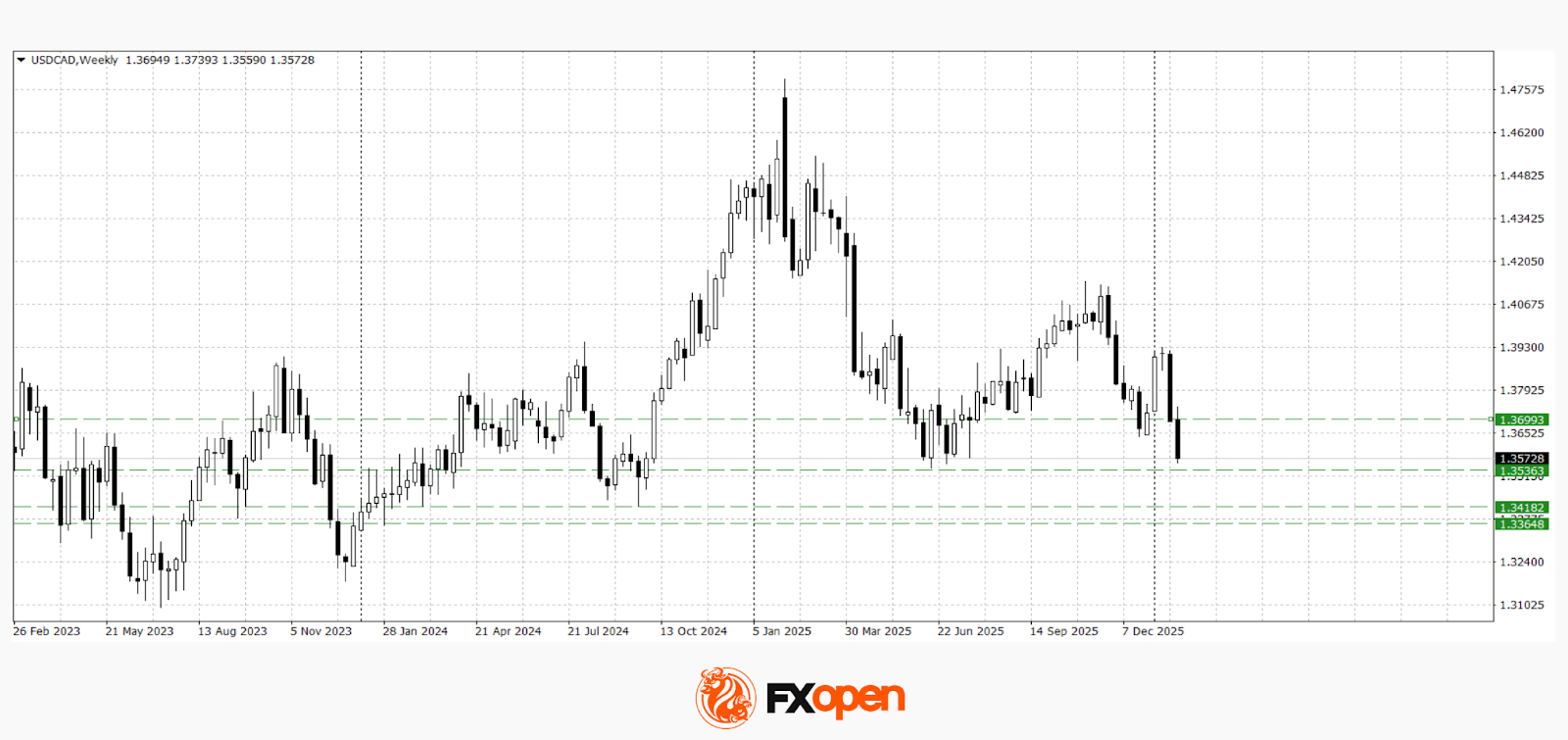

USD/CAD

The USD/CAD pair continues to decline, reflecting strength in the Canadian dollar and moving towards last year’s lows near 1.3500. The Canadian currency remains sensitive to expectations around Bank of Canada policy and developments in the oil market. The focus is on the BoC’s rate decision and press conference, as well as oil inventory data and key domestic indicators.

Depending on the tone of the Bank of Canada’s statements, the market may either continue to favour the CAD and extend the current momentum, or shift towards profit-taking and a moderate correction from current levels.

A break below the 1.3500–1.3540 support zone could reinforce the downside move towards 1.3400–1.3420. The bearish scenario would be invalidated by a sustained move above 1.3700.

Key events for USD/CAD:

- today at 15:30 (GMT+2): speech by US President Trump;

- today at 16:45 (GMT+2): Bank of Canada interest rate decision;

- today at 17:30 (GMT+2): Bank of Canada press conference.

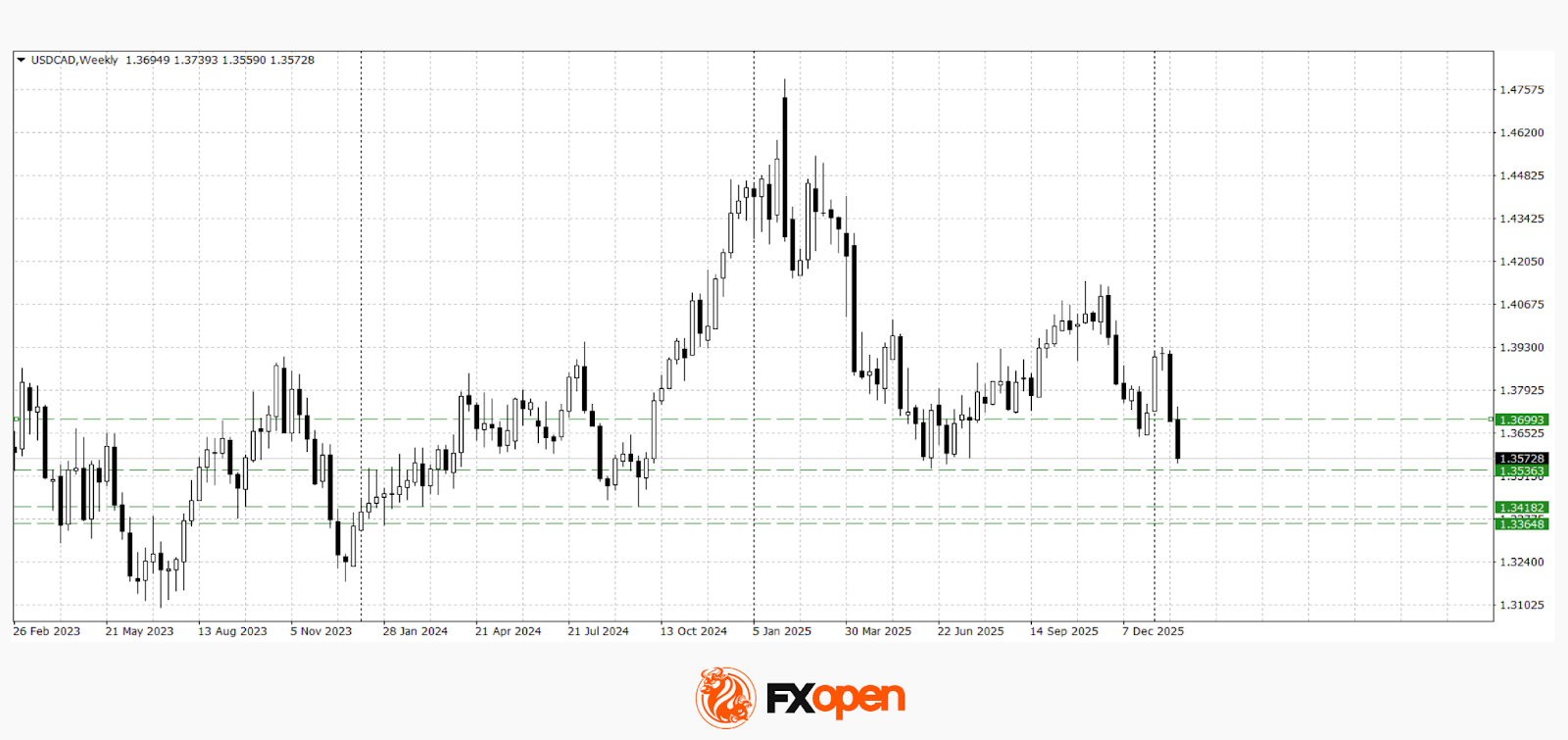

AUD/USD

AUD/USD buyers managed to test the key resistance level at 0.7000 this week. The pair has not traded above current levels for almost three years. If 0.7000 turns into support, AUD/USD may continue to rise towards 0.7100–0.7160. A corrective pullback could see the pair retreat to the 0.6900–0.6940 area.

Key events for AUD/USD:

- today at 21:00 (GMT+2): US Federal Reserve interest rate decision;

- today at 21:30 (GMT+2): Federal Open Market Committee press conference;

- tomorrow at 02:30 (GMT+2): Australia NAB business confidence index.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Ripple moves toward $1.35 support amid growth of new crypto utility protocols

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Ripple is testing key support near $1.35 as market attention increasingly shifts toward utility-driven DeFi platforms such as Mutuum Finance.

Summary

- About 66% of XRP supply is in unrealized loss as the token trades near critical support around $1.35.

- Investors are exploring projects with functional DeFi services rather than sentiment-driven tokens.

- Mutuum Finance has raised $20.7M+ and is testing a lending protocol featuring mtTokens, Debt Tokens, and dual lending markets.

Ripple (XRP), a long-standing leader in the cross-border payment sector, is currently testing the resolve of its holder base as it slides toward a critical psychological floor. This movement comes at a time when the broader market is shifting its focus toward productive digital assets, protocols that offer automated financial services and verifiable on-chain utility.

Ripple

Ripple is trading at approximately $1.35, maintaining a market capitalization of roughly $82.9 billion. The token is currently locked in a tight range following a period of high-volume selling that characterized the earlier trading sessions.

While XRP saw a brief recovery toward $1.47 last week, it has since entered a broader corrective phase. Technical data indicates that roughly 66% of the circulating XRP supply is currently in an “unrealized loss” position, which has increased the pressure on weak hands to sell into any minor rallies.

Traders are now closely watching whether the $1.35 support zone can hold. Buyers have stepped in to defend this level multiple times over the last 48 hours, but the lack of strong institutional follow-through has kept the price action subdued. If a rebound occurs, the immediate resistance targets are set near $1.36 and $1.37, with a more significant “ceiling” appearing at $1.40.

On the downside, a decisive break below $1.34 could open the door to a deeper retracement toward the $1.30 to $1.32 range, which served as a foundation earlier in the year. Participation in the derivatives market remains mixed, while futures Open Interest has shown a slight uptick to $2.35 billion, it remains well below the record highs seen in 2025.

The trend of new crypto utility protocols

The stagnation of many altcoins has coincided with increased interest in new crypto utility protocols. These projects aim to address specific operational needs, such as automated financial processes or non-custodial yield mechanisms. Unlike tokens that primarily respond to market sentiment, utility protocols are often evaluated based on their functionality and the volume of transactions they support.

This trend is reflected in Mutuum Finance (MUTM). As some investors seek alternatives to the sideways trading of assets like XRP, they are exploring Mutuum Finance’s audited lending platform. The project has reported raising over $20.7 million and has a user base of more than 19,000 individual investors. The MUTM token is currently priced at $0.04.

V1 Protocol: Lending, borrowing and mtTokens

Mutuum Finance has already demonstrated its technical capabilities through its V1 Protocol. This version introduces the mtToken system, which manages how liquidity providers earn returns. When a user deposits an asset like ETH, they receive mtTokens (such as mtETH) as a digital receipt.

These tokens are yield-bearing, meaning they grow in value as the protocol collects interest. For example, a deposit earning a 5% Annual Percentage Yield (APY) allows the user’s mtETH to eventually be redeemable for more than the original deposit, providing a passive income stream.

On the borrowing side, the system uses a strict Loan-to-Value (LTV) ratio to ensure the safety of the protocol. If a user provides collateral with a 75% LTV, they can safely borrow a portion of that value in stablecoins. To track this, the system issues Debt Tokens to the user’s account. These tokens provide a transparent record of the outstanding loan and stay linked to the collateral until the debt is settled. This automated approach is currently being stress-tested by the project’s 19,000 investors to ensure it can handle the complexities of the live market.

Mutuum Finance and Ripple roadmap plans

The long-term outlook for both projects is defined by their upcoming technical milestones. Ripple is focusing on the expansion of its RLUSD stablecoin, which recently reached a market cap of $1.56 billion.

Mutuum Finance is advancing a dual-market system to give users more choices for borrowing and lending. The Peer-to-Contract (P2C) market uses automated pools to offer instant loans, while the Peer-to-Peer (P2P) market lets people negotiate their own custom interest rates and timelines directly.

To keep these markets safe and accurate, the protocol uses decentralized oracles that provide real-time price data for all collateral. The team is also planning a native stablecoin to provide a steady unit of account for large liquidity lines.

To support the economy, a buy-and-distribute mechanism uses a share of platform fees to buy MUTM tokens and give them to users who stake their assets in the Safety Module to protect the network. This ensures the protocol stays secure while rewarding the community for its support.

Ripple (XRP) is navigating key technical support levels around $1.35 while exploring developments such as stablecoin initiatives aimed at maintaining institutional engagement. At the same time, newer crypto protocols reflect a broader interest in automated, non-custodial liquidity systems within decentralized finance. By incorporating features such as dual-market structures, decentralized oracles, and incentive mechanisms, Mutuum Finance (MUTM) aims to build infrastructure for more transparent financial services.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin Price Shows ‘Signs of Improvement’ as Iran Conflict Fears Ease

The price of Bitcoin (BTC) is showing early signs of stabilizing around the $70,000 level as fears of an escalating conflict involving Iran begin to ease.

The market recovery remains tentative following a brutal multi-week selloff that strongly correlated with a massive spike in global oil prices and deteriorating macro sentiment.

Traders are now watching closely to see if returning institutional ETF momentum and shifting on-chain supply metrics can push the asset past heavy structural resistance.

Discover: The best meme coins around

Iran Deescalation Rhetoric Eases Bitcoin Price Pressure

Just a fortnight ago, escalating tensions in the Middle East drove the price of Bitcoin rapidly down through the $66,000 pressure zone and eventually toward $63,000 as geopolitical panic gripped traditional markets.

Brent crude briefly spiked to $119.50 a barrel on fears of supply disruptions through the Strait of Hormuz.

That overarching macro pressure is rapidly retreating. Oil then fell again on Monday after President Donald Trump suggested the war involving Iran might soon de-escalate.

Risk assets reacted immediately to the softening war rhetoric. The S&P 500 closed 0.83% higher, while Bitcoin forcefully decoupled from struggling indices, climbing around 4% overnight on the daily chart.

Investors are now reassessing the forces driving crypto pricing as global stress metrics begin to wind down and policy momentum shifts back to the forefront.

Technical Price Analysis: The Bitcoin Price Levels That Change Everything

Bitcoin is currently trading near $68,800, still battling strong bearish dominance across short-term structures.

The asset remains roughly 42% below its October all-time high ($126,080), making the current local consolidation highly critical for any trend continuation.

From here, the next upside target sits around $75,000. Reaching that threshold requires sustained volume and a major shift in the Fear & Greed Index, which is currently stuck at an Extreme Fear reading of 13.

Traders analyzing recent market structure bottoms are eyeing the $65,000 mark as the primary line of defense. If this support level fails in the short term, bears will likely re-target the February floor of $63,000.

A deeper breakdown below the $60,000 floor signals a massive institutional wipeout. Anything above it keeps the tentative recovery thesis active.

Is Spot and Derivatives Demand Confirming the Recovery?

On-chain internal metrics suggest the worst of the recent market stress may actually be easing.

According to a new market note from Glassnode, overall condition signals are stabilizing as momentum, ETF demand, and profitability metrics improve.

The analytics firm notes that while price momentum has firmed modestly, it still lacks the raw strength required to confirm a decisive bullish pivot. Sustaining the current bounce relies heavily on continuous ETF inflows to absorb trapped sellers.

Macroeconomist Henrik Zeberg remains optimistic, forecasting that strong institutional ETF demand could eventually fuel a massive risk-on rally between $110,000 and $120,000 as geopolitical headwinds vanish completely.

However, short-term derivatives data present a sharper reality. Analysts warn that negative funding rates and cascading short liquidations drove the violent March 4 surge to $73,247, rather than pure spot accumulation. That implies the current floor relies more on futures positioning than genuine retail buying pressure.

What Traders Are Watching Next

Ultimately, for Bitcoin, holding the psychological fort at $70,000 for a sustained length of time clears the path toward upper breakout targets by mid-month.

Downside support at $65,000 must be rigorously defended by spot buyers heading into the US trading session.

The true macro trigger altering this price action remains crude oil futures and further ceasefire updates out of the Middle East.

If institutional momentum holds steady despite the recent macro shock, Bitcoin could close the week by firmly rejecting the sub-$60,000 narrative altogether.

Discover: The best pre-launch crypto sales

The post Bitcoin Price Shows ‘Signs of Improvement’ as Iran Conflict Fears Ease appeared first on Cryptonews.

Crypto World

Chainlink price technical analysis: LINK strengthens breakout setup

- Chainlink trades above $9 and could see a breakout amid a bullish technical setup.

- Market conditions and overall weakness may allow bears to eye support near $8.

- If bulls take control, LINK could rally towards past year highs.

Chainlink price rose slightly on Tuesday as the latest gains pushed Bitcoin to above $70,000 and altcoins showed strength amid easing investor jitters around the Iran war.

While LINK price remains in a downtrend amid the crypto market’s overall sentiment, bulls are holding steady above $9 and could extend upwards as a key technical setup strengthens.

At the time of writing, LINK’s price hovered around $9.13, up 3.4% in the past 24 hours and 6% in the past week as buyers pushed prices off lows of $8.40 reached on Monday, March 9.

Notably, Chainlink is edging higher amid an 8% increase in daily trading volume.

LINK price today

Chainlink’s latest price movement indicates resilience despite overall uncertainty around macro and geopolitical headwinds.

However, the gains to intraday highs of $9.16 means bulls have a slight cushion after Monday’s dip.

Daily volume stands at over $721 million.

A notable aspect of LINK price over the past month or so is the resilience shown through inflows into spot exchange-traded fund products.

According to SoSoValue data, Chainlink spot ETFs saw inflows of $2 million on March 9, up from $935k on March 6 and $1.93 million a day earlier.

Cumulative inflows totaled $92.66 million, suggesting investor conviction. Prices may rebound hard amid further ETF action.

Chainlink price technical forecast

The daily chart shows Chainlink price poised near the upper boundary of a long-term descending channel.

Bulls’ gains in the past week have also pushed the token into a tightening consolidation pattern marked by a downtrend line from the highs of $27 hit in August 2025.

As the chart shows, LINK has traded within a tight range between $7.84 and $9.55 since bouncing from the lows on February 5.

The $8.10 level has acted as a key support level during this time.

However, more importantly, LINK is near the resistance mark of both the parallel channel and the downtrend line.

While LINK price remains confined within the bearish structure, a breakout is likely to catapult prices to an initial supply zone around $12.

Buyers may also fancy a short-term push to highs of $14, another support-turned-resistance level from November and December 2025.

If a stronger uptick across crypto materializes, $19.85 would provide the next hurdle before bulls likely retest $27.

On the downside, bears could have fresh momentum at the $8.32–$8.50 zone.

But if bulls manage to hold above this area, LINK’s breakout structure will remain.

Crypto World

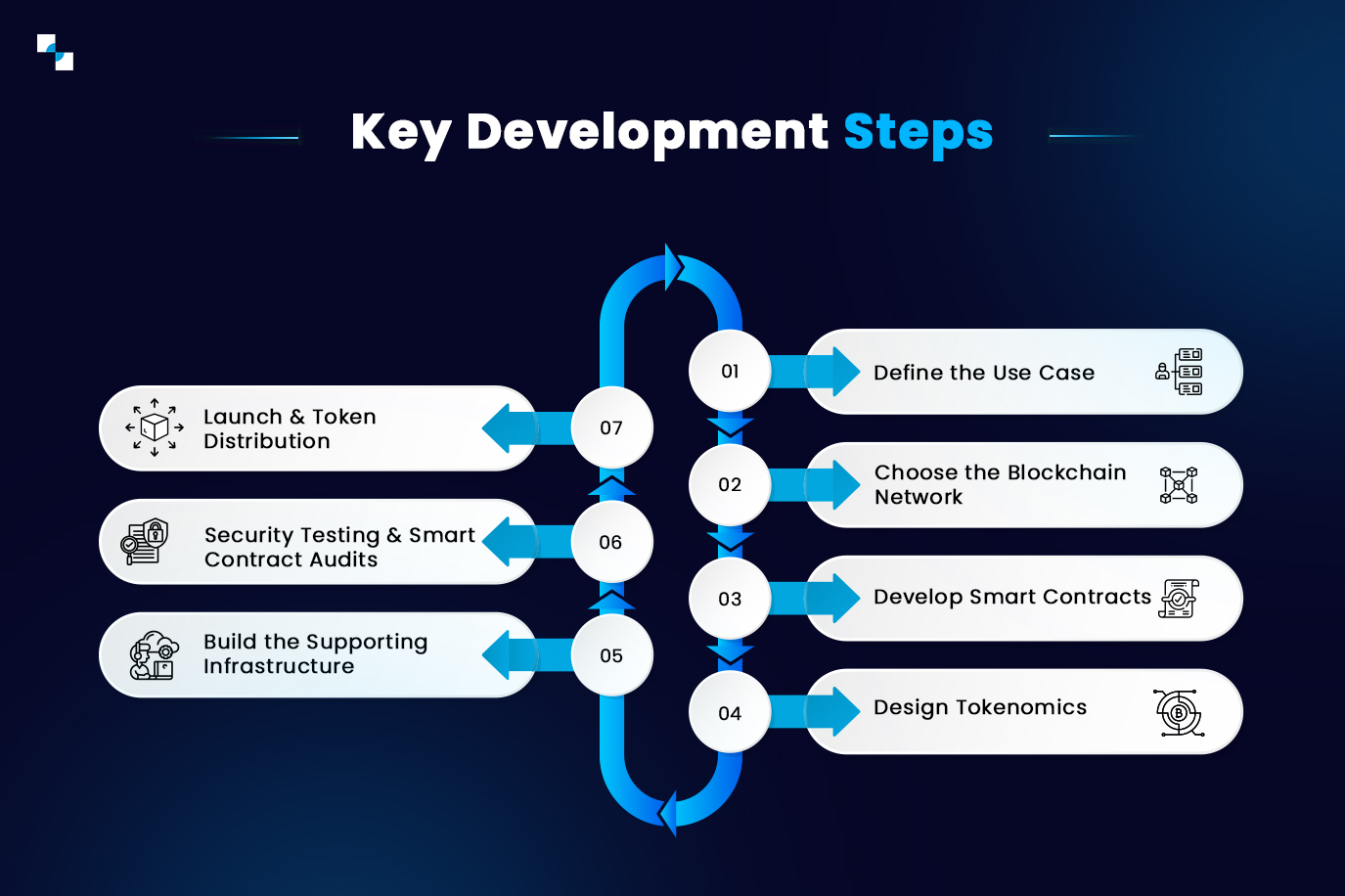

How to Create a Cryptocurrency in 2026 (Step-by-Step Guide)

AI Summary

- Cryptocurrency development involves designing and launching digital currencies using blockchain technology.

- This blog post explores the evolution of cryptocurrencies, the steps involved in creating one, and the various types of cryptocurrencies businesses can develop.

- It discusses the importance of blockchain networks, smart contracts, and tokenomics in the development process.

- The post also highlights the reasons why businesses are creating their own cryptocurrencies, such as decentralized payments and community incentives.

- Furthermore, it provides a step-by-step guide on how to create a cryptocurrency, emphasizing the significance of technologies like blockchain frameworks, smart contract languages, and security tools.

Cryptocurrency development refers to the process of designing, building, and launching a digital currency using blockchain technology. It involves creating secure token structures, writing smart contracts, selecting a blockchain network, and building the supporting ecosystem required for transactions, governance, and scalability.

Over the past decade, cryptocurrencies have evolved from experimental digital assets to powerful financial and technological tools. Today, startups, fintech companies, gaming platforms, and enterprises are launching their own cryptocurrencies to enable decentralized payments, incentivize users, and build token-driven ecosystems.

This guide explains how to create your own crypto coin, the technologies involved, the cost of building a digital currency, and the steps businesses follow to launch crypto projects in 2026.

What Is Cryptocurrency Development?

Coin development is the technical process of creating blockchain-based digital assets that can be transferred, stored, and verified on decentralized networks.

According to CoinMarketCap data, the global crypto ecosystem includes more than 36 million cryptocurrencies, with a total market capitalization of around $2.3 trillion as of 2026. This rapid expansion highlights the growing demand for blockchain-powered financial systems, dApps (decentralized applications), and tokenized digital economies.

A typical cryptocurrency system includes:

- Blockchain infrastructure

- Token or coin architecture

- Smart contracts

- Consensus mechanisms

- Wallets and transaction interfaces

These components work together to ensure that digital assets can be securely created, distributed, and exchanged without relying on centralized authorities.

Modern crypto coin development often involves multiple blockchain ecosystems. These networks can be broadly categorized into EVM-compatible (Ethereum Virtual Machine) and non-EVM chains, each offering unique benefits in scalability, security, and developer tooling.

| Blockchain | Type | Primary Language | Key Strength / Use Case |

|---|---|---|---|

| Ethereum | EVM | Solidity | Largest smart contract ecosystem and DeFi hub |

| BNB Chain | EVM | Solidity | Low transaction fees and strong DeFi adoption |

| Polygon | EVM (Layer 2) | Solidity | Scalable infrastructure for dApps and gaming |

| Avalanche | EVM | Solidity | High throughput and customizable subnets |

| Arbitrum | EVM (Layer 2) | Solidity | Optimistic rollup scaling for Ethereum |

| Optimism | EVM (Layer 2) | Solidity | Low-cost Ethereum transactions |

| Base | EVM (Layer 2) | Solidity | Fast-growing developer ecosystem |

| Solana | Non-EVM | Rust | Extremely high transaction throughput |

| Aptos | Non-EVM | Move | Parallel execution and high scalability |

| Sui | Non-EVM | Move | Object-centric architecture for speed |

| Cosmos | Non-EVM | Go | Cross-chain interoperability via IBC |

| Polkadot | Non-EVM | Rust | Multi-chain architecture using parachains |

Each blockchain ecosystem offers different trade-offs in performance, security, developer tools, and ecosystem support. Choosing the right network is an important step when working with a crypto coin development company, as it influences scalability, transaction costs, and long-term project growth.

Why Businesses and Startups Are Creating Their Own Cryptocurrencies

Many organizations are exploring cryptocurrencies because digital assets enable entirely new economic models. Businesses can build decentralized ecosystems where value can be transferred, rewarded, and managed without relying on traditional financial intermediaries. As adoption continues to grow, cryptocurrencies are being used for payments as well as for community engagement, platform incentives, and digital ownership models.

Some of the most common reasons businesses launch cryptocurrencies include:

- Decentralized Payments: Crypto tokens allow instant global transactions without traditional banking intermediaries. Businesses can facilitate faster payments, reduce transaction fees, and enable borderless financial interactions across digital platforms.

- Community Incentives: Projects often use tokens to reward users, creators, or contributors within their ecosystems. These incentives help build active communities and encourage long-term participation in the platform.

- DeFi Integration: Cryptocurrencies power DeFi applications that support activities such as lending, staking, liquidity provision, and decentralized trading. This allows projects to create financial services directly within their ecosystems.

- Tokenized Business Models: Companies can build token-driven ecosystems where digital assets represent platform access, rewards, governance rights, or participation in decentralized networks. This approach allows businesses to align incentives between users, developers, and stakeholders.

As a result, the rise of tokenized platforms and dApps has made cryptocurrency creation an important strategy for many startups, Web3 platforms, and technology-driven businesses.

Top 6 Types of Cryptocurrencies Businesses Can Create

Cryptocurrencies can serve different purposes depending on how they are designed and the ecosystem they support. Understanding the major types of cryptocurrencies helps businesses determine the most suitable model for their project.

1. Payment Cryptocurrencies

Payment cryptocurrencies are designed to function as digital money that enables peer-to-peer transactions across decentralized networks.

Examples include:

- Bitcoin

- Litecoin

- Bitcoin Cash

These cryptocurrencies focus on fast, secure, and borderless financial transactions.

2. Utility Tokens

Utility tokens provide access to specific products or services within a blockchain ecosystem.

For example, they may allow users to:

- Access platform features

- Pay for services

- Unlock premium functionalities

Many blockchain platforms launch utility tokens to power decentralized applications.

Not Sure Which Type Of Cryptocurrency Fits Your Project?

3. Governance Tokens

Governance tokens allow holders to participate in decision-making processes within decentralized platforms.

Token holders may vote on:

- Protocol upgrades

- Ecosystem changes

- Treasury allocations

This model is commonly used in decentralized finance platforms.

4. Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to real-world assets such as fiat currencies.

Examples include:

Stablecoins are widely used for trading, payments, and decentralized finance applications.

5. Asset-Backed Tokens

Asset-backed tokens represent ownership or value linked to real-world assets.

These may include:

- Real estate

- Commodities

- Financial assets

Tokenization allows these assets to be managed and transferred using blockchain technology.

6. Meme Coins

Meme coins are community-driven cryptocurrencies that often originate from internet culture or viral trends.

Examples include:

While many meme coins start as community experiments, some evolve into large ecosystems with active communities.

How to Create a Cryptocurrency (Step-by-Step)

Launching a crypto requires a structured development process that combines:

- Define the Use Case

The first step is identifying the purpose of the cryptocurrency and the problem it aims to solve. The use case determines the technical architecture and token design.

Common types of tokens include:

- Payment tokens

- Governance tokens

- Utility tokens for platforms

- Ecosystem reward tokens

Some coin development projects now use AI-driven market analysis tools to evaluate demand, analyze token models, and refine project strategies before development begins.

- Choose the Blockchain Network

The blockchain network determines how the cryptocurrency operates, including transaction speed, security, and scalability. Developers may also use AI-assisted analytics tools to compare network performance metrics such as transaction throughput, network congestion, and fee structures.

- Develop Smart Contracts

Smart contracts are self-executing programs that define how tokens are created, transferred, and managed on the blockchain.

Examples include:

- ERC-20 tokens on Ethereum

- BEP-20 tokens on Binance Smart Chain

These contracts control essential functions such as token minting, transfers, and governance rules. Because smart contracts operate autonomously, they must be carefully coded and audited to avoid vulnerabilities. AI tools are increasingly being used to assist developers in detecting smart contract vulnerabilities and potential security flaws during development.

- Design Tokenomics

Tokenomics defines the economic structure of a cryptocurrency and influences how the ecosystem grows.

Key elements include:

- Total token supply

- Distribution strategy

- Incentive mechanisms

- Governance structure

Some blockchain projects use AI-driven simulation tools to model different token distribution strategies and predict their long-term economic sustainability.

- Build the Supporting Infrastructure

A successful cryptocurrency requires an ecosystem that allows users to interact with the token. This infrastructure often includes:

- Crypto wallets

- Blockchain explorers

- Liquidity mechanisms

- Exchange integrations

AI-powered analytics platforms can also help projects monitor user activity, detect anomalies, and improve ecosystem performance.

- Security Testing & Smart Contract Audits

Security is one of the most critical aspects of development. Projects must perform comprehensive testing before deployment. Common security practices include:

- Smart contract audits

- Penetration testing

- Blockchain security reviews

Advanced security teams may use AI-based vulnerability scanning tools to identify potential threats and reduce risks before launch.

- Launch and Token Distribution

The final stage involves deploying the token on the blockchain and distributing it to the community or investors. Common launch models include:

- ICO (Initial Coin Offering)

- IDO (Initial DEX Offering)

- Ecosystem reward distributions

- Private investor allocations

A well-planned launch strategy helps ensure liquidity, adoption, and long-term ecosystem growth.

While these steps outline the core process of launching a digital asset, executing them effectively requires strong technical expertise and blockchain experience. This is why many startups and businesses collaborate with an experienced crypto coin development company when bringing their cryptocurrency to market.

Discover the 7 key insights behind building a successful cryptocurrency.

Technologies Powering Modern Crypto Coin Development

Modern development relies on a combination of blockchain infrastructure, smart contract frameworks, security tools, and data technologies that enable scalable and secure digital asset ecosystems.

1. Blockchain Frameworks and Protocols

The foundation of any cryptocurrency is the blockchain network that records transactions and maintains the distributed ledger.

Common blockchain technologies include:

- EVM – the execution environment used by many Ethereum-compatible networks

- Solana Runtime – designed for high-throughput decentralized applications

- Cosmos SDK – a modular framework for building custom blockchains

- Substrate – a flexible framework used to build blockchains within the Polkadot ecosystem

These languages allow developers to implement token standards, automate transactions, and build decentralized applications.

2. Token Standards

Token standards define how digital assets operate within a blockchain ecosystem.

Common standards include:

- ERC-20 – the most widely used token standard on Ethereum

- ERC-721 – used for non-fungible tokens (NFTs)

- BEP-20 – the token standard used on Binance Smart Chain

In many cases, projects implement token standards like ERC-1155, TRC-20, and SPL tokens to ensure compatibility across various blockchain ecosystems.

3. Smart Contract Languages

Smart contracts define how tokens behave and how transactions are executed on the blockchain.

Developers commonly use programming languages such as:

- Solidity – widely used for Ethereum and EVM-based networks

- Rust – preferred for performance-focused blockchains like Solana

- Vyper – a Python-like language designed for secure smart contracts

These languages allow developers to implement token standards, automate transactions, and build decentralized applications.

4. Wallet and Infrastructure Integration

Cryptocurrency platforms must integrate with digital wallets that enable users to securely store and transfer assets.

Popular wallet integrations include:

- MetaMask

- Trust Wallet

- Phantom

- WalletConnect

Wallet compatibility improves accessibility and ensures seamless interaction with blockchain networks.

5. AI and Data Analytics Tools

Artificial intelligence is increasingly being used to enhance cryptocurrency ecosystems and improve operational efficiency.

AI technologies can support:

- Blockchain data analytics

- Fraud detection and transaction monitoring

- Smart contract vulnerability detection

- Predictive market insights

By analyzing blockchain data and user activity patterns, AI-driven tools help projects improve security, optimize token ecosystems, and detect potential risks.

6. Security and Smart Contract Auditing Tools

Security is a critical component of cryptocurrency development. Specialized tools help identify vulnerabilities before deployment.

Common tools include:

- MythX – smart contract security analysis

- Slither – static analysis framework for Solidity

- OpenZeppelin libraries – secure smart contract templates

These tools help developers reduce risks and strengthen the reliability of blockchain applications.

How Much Does Cryptocurrency Development Cost?

The scope of crypto development can vary significantly depending on the project’s goals, architecture, and functionality. From creating a simple token to building a full blockchain ecosystem, each project requires different levels of technical design, security measures, and infrastructure.

Several factors influence the development process, including:

- Blockchain Network Selection: The choice of blockchain affects scalability, transaction efficiency, and overall system architecture.

- Smart Contract Architecture: The complexity of smart contracts determines how the cryptocurrency behaves, including token distribution, governance mechanisms, and automated transactions.

- Security and Auditing Requirements: Ensuring the reliability of smart contracts and blockchain infrastructure requires comprehensive security testing and professional audits.

- Platform and Ecosystem Integrations: Many cryptocurrency projects integrate with wallets, exchanges, decentralized applications, and other blockchain services to enhance accessibility and usability.

Because cryptocurrency development involves multiple technical layers, businesses often collaborate with experienced development teams to ensure their digital assets are secure, scalable, and ready for real-world deployment.

Conclusion

Creating a cryptocurrency is no longer limited to large technology firms or early blockchain innovators. Today, startups, fintech platforms, and digital businesses are exploring cryptocurrency development to power decentralized payments, build token-driven ecosystems, and unlock new digital economies. However, building a secure and scalable cryptocurrency requires careful planning, strong blockchain expertise, and the right development strategy. Partnering with an experienced cryptocurrency development company can help transform a concept into a fully functional digital asset while ensuring security, scalability, and seamless ecosystem integration.

With extensive experience in blockchain engineering and token development, Antier works with startups and enterprises to design, develop, and launch secure cryptocurrency projects, helping turn innovative blockchain ideas into practical and scalable solutions. Ready to build your own cryptocurrency? Connect with Antier’s experts today and take the first step toward launching your blockchain-powered digital asset.

Frequently Asked Questions

01. What is cryptocurrency development?

Cryptocurrency development is the process of designing, building, and launching a digital currency using blockchain technology, which includes creating secure token structures, writing smart contracts, and establishing the necessary ecosystem for transactions and governance.

02. What components are typically included in a cryptocurrency system?

A typical cryptocurrency system includes blockchain infrastructure, token or coin architecture, smart contracts, consensus mechanisms, and wallets and transaction interfaces to ensure secure creation, distribution, and exchange of digital assets.

03. What are EVM-compatible and non-EVM blockchain networks?

EVM-compatible networks, like Ethereum and BNB Chain, support the Ethereum Virtual Machine and offer benefits in scalability and developer tooling, while non-EVM chains provide alternative solutions with unique advantages for specific use cases in cryptocurrency development.

Crypto World

Rivian (RIVN) Stock Receives Buy Rating From TD Cowen as R2 Launch Nears

TLDR

- Rivian (RIVN) receives Buy rating from TD Cowen with $20 price target, raised from $17

- Rating change arrives two days prior to R2 SUV unveiling at SXSW 2026 on March 12

- Analyst forecasts R2 demand between 212,000 and 335,000 units per year at full production

- Shares down approximately 20% in 2025, currently trading near $15.87

- Wall Street expects revenue growth from $5.4B in 2025 to $16.3B by 2028

Wall Street is turning more bullish on Rivian (RIVN) stock as the electric vehicle maker prepares for one of its most important product launches, with TD Cowen elevating its rating to Buy mere days before the R2 SUV makes its debut.

Itay Michaeli, the TD Cowen analyst covering Rivian, increased his price target to $20 — marking his second upward revision in less than four weeks. His initial adjustment came February 14, moving from $13 to $17, followed by Tuesday’s additional $3 increase. Against Monday’s close of $15.87, the new target suggests potential upside of approximately 26%.

The upgrade timing is strategic. The company will take the wraps off its R2 SUV on March 12 during the SXSW 2026 Festival in Austin, Texas. This unveiling has been a focal point for market watchers for several months.

RIVN shares have declined roughly 20% since the start of 2025. The stock hit its yearly bottom at $12.50 in April amid tariff concerns, then rallied to a 2025 peak of $22.45 in late December. For the past month, shares have mostly hovered around the $15 mark.

TD Cowen’s analysis projects R2 sales reaching between 212,000 and 335,000 units annually once production reaches full capacity — significantly exceeding current Street estimates for 2027. The firm believes the risk-to-reward profile entering the unveiling event is favorable at present valuation levels.

The R2’s Strategic Importance

Rivian’s R2 carries a price tag around $45,000, making it $30,000–$40,000 less expensive than the current R1T pickup and R1S SUV. The automaker has indicated the R2 will also cost less to manufacture, utilizing fewer electronic control units, streamlined wiring architecture, and expanded use of castings.

This dual advantage — accessible pricing coupled with reduced production costs — has captured Wall Street’s focus. The company’s manufacturing output fell from 57,232 vehicles in 2023 to 42,284 in 2025, a decline management attributes to supply chain constraints, reduced EV incentives, and intensifying competition.

The R2 targets a significantly broader consumer segment. Rivian intends to leverage both its forthcoming Georgia manufacturing site and existing Illinois facility to expand capacity, aiming to triple total production capability by 2028.

Current revenue stands at $5.4 billion for 2025. Wall Street projections call for that figure to reach $16.3 billion by 2028, contingent on successful R2 production scaling. Adjusted EBITDA is anticipated to swing positive during that same timeframe.

Current Stock Positioning

Trading around $15 per share, RIVN sits more than 80% beneath its 2021 IPO valuation and represents less than three times estimated 2025 sales. Shares advanced to $17 in mid-February following stronger-than-anticipated Q4 earnings and positive early R2 media impressions.

The company maintains additional products in development. The premium-positioned R3 SUV is slated for late 2026 or early 2027 arrival, with the R2 serving to establish brand recognition and manufacturing momentum ahead of that release.

TD Cowen maintained a more conservative outlook previously, reducing its target to $13 last August and identifying Rivian’s AI Day and the R2 launch as the two primary near-term catalysts deserving attention.

The R2 unveiling is now under 48 hours away.

Crypto World

Polkadot price outlook: bulls test key resistance near $1.50

- Polkadot price fluctuated in a tight range near $1.50 on Tuesday.

- Bulls could push to above $1.67 ahead of DOT emissions cut.

- Sell-off pressure amid prevailing market conditions might derail this setup.

Polkadot is trading near $1.50 as bulls position amid a potential breakout, with eyes on the upcoming upgrade and overhaul of DOT’s tokenomics.

The cryptocurrency’s price is also off lows of $1.40 reached earlier in the week as investors ponder a potential boost to DOT from fresh institutional interest.

Bulls recently celebrated the launch of the first US spot Polkadot ETF.

DOT, ranked 33rd with a market capitalization of $2.54 billion, is bidding to extend gains amid overall upward movement for Bitcoin and top altcoins.

Polkadot (DOT) holds near $1.50 as upgrade nears

Polkadot’s price shows an intraday range of $1.49-1.54 in early trading during the US session on March 10.

The gains see buyers bid for a retest of recent highs, while holding the critical $1.50 level.

The backdrop to this price action is a scheduled reset of Polkadot’s tokenomics.

A new monetary framework will roll out on March 12, and analysts say anticipation could catalyze fresh momentum for DOT.

The uptick this past week coincided with notable buying as traders positioned ahead of the event.

Specifically, Polkadot’s tokenomics reset will involve the introduction of a 2.1 billion hard cap on DOT supply.

The upgrade targets a 53.6% cut in emissions as well as staking.

ETF buzz has also engulfed Polkadot over the past few days.

This follows the debut of 21Shares’ spot Polkadot ETF, the first US spot DOT ETF that went live on Nasdaq under the ticker TDOT.

The physically backed fund, seeded with $11 million, could strengthen the asset’s appeal as a longer‑term allocation within diversified crypto portfolios.

Polkadot technical analysis

From a technical perspective, DOT’s immediate focus is on converting the $1.50-$1.55 region from resistance into support.

Bulls are eyeing three consecutive green candles on the daily chart and look to have stemmed the downtrend from highs of $1.75 posted in late February.

RSI is neutral near 50, and an upturn could see buyers accelerate gains.

However, after a choppy start to the year, trading around this level means bulls may not be out of the woods yet.

The token may thus trade sideways as consolidation picks pace.

For a breakout, DOT has to achieve an emphatic daily close above $1.55.

A successful breach of resistance at $1.67 amid a bullish retest could trigger follow-through buying.

If this happens, it could open the door to a short-term test of recent local highs around $2.30.

Conversely, failure to hold $1.50 will keep DOT confined within its descending channel. Major support lies around $1.22.

Crypto World

DeFi Insurance Is The Final Frontier Of Onchain Finance

Opinion by: Jesus Rodriguez, co-founder of Sentora

If you look at decentralized finance (DeFi) as a stack of computational primitives, it’s remarkably complete — yet fundamentally broken.

We have automated market makers for liquidity, like Uniswap. We have lending markets for capital efficiency, and bridges for cross-chain “packet switching.” Step back and look at the architecture from a systems engineering perspective.

There is a gaping hole where the risk backstop should be.

Insurance is the “missing primitive” of the decentralized web. It is the translation layer that turns scary, opaque technical risk into a legible line item — a number you can compare, hedge and budget for. Without it, we aren’t building a financial system; we’re building a very sophisticated, high-stakes casino.

Insurance hasn’t worked, so far

A lot of chatter has been spent on why onchain insurance hasn’t “mooned” despite billions in total value locked (TVL). Personally, I suspect the failure is structural, not just a “lack of interest.” We’ve been fighting against the physics of risk management.

Most first-generation protocols tried to use DeFi-native assets, like Ether (ETH) or protocol tokens, to insure the very same DeFi stack those assets live in. This is a classic “reflexivity” trap. When a major exploit happens, the entire ecosystem usually suffers a setback. The collateral loses value at the exact moment the payout is triggered. In systems terms, this is a positive feedback loop of failure. It’s like trying to insure a house against fire using a bucket of gasoline. To work, insurance requires uncorrelated capital: assets that don’t care if a specific smart contract gets drained.

Historically, we relied on retail yield farmers to provide “cover.” These users don’t wake up caring about actuarial tables or underwriting. They care about APY and points. This is not the stable, long-term underwriting base that is required to build a multibillion-dollar risk engine. Real insurance requires a “low cost of capital” base — institutional-grade assets that are happy to sit and collect a steady 2%-4% spread without needing to “degenerate” into 100% APY schemes.

The scaling imperative

We’ve spent years obsessing over TVL as the North Star of DeFi. TVL is a vanity metric; it tells you how much capital is sitting in the “danger zone.” The metric we actually need to optimize for — the one that actually measures the maturity of the industry — is total value covered (TVC).

If we have $100 billion in TVL but only $500 million in TVC, the system is effectively 99.5% “naked.” In any traditional engineering discipline, this would be considered a catastrophic failure in safety margins. You wouldn’t fly in a plane that was 0.5% “safety tested.”

The scaling imperative for the next era of DeFi is to bridge this gap. We need a path where TVC scales linearly with TVL. Currently, they are decoupled. TVL grows exponentially based on speculation, while TVC crawls linearly because the “risk markets” are illiquid and manually managed. Scaling DeFi isn’t just about Layer 2 throughput; it’s about “risk throughput.”

Pricing the ghost in the machine

We often talk about risk as an ethereal, spooky thing that happens to other people. In a mature financial system, risk is a commodity. It needs to be assetized.

Think of DeFi insurance as the pricing engine of risk. Currently, when you deposit into a vault, you are consuming a bundle of risks: smart contract risk, oracle risk and economic design risk. These risks are currently unpriced — they are just hidden baggage you carry.

By building a robust insurance primitive, we turn those hidden risks into tradable assets. We move from “I hope this doesn’t break” to “The market says the probability of this breaking is exactly 0.8% per annum, and here is the tokenized instrument that pays out if it does.”

Related: AI will forever change smart contract audits

This assetization is powerful because it creates a market signal. If the cost of cover for Protocol A is 5% while Protocol B is 1%, the market has effectively “priced” the security of the code. Insurance isn’t just a safety net; it’s the global oracle for protocol health. It turns “security” from a vague marketing claim into a hard, liquid price.

The dream of programmable insurance

The “end state” of this technology isn’t just a decentralized version of Geico — it’s a transition from legal insurance to computational insurance.

Think about the difference between a traditional legal contract and a smart contract. Traditional insurance involves 40-page PDFs, adjusters and a six-month claims process. It is a “human-in-the-loop” bottleneck.

Programmable insurance is a primitive that can be integrated directly into the transaction stack. It includes granular cover and atomic payouts. You don’t just “insure a protocol” in the abstract. You insure a specific LP position, a specific oracle feed, or even a single high-value transaction. If the state of the blockchain detects an exploit, the payout happens in the same block. There is no “claims department”; there is only “state verification.”

This makes insurance a “first-class citizen” in the code. You can imagine an “Insurance” button on every swap or deposit, much like how you choose “priority gas” today. It becomes a toggle in the UI.

The next wave of DeFi adoption

The real challenge for DeFi adoption isn’t convincing another 1,000 degens to use a bridge; it’s onboarding the fintechs and neobanks.

These entities are already knocking on the door. They are considering the 5% onchain risk-free rates and comparing them to their legacy rails, which are clogged with overheads and rent-seekers. However, for a neobank (think of firms such as Revolut, Chime or Nubank), “The code is the law” is not a valid risk management strategy. Their regulators — and their own risk committees — simply won’t allow it.

For these players, insurance isn’t a “nice to have”; it’s a hard requirement for deployment. They represent the next “trillion-dollar” wave of liquidity, but they are currently standing on the sidelines. They need a “wrapper” that makes DeFi look like a bank account.

If we can provide a robust, programmatically backed insurance layer, we aren’t just protecting degens; we are providing the “regulatory-compliant shield” that allows a neobank to put $1 billion of customer deposits into a lending vault. Insurance is the bridge between “crypto-native” and “global finance.”

We’ve spent the last few years building the “engine” of the new financial system. We have the pistons (liquidity), the transmission (bridges) and the fuel (capital). But we forgot the brakes and the air bags.

Until we solve the insurance primitive, DeFi will remain a niche experiment for the risk tolerant. By shifting our focus from TVL to TVC, moving toward uncorrelated collateral and embracing the “pricing engine” of assetized risk, we can finally turn this experiment into a resilient, global utility.

Strap in. There is a lot of code to write and even more risk to underwrite.

Opinion by: Jesus Rodriguez, co-founder of Sentora.

This opinion article presents the author’s expert view, and it may not reflect the views of Cointelegraph.com. This content has undergone editorial review to ensure clarity and relevance. Cointelegraph remains committed to transparent reporting and upholding the highest standards of journalism. Readers are encouraged to conduct their own research before taking any actions related to the company.

Crypto World

U.S. seeks October retrial for Tornado Cash developer Roman Storm

U.S. prosecutors asked a federal judge to set an October date for the retrial of Tornado Cash developer Roman Storm on two unresolved criminal counts after a jury failed to reach unanimous verdicts during the original hearing, according to a letter filed Monday in the Southern District of New York.

In a letter to U.S. District Judge Katherine Polk Failla, U.S. attorney Jay Clayton, a former chair of the Securities and Exchange Commission (SEC, asked for a date now to “to avoid further unnecessary delays,” even though Storm, who is currently free on bail, has a pending motion for a judgment of acquittal. Oral arguments on that motion are scheduled for April 9.

Storm is a co-founder of Tornado Cash, a crypto mixer designed to obscure the origin and destination of blockchain transactions. In August, a jury convicted Storm on one count tied to operating an unlicensed money-transmitting business, and failed to agree on verdicts for two other charges, leaving alleged violations of money laundering sanctions law unresolved. He is currently free on bail while awaiting further proceedings.

Storm criticized the planned retrial in an X post on Tuesday, saying the jury’s split decision reflected uncertainty about the government’s case.

“A jury of 12 Americans heard four weeks of evidence and deadlocked: no verdict on money laundering, and no verdict on sanctions violations,” Storm wrote. “The government’s response? Try again to make writing code a crime.”

Storm also referred to a U.S. Treasury report acknowledging that mixing services like Tornado Cash can serve lawful purposes on public blockchains. The report came after years of opposition to crypto mixers.

Defense lawyers told prosecutors that setting a trial date before the April motion is resolved would be premature.

Crypto World

Winklevoss Twins Are Selling Bitcoin Again? Arkham Flags Big BTC Transfer to Gemini

Arkham’s data shows that their PnL on bitcoin has risen to $1.8 billion.

The Winklevoss twins, who have been predominantly vocal about Zcash and Cypherpunk lately, have made a large BTC transfer to the cryptocurrency exchange they co-founded a decade ago.

According to data from the analytics company Arkham, the $130 million transfer to Gemini’s hot wallets was done “presumably to sell.”

THE WINKLEVOSS TWINS SOLD $130M BTC

The Winklevoss Twins transferred $130M of BTC to Gemini Hot Wallets since last week, presumably to sell.

The Winklevosses once owned 1% of the circulating BTC supply – and now continue to hold $764M of BTC. Their total PnL on BTC is currently… pic.twitter.com/Pjzp45V3K7

— Arkham (@arkham) March 10, 2026

Their data further indicates that the brothers once owned roughly 1% of bitcoin’s supply. Previous reports suggested that they began buying BTC in 2011, purchasing $11 million in the cryptocurrency at $120 per unit from the $65 million they were awarded in cash and Facebook stock following a legal dispute with Mark Zuckerberg.

Although they reportedly sold a portion of their holdings to launch Gemini, their estimated PnL on bitcoin remains around $1.8 billion, Arkham added.

They have made several newsworthy donations over the years, including multi-million-dollar transfers of BTC to Donald Trump’s 2024 presidential campaign on the promise that he was pro-bitcoin, pro-crypto, and pro-business.

While championing for more privacy in the cryptocurrency industry, their focus has most recently switched toward Cypherpunk – a company dedicated to self-sovereignty.

You may also like:

In the initial statement, the brothers said they will “execute on our mission by accumulating, building, and supporting privacy-protecting assets and technologies at a time when the world needs them more than ever.”

The latest press release shared by the company reads that Cypherpunk Technologies has invested $5 million into Zcash Open Development Lab (ZODL), which is its first tech investment outside of ZEC.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

US Lawmakers Probe Trump-Linked Firm Over Chinese IPO Stock Scams

US lawmakers have launched an investigation into several Wall Street underwriters, including Dominari Securities, whose parent company is linked to the Trump family, over their role in bringing Chinese companies to US stock markets that were later tied to stock manipulation schemes.

On Monday, the House of Representatives Select Committee on China, chaired by Representative John Moolenaar with Rep. Ro Khanna as ranking member, sent letters to three US companies — D. Boral Capital, Dominari Securities and Revere Securities — seeking information about Chinese initial public offerings (IPOs) they helped underwrite.

“These scam centers defraud American households through coordinated “ramp-and-dump” stock manipulation schemes involving Chinese shell companies listed on American exchanges, which your firm appears to facilitate,” the lawmakers wrote.

The Chinese companies allegedly used US IPOs to inflate their share prices through coordinated trading and promotion, then dumped shares on retail investors before the stocks crashed. In some cases, dozens of accounts allegedly placed nearly identical buy orders above the IPO price, temporarily pushing valuations higher before insiders sold their stakes.

Related: Trump Sends Pro-Bitcoin Fed Chair Nomination to the Senate

Chinese stock schemes drain billions from investors

The lawmakers cited estimates that around $16 billion in US investor wealth has been drained since 2023 through such schemes. They also pointed to FBI data showing a 300% increase in complaints tied to Chinese stock manipulation cases.

The inquiry seeks documentation from the underwriters, including communications, trading records, funding sources and due diligence policies related to Chinese IPOs.

The committee said it is examining whether US financial intermediaries may have inadvertently helped facilitate manipulation schemes tied to Chinese issuers. The firms have been asked to submit the requested documents by Friday.

Related: Trump’s Media Company Closes $105M Crypto.com Deal

Dominari draws scrutiny in Chinese stock probe

One of the brokerage firms named in the probe is Dominari, which has ties to the Trump family. Located in New York’s Trump Tower, it is owned by Dominari Holdings, where Eric Trump, son of US President Donald Trump, is the fourth-largest shareholder. Eric Trump and Donald Trump Jr. joined the company’s advisory board in February 2025.

Last year, Dominari helped facilitate fundraising for Thumzup, a public company that adopted a Bitcoin (BTC) treasury strategy and also attracted millions of dollars in investment from Donald Trump Jr.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos1 day ago

News Videos1 day ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World22 hours ago

Crypto World22 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat13 hours ago

NewsBeat13 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech23 hours ago

Tech23 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business18 hours ago

Business18 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat5 days ago

NewsBeat5 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show