Crypto World

Bitcoin Dips to $60k as TRM Labs Joins Crypto Unicorn Club

Crypto markets endured a brutal week as liquidity worries resurfaced in the wake of a high-profile Federal Reserve nomination. Investors watched US liquidity signals tighten while Bitcoin ETFs experienced notable outflows, contributing to choppy price action across the sector. The period also featured a string of high-profile financing moves and notable risk events that underscored the fragility of liquidity and risk appetite in crypto markets. Bitcoin and other large assets began to show resilience only after a brief slide, with traders assessing how policy shifts could shape funding conditions in the months ahead.

Key takeaways

- Bitcoin ETFs saw three consecutive days of outflows totaling about $431 million, underscoring persistent liquidity concerns even as spot prices fluctuated and regained ground.

- The crypto market’s largest price swing this week came as BTC traded near the $60,000 neighborhood before reclaiming the $64,000 level, highlighting a delicate balance between selling pressure and support at key levels.

- TRM Labs closed a $70 million Series C, valuing the blockchain intelligence firm at $1 billion and signaling continued investor confidence in on-chain analytics as a bulwark against AI-augmented cybercrime.

- Avalanche’s on-chain tokenization activity surged in Q4, with real-world asset tokenization rising to more than $1.3 billion in TVL and daily momentum aided by BlackRock’s BUIDL fund and other institutional partnerships.

- Jupiter secured a $35 million strategic investment from ParaFi Capital, marking the first time Solana-based Jupiter accepted outside capital while expanding beyond swaps into perpetuals, lending and stablecoins.

Tickers mentioned: $BTC, $AVAX, $JUP, $SOL, $ZEC

Sentiment: Bearish

Price impact: Negative. The week’s liquidity concerns and continued selloffs pressured prices, with intraday volatility driven by ETF outflows and leveraged-liquidation activity.

Trading idea (Not Financial Advice): Hold. The near-term setup suggests sensitivity to macro signals and policy cues, but liquidity adaptations by major players could offer selective opportunities in risk-managed positions.

Market context: The period reflected broader crypto-market liquidity dynamics, policy expectations around the Federal Reserve, and ongoing flows into and out of crypto-related products that influence price trajectories and risk appetite.

Why it matters

The week highlighted how macro policy choices and liquidity conditions remain core to crypto pricing. The nomination of Kevin Warsh to head the Federal Reserve has sparked debate about whether policy will tilt toward stabilizing liquidity flows or sustaining tight funding conditions. Traders closely watched whether the nomination would translate into a more cautious stance on rate reductions and balance-sheet expansion, potentially placing continued pressure on risk assets, including digital currencies and DeFi platforms.

Meanwhile, institutional interest in on-chain analytics and risk-management tools continued to rise. TRM Labs’ unicorn status after a $70 million Series C underscores the market’s belief that blockchain intelligence and anti-fraud capabilities will be central to enterprise risk management as digital asset ecosystems grow in scale and complexity. The round, led by Blockchain Capital with participation from Goldman Sachs and others, signals ongoing appetite among traditional financial players to integrate crypto-native risk controls into broader financial operations.

On the product and network side, tokenization within Avalanche continued to gain momentum, a trend amplified by the involvement of traditional finance players. The platform’s growth in tokenizing real-world assets, combined with the launch of BlackRock’s BUIDL fund and the S&P Dow Jones partnership with Dinari, demonstrates how tokenized money markets, loans and indexes are becoming more central to institutional experimentation. The quarter’s numbers—an increase of tokenized real-world asset value by hundreds of percent year over year—underscore a shift from speculation toward utility in tokenized finance at scale.

In parallel, Jupiter’s infusion of outside capital marked a turning point for a Solana-based protocol that has long driven on-chain trading and liquidity aggregation. The ParaFi-led investment, coupled with the company’s expansion into on-chain perpetuals, lending and stablecoins, reinforces the trend of traditional funds seeking strategic exposure to fully on-chain ecosystems that promise deeper liquidity and more resilient product suites. The market also watched for the token’s performance, with Jupiter’s native token price rising in response to the news.

Still, the week wasn’t without turbulence. The Solana ecosystem saw a significant breach in treasury management on one DeFi platform, and other episodes highlighted the ongoing cybersecurity and operational risks that confront decentralized finance as activity scales. While some platforms have moved toward more centralized governance or governance-sharing arrangements, the overarching arc remains: innovation is accelerating, but risk controls must keep pace to sustain long-term confidence.

In aggregate, the DeFi universe ended the week with a mixed risk lens. While several projects advanced tokenization and institutional collaboration, broader market momentum remained tethered to policy signals and the health of traditional liquidity channels. The week’s data points—ranging from ETF withdrawals to multi-billion-dollar liquidation events—reflect a crypto market in transition: not only growing in sophistication but also increasingly sensitive to macro policy and systemic liquidity dynamics.

Avalanche tokenization hits Q4 high as BlackRock’s BUIDL expands onchain

Blockchain network Avalanche demonstrated notable institutional traction in tokenizing traditional assets during the fourth quarter. Total value locked (TVL) in tokenized real-world assets on Avalanche rose 68.6% quarter over quarter and nearly 950% year over year, surpassing $1.3 billion, according to Messari’s state-of-Avalanche Q4 2025 report. The surge was driven in part by the November launch of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), alongside broader deployments in tokenized money markets and loans.

The momentum was helped by strategic collaborations—Fortune 500 fintech FIS teamed with Avalanche-based Intain to bring tokenized loans to market, enabling securitization of billions of dollars in credit activity. The S&P Dow Jones Digital Markets 50 Index, launched in partnership with Dinari on Avalanche, tracks a cross-section of crypto-linked stocks and tokens and underscores the ongoing push to tie traditional benchmarks to on-chain exposure. The combination of these partnerships has supported a notable expansion of tokenized assets on the platform, contributing to a broader middleware layer that bridges real-world value with blockchain rails.

Traditional finance institutions are increasingly comfortable experimenting with tokenization, and the Securities and Exchange Commission’s more constructive stance toward crypto products has further lowered the regulatory headwinds facing such projects. This backdrop helps explain why on-chain asset issuance and tokenized funding mechanisms have gained traction on Avalanche, with real-world assets expanding beyond conventional crypto collateral and into more diversified financial instruments.

ParaFi Capital makes $35M investment in Solana-based Jupiter

Jupiter, a Solana-based on-chain trading and liquidity-aggregation protocol, announced a $35 million strategic investment led by ParaFi Capital. The deal marks the first time Jupiter has accepted external capital after years of bootstrapped growth. The investment included token purchases at market prices with no discount and an extended lockup period, settled entirely in Jupiter’s JupUSD stablecoin. The terms also included warrants allowing ParaFi to acquire additional tokens at higher prices, aligning long-term incentives with Jupiter’s growth trajectory.

The capital infusion comes as Jupiter broadens its product suite. After delivering a beta on-chain prediction market with Kalshi, the project rolled out JupUSD, a Solana-native stablecoin designed for on-chain settlement. Jupiter’s trading volume has surpassed $1 trillion in the past year, reflecting a rapid acceleration of liquidity and on-chain efficiency on Solana. The company has since expanded beyond swaps to perpetuals and lending, signaling a broader push to become an all-in-one on-chain liquidity hub.

Jupiter’s native token (JUP) responded to the news, rising roughly 9% over the prior 24 hours, underscoring investor appetite for Solana-native ecosystems that couple high throughput with diversified on-chain products. This momentum reflects a broader trend of cross-platform collaboration, where on-chain trading, governance, and liquidity provisioning are increasingly integrated with real-world asset workflows and institutional-grade risk controls.

Aave winds down Avara, phases out Family wallet in DeFi refocus

Aave Labs announced a strategic refocusing by winding down its umbrella brand Avara, which encompassed projects including the Family wallet and Lens, as the group doubles down on core DeFi initiatives. Stani Kulechov, Aave’s founder and CEO, noted that Avara is no longer required as the company concentrates on delivering broad DeFi access to users, with onboarding millions of users requiring purpose-built experiences rather than generic wallet interfaces.

The move aligns with Aave’s broader strategy to reallocate resources toward its flagship lending protocol and other core DeFi products. As governance and ecosystem partnerships evolve, projects like Lens have seen stewardship shifts to other collaborations, enabling Aave to focus on what it terms “DeFi for everyone.” The decision underscores the ongoing recalibration within the market as crypto firms chase product-market fit at scale and navigate regulatory expectations alongside user growth.

Kulechov indicated that the total effort within the team remains focused on unifying engineering and design toward a singular mission: bringing DeFi to a broad audience. The development trajectory suggests continued emphasis on user-friendly, accessible financial primitives and streamlined onboarding processes rather than sprawling, multi-brand architectures.

What to watch next

- Next batch of ETF outflow data and liquidity indicators to gauge whether funding conditions stabilize or deteriorate.

- Federal Reserve policy signals and potential implications for risk assets as the Warsh nomination progresses through confirmation and policy debate.

- Continued institutional participation in tokenization and on-chain finance, including Avalanche’s RWAs and partnerships with traditional finance players.

- Jupiter’s ongoing product expansion and ParaFi’s involvement in governance and token strategies.

Sources & verification

- Data on Bitcoin ETF outflows and price movements from Farside Investors and Cointelegraph coverage.

- Record of the Jan. 31 liquidation event reported by CoinGlass and related market data.

- TRM Labs’ Series C funding round and unicorn status as announced in its press release.

- Messari’s State of Avalanche Q4 2025 report, detailing RWAs and TVL growth.

- ParaFi Capital’s $35 million investment in Jupiter and the terms of the deal.

Crypto World

China’s Luckin Coffee opens its first high-end store

Chinese coffee giant Luckin opened its first flagship with premium drinks as the company takes on Starbucks Reserve.

Luckin Coffee

BEIJING — China’s Luckin Coffee is taking direct aim at Starbucks‘ high-end roastery chain with a new flagship store in the country’s south that sells premium drinks.

It’s Luckin’s first major departure from its original strategy of operating budget-priced coffee kiosks – a move that helped the company overtake Starbucks in terms of the number of storefronts in China.

Now, with the U.S. company selling off most of its struggling China business to a local investment firm, Luckin is proving it’s more than made a comeback from fraud allegations in 2020 that forced it to delist from the Nasdaq.

The Chinese company on Sunday officially opened its two-floor Luckin Coffee Origin Flagship in Shenzhen on the border with Hong Kong.

In contrast to Luckin’s typical offerings priced at roughly $1 or $2 for an Americano or latte, the flagship store has nudged prices slightly higher for a range of pour-over and cold brew coffee drinks. Customers can choose beans from Brazil, Ethiopia or China’s Yunnan province, as Luckin taps into the geographical sourcing “origin” theme popular with Starbucks and other coffee companies.

The new store also sells several specialty drinks such as a “tiramisu latte” with a pastry on top, according to posts on Chinese social media platform Xiaohongshu. Users have started posting about 1 to 3 hour waits for the drinks since the store’s soft launch on Jan. 20.

The 420-square-meter (4,521 square feet) store signals how intense the competition in China has become for Starbucks. Back in 2017, the U.S.-based coffee giant chose Shanghai for its second-ever Reserve Roastery “megastore,” after launching the premium store concept in Seattle three years earlier.

But as coffee has taken off in China, traditionally a tea-drinking market, Starbucks has run into a slew of competitors from boutique cafes to chains such as Cotti Coffee and Manner — which often sell drinks at half the price as Starbucks.

Luckin reported revenue of $1.55 billion for the three months ended Sept. 30, 2025, a nearly 48% increase from a year earlier.

That’s just for the company’s self-operated stores, which account for well over half of Luckin’s China locations and most of its handful of overseas stores. The new Shenzhen location is billed as Luckin’s 30,000th store. The company reported a total of 29,214 stores worldwide as at Sept. 30.

Pictured here is the second floor of Luckin’s new flagship in Shenzhen, China, that officially opened on Feb. 8, 2026.

Luckin

In contrast, Starbucks has just over 8,000 stores in China and around 16,900 in the U.S., its biggest market.

The Seattle-based coffee giant reported a 6% year-on-year increase in China net revenue to $831.6 million for the three months ended Sept. 28. Comparable same-store sales, a standard industry metric, was just 2%, but improved to 7% for the quarter ended Dec. 28.

Starbucks did not share China net revenue for the latest quarter. The company expects to close a deal in the spring to sell 60% of its China business to Boyu Capital, while retaining a 40% stake. When the deal was announced in November, Starbucks said it values its China business at $13 billion, including future licensing fees.

Luckin, whose shares still trade over-the-counter in the U.S., had a market value of around $10.46 billion as of Thursday.

Re-listing and expansion plans

Late last year, Luckin’s CEO Jinyi Guo hinted at plans to re-list the company in the U.S. He did not specify a date. Founded in late 2017, the company achieved a $2.9 billion valuation just 18 months later and listed on the Nasdaq in May 2019. But about a year later, Luckin said it discovered much of its 2019 sales were fabricated, leading to the stock’s delisting.

The Chinese coffee company continued to operate many of its stores — and kept its name and logo.

Luckin also jumped to attract consumers through a slew of timely collaborations — with premium spirits brand Moutai, the Minions cartoon characters and the hit video game Black Myth: Wukong just days after it surged in popularity.

What sets Luckin apart has been its ability to build a robust pool of private user traffic through its smartphone ordering app, said Mingchao Xiao, founder of Zhimeng Trends Consulting. Rather than placing orders with a counter clerk, Luckin customers select and pay for drinks directly through an app.

China’s coffee market is still in a period of rapid change, Xiao said. He added that young consumers today are more willing to try different experiences, and seek emotional fulfillment, which can be met through cross-industry brand collaborations.

Like many Chinese companies, Luckin is also ramping up its global expansion.

Last summer, Luckin opened its first U.S. stores in New York City. It debuted its 10th store in the city on Feb. 6.

Luckin also has 68 stores in Singapore after it entered the market nearly three years ago, and 45 jointly operated locations in Malaysia.

Crypto World

IBIT Position Limits Stay Put as Nasdaq Levels Bitcoin ETF Playing Field

TLDR:

- Nasdaq filing raises limits for FBTC, ARKB, HODL to match IBIT’s existing 250k position threshold

- IBIT maintains standard 250k limit under Option 9 rules, separate from January regulatory changes

- BlackRock filed in November to increase IBIT limit to 1 million contracts, pending regulatory approval

- Market analyst warns against AI-generated misinformation about crypto ETF regulatory developments

Rumors claiming Nasdaq eliminated position limits for iShares Bitcoin Trust options have been debunked by market analyst Jeff Park. The confusion stems from a January SEC filing that adjusted restrictions on several crypto ETFs.

Park clarified that the regulatory change does not grant unlimited leverage to Wall Street traders. Instead, the filing addresses position limits for other Bitcoin ETF products.

Regulatory Filing Targets Secondary Bitcoin ETFs

The SEC document in question raises position limits for FBTC, ARKB, HODL, and Ethereum ETFs from 25,000 to standard thresholds. IBIT already operates under the 250,000 position limit established in Nasdaq’s Option 9 rules.

BlackRock’s IBIT and Bitwise’s BITB have maintained this higher limit since their options launched. The January filing aims to level competitive conditions across Bitcoin ETF issuers.

Park highlighted that the regulatory change removes previous restrictions that penalized crypto assets with non-standard limits. The filing explicitly references exchange requirements preventing unfair discrimination between customers and issuers.

This adjustment brings smaller Bitcoin ETF products in line with established position limit frameworks. Market participants can verify current limits through the Options Clearing Corporation database.

IBIT Seeks Higher Position Limit Through Separate Process

A November 2024 filing reveals BlackRock’s attempt to increase IBIT’s position limit from 250,000 to one million contracts. This request remains pending with federal regulators as of February 2026.

The proposed expansion would represent a fourfold increase in maximum allowable positions. Park emphasized this separate filing as the actual development worth monitoring for potential leverage changes.

The analyst cautioned against relying solely on AI chatbots for verifying market information. He noted instances where automated tools provided incorrect statements about the regulatory changes.

Independent verification through official sources like the OCC database provides accurate position limit data. Park encouraged market participants to maintain due diligence when evaluating claims about regulatory developments.

The confusion highlights ongoing scrutiny of Bitcoin ETF derivatives markets. Position limits serve as risk management tools preventing excessive concentration in options contracts.

Regulatory adjustments to these limits reflect evolving approaches to crypto asset integration in traditional finance. The standardization process continues as more Bitcoin ETF products enter the derivatives market.

Crypto World

Huobi’s Li Lin Denies Trend Research Links as $373M ETH Loss Shakes Market

TLDR:

- Li Lin confirmed no BTC or ETH sales from Avenir Group during market crash period

- Trend Research sold 658,168 ETH worth $1.35B at $2,058 average versus $3,104 cost

- Total losses reached $688M, erasing prior $315M gains for $373M net deficit

- Ethereum held above $2,000 after eight-day liquidation concluded on exchanges

The founder of Huobi and Avenir Group has publicly rejected claims linking him to a major Ethereum liquidation event.

Li Lin stated he maintained his Bitcoin and ETH positions during the recent downturn. His denial comes as speculation swirled about a Hong Kong fund triggering the market crash.

Major Institutional Player Distances from Liquidation Event

Li Lin oversees Avenir Group, Asia’s largest institutional Bitcoin ETF holder.

The executive denied any investment ties to Trend Research or an entity called Garrett. His statement aimed to counter narratives suggesting his firm played a role in the selloff.

Market participants had pointed fingers at Asian institutions during the price drop. Bitcoin fell below key support levels as Ethereum struggled to hold above $2,000. The rumors intensified as liquidations mounted across centralized and decentralized platforms.

Wu Blockchain reported Li Lin’s position remained unchanged throughout the volatility.

Avenir Group’s Bitcoin ETF holdings stayed intact despite market pressure. The clarification sought to separate his operations from the unfolding liquidation crisis.

On-Chain Analysis Reveals Catastrophic Trading Loss

Data from ai_9684xtpa showed Trend Research liquidated its entire Ethereum position. The entity moved 658,168 ETH to exchanges over an eight-day period. The total value reached $1.354 billion at execution prices.

Trend Research bought Ethereum at an average cost of $3,104 per token. The selling occurred at roughly $2,058 per coin. This price difference generated losses exceeding $688 million on the trades.

The entity had previously secured profits of around $315 million from earlier positions. Those gains evaporated completely in the recent drawdown. Net losses now stand at approximately $373 million according to blockchain records.

The final transfer involved just 0.148 ETH moved to Binance. This small amount marked the complete exit from what was once a substantial holding. The selloff began on February 6 and concluded within days.

Ethereum prices stopped declining shortly after the massive selling commenced. The token stabilized above the $2,000 threshold despite continued pressure. Market observers noted the timing between the liquidation and price floor formation.

The event highlighted risks associated with leveraged DeFi strategies. Trend Research had reportedly deployed a looped position strategy worth over $2 billion. Market-wide liquidations surpassed $1 billion during the same window.

Crypto World

Crypto Industry Heading For ‘Massive Consolidation,’ Says Bullish CEO

The crypto industry is likely to see more projects snapped up by larger companies, which may lead to a much less fragmented sector in the months ahead, says Bullish CEO Tom Farley.

“I was in the exchange sector during continual massive consolidation…the same thing is going to happen starting right now in crypto,” Farley said during an interview on CNBC on Friday.

Farley, who served as president of the New York Stock Exchange (NYSE) until 2018, said the recent drop in the crypto market will be a key catalyst, with Bitcoin (BTC) down nearly 45% from its October all-time high of $126,100 and trading at $69,405 at the time of publication, according to CoinMarketCap

Farley says the consolidation should have already happened

However, he said that the industry’s consolidation should have happened earlier, but inflated valuations kept false optimism going. “It should have happened a year or two ago,” he said.

“People were still holding onto this hope that they’d get 2020 valuations, and so we’d have conversations with companies that would say, hey, we have $10 million in revenue, it’s not growing, we want $200 million to buy the company,” he said.

“That dream is going to be over,” Farley said, adding that “people are going to realize they don’t have businesses, they have products, and they need to merge up, and they need to scale, and that is going to happen.”

Consolidation in the crypto industry can cut both ways. Underperforming projects may be absorbed by larger companies, but this process can lead to redundancies, layoffs, and internal disruption in the industry as companies merge or wind down.

Related: Crypto retail investors are trying to ‘meta-analyze’ crypto crash: Santiment

Eva Oberholzer, the chief investment officer at venture capital firm Ajna Capital, told Cointelegraph in September 2025 that VC firms have become much more selective with the crypto projects they invest in, due to market maturation.

“It’s harder because we have reached a different stage in crypto, similar to every cycle we have seen for other technologies in the past,” Oberholzer told Cointelegraph.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Stablecoins Gain Federal Backing as CFTC Expands Issuer List

TLDR:

- The CFTC update formally includes national trust banks as approved issuers of payment stablecoins for derivatives margin use.

- Staff Letter 25-40 still requires full reserve backing and strict redemption rules for qualifying payment stablecoins.

- The guidance aligns federal trust banks with existing state-regulated stablecoin issuers like Circle and Paxos.

- Combined with the GENIUS Act, the rule signals tighter integration of stablecoins into U.S. financial markets.

The U.S. Commodity Futures Trading Commission has expanded its regulatory guidance on payment stablecoins used in derivatives markets. The change allows national trust banks to qualify as approved issuers under an existing no-action framework.

The update removes a key limitation that had excluded federally chartered trust institutions. It signals deeper integration of stablecoins into regulated financial infrastructure.

CFTC Updates Definition of Payment Stablecoins

The CFTC’s Market Participants Division reissued Staff Letter 25-40 with a revised definition of payment stablecoins. The clarification confirms that national trust banks qualify as permitted issuers.

The original letter, released in December 2025, granted no-action relief to futures commission merchants. It allowed them to accept qualifying payment stablecoins as customer margin collateral.

The guidance also permits firms to hold proprietary stablecoins in segregated customer accounts. These holdings count toward regulatory calculations under strict risk controls.

According to a CFTC press release, staff later realized the original wording unintentionally excluded national trust banks. The revision corrects that oversight and aligns them with state-regulated issuers such as Circle and Paxos.

The framework requires stablecoins to maintain full reserve backing and clear redemption rights. It also mandates operational safeguards and compliance with existing risk management standards.

Social commentary from crypto analysts described the update as a major step for stablecoin adoption in regulated derivatives trading. The reaction focused on its impact on market structure rather than token prices.

GENIUS Act and FDIC Framework Shape Stablecoin Policy

The revised CFTC guidance builds on the GENIUS Act signed into law in July 2025. The legislation created the first federal framework for payment stablecoins used in payments and transfers.

The law introduced reserve requirements and defined oversight roles for both bank and nonbank issuers. It also opened formal pathways for national institutions to participate in stablecoin issuance.

In December 2025, the FDIC proposed a separate rule for banks to issue stablecoins through subsidiaries. That proposal requires supervisory approval and safety and soundness reviews.

The FDIC recently extended its public comment period, according to regulatory notices cited in February 2026 updates. The proposal remains under consideration and has not yet taken effect.

Together, the CFTC and FDIC actions point to a coordinated regulatory direction. Stablecoins now sit closer to traditional banking and derivatives infrastructure.

CFTC Chairman Michael Selig noted that national trust banks have played a role in custody and issuance since their creation under earlier OCC charters. The updated letter reflects their continued position in the payment stablecoin ecosystem.

The move narrows regulatory gaps between state and federally chartered issuers. It also reinforces the U.S. strategy to formalize digital asset markets under post-GENIUS Act policy.

Crypto World

Hyperliquid Revenue Beats Ethereum as HYPE Shows Strength

TLDR:

- Hyperliquid recorded over $5.5 million in daily fees, surpassing Ethereum and Tron in revenue generation.

- More than 2.32 million HYPE tokens were removed from supply through buybacks over the past 30 days.

- HIP-3 trading volume reached $5.21 billion daily, signaling rapid adoption of on-chain derivatives products.

- Hyperliquid’s perpetual DEX market share crossed 30% after five consecutive weeks of sustained growth.

Bitcoin and most major cryptocurrencies have faced sharp price swings over recent weeks. During the same period, Hyperliquid’s native token HYPE showed limited downside movement.

Trading data also points to growing activity on the protocol’s perpetual exchange. These shifts place Hyperliquid among the most closely watched on-chain derivatives platforms.

HYPE Shows Relative Price Strength Amid Crypto Volatility

Bitcoin moved from $90,000 to $60,000 before recovering toward $70,000. Over that period, HYPE remained near the $32 level, according to data shared by Wise Advice on X.

Since the recent market bottom, HYPE has gained about 60%. Meanwhile, open interest declined from $8.4 billion to $5.39 billion.

This combination shows price appreciation alongside falling leverage. Market data providers describe such patterns as a sign of spot-driven demand rather than speculative excess.

At the time of publication, CoinGecko data showed HYPE trading at $31.45 with a 24-hour volume of about $408 million. The token was down 5.25% daily and 2.48% weekly.

Hyperliquid’s revenue metrics have also moved higher. The protocol generated roughly $5.5 million in fees over the past 24 hours, exceeding Ethereum and Tron during the same window.

Buyback activity followed revenue growth. Platform data shows $5.25 million in buybacks in 24 hours, $25.9 million in seven days, and $62.9 million over 30 days.

Roughly 2.32 million HYPE tokens were removed from circulation during that period. This links protocol revenue directly to supply contraction.

Hyperliquid Expands On-chain Perps Share as Adoption and Volume Rise

HIP-3 trading activity reached a new all-time high with daily volume of $5.21 billion. Gold and silver contracts accounted for more than $20 billion over ten days.

That figure equals about 1% of daily COMEX volume. Two weeks earlier, HIP-3 accounted for less than 0.1% of comparable volume.

Cumulative HIP-3 statistics now show $55 billion in total volume, 39.9 million trades, and more than 103,000 users. Platform data attributes the growth to increased participation rather than trader rotation.

Perpetual decentralized exchange market share crossed 30% for the first time since September. The sector has recorded five consecutive weeks of growth.

Data shared by Wise Advice shows Hyperliquid expanding while rival venues remain stable or consolidate. Centralized exchange volumes continue to fluctuate with broader market conditions.

On-chain derivatives activity, however, has shown structural growth. Hyperliquid captured a growing portion of that flow.

The combination of stable pricing, rising revenue, expanding market share, and user growth places Hyperliquid among the strongest performers in the decentralized trading sector.

Crypto World

How Low Will Bitcoin Price Drop This Cycle?

Bitcoin recently experienced a sharp sell-off that nearly dragged the price down to the $60,000 level before a swift bounce followed. Dip buying helped BTC stabilize near current levels, but this rebound alone does not confirm a trend reversal.

Instead, the move appears more like a temporary pause within a broader corrective phase, leaving investors questioning whether further downside lies ahead.

Sponsored

This Is What Bitcoin Signals Suggest

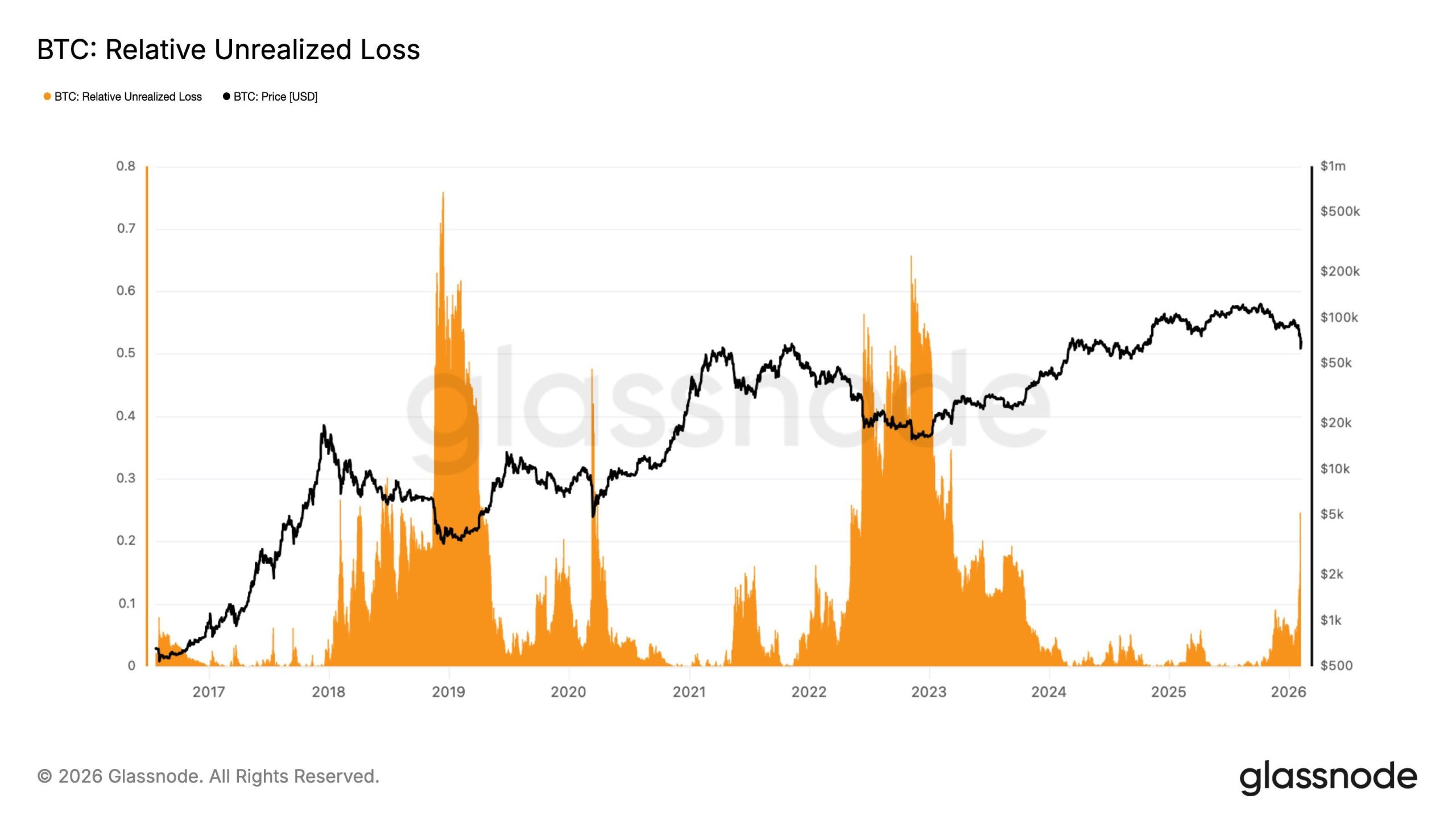

One defining characteristic of bear markets is elevated Relative Unrealized Loss, which measures the dollar value of underwater coins relative to total market capitalization. During Bitcoin’s drop toward $60,000, this ratio surged to roughly 24%.

That level sits well above the typical bull-bear transition zone, placing the market firmly in bearish territory.

While the metric signals an intense bear regime, it remains below extreme capitulation levels historically seen above 50%. This suggests Bitcoin is undergoing an active capitulation process rather than reaching its final bottom. Selling pressure is widespread, but not yet exhausted, implying further volatility as the market seeks equilibrium.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Another lens into investor behavior is the distribution of Bitcoin supply among wallet sizes. Data shows wallets holding less than 0.01 BTC have been steadily increasing their share of supply. This group represents small retail participants who often react emotionally to price swings but are currently accumulating.

Sponsored

At the same time, wallets holding between 10 and 10,000 BTC have shown mild net distribution during the dip. This divergence is notable because public sentiment on social platforms remains overwhelmingly bearish.

Despite negative commentary, small traders are quietly adding exposure, signaling belief that current prices offer value.

This imbalance suggests optimism has not fully reset. Ideally, deeper bear phases see retail capitulation align with bearish social metrics.

Until small retail supply begins declining, rebounds may struggle to gain lasting traction, limiting the upside of near-term recovery attempts.

Sponsored

Bitcoin Continues To Witness Support

Despite price weakness, network activity presents a contrasting signal. Bitcoin has seen a sharp rise in new addresses over the past week. The number of investors conducting their first on-chain transaction increased by roughly 37%, indicating fresh participation entering the network.

Such growth reflects continued interest in Bitcoin as prices correct. New entrants often emerge during periods of volatility, attempting to position early for potential recoveries.

While not a guarantee of immediate upside, rising address activity suggests confidence in Bitcoin’s longer-term value proposition remains intact.

Sponsored

This influx of new users can provide support during consolidation phases. However, if macro pressure persists, even strong network growth may struggle to offset broader risk-off conditions across financial markets.

BTC Price Levels To Watch

Bitcoin price is trading near $69,077 at the time of writing after rebounding from the $63,007 support during the recent crash. Aggressive dip buying prevented a deeper slide toward $60,000. This defense highlights strong demand at lower levels, at least in the short term.

Despite this bounce, downside risk remains elevated. The broader macro outlook suggests Bitcoin may still face further breakdowns in the coming weeks. A loss of the $63,007 support would reinforce a bearish continuation, with the next major downside target near $55,500 based on historical support zones.

A short-term recovery remains possible if fresh capital inflows persist. Rising new address activity could help Bitcoin consolidate and reclaim $71,672 as support. Securing that level would invalidate the immediate bearish setup and signal stabilization, though it would not fully negate the broader bear market structure.

Crypto World

Short-Term Capitulation Hits as Bitcoin Diverges From Long-Term Value

TLDR:

- Bitcoin shows strong correlation with equities, placing short-term price action under macro and liquidity influence.

- Short-term holders sent over 94,000 BTC to exchanges at a loss, marking the largest capitulation of this correction.

- Options data shows negative gamma exposure, increasing the chance of sharp moves around key expiration dates.

- Long-term power-law valuation signals Bitcoin trades over 40% below trend despite ongoing macro pressure.

Bitcoin traded in volatile ranges as macro pressure and investor panic shaped near-term price action. Data showed heavy selling from short-term holders as the asset slipped below key technical levels.

At the same time, long-term valuation models signaled a widening gap between price and trend value. The divergence revealed a market pulled between liquidity stress and structural repricing forces.

Bitcoin Price Mispricing Tied to Macro Correlation and Options Structure

Bitcoin moved in step with U.S. equities during the latest pullback. Thirty-day correlations showed strong alignment with Nasdaq, S&P 500, and high-yield bonds.

Recency-weighted data confirmed the link with risk assets remained elevated. This pattern placed short-term direction under macro and liquidity influence rather than narrative-driven trading.

Lead and lag signals showed equities and credit markets moving before Bitcoin. According to figures shared by David (@david_eng_mba), the Nasdaq led Bitcoin by about four days, while the dollar index led by roughly ten days.

Options market positioning reinforced near-term uncertainty. Spot price hovered near the gamma flip zone, with resistance clustered near $70,000 and risk concentrated below that level.

Net gamma exposure remained negative, pointing to unstable price behavior. A squeeze score above the midpoint suggested sensitivity to sharp intraday moves.

Upcoming expiries added another layer of pressure. More than 15% of total gamma was set to roll off on February 13, with larger portions expiring later in February and March.

These expiries increased the probability of breakouts once hedging pressure faded. Until then, price action stayed confined between heavy put and call walls.

Short-Term Holder Capitulation Highlights Bitcoin Price Mispricing Gap

On-chain data showed panic-driven transfers from short-term holders. Darkfost (@Darkfost_Coc) reported daily average flows of over 94,000 BTC to exchanges at a loss.

The transfers occurred as Bitcoin dropped below $65,000. Exchange inflows from short-term holders often indicate intent to sell rather than reposition.

This behavior marked the largest capitulation event of the correction cycle. It reflected emotional reactions during rapid downside moves.

While near-term selling intensified, long-term valuation metrics pointed elsewhere. Power-law trend models placed fair value above $120,000.

The gap between market price and model value exceeded 40%. A negative Z-score signaled an oversold condition relative to historical norms.

Mean-reversion timelines projected gradual recovery over several months. These projections extended into mid and late 2026 based on trend reversion math.

Short-term volatility and long-term valuation now diverged sharply. Macro weakness dictated immediate price movement, while structural models framed a different trajectory.

Crypto World

Crypto Retail Investors Try Meta-Analysis of the Market

Retail investors are scanning the crypto landscape for signs a bottom may be forming, hoping to time new purchases as market conditions potentially improve. A weekly briefing from Santiment on Saturday noted that retail traders are meta-analyzing price action, seeking indications that others are capitulating—a behavior that often marks troughs in bear markets. The term has surged as a top topic on social media, with Santiment tying the chatter to rising selling pressure. Google Trends data show a clear uptick in searches for “crypto capitulation” over recent days, underscoring how participants interpret price swings as signals rather than mere volatility. In this environment, Bitcoin has traded under pressure, dipping toward the $60,000 level on Thursday as part of a broader downtrend that has persisted for months.

The term capitulation describes a scenario where investors rush to exit positions out of fear that the market will not recover, a dynamic analysts monitor when assessing a market bottom. If the chorus of sellers grows loud enough that many participants capitulate at once, some interpret that as a sign that the worst may be behind them, even if others argue that bottoms in bear markets often arrive after multiple rounds of selling pressure. The debate remains a central theme as markets test psychological support levels and risk appetite remains fragile.

Capitulation signals and the coming bottom

“If everyone is waiting for ‘capitulation,’ the bottom might have already happened while they were waiting for a clearer sign,” Santiment cautioned in its assessment. The idea is that waiting for a definitive capitulation before buying can cause investors to miss a move that follows the initial flush of fear, a phenomenon that has played out in past cycles. Yet, several voices in the analyst community urge caution. Caleb Franzen, a market observer active on X, pointed out that capitulation is often a recurring theme in bear markets and that a single event rarely marks the ultimate bottom. “Bear markets typically experience multiple capitulation events,” Franzen wrote, highlighting the risk that the downturn may extend even after a strong capitulation signal appears.

As the debate unfolds, Bitcoin’s price action continues to weigh on sentiment. The flagship asset has seen volatility and regional price pressures, with a notable moment when it briefly struck a $60,000 level—an area not visited since October 2024 during this cycle’s slide. While some traders see this as an opportunity to accumulate, others caution that the move could be a continuation of the downtrend unless stronger catalysts emerge. The market’s complexity is underscored by a mix of on-chain data, macro considerations, and shifting liquidity conditions that collectively shape the near-term trajectory.

Further context comes from the broader sentiment gauges that traders monitor. The Crypto Fear & Greed Index, a composite measure of risk appetite across the market, slid deeper into an Extreme Fear zone in recent days, signaling a cautious stance among participants. This mood aligns with the period of heightened scrutiny around capitulation narratives and the ongoing debate over whether a bottom is in place or still distant. The blend of sentiment metrics and price dynamics creates a nuanced backdrop where several outcomes remain plausible in the weeks ahead.

In parallel, a separate thread of analysis emphasizes that capitulation—while relevant—may not be a single event but a process that unfolds over multiple episodes. CryptoGoos noted that true capitulation in Bitcoin had not yet materialized, a stance echoed by other analysts who stress that bottoms often require a confluence of confirmation signals, including on-chain activity, macro surprises, and investor positioning. The conversation reflects a market that is trying to quantify risk, distinguish genuine signaling events from noise, and position for a potential reversal when the confluence of factors tilts toward relief selling abating and demand reasserting itself.

Bitcoin’s recent movement sits at the center of these debates. Data from CoinMarketCap show the asset had fallen about 24% over the last 30 days, trading around $68,970 at the time of publication, with a low near $60,000 earlier in the week. The slide has kept risk managers vigilant, as fluctuations can influence leverage, funding rates, and liquidity across exchanges. In this environment, investors are weighing the potential for a sustainable bottom against the risk that the market could slip further before any durable recovery takes hold.

The market’s current state is a reminder that retail participation often shapes near-term moves, yet the longer-term trend remains dependent on a complex mix of factors, including macro policy expectations, liquidity dynamics, and how quickly market participants can absorb new information. While capitulation remains a focal point for many observers, the ultimate measure of a bottom will likely come from a broader pattern of price stabilization, sustained demand, and a shift in sentiment that signals a durable change in risk appetite.

Why it matters

For retail investors, the ongoing capitulation narrative frames risk tolerance and entry points. The possibility that a bottom could be forming—even if still contested—offers a potential upside scenario if buyers re-enter on perceived oversold conditions. For builders and traders, the discussion underscores the importance of risk controls, liquidity access, and the ability to distinguish meaningful capitulation signals from temporary price shocks. The broader market context—where macro indicators and regulatory developments can abruptly reframe risk sentiment—remains a critical backdrop for decision-making.

From a market-structure perspective, the unfolding dialogue around capitulation highlights how sentiment analytics, on-chain data, and price action interact to create a narrative about participation. While the data points discussed—ranging from Santiment’s retail-trader observations to Google Trends spikes and the Crypto Fear & Greed Index—offer a composite picture, they do not guarantee a bottom. Instead, they contribute to a framework that investors can use to calibrate expectations, manage risk, and prepare for a potential shift in momentum as the market weighs new information and potential catalysts.

What to watch next

- Watch for any sustained price stabilization around key support zones near $60,000 and above, which could indicate a base forming.

- Monitor capitulation signals and on-chain activity for confirmation that selling pressure is abating, not simply cooling temporarily.

- Track Google Trends and social sentiment to assess whether interest in capitulation remains elevated or begins to fade as prices stabilize.

- Follow macro developments and regulatory updates that could shift risk appetite and liquidity conditions across markets.

- Observe price action around major technical levels and liquidity at major exchanges, which can influence short-term volatility and trader positioning.

Sources & verification

- Santiment weekly summary on retail capitulation and bottom signals, including links to the full written report.

- Google Trends data showing rising searches for “crypto capitulation” during Feb 1–Feb 8, 2026.

- Bitcoin price data and 30-day performance from CoinMarketCap.

- On-chain and market commentary from analysts referencing capitulation dynamics and multiple capitulation events in bear markets.

- CryptoFear & Greed Index readings indicating current sentiment levels (Extreme Fear).

Crypto World

Crypto Retail Investors Are Trying To ‘Meta-Analyze’ Market

Retail investors are scrutinizing the crypto market for signs that it may have bottomed out to gauge when to buy more crypto assets, according to crypto sentiment platform Santiment.

“Retail traders are trying to meta-analyze the market, looking for signs of others quitting to time their own entries, which often happens near bottoms,” Santiment said in a report on Saturday.

Santiment has linked this to the word “capitulation,” which has become a top-trending crypto term on social media, according to the platform’s data.

The term describes investors selling their holdings out of fear that the market won’t recover, a scenario that analysts typically monitor when assessing whether the market has reached a bottom.

“Capitulation” may have already happened, says Santiment

“If everyone is waiting for ‘capitulation,’ the bottom might have already happened while they were waiting for a clearer sign,” Santiment said.

Meanwhile, Google Trends data shows searches for “crypto capitulation” rising from a score of 11 to 58 between the weeks ending Feb. 1 and Feb. 8.

Crypto investors are usually cautious about calling a market bottom too soon. History shows prices can keep falling even when most people think the worst is over.

Market analyst Caleb Franzen said in an X post on Saturday that while capitulation is the “word of the week,” many investors don’t understand that “bear markets typically experience multiple capitulation events.”

It comes as Bitcoin’s (BTC) price dropped as low as $60,000 on Thursday, a level it hasn’t seen since October 2024, amid its ongoing downtrend.

Some analysts are skeptical of the “cycle bottom”

Crypto analyst Ted said in an X post on Friday that “yesterday’s dump looks like capitulation, but it’s not the cycle bottom.”

Echoing a similar sentiment, crypto analyst CryptoGoos said, “We haven’t seen true Bitcoin capitulation so far.”

Related: Over 23% of traders now expect interest rate cut at next FOMC meeting

Over the past 30 days, Bitcoin has fallen 24.27%, trading at $68,970 as of publication, according to CoinMarketCap.

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, fell further into the “Extreme Fear” territory on Sunday, with a score of 7, signaling extreme caution among investors.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Tech1 day ago

Tech1 day agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports17 hours ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat1 day ago

NewsBeat1 day agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World3 days ago

Crypto World3 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World2 days ago

Crypto World2 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Fashion2 days ago

Fashion2 days agoKelly Rowland and Method Man Bring the Fashion for Relationship Goals Press Tour: Courtside in a Fringed TTSWTRS Jacket, Black and White Rowen Rose, Stella McCartney, and More!