CryptoCurrency

Binance Records $1.25B USDT Outflow as Whale Wallets Accumulate $4.7B in Stablecoins

TLDR:

- Binance experienced its largest USDT withdrawal since September, with over $1.25 billion leaving the exchange.

- Total USDT reserves on Binance dropped from $11.3 billion to $9.6 billion within a 48-hour window this week.

- Whale wallets holding over $100 million accumulated $4.7 billion USDT on Ethereum during the same timeframe.

- Declining exchange liquidity combined with whale accumulation suggests cautious repositioning among major holders.

Binance recorded its largest USDT outflow since September, with withdrawals exceeding $1.25 billion in a single day.

The exchange’s stablecoin reserves fell from $11.3 billion to $9.6 billion between January 8 and January 10.

Meanwhile, whale wallets accumulated $4.7 billion in USDT on the Ethereum network during the same period.

Large-Scale Withdrawals Signal Shifting Market Dynamics

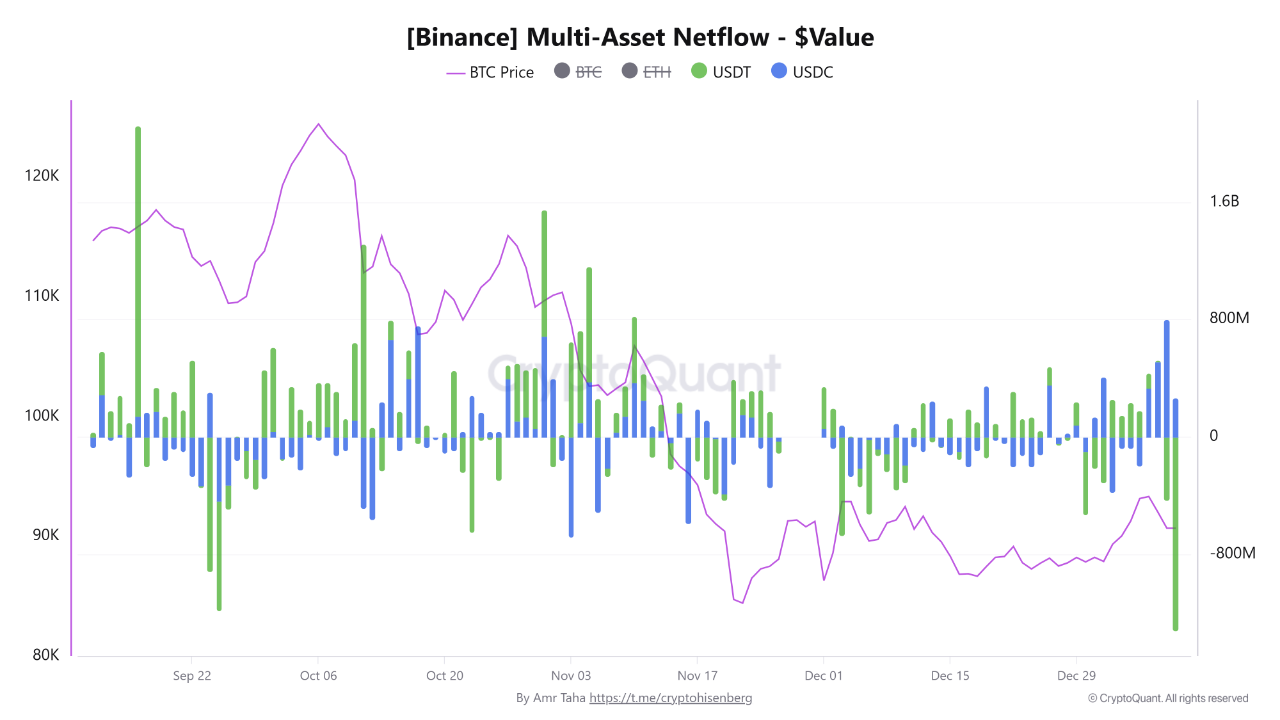

Daily netflow data revealed substantial negative movement on Binance’s platform this week. The exchange saw USDT withdrawals surpass deposits by more than $1.25 billion. This marked the most significant single-day outflow in nearly four months.

Cumulative netflow charts showed a clear contraction in available USDT liquidity on the platform.

Source: Cryptoquant

The green area representing USDT reserves declined noticeably over 48 hours. Binance’s total USDT holdings dropped by approximately $1.7 billion during this timeframe.

Historical patterns suggest declining stablecoin reserves on spot exchanges often correlate with reduced immediate buying pressure.

However, such movements do not necessarily indicate bearish sentiment in all cases. Market participants frequently withdraw stablecoins during profit-taking phases or periods of heightened caution.

The timing of these outflows coincided with broader market volatility across cryptocurrency markets.

Traders appear to be repositioning their capital in response to recent price movements. Such behavior typically reflects a more conservative approach to market exposure during uncertain periods.

Whale Accumulation Contrasts With Exchange Outflows

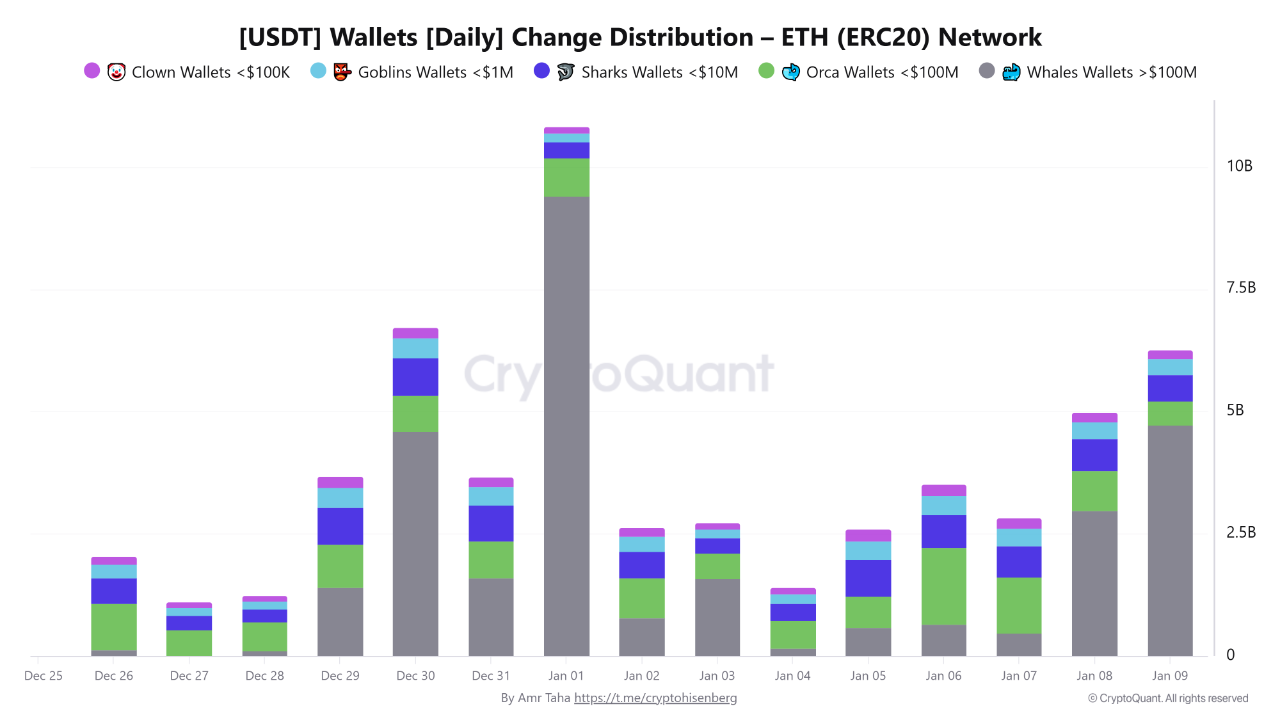

Data from the Ethereum ERC20 network painted a different picture for large holders. Wallets containing over $100 million in USDT added $4.7 billion on January 9. Smaller retail wallets remained relatively flat during the same observation period.

Source: CryptoQuant

The divergence between exchange outflows and whale accumulation presents an interesting market structure.

Large holders appeared to move stablecoins off exchanges while consolidating positions in private wallets. Retail participants showed minimal activity across various wallet size categories.

This distribution pattern reflects a temporary cooling in risk appetite rather than outright market pessimism.

Stablecoin flows provide valuable insight into participant behavior and liquidity positioning. The current environment shows reduced capital available for immediate spot market deployment.

Market observers noted that less USDT on exchanges, combined with higher whale holdings, creates specific conditions. Buying pressure may decrease in the short term if sudden demand materializes.

Concentrated holdings in large wallets could also enable rapid redeployment when conditions shift. Tracking these flows offers clarity on liquidity trends and participant positioning across the cryptocurrency ecosystem.