Crypto World

Bitcoin Climbs Above $88K After Trump Tariff Warning

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin edged slightly higher on Tuesday, but still remains rangebound below the $90,000 mark, now hovering not far from its one-month lows, as traders remained cautious after Trump threatened a 25% tariff hike on South Korea and ahead of the Federal Reserve’s policy meeting.

BTC price edged up a fraction of a percentage over the last 24 hours to trade at $88,269 as of 03:18, as it continues to struggle to regain notable momentum after sharp losses last week and underperforms other assets.

The crypto market also saw a slight jump to a market capitalization of about $3.07 trillion.

Trade Tensions Spike as Trump Hits South Korea with 25% Tariffs

US President Donald Trump announced he is raising tariffs on South Korean imports to 25% after accusing the country of failing to live up to a trade deal reached last year.

Under the deal in October 2025, Seoul pledged $350 billion of investments into strategic US industries in return for tariffs being capped at 15%.

However, the government noted that “it is unlikely” that the investment could begin in the first half of this year, citing administrative reasons and currency market volatility.

In a social media post, Trump said he would increase levies on South Korean imports to 25% across various products, including automobiles, lumber, pharmaceuticals, and “all other Reciprocal TARIFFS.”

Trump: I Am Hereby Increasing South Korean Tariffs on Autos, Lumber, Pharma, and All Other Reciprocal Tariffs From 15% to 25% – $QQQ $SPY pic.twitter.com/eMFvEjB1fk

— Hardik Shah (@AIStockSavvy) January 26, 2026

According to Trump, South Korean lawmakers have been slow to approve the deal, while the US has acted swiftly to reduce its tariffs in line with the transaction agreed to.

After Trump threatened to impose 100% tariffs on Canada over the weekend, and now South Korea, traders remain cautious, driving safe-haven assets like gold and silver to all-time highs.

Traders Watching The Federal Reserve Decision

To add to the market’s indecision, focus has shifted to the Federal Reserve’s two-day meeting, which begins today, January 27, and ends on January 28. Economists are widely expecting the policymakers to keep interest rates unchanged on Wednesday.

Traders are watching closely at the Fed’s statement and Chair Jerome Powell’s press conference for clues on the timing of potential rate cuts and the central bank’s inflation outlook.

💥 BREAKING

🇺🇸 THE FEDERAL RESERVE ANNOUNCES ITS INTEREST RATE DECISION THIS WEDNESDAY AT 2:00 PM ET

THE DOLLAR INDEX IS SLIDING SHARPLY, AND ALL EYES ARE ON THE FED.

WILL THEY PULL THE TRIGGER ON A RATE CUT? 👀 pic.twitter.com/0sF2lOiPp2

— Mr. Crypto Whale 🐋 (@Mrcryptoxwhale) January 26, 2026

Any shift in Powell’s tone could influence risk sentiment and liquidity conditions, both of which are key drivers of risk assets like Bitcoin.

With Bitcoin down 4.5% over the last 2 weeks, can it recover above $90,000?

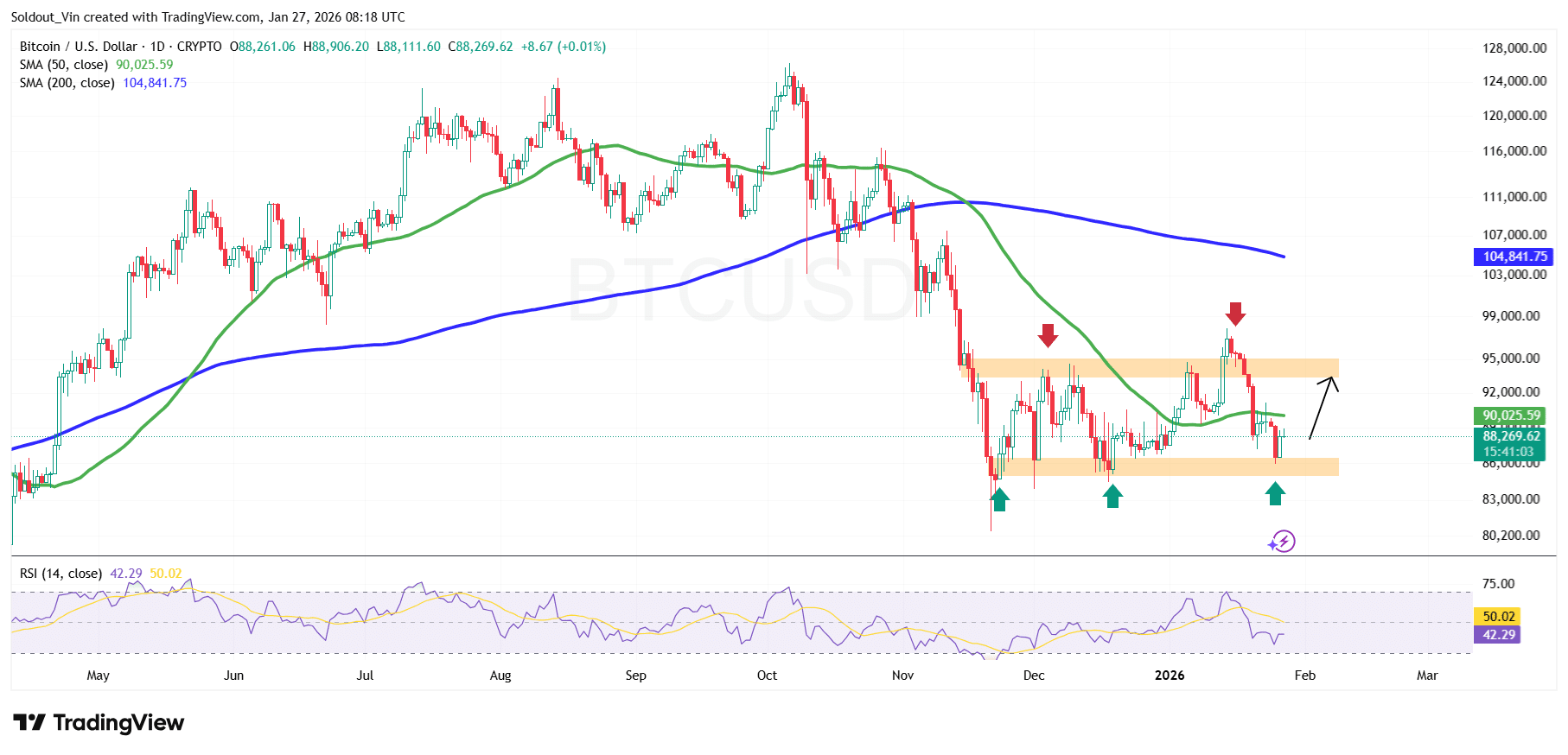

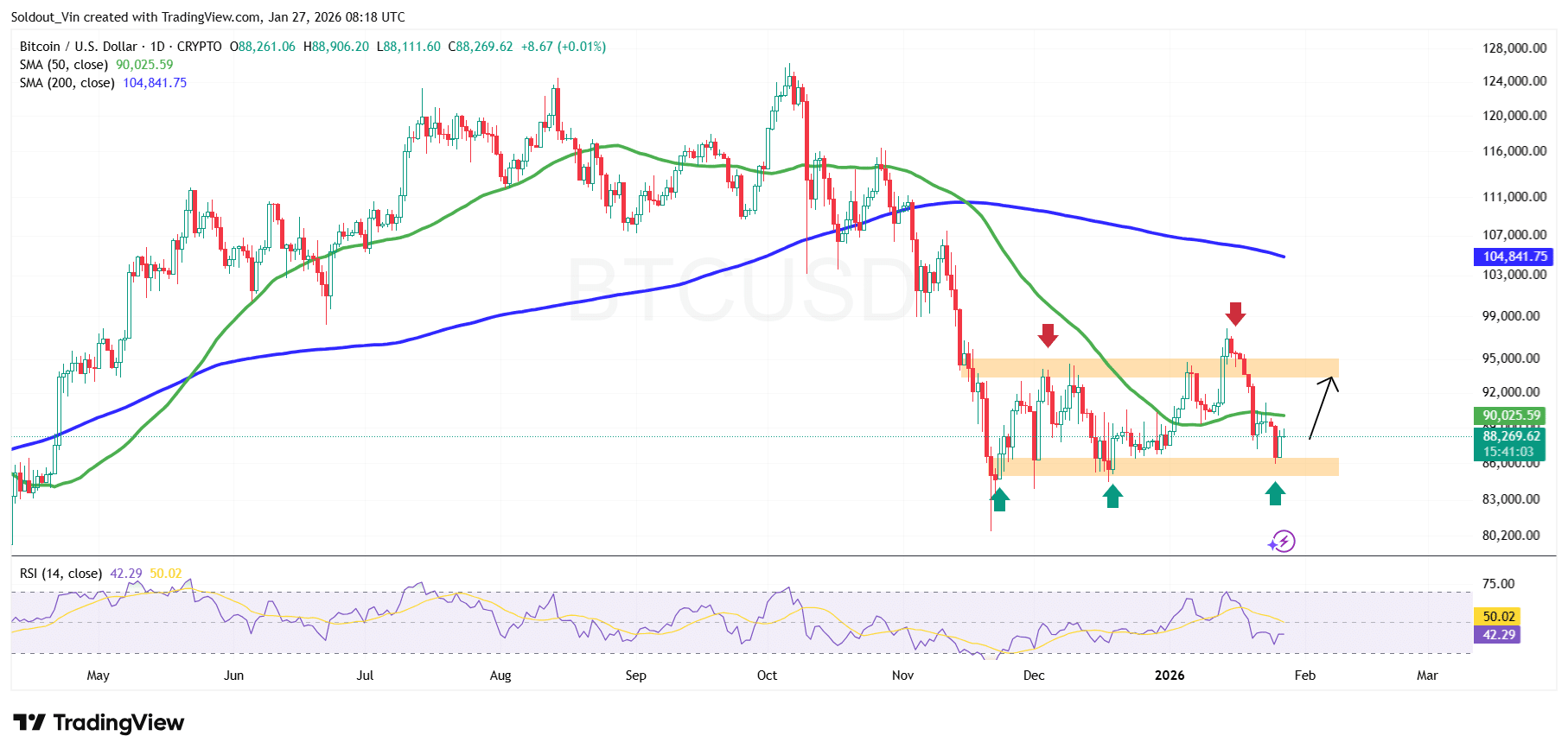

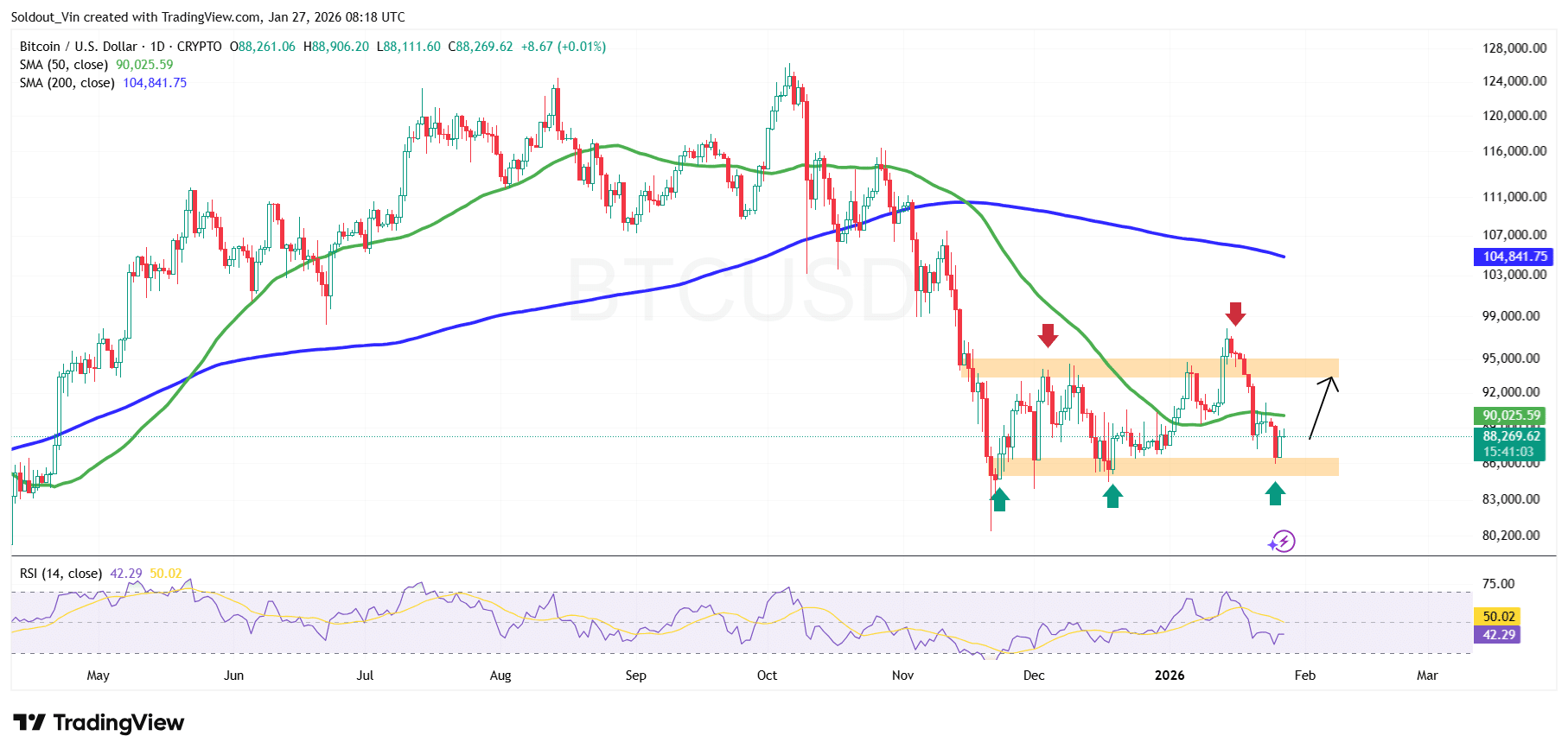

Bitcoin Price Analysis: BTC Holds Strong Above Support

Bitcoin is currently trading within a well-defined consolidation range, in a sideways pattern, with the asset holding near the $86,500–$89,000 support zone after a sharp pullback from the late-2025 highs.

This area aligns with a previous demand zone in December, as BTC formed a strong support. BTC price now sits below the 50-day Simple Moving Average (SMA) ($90,025) and the 200-day SMA around $104,800, which continues to reflect the broader long-term uptrend.

Following a strong rally earlier in 2025, Bitcoin established a series of higher highs before momentum stalled near its all-time high around $126,000. This rejection led to a sustained price correction to around $80,500.

Since that drop, the price of BTC action has shifted into a range-bound structure, with buyers repeatedly stepping in near the $86,000 area, as highlighted by multiple downside rejections. This behavior suggests underlying demand is still in play, even as upside attempts continue to face resistance.

Each push toward the $93,000–$95,000 region has been met with selling, confirming this zone as an active supply area.

Momentum indicators echo this cautious tone. The daily RSI is currently hovering near 42, below the neutral 50 level. This shows reduced bullish momentum and a tilt toward seller control, though RSI is not yet in deeply oversold territory.

BTC Price Prediction: $90,000 in Sight

From a technical view, the Bitcoin price is approaching a decision zone. Holding above the $86,000–$88,000 support region could allow BTC price to stabilize and attempt another push toward the $93,000–$95,000 resistance zone.

A sustained daily close back above the 50-day SMA would improve the bullish narrative and increase the probability of a recovery toward the $100,000–$104,000 area, near the 200-day SMA and prior breakout levels.

On the downside, a confirmed breakdown below the current support range around the $86,000 area would invalidate any bullish attempts. In this scenario, the next likely support zone and a cushion against downward pressure could be the $84,475 level, which has previously acted as a demand area.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Ethereum Foundation begins staking 70,000 ETH from treasury

The Ethereum Foundation has begun staking a portion of its treasury holdings, marking a significant shift in how the organization manages its ETH reserves.

Summary

- The Ethereum Foundation has begun staking its treasury, starting with a 2,016 ETH deposit and planning to stake approximately 70,000 ETH in total.

- Staking rewards will be directed back to the foundation’s treasury to help fund core operations, including protocol R&D, ecosystem grants and community development.

- The validator setup uses open-source tools from Attestant, including Dirk and Vouch, with a focus on distributed signing, minority clients and multi-jurisdiction infrastructure.

Ethereum Foundation puts treasury to work with 70K ETH staking plan

In a post on X, the foundation said it has made an initial deposit of 2,016 Ethereum (ETH) and plans to stake approximately 70,000 ETH in total, with staking rewards directed back into its treasury. The move follows a Treasury Policy announced last year and is designed to both support network security and help fund the foundation’s core operations.

The staking setup is being implemented using open-source tools developed by Attestant, including Dirk and Vouch.

Dirk functions as a distributed signer, allowing validators to be operated across multiple jurisdictions and reducing the risk of a single point of failure.

Vouch enables the use of multiple consensus and execution client pairings, helping mitigate client diversity risks, a key concern for Ethereum’s decentralization model. The foundation said its validator setup incorporates minority clients and a mix of hosted infrastructure and self-managed hardware spread across several regions.

The announcement comes at a notable moment for Ethereum. Recently co-founder Vitalik Buterin sold roughly $7 million worth of ETH amid a broader price pullback, sparking discussion about treasury management and market signals.

At the same time, the foundation has been expanding ecosystem support through new grant initiatives, including updates to its Ecosystem Support Program aimed at funding protocol research, community development and public goods projects.

By staking a portion of its holdings, the foundation is effectively putting dormant ETH to work, generating yield while reinforcing validator participation. The move aligns the treasury more closely with Ethereum’s proof-of-stake design and provides an additional funding stream for long-term development efforts without relying solely on asset sales.

Crypto World

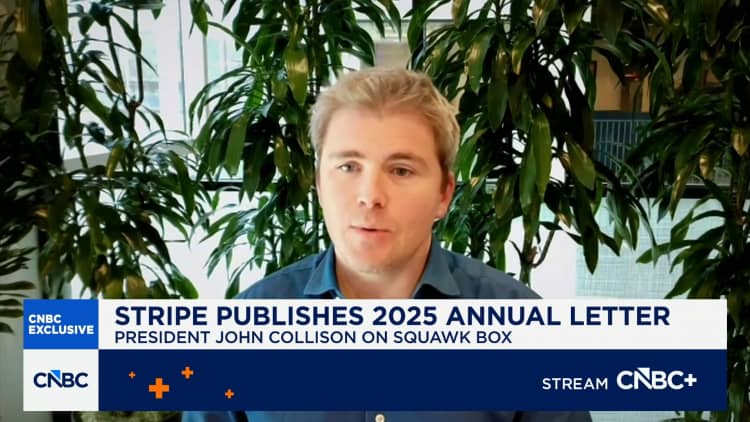

Stripe Eyes PayPal Acquisition as Stock Hits Multi-Year Low

Payment processing firm Stripe is reportedly considering an acquisition of all or parts of its rival PayPal Holdings.

Stripe is in early talks and has expressed preliminary interest in PayPal or parts of its business, though no deal is guaranteed, Bloomberg reported on Tuesday, citing people familiar with the matter.

It comes as Stripe, which enables enterprises to accept payments, make payouts, and automate financial processes, said on Tuesday that it was valued at $159 billion in a tender offer to shareholders and employees, a 74% jump from a year ago.

The move comes as PayPal has been reportedly struggling to compete with the likes of Google Pay and Apple Pay, which are embedded in consumer smartphones.

Stripe president John Collison told Bloomberg that “PayPal has had, obviously, a tough time over the past few years, and the landscape has changed quite a bit with Apple Pay and Google Pay and everything like that.”

“I can’t talk about any, you know, M&A [mergers and acquisitions] hypotheticals, but they’ve definitely had a tough time,” he added.

PayPal stock gains on the day

PayPal is also in leadership transition, with new CEO Enrique Lores set to take over on March 1 following the ouster of Alex Chriss, amid missed earnings estimates and slowing payment volumes.

Related: PayPal draws takeover interest following 46% stock slide: Report

PayPal stock (PYPL) gained 6.74% on Tuesday to end the day trading at $47.02, according to Google Finance. However, shares in the payments platform have declined almost 20% since the beginning of this year and are down 85% from their 2021 all-time high of just over $300.

PayPal, Stripe have serious stablecoin ambitions

PayPal began offering crypto trading in the US in 2020 and launched its own stablecoin PYUSD in 2023. The dollar-pegged asset has gained traction in recent months with its market capitalization topping $4 billion for the first time on Feb. 14.

Stripe has also been dabbling in crypto with its stablecoin platform Bridge, which received conditional approval to operate as a federally chartered national trust bank under the US Office of the Comptroller of the Currency (OCC) on Feb. 17.

Stripe first offered stablecoin-based accounts globally in May 2025. A merger could see the new entity become a serious player in the stablecoin market.

Magazine: Bitdeer sells all Bitcoin, Metaplanet rejects misconduct claims: Asia Express

Crypto World

Bitcoin loses 200-week EMA, analysts eye deeper 3-day death cross

Bitcoin fell below 200-week EMA, over 52% off peak, risking death-cross capitulation.

Summary

- BTC closed last week under the 200-week EMA, a key confluence zone tied to post-halving re-accumulation range highs, after three weeks of elevated sell volume and weak demand.

- Analysts warn BTC may retest the underside of the 200-week EMA as new resistance, echoing 2018 and 2022 structures that triggered a second bearish acceleration wave.

- BTC has dropped over 52% from its October top and approaches a 3-day 50/200 SMA death cross by late February, historically followed by an additional 45%-52% drawdown.

Bitcoin (BTC) closed the week below a critical support level, falling beneath that threshold for the first time since early February and reaching a two-week low, according to market data. Analysts have warned that the cryptocurrency could face additional downward pressure.

Analyst Rekt Capital stated that Bitcoin closed last week below the 200-week Exponential Moving Average (EMA), which sits at the center of a major confluence zone. The 200-week EMA aligns with the Post-Halving Re-accumulation Range highs, while the Post-Halving Re-accumulation Range lows define the broader structure of Bitcoin’s current range, according to the analyst.

Over the past three weeks, the cryptocurrency attempted to develop a demand region around this area, which was previously a major supply area, Rekt Capital noted. The analyst stated that this level has not historically been a structurally reliable support, noting that it previously acted as a 10-month resistance.

“In the current structure, we have seen three consecutive weeks of elevated sell-side volume in this region, with limited meaningful buy-side response,” the analyst stated in a post. The imbalance led to a weekly close below the 200-week EMA, losing it as support in this timeframe, according to the analysis.

Rekt Capital stated that there is a strong probability that Bitcoin will press back toward the underside of that EMA to attempt turning it into new resistance. If the underside retest holds, the structure would shift from defending the support to confirming the resistance at this level, the analyst said. The analyst added that if that level begins to act as resistance, downside continuation will become increasingly probable.

The analyst also noted that Bitcoin’s recent performance aligns closely with its price action in prior cycles. In 2018 and 2022, a weekly close below the 200-week EMA acted as a structural trigger to the second wave of bearish acceleration, according to the analysis. “Bitcoin would attempt to reclaim the level, turn it into resistance, and then dissipate lower. That pattern is now attempting to replicate itself,” Rekt Capital stated.

Analyst Ali Martinez pointed to the cryptocurrency’s historical performance on the three-day chart, stating that this has been one of Bitcoin’s key timeframes from a macro perspective. Martinez said market observers must watch the upcoming interaction of the 50-day and 200-day Simple Moving Averages (SMAs), as the crossover between these two indicators on the three-day timeframe has historically preceded the final leg down of the bear market.

Bitcoin dropped approximately 50% to 72% from its cycle tops in past cycles before death crosses took place in subsequent years, according to historical data. Following those SMA crossovers, the cryptocurrency experienced another 45% to 52% decline, Martinez noted. Bitcoin has fallen more than 52% from its October peak and is approaching a potential death cross on the three-day chart by the end of February, according to the analyst.

“If history repeats — even partially — this could signal the beginning of the final leg down of this cycle,” Martinez stated. The analyst predicted that another substantial correction from current levels could follow, placing the cryptocurrency’s target near lower support levels. “If the cross confirms, it becomes a level to take very seriously,” Martinez said.

Crypto World

Binance Alpha adds support for Ondo tokenized stocks

Binance has added support for tokenized U.S. stocks and exchange-traded funds on its Alpha trading platform, giving users new ways to access traditional assets through blockchain-based products.

Summary

- Binance Alpha listed Ondo tokenized securities on its platform.

- The launch includes 10 major U.S. stocks and ETFs with low or zero trading fees.

- The move marks Binance’s return to tokenized equities under clearer regulations.

The update allows users to trade tokenized securities directly using funds held on Binance Exchange, without moving assets to external wallets. Trading is available through the Alpha section of the platform.

The initial rollout includes 10 products, covering major technology stocks and the Nasdaq-100 ETF. At launch, supported assets include tokenized versions of Apple, Tesla, Nvidia, Amazon, Meta, Microsoft, Alphabet, and the Invesco QQQ ETF.

Regulated structure and trading features

Binance said the tokenized securities are classified as structured products under regulations issued by the Financial Services Regulatory Authority in Abu Dhabi’s Abu Dhabi Global Market. Under this framework, the products are offered in approved jurisdictions and are not available to users in the United States.

Each token is designed to reflect the market price of its underlying stock or ETF. While holders gain exposure to price movements, they do not receive voting rights or other shareholder privileges.

The exchange said users can place both market and limit orders through the Alpha interface. Trading fees may fall to 0%, and gas fees for placing and canceling orders are being waived for a limited period.

Binance also introduced a rewards system tied to the new listings. By trading or holding tokenized securities, users can accrue Alpha Points, which can then be redeemed for token sales, promotions, and airdrops.

Ondo Global Markets has reported a total value locked of more than $550 million since its launch last year. The company has focused on developing compliant infrastructure for tokenized stocks and ETFs.

Return to tokenized equities and market impact

After closing a similar product in 2021 due to regulatory pressure, Binance is making a comeback to tokenized stocks with this listing. Since then, the exchange has adopted a more cautious stance, emphasizing regional approvals and regulated structures.

Binance can now re-enter the market while lowering legal risk thanks to the partnership with Ondo. For users outside the U.S., the products offer access to popular equities that may otherwise be difficult to trade directly.

The integration has also drawn attention to Ondo’s wider plans, including its work on a dedicated blockchain for institutional real-world assets and its expansion into derivatives and structured finance products.

Following the announcement, Ondo (ONDO) token gained about 5% as trading activity surged. Market observers say the move reflects rising demand for regulated ways to trade traditional assets through crypto platforms.

Binance stated that it may expand its tokenized securities lineup in the future, depending on user demand and regulatory developments.

Crypto World

Crypto exchange giant Binance revives tokenized stocks trading with Ondo Finance

Binance, the world’s largest crypto exchange by trading volume, is returning to offer tokenized stocks nearly five years after shelving a similar product under regulatory pressure.

The exchange has teamed up with tokenization specialist Ondo Finance to list 10 tokenized U.S. stocks, ETFs and commodity-linked products on the Binance Alpha platform, the companies said in a Tuesday press release.

Binance Alpha is a platform within Binance Wallet, the exchange’s crypto wallet service, that allows users to trade early-stage, riskier crypto projects before listing them on the centralized spot marketplace.

The lineup includes blockchain-based token versions of Apple, Google, Tesla and Nvidia shares, along with the Invesco’s Nasdaq-tracking QQQ ETF.

The tokenized stocks are not available to users in the United States.

“Our users now have even more convenient ways to explore and trade tokenized securities, in line with our mission to offer innovative and accessible trading opportunities,” Jeff Li, Binance’s vice president of product, said in a statement.

The move marks a comeback for Binance, having offered tokenized stocks in April 2021 with Tesla and later added Coinbase, Strategy, Microsoft and Apple, before shutting the service after scrutiny from the U.K.’s Financial Conduct Authority and Germany’s BaFin.

Last month, Binance said it was weighing a fresh push into tokenized equities. Listing the Ondo-issued tokens on the platform now puts that plan into action.

Tokenized stocks have gained traction across crypto and traditional finance, with sector’s total value is approaching $1 billion, led by Ondo’s more than $550 million in locked value and $11 billion in cumulative trading volume since September 2025.

Trading venues such as Kraken, Bybit and Gemini and brokerages like Robinhood rolled out their versions of tokenized equities trading. Wall Street exchanges such as Nasdaq and the New York Stock Exchange (NYSE) also laid out plans to offer trading with stocks tokens.

Blockchain-based stocks can widen investor access, especially to retail users in developing countries without easy access to brokerage accounts offering U.S. stocks, proponents say. The tokens can also serve as collateral for borrowing in decentralized finance (DeFi).

Read more: NYSE’s 24/7 plan could fix key problem for stock tokens, Ondo’s de Bode says

Crypto World

MoonPay launches non-custodial wallets for AI agents

Crypto payments platform MoonPay has introduced a new product designed to give artificial intelligence systems direct access to digital wallets and on-chain transactions.

Summary

- MoonPay launched MoonPay Agents on to support non-custodial AI wallets.

- The platform enables automated trading, funding, and machine-to-machine payments.

- The product targets developers building large-scale autonomous financial systems.

MoonPay Agents, a non-custodial software layer that enables AI agents to create wallets, manage funds, and trade on behalf of verified users, was officially launched by the company on Feb. 24.

The system is built on MoonPay’s command-line interface and is aimed at developers building automated programs that need to move money without relying on centralized custody. Once a user completes identity checks and funds a wallet, an AI agent can trade, swap, and transfer assets independently.

Connecting AI systems to digital money

MoonPay said the product supports the full financial cycle, including fiat-to-crypto funding, portfolio tracking, and conversion back to traditional currencies. Users can also receive funds through virtual accounts or payment services such as Apple Pay, PayPal, and Venmo.

“AI agents can reason, but they cannot act economically without capital infrastructure,” said Ivan Soto-Wright, the company’s chief executive officer. He said the goal is to make crypto the default financial layer for autonomous systems.

According to MoonPay, users can set up a working wallet and agent connection in minutes, allowing automated systems to begin executing strategies almost immediately.

MoonPay Agents includes tools such as recurring purchases, real-time cross-chain swaps, machine-to-machine payments, and automated fiat funding via on-ramps. These features are designed to ensure that agents always have access to liquidity when operating.

Additionally, the platform supports portfolio monitoring, token discovery, and basic risk analysis, enabling developers to incorporate financial management straight into their apps. Wallets are stored on users’ own devices, giving them direct control over private keys.

The product is built to scale from single-user setups to networks of thousands of agents. It runs on the same infrastructure that supports nearly 500 enterprise customers and more than 30 million users across 180 countries.

Part of a the growing “agent economy” trend

The launch comes amid growing interest in so-called “agentic” systems that can plan and act without continuous human oversight. Industry forecasts suggest the autonomous agent economy could reach $30 trillion by 2030, with AI systems managing a large share of routine financial decisions.

In crypto markets, this shift is already underway. AI-powered wallets are being used for trading, DeFi activity, and machine-to-machine payments. At ETHDenver 2026, developers showcased blockchain-based identity tools, automated treasuries, and agent-led trading systems, highlighting the rapid growth of this trend.

According to company executives, MoonPay Agents will serve as a default financial rail for developers building trading bots, gaming platforms, and automated payment systems. With AI systems increasingly taking on financial tasks, MoonPay is positioning its infrastructure as a foundation for this emerging market.

Crypto World

PayPal pops nearly 7% on report Stripe is weighing an acquisition

Thomas Fuller | SOPA Images | Lightrocket | Getty Images

PayPal‘s stock surged nearly 7% on Tuesday following a report that fintech startup Stripe is weighing buying the payments platform.

Bloomberg reported the news, citing people familiar with the matter, and said the discussions are in early stages. The report said Stripe is considering buying all or some segments of PayPal’s business.

The news comes a day after reports that buyer interest has picked up in the company following its recent stock slump.

PayPal and Stripe declined to comment on the report.

PayPal, which is grappling with slowing growth in an increasingly competitive financial payments industry, has plummeted more than 19% since the start of the year. The company shed nearly a third of its value in 2025.

Earlier this month, the stock plunged on lackluster profit guidance and its board appointed HP’s Enrique Lores as its new CEO to start at the beginning of March.

Meanwhile, fintech startup Stripe hit a $159 billion valuation on Tuesday following a secondary stock sale for employees and shareholders.

That’s up from the $91.5 billion a year ago. Stripe said in a business update that its revenue suite is slated to reach an annual run rate of $1 billion this year.

Stripe, which ranked 10th on CNBC’s Disruptor 50 list last year, has transformed into one of the most valuable private companies yet and recently acquired billing startup Metronome in January.

Stripe co-founder and president John Collison told CNBC’s Andrew Ross Sorkin on Tuesday that the company isn’t yet aiming for an IPO, which would sidetrack its current product and business growth.

Read the full Bloomberg article here.

Crypto World

Why Bitcoin’s Rising HODL Cohorts Are a Bearish Signal This Time

Short-term coin activity remains near historic lows, highlighting weak participation from new buyers across the network.

Bitcoin faced renewed sell pressure on Tuesday, briefly dragging the price down to $62,700 after a 5% decline, as macro concerns continued to weigh on investor sentiment.

New data suggest that BTC remains in a defensive phase as capital continues to exit the network and supply ages steadily without signs of renewed accumulation.

Peak Buyers Now Frozen

Realized Cap, which measures the aggregate value of all coins at the price they last moved, has declined for a second consecutive month. According to the latest analysis by Axel Adler Junior, this indicates that capital continues to exit the network rather than flow into it.

The 30-day Realized Cap Net Position Change currently stands at -2.26% and has remained negative for several weeks, which means that coins are either being transferred below their cost basis or that incoming capital is insufficient to offset ongoing outflows. Realized Cap peaked on November 26, 2025, at approximately $1.127 trillion and has since fallen to around $1.094 trillion – a compression of roughly $33 billion.

Daily net position changes continue to hover around zero or remain negative, amidst the absence of new capital entering the market. As long as the 30-day Realized Cap metric stays below zero, the network remains in net outflow mode. A move back into positive territory is the first condition required for a shift toward accumulation.

In addition, HODL Waves data revealed a sharp structural change in coin age distribution that is consistent with this defensive regime. Coins that last moved 3-6 months ago now make up about 26% of Bitcoin’s supply, up from 19% earlier this month. These coins were mostly bought near the last market peak and haven’t moved since.

The share of Bitcoin held for 6-12 months has grown to just over 20%, while coins moved within the past month account for less than 10% of the supply. This shows that few new buyers are entering the market, as per Adler Junior. Most circulating coins were bought at higher prices and are now sitting at a loss, which has left holders reluctant to sell and effectively locking supply in place.

You may also like:

The growth of older cohorts does not represent strategic accumulation but rather forced holding due to unfavorable price conditions. The structure would only see a meaningful change if coins in the 3-6 month band begin migrating into longer-term cohorts without triggering renewed selling pressure, alongside a measurable return of short-term activity.

Familiar Bear Signal Is Back

Against the backdrop of bleeding capital, an important technical signal that has appeared near the end of past Bitcoin bear markets is starting to form again. According to analyst Ali Martinez, a potential death cross on Bitcoin’s three-day chart is projected to occur in late February.

In previous cycles, this signal consistently showed up just before the final major drop. With the crypto asset still 50% below its October 2025 peak, Martinez warned that a similar setup could open the door to further downside.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Mark Zuckerberg’s Meta is planning stablecoin comeback in the second half amid U.S. regulatory shift

Meta, the U.S. tech giant helmed by Facebook creator Mark Zuckerberg, is aiming to enter the stablecoin space later this year, pending successful integration with a third-party firm to facilitate payments using the dollar-pegged token technology, according to three people familiar with the plans.

The tech giant, which owns Facebook, WhatsApp and Instagram and has more than 3 billion users, wants to begin its stablecoin integration early in the second half of this year, said one of the people, who spoke on condition of anonymity because the plans are not public. Meta is planning to integrate a vendor to help administer stablecoin-backed payments and implement a new wallet, the person said.

A second person said that Meta has sent out a request for product (RFP) to third-party firms and mentioned Stripe as a likely candidate for piloting Meta’s stablecoin.

Stripe, which acquired stablecoin specialist Bridge last year, is a long-time partner of Meta, and Stripe CEO Patrick Collison joined Meta’s board of directors in April 2025.

Meta, Stripe, and Bridge were approached for comment, but none responded by the time of publication.

Meta introducing stablecoins would let it open payment rails to its massive user base while bypassing expensive traditional banking fees, and potentially position it as a global leader in “social commerce” and cross-border remittances.

The move would also put the tech giant in direct competition with the likes of Elon Musk’s social media platform X as well as messaging platform Telegram, both of which are aiming to bring payments in-house by becoming “super apps.” This was one of the original goals for the planned Libra project — allowing the social media company to tap its vast networks, including WhatsApp’s peer-to-peer messaging service and Facebook and Instagram’s network and commerce tools, for payments.

Regulatory shift

Meta famously tried to introduce the Libra stablecoin, later renamed Diem, in 2019, only to face strong headwinds due to a less favorable regulatory climate than today’s and a lingering reputational hit from the Cambridge Analytica scandal.

In the face of a pushback against the project by U.S. lawmakers, the Libra Association, as it was then called, scaled back its ambitions in 2020, pivoting to the development of a number of stablecoins pegged to different currencies, as opposed to the original plan of a global digital currency backed by a basket of national currencies.

In the end, Meta’s stablecoin never formally launched, and the project was shut down and its assets sold off in early 2022.

The regulatory climate in the U.S. today is quite different. There are several crypto regulatory regimes underway, including President Donald Trump’s GENIUS Act, which, for the first time, established a legal foundation for U.S. stablecoin issuers and opened the floodgates for market entrants with new tokens. However, U.S. regulators are still only in the early stages of drafting the regulations governing issuers.

That said, the whole Libra/Diem experience has led Meta to prefer relying on a third-party stablecoin payments provider this time around, according to one of the sources.

“They want to do this, but at arm’s length,” said the source.

Crypto World

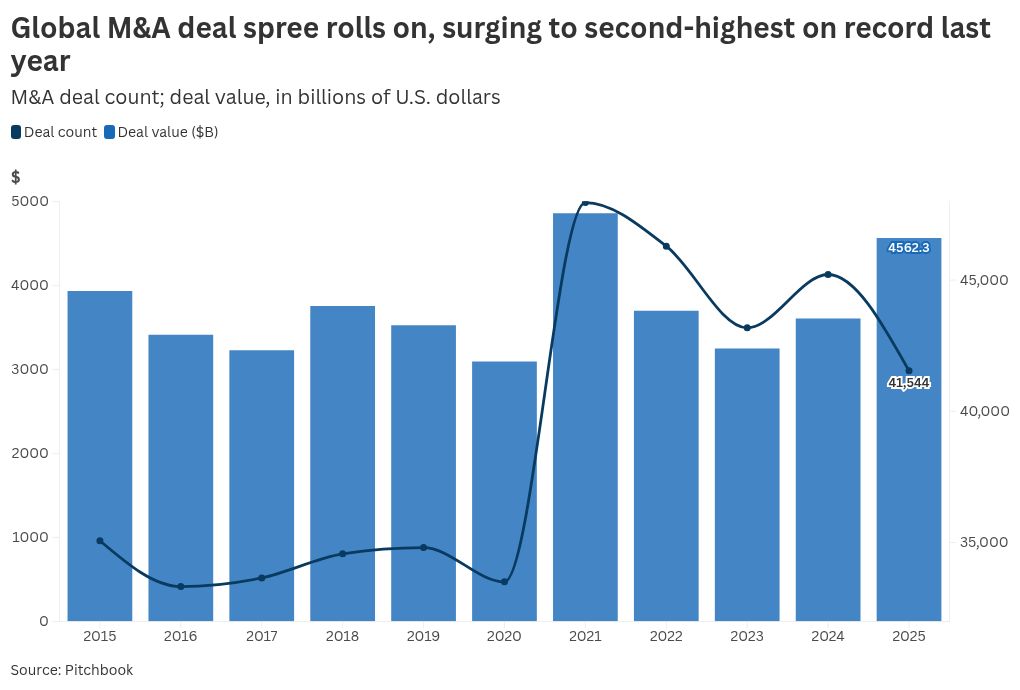

Global M&A stays strong in 2026 despite tightest capital squeeze in 30 years

A Goldman Sachs logo is displayed on the floor of the New York Stock Exchange in New York City, on Wednesday, August 11, 2010.

Ramin Talaie | Corbis Historical | Getty Images

The global mergers and acquisitions boom that defined 2025 is carrying into 2026, as companies reassess their portfolios and artificial intelligence-led demand fuels large-scale transactions. However, a tightening capital pool is forcing executives to be more selective than ever.

Despite a sluggish start as Trump’s sweeping tariffs early last year briefly scuttled acquisitions and new public listings, the total value of deal-making activity surged 40% to $4.9 trillion in 2025, according to Bain & Company’s annual M&A report.

That marked the second-highest level on record, trailing only the $5.6 trillion peak in 2021, when low borrowing costs and buoyant equity markets propelled a historic dealmaking frenzy.

Dealmaking activity last year rebounded as central banks cut interest rates, valuations improved and companies increased spending on artificial intelligence.

Markets are betting that the surge will continue, as Wall Street regains its appetite for large deals amid the prospect of lower borrowing costs.

A Bain survey of 300 M&A executives found that 80% expect to sustain or increase deal activity this year, citing improved macroeconomic conditions and a growing backlog of private equity and venture capital assets awaiting exit.

As abrupt shifts in trade policies settled into a pattern of less threatening change, relief turned into confidence and then a fear of missing out.

Jake Henry

Global co-leader, McKinsey’s M&A Practice.

Goldman Sachs, drawing on its own poll of 600 corporate and financial sponsor clients, found that 57% believe scale and strategic growth will be the primary driver of deal decisions this year.

“As abrupt shifts in trade policies settled into a pattern of less threatening change, relief turned into confidence and then a fear of missing out,” said Jake Henry, global coleader of McKinsey’s M&A Practice.

Central to the shift is a decisive push by companies to reassess their portfolios, as geopolitical risks, economic fragmentation and uneven global growth force boards to reconsider where they operate and the risks they are willing to take.

“Leaders across industries recognize that many traditional business models have reached the limits of their historical growth engines,” said Suzanne Kumar, executive vice president of Bain’s global M&A and divestiture practice.

“Companies urgently need to reinvent themselves to get out ahead of the big forces of technology disruption, a post-globalization economy, and shifting profit pools,” Kumar added.

Goldman topped the global M&A ranking last year, advising on nearly 40 deals worth $1.48 trillion in total volume. It marked the strongest period for mega-deals by volume, according to Reuters, citing LSEG records dating back to 1980.

Still, companies remain cautious. Boston Consulting Group’s M&A sentiment index rebounded to 75 from its low in late 2022 — but still remained well below the long-term average of 100, reflecting “an improving but cautious stance.” A higher value than the prior month indicates that M&A market momentum is accelerating, while a lower value suggests a deceleration.

Tightest funding squeeze in decades

While the appetite for deals remains strong, the pool of discretionary capital to fund them is historically thin, forcing executives to pursue only transactions that deliver clear returns.

The proportion of capital allocated to M&A hit a 30-year low in 2025, according to Bain, as companies directed more cash towards dividends, buybacks, capital expenditures as well as research and development.

“Executives must pressure test whether M&A pathways and specific deals will help the company better compete in the most attractive markets … rethink portfolio boundaries, and make bigger, bolder decisions about what capabilities they must own vs. access,” said Kumar.

“As competing demands for capital raise the bar for deals, disciplined reinvention and value creation are essential,” she added.

The funding crunch has pushed private capital to the center of dealmaking. Private equity firms are seeking to deploy idle cash, borrowers are turning to private credit funds for flexibility, and sovereign wealth funds are increasingly acting as lead investors rather than passive backers.

Private equity now accounts for roughly 40% of global M&A activity, according to Goldman. Despite signs of stress in the private credit market — now valued at roughly $2.1 trillion — Goldman expects the asset class to more than double by 2030, broadening the pool of capital available to fund large transactions.

AI capital expenditure ‘supercycle’

Blockbuster deals are fueling the resurgence in M&A, powered by AI-related demand, according to industry reports.

Mega-deals valued at greater than $5 billion accounted for more than 73% of the increase in deal value in 2025, according to Bain.

The number of deals exceeding the $10 billion threshold swelled to 60 last year, the highest level since 2021, said McKinsey’s Henry.

“We expect more big deals in 2026, with continued consolidation and geographic expansion,” Henry said, with AI-related service providers fueling “big-deal fever” this year.

However, the heavy capital spending in AI could constrain M&A activity in the near term, Brian Levy, global deals industries leader at PwC, said.

As AI adoption accelerates, demand for computing power has surged across digital infrastructure, energy, semiconductors, and hardware optimization. In response, many companies are opting to acquire rather than build across the technology stack.

Between the first quarter of 2024 and the third quarter of last year, U.S. hyperscalers’ capital expenditures averaged $760 million per day, according to Goldman Sachs.

The Wall Street bank estimates that by 2030, another 65 gigawatts of data center capacity will come online — more than double the amount added from 2019 to 2024.

“Investment in AI is being directed towards data centres, energy, and other infrastructure as well as technology development and customisation,” Levy said.

“In the near term, the scale of this multitrillion-dollar investment may divert capital and temper M&A activity.”

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World20 hours ago

Crypto World20 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech9 hours ago

Tech9 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 hours ago

NewsBeat5 hours agoPolice latest as search for missing woman enters day nine