CryptoCurrency

Bitcoin (BTC) Weakness Hits Ripple Even as ETF Flows Remain Strong

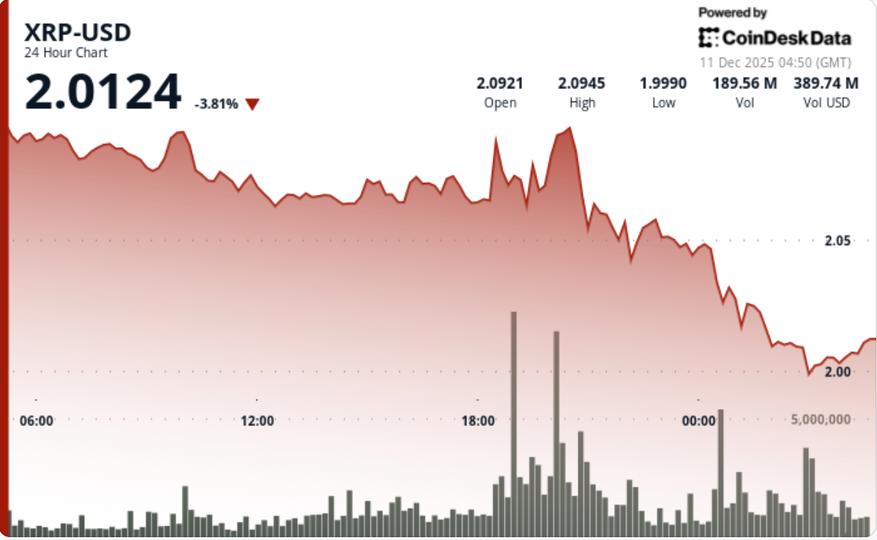

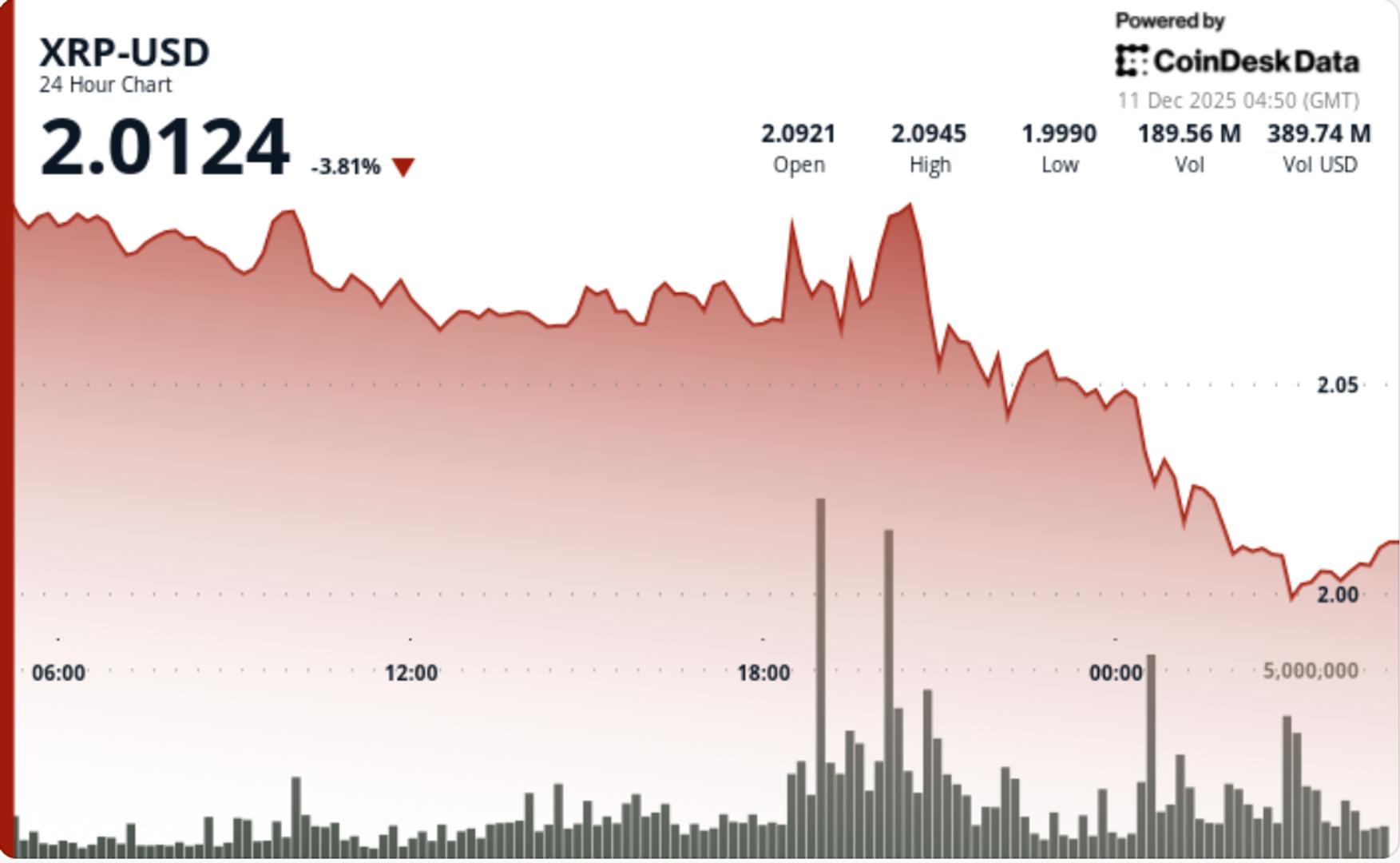

Institutional flows jumped more than 50% above trend on Wednesday as XRP failed again to break through the $2.09–$2.10 ceiling. Sellers slammed the token off resistance and forced a clean move back into the $2.00 psychological shelf, leaving the broader structure stuck in multi-week compression while ETF inflows quietly tighten supply underneath.

What to Know

- XRP slipped from $2.09 to $2.00, losing 4.3% on the session and underperforming the broader crypto market by roughly 1%.

- The rejection was decisive: a 172.8M volume spike (205% above the daily average) hit right as XRP tagged $2.08, flipping the entire move into a failed breakout.The selloff didn’t come from retail panic.

- Volume across the session ran 54% above the 7-day average — classic institutional distribution above resistance rather than emotional dumping.

- Exchange balances dropped from 3.95B to 2.6B tokens over the last 60 days, compressing supply even as spot price failed to hold the breakout attempt. That divergence is setting up an increasingly asymmetric structure as XRP trades in a narrowing multi-month triangle

News Background

- U.S. spot XRP ETFs pulled in over $170 million in weekly inflows, marking another week with zero outflows.

- Heavy spot selling continues to hit the $2.09–$2.10 band, where XRP has now failed multiple times.

- Market makers flagged rising distribution pressure ahead of yesterday’s move, with heavy offers sitting above $2.10.

- Exchange supply continues to grind lower, falling to 2.6B tokens, strengthening long-term supply compression.

- Despite the ETF support, XRP lagged broader crypto as CD5 fell 3.1% on the day — suggesting the move was token-specific rather than macro-driven.

Price Action Summary

XRP dropped 4.3% from $2.09 → $2.00

• Intraday range: 5.4% as resistance rejection triggered high-volatility unwind

• Volume: 172.8M peak at 19:00 UTC (up 205% above daily average)

• Multiple rejections at $2.08–$2.10 created a hard ceiling

• Late-session stabilization formed higher lows near $1.999–$2.005

• Relative performance: lagged broader crypto by ~1%

Technical Analysis

- Support:$2.00 psychological shelf. Below that sits a soft zone at $1.95, aligned with prior demand clusters.

- Resistance:$2.09–$2.10 is the dominant wall — the session created a clear supply shelf here. Any close above $2.10 flips the entire structure short-term bullish.

- Volume Structure: 54% above weekly averages = institutional flows, not noiseThe 172.8M spike exactly at the failed breakout confirms aggressive sellers defending the level.

- Pattern: Multi-month triangular compression tightening as exchange supply falls. Price remains mid-range; neither breakout nor breakdown confirmed.

- Momentum skewed bearish short-term after clean rejection. Bounce attempts capped below $2.08 on declining volume is equal to a weak follow-through.

What Traders Are Watching.

- Can $2.00 survive a second test? A clean break exposes a fast move toward $1.95.

- ETF inflows remain the biggest offset to spot weakness — any slowdown removes the floor.

- A breakout requires multiple hourly closes above $2.10 with sustained >100M volume.

- Compression now extremely tight — the next move should be larger than the last.

- Exchange balance drop is the wildcard: thinner supply = faster swings once direction confirms