Crypto World

Bitcoin ETFs add $88M, ending three-day outflow streak

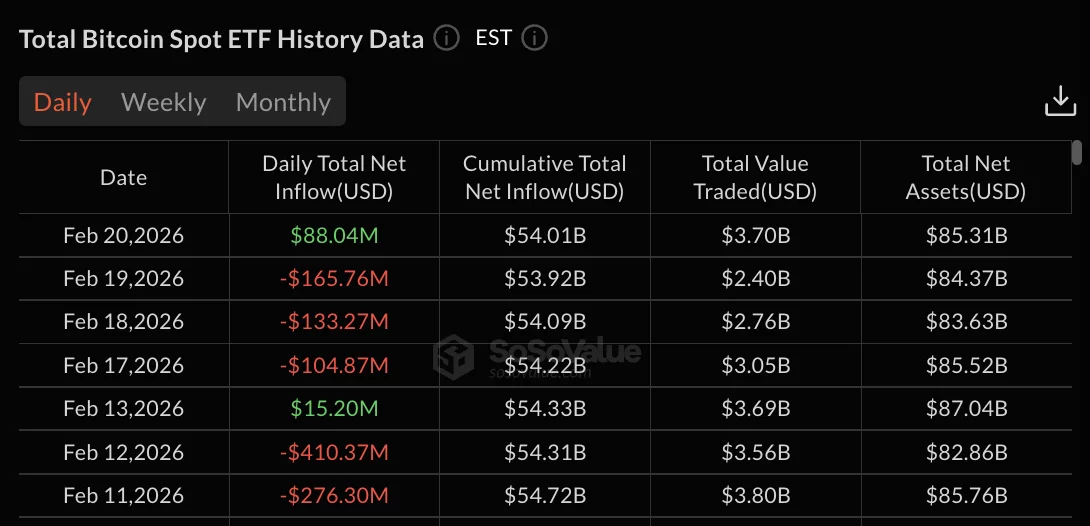

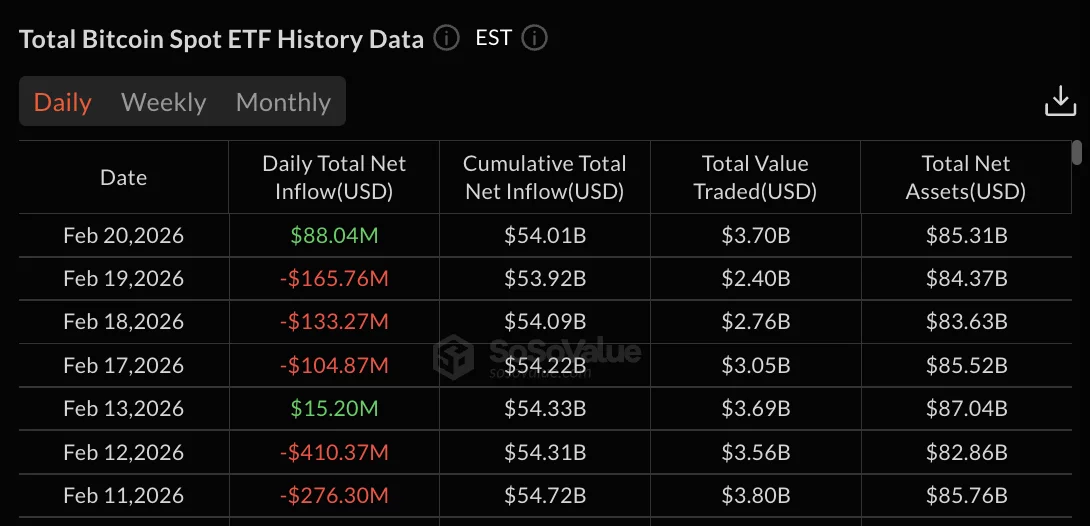

Bitcoin ETFs recorded $88.04 million in net inflows on February 20, breaking a three-day outflow streak that drained $403.90 million.

Summary

- Bitcoin ETFs post $88M inflows after three days of $403M outflows.

- IBIT and FBTC drive all flows as most funds remain inactive.

- Weekly redemptions continue with $315M leaving BTC products.

BlackRock’s IBIT led with $64.46 million while Fidelity’s FBTC attracted $23.59 million, with remaining funds posting zero flows.

Bitcoin (BTC) traded at $67,800 with minimal 24-hour movement after touching a low of $66,452 during the session.

Total net assets reached $85.31 billion while cumulative total net inflow stood at $54.01 billion.

Three-day Bitcoin ETF outflow streak totaled $403 million

February 17-19 posted consecutive days of redemptions before February 20’s reversal. February 19 recorded the largest single-day withdrawal at $165.76 million.

This was followed by February 18’s $133.27 million and February 17’s $104.87 million in outflows.

The selling pressure dropped total net assets from $87.04 billion on February 13 to $85.31 billion on February 20.

February 13’s $15.20 million inflow briefly interrupted the pattern before three days of sustained withdrawals resumed.

Most Bitcoin ETF products recorded zero activity on February 20, with only IBIT and FBTC posting flows.

Grayscale’s GBTC and mini BTC trust, along with Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all showed no movement.

BlackRock’s IBIT maintains $61.30 billion in cumulative net inflows. Fidelity’s FBTC holds $10.96 billion in total inflows.

Weekly outflows persist at $315 million

The week ending February 20 posted $315.86 million in net outflows and was the fourth consecutive weekly redemption period.

The week ending February 13 recorded $359.91 million in withdrawals, while the week ending February 6 saw $318.07 million in outflows.

Late January posted the heaviest weekly redemptions. The week ending January 30 drained $1.49 billion from Bitcoin ETFs, while the week ending January 23 recorded $1.33 billion in withdrawals.

The four-week outflow period from January 23 through February 20 totals approximately $2.48 billion.

Weekly trading volume reached $11.91 billion for the period ending February 20, down from $18.91 billion the previous week.

Crypto World

Here Is Why Aptos’ Structural Fixes Failed to Spark a Price Rally

TLDR:

- Aptos slashed staking rewards from 5.19% to 2.6%, cutting sell pressure on APT nearly in half immediately.

- The Aptos Foundation locked 210 million APT, removing roughly 18% of the total circulating supply from the market.

- Programmatic buybacks and a 32 million APT annual burn were introduced to create consistent token demand.

- Despite strong tokenomics reforms, the APT price saw no reaction due to weak retail interest and no clear narrative.

APT, the native token of the Aptos blockchain, recently received a major tokenomics upgrade. The changes addressed long-standing structural concerns around inflation and supply pressure.

However, the price showed little reaction following the announcement. Analysts point to a deeper problem rooted in weakened market confidence.

The fixes may improve the foundation, but demand has not followed. The central question now is whether these reforms came too late to matter this cycle.

What the Aptos Tokenomics Upgrade Actually Changed

Aptos cut staking rewards nearly in half, dropping from 5.19% to 2.6%. This move directly reduces the selling pressure that had weighed on APT for months.

The Aptos Foundation also locked 210 million APT, removing roughly 18% of the circulating supply. A hard cap of 2.1 billion tokens was also clarified for the market.

Beyond supply controls, the project introduced programmatic buybacks and a projected annual burn of 32 million APT. Grant issuance was shifted to a performance-based model, tightening how new tokens enter circulation.

Together, these changes represent a meaningful pivot in how the project manages its token economy. On paper, the reforms are serious and directly responsive to earlier criticism.

Crypto analyst account @ourcryptotalk noted the changes address structural issues it raised two months prior. The account stated that emissions cut nearly in half immediately reduces selling pressure.

It also noted the foundation lock removes roughly 18% of the circulating supply permanently. Buybacks, it added, create systematic demand.

Still, the market responded with indifference. Retail investors have not rotated into APT following the announcement.

Institutions have not signaled a clear preference for the asset either. On-chain activity has not produced the kind of demand shock that typically moves prices.

Why Price Ignored the News and What Comes Next

Markets generally do not reward projects for correcting past mistakes. The lack of price reaction reflects this well-established pattern in crypto.

Trust, once broken by poor tokenomics design and unlock cycles, requires more than adjusted numbers to rebuild. It requires a visible surge in usage and ecosystem activity.

Aptos also lacks a dominant narrative in the current market cycle. Move language is a technical feature, not a category-defining story.

Competing chains have captured niches in areas like real-world assets, gaming, and institutional infrastructure. Aptos has not yet claimed ownership of any single space.

Ourcryptotalk framed the remaining challenge clearly. The project needs live dashboards for burn, emissions, and buybacks to build transparency.

It also needs to route ecosystem fees into stakers or burns to make APT feel like true ownership. Without a killer narrative, the token risks fading even with improved supply mechanics.

If ecosystem growth accelerates while emissions remain suppressed, a supply squeeze could quietly develop. Without that growth, the tokenomics upgrade alone is unlikely to drive a sustained rally.

Crypto World

Official Trump (TRUMP) Soared 10% After POTUS Teased Alien Disclosure: Details Here

At one point, TRUMP’s market capitalization approached the psychological mark of $1 billion.

Several Trump-related meme coins experienced a significant resurgence on Friday, following an intriguing announcement made by the President of the United States.

However, the asset lost almost all gains in the following hours, perhaps driven by a blow against Trump from the US Supreme Court.

The Trump Effect or Just a Coincidence?

Official Trump (TRUMP) – the biggest meme coin related to the POTUS – jumped to almost $3.80 on Friday, its highest point since the beginning of February. Its market capitalization neared $900 million, solidifying it as the sixth-largest meme coin.

Other Trump-themed tokens, including Pepe Trump (PTRUMP), Super Trump (STRUMP), and SUI TRUMP (SUITRUMP), also headed north, albeit charting more modest gains.

Their revival coincides with the president’s pledge to direct the Secretary of War and other relevant departments to begin identifying and releasing government files concerning alien and extraterrestrial life. The topic has always fascinated the public, but a recent podcast featuring the former US leader Barack Obama has further amplified attention.

Asked about the existence of aliens, he affirmed they are real but clarified that he has never personally seen any. Moreover, Obama said they are not being kept at the notorious Area 51 “unless there’s this enormous conspiracy and they hid it from the president of the United States.”

It is important to note that Trump’s pledge on that front may not be the only factor fueling a resurgence for the aforementioned meme coins. The broader cryptocurrency market, where Bitcoin (BTC) and many altcoins have seen minor increases over the last 24 hours, could also have played a role.

You may also like:

What’s Next?

Some commentators on X noted TRUMP’s recent pump, suggesting it might have more fuel left for additional gains. The analyst who goes by the moniker Don claimed the meme coin “looks good,” hinting that its price structure signals potential upside to $13.29.

Nonetheless, investors and traders should be extremely cautious when dealing with such assets due to their infamous volatility. TRUMP, which saw the light of day in January last year, initially exploded above $70 only to crash by double digits mere days later.

The asset’s Relative Strength Index (RSI) also indicates a possible correction ahead. The technical analysis tool measures the speed and magnitude of recent price changes and provides traders with an idea of potential reversal points. It ranges from 0 to 100, with ratios around and above 70 suggesting the token is overbought and due for a pullback. On the other hand, anything below 30 is considered a buying opportunity. Currently, the RSI stands just south of the bearish zone.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Price Flashes Its Biggest Warning of 2026

Bitcoin price has rebounded more than 4% since February 19, helping it recover above $68,200. This bounce offered temporary relief after weeks of weakness. However, new technical and on-chain signals now show that Bitcoin may be approaching its most dangerous level of 2026.

A combination of bearish chart structure, heavy supply clusters below price, and rising leverage risk suggests a deeper correction could begin soon.

Bitcoin’s 8-hour chart currently shows a head-and-shoulders pattern. This is a bearish reversal structure that forms when price creates three peaks, with the middle peak higher than the others. It signals weakening buying strength and increasing selling pressure.

At the same time, Bitcoin has formed a hidden bearish divergence between February 6 and February 20. During this period, the Bitcoin price created a lower high, meaning the recovery failed to fully regain its previous peak.

However, the Relative Strength Index, or RSI, formed a higher high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

RSI measures buying and selling momentum on a scale from 0 to 100. When RSI rises, but price fails to rise equally, it shows that buying strength is weakening. This pattern often appears before price declines or pullbacks.

The biggest risk now comes from Bitcoin’s on-chain cost basis levels. Data from the UTXO Realized Price Distribution, or URPD, shows that the largest supply cluster sits at above $66,800. This level holds 3.17% of Bitcoin’s total circulating supply.

Another major cluster sits at $65,636, holding an additional 1.38% of supply.

These levels are important because they represent prices at which many investors bought Bitcoin. If Bitcoin falls below these levels, holders may begin selling to avoid losses. This can accelerate the price decline quickly.

Together, these clusters represent more than 4.5% of Bitcoin’s supply concentrated just below the current price. This creates a high-risk zone directly under Bitcoin’s support. That explains the biggest price warning

If Bitcoin closes below this region, the head-and-shoulders pattern realization could gain strength.

Rising Leverage and ETF Outflows Increase Liquidation Threat

Derivatives data shows rising liquidation risk as Bitcoin rebounded. Open interest, which measures the total value of active futures positions, has increased from $19.54 billion on February 19 to about $20.71 billion now, during the bounce.

This means more traders have entered leveraged positions during the recovery.

At the same time, funding rates have turned positive. Funding rates are payments between long and short traders. Positive funding means more traders are betting on price increases. This creates a dangerous situation.

If the Bitcoin price starts falling, these leveraged long positions may be forced to close. This triggers a long squeeze, where bullish traders are pushed out of their positions. Such forced exits can create a liquidation cascade, adding extra selling pressure and accelerating the price drop.

Institutional sentiment also remains weak. Spot Bitcoin ETFs have now recorded five consecutive weeks of net outflows. This shows that institutional investors are still withdrawing capital rather than accumulating.

This reduces support during price declines.

Bitcoin Price Faces Critical Test Below Institutional Resistance

Bitcoin also remains below its monthly Volume Weighted Average Price, or VWAP, which sits near $70,000. VWAP represents the average price weighted by trading volume. Monthly VWAP is widely used as a proxy for institutional cost basis.

When Bitcoin trades below VWAP, it means the average institutional position is currently at a loss. This often causes institutions to reduce exposure or avoid new buying, explaining the ETF apathy.

A recovery above $70,000 would signal renewed institutional strength. But as long as Bitcoin stays below this level, recovery attempts may remain limited, and the broader structure remains bearish.

On the downside, Bitcoin’s first key support sits near $67,300. If this level breaks, the next support appears at $66,500, followed by $65,300. These levels align closely with the major supply clusters mentioned earlier. Failure to hold these levels could trigger the larger head-and-shoulders breakdown near the $60,800 neckline.

A breakdown can then trigger a price breakdown target of over 7.5%, hinting at a target price of $56,000, in the near-to-mid-term.

On the upside, Bitcoin must reclaim $68,200 to stabilize its short-term structure. However, a full recovery would require reclaiming the $70,000 VWAP level.

Crypto World

Feed Every Gorilla (FEG) Marks Five Years of Decentralized Finance Infrastructure Development

[PRESS RELEASE – Dubai, UAE, February 20th, 2026]

Feed Every Gorilla (FEG), a decentralized finance infrastructure project established in 2021, marks its five-year anniversary, reflecting continued development of blockchain-based protocol infrastructure designed to support decentralized token ecosystems and on-chain financial systems.

Since its launch, FEG has focused on developing transparent and verifiable smart contract infrastructure intended to support decentralized finance participants. Over the past five years, the project has implemented multiple protocol improvements, strengthened its contract architecture, and completed independent security audits to support system integrity and operational reliability.

A central component of the ecosystem is the SmartDeFi Launchpad, a decentralized protocol framework designed to support token creation, deployment, and lifecycle management through transparent on-chain mechanisms. The infrastructure enables developers to deploy and manage tokens within a structured protocol environment designed to improve accessibility and consistency across decentralized ecosystems.

As part of its ongoing roadmap, SmartDeFi’s bonding curve infrastructure is currently in the final stages of testing. This protocol-level mechanism is designed to introduce structured liquidity functionality directly within token infrastructure. The SmartDeFi Launchpad is also preparing for expansion across additional EVM-compatible blockchain networks, supporting broader developer participation and ecosystem accessibility.

The five-year milestone represents continued protocol development and infrastructure expansion, as FEG focuses on supporting decentralized finance through transparent, blockchain-based systems.

About Feed Every Gorilla (FEG)

Feed Every Gorilla (FEG) is a decentralized finance infrastructure project focused on developing blockchain-based protocol frameworks and tools designed to support decentralized token ecosystems. Established in 2021, the project develops infrastructure for token deployment, on-chain trading systems, and decentralized ecosystem management.

Its core protocol, the SmartDeFi Launchpad, provides decentralized infrastructure for token creation and lifecycle management using transparent smart contract systems. FEG’s development efforts emphasize verifiable on-chain functionality, protocol transparency, and ongoing infrastructure advancement.

The project continues to expand its infrastructure and protocol capabilities to support decentralized finance participants, developers, and blockchain ecosystems globally.

Website: https://FEG.io

Launchpad: https://SmartDeFi.com

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin, Ether Hold Strong as Trump Announces Additional Universal 10% Tariff

Cryptocurrency markets showed resilience Friday after US President Donald Trump unveiled a new universal 10% tariff on imports, even as the policy followed a Supreme Court decision blocking his earlier use of emergency economic powers.

Key Takeaways:

- Crypto prices held steady despite Trump announcing a new 10% universal tariff.

- The Supreme Court blocked the use of emergency powers, but the administration shifted to other trade laws.

- Unlike past trade tensions, markets reacted cautiously with no major selloff in Bitcoin or Ether.

Bitcoin traded near $67,800 during the session, while Ether held around $1,960, according to data from CoinMarketCap.

Broader crypto conditions remained steady, with the total digital asset market capitalization hovering around $2.33 trillion and sentiment indicators continued to reflect caution rather than panic.

Trump Orders 10% Global Tariff Using New Legal Authority After Court Ruling

Trump sharply criticized the court’s ruling during a press conference, calling the decision “ridiculous,” and said his administration would proceed using alternative legal authorities.

“Effective immediately… I will sign an order to impose a 10% Global tariff under Section 122 over and above our normal tariffs already being charged,” he said, adding that national security tariffs under Sections 232 and 301 would remain in force.

The Supreme Court earlier ruled that the White House lacked authority to impose tariffs under the International Emergency Economic Powers Act (IEEPA) during peacetime.

In its opinion, the court emphasized that the Constitution grants Congress, not the executive branch, the power to levy duties and taxes, noting no previous administration had used the statute to enact tariffs of comparable scale.

Tariffs have historically unsettled risk assets, including equities and digital currencies, as trade disputes tend to tighten liquidity expectations and cloud economic forecasts.

Previous tariff announcements from Washington have often triggered rapid selloffs across global markets.

This time, however, crypto traders appeared to take a measured stance. Bitcoin showed only marginal intraday changes and Ethereum posted small gains over 24 hours, while major tokens such as XRP and BNB also moved modestly.

Trump had previously imposed tariffs of 25% on certain imports from Canada and Mexico and 10% on Chinese goods, citing national security and trade deficit concerns.

The court rejected those justifications under the emergency statute, but the administration’s new order relies on longstanding trade laws, including the Trade Expansion Act of 1962 and the Trade Act of 1974.

Bitcoin Loses 25,000 Millionaire Addresses Under Trump

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The pullback was less severe among the largest holders. Addresses with more than $10 million in Bitcoin declined by about 12.5%, indicating that top-tier investors were better able to withstand price volatility, while wallets near the millionaire threshold were more exposed to market swings.

Much of the increase in Bitcoin millionaire addresses occurred before Trump took office, driven by a late-2024 rally fueled by election-related optimism and expectations of deregulation.

The post Bitcoin, Ether Hold Strong as Trump Announces Additional Universal 10% Tariff appeared first on Cryptonews.

Crypto World

MARA Takes Controlling Stake in French AI Data Center Operator Exaion

MARA Holdings has completed the purchase of a majority stake in French computing infrastructure operator Exaion, deepening its push into artificial intelligence (AI) and cloud services.

The deal, first agreed in August 2025 with EDF Pulse Ventures, gives MARA France a 64% stake in Exaion after required regulatory approvals were secured, the Bitcoin miner said in a Friday announcement. French energy giant EDF will remain a minority shareholder and continue as a customer of the business.

The investment also creates a broader alliance. NJJ Capital, the investment vehicle of telecom entrepreneur Xavier Niel, will acquire a 10% stake in MARA France as part of a partnership with MARA.

Governance of Exaion will reflect the new ownership structure. The company’s board will include three representatives from MARA, three from EDF Pulse Ventures and one from NJJ, alongside Exaion’s chief executive and co-founder. Niel and MARA CEO Fred Thiel will both hold seats on the board.

Related: Bitcoin miners chase 30 GW AI capacity to offset hashprice pressure

Bitcoin miners pivot to AI amid pressure

Bitcoin mining companies are increasingly turning to AI and data center computing as pressure on mining economics grows. After the 2024 halving cut block rewards and rising network difficulty squeezed margins, several publicly traded miners began adopting a hybrid model, keeping mining as a source of cash flow while building steadier revenue from AI cloud and high-performance computing services.

HIVE Digital Technologies is one example of the shift. The company reported strong results even during weaker Bitcoin prices, supported by expanding AI operations. CoreWeave has also moved from crypto mining to become a major AI infrastructure provider after GPU mining demand fell.

Other firms, including TeraWulf, Hut 8, IREN and MARA, are also repurposing mining facilities and energy capacity into AI data centers.

In November last year, CleanSpark announced plans to raise roughly $1.13 billion in net proceeds, up to $1.28 billion if additional notes are purchased, through a $1.15 billion senior convertible note offering to fund expansion of its Bitcoin mining and data center operations.

Related: Crypto miner Bitdeer tanks 17% after $300M debt offering

Bitcoin mining difficulty jumps 15%

Meanwhile, Bitcoin’s mining difficulty rose about 15% to 144.4 trillion on Friday, reversing an 11% drop earlier in the month, the steepest decline since China’s 2021 mining ban. The earlier fall followed severe winter storms across the United States that disrupted power grids and temporarily forced many miners offline, sharply reducing hash rate.

While the higher difficulty reinforces Bitcoin’s security, it also raises the computing effort needed to mine new blocks, adding further margin pressure on operators already dealing with rising costs.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Uniswap Founder Slams Scam Crypto Ads After Victim ‘Lost Everything’

Hayden Adams, founder of the decentralized exchange Uniswap, has warned users about fraudulent ads impersonating the platform, highlighting a case in which a victim reportedly lost everything.

It comes after January saw the highest amount of money stolen in crypto scams in 11 months.

“Scam ads keep returning despite years of reporting,” Adams said in an X post on Friday. “There were scam Uniswap apps while we waited months for App Store approval,” he said.

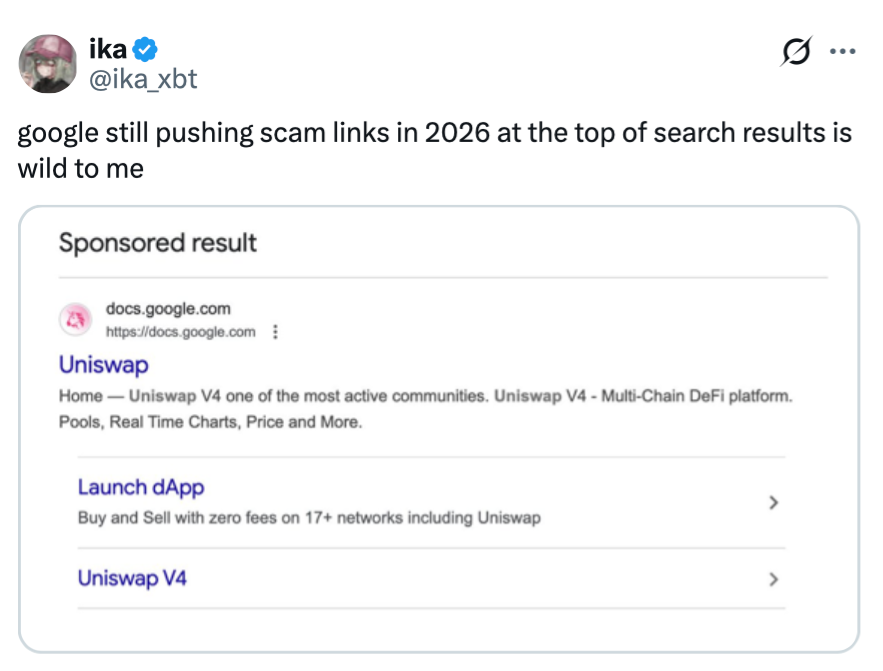

Scammers are increasingly buying ads on popular search engines targeting keywords like “Uniswap,” so when crypto users search for it, the top result looks official.

Unsuspecting users may then connect their wallets and approve a transaction, allowing scammers to drain their entire funds.

A consequence of a “long chain of bad decisions”

An X user named “Ika” said in an X article, titled “I lost everything, what’s next?” that his crypto wallet, valued in the mid-six-figure range, was drained despite his extreme care. “Disciplined for two years. Half-searching for a web3 job, half-hoping to make it fast enough not to need one,” he said.

“I believe that getting drained isn’t bad luck. It’s the final consequence of a long chain of bad decisions,” Ika said.

The lengthy post on X came shortly after he posted a screenshot of a top Google search result with an inauthentic Uniswap link.

It isn’t the first time that Uniswap has experienced this issue. In October 2024, Cointelegraph reported that scammers recognized the website’s lack of domain authority and created a version of the site that looks exactly like the real one, except that it featured a “connect” button where “get started” should have been and a “bridge” button where “read the docs” should have been.

Related: Dutch authorities call on Polymarket arm to cease activities

More recently, the value of cryptocurrency stolen through exploits and scams reached $370.3 million last month, the highest monthly figure in 11 months and a nearly fourfold rise from January 2025.

Crypto security company CertiK said that of the 40 exploit and scam incidents over January, the majority of the total value stolen came from one victim that lost around $284 million due to a social engineering scam.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Dutch Authorities Call on Polymarket’s Dutch Arm to Cease Activities

The Dutch gambling regulator has taken aim at a cryptocurrency-forward prediction platform, targeting its local arm for offering unlicensed gambling to residents. The Netherlands Gambling Authority accused Adventure One of Polymarket of marketing event-based bets without the required license, prompting a formal order to halt activities immediately and warning of steep penalties should the injunction be ignored. The action underscores the tension between innovative online prediction markets and national licensing regimes, a friction that regulators in multiple jurisdictions continue to scrutinize as crypto-based products gain traction. The enforcement also arrived amid broader domestic policy debates in the Netherlands over how to tax crypto investments, a topic that could reshape the financial landscape for digital assets if a proposed 36% capital gains tax clears the legislature and becomes law in 2028. Within days of the decision, lawmakers moved forward on the tax plan, framing the issue as part of a wider effort to bring crypto activity under clearer fiscal rules. The clash between a global platform and national regulators highlights how cross-border prediction markets navigate divergent legal environments while seeking to scale in regulated markets.

Key takeaways

- Netherlands Gambling Authority ordered Adventure One to cease “immediately,” with fines potentially reaching $990,000 for non-compliance.

- The regulator cited specific bets on local Dutch elections as part of the illegal offerings, noting no response from Polymarket to enforcement requests.

- Polymarket’s leadership signaled openness to dialogue with state authorities while federal courts in the United States weigh jurisdictional questions.

- Within a week of the Polymarket action, the Dutch House of Representatives advanced a 36% capital gains tax on investments that would likely include crypto assets, signaling growing tax scrutiny for digital assets.

- The case sits at the intersection of evolving regulation for prediction markets, global licensing regimes, and jurisdictions asserting control over the terrain where crypto-based bets live.

Tickers mentioned:

Sentiment: Neutral

Price impact: Negative. The immediate enforcement and potential fines constrain the operator’s Dutch activities and signal regulatory risk for similar platforms operating in the Netherlands.

Market context: The dispute unfolds as global authorities tighten oversight of prediction markets and crypto-related platforms, with U.S. regulators asserting jurisdiction even as state actions proliferate. The Netherlands’ move dovetails with ongoing debates over crypto taxation and licensing frameworks that influence international operators’ strategic choices.

Why it matters

The Netherlands’ abrupt intervention against Adventure One spotlights how prediction markets — platforms that allow users to place bets on future real-world events — are navigating a patchwork of national licenses and prohibitions. While such markets have expanded in several jurisdictions, unlicensed activity can trigger swift enforcement actions, creating a precedent for other operators that might be testing the boundaries of local gaming or securities law. The regulator’s decision emphasizes that even platforms with international footprints must respect domestic licensing rules when offering gambling products to residents, a principle that could shape the regulatory calculus for similar ventures across Europe and beyond.

For Polymarket, the event underscores a broader strategic risk: regulatory buy-in in some regions remains elusive, and the firm faces potential legal and financial penalties if it does not align its offerings with local requirements. The company has framed the tension as a jurisdictional question, signaling willingness to engage with authorities as courts in the United States weigh how such prediction markets should be regulated at the federal level. This stance reflects a broader industry pattern where operators seek clarity on how cross-border platforms can operate under varied regulatory regimes while safeguarding consumer protections and licensing standards. The tension between innovation and regulation is unlikely to dissipate soon, given the volume of political and regulatory attention on crypto-enabled financial products.

Beyond the enforcement action, the episode intersects with a domestic policy thread: the push to tax crypto investments more aggressively. The Dutch House of Representatives has moved forward with a proposal that would impose a 36% capital gains tax on investments, a category that would likely capture the gains from crypto trading and related digital-asset bets. If enacted and signed into law, the measure could take effect as early as 2028, reshaping the financial calculus for individuals participating in crypto markets, including those who engage in prediction-market activities. The regulatory and fiscal shifts together could influence where operators focus their growth efforts and how they structure user access to markets that hinge on real-world events, such as elections or policy announcements.

Analysts watching the Netherlands’ regulatory environment note that this action aligns with a broader global pattern: authorities are increasingly categorizing certain online prediction markets as gambling or financial products that require licensing, consumer protections, and robust compliance programs. The tension between federal regulatory ambitions in the United States and state-level experimentation adds another layer of complexity for platforms that operate in multiple jurisdictions. As policymakers weigh the appropriate boundaries for prediction markets, stakeholders anticipate continued legal disputes and evolving licensure requirements that will shape the architecture of future, crypto-enabled betting platforms.

For readers following the regulatory frontier, the Dutch case serves as a cautionary tale about the need to verify a platform’s licensing status before participating in event-based bets. It also highlights the importance of transparent engagement with regulators, as policymakers weigh how to balance innovation with consumer protection and tax compliance in a rapidly changing digital asset landscape.

What to watch next

- Polymarket’s formal response to the Dutch order and any subsequent steps the platform takes to address licensing concerns.

- Possible updates to the Dutch crypto tax framework and whether the 36% capital gains tax advances to become law in 2028.

- Potential regulatory alignments or conflicts between Dutch authorities and U.S. regulators as jurisdictional questions around prediction markets persist.

- Any future enforcement actions in the Netherlands or other EU states targeting unlicensed gambling or prediction-market activity.

Sources & verification

- Kansspelautoriteit (Dutch Gambling Authority) notice: “last onder dwangsom voor illegaal kansspelaanbod Polymarket” — https://kansspelautoriteit.nl/last-onder-dwangsom-voor-illegaal-kansspelaanbod-polymarket

- US CFTC leadership statements defending prediction markets — https://cointelegraph.com/news/cftc-michael-selig-defending-prediction-markets

- Polymarket commentary on jurisdiction and dialogue with states — https://x.com/HereComesKumar/status/2020845618789265743

- Polymarket-related lawsuit coverage and regulatory questions — https://cointelegraph.com/news/polymarket-s-lawsuit-could-decide-who-regulates-us-prediction-markets

- Dutch House advances 36% crypto tax — https://cointelegraph.com/news/dutch-house-advances-36-tax-law

What the story means for markets and regulation

The Netherlands’ move against Adventure One is a reminder that prediction markets, while innovative, remain squarely under regulatory scrutiny. As authorities in different jurisdictions refine licensing regimes and tax policies, platforms will need robust compliance programs to operate across borders. The broader regulatory backdrop — including ongoing debates about crypto taxation and jurisdictional authority over prediction markets — will likely influence how market participants structure bets, manage risk, and engage with policymakers in the months and years ahead. For investors and users, the episode reinforces the imperative to assess regulatory risk and to monitor statements from regulators and platform operators alike as the global landscape for crypto-enabled markets continues to evolve.

What to watch next

- Regulatory updates from the Netherlands on licensing for online betting and crypto-related platforms, including potential licensing reforms.

- Any official response from Polymarket regarding the Dutch order and its approach to compliance in Europe.

- Regulatory clarifications in the United States as courts weigh jurisdiction over prediction markets and enforcement actions expand at the state level.

Crypto World

Small investors, or shrimps, are buying BTC. But it’s the whales who keep rallies going.

For much of this month, bitcoin has been trading around the mid-$60,000s. That much is humdrum.

The interesting bit is a developing split in coin ownership that could shape what happens next.

Data from Santiment shows the number of wallets holding less than 0.1 BTC, a level typically associated with retail investors, has increased by 2.5% since the largest cryptocurrency hit a record high in October. The growth has pushed the so-called shrimps’ share of supply to its highest since mid-2024.

In practice, though, it’s the larger holders known as whales and sharks who tend to set the tone for price direction. Those investors, with wallets holding between 10 and 10,000 BTC, went the other way, dropping about 0.8%.

It’s the kind of split that tends to produce choppy, frustrating price action rather than clean trends.

Retail provides a floor and can spark short-term momentum. Rallies that stick require bigger players who are prepared to buy whatever’s on offer.

The divergence is especially notable because the picture looked different just a few weeks ago.

After bitcoin cratered toward $60,000 on Feb. 5 — a drawdown of more than 50% from its October peak — Glassnode’s Accumulation Trend Score climbed to 0.68, the strongest broad-based reading since late November, as CoinDesk reported earlier in the month.

Glassnode’s metric measures the relative strength of accumulation across different wallet sizes by factoring in both entity size and the amount of BTC accumulated over the past 15 days. A score closer to 1 signals accumulation, while a score closer to 0 indicates distribution.

During the flash, the 10-to-100 BTC cohort was the most aggressive dip buyer, and the data suggested the market was shifting from capitulation into something more synchronized.

Santiment’s wider lens complicates that reading. Its 10-to-10,000 BTC band captures a much broader slice of large holders than Glassnode’s dip-buying cohort, and across that full range, net positioning since October is still negative.

One way to reconcile the two takes: mid-sized wallets may have genuinely bought the panic while the largest holders kept distributing into every recovery, dragging the aggregate number down.

It matters because bitcoin doesn’t need retail to show up. Retail is already here.

What it needs is for the distribution from large wallets to stop, or better yet, reverse. Without that, every rally risks being sold into by the very cohort that needs to provide structural demand if it is to succeed.

The shrimps are doing their part. They are waiting for the whales join in.

Crypto World

What Pioneers Need to Know

There’s only one step left until the v20 version.

Pi Network’s Core Team took it to X at the end of the business week to announce the latest blockchain update that was successfully migrated. The protocol v19.6 has been implemented, leaving version 19.9, which is next in line, the only one left before the highly-anticipated v20.

The announcement also urged nodes to ensure they had upgraded to comply with the new version.

Network Update: Protocol v19.6 migration successfully completed ✅ Next up is v19.9 — the final step before v20. Node operators should make sure they’re upgraded and stay tuned for further instructions: https://t.co/mnbwVzhaD9

— Pi Network (@PiCoreTeam) February 20, 2026

Nodes, The Update Is Here

Recall that the team first outlined the upcoming series of upgrades last week, stating that the Pi nodes have until February 15 to complete their migration to remain connected to the network once it’s implemented.

In the explanatory post dedicated to nodes, the team described them as the “fourth role within the Pi ecosystem,” which needs to operate on laptops and desktop computers rather than mobile devices. Similar to nodes in other blockchains, they have to validate transactions and maintain the distributed ledger by reaching consensus on the order of transactions.

However, there’s a difference between Pi Network’s nodes and those operating on proof-of-work systems, such as Bitcoin. Since Pi employs a consensus mechanism derived from the Stellar Consensus Protocol (SCP), nodes from trusted groups, known as quorum slices, validate transactions only when trusted peers agree.

It’s worth noting that security circles created by mobile miners form a global trust graph that helps determine which nodes can participate in validation.

You may also like:

Build for Accessibility

The Core Team also emphasized another difference between nodes on different blockchains and those operating within the Pi ecosystem. They explained that Pi Network’s entire concept is to work under a user-centric design where even less technically savvy Pioneers can install the Pi Node desktop application and enable or disable node participation with a simple interface.

The team noted that this method aligns with Pi’s strategy of “progressive decentralization,” which allows the network to evolve toward full decentralization while remaining accessible to everyday users.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion13 hours ago

Fashion13 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show

Gavin Newsom isn’t mincing words:

Gavin Newsom isn’t mincing words: