Crypto World

Binance’s $1B BTC buy fails to win back trust after Oct. 10

This morning, Binance announced a $1 billion purchase of bitcoin (BTC) from its SAFU fund. Unfortunately, the swap from its stablecoin reserves did little to repair confidence from catastrophic liquidations that originated on the exchange during the October 10, 2025 crypto crash.

On that date, Donald Trump threatened China with an unprecedented, 100% import tariff rate. Investors duly panicked.

As a result, BTC tanked 14% while smaller digital assets experienced even worse sell-offs. At its worst moment, the native coin of Cosmos’ blockchain traded 99.99% lower on Binance.

Rumors (which Binance never confirmed) circulated that the exchange or one of CZ’s funds secretly stepped in with their own capital to buy unfairly cheap coins during the panic.

True or not, skeptics are still unconvinced that Binance has made markets whole since that incident three months ago, and are using today’s news to reiterate their dissatisfaction.

At its $83,000 price at time of writing, BTC is down 32% from its $122,000 start on October 10. The asset also traded over $80 billion worth of volume over the last 24 hours, adding further doubt to the meaningful impact of Binance’s $1 billion buy.

Crypto markets haven’t recovered since October 10

Two days after the October 10 incident, a viral post from ElonTrades placed blame for $19 billion worth of liquidations mostly on Binance.

The skeptic questioned Binance’s oracle design flaw and a cross-margin, Unified Account problem with the USDE stablecoin.

On that day, curiously low prices for many assets only existed on Binance. Moreover, Binance partially, tacitly admitted to the idiosyncratic role it played in certain trading pair crashes by paying out hundreds of millions of dollars in restitution, while disclaiming any actual responsibility in those same blog posts.

Read more: Mapping Binance’s globe-trotting empire

Specifically, Binance paid $283 million to “Futures, Margin, and Loan users who held USDE, BNSOL, and WBETH as collateral and were impacted by the depeg.”

In addition, the company committed $100 million in low-interest loans plus $300 million in Rewards Hub vouchers “to eligible users who lost at least $50 during a forced liquidation.”

Moreover, Binance paid another $45 million to BNB memecoin investors who lost money.

Unimpressed by those payouts after $19 billion worth of industry-wide liquidations and mark-to-market losses of up to $600 billion during its worst moments, lawyers quickly invited victims to join class action lawsuits.

The head of OKX called Binance’s damage from October 10 “real and lasting.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

PI holds $0.16 as 778K tokens leave exchanges: rebound brewing?

- PI price rose slightly on Tuesday, with buyers testing resistance above $0.16.

- Holder balances on centralized exchanges have reduced by over 700,000 PI tokens over the last 24 hours.

- The technical outlook for PI is mixed amid overall bearish sentiment.

Pi Network’s token is showing some resilience amid broader crypto market weakness, with price retesting resistance above $0.16 despite key losses for Bitcoin and major altcoins.

The PI token traded to its intraday highs on a slight uptick in daily volume as on-chain data reveals a sharp decrease in token balances on centralized exchanges (CEXs).

While the upward move from lows of $0.13 on February 11 suggests bullish resilience, PI must extend gains above the latest barrier level to give buyers an upper hand.

Testing the key level amid broader crypto sentiment means a potential downward flip could follow if profit-taking deals mount.

Pi Network sees over 700,000 PI exit exchanges

PiScan data reveals CEX balances have shrunk sharply in the past 24 hours, with more than 778,434 PI tokens leaving CEXs such as OKX, Bitget, and MEXC.

The outflows suggest strong holder conviction, and are key to the reduced selling pressure currently helping bulls hold the advantage.

Net outflows indicate accumulation rather than distribution.

Buyers could capitalize on this outlook to drive prices higher, more likely if the broader market sentiment improves.

Despite CEX outflows, the PI price is signalling upside potential amid Pi Network’s Open Network expansion.

The project has accelerated its KYC verifications and mainnet migrations.

Meanwhile, the Pi Core Team sees milestones such as the release of details on the Ecosystem Token Design as crucial steps.

The Pi Request for Comment (PRC) for community input is among ecosystem developments that are adding to investor confidence.

Pi Network technical outlook

Despite the intraday gains, Pi Network’s price remains 9% down this past week.

The token is also in the red over the past month and year-to-date time frames, about 11% and 20%, respectively.

PI’s technical picture shows sentiment is largely bearish, with oscillators neutral. However, moving averages are leaning “strong sell”.

Bulls could muster upward momentum if prices stabilize above the $0.15. Support here and increased volume could allow PI to target $0.18 and then $0.27.

However, bears may yet dominate if bulls fail to hold above a downtrend line going back to the October 10, 2025, crash.

Should short-term losses accelerate below $0.15, major support lies around $0.13, an area that marked PI’s all-time low on Feb 11.

Indicators like MACD and RSI on the daily chart are offering a mixed outlook.

The MACD suggests a bearish crossover, while the RSI sits at 46 and outlines a possible leg up.

PI price, like most cryptocurrencies, will likely track risk asset sentiment and performance in the short term. Macroeconomic and geopolitical factors will be key catalysts.

Crypto World

Cronos (CRO) price outlook as Crypto.com secures conditional OCC approval in the US

- Crypto.com gains credibility after conditional approval from the OCC.

- Cronos (CRO) remains far below its peak, but fundamentals are stabilising.

- The regulatory approval strengthens Cronos’ long-term investment case.

Cronos (CRO) is once again in focus as regulatory progress at Crypto.com reshapes the long-term narrative around the ecosystem.

The token has spent much of the past year trading under pressure, mirroring broader market uncertainty and fading risk appetite.

Recent developments in the United States, however, have injected a new layer of strategic significance into CRO’s outlook.

Crypto.com has secured conditional approval from the Office of the Comptroller of the Currency (OCC) to establish a nationally regulated trust bank.

This approval does not mean full operational status yet. It does, however, signal regulatory acceptance at the highest federal level.

That signal alone carries weight in a market where regulatory clarity often defines winners and losers.

Crypto.com’s regulatory progress in the US

The planned Crypto.com national trust bank will not operate like a traditional retail bank.

It will, for instance, not accept deposits or issue loans.

Its role is focused on digital asset custody, settlement, and staking services under federal oversight.

This positioning places Crypto.com closer to the infrastructure layer of institutional finance rather than consumer banking.

For the broader crypto market, the conditional approval suggests Crypto.com is on track to become a federally regulated custodian before committing serious capital.

It also reduces reliance on fragmented state-by-state licensing. From a credibility standpoint, this is a meaningful step forward.

For Cronos, the implications are indirect but important.

Cronos exists as part of the Crypto.com ecosystem. Any expansion in regulated services strengthens the ecosystem’s long-term utility.

That utility underpins demand, even if price reactions are not immediate.

CRO price analysis

Cronos (CRO) is currently trading far below its all-time high.

The token peaked near $0.97 during the 2021 bull market, but today it trades closer to the $0.07 range. That decline reflects both market cycles and shifting sentiment around exchange tokens.

Despite the drawdown, however, Cronos maintains a multi-billion-dollar market capitalisation.

Liquidity remains steady, though daily trading volumes are modest compared to previous cycles. While short-term momentum remains weak, long-term positioning is beginning to look more nuanced.

How the OCC approval feeds into Cronos’ price outlook

The conditional OCC approval does not directly change CRO’s tokenomics, nor does it alter supply or introduce immediate new use cases.

What it does is reinforce the ecosystem’s regulatory durability, which matters as capital becomes more selective.

Following the approval, institutional staking, custody, and settlement services could eventually intersect with Cronos-based activity.

Even if adoption grows slowly, the direction is clear.

For long-term holders, the narrative around Cronos is shifting from speculative growth to regulated infrastructure alignment.

As Crypto.com moves closer to full approval, attention on Cronos is likely to increase.

The price recovery will, however, still depend on broader market cycles, although the path forward now looks more credible than it did a year ago.

Crypto World

Adam Back’s SPAC merger with Cantor Equity Partners could come as soon as April

Undaunted by the plunge in bitcoin and the even worse price action for bitcoin treasury companies, Adam Back, the CEO of Bitcoin Standard Treasury Company (BSTR), says shareholder approval for a public listing could come as soon as April.

The public listing would come via a SPAC merger with Brandon Lutnick’s Cantor Equity Partners I (CEPO).

BSTR intends to debut with 30,000 bitcoin on its balance sheet. Of that total, 25,000 coins will be contributed by Back and other founding shareholders. A further 5,000 BTC will be contributed in-kind by early investors.

The merger plans were announced in the summer of 2025 amid a frenzy of hastily formed crypto treasury companies that hoped to mimic the success of Michael Saylor’s Strategy.

Since, though, the price of bitcoin has crashed to $63,000, and the performance of crypto treasury companies has been far worse, with many prominent ones vaporizing 90% or more of investor capital.

Speaking with CNBC on Monday, Back said a weaker bitcoin price could benefit BSTR ahead of its listing. Launching at a lower reference price would enable the company to accumulate more bitcoin at discounted levels, potentially strengthening its balance sheet and increasing long-term upside if market conditions improve.

Addressing bitcoin’s recent decline, Back noted that it occurred despite what he characterized as a favorable regulatory backdrop in the United States. He attributed the pullback to broader macroeconomic factors, including geopolitical tensions and tariff-related uncertainty, which have weighed on risk assets more broadly.

Back added that bitcoin treasury companies play a supportive role in the market. Their core strategy centers on acquiring and holding bitcoin, though he acknowledged that the pace of accumulation typically slows during bear markets. Ultimately, he said, bitcoin treasury companies are taking bitcoin off the market, which is a long-term bullish catalyst.

Crypto World

HBAR price risks correction to $0.07 as structure shifts

HBAR price faces downside risk after losing key support at $0.09, with bearish intraday structure increasing the probability of a corrective move toward $0.07.

Summary

- $0.09 support flipped into resistance confirms bearish structure

- Loss of point of control could accelerate downside momentum

- $0.07 high-timeframe support becomes next downside target

Hedera (HBAR) price action is showing early signs of structural weakness following a decisive loss of high-timeframe support near the $0.09 level. What previously acted as a strong demand zone has now transitioned into resistance, marking an important shift in market structure.

This transition is technically significant. When former support flips into resistance, it often signals a change in market control from buyers to sellers. Recent price movements suggest that HBAR is now undergoing a bearish retest of this level, a common market behavior that frequently precedes continuation to the downside.

As long as HBAR trades below $0.09, the broader technical outlook favors further corrective movement, with the next major support region located near $0.07 coming into focus.

HBAR price key technical points

- $0.09 support flipped into resistance: Structural breakdown confirms bearish shift

- Point of control under threat: Loss of key volume support could accelerate downside momentum

- $0.07 high-timeframe support targeted: Next major demand zone within current range

HBAR’s recent price action has been technically constructive in defining market direction. The confirmed loss of the $0.09 level represents a major structural development. Markets often respect these transitions strongly, as participants who previously bought at support may begin selling when price retests the level from below.

The current bounce toward resistance appears corrective rather than impulsive. Instead of establishing higher highs, price is forming a potential lower high within the intraday structure. This behavior aligns with a bearish retest scenario, where temporary upward movement allows sellers to re-enter positions before continuation lower.

From a market structure perspective, maintaining acceptance below $0.09 keeps sellers firmly in control. Until this level is reclaimed, bullish continuation remains unlikely in the short term.

Point of control becomes critical volume support

Another important level to monitor is the point of control (POC), which represents the area of highest traded volume within the broader range. The POC often acts as a final area of equilibrium before price transitions into expansion.

If HBAR loses acceptance around this level, it would signal that the market has abandoned its last major volume-based support. This development could significantly increase downside momentum.Below the POC lies a region of relatively thin volume, meaning fewer historical transactions exist to slow price movement. When markets enter low-volume zones, price tends to move quickly as liquidity gaps allow accelerated rotations toward lower value areas.

This technical dynamic strengthens the probability of a move toward the value area low and ultimately the $0.07 high-timeframe support.

Bearish retest suggests lower high formation

From a price action standpoint, the current local bounce appears to be a bearish retest rather than a trend reversal. Intraday structure continues to favor lower highs and weakening momentum, suggesting that the market is preparing for another rotational move downward.

Bearish retests typically occur after structural breakdowns, allowing price to revisit former support levels before sellers resume control. HBAR’s inability to reclaim resistance supports this interpretation.

If price forms a confirmed lower high beneath $0.09, it would further validate the bearish continuation thesis. This setup increases the likelihood that HBAR rotates toward deeper support levels as part of a broader corrective phase.

What to expect in the coming price action

From a technical, price action, and market structure perspective, HBAR remains vulnerable while trading below the $0.09 resistance. The current rebound appears corrective within a bearish intraday trend. A loss of the point of control could trigger accelerated downside movement toward the $0.07 high-timeframe support.

Unless buyers reclaim higher value and invalidate the lower-high structure, the probability favors continued downside rotation in the near term.

Crypto World

Price Falls While Network Activity Surges

XRP Ledger recorded multiple breakthrough metrics in February. These figures reflect Ripple’s effectiveness in attracting attention and accelerating adoption on its underlying blockchain.

However, XRP’s price remained stuck below $1.4 during the final week of February, despite several positive signals that predicted an upcoming recovery.

Activity on XRP Ledger Increased in February After Upgrades

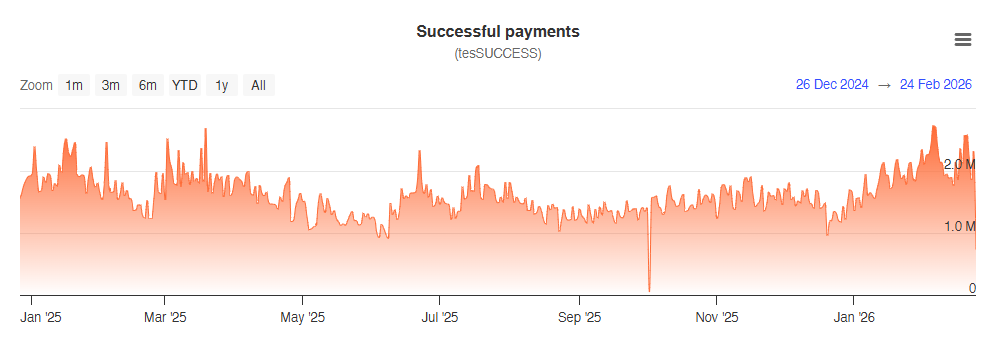

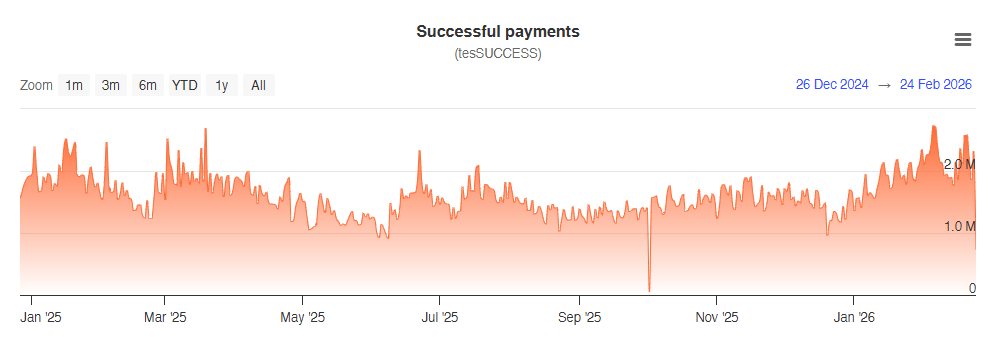

Data from XRPscan shows that the number of successful payments on the XRP Ledger has continuously increased over the past month. The figure rose from a low of 1 million payments at the end of December last year to more than 2.7 million in February. This marks the highest level in 12 months.

On the XRP Ledger, a successful payment is a transaction that validators have confirmed and recorded on the distributed ledger.

Therefore, this increase reflects the growing vibrancy of the XRP Ledger. A higher number of successful transactions proves that users genuinely use the network for payments, transfers, DeFi, or other applications.

“XRP network activity stays strong. Around 2M transactions per day and roughly 40K active addresses. That is real usage. While most chains chase narratives, XRPL keeps moving value. Payments. Settlements. This kind of consistency is what institutions look for,” crypto investor CryptoSensei said.

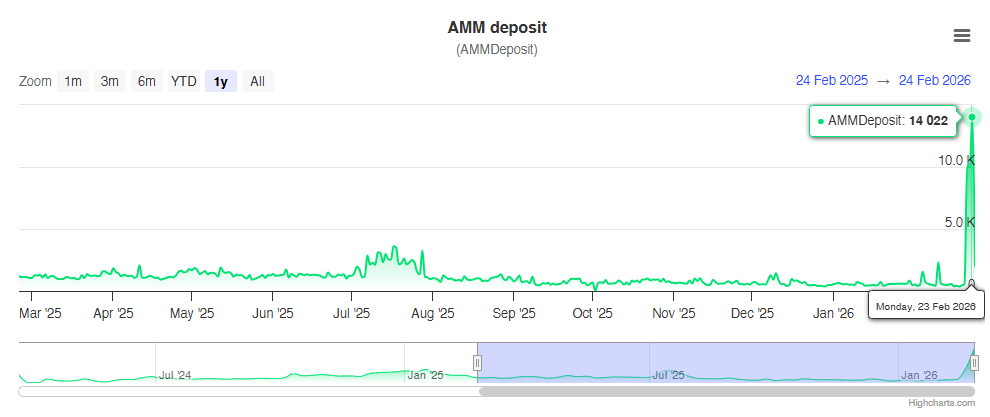

In addition, the Automated Market Maker (AMM) on the XRPL DEX showed signs of a breakout, with more than 14,000 deposits. This development provides XRPL with additional decentralized liquidity and reduces trading slippage.

Notably, AMM activity has never been this before. This breakout occurred after the Permissioned Domains upgrade was activated in early February. The network enabled the Permissioned DEX two weeks later.

Investors expect the Permissioned DEX to pave the way for banks, payment providers, and financial institutions to trade within a controlled liquidity environment on XRP Ledger.

Despite these positive signs, XRP’s price continued into its fifth consecutive month of decline, and the final week of February closed in the red. At the time of writing, XRP is trading at $1.33, down 45% from its early-year high.

A recent report from BeInCrypto shows that rising whale inflows to exchanges continue to create selling pressure. Realized losses have reached their highest level since 2022.

However, historical signals also suggest that such extreme negativity often precedes a price bottom and a strong recovery. The latest analysis from BeInCrypto clarifies that XRP now needs confirmation through a breakout above the $1.47 resistance level.

Crypto World

Nansen to Set up Bhutan Entity in Gelephu Mindfulness City

Blockchain analytics company Nansen will establish a local entity and build a Bhutan-based team in Gelephu Mindfulness City (GMC), expanding into the kingdom as its Special Administrative Region advances its digital asset strategy.

According to a joint announcement shared with Cointelegraph, Nansen plans to incorporate within GMC and develop on-the-ground analytics capabilities to provide blockchain data and market intelligence to industry participants operating in the region.

GMC is a purpose-built Special Administrative Region in southern Bhutan focused on long-term economic development. The region has previously announced digital asset initiatives spanning custody infrastructure, tokenization, institutional liquidity and regulatory frameworks.

The move does not replace Nansen’s existing operations in Singapore, CEO Alex Svanevik told Cointelegraph, but adds an additional entity within GMC, saying that the company “chose GMC because of the vision behind it.”

Svanevik added that Bhutan stood out because digital assets are being integrated into the region’s economic framework from the outset. He said:

Most crypto-friendly jurisdictions are optimizing for what exists today. Bhutan is building something fundamentally different — a values-driven economic zone with digital assets baked into the foundation, not bolted on as an afterthought. GMC has crypto in its strategic reserves, a progressive regulatory framework, and genuine sovereign conviction behind it. That’s rare. We want to be pioneers in that ecosystem.

Nansen plans to hire locally as part of the expansion. While the company did not disclose specific staffing targets, Svanevik said the intention is to build a “meaningful local team,” with details on roles and office setup expected in the coming months.

Nansen describes itself as an AI-native onchain analytics platform tracking more than 500 million labeled blockchain addresses and providing real-time data tools across major blockchain networks.

Related: Bhutan migrates its national ID system to Ethereum

Bhutan positions Gelephu Mindfulness City at the center of its digital asset strategy

Announced in 2023, Gelephu Mindfulness City is a special administrative region designed as a new economic hub to create high-value local jobs and attract businesses across sectors including finance, green energy, technology, healthcare and agriculture, while offering regulatory flexibility for crypto and fintech companies.

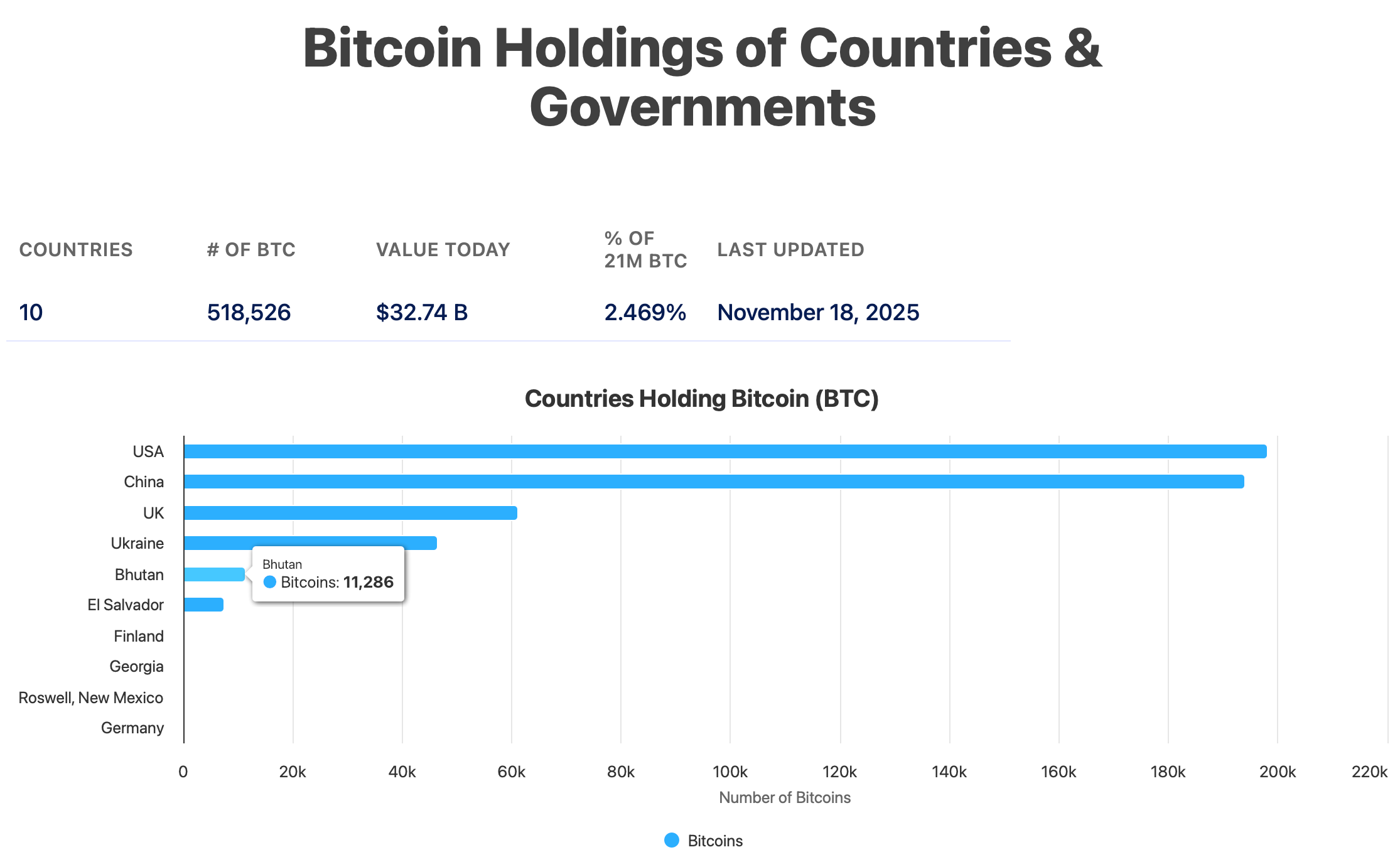

In December, the government said it would allocate up to 10,000 Bitcoin (BTC) from its national holdings to support the city’s development. Officials said they were evaluating treasury and risk-managed yield strategies for the Bitcoin holdings, alongside long-term plans aimed at preserving value while supporting stable and sustainable growth.

Nansen is not the first digital asset company to enter the region. Also in December, Crypto market maker Cumberland DRW signed a multi-year memorandum of understanding to help develop digital asset infrastructure in GMC, including financial frameworks, sustainable mining and AI compute, yield strategies and stablecoin infrastructure.

Bhutan holds the world’s fifth-largest national Bitcoin reserve, with Bitbo estimating its holdings at 11,286 BTC, as of Nov. 18.

The country’s crypto strategy is spearheaded by Druk Holding and Investments (DHI), the commercial arm of the royal government.

In an April 2025 interview with Reuters, DHI CEO Ujjwal Deep Dahal said the fund began accumulating cryptocurrencies in 2019 to convert surplus hydropower into foreign-currency liquidity, and senior officials in the capital of Thimphu have said some profits have helped support government salary payments over the past two years.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

ZachXBT Insider Trading Report Targets Major Crypto Firm in 2 Days

A major shake up could be coming as on chain investigator ZachXBT says he will publish a full insider trading exposé on February 26, targeting what he calls a major industry player tied to systemic market abuse.

Traders are not waiting. Prediction market volume around the target’s identity has surged toward $3M as participants hedge for potential fallout.

Right now, odds point toward names like Solana based liquidity protocol Meteora and the Trump backed World Liberty Financial as leading suspects.

Key Takeaways

- $6 Million Prediction Market Volume: Trading activity on the ZachXBT investigation market has surpassed $5.6 million as speculators attempt to price in the target’s identity.

- Meteora at 43% Odds: The Solana-based liquidity layer is currently the betting favorite to be named in the report, followed by infrastructure provider Axiom.

- Systemic MNPI Abuse: The investigation alleges that multiple employees exploited Material Non-Public Information to execute profitable trades over a prolonged period.

What Is the ZachXBT MNPI Investigation?

ZachXBT, known for tracing illicit crypto flows, says a major report is coming on February 26. The target is described as one of the industry’s most profitable firms, with allegations that insiders traded on material non public information to front run announcements.

The case reportedly began with a January Telegram exchange where wallet addresses tied to a firm’s treasury were shared, showing accumulation before public news. That kind of on chain trail can be hard to dismiss and often draws regulatory attention.

ZachXBT’s track record adds weight. Past investigations have led to frozen funds and law enforcement action. That is why traders see February 26 as a binary event. Either the evidence is strong enough to trigger serious fallout, or the accused project walks away under heavy scrutiny.

Prediction Markets Hit $3M as ZachXBT Odds Shift to Meteora

Speculators are already trading on the rumor. On Polymarket, volume on the “Which crypto company will ZachXBT expose?” contract is nearing $6M. Meteora leads with around 42% odds, followed by Axiom at 15% and Pump.fun near 9%.

The sharp jump in Meteora’s probability, while others like Jupiter and MEXC lag in single digits, shows concentrated conviction. Big names like Tether, Binance, and Coinbase are listed, but with low odds.

Still, prediction markets price belief, not proof. They reflect positioning and sentiment ahead of confirmation.

Why Meteora Is the Leading Suspect in the MNPI Probe

Meteora has emerged as the top suspect because it fits the profile of a highly profitable Solana based liquidity protocol with access to sensitive incentive data.

Onchain analysts have flagged wallet clusters interacting with its pools that appear to position ahead of yield adjustments, fueling speculation of potential MNPI abuse.

If confirmed, the fallout could ripple across the Solana ecosystem, especially if aggregators and routing platforms distance themselves quickly.

WLFI remains a lower probability but higher impact scenario. Its political ties raise the stakes, and any confirmed insider trading linked to a Trump affiliated project would likely draw immediate regulatory scrutiny. While markets see Meteora as the base case, WLFI represents a volatile tail risk.

If ZachXBT’s report delivers clear wallet attribution, the targeted token could see a sharp downside within minutes. Until then, prediction market volume reflects positioning, not proof.

Discover: Here are the crypto likely to explode!

The post ZachXBT Insider Trading Report Targets Major Crypto Firm in 2 Days appeared first on Cryptonews.

Crypto World

Fed’s Goolsbee calls for a hold on cuts as current rate of inflation is ‘not good enough’

Austan Goolsbee, president and chief executive officer of the Federal Reserve Bank of Chicago, speaks during the National Association of Business Economics (NABE) economic policy conference in Washington, DC, US, on Tuesday, Feb. 24, 2026.

Graeme Sloane | Bloomberg | Getty Images

Chicago Federal Reserve President Austan Goolsbee said Tuesday that interest rate cuts aren’t appropriate until there’s more evidence that inflation is on its way down.

With recent indicators showing that inflation well off its highs but still above the Fed’s 2% target, Goolsbee noted that policymakers “have been burned by assuming transitory inflation” in the past and shouldn’t make the same mistake again.

“I feel that front-loading too many rate cuts is not prudent in that circumstance,” he said in remarks before the National Association for Business Economics at its annual gathering in Washington, D.C. “People express that prices are one of their most pressing concerns. Let’s pay attention. Before we cut rates more to stimulate the economy, let’s be sure inflation is heading back to 2%.”

The most recent inflation data, for December, showed core inflation, which excludes volatile food and energy prices, running at 3%, as measured by the consumption expenditures price index, the Fed’s primary forecasting gauge. That was up 0.2 percentage point from November and came somewhat due to tariffs, which are viewed as temporary, but also from underlying pressures in the service sector and areas not directly impacted by the duties.

Specifically, Goolsbee said stubbornly high housing inflation isn’t tariff driven, emphasizing the need for the Fed to be “vigilant.”

Goolsbee noted that a 3% inflation rate “is not good enough — and it’s not what we promised when the Federal Reserve committed to the 2% target. Stalling out at 3% is not a safe place to be for a myriad of reasons we know all too well.” He has said previously that he thinks the Fed will be able to cut later in the year.

The remarks come with markets expecting the Federal Open Market Committee, of which Goolsbee is a voter this year, to stay on hold until at least June and probably July. Futures traders are placing about a 50-50 chance of a cut in June and about a 71% probability of a July cut, according to the CME Group’s FedWatch gauge. The Fed enacted three quarter-percentage-point cuts in the latter part of 2025.

Fed Governor Christopher Waller, who has been an advocate for lower rates, took a more measured approach Monday while also speaking to the NABE conference.

Though Waller said he thinks policymakers should “look through” tariff impacts, he said recent data show the labor market may be in better shape than previously indicated, mitigating the need for further cuts. If the jobs picture continues to improve, that would further lessen the case for cuts, though he said he isn’t convinced that the January nonfarm payrolls data wasn’t “more noise than signal.”

Tuesday will be an active day Fed speakers, with Governor Lisa Cook also due to present to the NABE later in the morning.

Crypto World

What Past Cycles Say Happens Before the Bottom

Bitcoin price dropped 25% in 2022 and 50% in 2018 after similar on-chain loss signals, a warning sign for BTC’s next move.

Bitcoin (BTC) traders are selling at a loss for the first time since 2022, raising odds that the biggest cryptocurrency’s ongoing price correction may deepen in the coming weeks.

Key takeaways:

-

Bitcoin is witnessing loss-driven selling that has historically lasted six months or more.

-

These signals surfaced during previous bear markets, preceding sharp downtrends each time.

BTC capitulation may last for another six months

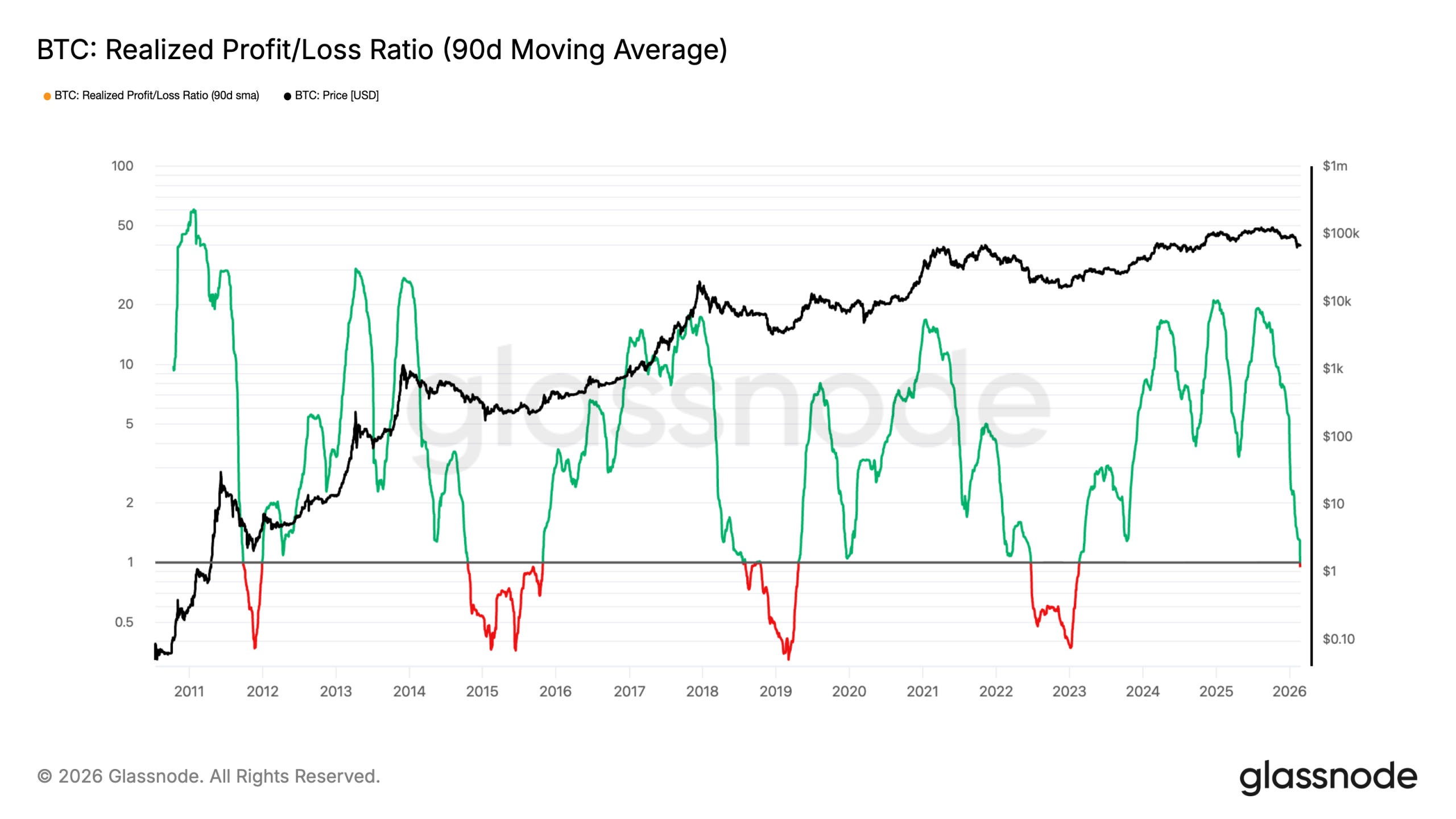

On Monday, Bitcoin’s realized profit/loss ratio (90-day moving average) slipped below 1.

The drop indicated that traders were dumping their BTC holdings at a loss, which is often linked to panic selling, margin pressure, or broader risk-off conditions.

Historically, breaks below 1 preceded at least six months of loss realization, according to on-chain data resource Glassnode. Meanwhile, a move back above 1 usually suggests that selling pressure is easing.

Traders often sell at a loss when they expect the downtrend to continue. In prior bear markets, loss-taking typically accelerated midway through the cycle, followed by more downside in Bitcoin’s price.

During the 2022 bear market, for instance, BTC declined 25% six months after its realized profit/loss ratio dropped below 1. In 2018, it plunged by over 50% in five months under similar conditions, as shown below.

The BTC price may continue its downtrend for another five months or more if history repeats. That will confirm “a full transition into an excess loss-realization regime,” Glassnode wrote.

Bitcoin price may bottom around $44,000

Bitcoin’s rising loss-realization may, therefore, drag the BTC price into its “extreme low” valuation zones.

These lows exist within the MVRV Pricing Bands metric, which maps where Bitcoin reaches extreme unrealized profit or loss zones. Historically, its lowest band (the blue line) has coincided with Bitcoin bear market bottoms.

As of February, the extreme low was around $43,760, a potential downside target by August if BTC’s price decline continue further.

Related: Bitcoin’s Mayer Multiple hits 2022 levels: Where is BTC price bottom?

The level also sits within the broader $40,000–$50,000 bottom range flagged by multiple analysts as a potential late-2026 target.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Kraken brings crypto-style, 24/7 perpetuals trading for tokenized U.S. stocks

Crypto exchange Kraken is launching what it calls the first regulated perpetual futures contracts based on tokenized stocks, the firm told CoinDesk.

The products, available to eligible non-U.S. users in more than 110 countries, track digital versions of major U.S. stocks, indices and a gold ETF, building on the tokenized equities offering of xStocks that Kraken acquired in December.

Initial listings include tokenized versions of the S&P 500, the Nasdaq 100, Apple, Nvidia, Tesla and SPDR’s gold ETF (GLD), the firm said.

Kraken’s launch matters because perpetuals trading has enjoyed a rapid growth, dominating crypto derivatives trading. Blockchain-based decentralized exchanges processed over $600 billion in perps trading volume in January, with Hyperliquid claiming the biggest market share with $200 billion monthly volume, data by The Block shows.

Unlike traditional futures contracts, perps do not expire and trade 24/7 and allow users to trade with high leverage. Investors favor them for continuous access, capital efficiency and the ability to take long or short positions at any time.

With Kraken’s move, that structure now is expanded to other asset classes like equities. The underlying xStocks tokens are fully collateralized and backed 1:1 by the referenced assets, according to the company. That provides a pricing anchor even when U.S. exchanges are closed. The tokenized stocks trade around the clock and support leverage of up to 20x.

“This is what it looks like when traditional markets are rebuilt for a crypto-native, always-on world, not a moment too soon given the volatility that all markets are exhibiting,” Mark Greenberg, Kraken’s global head of consumer, said in a statement.

“Regulated tokenized equities as perpetual futures represent a new chapter for global capital markets, one where equities, indices, and commodities trade with the same speed, accessibility, and flexibility as crypto via tokenization, delivering a more robust risk management experience,” he added.

Kraken said it plans to expand the lineup with more tokenized stocks and ETFs in the coming months.

Rival tokenization firm Ondo Finance earlier this month also announced plans to launch perps trading with its tokenized stocks.

Read more: Kraken’s co-CEO could trust AI with 100% of his crypto — Dragonfly’s Haseeb Qureshi isn’t convinced

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports21 hours ago

Sports21 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics22 hours ago

Politics22 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World9 hours ago

Crypto World9 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market