Crypto World

Binance price eyes $615 fibonacci support as oversold conditions build

Binance’s price is approaching the $615 support zone as oversold conditions intensify, placing it at a critical technical inflection point.

Summary

- $615 is a major confluence support combining the 0.618 Fibonacci, VWAP, and prior value area high

- Rejection at $932 confirms bearish structure, keeping pressure on price in the short term

- Oversold conditions raise bounce probability, but confirmation is needed for reversal

Binance (BNB) price has entered a sharp corrective phase following its recent swing high, with bearish momentum accelerating across multiple timeframes. After failing to sustain upside continuation, price has rotated lower in an impulsive fashion, signaling a clear shift in short- to medium-term market structure.

As BNB continues to unwind recent gains, attention is now turning toward a key high-timeframe support region near $615, where technical confluence suggests this level may play a decisive role in determining the next directional move.

Binance price key technical points

- $615 marks a major confluence support zone, aligning with the 0.618 Fibonacci retracement and VWAP support

- High-timeframe resistance at $932 remains intact, reinforcing the broader corrective structure

- Oversold conditions increase the probability of a relief bounce, provided structural support holds

The current corrective move began after Binance Coin established a new high at a time-frame resistance near $932.

This level acted as a decisive rejection point, where bullish momentum stalled and sellers regained control.

The failure to reclaim acceptance above this resistance confirmed a structural low and initiated the current impulsive move to the downside.

Since that rejection, price action has remained consistently bearish, with lower highs and expanding downside candles reflecting aggressive selling pressure. This behavior suggests that the move lower is not merely a shallow pullback, but a broader corrective rotation within the prevailing market cycle.

$615 support zone comes into focus

As price continues to decline, the $615 region has emerged as the most important technical level in the near term.

This zone represents a high-confluence area where multiple technical factors align, including the 0.618 Fibonacci retracement of the broader move and VWAP-based support.

Additionally, this region sits above the previous range value area high, strengthening its relevance as a structural support level.

Historically, when price revisits such confluence zones after an impulsive move, the market often pauses to reassess value. If buyers step in to defend this area, it increases the likelihood that prices will stabilize and form a base for a corrective rebound.

Oversold conditions signal potential exhaustion

Momentum indicators are now beginning to reflect oversold conditions following the extensive selling seen over recent days and weeks. While bearish trends can persist longer than expected, oversold readings often signal that downside momentum may be nearing exhaustion, especially when price approaches major support.

Importantly, oversold conditions alone do not confirm a reversal. However, when combined with strong structural support, they increase the probability of at least a short-term relief bounce. Any such bounce would likely be corrective in nature unless accompanied by a clear reclaim of higher resistance levels.

What to expect in the coming price action

From a technical, price action, and market structure perspective, the $615 region represents a critical make-or-break level for Binance Coin. A successful defense of this support could allow BNB to establish a higher low and trigger a rotation back toward higher price targets. Conversely, failure to hold this zone would expose the market to deeper corrective levels and extend the bearish structure.

Until confirmation emerges, traders should closely monitor volume behavior and price reaction around support. A strong bullish response would signal improving demand, while continued weakness would reinforce downside risk. For now, all eyes remain on $615 as the market approaches a pivotal moment in Binance Coin’s corrective cycle.

Crypto World

Polymarket user pockets $400K betting on ZachXBT investigation

U.S. lawmakers and regulators are sharpening their focus on prediction markets as a high-profile insider-trading narrative unfolds around Polymarket and Axiom. At the center is a claim by on-chain investigator ZachXBT that an Axiom employee—Broox Bauer—and others allegedly used internal tools to access sensitive user data and execute profitable insider trades, a practice the researcher says may have persisted since early 2025. The timing is notable: Polymarket traders had placed large bets on the outcome of ZachXBT’s disclosures, with activity approaching tens of millions of dollars. In response, Axiom said it has removed access to the implicated tools and pledged to investigate and hold responsible parties to account, framing the episode as a test of governance and user protection within the evolving prediction-market ecosystem.

Key takeaways

- On-chain sleuth ZachXBT alleged that an Axiom employee, Broox Bauer, and others conducted insider trading by leveraging internal tools to access private user data, with the investigation dating back to early 2025.

- Axiom stated it has cut off access to the questioned tools and committed to an internal probe, stressing that the incident does not reflect the broader team or its user-first ethos.

- Polymarket bettors wagered nearly $40 million on the investigation’s outcome, with at least one user profiting about $400,000 and others winning more than $9.7 million on the contract asking which crypto company ZachXBT would expose.

- The episode arrives as U.S. regulators debate the proper reach of federal oversight over prediction markets, with CFTC Chair Michael Selig asserting exclusive jurisdiction and signaling potential clashes with state authorities.

- The case adds to a broader tightening of governance norms and data-access controls across crypto prediction platforms, underscoring regulatory risk and the need for transparent, auditable processes.

Market context: The unfolding events occur against a backdrop of ongoing regulatory scrutiny of prediction markets, where federal and state authorities have historically juggled distinct jurisdictions. The CFTC has stressed federal authority, while some states have pursued their own enforcement actions, creating a patchwork that operators must navigate as markets rely on on-chain data and user-submitted contracts.

Why it matters

The allegations touch on core governance questions for crypto-enabled prediction platforms. If internal tools can be leveraged to access user data for trading advantage, it raises serious concerns about user privacy, algorithmic transparency, and the integrity of market signals. Platforms that rely on public-facing interfaces for forecasting outcomes must demonstrate robust controls, independent audits, and clear incident-response playbooks to preserve trust among participants who treat these markets as both entertainment and hedged exposure to real-world events.

From a market-structure perspective, the episode illustrates how prediction markets intersect with fast-moving on-chain analytics. The ZachXBT disclosures, if verified, would imply a potential mismatch between platform-level governance and user expectations, potentially inviting regulatory actions if risk controls are perceived as lax or opaque. For investors and builders, the case underscores the importance of transparent data-access policies, strict separation between product tooling and private data, and incident disclosures that are timely and verifiable.

On the regulatory front, the scenario underscores the tension between federal authority and state initiatives in enforcement. The CFTC chair’s comments about exclusive jurisdiction suggest a preference for centralized oversight, which could influence how prediction-market platforms structure offerings, disclosures, and compliance programs going forward. Traders and operators should monitor not only the outcomes of internal investigations but also any subsequent regulatory guidance that clarifies permissible use of internal tools, data access, and administrative controls within prediction markets.

Ultimately, the incident matters because it tests the resilience of prediction markets as legitimate, auditable venues for price discovery on real-world events. If platforms fail to demonstrate robust safeguards, participants may migrate to environments with stronger governance or shifted risk profiles. Conversely, transparent corrective steps that restore trust—such as rapid suspension of the implicated tools, independent audits, and clear accountability measures—could reinforce the long-term appeal of crypto-enabled prediction markets as competitive and innovative financial infrastructure.

What to watch next

- Updates from Axiom’s internal investigation, including findings and any leadership actions taken against implicated personnel.

- Any formal statements or enforcement actions from U.S. regulators, particularly the CFTC, regarding prediction-market governance and data-access policies.

- Responses from Polymarket and other platforms about governance changes, risk controls, and disclosures in light of these revelations.

- Further disclosures from ZachXBT or other researchers that could corroborate or challenge the claims of insider trading and tool misuse.

- New disclosures or developments around the contract categories that speculated on the case, including volumes and settlement outcomes.

Sources & verification

- ZachXBT’s X post alleging insider trading by an Axiom employee and others (link: https://x.com/zachxbt/status/2027016064534757659).

- Axiom’s X post acknowledging the incident, stating access to tools has been removed and that the team will investigate (link: https://x.com/AxiomExchange/status/2027018976929423583).

- Polymarket bettors’ activity surrounding the ZachXBT insider-trading exposure, including bets near $40 million (link: https://cointelegraph.com/news/polymarket-bets-zachxbt-insider-trading).

- CFTC Chair Michael Selig’s remarks on exclusive jurisdiction over prediction markets (link: https://cointelegraph.com/news/cftc-michael-selig-defending-prediction-markets).

- Related coverage on Kalshi’s governance and insider-trading-related actions (link: https://cointelegraph.com/news/kalshi-booted-politician-youtuber-insider-trading).

Market reaction and key details

The contemporary disclosure cycle around insider-trading claims in crypto prediction markets marks a pivotal moment for the sector. As the industry grapples with how to regulate and supervise on-chain prediction activities, observers are watching closely how platforms respond to allegations of improper data access and trading influence. The rapid public responses from Axiom reflect a recognition that reputational risk in this space can translate into regulatory risk quickly, especially when user trust is at stake and the outcomes of investigations are uncertain.

Why it matters for users, builders, and the market

For users, the episode reinforces the importance of data governance, transparent tool access, and clear incident reporting. Any perception that insiders could exploit tools to gain an edge undermines confidence in the integrity of the market and may deter participation, especially from risk-averse traders who rely on credible price signals. For builders and operators, the episode highlights the value—and the cost—of implementing verifiable controls, independent audits, and robust user-privacy protections as a competitive differentiator in a crowded field of prediction platforms.

From a market-wide lens, the incident sits at the intersection of regulatory clarity and technological experimentation. The CFTC’s insistence on federal jurisdiction signals that there could be a stricter, more standardized framework for how prediction markets operate in the United States, potentially influencing product design, KYC/AML considerations, and inter-exchange cooperation. Participants should expect a period of heightened scrutiny across platforms as governance models evolve and as regulators balance innovation with the protection of market integrity and consumer data.

What to watch next

- Formal disclosures from Axiom detailing the investigation’s scope and any disciplinary actions.

- Regulatory updates or new guidance from the CFTC and state authorities on prediction-market governance and data access.

- Material changes to Polymarket’s or other platforms’ risk controls and user-privacy policies.

- Additional research or forensic findings from ZachXBT or other researchers that corroborate or challenge the claims.

Sources & verification

- ZachXBT’s X post alleging insider trading by a named Axiom employee and others (link: https://x.com/zachxbt/status/2027016064534757659).

- Axiom Exchange’s official comment and tool-access suspension (link: https://x.com/AxiomExchange/status/2027018976929423583).

- Polymarket bet coverage on ZachXBT insider-trading exposure (link: https://cointelegraph.com/news/polymarket-bets-zachxbt-insider-trading).

- CFTC leadership remarks on exclusive jurisdiction over prediction markets (link: https://cointelegraph.com/news/cftc-michael-selig-defending-prediction-markets).

- Related coverage on Kalshi’s enforcement actions and governance (link: https://cointelegraph.com/news/kalshi-booted-politician-youtuber-insider-trading).

What the investigation changes for the landscape of prediction markets

The case underscores the delicate balance prediction-market platforms must strike between enabling rapid, data-driven bets and enforcing robust controls that prevent misuse of internal tools. It also highlights the evolving role of on-chain researchers in surfacing governance and ethics concerns, and the extent to which platforms must respond quickly and transparently to preserve market integrity and participant confidence. As regulators intensify their focus, the sector will likely see accelerated moves toward standardized governance practices, clearer lines of responsibility, and more explicit privacy safeguards—elements that could determine whether prediction markets remain a vibrant, trust-worthy corner of the crypto ecosystem.

Crypto World

Morph Integrates USDC and CCTP for Stablecoin Settlement

TLDR

- Morph will support native USDC issued directly by Circle’s regulated entities on its network.

- Morph will integrate Circle’s Cross-Chain Transfer Protocol to enable burn-and-mint USDC transfers.

- The integration removes reliance on wrapped USDC versions created by third-party bridges.

- Circle’s CCTP V2 will serve as the standard for cross-chain USDC movement on Morph.

- Morph launched a $150 million Payment Accelerator to support on-chain payment companies.

Morph has moved to support USDC and Circle’s Cross-Chain Transfer Protocol on its network. The integration centers on standardized dollar settlement for on-chain payment systems. The network confirmed it will issue native USDC through Circle’s regulated entities.

Morph Advances Stablecoin Settlement With USDC and CCTP

Morph confirmed that it will support USDC issued directly by Circle affiliates. The network stated that developers will access the official version rather than the bridged copies. This structure keeps redemption aligned with Circle’s regulated reserve framework.

USDC remains a digital dollar backed by cash and cash-equivalent assets. Circle redeems USDC one-to-one for U.S. dollars under its reserve model. Morph said this approach removes uncertainty tied to wrapped stablecoin versions.

Circle’s Cross-Chain Transfer Protocol enables USDC transfers through a burn-and-mint process. The protocol burns tokens on the source chain and mints them on the destination chain. Circle said this model avoids liquidity pools and wrapped bridges.

Morph plans to integrate CCTP V2 as the standard cross-chain framework. Circle has aligned its ecosystem around this version. The companies stated that the integration keeps supply integrity consistent across supported networks.

Morph said the system allows teams to separate funding sources from settlement chains. Developers can move USDC to Morph without converting it into synthetic assets. The network confirmed that balances will remain native after transfer.

Payment Infrastructure Focus Expands Across Ecosystem

Morph launched a $150 million Payment Accelerator to support on-chain payment companies. The program offers funding, technical support, and distribution resources. The network said it targets high-volume settlement platforms.

The accelerator focuses on gateways, remittance providers, and card-linked services. Morph stated that payment firms require predictable settlement assets. The network positioned USDC as the default settlement token within this initiative.

Card and neobank-style platforms often manage assets across several chains. However, settlement layers require stable balances on a single network. Morph said CCTP allows direct USDC movement without wrapped conversions.

Remittance and payout providers have increased stablecoin usage for cross-border transfers. Circle has expanded partnerships across the financial ecosystem for this purpose. Morph stated that native issuance improves reconciliation and tracking.

Payment gateways require consistent asset behavior across chains. Wrapped tokens can introduce variations in redemption paths. Morph said the official USDC reduces discrepancies during settlement cycles.

DeFi applications within the ecosystem also rely on predictable collateral assets. USDC supports lending, routing, and liquidity operations across networks. Morph confirmed that CCTP maintains uniform supply accounting.

Crypto World

AI agents want to identify your crypto wallet using social media

Crypto influencers are taking a preprint, non-peer-reviewed research paper as a terrifying warning about a new unlock for AI agents that allegedly grants them power to deanonymize crypto wallets.

Almost all blockchains like Bitcoin and Ethereum employ pseudonymity in wallet addresses, which are usually presented as a string of characters.

Although wallet addresses are just a string of characters, AIs and easy-to-use agentic tools like Claude Cowork and Perplexity Computer are advancing the capabilities of casual users to deanonymize them.

According to their research, new versions of AI are gaining the power to conduct large-scale deanonymization by taking in posts by billions of humans and linking distinct usernames using highly-processed probability scores.

This is akin to making educated inferences that the person behind one username is likely the same person behind another username.

Researchers used Claude tools by the AI giant Anthropic. The paper is a preprint and as such hasn’t been accepted for publication in a peer-reviewed academic journal. However, its conclusions are potentially disturbing and reinforce concerns about crypto privacy.

Exploiting a common opsec error

Unfortunately, many people re-use the same crypto wallet addresses. Although this is bad practice from an operational security (OpSec) and privacy perspective, the commonplace occurrence allows researchers to glean and infer a tremendous amount of information.

Tracing and deanonymizing crypto has been popular for years at Chainalysis, Elliptic, TRM, Crystal, Coinglass, and Arkham.

However, the use of AI agents to easily link wallets to social and internet platforms is the breakthrough.

Users of Claude Cowork or Perplexity Computer are already asking AI to connect crypto wallets to activity elsewhere.

Read more: AI Agent BadCoin fumbles BSC launch, anti-sniping software flags traders

Four stages of AI deanonymization

Researchers automated hours of manual research by building a pipeline with four stages:

- In the “extract” step, AI agents searched for identity-relevant data from social posts that indicated interests and writing style. Importantly, the researchers used raw, unstructured text directly from social networks.

- The “search” step encoded the extracted data to perform “nearest neighbor” queries across tens of thousands of candidate profiles.

- Next, the “reason” phase applied multi-stage, LLM logic using ChatGPT to select the most likely match.

- Finally, the “calibrate” stage asked other AI models to double-check, error-correct, and assign confidence scores. This allowed the researchers to present their inferences as to which usernames across social networks were likely the same person.

Although researchers didn’t focus on crypto wallets specifically — they focused on linking Reddit, Hacker News, and LinkedIn profiles — the implications for crypto are obvious.

Most concerningly, their financial cost per deanonymization attempt was, in many cases, less than $4, putting the capability of deanonymization well within reach of even conservatively funded adversaries.

Mert Mumtaz, CEO of Helius Labs, amplified the research within the crypto community.

Blockchain transactions are visible to anyone. Although crypto is already accustomed to the use of machine learning, heuristics, and clustering algorithms to link wallet addresses to real-world identities by correlating on-chain behavior with off-chain data, this new research demonstrates how off-blockchain data sets like forum posts and social media activity are now exponentially larger in size and trivially automatable.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

WLFI price prediction as World Liberty Financial proposes governance overhaul

- The World Liberty Financial governance overhaul proposal proposes 180-day staking for voting rights.

- The WLFI price closely mirrors Bitcoin’s price and overall crypto market sentiment.

- The key WLFI price levels to watch are the support at $0.115 and the resistances at $0.120 and $0.1428.

World Liberty Financial (WLFI) is making headlines with a major governance overhaul proposal that could reshape how its token holders participate in the protocol.

The proposal requires all holders with unlocked WLFI tokens to stake them for at least 180 days to qualify for governance voting.

This is designed to encourage long-term commitment and reduce short-term speculation.

If the proposal passes, voting power will now take into account both the number of tokens staked and the remaining lock-up time.

Larger holders who commit for longer periods will have a stronger influence on protocol decisions.

In addition to staking requirements, the overhaul introduces a tiered reward system.

Token holders who stake and participate in at least two governance votes during the lock-up period can earn a roughly 2% annual yield.

These incentives aim to reward active governance engagement rather than just holding tokens passively.

WLFI is also integrating USD1 stablecoin usage into its reward framework. Stakers may receive additional benefits for depositing USD1 on the WLFI trading and lending platform.

Large stakers, designated as nodes or supernodes, will gain further privileges such as access to USD1 conversion services and priority partnership opportunities.

World Liberty Financial (WLFI) token price reaction

These reforms come as WLFI’s market performance reflects broader crypto trends.

The token currently trades at $0.1155, down about 2.9% over 24 hours, with a market cap of roughly $3.2 billion.

Notably, WLFI’s price action has closely mirrored Bitcoin’s recent 2.55% decline, as well as a 2.48% drop in total cryptocurrency market capitalisation.

This high correlation indicates that WLFI is behaving as a high-beta asset, amplifying broader market movements.

Market sentiment is notably negative, with the Fear & Greed Index indicating “Extreme Fear.”

Traders are watching Bitcoin’s price closely, as any significant move below $66,734 could drag WLFI lower.

Conversely, Bitcoin’s stabilisation above $66,000 may allow WLFI to consolidate near its current range between $0.115 and $0.12.

Technically, WLFI has found short-term support around $0.0994. Resistance levels have been observed at $0.1200, $0.1428, and $0.1632.

A sustained move above $0.1200 could pave the way for higher ranges, while failure to hold above support could trigger testing of lower levels near $0.11.

The token’s historical price volatility highlights both opportunities and risks.

It recently reached an all-time high of $0.3313 but has since declined more than 65%.

Its all-time low in recent weeks was $0.09831, showing that buyers have stepped in at sub-$0.10 levels.

WLFI price forecast

The governance overhaul adds a long-term bullish element, as staking reduces circulating supply and encourages sustained engagement.

However, WLFI’s price remains tethered to broader market trends, making Bitcoin and general crypto sentiment key determinants for its short-term trajectory.

The immediate support lies at $0.115, and a breakdown below this level may see WLFI test $0.11, especially if Bitcoin weakens further.

On the upside, breaking through $0.1200 could open the door to $0.1428, followed by $0.1632 if bullish momentum persists.

Crypto World

Will MicroStrategy Share Prices Drops Below $100 Soon?

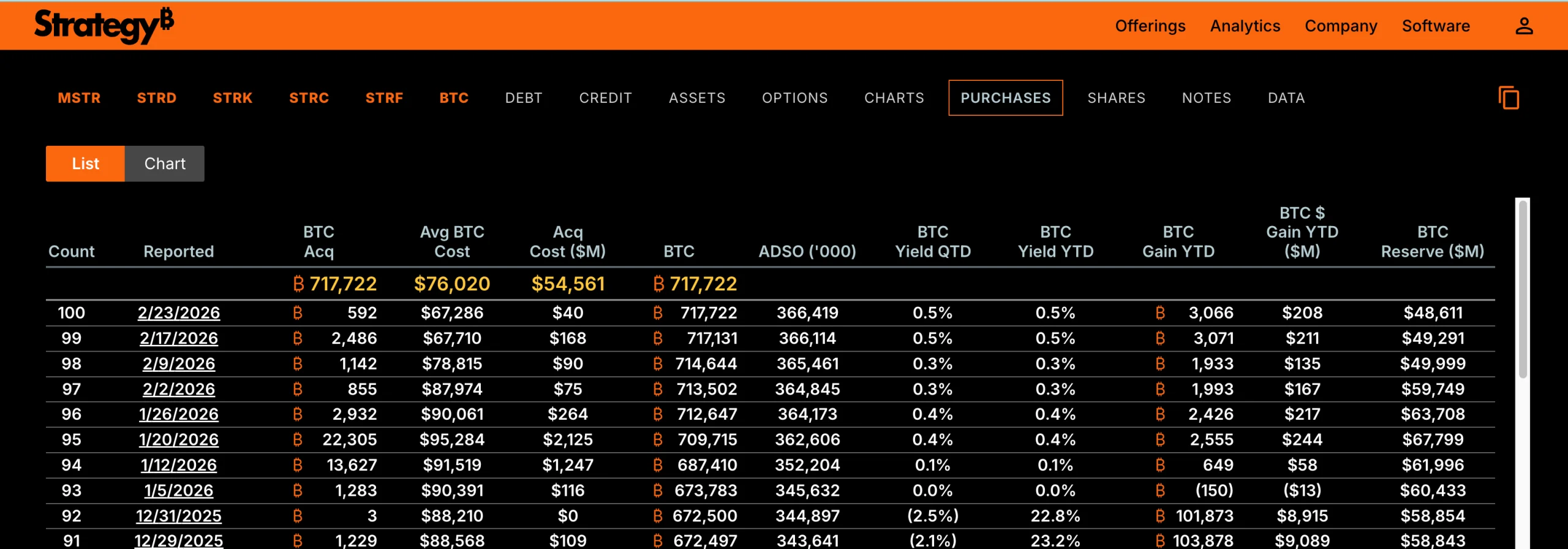

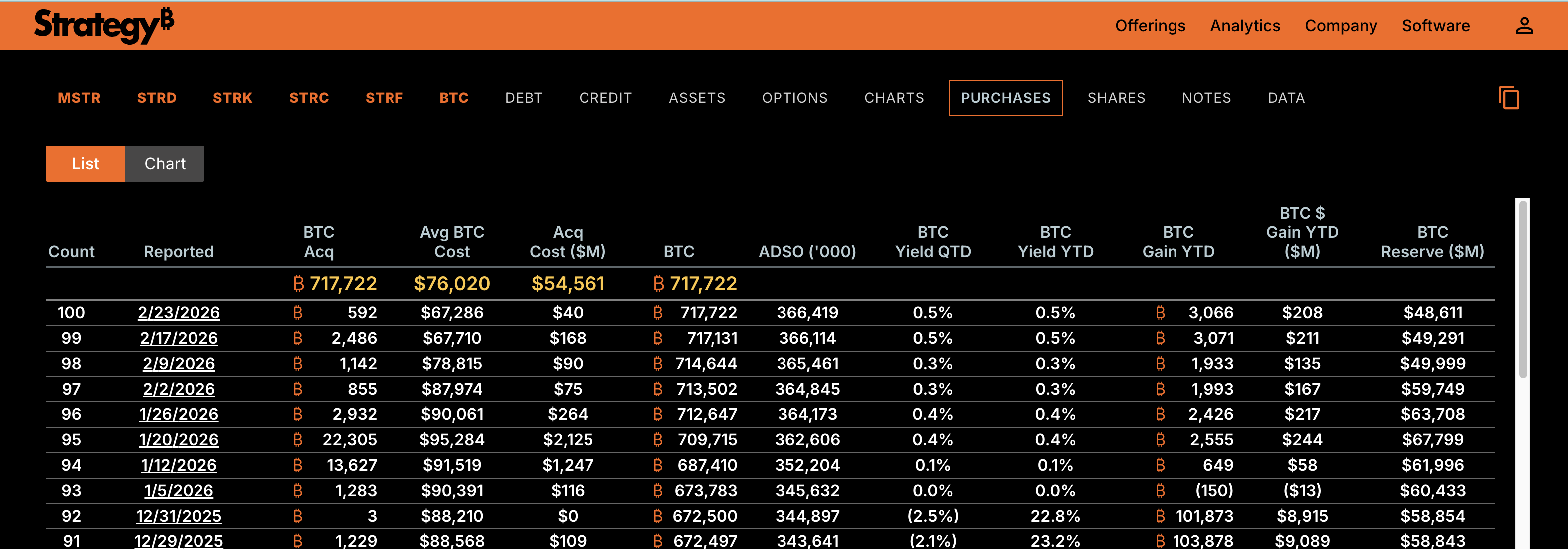

The MicroStrategy stock price couldn’t continue its upswing despite the company continuing to buy more Bitcoin. Its latest $40 million purchase, on February 23, came just as the stock began sliding again. But that wasn’t the entire story.

While MSTR stock dipped by over 9% on February 24, a 16% bounce followed on February 25, showing excitement. At press time, it’s down over 3% since yesterday’s close. The stock is now down about 4% from last Friday’s high and almost 63% over six months, raising fresh concerns about a deeper breakdown, all while the BTC stash was loaded again.

Latest $40 Million Bitcoin Buy Fails to Stop MSTR’s Slide

MicroStrategy added 592 Bitcoin on February 23, spending about $40 million at an average price near $67,286. This pushed its total holdings to 717,722 Bitcoin, with an overall average cost basis of $76,020.

Normally, such aggressive buying supports investor confidence because it signals long-term conviction in Bitcoin’s future.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But at this time, the MicroStrategy stock price continued to fall rather than stabilize, moving steadily on its bear-flag breakdown path that started on February 19, despite a few rebounds. This weakness closely reflects Bitcoin’s own behavior.

The stock had briefly rallied to $137 on February 25, riding Bitcoin’s rebound from $64,500 to $69,400, a 2.5% move. However, as Bitcoin cooled again, MicroStrategy immediately reversed lower, showing how tightly its performance remains tied to Bitcoin’s direction.

This shows MicroStrategy is still trading like a leveraged Bitcoin proxy. When Bitcoin pauses or weakens, MicroStrategy often falls faster because its valuation already assumes strong upside from its Bitcoin holdings.

The latest Bitcoin purchase did not change that dynamic, raising a more important question: whether institutional investors still support the stock.

Institutional Money Flow Signals Growing Exit Risk

The Chaikin Money Flow (CMF) indicator is now flashing a warning sign. CMF measures whether large investors are buying or selling by combining price and volume.

When CMF rises above zero, it signals accumulation, meaning institutional investors are buying. When it drops below zero, it signals distribution, meaning capital is leaving the asset.

Earlier, between January 12 and February 23, CMF rose while MicroStrategy’s stock price fell, with a few bounces above the zero line. This bullish divergence showed that institutional investors were quietly accumulating shares during weakness. That accumulation even translated into net positive flows at times, leading to sizeable rebounds.

It even helped fuel a 33% rebound between February 5 and February 25. However, the situation is different now. The CMF has flatlined, hugging the zero line. This shows institutional money is undecided at the moment.

What’s troubling is that the shift happened immediately after MicroStrategy announced its latest Bitcoin purchase on February 23. CMF suggests institutional investors may not be accumulating MicroStrategy stock despite its Bitcoin buying.

This disconnect weakens the bullish case and suggests confidence in the stock itself may be fading. The next direction the CMF line takes might decide the fate of the MSTR stock price.

At the same time, momentum indicators show that the recent drop (between February 25 and February 26) was not unexpected, as underlying strength had already been weakening.

Bearish Divergence Warned of MSTR Stock Price Drop

The Relative Strength Index (RSI), which measures momentum strength on a scale from 0 to 100, showed a bearish divergence before the recent drop.

Between December 9 and February 25, the MicroStrategy stock price formed a lower high, while RSI formed a higher high. This pattern signals weakening momentum because the price is rising without strong buying support.

This type of divergence often appears before major pullbacks. Similar divergences have appeared multiple times in recent months, and each one led to sharp corrections.

For example, a previous divergence completed in mid-Jan triggered a 45% crash, forming the major downtrend that still defines the stock’s broader structure.

A recent one, concluding on February 20, led to a near 13% dip. The current one has already eaten into 6% of the gains, but because the broader bearish pattern remains active, this decline may be only the early stage of a larger move lower. That wouldn’t be great news for the MicroStrategy shareholders.

MicroStrategy Stock Price Breakdown Structure Points Toward $70

The MicroStrategy stock price has already broken below a bear flag pattern, which is a continuation pattern that forms during temporary rebounds inside larger downtrends. When this pattern breaks down, it usually leads to another strong leg lower.

Right now, the most important support level sits near $119. If this level fails, the next support appears near $106, followed by a stronger technical level near $85.

However, the full breakdown projection based on Fibonacci retracement levels points toward the $71 (the $70 zone) region, which aligns with the 0.786 Fibonacci level and pole’s projected 45%+ dip.

On the upside, the first sign of strength would only appear if MicroStrategy reclaims $139. However, the broader bearish structure would remain intact unless the stock breaks above $155, which would invalidate the breakdown pattern and signal a potential trend reversal.

Until those resistance levels are reclaimed, the current structure suggests MicroStrategy remains vulnerable to further downside, with the $70 zone now emerging as a realistic technical target if $85 gives way, given Bitcoin’s continued weakness.

Crypto World

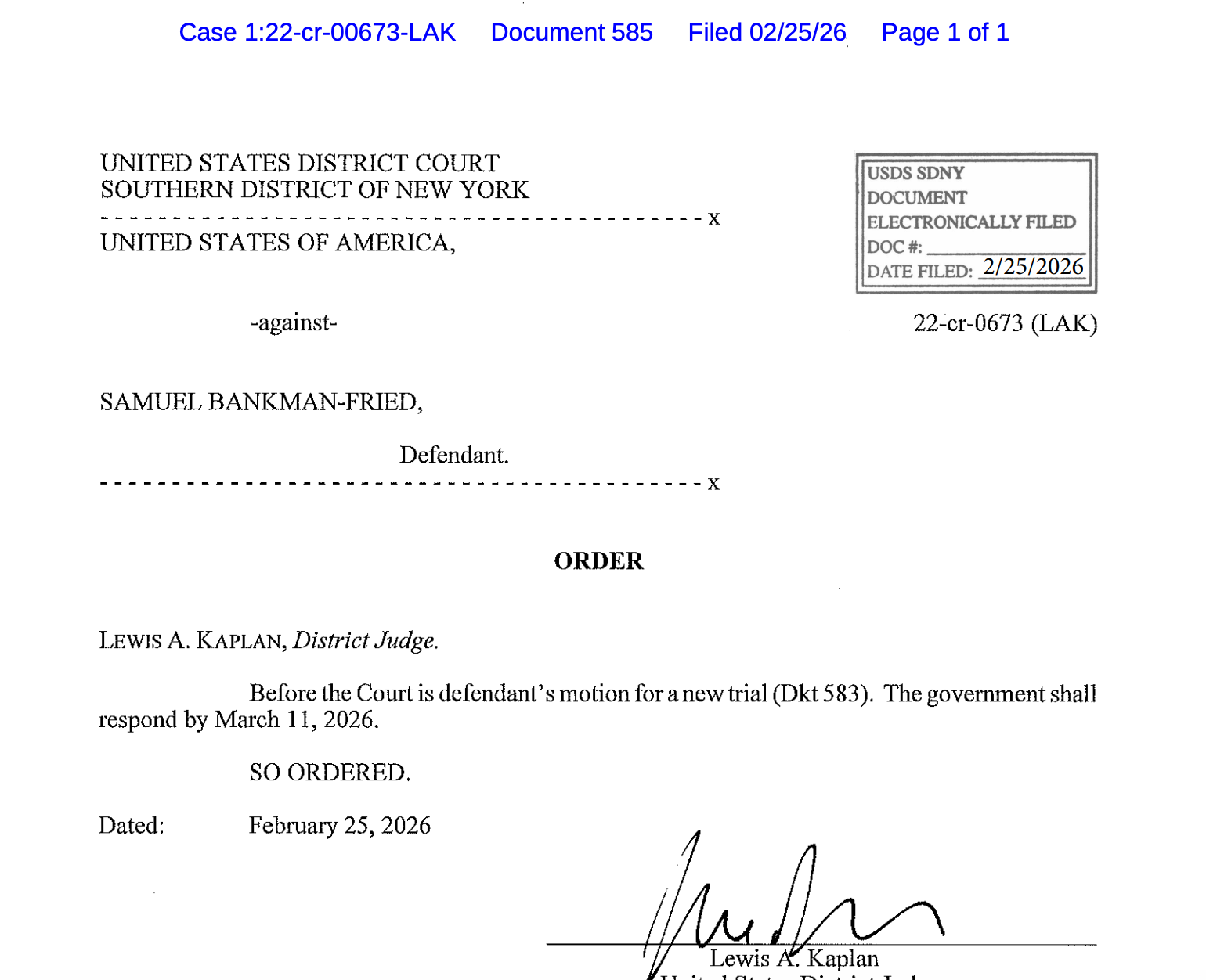

Court sets deadline for US to address Sam Bankman-Fried‘s potential trial

Lawyers representing the US government in the case against Sam “SBF” Bankman-Fried have two weeks to respond to the former FTX CEO’s motion for a new criminal trial.

In a Wednesday filing in the US District Court for the Southern District of New York, Judge Lewis Kaplan said that the US government shall respond by March 11 to SBF’s motion for a new trial. The former FTX CEO, who was convicted of seven felony counts in 2023 and later sentenced to 25 years in prison, requested a new trial earlier this month, claiming that new witness testimony could help bolster his case.

Bankman-Fried, once revered by many as one of the most prominent faces representing the crypto and blockchain industry, was at the center of the controversy around the collapse of FTX. He stepped down as CEO in November 2022, later facing criminal charges in the US for the misuse of user funds.

After Kaplan ordered the former CEO to serve 25 years in prison in March 2024, SBF’s lawyers filed to appeal the conviction and sentence. As of Thursday, the US Court of Appeals for the Second Circuit had not reached a ruling on the filing.

Related: Kalshi bans US politician over alleged insider trading violation

Former Alameda Research CEO Caroline Ellison, who testified against SBF at trial as part of a plea deal with US authorities, was released in January, having spent 440 days in US custody. Ryan Salame, the former co-CEO of FTX Digital Markets, was sentenced to more than seven years and remains incarcerated at the time of publication.

Is Bankman-Fried angling for a presidential pardon?

Although the former CEO was largely silent on social media for his first year in prison, Bankman-Fried later began posting messages supporting US President Donald Trump and challenging information about the collapse of FTX.

In March 2025, SBF gave an interview to political commentator Tucker Carlson — a move that reportedly led to his transfer to a federal correctional institution — claiming that he had better relationships with Republicans than Democrats.

This year, he has posted several times to X, claiming that there had been “political bias” in his case. Bankman-Fried praised Trump’s actions in “standing up” to such bias, while also criticizing Kaplan for overseeing the civil defamation case brought against the then-presidential candidate in 2023.

However, despite Bankman-Fried’s efforts and speculation by many in the crypto industry, the White House has repeatedly said that Trump is not considering a pardon for the former CEO, both in a January New York Times interview and according to a Tuesday report by Fortune. Trump has pardoned several figures in the crypto and blockchain industry since taking office, including former Binance CEO Changpeng Zhao and Silk Road founder Ross Ulbricht.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Toncoin (TON) price heavily oversold as Telegram introduces Vaults in TON Wallet

- The TON Wallet Vaults will let users earn yield on BTC, ETH, and USDT.

- Toncoin (TON) is deeply oversold, trading near $1.29 with bearish momentum.

- The key levels to watch are the support around $1.23–$1.26 and the resistance around $1.41–$2.02.

Toncoin (TON) cryptocurrency has faced a sharp decline even as Telegram rolls out its new Vault feature within the TON Wallet.

The launch of “Vault” in TON Wallet allows users to earn yield on Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) without leaving the app.

Vaults are self-custodial, meaning users retain control of their private keys and assets while participating in decentralised earning strategies.

This integration of decentralised finance (DeFi) into a widely used messenger app marks one of the most accessible on-ramps to DeFi for everyday users.

The TON Wallet uses a combination of DeFi protocols to generate yield behind the scenes.

Morpho provides the lending backbone, while the TON Applications Chain executes transactions, and Re7 manages risk and strategy design.

Users simply interact through the Telegram interface, making the process seamless and user-friendly.

Toncoin market reaction

Despite the positive news, Toncoin’s market performance has been under pressure.

The cryptocurrency has dropped to $1.29, down 3.6% over 24 hours.

This decline aligns with a broader market-wide risk-off rotation.

The total crypto market cap fell 2.43%, and sentiment remains in extreme fear, with the Fear & Greed Index at 16.

Notably, altcoins are underperforming Bitcoin, and Toncoin has moved in line with the market.

TON price technical analysis

Technical indicators show a bearish trend.

The price has broken both the 7-day and 30-day simple moving averages, confirming downward momentum.

In addition, the Relative Strength Index (RSI) reads 26.42, indicating deeply oversold conditions.

The selling volume has also increased by almost 30%, showing persistent pressure despite the oversold state.

Looking at the historical chart movements, the key support lies between $1.23 and $1.30, and the Fibonacci levels highlight this zone as critical for potential short-term rebounds.

A bounce could occur if buyers step in at these levels, especially if Bitcoin stabilises after its recent decline.

CoinLore’s analysis highlights additional support at $1.06 and a secondary zone near $0.8280.

On the upside, the immediate resistance is at $1.41, $1.79, and $2.02, marking key thresholds for traders to watch.

Traders should focus on high-volume rejection or acceptance around the $1.26–$1.30 range to gauge the next move.

Toncoin price prediction

With the introduction of Vaults, TON now combines utility and DeFi access, which could support demand if broader market conditions improve.

If the Toncoin price holds above the $1.23–$1.26 support zone, a short-term rebound toward the 7-day SMA at $1.33 could be possible.

Otherwise, a break below $1.23 may open the path to $1.14, where further downside could extend toward $1.06.

But the oversold RSI suggest a potential bounce, although caution is advised, as the market remains under pressure.

In case of a rebound, clearing the $1.41 resistance would signal strength and potentially push TON toward $1.79 and $2.02.

Crypto World

Polymarket User Gains $400K Betting on ZachXBT Investigation

As US policymakers scrutinize prediction markets platforms, many Polymarket users won bets over speculation as to which insider trading an online sleuth had exposed.

Polymarket users betting on an employee at trading platform Axiom as the target of an insider trading investigation by ZachXBT were rewarded after the crypto sleuth announced the results on social media to his 977,500 followers.

In a Thursday X post, ZachXBT said Axiom employee Broox Bauer and others allegedly were responsible for insider trading activity at the company “since early 2025.” According to the pseudonymous onchain investigator, Bauer allegedly used internal tools “to lookup sensitive user details to insider trade by tracking private wallet activity.”

ZachXBT shared audio clips related to the investigation, in which an individual he said was Bauer claimed he could track Axiom users. In an X post following the announcement, Axiom said it was “shocked and disappointed” in the news.

“We have removed access to these tools and will continue to investigate and hold the offending parties responsible,” said Axiom. “This does not represent us as a team, we have always tried to put the user first.”

The investigation was the latest by the online sleuth, known in the industry for uncovering scams, hacks and instances of insider trading or other unscrupulous activities. Polymarket users bet nearly $40 million leading up to today’s reveal speculating that Axiom would be the target of the probe.

Related: Kalshi bans US politician over alleged insider trading violation

One Polymarket user, who placed separate bets on a similar event contract, profited by about $400,000. Others traded more than $9.7 million on the platform’s “Which crypto company will ZachXBT expose for insider trading?” contract, winning their bets.

Prediction platforms under scrutiny in US for state-federal divide on enforcement

Last week, Commodity Futures Trading Commission (CFTC) Chair Michael Selig said that the federal regulator had “exclusive jurisdiction” over prediction markets, pushing back against several state-level authorities targeting platforms like Polymarket and Kalshi over sports betting. The CFTC chair warned that any state-level entities challenging the federal agency would be met in court.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

A look at what’s driving WBT’s 3-year rally and where it could go

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

WhiteBIT’s WBT surges 3,337% in three years, hitting $65.30 from a $1.90 launch price.

Summary

- WhiteBIT’s WBT surges from $1.9 in 2022 to $65.30, marking a 3,337% rise in three years.

- WBT powers WhiteBIT’s ecosystem, offering fee discounts, staking perks, and weekly token burns to cut supply.

- WBT joins five S&P Crypto indices, signaling growing institutional recognition of exchange-based tokens.

WhiteBIT launched its native token WBT in August 2022 at around $1.9. Three years later, it touched an all-time high of $65.30 — a roughly 3,337% gain from its low — making it one of the top-performing exchange tokens in the market.

The numbers tell the story

WBT bottomed at around $3 in September 2022, just weeks after launch. It spent most of 2023 quietly grinding between $3 and $6. Nothing flashy. By the end of 2023, it closed the year at $5.78. A slow start by crypto standards.

Then came 2024. The token climbed steadily to close the year at around $24.61, roughly a 4x from where it started the year. And 2025 is where things really accelerated. WBT went past $30, then $40, then $50, eventually hitting $65.30 on November 18, 2025, according to CoinMarketCap. As of February 2026, it’s consolidating around $50, sitting at a market cap above $10 billion and ranking among the top 15 globally.

What’s actually driving it

WBT is not a standalone token. It’s the native coin of WhiteBIT, one of the largest European crypto exchanges by traffic. The exchange was founded in 2018 and serves 8 million customers. It’s also a part of the W Group, which serves 35 million customers globally, and reached a total capitalization of $38.9 billion in 2025.

WBT’s utility is embedded in the platform. It is said that holders of WBT get up to 90% off taker fees, up to 100% off maker fees, free daily ERC 20 and ETH withdrawals, free AML checks, boosted referral rates up to 50%, access to staking rewards, VIP status, and access to the Earn program.

WBT has a maximum token number of 400 million. On top of that, the exchange runs a weekly token burn mechanism, creating a deflationary pressure that reduces circulating supply over time. As of early 2026, about 214 million tokens are in circulation.

Most notably, WBT was added to 5 S&P Crypto indices, underscoring the platform’s expanding influence in the global digital asset market and highlighting a broader industry shift toward regulated, infrastructure-focused players.

Strategic moves that mattered

WhiteBIT relies on tokenomics, but the exchange has also made strategic bets that directly impacted WBT’s visibility and credibility.

In 2025, WhiteBIT doubled down by becoming the sleeve partner and official cryptocurrency exchange partner of Juventus FC. The deal marked a strategic move towards the company’s mission to make cryptocurrency more accessible to a wider audience.

On the expansion side, WhiteBIT launched operations in the United States through WhiteBIT US, an independent entity to scale and operate locally across the country. It also entered a cooperation agreement with Saudi Arabia, focusing on Kingdom’s blockchain infrastructure and CBDC framework development, and stock market tokenization.

Where could it go from here?

WBT is currently trading about 25% below its all-time high, with 99.52% of its circulating supply in profit according to recent on-chain data. That’s a positive position, but it also means the token is at a level where holders could take profits during any broader market weakness.

The bull case rests on continued exchange growth, further geographic expansion (the US and Saudi launches are still early), institutional adoption, and the deflationary burn mechanism steadily compressing supply. WhiteBIT has also mentioned that it is currently progressing with its MiCA compliance efforts and pursuing EU licensing.

If WhiteBIT continues scaling at its current pace and the broader crypto market enters a sustained bull cycle, WBT could push past its previous high.

The bear case is simpler: exchange tokens live and die by the exchange’s performance. Regulatory headwinds, increased competition from Binance or Coinbase, or a prolonged market downturn could stall momentum.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Ethereum adds $15b in market value amid rising allocations to emerging crypto protocols

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Mutuum Finance gains momentum as Ethereum rebounds, raising $20.6m with 19,000+ holders.

Summary

- Mutuum Finance raises $20.6m as Ethereum gains momentum, with MUTM priced at $0.04 and 19,000+ holders.

- Ethereum-based Mutuum lets users borrow via over-collateralization while retaining full asset ownership.

- Lenders earn yield through mtTokens, which grow in value as borrowers repay interest-backed loans.

While much of the early year was defined by caution, a sudden surge in crypto buying activity has caught the attention of global analysts. Ethereum (ETH), the world’s second-largest cryptocurrency, is leading this recovery.

This move represents a deeper change in how the market values blockchain projects. Large investors are increasingly looking for platforms that provide transparent financial services. By rotating capital back into Ethereum and its broader ecosystem, investors are prioritizing projects with deeper liquidity, stronger fundamentals, and proven infrastructure.

Ethereum

The road to this recovery has been difficult for Ethereum. Since reaching peaks in August 2025, the asset faced a long and steady decline. By February 6, 2026, the Ethereum price had fallen to approximately $1,746, representing a drop of over 45% from its previous highs.

This fading period was caused by a mix of high interest rates and a general lack of confidence in the broader market. Many traders feared that the asset would continue to slide as leverage was wiped out across various exchanges.

However, the trend shifted dramatically in late February. In less than 24 hours, Ethereum managed to add more than $15 billion to its total market capitalization. This sudden jump pushed the asset back toward the $2,000 mark and restored a sense of optimism to the ecosystem.

This increase is crucial because it suggests that a “market bottom” has likely been formed. When such a massive amount of value is added in a single day, it usually indicates that institutional buyers are stepping in to secure positions before the next growth cycle begins.

This recovery is also supported by a massive drop in “open interest.” After a $7 billion leverage collapse earlier in the month, the market is now much “cleaner.” Most of the risky, debt-based positions have been closed, leaving behind long-term holders and spot buyers. With the market cap now holding firm, the focus has shifted to the projects being built on top of this rejuvenated network.

Mutuum Finance

As Ethereum regains its strength, the Mutuum Finance (MUTM) protocol is showing similar momentum. This Ethereum-based project has raised over $20.6 million in total funding, with the MUTM price currently at $0.04. This financial success is backed by a rapidly growing community that has officially surpassed 19,000 individual holders.

Preparing the dual-market mechanism

One of the primary reasons Mutuum Finance is catching the eye of professional investors is its dual-market design. According to its official plans, the protocol is preparing two distinct ways for users to interact with liquidity:

- Peer-to-Contract (P2C): This model uses automated liquidity pools. It allows lenders to deposit assets and earn immediate interest. Borrowers can access these pools to get instant loans without needing a direct match with another person. This is ideal for major assets like ETH and USDT where speed and high liquidity are needed.

- Peer-to-Peer (P2P): This market is designed for more customized deals. It allows two individuals to agree on their own terms, such as specific interest rates or loan lengths. This is perfect for niche or more volatile assets that might not fit into a standard pool.

By preparing both models, Mutuum Finance provides a complete solution for different types of risk profiles. It gives users the freedom to choose between automated, fast transactions and direct, custom agreements.

How lending and borrowing works

The Mutuum Finance whitepaper describes a system where users can unlock the value of their crypto without selling it. This is done through a process of over-collateralization. Those want to borrow money must provide assets that are worth more than the loan itself. This ensures the protocol remains safe even if the market becomes volatile.

While providing more collateral than the loan amount may seem counterintuitive, the advantage is that users keep 100% ownership of their assets. If the price of the collateral (like ETH or WBTC) increases while the user has an active loan, they still benefit from that entire price appreciation.

Lenders play a vital role by supplying these assets to the protocol. In return, they receive mtTokens. These are yield-bearing receipts that represent their share of the pool. As borrowers pay back their loans with interest, the value of the mtTokens grows.

This means a lender’s balance increases automatically over time. This mechanism is a draw for long-term holders who want to earn passive income while keeping their original investments.

Protocol launch and on-chain whale allocations

The recent activation of the V1 protocol on the Sepolia testnet has moved Mutuum Finance from a concept to a working product. This version allows the community to test the lending pools, the mtToken system, and the automated risk bots in a live risk-free environment. It supports major assets like WBTC, LINK, ETH, and USDT, giving a look at how the platform handles liquidity.

Since the V1 launch, on-chain data has revealed a significant spike in activity. Several whale allocations have been spotted, with single investments exceeding $100,000. By delivering a working protocol on the testnet and completing a security audit with Halborn, Mutuum Finance has provided the transparency that these larger players require.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

-

Video7 days ago

Video7 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics5 days ago

Politics5 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports3 days ago

Sports3 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics3 days ago

Politics3 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business2 days ago

Business2 days agoTrue Citrus debuts functional drink mix collection

-

Crypto World3 days ago

Crypto World3 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business4 days ago

Business4 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business4 days ago

Business4 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech2 days ago

Tech2 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat19 hours ago

NewsBeat19 hours agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat21 hours ago

NewsBeat21 hours agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech4 days ago

Tech4 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat4 days ago

NewsBeat4 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics4 days ago

Politics4 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat2 days ago

NewsBeat2 days agoPolice latest as search for missing woman enters day nine

-

Business16 hours ago

Business16 hours agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Crypto World2 days ago

Crypto World2 days agoEntering new markets without increasing payment costs

-

Sports3 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week