Crypto World

Bitcoin ETFs See $331M Inflows as BTC Recovers Above $70K

Bitcoin ETFs recorded $330.67 million in net inflows on February 6, ending a three-day outflow streak that drained $1.25 billion from products.

Summary

- Bitcoin ETFs recorded $330.7M in inflows on Feb. 6, ending a $1.25B outflow streak.

- BlackRock’s IBIT led with $231.6M as BTC rallied 6.6% above $70,000.

- Ethereum ETFs diverged with $21.4M in outflows, led by BlackRock’s ETHA.

BlackRock’s IBIT led with $231.62 million in inflows. At the same time, Ark & 21Shares’ ARKB has brought in $43.25 million and Bitwise’s BITB posted $28.70 million in inflows.

The reversal came as Bitcoin (BTC) price climbed 6.6% over 24 hours and quickly fell to the $67,000 level.

Total net assets under management rose to approximately $105 billion from $80.76 billion on February 5, while cumulative total net inflow reached $54.65 billion. VanEck’s HODL and Fidelity’s FBTC showed no updated data for the trading session.

February 2-5 posted $1.25B in Bitcoin ETFs redemption

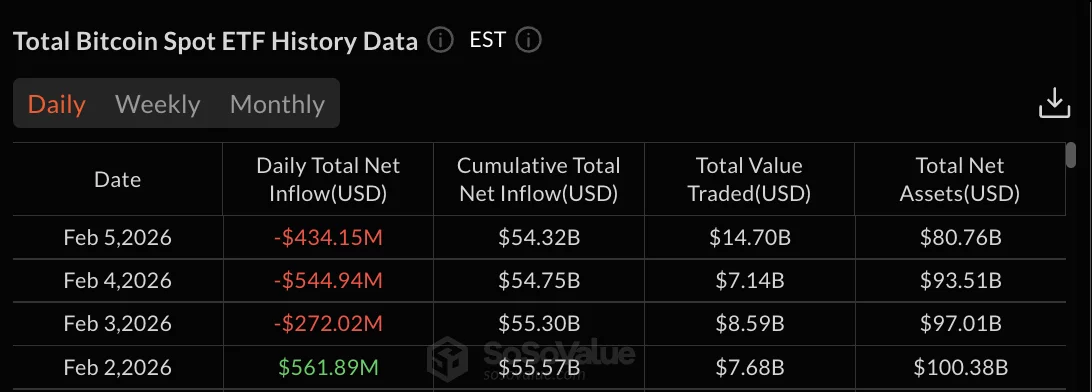

The three-day selling wave began February 3 with $272.02 million in outflows, followed by the streak’s largest single-day withdrawal of $544.94 million on February 4.

February 5 recorded $434.15 million in Bitcoin ETFs redemptions before buying pressure resumed.

February 2 briefly interrupted the selling with $561.89 million in inflows, but failed to establish sustained surge.

Total net assets fell from $100.38 billion on February 2 to a low of $80.76 billion on February 5 before recovering with February 6’s inflows.

Grayscale’s mini BTC trust attracted $20.13 million while the primary GBTC product recorded zero flows. Invesco’s BTCO posted $6.97 million in inflows. Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero activity.

BlackRock’s IBIT maintains $61.84 billion in cumulative net inflows. Grayscale’s GBTC holds -$25.88 billion in net outflows since converting from a trust structure.

Fidelity’s FBTC has accumulated approximately $11.08 billion in cumulative inflows based on available data.

Ethereum posts $21 million in outflows as BlackRock withdraws

Ethereum spot ETFs recorded $21.37 million in net outflows on February 6 despite Bitcoin’s reversal to positive flows.

BlackRock’s ETHA accounted for $45.44 million in redemptions, offsetting positive flows from four other products.

Bitwise’s ETHW led Ethereum inflows with $11.80 million, followed by Grayscale’s mini ETH trust at $6.80 million, VanEck’s ETHV at $3.01 million, and Invesco’s QETH at $2.45 million. Grayscale’s ETHE, Franklin’s EZET, and 21Shares’ TETH recorded zero flows.

Total net assets for Ethereum products fell to $10.90 billion from $13.69 billion on February 2. Cumulative total net inflow dropped to $11.80 billion.

Ethereum has posted outflows in three of the past four trading days, with February 4 and 5 recording $79.48 million and $80.79 million in withdrawals respectively.

February 3 provided brief relief with $14.06 million in inflows before redemptions resumed.

Crypto World

Tron Joins the AAIF Governing Board to Help Support Agentic AI Adoption

Justin Sun’s Tron network has joined the Agentic AI Foundation to prepare and support the widespread adoption of AI agents.

In an announcement on Monday, Tron’s decentralized autonomous organization (DAO) revealed that the Tron network has signed on as a member of the Agentic AI Foundation (AAIF) and will serve on its governing board.

Tron DAO said that there will be significant demand coming from agentic AI in the future, and as such, it requires collaboration and interoperability to establish systems that can handle “continuous, high-volume, low-value transactions efficiently at scale.”

“Interoperable frameworks are expected to play an important role in ensuring that AI agents can operate across platforms and services without creating fragmented ecosystems,” the DAO said.

Last month, Stripe CEO and co-founder Patrick Collison and co-founder John Collison said there is a significant infrastructure gap in blockchain and said significant scaling improvements would be required to meet this incoming demand.

“By supporting the development of open infrastructure through the Foundation, TRON DAO aims to contribute to collaborative standards that make AI agents easier to build, safer to operate, and more accessible,” it added.

The AAIF is run by the Linux Foundation and was designed to promote open-source agentic AI development, alongside helping establish industry standards for governance, safety, and interoperability. Tron joins the likes of Circle and JPMorgan in jumping on board the AAIF.

Tron’s 2026 focus is AI, says founder

Sun last month said that AI will “definitely” be a key focus for the network this year, arguing that Tron’s speed, scalability, and low fees are prime for hosting agentic AI transactions.

Related: Using AI at work is causing ‘brain fry,’ researchers say

Sun indicated that the network is working on building infrastructure and collaborating to support AI demand. One recent example is the Bank of AI, a financial layer built for AI agents by AINFT, which first launched on Tron and BNB Chain in mid-February.

DeFiLlama data indicates that Tron currently tops the charts in terms of revenue generated by all blockchains across the past 24 hours, seven days, and 30 days, at $1.01 million, $6.54 million and $25.58 million apiece.

Earlier this month, Sun indicated that some of the revenue is being driven by AI.

“AI is scaling fast. When agents transact, demand shows up in the network metrics. TRON keeps leading on real usage,” he said.

Magazine: AI won’t make you rich but crypto games might, Axie founder steps down: Web3 Gamer

Crypto World

Vitalik Buterin outlines ‘DVT-lite’ plan to simplify distributed Ethereum staking

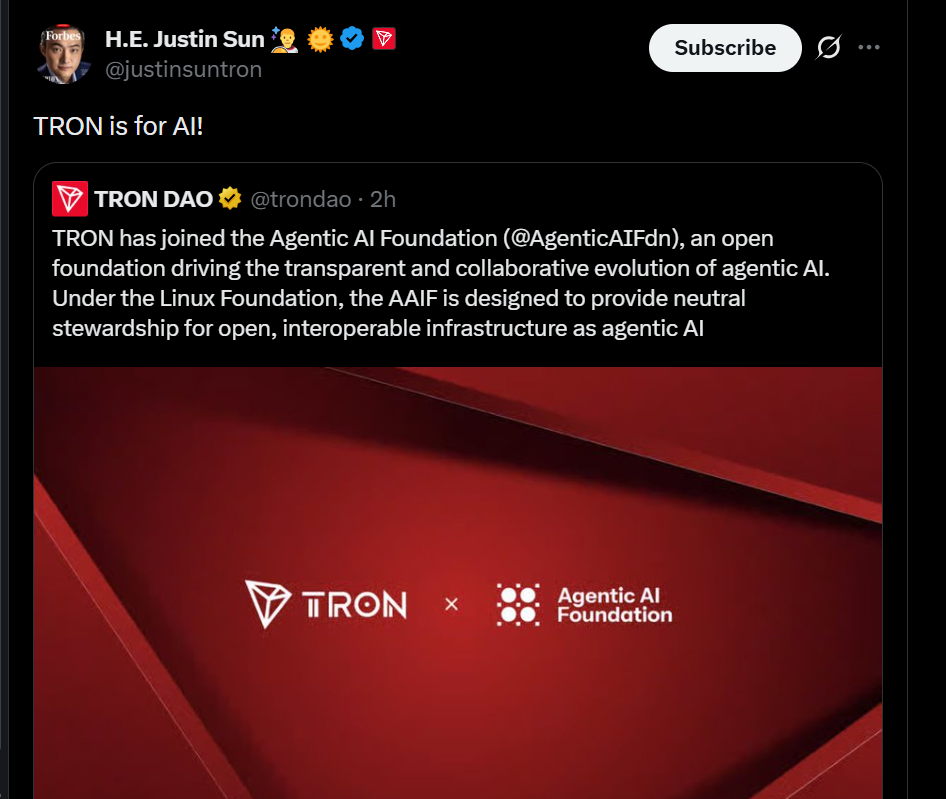

Vitalik Buterin has outlined a plan to simplify distributed staking infrastructure on Ethereum, arguing that running validator nodes should not require specialized technical expertise.

Summary

- Vitalik Buterin outlined a “DVT-lite” approach designed to simplify distributed Ethereum staking infrastructure.

- He argued that complex validator setups are “anti-decentralization” and should be replaced with easier deployments.

- The goal is to enable simple, near “one-click” distributed staking, particularly for institutions holding large amounts of ETH.

In a recent social media post, Buterin discussed how the Ethereum Foundation is using a simplified “DVT-lite” setup to stake 72,000 ETH, describing the effort as part of a broader push to make distributed validator technology easier to deploy.

Distributed validator technology, or DVT, allows multiple machines or operators to collectively run a validator using a shared key, rather than relying on a single server or operator. The approach is widely viewed as a way to improve network resilience and reduce the risk of validator outages.

Buterin said his goal is to make deploying such infrastructure “maximally easy,” particularly for institutions that hold significant amounts of Ether but may lack the technical capacity to operate complex validator systems.

“My hope for this project is that in the process, we can make it maximally easy and one-click to do distributed staking for institutions,” he wrote.

Under the concept he described, node operators could run a validator through a simple containerized setup, such as a Docker container or a similar environment. Each participating node would use the same validator key and automatically discover the other nodes in the cluster.

Once the nodes connect, the networking setup and distributed key generation process would run automatically before staking begins.

Buterin also criticized the perception that operating blockchain infrastructure requires professional-level expertise.

“The idea that running infrastructure is this scary complicated thing where each person participating must be a ‘professional’ is awful and anti-decentralization,” he said.

According to Buterin, simplifying distributed validator deployment could help spread authority over Ethereum staking across a wider set of participants. He added that he personally plans to use the setup and hopes more large Ether holders will adopt similar distributed staking configurations.

Crypto World

Bhutan moves $11M in Bitcoin as Arkham flags fresh sovereign transfer

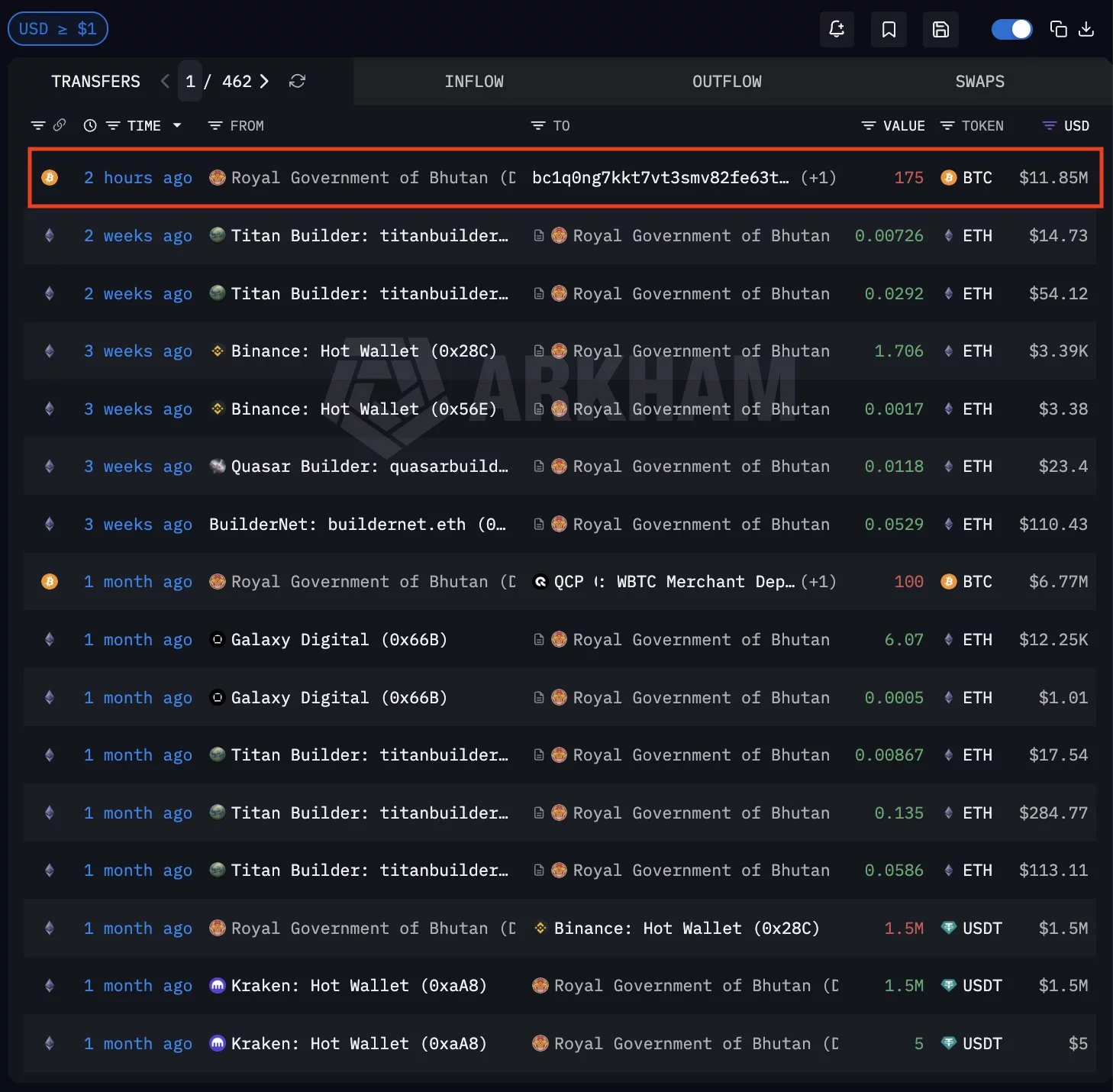

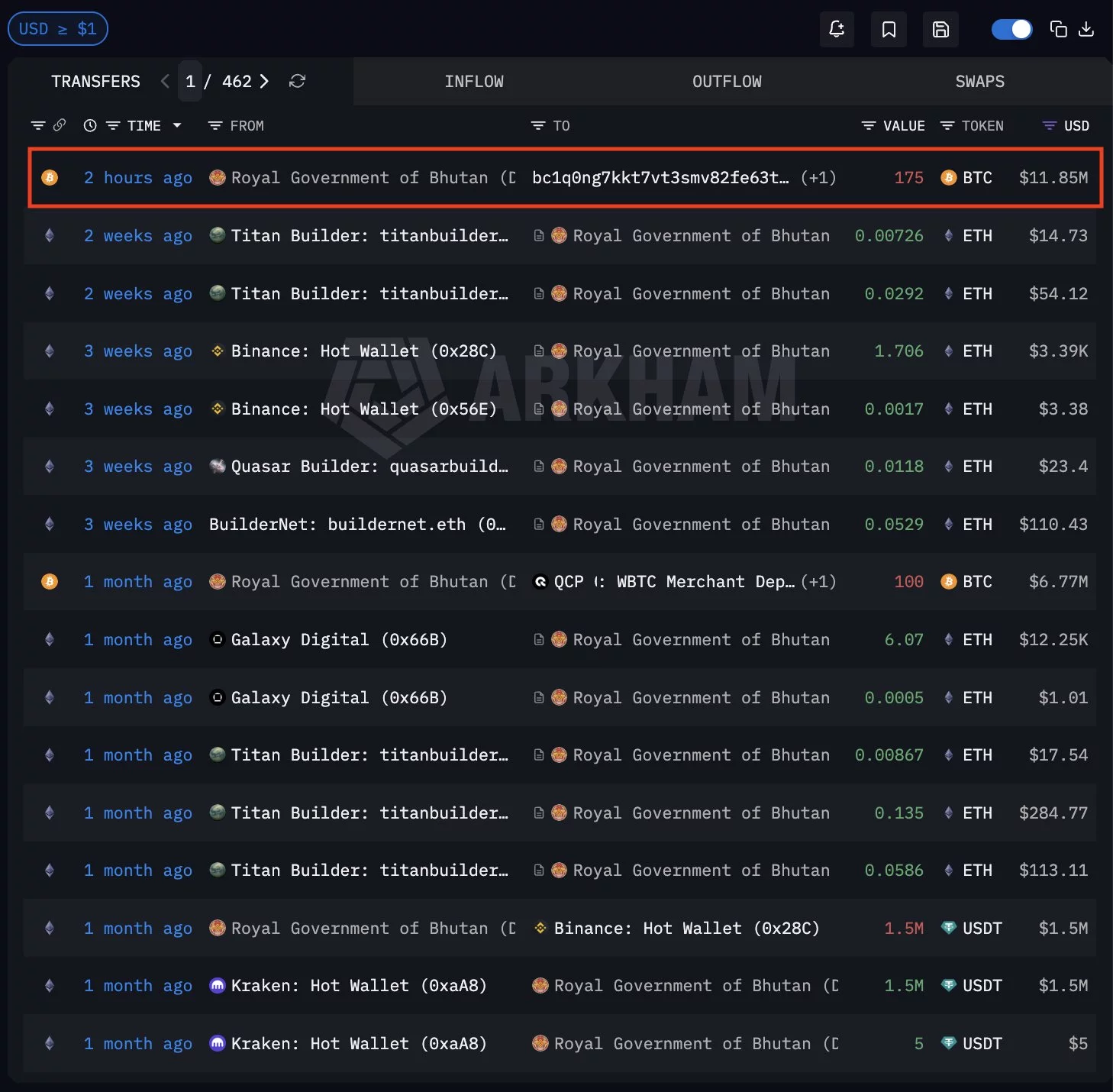

Bhutan has transferred roughly $11 million worth of Bitcoin from wallets linked to its sovereign holdings, according to blockchain analytics firm Arkham Intelligence.

Summary

- Bhutan moved about $11 million in Bitcoin, according to Arkham Intelligence on-chain data.

- The transfer follows a $7 million BTC sale through QCP Capital roughly a month earlier.

- Bhutan typically sells $5M–$10M BTC clips, maintaining a structured treasury management strategy.

Arkham flagged the movement in a recent post on X, stating that Bhutan moved the funds out of its main holding addresses, continuing a pattern of periodic transfers tied to the country’s crypto treasury activity.

The analytics platform noted that the last similar transfer occurred about a month ago, when Bhutan sold approximately $7 million worth of Bitcoin (BTC) through QCP Capital, a digital asset trading firm often used by institutional market participants.

Arkham also observed that Bhutan typically sells portions of its Bitcoin holdings in smaller clips ranging from $5 million to $10 million, rather than executing large single liquidations. The firm previously identified a particularly heavy period of selling activity between mid and late September 2025.

The latest movement continues a broader pattern of on-chain activity from Bhutan-linked wallets that has drawn attention across crypto markets.

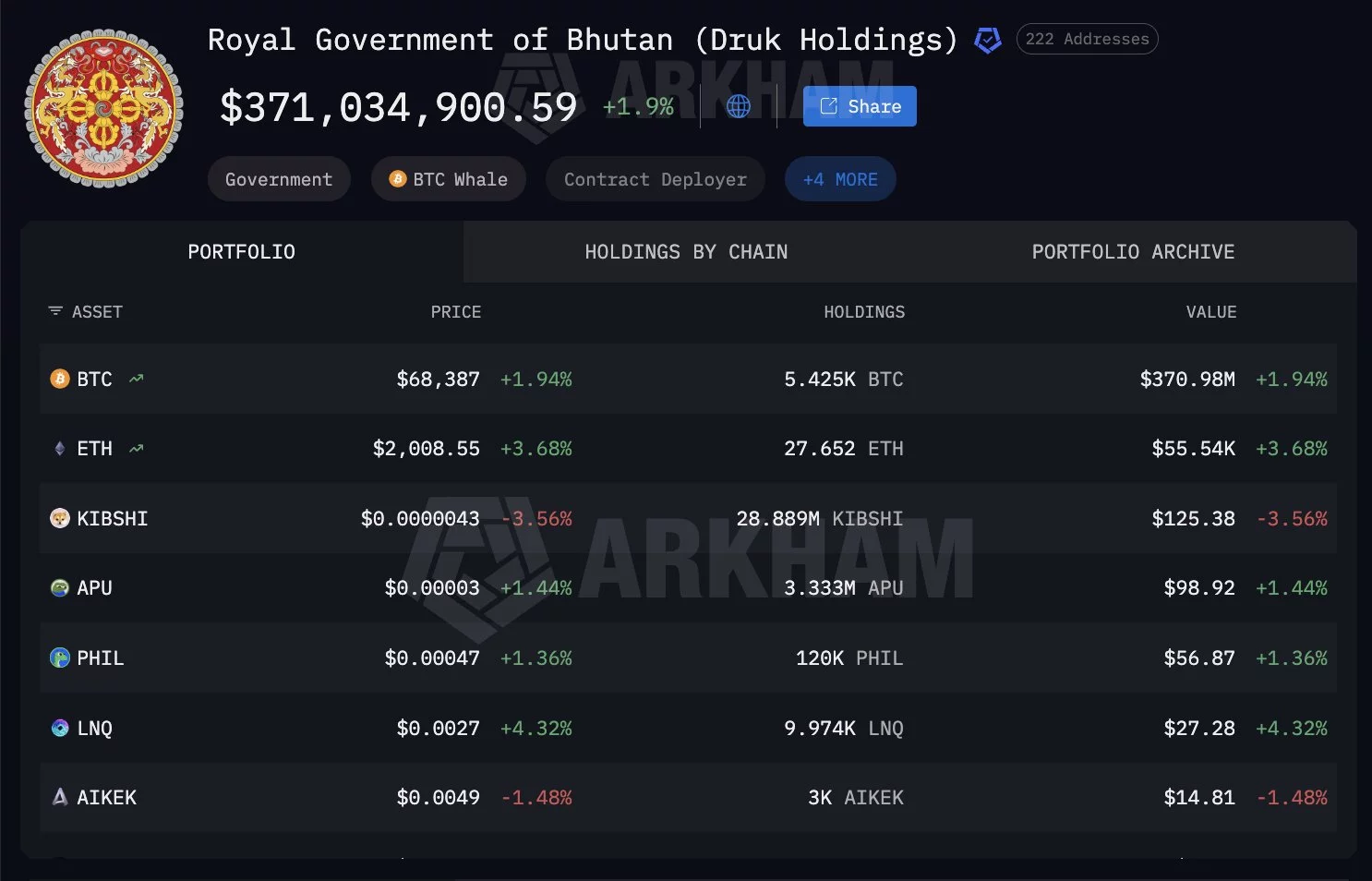

Despite these periodic sales, Bhutan remains one of the largest sovereign Bitcoin holders. Arkham-tracked wallets show the country still holding around 5,600 BTC, valued at hundreds of millions of dollars.

Bhutan’s Bitcoin reserves largely originate from state-backed mining operations powered by hydroelectric energy, which have allowed the Himalayan kingdom to accumulate a sizable digital asset treasury in recent years.

Crypto World

Bhutan Moves $11.8M in BTC From National Reserves: Arkham

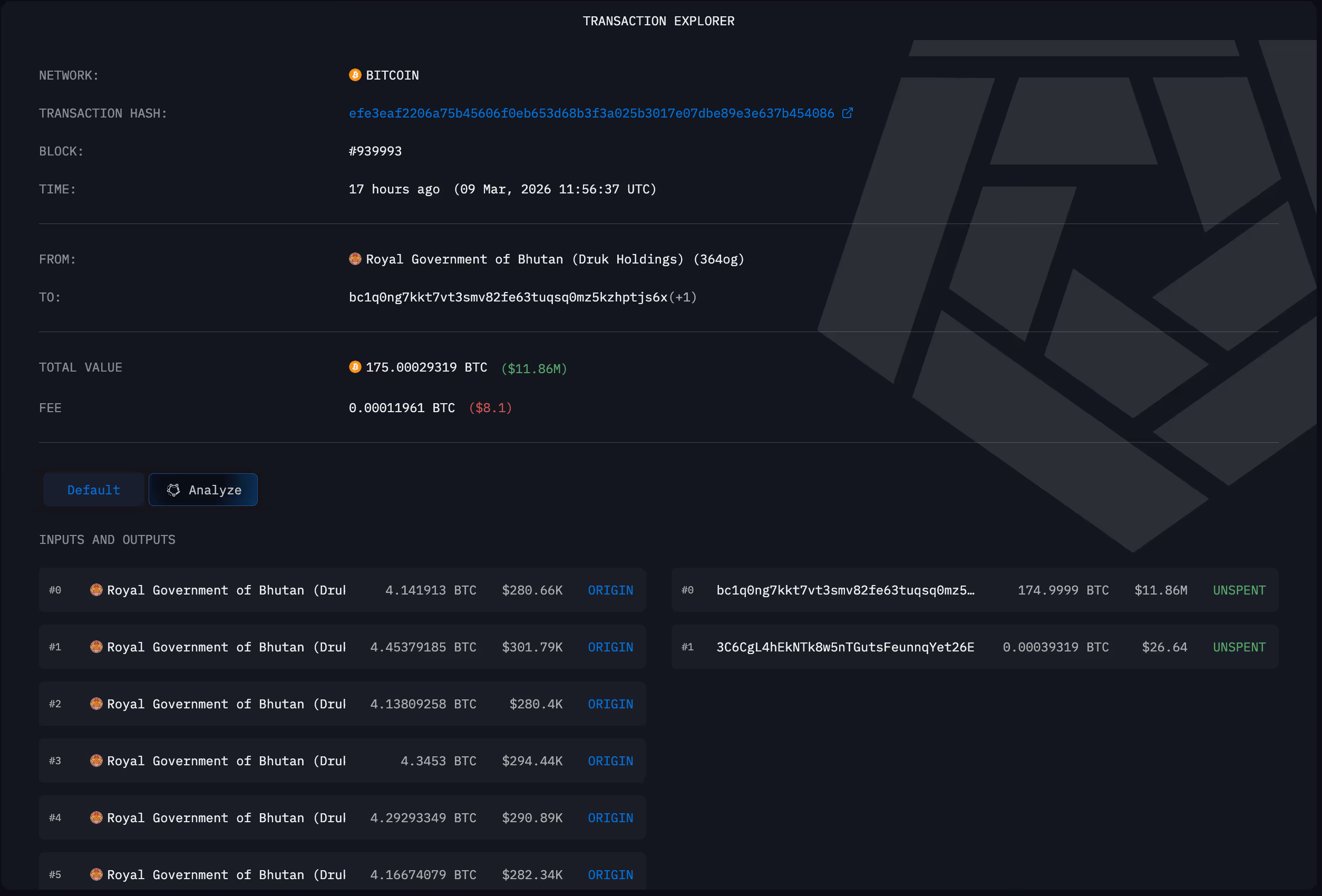

Bhutan’s sovereign investment arm quietly adjusted its Bitcoin reserve on Monday, moving a block of 175 BTC from the kingdom’s primary holding wallet to a newly created address. The transaction, valued at around $11.85 million at the time, arrived as cryptocurrency markets posted modest gains, suggesting tactical reallocation rather than a wholesale shift in policy. blockchain analytics firm Arkham tracked the transfer, noting the destination address had previously received 184 BTC from the same source within a month and has since begun to show a steady rhythm of activity. The earlier 184 BTC were sent to a third address that, in aggregate, has received about 1,910 BTC since 2024 and currently holds 126 BTC.

In a post on X, Arkham highlighted Bhutan’s handling pattern, pointing out that the last time the country moved a similar amount of Bitcoin — in February — it sold around $7 million of BTC in collaboration with QCP Capital. The kingdom has already conducted several sales this year, a pattern Arkham described as “clips of $5–10 million,” with a notably heavier selling period around mid-late September 2025. These colorations come as part of Bhutan’s ongoing effort to translate a sovereign crypto reserve into tangible services, a strategy that has drawn scrutiny and curiosity from market observers and policymakers alike. Read more.

Current estimates place Bhutan’s total crypto holdings at roughly 5,400 BTC, a figure that positions the country as the seventh-largest state-backed holder. By comparison, the United States remains the largest state holder with about 328,372 BTC. These rankings underscore the growing footprint of national-level crypto treasuries, even as market dynamics—such as the post-2024 halving environment—continue to exert influence on liquidity and strategy. In addition to Bitcoin, Bhutan’s sovereign fund, Druk Holding and Investments, holds a modest mix of other digital assets, including 28 ETH and 28 KiboShib, a memecoin linked to AI themes.

Druk Holding and Investments, Bhutan’s state-backed wealth manager, has long integrated energy economics into its crypto program. Bhutan’s hydropower surplus during the summer months has enabled the country to sustain mining activity, a practice the government began in 2019. Yet the 2024 halving, which trimmed block rewards to 3.125 BTC, pressed mining economics and pushed operators toward broader tech services, including artificial intelligence and high-performance computing, as miners sought alternative revenue streams. The country’s approach has been described as a balancing act—leveraging surplus energy to generate revenue while managing the risk profile of a volatile asset class.

Public commentary from Bhutan’s leadership has framed Bitcoin mining as a means to fund public services. In comments to international media, Bhutan’s Prime Minister noted that revenue from the reserve has supported healthcare, environmental initiatives, and public servant salaries. That framing aligns with a broader narrative of state actors trying to retain strategic leverage over volatile assets while maintaining social returns. Still, the movement of large BTC blocks underscores the ongoing challenge of governance in sovereign crypto programs: how to synchronize reserve management with the need for liquidity and transparency.

As miners and investable assets migrate toward more diversified implementations of compute power, Bhutan’s case sits at the intersection of energy policy, national finance, and crypto economics. A growing cohort of governments is watching how state-held BTC interacts with public budgets and national energy strategies, especially in jurisdictions with abundant renewable resources and robust hydropower capacity. The narrative surrounding Bhutan’s holdings—both the 175 BTC transfer and the broader 5,400 BTC stake—illustrates how state actors are choreographing exposures to a volatile asset class while attempting to translate holdings into measurable public benefits.

Beyond Bitcoin, the country’s asset mix reflects a cautious diversification approach. The 28 ETH holding indicates a level of exposure to Ethereum-based ecosystems, while the presence of KiboShib signals an interest in tokenized AI-themed narratives, albeit in relatively small quantities. These positions are managed under the umbrella of Druk Holding and Investments, which maintains an evolving, data-driven approach to how the reserves are deployed and reported. The transparency of transfers—documented through blockchain explorers and corroborated by analytics firms—adds a layer of accountability that is increasingly expected of state-backed crypto programs.

For observers, Bhutan’s latest move comes amid a broader market backdrop that includes ongoing scrutiny of national crypto reserves and a shifting mining landscape shaped by the halving dynamics and energy costs. As the world’s capital flows into digital assets evolve, sovereign activity offers a rare, high-level lens on how governments view Bitcoin and related tokens as strategic resources rather than mere commodities. The path forward will likely involve a combination of measured selling, careful allocation to select assets, and continued investment in energy-based mining capacity and AI-enabled services.

Source tracing remains critical: Arkham’s public notes on the transfer pattern, along with blockchain explorer data tracing addresses bc1q0ng7kkt7vt3smv82fe63tuqsq0mz5kzhptjs6x and bc1q73fm7mkd2ces69gchq7xp5td5yzwa085al9gku, offer precise visibility into how Bhutan is moving assets. The country’s public communications—through interviews and media coverage—also reinforce the idea that its crypto holdings are being managed with a view toward social outcomes, not merely financial returns. As this conversation unfolds, analysts will be watching for the next set of moves, especially any announcements around future sales windows and the evolution of the reserve’s asset mix.

Why it matters

The case of Bhutan’s Bitcoin reserve is a signal of growing state-level engagement with digital assets. It demonstrates that sovereign actors are not only accumulating Bitcoin but also managing the cadence of sales to fund public initiatives. The transparency afforded by on-chain data—paired with analytics from firms like Arkham—provides a rare lens into how a state-backed treasury navigates volatility, liquidity requirements, and public accountability.

Moreover, Bhutan’s energy-backed mining strategy highlights how countries with abundant renewable resources can align economic activity with national energy policy. The hydropower surplus used to fund mining and, by extension, public services, offers a model where environmental assets and digital assets intersect. As the 2024 halving reshaped mining economics, Bhutan’s pivot toward a broader compute economy—AI and high-performance computing services—illustrates a practical response to lower issuance rewards while maintaining capacity to monetize energy-derived flows.

For investors and researchers, the Bhutan narrative underscores the importance of data provenance in sovereign crypto markets. The combination of on-chain transfers, official statements, and third-party analyses creates a holistic picture of how a nation-state approaches holdings in a volatile asset class. It also raises questions about governance, governance disclosures, and how future policy could integrate crypto reserves with broader national finance strategies.

What to watch next

- Monitor any additional transfers from Bhutan’s main reserve to new addresses, including potential batching patterns in the coming quarters.

- Track whether Bhutan continues to divest, especially around anticipated selling windows in September 2025 and beyond.

- Observe movements in Bhutan’s non-BTC holdings (ETH and KiboShib) for signs of broader diversification or strategic shifts.

- Watch for public statements or budgetary disclosures that link reserve activity to specific social programs or healthcare initiatives.

Sources & verification

- Arkham’s public notes on Bhutan’s transfer pattern and the February sale with QCP Capital, available via the Arkham post and X thread (Arkham).

- Blockchain explorer data for the addresses involved in the transfers: bc1q0ng7kkt7vt3smv82fe63tuqsq0mz5kzhptjs6x and bc1q73fm7mkd2ces69gchq7xp5td5yzwa085al9gku (address details, address details).

- Al Jazeera interview and reporting on Bhutan’s use of Bitcoin proceeds for public services (Al Jazeera).

- Cointelegraph reporting on Bhutan’s reserve activity and prior sales (Cointelegraph).

- Bitcointreasuries government holdings page for comparison with the U.S. position (Bitcoin Treasuries).

- Druk Holding and Investments’ public data on Bhutan’s asset management and energy-linked mining strategy (Arkham Intel).

Key details

Tickers mentioned: $BTC, $ETH

Crypto World

Bhutan sells $42.5 Million of BTC in 2026 as national stack drops 58% from peak

The tiny country of Bhutan is quietly selling its bitcoin, and the stack is getting thinner each month.

The Royal Government of Bhutan moved 175 BTC worth $11.85 million late on Monday, according to Arkham Intelligence data, moving assets to the same bc1q wallet address that received 184 BTC worth $14.09 million in February. It suggests a consistent OTC or treasury management counterparty.

The activity is done by Bhutan’s state-owned investment arm, Druk Holding and Investments (DHI), which spearheads the country’s BTC mining operations.

The February activity was more extensive than a single transfer. Arkham’s outflow data shows four separate moves that month: the 184 BTC transfer, two sends to QCP Capital’s merchant deposit address totaling roughly 200 BTC worth $15 million combined, and a $1.5 million USDT transfer to a Binance hot wallet.

That’s about $30.7 million in February alone, followed by Monday’s $11.85 million, bringing 2026 outflows to roughly $42.5 million.

The QCP Capital transfers stand out as sending bitcoin to a trading firm’s deposit address twice in one month is more active than simple treasury drawdowns. It suggests OTC selling or structured liquidity management rather than just moving coins between cold wallets.

The balance history chart tells a bigger story, however.

Bhutan’s stack peaked around 13,000 BTC in late 2024, built up over several years through state-backed hydroelectric mining. The drawdown began in earnest after October 2024 and has been steep.

From 13,000 to roughly 5,400 is a 58% reduction in coins. The dollar value has been hit twice, by the selling and by bitcoin’s decline from around $119,000 at the peak to $69,000 today.

What was likely a position worth over $1.5 billion at its height is now $374 million.

In December, Bhutan unveiled a national Bitcoin Development Pledge committing up to 10,000 BTC to fund Gelephu Mindfulness City, a special economic zone designed to use digital assets for its financial reserves.

Bhutan mined its coins using surplus hydropower, which means the cost basis is effectively zero. Unlike Strategy or corporate treasuries that bought at market prices, there’s no break-even math pressuring these sales. Every transfer is profit.

The Arkham balance chart shows the full arc. A slow build from near zero in early 2021, steady accumulation through the bear market, a ramp to roughly 13,000 BTC by late 2024, and then a sharp decline that hasn’t let up.

The transfers have gone to the same counterparties in similar sizes without any obvious correlation to specific price moves, which looks more like a treasury running a planned drawdown than a holder getting shaken out.

Druk holdings did not immediately reply to CoinDesk’s request for comment in Asian morning hours.

Crypto World

Pudgy Penguins launches its Club Penguin moment, and the game doesn’t feel like crypto at all

Pudgy Penguins shipped its flagship game to the general public on Monday, and the most notable thing about it is that you wouldn’t know it had anything to do with crypto unless someone told you.

Pudgy World, the browser-based game first announced at Art Basel in late 2023, went live with 12 unique towns across a world called The Berg, narrative quests where players help a penguin named Pengu find someone named Polly, and a set of mini-games.

CoinDesk played a 10-minute session and came away with a simple takeaway. It’s smooth, responsive, intuitive, and clearly not built with a crypto-first user in mind.

The game could be pure Club Penguin nostalgia for some users. The game was Disney’s browser-based virtual world that ran from 2005 to 2017 and peaked at over 200 million registered users, mostly kids who customized penguin avatars and played mini-games.

It remains the template for what a mass-market penguin game looks like, and the comparison Pudgy World could be measured against in the broader audience.

The NFT gaming space has spent years producing products that feel like wallets with gameplay bolted on. Pudgy World goes the other direction, building something that works as a game first and connects to the token economy second.

Whether that translates to retention and revenue is a different question, but the UX approach is a deliberate break from the pattern.

The PENGU token responded, jumping 9% on the day. Pudgy Penguin NFT floor prices held flat in ETH terms, though ether itself was up 5%, meaning the dollar-denominated floor rose with it.

The broader context is that crypto gaming has mostly failed to produce anything people actually want to play. Projects that led with token incentives attracted mercenary farmers who left the moment monetary yields dried up.

Pudgy’s bet is that building an audience through toys, memes, and brand affinity first, then giving that audience a game, works better than the other way around.

One game launch doesn’t prove the thesis. But shipping a product that feels like a game rather than a DeFi dashboard is further than most NFT projects have gotten.

Crypto World

Here’s how traders and big buyers played bitcoin during the oil shock

The Iran war and oil surge rocked global equity markets this month. Yet bitcoin barely budged — because large traders, institutional flows and sizeable wallet holders stepped in during the dips, keeping demand firm even as traditional markets wobbled.

Major oil benchmarks, Brent and WTI, have surged 30% this month, trading above $100 per barrel early Monday. The massive surge has weighed heavily on Asian equity markets and also caused downside volatility in Asian and European equities.

Bitcoin, however, has risen nearly 4% to $70,200 this month, according to CoinDesk data. The market has been propped by large traders snapping up BTC over-the-counter (OTC) in a privately negotiated deal, according to Paul Howard, senior director at high-frequency trading firm and liquidity provider Wincent.

“The demand has been driven by some large over-the-counter [OTC] trades, positioning for a swift end to the conflict in Iran, and also MSTR’s acquisition. The timing of which, with the geopolitical events, may be an indicator of confidence returning to risk assets,” Howard said in an email to CoinDesk.

OTC desks are private trading venues where buyers and sellers can execute large cryptocurrency transactions without going through public exchanges. Instead of placing orders on open order books, trades are negotiated directly between parties or facilitated by a broker. Large traders and institutions typically trade over-the-counter to avoid influencing the spot market price.

Howard also highlighted renewed investor interest in the popular “carry trade,” where traders short (bearish bet) Strategy (MSTR) stock while buying bitcoin ETFs at the same time. The strategy profits if BTC rises faster than MSTR falls, allowing traders to hedge risk while still benefiting from bitcoin’s moves.

Speaking of ETFs, the 11 U.S.-listed funds have registered net inflows of over $700 million this month, according to data source SoSoValue. That’s a sign of renewed institutional appetite for the cryptocurrency.

“Institutional flows have also turned supportive. Spot Bitcoin exchange-traded funds have seen net inflows of around $1.7 billion since late February. This reversed a stretch of outflows that lasted roughly four months. For the March 8-10 period, flows contributed to a weekly net inflow of about $568 million,” Vikram Subburaj, CEO of India-based Giottus exchange, said.

Nexo, meanwhile, pointed to Strategy’s continued accumulation of bitcoin as a major bullish factor. The Nasdaq-listed firm purchased 17,994 BTC between March 2 and March 8, boosting its total holdings to 738,731 BTC.

The latest purchase matches several days’ worth of new bitcoin entering the market.

“The network has now surpassed 20 million BTC mined, leaving fewer than 1 million coins to be issued. At roughly 450 BTC per day, incremental supply remains limited. Strategy added 17,994 BTC, equivalent to approximately five weeks of issuance, bringing its holdings to roughly 3.7% of the circulating supply,” Nexo’s analyst Iliya Kalchev told CoinDesk.

Demand also funneled through bullish on-chain activity.

“Larger wallets holding more than 1,000 BTC added roughly 0.3% to their balances during recent dips. This points to prudent accumulation during periods of weakness,” Vikram Subburaj said.

He added that more than 400,000 BTC recently changed hands between $60,000 and $70,000.

Crypto World

Roman Storm reacts as U.S. prosecutors push for October retrial in Tornado Cash case

Tornado Cash developer Roman Storm reacted after federal prosecutors in the Southern District of New York asked a judge to schedule an October retrial on two criminal counts that a jury previously failed to resolve.

Summary

- SDNY prosecutors requested an October retrial for Tornado Cash developer Roman Storm on two unresolved charges.

- A prior jury deadlocked on money-laundering and sanctions counts after a four-week trial.

- Storm says the two counts carry up to 40 years in prison if he is ultimately convicted.

U.S. prosecutors push for second trial of Roman Storm after jury deadlock

In a letter filed with U.S. District Judge Katherine Polk Failla, prosecutors requested that the court set a new trial date in October to retry Storm on conspiracy to commit money laundering and conspiracy to violate U.S. sanctions. These are the two charges on which jurors were unable to reach a unanimous verdict after weeks of testimony and deliberation.

The filing follows Storm’s earlier trial in Manhattan, which lasted roughly four weeks. At the conclusion of the proceedings, a 12-member jury returned a split outcome, reaching a verdict on one count while deadlocking on the two remaining charges.

As the jury could not reach a unanimous decision on those counts, the court declared a mistrial on them.

Prosecutors now argue that the unresolved charges should be retried before a new jury and proposed October as the timeframe for the proceedings.

Storm publicly responded to the filing in a social media post, saying the government was seeking another trial despite the earlier jury deadlock. He noted that jurors had been unable to reach a unanimous decision on the money-laundering and sanctions-related counts after hearing the full case presented by prosecutors.

According to Storm, the two unresolved counts together carry a potential sentence of up to 40 years in federal prison if a future jury were to convict.

“The 2 counts = up to 40 years in federal prison. For writing open-source code. For a protocol I don’t control. For transactions I never touched. A jury already couldn’t agree this was criminal. But the SDNY prosecutors want to keep trying with the hope of getting a different answer,” Storm wrote on Twitter.

Storm, who helped develop the privacy protocol Tornado Cash, also said the prospect of another trial poses significant financial challenges for his defense. He stated that his legal defense funds had largely been exhausted after the initial four-week trial.

Judge Failla has not yet ruled on the prosecutors’ request to set a new trial date or issued a schedule for how the case will proceed.

Crypto World

Bitcoin’s Leverage Ratio Drops Sharply

Excess leverage in crypto markets has virtually dissappeared which could result in a healthier spot-based market recovery, say analysts.

Global tensions, particularly the Iran-US conflict, have rattled crypto markets and pushed investors away from risk-taking.

“Periods like this are generally not favorable for risk-taking, and this can be clearly observed in the sharp decline of Bitcoin’s Estimated Leverage Ratio on Binance,” said CryptoQuant analyst Darkfost on Monday.

The metric measures the intensity with which investors use leverage and is calculated by comparing the futures Open Interest (OI) with the amount of BTC reserves held on the exchange. Since February, this ratio has fallen sharply from 0.198 to 0.152 — coinciding with Bitcoin dropping from $96,000to $69,000.

A Healthier Market Dynamic

If the ratio remains low while Bitcoin consolidates, it likely signals that spot buying rather than leveraged speculation is becoming the dominant price driver, which is a generally healthier dynamic.

“Lower leverage generally means less systemic pressure, which can help stabilize price action before the market enters a new directional phase.”

🗞️Bitcoin leverage reset after market volatility

“Since February, Bitcoin’s Estimated Leverage Ratio on Binance has dropped from 0.198 to 0.152, representing a significant and rapid decline. This type of move is typically observed after periods of strong volatility and major… pic.twitter.com/q1MVOR5CZa

— Darkfost (@Darkfost_Coc) March 9, 2026

In a separate post, CryptoQuant analyst “IT tech” said that “bottom callers are multiplying.” One metric just hit 29 consecutive days in distress territory, they added, highlighting the Bitcoin long-term holder-to-short-term holder SOPR ratio, which is at 0.89.

“Recent buyers are underwater. LTHs aren’t selling, but they’re not absorbing either. STH capitulation building, but nowhere near extremes. Calling a structural low here is premature.”

Meanwhile, Glassnode reported on Monday that momentum has “firmed modestly,” with RSI lifting from recent lows, “but price action still lacks the strength of a decisive bullish shift.”

“Spot activity remains subdued, with lower trading volume pointing to softer participation even as conditions begin to stabilize.”

Crypto Market Outlook

Spot markets have climbed 4.3% on the day to reach $2.46 trillion in a move that follows US President Trump’s comments that the war with Iran could be “over soon.” Bitcoin reclaimed $70,000 in early trading in Asia on Tuesday as oil prices tanked 28% from Monday’s high of $120.

You may also like:

Ether remained weak, but it was holding above the $2,000 level at the time of writing. Meanwhile, some altcoins were seeing larger gains, including Hyperliquid and Zcash, which surged more than 11% each.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

US to Retry Roman Storm After Mixed Verdict

US prosecutors have requested a retrial of crypto mixer Tornado Cash co-founder Roman Storm after a jury failed to reach a unanimous verdict on two charges at his trial last year.

US Attorney for Manhattan Jay Clayton asked federal Judge Katherine Polk Failla in a letter on Monday for a trial date to retry Storm on charges of conspiracy to commit money laundering and conspiracy to violate sanctions.

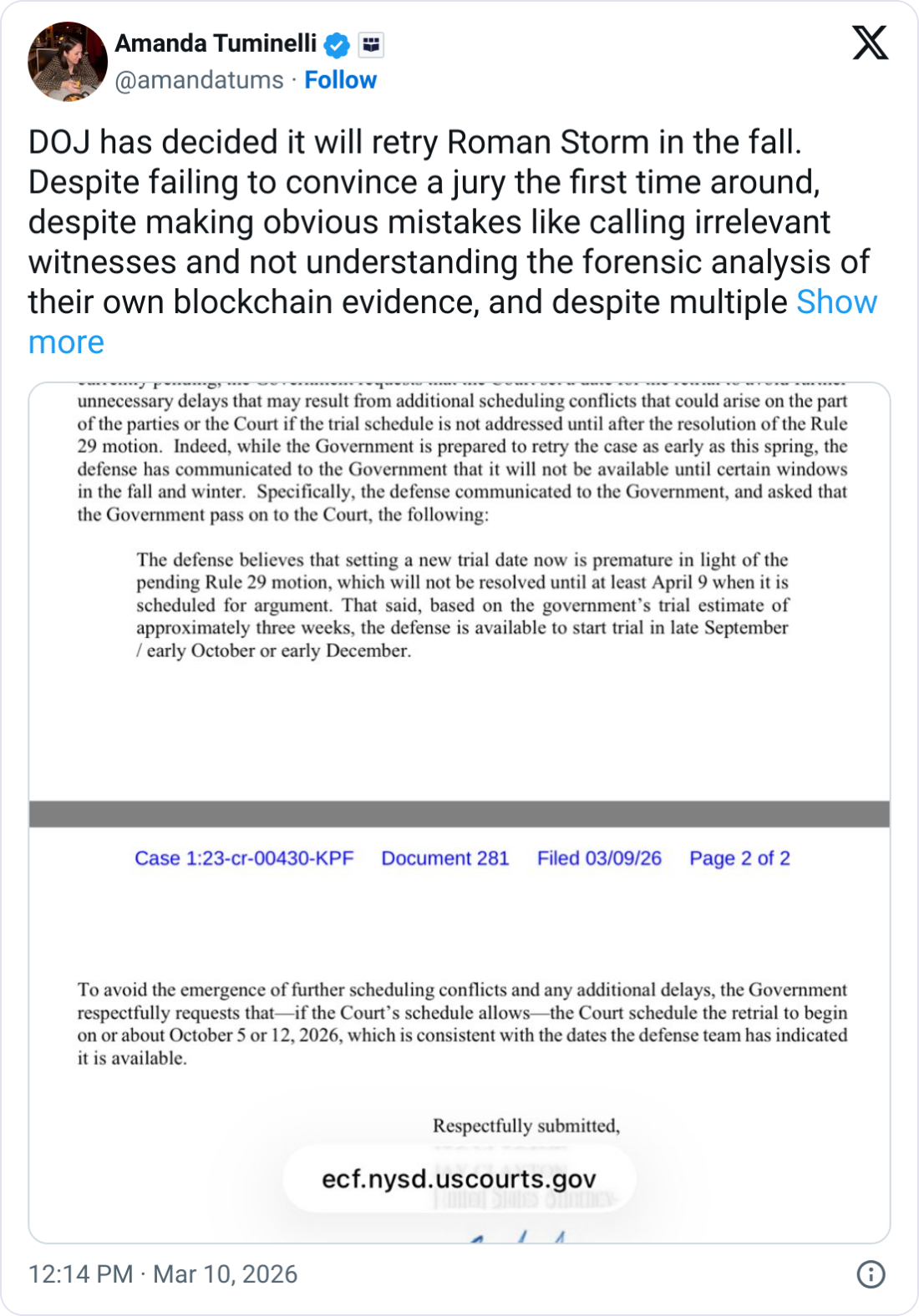

The letter asked the court for the retrial to begin on or around Oct. 5 to 12, with the trial expected to last three weeks. It said prosecutors were prepared to retry the case as early as spring, between March and May, but Storm’s defense lawyers said they weren’t available until late 2026.

In August, a jury convicted Storm of conspiring to operate an unlicensed money transmitting business, but was deadlocked on the money laundering and sanctions violation conspiracy charges, which has allowed prosecutors to retry those charges.

Storm had pleaded not guilty and asked Judge Polk Failla in October to acquit him of the money transmitting charge, arguing prosecutors failed to prove he intended to help bad actors use Tornado Cash.

Clayton wrote in his letter that Storm’s lawyers told prosecutors that setting a new trial date was premature due to the pending acquittal motion, which wouldn’t be resolved until early April, when it is scheduled for argument.

Prosecutors hope for “different answer,” says Storm

Storm posted on X that the two counts the government plans to retry him on could see him spend “up to 40 years in federal prison. For writing open-source code. For a protocol I don’t control. For transactions I never touched.”

“A jury already couldn’t agree this was criminal. But the SDNY [Southern District of New York] prosecutors want to keep trying with the hope of getting a different answer,” he added.

Amanda Tuminelli, the legal chief at crypto advocacy group the DeFi Education Fund, said the Justice Department’s decision to retry Storm was “incredibly disappointing.”

“Despite failing to convince a jury the first time around, despite making obvious mistakes like calling irrelevant witnesses and not understanding the forensic analysis of their own blockchain evidence, and despite multiple legal and logical fallacies to their allegations of third-party dev liability, the SDNY will retry Roman Storm,” she added.

Related: DOJ finalizes $400M crypto forfeiture in Helix Bitcoin mixer case

Clayton’s letter comes as a report that the US Treasury submitted to Congress this month acknowledged some lawful uses of crypto mixers, including those who use such services “to maintain more privacy in their consumer spending habits.”

In his X post, Storm also noted that US Deputy Attorney General Todd Blanche had issued a memo in April saying the Justice Department “is not a digital assets regulator,” and the agency would “no longer pursue litigation or enforcement actions that have the effect of superimposing regulatory frameworks on digital assets.”

“Same country, same DOJ — just filed to retry me anyway,” Storm said.

Magazine: Can privacy survive in US crypto policy after Roman Storm’s conviction?

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos19 hours ago

News Videos19 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World15 hours ago

Crypto World15 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat6 hours ago

NewsBeat6 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech17 hours ago

Tech17 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death