Crypto World

Binance CEO Richard Teng breaks down the ‘10/10’ nightmare that rocked crypto

Binance did not cause the crypto market liquidation event on Oct. 10, but every exchange — centralized or decentralized — saw massive liquidations that day after China imposed rare earth metal controls and the U.S. announced fresh tariffs, said Binance Co-CEO Richard Teng.

About 75% of the liquidations took place around 9:00 p.m. ET, alongside two unrelated, isolated issues: a stablecoin depegging and “some slowness in terms of asset transfer,” Teng said Thursday at CoinDesk’s Consensus Hong Kong conference.

“The U.S. equity market plunged $1.5 trillion in value that day,” he said. “The U.S. equity market alone saw $150 billion of liquidation. The crypto market is much smaller. It was about $19 billion. And the liquidation on crypto happened across all the exchanges.”

Some users were affected by this, which Binance helped support, he said, an action other exchanges did not take.

Binance facilitated $34 trillion in trading volume last year, he said, with 300 million users. Trading data does not indicate any massive withdrawals from the platform.

“The data speaks for itself,” he said.

Speaking more broadly, Teng said the crypto market was tracking broader geopolitical tensions but that institutions are still pouring into the sector.

“At the macro level, I think people are still uncertain about interest rate movements going forward,” he said. “And there’s always the trend of geopolitics, tension, etc. Those weigh on these assets, such as crypto.”

However, pointing to how the sector has changed over the past four to six years, Teng said long-term industry participants will have noticed that crypto prices move cyclically.

“I think what we have to look at is the underlying development,” he said. “At this point in time, retail demand is somewhat more muted compared to the past year, but the institutional deployment, the corporate deployment is still strong.”

Institutions are still entering the sector, even despite the market, he said, “meaning the smart money is deploying.”

Crypto World

Pro Traders Anticipate Low Odds of a Bitcoin Rally Toward $78,000

Key takeaways:

-

Professional traders remain cautious, pricing low odds for a Bitcoin breakout to $78,000 despite recent ETF inflows.

-

US and Israel-Iran war and soft US labor data offset momentum in Bitcoin ETFs.

Bitcoin options: 17% chance of breaking $78,000

Bitcoin (BTC) reclaimed the $70,000 mark again on Wednesday. However, repeated failed attempts to break above $74,000 over the last five weeks have fueled skepticism. The ongoing US and Israel-Iran war, coupled with disappointing US labor numbers, has only added to the cautious outlook.

Traders are now evaluating whether recent inflows into Bitcoin exchange-traded funds (ETFs) signal an imminent bullish breakout.

While US-listed Bitcoin ETFs saw $414 million in net inflows between Monday and Tuesday, this was insufficient to offset the $576 million in net outflows recorded the previous Thursday and Friday.

Data from the derivatives market suggests that professional traders are skeptical of a significant rally before the end of the month.

Bitcoin call options on Deribit for March 27, which target a $78,000 strike price, traded at $704 on Wednesday. This pricing indicates that whales and market makers see less than a 17% chance of Bitcoin gaining roughly 12% from its current levels.

This cautious outlook is also visible in the futures market, where demand for leveraged long positions remains stagnant.

The annualized premium (basis rate) for monthly Bitcoin futures has stayed below the 4% neutral threshold. Notably, this metric failed to shift even after a 16% four-day rally that peaked with a retest of $74,000 on March 4.

Current onchain and derivatives data point toward indifference rather than an expectation of a sharp crash.

Economic outlook offsets institutional BTC inflows

Professional traders appear wary of sustained BTC price momentum, largely due to a worsening global economy.

Seema Shah, chief global strategist at Principal Asset Management, said that investors are far more focused on how the conflict feeds into inflation, according to Yahoo Finance.

Raymond James strategist Tavis McCourt wrote on Monday that the $25 oil price gain essentially offsets the fiscal benefit from the One Big Beautiful Bill Act, according to CNBC.

McCourt added that after the Gulf War in 1990 and the Russian invasion of Ukraine in 2022, it took about six months for oil prices to get back to where they were before.

The 92,000 job positions cut in the US during February, announced on Friday, vastly disappointed analysts, as consensus anticipated a 55,000 increase. Sentiment further deteriorated on Monday after JPMorgan reportedly reduced the value of private credit loans made to software firms, according to Financial Times.

Regardless of the economic outlook, yield products revolving around Strategy (MSTR US) shares are becoming increasingly supportive for Bitcoin’s price. The company announced a record high daily average price and trading volume, offering opportunities to issue at-the-market share offerings and use the proceeds to buy additional spot Bitcoin positions.

Related: Price predictions 3/11: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

X user “gumsays” said that Strategy Variable Rate Perpetual (STRC US) adoption would lead to Strategy buying billions worth of Bitcoin per week.

The analysis added that a potential series of ETF inflows could result in sustained institutional demand. Therefore, traders will likely have to wait until after March for Bitcoin to break $78,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

SEC, CFTC end years of rivalry with deal that will mean combined crypto oversight

The U.S. markets regulators are melding their operations in the places where the duties of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) overlap, and building a crypto oversight framework is listed among the core aims of a written agreement released on Wednesday.

Most of the objectives of the memorandum of understanding in combining supervision, product approvals and policy interpretations, plus coordinating enforcement actions and providing dual registration, will effect the regulated majority of the crypto sector. But the agreement also specifically listed “Providing a fit-for-purpose regulatory framework for crypto assets and other emerging technologies,” as a top goal.

SEC Chairman Paul Atkins had previewed the MOU in Tuesday remarks, detailing how the agencies are offering contact information for regulated firms to call combined meetings to discuss policy matters and product applications.

“For decades, regulatory turf wars, duplicative agency registrations, and different sets of regulations between the SEC and CFTC have stifled innovation and pushed market participants to other jurisdictions,” Atkins said in a statement on Wednesday. “By aligning regulatory definitions, coordinating oversight, and facilitating seamless, secure data sharing between agencies, we will ensure our rules and regulations deliver the clarity market participants deserve.”

The new agreement says the staff of the CFTC and SEC will meet regularly and share data on mutual interests. That includes enforcement actions, which have historically been pursued independently, sometimes leaving a crypto firm confronted with similar accusations by both agencies. If the two regulators overlap in an enforcement case, they’re agreeing to “confer on potential charges and relief, sequencing of filings, litigation strategy and public communications.”

During the previous administration, other crypto positions of the two agencies sometimes directly contradicted each other, including in how certain assets were being placed in which bucket: securities or commodities.

Now, their enthusiasm for friendly crypto rules is mutual and essentially unopposed, with the CFTC run by a sole Republican chairman on an otherwise empty five-member commission and the SEC led by Atkins and two other Republicans, with the Democrat seats kept vacant.

The chairmen of the agencies were both appointed by President Donald Trump, who arrived in office last year with a new-found enthusiasm for crypto, stemming in part from his own growing business interests. Both Atkins and CFTC Chairman Mike Selig had worked for crypto clients prior to taking their jobs.

Crypto World

MetaMask plugs Uniswap API directly into in-wallet swaps

MetaMask has integrated the Uniswap API as a core swap provider, routing in-wallet trades through Uniswap v2, v3, v4, and UniswapX across 16+ networks for deeper, CEX-like liquidity.

Summary

- MetaMask now routes swaps through the Uniswap API, tapping v2, v3, v4, and UniswapX liquidity across more than 16 networks directly from the wallet UI.

- The API already underpins routing for Uniswap’s own products plus OKX, Talos, Fireblocks, Anchorage Digital, and Ledger, giving MetaMask users institutional-grade pricing and depth.

- With Uniswap’s protocol volume surpassing 40 trillion dollars, the link positions MetaMask as default EVM wallet and Uniswap as default DEX backend, squeezing centralized venues and rival aggregators.

MetaMask has integrated the Uniswap API as one of its core swap providers, allowing users to route trades directly through Uniswap v2, v3, v4, and UniswapX from within the wallet across more than 16 networks. The move tightens the link between the most widely used self-custodial wallet and the largest on-chain DEX liquidity venue, effectively turning MetaMask into a front-end for Uniswap’s full routing stack rather than just a generic swap aggregator.

According to the announcement, MetaMask selected the Uniswap API based on liquidity depth, pricing efficiency, and infrastructure reliability across supported chains. The same API already powers swap flows for Uniswap Labs’ own products, as well as institutional and retail platforms including OKX, Talos, Fireblocks, Anchorage Digital, and Ledger, giving it a track record with both exchanges and custody providers. For end users, this means tighter spreads and deeper routing for volatile or long-tail assets without leaving the wallet.

The scale is non-trivial: cumulative historical trading volume through the Uniswap protocol has now exceeded 40 trillion dollars, underscoring how much order flow and price discovery sits on its pools. By plugging that liquidity into MetaMask’s native swap UX, the integration effectively reduces friction between retail order flow and DeFi’s largest AMM infrastructure. In practical terms, MetaMask users get a more “CEX-like” experience on-chain: one click to quote and execute across fragmented pools and versions.

For developers, the Uniswap API remains free to integrate, with no subscription or per-call fees; teams can generate API keys via the Uniswap developer platform and tap into the same routing engine now wired into MetaMask. That pricing model keeps barriers low for wallets, fintechs, and trading tools that want industrial-grade routing without building their own infrastructure or paying SaaS-style tolls. Over time, this could consolidate more of the retail swap stack around Uniswap’s infra, even as liquidity at the protocol level remains open and permissionless.

Strategically, the MetaMask–Uniswap link pushes the ecosystem a step closer to a de facto standard: MetaMask as the default EVM wallet, Uniswap as the default DEX backend. For centralized venues and competing aggregators, the risk is that a growing share of high-intent order flow never touches their rails, instead going straight from self-custody into Uniswap liquidity via wallet-native swaps. For users, the incentive is simple: fewer hops, deeper liquidity, and reduced reliance on centralized intermediaries for everyday trading.

Crypto World

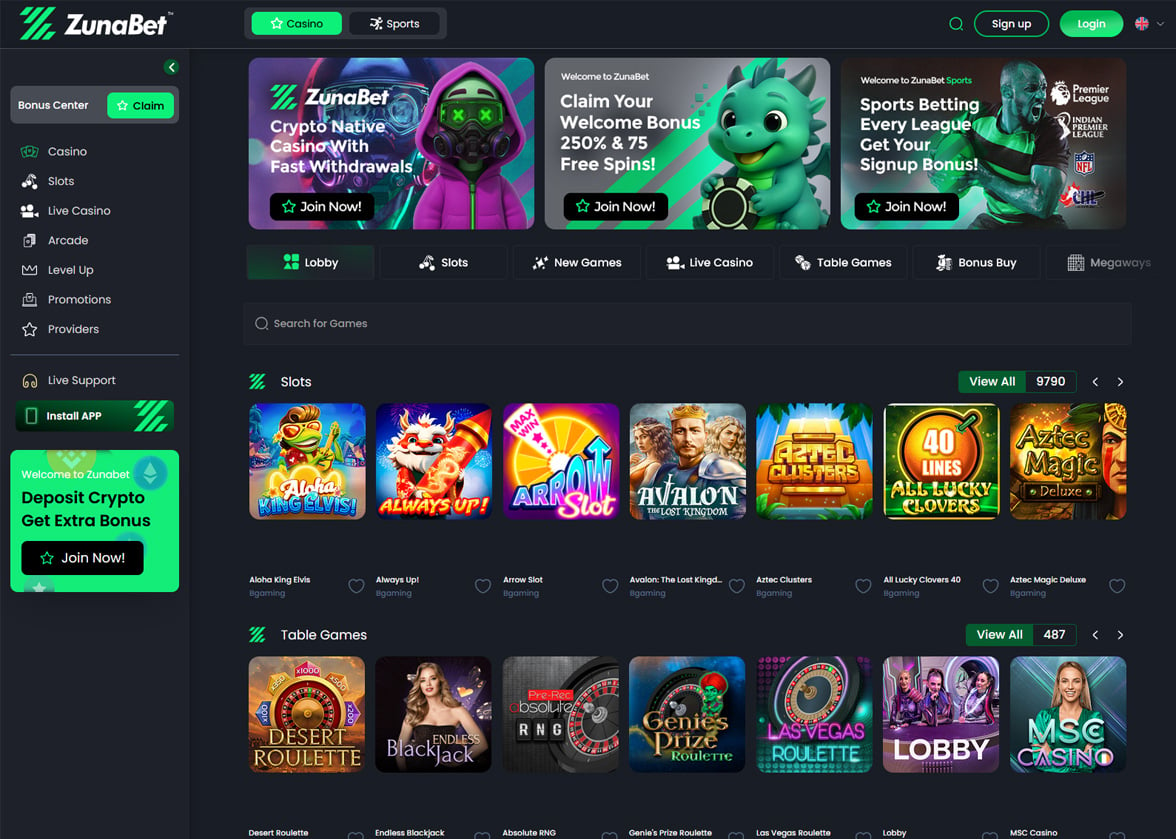

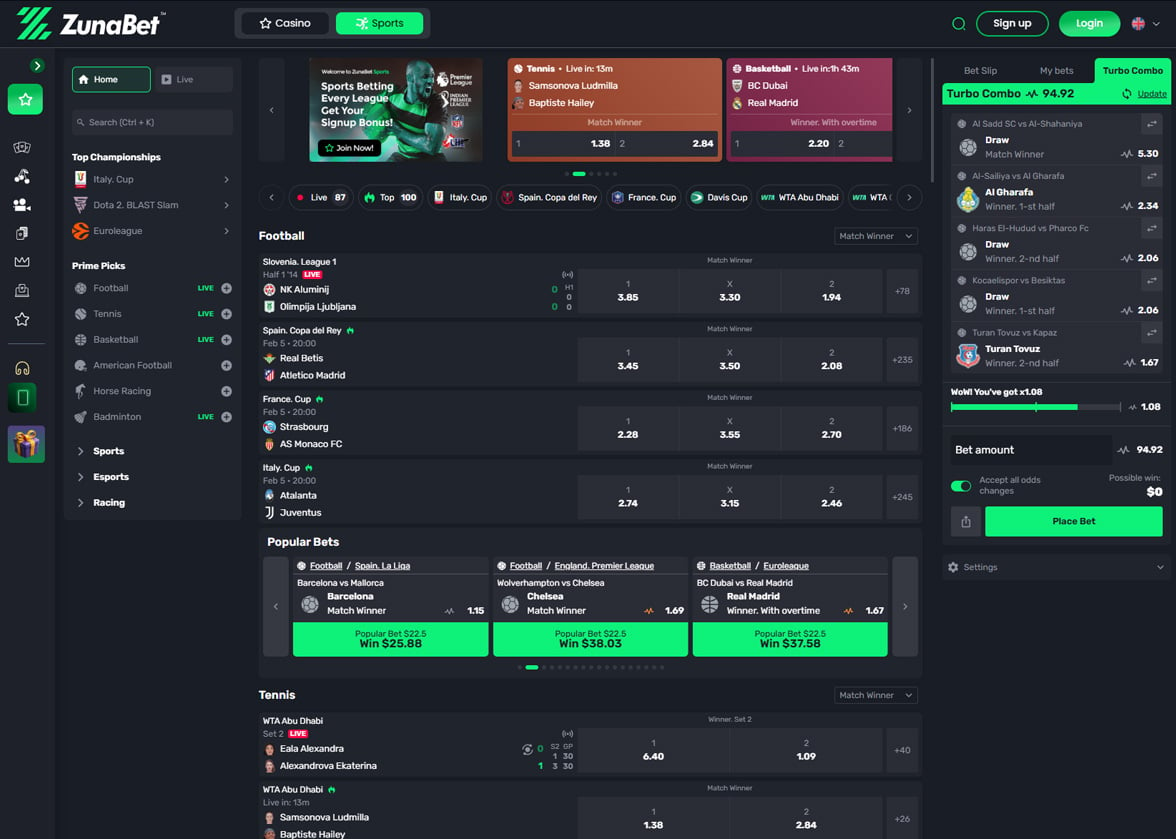

888casino vs ZunaBet: Comparing Bonuses and Features

Bonuses and features are often the first things players look at when choosing an online casino. They shape the initial experience, influence how far a bankroll stretches, and determine whether a platform feels rewarding over time or just during the first deposit. 888casino and ZunaBet both compete for player attention in 2026, but they do so with very different toolkits. One is a long-established brand operating within traditional frameworks. The other is a crypto-native newcomer that arrived this year with a bonus structure, game library, and reward system designed to outperform what legacy platforms typically offer. Here is how they actually compare when you break down what each one puts in front of players.

888casino: A Familiar Name With a Traditional Approach

888casino has been part of the online gambling landscape since 1997, making it one of the oldest platforms still in operation. It operates under 888 Holdings, a company listed on the London Stock Exchange with licenses from the UK Gambling Commission, Gibraltar Regulatory Authority, and other jurisdictions. The brand carries nearly three decades of recognition and has maintained a steady presence across European and international markets.

The casino library at 888casino covers standard ground. Slots make up the largest portion, joined by table games, video poker, and live dealer experiences. The platform operates its own proprietary software alongside games from external providers, which gives it some exclusive titles not found elsewhere. Total game counts vary by market but generally land in the range of a couple of thousand titles. It is a mature library that covers mainstream categories without pushing into exceptional territory on volume.

888casino also connects to 888sport, the company’s sportsbook product. Football, tennis, basketball, horse racing, and other popular sports are covered with competitive odds. The sportsbook is functional and well-integrated but operates as a companion product rather than a standout feature in its own right.

Welcome bonuses at 888casino have historically been modest compared to some competitors. Offers vary by market and change periodically, but they typically involve a deposit match with a cap that sits well below what many newer platforms now offer. The terms tend to come with standard wagering requirements that players need to work through before any bonus funds become withdrawable.

Payments run through conventional channels. Visa, Mastercard, PayPal, Skrill, Neteller, bank transfers, and other traditional methods handle deposits and withdrawals. Processing times follow the usual patterns — e-wallets are quickest while bank and card methods can take several business days. The system is comprehensive but operates within the standard limitations of traditional financial infrastructure.

888casino rewards loyal players through a VIP program with tiered levels. Players earn comp points through real-money wagering that can be exchanged for bonus funds. Higher tiers offer improved conversion rates, faster withdrawals, and access to exclusive promotions. It is a structured program, which puts it ahead of operators that rely solely on ad hoc promotions, though the actual return rates remain modest compared to what newer platforms are now introducing.

ZunaBet: Bigger Numbers at Every Level

ZunaBet launched in 2026 under Strathvale Group Ltd with an Anjouan gaming license. The team behind it brings over 20 years of combined gambling industry experience, and they used that experience to build a crypto-native platform that challenges established operators on bonuses, features, and player value simultaneously. Everything from the welcome offer to the loyalty program to the payment system was designed to outperform what traditional platforms deliver.

The game library sets the scale immediately. ZunaBet hosts 11,294 games from 63 providers. Pragmatic Play, Evolution, Hacksaw Gaming, BGaming, and Yggdrasil headline the list, while more than fifty additional studios push the variety well beyond what most single platforms offer. Slots dominate the count as expected, but live dealer rooms and RNG table games carry genuine depth. Comparing this to a traditional library of a couple of thousand titles illustrates just how wide the content gap has become between legacy and next-generation platforms.

The sportsbook was built as a full standalone product. Football, basketball, tennis, hockey, and other major global sports get comprehensive market coverage. Esports occupy a permanent position with dedicated markets on CS2, Dota 2, League of Legends, and Valorant. Virtual sports and combat sports extend the offering further. The sportsbook is not an afterthought attached to the casino — it stands on its own merits for players whose primary interest is sports betting.

The welcome bonus immediately distinguishes ZunaBet from more conservative operators. New players can claim up to $5,000 plus 75 free spins across three deposits. The first deposit matches at 100% up to $2,000 with 25 spins. The second matches at 50% up to $1,500 with 25 spins. The third matches at 100% up to $1,500 with 25 spins. The total package dwarfs what most traditional casinos offer and sustains bonus value across three separate deposits rather than concentrating everything into a single moment.

Payments are entirely crypto-based. Over 20 coins are accepted including BTC, ETH, USDT across multiple chains, SOL, DOGE, ADA, XRP, and more. ZunaBet charges no processing fees. Withdrawals move through the blockchain without bank involvement, business hour restrictions, or geographic speed variations. Fast, free, and consistent for every player on the platform.

Native apps cover iOS, Android, Windows, and MacOS. The dark-themed responsive interface loads quickly across all devices. Live chat support operates around the clock.

Bonus Structures: Conservative vs Aggressive

The welcome bonus comparison alone tells a significant story about how these platforms position themselves.

888casino has traditionally kept its welcome offers relatively contained. Deposit matches with moderate caps and standard wagering requirements are the norm. The offers are fine for casual players looking for a small boost, but they do not dramatically extend a new player’s runway or create a compelling incentive to make multiple deposits.

ZunaBet’s $5,000 plus 75 free spins welcome package operates on a completely different scale. The three-deposit structure is particularly notable because it rewards players who stick around rather than just showing up once. Each deposit triggers its own match and its own batch of free spins, creating three separate waves of bonus value rather than a single event. For players evaluating where their first deposits will go the furthest, the math favours ZunaBet by a considerable margin.

Loyalty: Comp Points vs Direct Rakeback

Beyond the welcome bonus, the ongoing loyalty experience determines how much value a platform returns to regular players over time.

888casino uses a comp points system tied to its VIP tiers. Real-money wagering earns points that convert to bonus funds at rates that improve as players climb through the levels. Higher tiers bring perks like faster withdrawals, dedicated account managers, and exclusive promotions. It is a structured system and more transparent than platforms that rely purely on rotating promotions. However, the conversion rates and overall return remain conservative, and the value can feel modest relative to the volume of play needed to reach the upper tiers.

ZunaBet approaches loyalty through its dragon evolution program with six tiers — Squire at 1% rakeback, Warden at 2%, Champion at 4%, Divine at 5%, Knight at 10%, and Ultimate at 20%. A dragon mascot named Zuno evolves alongside the player’s progression. Higher tiers add up to 1,000 free spins, VIP club access, and double wheel spins.

The core difference is the mechanism. Comp points require conversion and the resulting value depends on exchange rates set by the platform. Rakeback is direct — a percentage of your wagering comes back without conversion steps or variable rates. At 20%, the return is substantial and easy to calculate. A player does not need to track points, check conversion tables, or wonder what their loyalty is worth. The number is right there, applied automatically, every session. For regular players who care about maximizing the return on their activity, rakeback at these rates represents a meaningful upgrade over traditional comp point economics.

Payment Speed and Cost

888casino processes payments through conventional methods that work reliably but slowly by modern standards. E-wallet withdrawals are fastest, card and bank methods stretch across multiple business days, and international players may encounter conversion fees depending on their location and currency. It is the standard experience that traditional platforms have offered for years.

ZunaBet eliminates the wait entirely. Crypto withdrawals process on-chain without banks, without card networks, and without fees from the platform. There is no variation in speed based on geography or payment method because there is only one payment channel and it works the same way for everyone. For players who have experienced the difference between waiting days for a traditional withdrawal and receiving crypto within the same session, the choice becomes straightforward.

What the Comparison Reveals

888casino has earned its longevity. Nearly three decades in operation, publicly traded, and licensed across major jurisdictions all speak to a platform with genuine staying power. For players who value brand history, traditional VIP structures, and conventional banking, it remains a reasonable choice with a track record to back it up.

But the specifics of what each platform offers tell a clear story in 2026. ZunaBet’s welcome bonus is several times larger. Its game library is several times bigger. Its rakeback system returns more to players more transparently than comp points can match. Its payment system moves money faster and cheaper than any traditional method available at 888casino.

ZunaBet was designed for a generation of players who evaluate platforms on measurable output rather than brand familiarity. More games, bigger bonuses, better loyalty returns, and faster payments — every metric that directly affects the player experience tilts in ZunaBet’s direction. For anyone making a fresh choice about where to play in 2026, the numbers make a compelling case.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Revolut Granted Banking License in the United Kingdom

Financial technology company Revolut announced on Wednesday that it has launched a bank in the United Kingdom after receiving regulatory approval from the Prudential Regulation Authority (PRA), a banking and financial services regulator.

Revolut Bank UK will begin offering deposit accounts for individuals and businesses, with eligible deposits up to 120,000 British pounds ($160,958) protected by the Financial Services Compensation Scheme (FSCS), according to the company’s announcement.

The FSCS offers a safety net for customer deposits at banks and other financial institutions, similar to the Federal Deposit Insurance Corporation (FDIC) insurance for US bank deposits up to $250,000.

Existing Revolut UK customers will be rolled over to the new account type gradually, with the process expected to take several months to fully complete, according to the company.

The new bank sets the stage for offering a “wider range” of services in the future, including lending, the company said.

Revolut also applied for a full banking license in Peru and a federal banking charter in the United States in January, as crypto and financial technology companies pivot to become banks, blurring the line between digital and traditional finance.

Related: Revolut makes second attempt at US bank charter, names new CEO for US business

Crypto industry has eyes on banks, but banking industry pushes back

Crypto industry companies are increasingly looking to acquire national bank charters in the US and other regulatory designations that would plug crypto directly into the traditional financial system.

These companies include blockchain developer company Ripple, institutional-grade blockchain infrastructure provider Paxos, and stablecoin issuer Circle.

In March, crypto exchange Kraken was granted a limited-purpose master account with the Federal Reserve Bank of Kansas City, giving the company direct, but limited, access to the Federal Reserve’s payments system.

The approval of Kraken’s limited-purpose master account was a historic first for the cryptocurrency industry.

However, a trade organization representing the banking sector in the US is reportedly considering filing a lawsuit against the Office of the Comptroller of the Currency (OCC) to block crypto companies from acquiring bank charters.

The banking lobby has repeatedly pushed back against yield-bearing stablecoins and crypto companies offering banking services over fears that blockchain-based financial services will erode the market share of traditional banks.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in the stablecoin fight

Crypto World

March CPI print already baked into BTC price

The February CPI data came in broadly as anticipated, reinforcing that higher inflation remains a factor but not a surprise driver for markets. Analysts at 21Shares argued that the macro picture had already priced in the March print, shifting attention to how the Federal Reserve would respond. The Bureau of Labor Statistics reported shelter costs rose 0.2% in February, while food climbed 0.4% and energy rose 0.6%; the core measure excluding food and energy rose 0.2%. Those numbers underscore a broad, uneven inflation trajectory. In crypto markets, the Total 3 market indicator — which tracks the broader crypto capitalization outside the two largest assets by market cap — dipped about 1% from an intraday high near $722 billion as traders absorbed the data. For readers tracking the macro narrative, the CPI release keeps the Fed in sharper focus while liquidity remains a driver for risk assets across crypto landscapes. CPI release.

Key takeaways

- The February CPI print aligned with estimates, reinforcing expectations that inflation momentum remains contained but persistent enough to influence policy signaling.

- Macro data priced in, shifting attention to the Fed’s reaction function and whether policymakers will “look through” temporary shocks or tighten preemptively.

- Crypto markets showed resilience, with the broader market excluding the leading two assets dipping about 1% from an intraday peak near $722 billion.

- Near-term Bitcoin price prospects point to a range around $68,000–$74,000, with a breakout above $75,000 potentially lifting the next leg toward $77,000–$80,000.

- Market expectations for near-term policy action remain modest, with roughly 0.6% of traders pricing in a rate cut at the March 18 meeting, per CME FedWatch.

Market context: The CPI outcome intersected with expectations about the Federal Reserve’s policy path, reinforcing a regime where macro data and liquidity conditions increasingly shape asset allocation across crypto markets. As investors parse the data, attention remains on potential ETF flows, liquidity conditions, and regulatory signals that could influence risk-on appetite in the sector.

Sentiment: Neutral

Market context: The broader crypto environment continues to respond to macro cues while traders weigh the durability of trend reversals and the potential for regime shifts in monetary policy. The latest price action sits within a framework of cautious optimism, where a measured CPI path and any dovish pivot from the Fed could catalyze incremental risk-taking among digital-asset traders.

Why it matters

The February CPI numbers anchor expectations for the Federal Reserve’s near-term trajectory, with market participants watching for clues about whether policy will remain restrictive or begin to ease as inflation cools. The quote from Stephen Coltman, head of macro at 21Shares, encapsulates the key debate: will the Fed “look through” a temporary inflation shock or tilt hawkish in anticipation of renewed price pressures? His question captures a central tension in macro markets: policymakers must balance the risk of stale data against the risk that over-tightening slows growth more than necessary. The CPI multipliers, the timing of potential rate cuts, and the path of the Fed’s balance sheet all feed directly into how risk assets, including crypto, are repriced in real time.

On the crypto side, Bitcoin and its peers have shown resilience even as macro indicators flash caution. The broader market—measured by Total 3, which excludes the two largest assets by market cap—has managed to hold a high-water mark even as the broader market cooled slightly after the CPI release. The dynamic is clear: when macro momentum remains supportive and liquidity is plentiful, infrastructure developers, traders, and hedgers position themselves for a range of outcomes. The interplay between inflation data, the Fed’s policy stance, and risk sentiment remains the dominant driver of near-term price action in digital assets, even as structural developments in the sector—such as staking, layer-2 scaling, and DeFi adoption—continue to underpin longer-term value propositions.

From a tactical perspective, the crypto narrative often hinges on price catalysts that align with macro cues. If the CPI prints continue to signal softening inflation and the Fed signals a more accommodative stance, the environment could become conducive to a slow but steady reallocation into risk assets, including crypto. Conversely, if the data surprises higher or the Fed remains steadfast in a hawkish posture, liquidity could tighten and risk appetite could wane, pressing prices lower in the near term. In this context, Bitcoin and Ethereum—each with distinct on-ramps to risk markets and different catalysts (security, scalability, staking yields, and institutional adoption)—will be watched closely as leading indicators of broader sentiment in the sector. Ethereum (CRYPTO: ETH) remains a focal point for investors watching network upgrades and the evolving dynamics of on-chain activity, while Bitcoin continues to serve as the benchmark for institutional sentiment toward digital assets as an entire category.

In the immediate horizon, price action for Bitcoin appears to be constrained within a corridor rather than forming a new uptrend. The market narrative suggests that a sustained break above the $75,000 mark could unlock a phase of consolidation between $75,000 and $80,000, with momentum dependent on macro signals, liquidity availability, and the pace at which policy expectations evolve. Historical patterns show that geopolitical shocks can trigger sharp but often brief rebounds in risk assets, including crypto, as investors reposition portfolios and seek hedges or uncorrelated stores of value. A potential easing cycle in 2026, if it materializes, could further accelerate any durable upside by reducing discount rates on future cash flows and encouraging risk-taking among diversified portfolios. For now, near-term traders appear to be watching for a decisive move beyond key resistance levels while staying mindful of the macro backdrop.

The market’s next phase will hinge on the March 18 FOMC decision and the accompanying dot plot. While the probability of a rate cut is currently modest, any shift in messaging toward a more permissive stance would likely be interpreted as a positive catalyst for both traditional and crypto markets. Investors should remain alert to any new inflation data and to updates in regulatory and ETF-related developments that could alter risk appetite and liquidity dynamics in this evolving space.

What to watch next

- March 18: Federal Reserve meeting outcomes and the accompanying policy statement; assess shifts in the policy stance and the dot plot.

- Bitcoin price signal: monitor whether the price sustains a break above $75,000 and whether it can push into the $77,000–$80,000 range.

- Evidence of sustained liquidity: track ETF inflows, macro liquidity conditions, and funding rates that could affect risk assets including crypto.

- Geopolitical or macro shocks: observe whether external events drive a rapid re-pricing across crypto markets and whether they catalyze follow-on rebounds.

- Regulatory and on-chain developments: continue to watch network upgrades, staking dynamics, and DeFi activity that influence long-term value propositions.

Sources & verification

- U.S. Bureau of Labor Statistics CPI February release and sector breakdowns (shelter, food, energy, core).

- Comments from Stephen Coltman, head of macro at 21Shares, regarding the Fed reaction function and policy signaling.

- CME FedWatch tool for probability of near-term rate cuts and market expectations at the March 18 meeting.

- Price charts and intraday levels referenced via TradingView and reputable price-tracking data for Bitcoin and Ethereum.

Markets digest CPI data as Fed policy looms and Bitcoin eyes a breakout

The February CPI print arrived in line with expectations, reinforcing the view that inflation momentum remains a factor but not a surprise driver for markets. In a briefing that highlighted the breadth of price pressures, shelter costs rose 0.2% in February, food increased 0.4%, and energy advanced 0.6%. The core CPI, which strips out volatile food and energy components, rose 0.2%. These figures, released by the U.S. Bureau of Labor Statistics, reflect a broad inflation path with pockets of resilience in housing and energy alongside more modest gains in some other sectors. Analysts at 21Shares noted that the print is now part of the pricing backdrop for the March data, complicating the path for policy but not delivering an outsized surprise that would upend markets. The crypto space, meanwhile, showed a measure of resilience as Total 3 — the broader market value outside the leading two assets — retraced roughly 1% from an intraday high near $722 billion, underscoring that liquidity and risk sentiment remain critical levers for digital assets in the near term. CPI release.

Market observers at 21Shares framed the data through the lens of the Fed’s reaction function. Stephen Coltman asked whether policymakers will “look through” temporary inflation shocks or tilt hawkish as a precaution, pointing to a central question as officials balance the persistence of price pressures against the evidence of cooling momentum. The answer, to many, will hinge on how the Fed interprets the trajectory of inflation and how aggressively it views the risk of a renewed uptick. The outcome will shape not just traditional asset classes but the risk appetite that propels crypto markets higher or lower in the weeks to come.

Looking at the near-term price action, Bitcoin’s path remains tethered to momentum around major psychological thresholds and resistance levels. In a scenario where the price breaks decisively above the $75,000 mark, bulls could push into a consolidation zone roughly between $75,000 and $80,000, with the potential to test the upper end of that band depending on macro cues and liquidity conditions. If, instead, the market fails to clear that resistance, the asset could consolidate in the lower to mid-$70,000s as traders await clearer signals from policymakers and the broader economy. The relevance of macro factors to crypto is a reminder that while the technology and use cases continue to evolve, the sector remains highly sensitive to the policy and liquidity backdrop that governs all risk assets.

Beyond Bitcoin, Ethereum’s ongoing developments around staking dynamics, network upgrades, and layer-2 scaling will continue to influence demand and on-chain activity. These structural factors can interact with macro signals to shape price trajectories over a longer horizon, even as the near term remains dominated by inflation data and monetary policy expectations. In sum, the CPI data reinforces a delicate balance: a still-elevated inflation backdrop paired with a potential shift in policy signaling could, if realized, unlock new phases of risk-on behavior that bolster crypto markets—provided liquidity holds and macro momentum remains supportive.

Crypto World

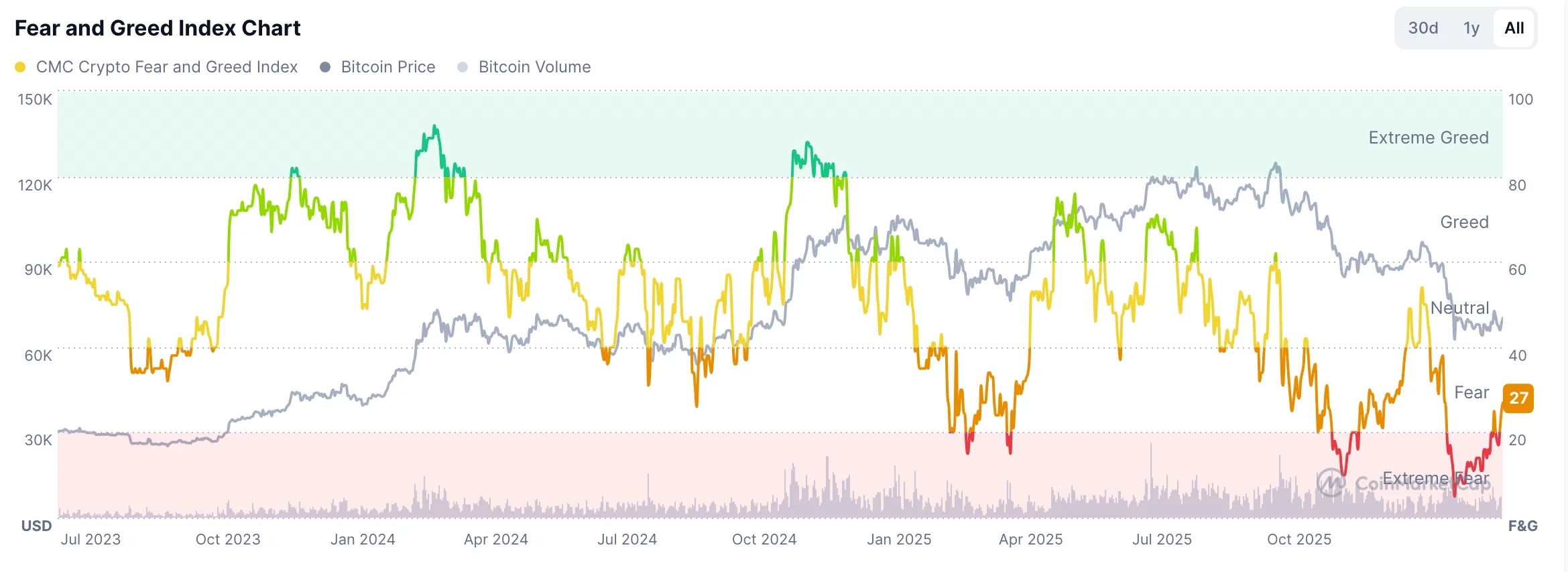

Crypto bull run possible as Trump predicts Iran war will end soon

A crypto bull run could be on the horizon after President Donald Trump hinted that the ongoing Iran war will end soon, and as the Fear and Greed Index continues rising.

Summary

- Bitcoin and most altcoins jumped on Wednesday.

- Donald Trump hinted that the Iran war will end soon.

- The Crypto Fear and Greed Index is about to exit the fear zone.

Bitcoin (BTC) price rose to $71,000, while Ethereum was stuck above $2,000. The market capitalization of all coins jumped to $2.41 trillion.

The main reason for the potential crypto bull run is a statement from Trump, who noted that the Iran war will likely end soon, with officials predicting two more weeks of fighting. This means that it may end at the end of this month.

He noted that the war will end as there will be nothing more left to attack. As a result, ending of this war will be bullish for Bitcoin and other altcoins because it will remove one of the main risks in the market. It will also lower the ongoing inflation concerns, which explains why crude oil prices have dropped sharply from the weekly high.

Still, the main risk is whether Iran will stop the war. Analysts believe that it is in its interest to continue fighting for longer to prevent future attacks from the US and Iran. Indeed, Iranian officials noted that they would switch to continuous attacks with the goal of pushing oil prices to $200 a barrel.

The other potential catalyst for a crypto bull run is the Fear and Greed Index has risen gradually. It has jumped from the year-to-date low of 10 to 27. If the trend continues, it will likely move to the neutral zone followed by the green area.

Historically, crypto bull runs normally start whenever the index is rising. Prices then start their bear markets whenever they move to the extreme greed zone. This view mirrors the popular quote by Warren Buffett, where he recommends buying when others are fearful and selling when others are greedy.

Crypto World

Revolut Secures UK Bank License, Teases Upcoming Services

Revolut has received regulatory clearance to operate a fully licensed bank in the United Kingdom, launching Revolut Bank UK after approval from the Prudential Regulation Authority (PRA). The bank will offer deposit accounts to individuals and businesses, with insured deposits capped at 120,000 pounds by the Financial Services Compensation Scheme (FSCS). The transition for existing Revolut UK customers will be rolled out gradually over several months to integrate the new banking framework, while the fintech outlines a roadmap that includes lending and other services beyond basic accounts. In a broader push, Revolut also disclosed that it had filed for a full banking license in Peru and a federal US banking charter in January, signaling a multi-jurisdictional strategy to blend digital finance with traditional banking regulation.

Details of the PRA approval were echoed by Revolut in a post on X, linking to the announcement from the company. The step marks a notable milestone for a fintech that has built a reputation around rapid, user-friendly digital services and now seeks to operate within the safety nets and supervisory standards that govern traditional banks.

Revolut’s UK rollout is positioned as a foundational move that could unlock a broader range of services in due course. The bank will begin by offering deposit accounts to eligible customers, with the FSCS providing a safety net similar to the way insured deposits work in other jurisdictions. The gradual migration means customers can expect a phased onboarding process as Revolut builds the operational capacity to handle regulatory compliance, risk management, and capital requirements that accompany a licensed bank. While the immediate focus is deposit taking, the company has signaled that lending, payments, and other regulated activities could follow as the business scales within the safety framework of UK banking supervision.

The announcement aligns with a wider trend in which fintechs and crypto-adjacent firms are pursuing formal banking relationships or licenses to access regulated payment rails and traditional funding channels. Revolut’s move mirrors a broader strategic arc in the sector, where digital-first financial platforms are increasingly comfortable trading in a regulated environment that offers consumer protections and a defined line of accountability for capital and operations. In that context, Revolut’s UK license acts as both a proof of concept and a potential template for regional expansion, should regulatory approvals in other jurisdictions align with its product roadmap.

Beyond the UK, Revolut’s filings point to a multi-regional ambition. In January, the company disclosed it had applied for a full banking license in Peru and a federal banking charter in the United States. Peruvian licensing could open doors to cross-border remittances and local consumer banking, while a U.S. banking charter would place Revolut on a sharply regulated stage with potential access to broader U.S. payments infrastructure. Taken together, these moves illustrate how fintechs are recalibrating their growth strategies—seeking regulatory legitimacy not as a mere compliance checkbox, but as a platform for diversified financial services that can compete with incumbents on a more level playing field.

The sector’s momentum toward formal banking has also intensified discussions about the role of crypto and digital assets within regulated systems. A subset of crypto-focused firms has long argued that national bank charters could unlock direct access to the payments rails and reduce friction for on-ramps and off-ramps between crypto ecosystems and traditional finance. Notable examples cited in industry conversations include Ripple, Paxos, and Circle, all of which have pursued or explored regulatory designations that would position crypto-related activities within the broader banking ecosystem. In March, Kraken—one of the largest crypto exchanges—was granted a limited-purpose master account with the Federal Reserve Bank of Kansas City, marking a historic step toward direct Fed access for crypto entities, albeit with clear constraints designed to preserve safety and supervision of the payments system.

The broader regulatory environment remains dynamic. A banking trade association in the United States has reportedly considered legal action against the Office of the Comptroller of the Currency (OCC) to block crypto firms from acquiring bank charters, highlighting the friction between innovation and traditional banking controls. At the same time, bankers and lobbyists have pushed back against yield-bearing stablecoins and other crypto-enabled services that could shift market share away from established lenders. The tension between encouraging financial innovation and maintaining systemic safeguards continues to shape policy, litigation, and strategic partnerships across the fintech and crypto sectors.

From a market perspective, these developments come amid ongoing debates about how to balance consumer protection, financial stability, and competitive innovation. While Revolut’s UK launch demonstrates growing appetite for regulated, tech-enabled banking, the path forward will likely hinge on how regulators interpret cross-border licensing, consumer protections, and the interplay between digital assets and traditional financial rails. The next 12 to 24 months could see a flurry of licensing activity, updated supervisory frameworks, and more structured collaborations between fintechs, crypto firms, and conventional banks as the financial system absorbs rapidly evolving digital capabilities.

In parallel, the industry’s push toward deeper integration with the formal banking system underscores a broader shift in which digital-first firms are increasingly treated as participants in traditional finance rather than isolated disruptors. That shift is fueling a dual dynamic: a demand for robust regulatory compliance to gain legitimacy and, at the same time, a push to innovate on product design and customer experience within those regulatory boundaries. Revolut’s UK bank launch is a concrete manifestation of this trend, signaling that the boundary between fintech and conventional banking is continuing to blur in a carefully managed, policy-driven manner.

Key takeaways

- Revolut Bank UK begins operations after PRA approval, offering deposit accounts with FSCS protection up to 120,000 pounds per depositor.

- Existing Revolut UK customers will be transitioned gradually to the new bank accounts over several months, with lending among the future service expansions.

- Revolut has pursued cross-border licensing, filing for a full Peruvian banking license and a US federal banking charter in January.

- The crypto industry continues to seek bank charters to access traditional payment rails, while regulators and bankers push back on risk and market disruption.

- Kraken secured a limited-purpose master account with the Federal Reserve Bank of Kansas City in March, marking a milestone for crypto access to the Fed system, albeit within defined limits.

- Regulatory debates around stablecoins and crypto banking remain a central battleground for incumbents and fintechs alike.

- Timeline for Revolut Bank UK’s onboarding of existing customers and the rollout of new lending products.

- Progress and outcomes of Revolut’s Peru banking license application and the US federal charter filing made in January.

- Regulatory responses to crypto firms pursuing bank charters, including any developments from the OCC or related lawsuits.

- Further updates on crypto firms’ access to Fed-like payment rails, including any new master accounts or adjusted eligibility criteria.

- Revolut’s official announcement confirming Revolut Bank UK and FSCS-deposits coverage of up to 120,000 pounds.

- PRA regulatory approval documentation for Revolut Bank UK.

- Revolut’s disclosures about Peru and the US banking charter filing in January.

- Kraken’s master account with the Federal Reserve Bank of Kansas City and related coverage of Fed access for crypto firms.

- Public industry discussions regarding crypto banking, OCC actions, and debates on stablecoins and traditional banking disruption.

Sentiment: Neutral

Market context: The move illustrates a broader trend of fintechs seeking regulated banking status to access payments rails and expand product offerings, while regulators balance innovation with consumer protection and systemic resilience.

Why it matters

For consumers and businesses, Revolut Bank UK unlocks insured banking through a familiar digital platform, potentially simplifying tasks such as savings, payments, and lending within a single ecosystem. The FSCS protection up to 120,000 pounds provides a safety net that investors and everyday users expect from a licensed bank, enhancing trust as customers migrate from non-bank services to regulated accounts.

From a broader industry perspective, the move signals a continued convergence between fintechs, crypto-adjacent firms, and traditional banking. By pursuing regulated status, fintechs aim to secure greater access to payments infrastructure, risk controls, and capital markets channels—without surrendering the speed and user-centric design that define their brands. Yet the path is not without risk: industry advocates must navigate a complicated regulatory landscape and potential pushback from lenders wary of new entrants encroaching on the core of conventional banking. The Kraken development and the OCC-related discussions underscore how policy, liquidity access, and the stability of the payments system remain central to any expansion of crypto and fintech activities into licensed banking territory.

What to watch next

Sources & verification

Crypto World

Ledger Uncovers Security Vulnerability That Could Affect 25% of Android Phones

The chip vulnerability makes it possible for hackers to decrypt affected Android smartphones, and steal data — including crypto wallet private keys.

Ledger said on Wednesday, March 11, that it has discovered a vulnerability that could affect as much as 25% of Android phones, letting hackers steal users’ private keys, according to a press release shared with The Defiant.

The hardware wallet company’s in-house white-hat security team, the Donjon, has disclosed a critical vulnerability in Android smartphones powered by MediaTek chips that allows an attacker to extract user data — including wallet seed phrases and PINs — in under a minute, even when the phone is off.

In a proof-of-concept test, the Donjon plugged a Nothing CMF Phone 1 into a laptop and, within 45 seconds, was able to recover the device’s PIN, decrypt its storage, and extract seed phrases from six major crypto wallet apps: Trust Wallet, Base, Kraken Wallet, Rabby, tangem, and Phantom.

Before the operating system of the MediaTek-powered Android device even loads, Ledger’s security team found that an attacker can connect over USB and steal the root cryptographic keys that ensure the phone’s full-disk encryption, per the release. The phone’s data can than be fully decrypted offline.

The vulnerability could affects phones using Trustonic’s Trusted Execution Environment (TEE), the release said, including the Solana Seeker phone.

“Smartphones were never designed to be vaults,” said Charles Guillemet, Ledger’s CTO, adding:

“If your crypto sits on a phone, it’s only as safe as the weakest link in that phone’s hardware, firmware, or software.”

Following the standard 90-day responsible disclosure process, Ledger said it reported the flaw to both MediaTek and Trustonic. MediaTek confirmed it delivered a fix to affected original equipment manufacturers in January.

Ledger advised users of potentially affected Androids to install the latest security updates immediately.

The news comes crypto-related theft has been on the rise. As The Defiant reported, 2025 was a record year for crypto crime, with North Korea alone stealing roughly $2 billion — including the $1.5 billion Bybit hack, the largest hack on record.

But the threat isn’t limited to centralized exchanges. In December, Trust Wallet confirmed $7 million was stolen via a malicious Chrome extension update that harvested seed phrases directly from users’ browsers. Hackers have also reportedly been increasingly using AI tools and phishing-as-a-service infrastructure to increase the number of attacks.

This article was written with the assistance of AI workflows. All our stories are curated, edited and fact-checked by a human.

Crypto World

Mastercard Launches Crypto Partner Program with 85+ Industry firms

Mastercard has launched a global crypto partner program that initially brings together more than 85 companies across the digital asset and payments industries to collaborate on blockchain-based payment and settlement systems.

The initiative is designed to connect crypto companies, financial institutions and payments providers as digital assets begin playing a larger role in cross-border transfers, payouts and other financial services.

Participants include crypto exchanges, blockchain networks and infrastructure providers including Binance, Circle, Gemini, Paxos, Ripple, PayPal, Polygon, Solana, Crypto.com, MoonPay, Fireblocks and the Canton Network.

They will work with Mastercard on products that integrate blockchain-based systems with existing payment infrastructure. According to the announcement, the program will focus on use cases such as cross-border money movement, settlements and commercial payments.

In a post on X on Wednesday, Mastercard said “digital assets are entering a new phase,” with technologies that once operated alongside traditional finance increasingly being applied to practical uses such as cross-border remittances and business-to-business payments.

Mastercard said the initiative builds on its existing work in digital assets, including partnerships with crypto companies, programs supporting blockchain startups and crypto-linked payment cards.

Related: Mastercard, MetaMask launch US crypto card, debuting in New York

Visa and Mastercard deepen embrace of digital assets

Mastercard’s new partner program comes as major payments networks deepen their embrace of digital assets. Both Mastercard and Visa have launched initiatives in recent years aimed at integrating blockchain technology and stablecoins with traditional payment infrastructure.

In September, Visa announced a pilot that allows banks to pre-fund cross-border payments with stablecoins through its Visa Direct platform, enabling near-instant payouts.

About a month later, the company said it would expand its crypto services to support four additional stablecoins across four blockchains, in addition to stablecoins it already supports on networks including Ethereum (ETH), Solana (SOL), Stellar (XLM) and Avalanche (AVAX).

Rival Mastercard said about 30% of its transactions were tokenized in 2024 as it continued expanding efforts to integrate blockchain technology and digital assets into its payment infrastructure.

Earlier this month, Mastercard and SoFi Technologies teamed up to enable settlement using SoFi’s dollar-backed stablecoin, SoFiUSD, across Mastercard’s payments network.

The agreement allows issuers and acquirers to settle card transactions using the bank-issued digital dollar, with SoFi Bank planning to settle its own Mastercard credit and debit transactions in the stablecoin.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoBitwarden adds support for passkey login on Windows 11

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech16 hours ago

Tech16 hours agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports6 days ago

Sports6 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

Politics6 days agoTop Mamdani aide takes progressive project to the UK

-

Business1 day ago

Business1 day agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Sports4 days ago

Sports4 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports4 days ago

Sports4 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat5 hours ago

NewsBeat5 hours agoResidents reaction as Shildon murder probe enters second day

-

Entertainment5 days ago

Entertainment5 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat6 days ago

NewsBeat6 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business3 days ago

Business3 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business16 hours ago

Business16 hours agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat2 days ago

NewsBeat2 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment7 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Tech7 days ago

Tech7 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview