Crypto World

Bitcoin ETFs Slide Further as Daily Outflows Hit $545M

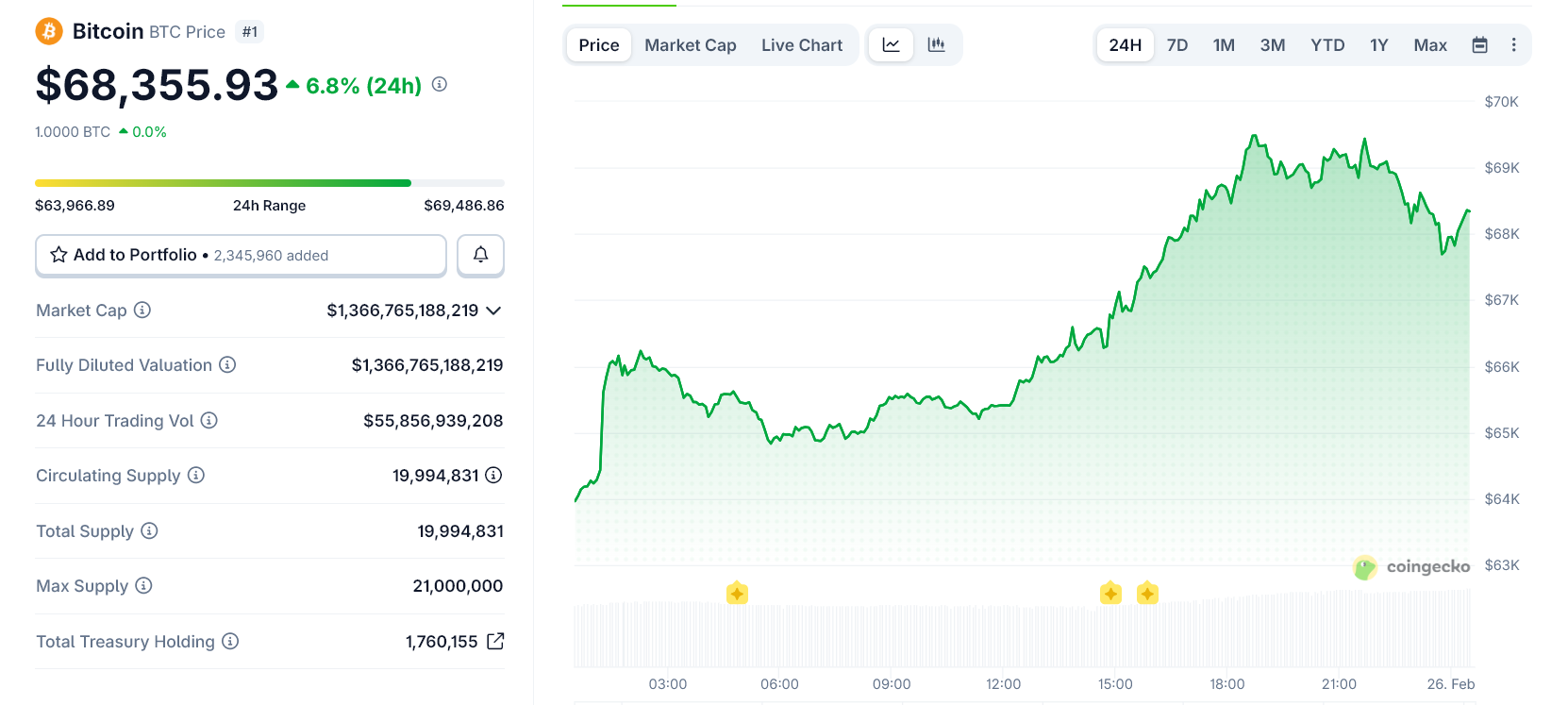

Bitcoin (CRYPTO: BTC) exchange-traded funds extended losses on Wednesday as the spot price hovered near the $70,000 threshold, underscoring ongoing headwinds across digital-asset markets. SoSoValue data show spot Bitcoin ETFs posting $545 million in outflows for the session, contributing to a negative weekly cadence of about $255 million. Year-to-date inflows have totaled roughly $3.5 billion, yet redemptions in the same period reached $5.4 billion, leaving net outflows of about $1.8 billion and total assets under management near $93.5 billion.

Key takeaways

- Spot Bitcoin ETFs recorded $545 million in daily outflows, extending a weekly net drain of approximately $255 million.

- Year-to-date, cumulative inflows stand around $3.5 billion, but redemptions total about $5.4 billion, yielding a net negative of roughly $1.8 billion.

- Total assets under management for spot BTC ETFs sit near $93.5 billion.

- Broader market breadth has deteriorated, with the overall crypto market capitalization down about 20% year-to-date to around $2.5 trillion per CoinGecko.

- Investor behavior appears cautiously resolute: about 6% of ETF assets have exited, while a heavyweight ETF issuer’s exposure has retreated from a peak near $100 billion to around $60 billion.

Tickers mentioned: $BTC, $ETH, $XRP, $SOL, $IBIT

Sentiment: Neutral

Price impact: Negative. The ongoing outflows from BTC ETFs and a broader market pullback contributed to downside pressure, with the crypto market cap retreating roughly 20% YTD.

Trading idea (Not Financial Advice): Hold. Market participants have, on balance, remained invested through the current downturn, suggesting a cautious, patient stance rather than aggressive repositioning.

Market context: ETF flows continue to reflect a liquidity-constrained environment and a shift in risk appetite as macro signals and regulatory developments influence investor decisions in crypto assets.

Why it matters

The ongoing pressure on Bitcoin ETFs matters because these products are among the most liquid conduits to gain regulated exposure to digital assets. The persistent outflows indicate a dissonance between investor expectations for ETF-driven liquidity and the prevailing risk-off sentiment that has cooled appetite for risk assets. While inflows remain in positive territory for the year, the magnitude of redemptions underscores the fragility of demand in a challenging macro backdrop.

Industry analysts have observed a paradox: despite the outflows, the cohort of ETF holders has largely stayed put. In comments cited by market watchers, some analysts described the BTC ETF ecosystem as resilient in the face of volatility, with a relatively small portion of assets exiting funds. The dynamics at play point to a nuanced landscape where big-name issuers, like the iShares Bitcoin ETF (IBIT), have seen their asset bases retreat from peak levels yet still maintain a substantial footprint. This juxtaposition—scarcity of new inflows against a backdrop of stubborn existing holders—speaks to the complexity of crypto-asset exposure via regulated wrappers in a volatile market regime.

Altcoin funds, meanwhile, delivered a mixed signal. Ethereum (CRYPTO: ETH) ETFs registered meaningful outflows, while XRP (CRYPTO: XRP) funds drew modest inflows and Solana (CRYPTO: SOL) saw small withdrawals. These patterns illustrate that capital is not uniformly fleeing all digital-asset exposures; rather, it is rebalancing within the broader lattice of crypto instruments as traders reassess risk, duration, and yield prospects in a high-stakes environment.

As discussed by several market observers, the sector’s longer-term trajectory will hinge on how regulatory and policy signaling evolves, and whether large institutions can sustain long-hold strategies through drawdowns. The cumulative inflows for spot BTC ETFs—neatly summarized at around $54.8 billion since inception, and just a shade below the prior peak of $62.9 billion—reflect a tempered but persistent demand for regulated crypto exposure despite periodic bouts of stress. The narrative remains one of guarded optimism: potential upside for ETF products if risk sentiment improves, tempered by the reality that macro headwinds and competition from non-regulated venues continue to pressure flows.

In context, Bitcoin’s price dynamics remain a critical influence on ETF behavior. If the market sustains a move back toward prior highs, ETF inflows could accelerate, reinforcing a favorable feedback loop for price discovery. However, negative signals—whether from macro data, regulatory developments, or a renewed round of capital outflows—could precipitate further reductions in new fund subscriptions and redemptions from existing positions. Investors and issuers alike will be watching closely how the balance between demand for regulated crypto exposure and risk-off sentiment evolves in the weeks ahead.

What to watch next

- Upcoming spot BTC ETF flow data releases to gauge whether the current outflows persist or reverse in the next reporting window.

- Regulatory and product announcements from major issuers (including IBIT) that could affect investor demand for exchange-traded crypto exposure.

- BTC price action relative to the $70,000 level and its potential impact on ETF inflows and selling pressure.

- Altcoin ETF flow trajectories, with attention to Ethereum, XRP, and Solana funds, over the near term.

- Analysts’ updates on market breadth and investor behavior in the wake of ongoing macro volatility and regulatory scrutiny.

Sources & verification

- SoSoValue data on spot BTC ETF flows for the cited session and weekly period.

- CoinGecko metrics documenting the approximate 20% year-to-date decline in total crypto market capitalization to around $2.5 trillion.

- Public comments from James Seyffart on ETF inflows versus peak inflows in the BTC ETF space.

- Eric Balchunas commentary on investor behavior within BTC ETFs and the IBIT asset trajectory.

Bitcoin ETFs in retreat as spot flows remain negative and risk appetite dampens

Bitcoin (CRYPTO: BTC) exchange-traded funds continue to retreat as the spot market trades near pivotal levels, highlighting how a risk-off stance is shaping fund flows. The latest data show spot BTC ETFs registering a $545 million outflow on a single session, intensifying a broader weekly draw of roughly $255 million. While year-to-date inflows have totaled around $3.5 billion, redemptions have climbed to about $5.4 billion, resulting in a net negative of nearly $1.8 billion and an assets-under-management tally around $93.5 billion. This backdrop mirrors a wider contraction in crypto liquidity, with the total market cap down about 20% year-to-date to roughly $2.5 trillion, according to CoinGecko.

Among the ETF universe, investor behavior has shown a blend of caution and resolve. The data imply that a small minority has exited positions—approximate turnover sits near 6% of total assets—while the bulk of holders remain invested despite repeated bouts of price volatility. The dynamics at play are further illustrated by the performance of the iShares Bitcoin ETF (EXCHANGE: IBIT), which has seen its assets retreat from a recent peak close to $100 billion to around $60 billion as risk sentiment waxes and wanes. As one Bloomberg analyst noted, the scale of inflows during the peak period was substantial, and the current retreat does not erase the earlier strength of demand for regulated exposure.

Against this backdrop, altcoin funds have shown a mixed complexion. Ethereum (CRYPTO: ETH) ETFs posted outflows of roughly $79.5 million, while XRP (CRYPTO: XRP) funds attracted about $4.8 million in net inflows. Solana (CRYPTO: SOL) ETFs also faced outflows, totaling around $6.7 million. The divergence within the altcoin cohort underscores the sophisticated nature of investor preference in a risk-off environment, where different narratives and fundamental updates across projects can drive uneven demand for ETF wrappers and direct exposure alike.

For investors and market watchers, the BTC ETF story remains a barometer of wider liquidity conditions and the pace at which regulated vehicles can deliver accessible exposure to a volatile asset class. The narrative will likely hinge on whether macro conditions improve enough to spur new inflows, or whether the market’s risk-off tilt persists, dampening appetite for crypto risk assets across the board.

https://platform.twitter.com/widgets.js

Crypto World

Circle Revenue Rises 77% as USDC Tops RLUSD Scale

TLDR

- Circle reported a 77% increase in total revenue and reserve income for Q4 2025.

- Circle generated $770 million in revenue, including $733 million in reserve income.

- USDC circulation reached $75.3 billion, rising 72% year over year.

- On-chain transaction volume hit $11.9 trillion in Q4, up 247% from last year.

- Circle posted $133 million in net income and $167 million in adjusted EBITDA.

Circle reported a 77% year over year increase in total revenue and reserve income for the fourth quarter of 2025. The company linked the growth to higher USDC circulation and reserve income. The latest figures outline a widening scale gap between USDC and Ripple’s RLUSD.

Circle Reports Revenue Surge as USDC Circulation Expands

Circle posted $770 million in total revenue and reserve income for Q4 2025. The company generated $733 million of that figure from reserve income.

Reserve income rose 69% from the previous year. Average USDC circulation expanded 100% during the same period.

USDC closed 2025 with $75.3 billion in circulation. That figure marked a 72% increase year over year.

Circle recorded $11.9 trillion in on-chain transaction volume during the fourth quarter. The volume represented a 247% increase from a year earlier.

The reserve yield declined to 3.8% during the quarter. The yield fell by 68 basis points compared with last year.

Revenue less distribution costs increased 136% to $309 million. Circle reported a margin of 40% for the period.

Net income from continuing operations reached $133 million. Adjusted EBITDA rose 412% to $167 million.

Circle stated that higher circulation supported reserve balances and interest income. The company attributed revenue growth to expanded USDC usage.

RLUSD Operates from Smaller Base in Stablecoin Market

Ripple’s RLUSD holds a market capitalization of nearly $1.56 billion. Daily trading volume stands around $124 million.

The supply gap between USDC and RLUSD shapes reserve income capacity. Larger circulation allows higher reserve balances and interest earnings.

Ripple remains privately held and does not publish detailed quarterly financial statements. As a result, direct profitability comparisons remain limited.

RLUSD benefits from Ripple’s global payments network and exchange integrations. However, public data shows a lower circulation base.

USDC’s market capitalization stands at $74.9 billion. That scale exceeds RLUSD by a wide margin.

Circle’s reported earnings provide measurable data on reserve income and operating performance. Ripple has not released comparable quarterly metrics for RLUSD.

Crypto World

Coinbase CEO Brian Armstrong pushes back on UK stablecoin caps

Coinbase CEO Brian Armstrong has warned that proposed stablecoin rules in the United Kingdom risk undermining the country’s competitiveness as a global financial hub, arguing that draft measures could stifle innovation rather than support it.

Summary

- Brian Armstrong warned that proposed stablecoin caps by the Bank of England could damage the UK’s competitiveness in digital finance.

- Draft rules reportedly include a £20,000 limit for individuals and £10 million for businesses, prompting concerns the UK could fall behind the $180B global stablecoin market.

- A pro-crypto petition has surpassed 80,000 signatures and could be debated in Parliament if it reaches 100,000.

Coinbase CEO urges UK to rethink stablecoin caps

In a post on X, Armstrong said stablecoin regulations currently being finalized by the Bank of England include proposals to cap stablecoin holdings for individuals and businesses.

Critics of the framework say the suggested limits around £20,000 for individuals and £10 million for businesses, could act as structural barriers to adoption in a market valued at more than $180 billion globally.

“The UK has a long history of being a financial hub,” Armstrong wrote, adding that embracing blockchain innovation is critical as other jurisdictions move quickly to establish clearer crypto frameworks.

He urged UK residents to support a petition organized by Stand With Crypto UK, which has gathered more than 80,000 signatures. Under parliamentary rules, petitions crossing 100,000 signatures are considered for debate in Parliament.

The comments sparked debate online. Some users argued the U.S. should first resolve its own regulatory uncertainty, pointing to the pending Clarity Act in Congress. Others said regulation should manage systemic risk without suppressing innovation, calling for proportional frameworks that allow stablecoins to scale responsibly.

The debate highlights mounting global competition over stablecoin policy, as lawmakers in the U.S. and European Union push forward with new frameworks. For London, long seen as a premier financial center, the final shape of stablecoin rules may determine whether it remains at the forefront of digital asset finance or risks ceding ground to more agile jurisdictions.

Crypto World

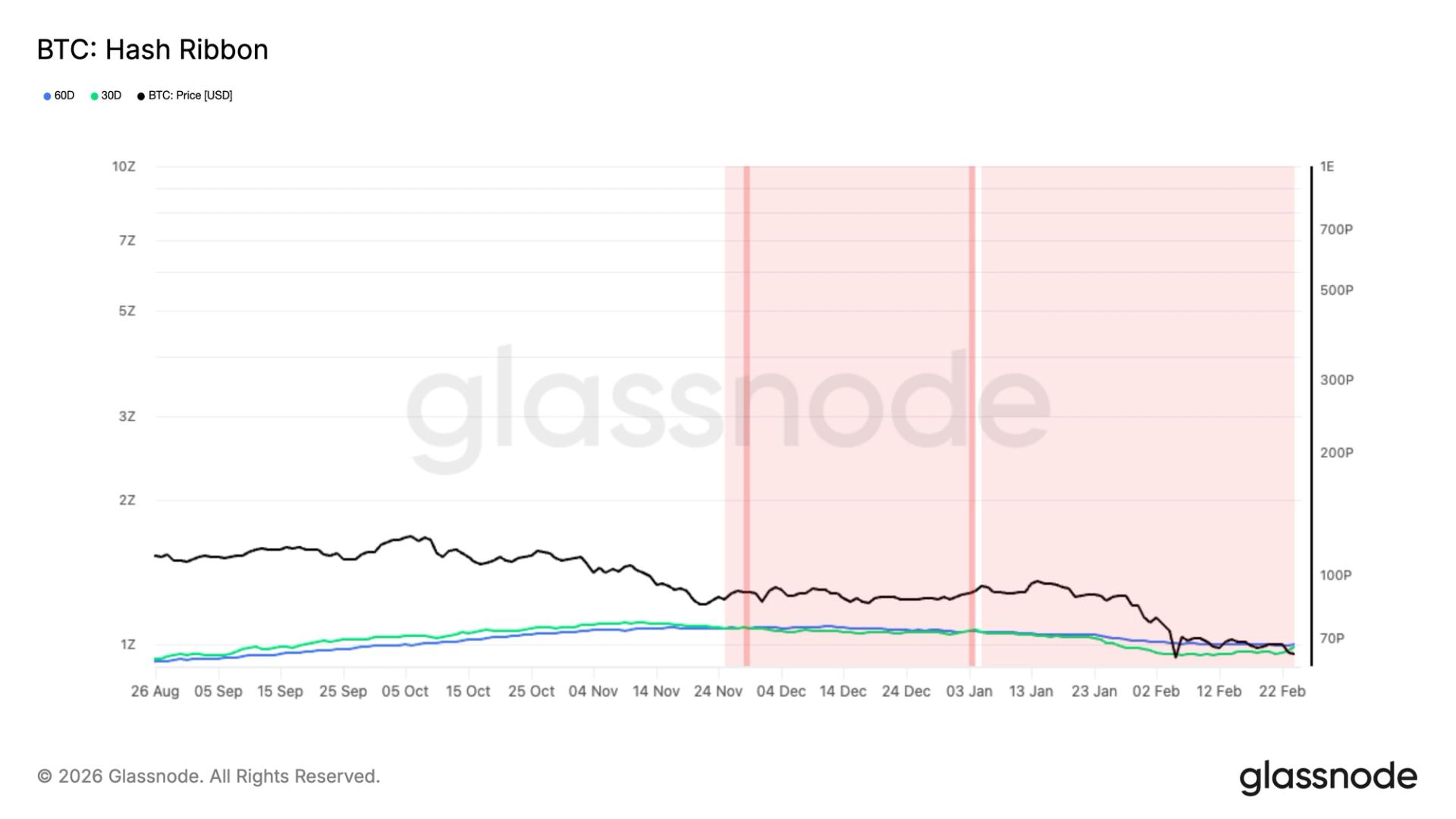

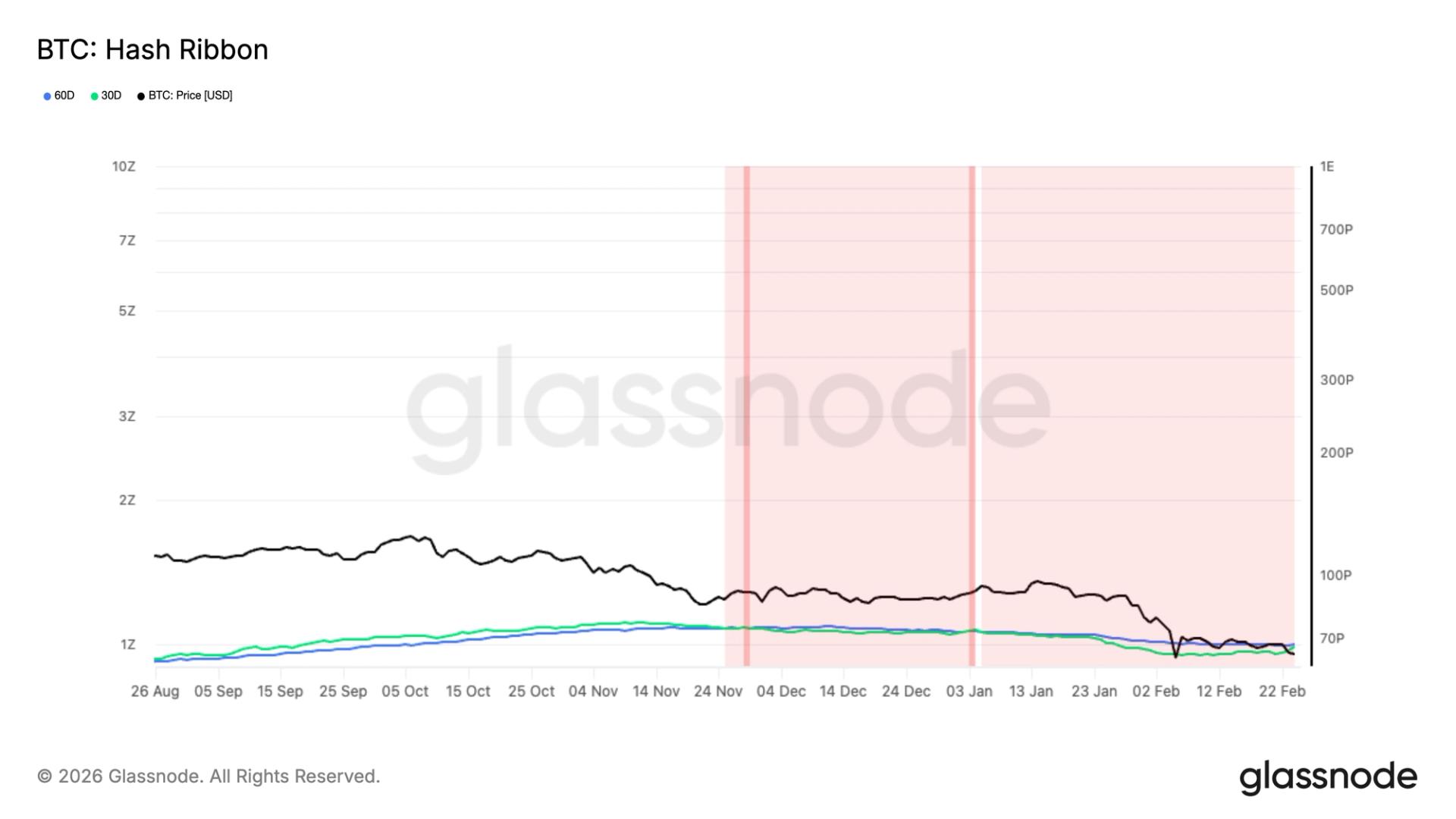

Historic mining capitulation nears end, pointing to bitcoin price stabilization

The worst of bitcoin’s 50% drawdown may already be behind us.

The Hash Ribbon indicator is close to signaling the end of a three month miner capitulation. One of the longest capitulations on record, according to Glassnode data.

The metric compares the 30 day and 60 day moving averages of hash rate and is based on the observation that bitcoin often bottoms when miners are under maximum financial stress. Capitulation occurs when mining revenue drops below operating costs, forcing less efficient miners to shut down machines and sell BTC reserves to fund electricity, debt, and overhead. That combination reduces hash rate and adds sustained sell pressure to the market.

A recovery signal is triggered when the 30 day hash rate moving average crosses back above the 60 day, indicating miners are returning online and network stress is easing and that moment is approaching. Historically, when this crossover aligns with improving price momentum, it has marked strong accumulation zones.

Since late November, when the metric first inverted, bitcoin has fallen from around $90,000 to a low near $60,000 in early February, before rebounding to roughly $65,000 as of press time.

Such major corrections are typical during miner stress events. Since 2011, there have been about 20 mining capitulations, most coinciding with local or major bottoms, including January 2015, December 2018 and December 2022.

Hash rate which is the total computational power securing the network is now rebounding, signaling renewed confidence among miners.

At the same time, bitcoin is now trading below its estimated average production cost of $66,000, a level often associated with deep value, according to checkonchain data. The last time this occurred was November 2022, when BTC bottomed near $15,500.

Crypto World

Will Polygon price retest January highs as stablecoin activity and app revenue surges?

Polygon has fallen nearly 40% from its yearly high in tandem with a market-wide weakness. Can it recover from its losses now as its stablecoin market and app revenues surge?

Summary

- Polygon price is eyeing a rebound amid strengthening fundamentals, including stablecoin activity and revenue surge.

- A potential bullish crossover is forming on the daily chart.

According to data from crypto.news, the Polygon (POL) price fell over 50% from its January high to a yearly low of $0.088 on Feb. 11. This occurred amid a broader market pullback triggered by massive liquidations across leveraged markets as Bitcoin fell below multiple key support zones due to macroeconomic and geopolitical stress.

POL has since bounced back and remained in consolidation between $0.100 and $0.115.

The Polygon network is showing signs of strength, which may position it for a breakout

First, its on-chain stats have grown significantly stronger over recent weeks. Data from DeFiLlama shows that the total supply of stablecoins on the network has surged to $3.26 billion from the $2.4 billion seen at the beginning of February.

At the same time, the weekly revenue generated by DeFi apps on the network has also soared by nearly 70% within the period.

A stronger stablecoin supply and weekly revenue suggest a surge in activity and liquidity, which is a healthy sign for a network and could likely attract more institutional capital.

Second, Polygon’s aggressive token burn strategy is also helping support its price gains. It has recently completed burning over 100 million POL tokens. As tokens are burnt, they are permanently removed from the circulating supply, driving scarcity and providing an accessible bullish narrative for short-term traders.

Third, the daily chart shows that the Polygon price is close to confirming a bullish crossover between the 50-day and 100-day moving averages. Bullish crossovers are typically followed by sustained rallies once confirmed.

Key levels to watch

For now, the next overhead resistance level lies at $0.122, which is the strong pivot reverse level of the Murrey Math lines. Bulls must reclaim this level to confirm a trend reversal.

Subsequently, bulls can then try to push the token all the way up to its January high at $0.184, which would mark a roughly 64% rally from its current price of $0.112.

On the contrary, failure to hold the ultimate support level of the Murrey Math lines at $0.097 will result in a drop back to its yearly low of $0.088.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

South Korea targets finfluencers with strict asset disclosure law

South Korea plans finfluencer disclosure law to curb manipulation and protect investors.

Summary

- Bill amends Capital Markets and Virtual Asset User Protection Acts to cover stocks and crypto promotions.

- Influencers must disclose asset types, quantities, and any paid compensation tied to recommendations.

- Violations face penalties similar to unfair trading, including fines and criminal liability, alongside new AI-based market surveillance.

South Korea’s Democratic Party has introduced legislation requiring financial influencers to disclose personal asset holdings and compensation when recommending cryptocurrencies or stocks, according to reports from the country’s legislative assembly.

The proposal, led by lawmaker Kim Seung-won, includes amendments to the Capital Markets Act and the Virtual Asset User Protection Act. The draft framework would mandate that influencers disclose the type and quantity of assets held when promoting specific tokens or stocks through social media, livestreams, or broadcast channels, according to the legislative text.

Influencers would also be required to reveal any compensation received in exchange for recommendations. Violations would carry penalties similar to those applied in unfair trading practice cases, including fines and potential criminal liability, the proposal states.

The legislation aims to prevent undisclosed promotional activity that can lead to pump-and-dump schemes, where influencers promote assets before selling into price increases, according to the Democratic Party’s statement. The measures seek to reduce market manipulation risks and improve investor protection through mandatory transparency around holdings and financial incentives.

The proposal follows broader regulatory expansion in South Korea throughout 2026. The Financial Supervisory Service has deployed AI-based monitoring tools designed to detect abnormal trading patterns and market manipulation in real time, according to the agency.

Additional measures introduced this year include new reporting requirements for foreign property investors, who must now disclose cryptocurrency transaction histories in certain cases, regulatory filings show.

South Korea maintains one of the world’s most active retail cryptocurrency markets. The legislation, if passed, would represent one of the most direct regulatory actions globally targeting social media-driven financial promotion in the digital asset sector, according to regulatory analysts.

Crypto World

Rebuild trust in local currency with digital bonds

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Trust in money doesn’t collapse overnight. It erodes slowly, through years of inflation and political interference that leave savers feeling exposed. When confidence finally breaks, people respond rationally: they abandon the faulty currency. They move their savings into foreign currencies or assets like gold and real estate.

Summary

- Currency trust is structural, not rhetorical: When savers abandon local money, speeches don’t fix it — credible, transparent infrastructure does. Tokenized bonds can provide that signal.

- Demand for bonds drives demand for currency: By improving liquidity, transparency, and settlement, digital local-currency debt can reduce dollarization and keep capital onshore.

- Transparency reshapes monetary politics: On-chain issuance and settlement reduce opacity, compress risk premiums, and shift credibility from promises to verifiable data.

Governments often try to reverse this dynamic with rhetoric: pledges of fiscal discipline, independence, or reform. But speeches aren’t always enough to restore trust; you sometimes need new institutions and infrastructure. In other words, you need credible signals that saving and investing locally is no longer a gamble. Nations now have a new tool to do this: by issuing tokenized bonds.

Tokenization brings transparency, programmability, and fast settlement to investment vehicles that are often perceived as opaque or risky. Applied to sovereign and corporate debt, these features can materially improve how local-currency markets function. Digital bonds obviously can’t be a substitute for good macroeconomic policy, but by eliminating some frictions, they can help restore confidence in a currency.

How tokenized bonds support local currencies

A currency’s strength depends heavily on demand for assets denominated in it. People hold currencies not because they like them, but because they want the assets priced in them. When local bond markets are illiquid or unreliable, demand for the currency weakens structurally. Tokenized bonds address this problem by making local-currency debt easier to access, cheaper to trade, and far more transparent. They’re not a silver bullet, but they help ease the problem.

Digital bonds can be purchased with fewer intermediaries and lower operational costs. They can also be fractionalized, integrated into digital wallets, and distributed globally. All of this lowers the barriers for domestic and foreign investors to hold local sovereign and corporate debt. More buyers of local-currency bonds translates into sustained demand for the currency itself. Over time, that demand makes an impact, big or small, on the strength of a given currency.

Improving domestic savings instruments also reduces the incentive to dollarize. In many countries around the world, households and firms turn to U.S. dollars when they don’t trust local institutions to preserve value or honor contracts.

But tokenized bonds offer visible proof that rules are being enforced, payments are happening as promised, and ownership is secure. When people feel confident saving and investing in their own currency, it opens a path for dollarization to recede organically, strengthening foreign-exchange stability.

The same logic applies to institutional capital. Pension funds and asset managers in emerging markets often overweight dollar assets because local-currency markets carry higher operational risk — slow settlement, unreliable registries, and opaque ownership records. Digital bonds reduce these risks, giving local institutions fewer reasons to export capital abroad. Keeping savings onshore can be an effective way of supporting a currency.

Tokenized bonds also impact monetary politics

One of the weaknesses of local debt markets is opacity. Investors rarely have a clear view of who owns what, how liquid the market really is, or whether issuance and settlement data can be trusted. Tokenized bonds change this by moving issuance, ownership, settlement, and secondary-market activity on-chain, where it can be observed in real time. This transparency lowers the opacity premium that investors demand for holding local-currency debt.

Moreover, central banks traditionally rely on reputational capital to guide expectations. But reputation is fragile in countries with a history of fiscal dominance. Tokenized bond markets shift part of that burden from institutional trust to observable data. Real-time signals allow investors to assess conditions independently of official messaging. Issuing digital bonds is also a visible signal of competence; it demonstrates accountability in ways that no press release can.

Smart contracts reinforce this effect through automation. By reducing reliance on intermediaries and manual processes, they minimize operational failures that usually undermine confidence in otherwise well-managed systems.

Immutability also matters politically. On-chain records make it much harder to quietly manipulate issuance volumes or obscure outstanding supply. For investors who worry about opaque fiscal practices or political interference, this permanence helps to anchor credibility.

The benefits to the market

The market-level benefits end up compounding. In many emerging economies, slow and unreliable settlement cycles are a major source of mistrust. Trades that take days to clear discourage participation and inflate yields. Digital bonds eliminate much of this friction, which in turn restores some confidence in the basic functioning of the market.

High yields in local-currency debt are often misinterpreted as pure compensation for inflation or credit risk. In reality, they also reflect settlement risk, inefficient infrastructure, questionable registries, and unpredictable liquidity. By removing these issues, tokenized bonds can naturally help compress yields and improve trust in the currency.

Tokenized bonds also open local markets to retail savers, expatriates, and global asset managers who were previously locked out by operational complexity. Greater access means there is a chance for more participants, which in turn could bring deeper liquidity and better price discovery to the local sovereign debt market.

And instead of thin, sporadically traded markets where rumors dominate, tokenized bonds provide constant visibility into yield curves and credit spreads. Clearer price signals anchor expectations and reduce the informational chaos that often precedes currency stress.

Finally, currency stability depends on whether policy decisions actually flow through the financial system. With real-time pricing and instant settlement, bond markets respond more efficiently to interest-rate changes and liquidity operations. Policy becomes more effective not because it is harsher, but because it is better transmitted.

At the end of the day, currency credibility mostly depends on fiscal and monetary fundamentals. But tokenized bonds help governments get rid of many small frictions they have to deal with, even under the best circumstances. Tokenized bonds can’t replace sound policy, but they can strengthen market plumbing. All of the small advantages that they bring end up compounding to provide support for local currencies.

Crypto World

Elon’s Grok AI Predicts the Price of XRP, Cardano, and Ethereum By the End of 2026

Running carefully structured prompts through Grok AI produces ambitious 2026 price outlooks for XRP, Cardano and Ethereum, despite the near-term uncertainty rocking markets.

Below, we examine how realistic Grok’s projections are in the current cycle.

XRP (XRP): Grok AI Bets XRP to Hit $8 by 2026

In a recent update, Ripple reiterated that XRP ($XRP) remains the cornerstone of its plan to establish the XRP Ledger as a global, enterprise grade payments network.

With near instant settlement and extremely low fees, the Ripple is strategically manoeuvring to capture an early led in two rapidly expanding segments: stablecoins and tokenized real-world assets.

XRP currently trades around $1.42. According to Grok’s AI-driven, the token could rise to $8 by the end of 2026, implying gains of almost 6x from current levels.

Technical indicators support the constructive outlook. XRP’s Relative Strength Index (RSI) is rapidly climbing up from 44, while price remains below the 30-day moving average, a combination often associated with players buying the dip.

Potential price catalysts to anticipate include institutional demand following the rollout of U.S. XRP ETFs, Ripple’s growing list of international partnerships, and improved regulatory clarity if the proposed U.S. CLARITY bill advances this year.

Cardano (ADA): Grok Assigns Hoskinson’s Ethereum Rival a 1,250% Upside Scenario

Created by Ethereum co-founder Charles Hoskinson, Cardano ($ADA) focuses on academically peer-reviewed development, strong security guarantees, scalability, and long-term network resilience.

Despite broader market weakness, Cardano’s ecosystem continues to expand. The network holds a market capitalization of $10.3 billion and more than $124 million in total value locked (TVL).

Grok’s projections suggest ADA could surge by just over 1,250%, climbing from approximately $0.28 today to nearly $3.80 by the end of 2026. Such a move would push Cardano well beyond its previous 2021 high of $3.09.

That said, ADA is currently trading at its lowest levels since October 2024.

Given the volatility seen throughout this year, a prolonged bear scenario, could see prices potentially sliding down to $0.15.

Ethereum (ETH): Grok AI Sees a Run to $10k on the Cards

Ethereum ($ETH) remains the dominant smart contract blockchain and the backbone of most DeFi and Web3 applications.

With a market capitalization near $238 billion and over $54 billion locked across DeFi protocols, Ethereum is the primary settlement layer for on-chain commercial activity.

Its track record for security, leadership in stablecoin infrastructure, and early progress in tokenizing real-world assets place Ethereum in a strong position to attract substantial institutional interest.

However, meaningful capital inflows hinge on U.S. lawmakers passing the CLARITY bill, which would provide the regulatory certainty institutions need to deploy funds via stablecoins or tokenized assets on Ethereum.

ETH currently trades around $2,000, with significant resistance expected near $5,000 after setting an all-time high of $4,946.05 last August.

If Grok’s bullish scenario plays out, a breakout above $5,000 could unlock a series of new highs in 2026, with Grok calling $10,000 a bull target.

Maxi Doge: Early-Stage Meme Coin Aims for Outsized Growth

While Grok indicates that these top altcoins could deliver strong returns over time, their large market capitalizations may cap explosive upside compared to newer, smaller-cap projects.

Maxi Doge ($MAXI) is still in its early stages. The project has already raised $4.6 million during its ongoing presale among investors looking to recapture the magic of meme coins.

The character behind Maxi Doge is a loud, gym-obsessed, self-styled alpha doge, a distant rival and cousin to Dogecoin. His comic branding taps into the high-energy, irreverent tone that fueled the meme coin boom of 2021.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a lower environmental footprint compared to Dogecoin’s proof-of-work model.

Early presale buyers can currently stake MAXI for yields of up to 67% APY, though returns decrease as more tokens enter the staking pool.

The token is $0.0002805 during the current presale phase, with automatic price increases at each funding milestone. Purchases are supported through wallets such as MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here.

The post Elon’s Grok AI Predicts the Price of XRP, Cardano, and Ethereum By the End of 2026 appeared first on Cryptonews.

Crypto World

Michael Saylor Bets on Solana to Power the Future of Programmable Digital Credit

TLDR:

- Michael Saylor named Solana as the primary blockchain for deploying programmable digital credit at scale.

- Strategy’s STRF converts Bitcoin’s economic energy into structured cash flows with principal protection for investors.

- Saylor introduced BTC rating, BTC risk, and credit spread as core metrics for measuring digital credit risk.

- A reflexive flywheel effect ties credit creation to Bitcoin demand, driving equity value across the broader ecosystem.

Michael Saylor has made a bold claim about the future of programmable digital credit. The Strategy executive chairman recently stated that Solana will serve as the primary blockchain for deploying this next generation of digital credit instruments.

His remarks came alongside a detailed breakdown of Strategy’s STRF product and a broader framework for Bitcoin-backed credit.

The statement drew attention from across the crypto industry given Saylor’s long-standing association with Bitcoin maximalism.

Saylor Points to Solana as the Infrastructure for Digital Credit Deployment

Saylor’s choice of Solana as the deployment platform surprised many observers in the crypto space. He cited the blockchain’s speed, accessibility, and scalability as key reasons for the selection.

According to Saylor, programmable digital credit requires infrastructure that can handle tokenized instruments operating at scale. Solana, in his view, meets those technical requirements more effectively than other available options.

His vision extends beyond a single product. Saylor outlined how digital credit can be embedded into ETFs, tokens, bank accounts, and layer 3 blockchain solutions.

Each of these serves as a building block for creating digital yield and accessible digital money. Together, they form an interconnected system designed to move value across digital rails efficiently.

The programmable nature of this credit is central to Saylor’s argument. By encoding credit terms directly into blockchain infrastructure, issuers can automate dividend payments, collateral checks, and risk adjustments.

This removes the friction associated with traditional credit instruments and opens access to a much wider investor base. Solana’s architecture makes this level of programmability practical at a global scale.

Saylor also described a reflexive flywheel effect that programmable digital credit can trigger. Credit creation drives Bitcoin demand, which raises Bitcoin’s price and increases equity value.

That, in turn, strengthens the entire ecosystem and encourages further credit issuance. Deploying this mechanism on Solana, he argued, amplifies its reach and speed considerably.

Strategy’s STRF Lays the Foundation for Bitcoin-Backed Credit on Chain

STRF sits at the core of Saylor’s digital credit framework. Strategy converts Bitcoin’s economic energy into structured cash flows by stripping away risk, dampening volatility, and extracting yield.

The result is a variable preferred security that offers both principal protection and higher returns than traditional credit. Investors also benefit from return-of-capital tax treatment, which reduces their overall tax liability directly.

Saylor introduced three metrics for evaluating digital credit risk: BTC rating, BTC risk, and credit spread. These tools give investors a clear and measurable way to assess collateral coverage and under-collateralization probability.

Excess Bitcoin volatility is transferred to MSTR common equity holders rather than to credit investors. This structure protects STRF holders during market downturns.

STRF’s track record supports Saylor’s framework. The product maintained its value and continued paying dividends through significant Bitcoin price drawdowns.

That stability makes it competitive with traditional credit instruments that are often tax-inefficient and difficult to access. STRF, by contrast, is designed to be widely accessible and straightforward to hold.

Corporate treasuries represent a major target market for this product. Saylor argued that companies allocating a portion of holdings to STRF could potentially double their cash flow.

With Solana as the deployment layer, that access becomes even broader and more seamless for institutional and retail participants alike.

Crypto World

BitMine ramps Ethereum to 3.6% supply while price tests support

Ethereum slid ~5% toward $1.9k as whale selling and ETF outflows hit sentiment, despite bullish RSI divergence hinting at a potential reversal.

Summary

- ETH trades around $1.9k with key support at $1.8k–$1.85k; a daily close below opens $1.7k–$1.6k downside.

- Spot ETH ETFs logged multi‑week net outflows in recent sessions, with single‑day withdrawals near $40m–$50m weighing on demand.

- BitMine now holds about 4.42m ETH (3.66% of supply), mostly staked, while other whales and even Vitalik reduced exposure, adding mixed on‑chain signals.

Ethereum (ETH) traded near a critical support level as large holders sold significant amounts of the cryptocurrency, creating downward pressure despite technical indicators suggesting a potential reversal, according to market data and on-chain analytics.

The cryptocurrency displayed bullish divergence on 12-hour charts, with the Relative Strength Index making a higher low while the price established a lower low over the prior month. This technical pattern typically precedes price reversals in traditional technical analysis.

However, substantial selling activity by large holders has complicated the technical outlook. A major wallet address sold a substantial amount of Ethereum in a concentrated period, according to blockchain data. Another dormant whale address transferred coins to an exchange after remaining inactive for years, a movement typically associated with selling intentions. Ethereum co-founder Vitalik Buterin also sold a notable amount over recent days, data showed.

BitMine Immersion Technologies moved counter to the broader trend, substantially increasing its Ethereum holdings to represent a notable share of circulating supply, according to company disclosures. The firm maintains a large staked position generating annualized yield and completed a major purchase last week. The company has publicly stated an acquisition target that would capture a meaningful share of total supply.

Traditional financial institutions showed opposite behavior. Ethereum exchange-traded funds posted consecutive weeks of net outflows, indicating capital exiting these regulated investment products, according to fund flow data.

On-chain metrics presented mixed signals. New wallets received materially higher-than-normal inflows, whale inflows spiked well above average levels, and top profit-and-loss wallets added sizable amounts, blockchain analytics firms reported. The combination of ETF outflows and major whale selling has kept downward pressure on the price in the near term.

The cryptocurrency’s price trajectory depends on whether current support levels hold, analysts noted. A daily close below the key support level would invalidate the bullish divergence pattern and expose lower support zones. Technical analysts identified a downside scenario involving continued large holder selling, ongoing ETF outflows, and absent buying interest until a lower level triggers capitulation selling.

The alternative scenario requires the support level to hold, followed by a reclaim of recent consolidation highs, which would signal a reversal pattern and open movement toward the next technical resistance level, according to chart analysis.

Crypto World

Is Bitcoin’s Bear Market Ending or Just Getting Worse?

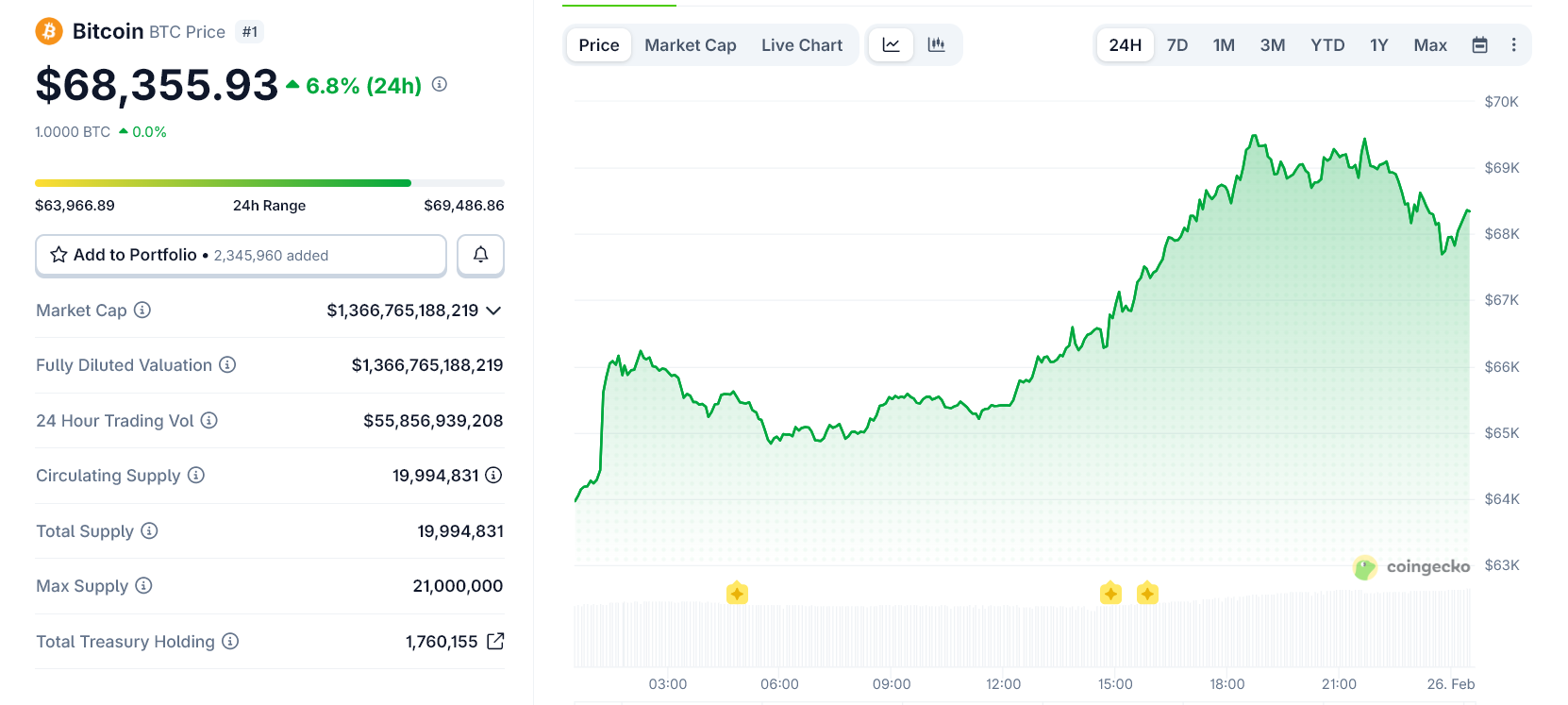

Bitcoin surged sharply this week, briefly nearing $70,000 before pulling back. The move sparked debate across the market: has Bitcoin finally bottomed, or is this just another relief rally inside a broader bear phase?

Multiple on-chain, derivatives, and institutional indicators show early signs of stabilization. However, key signals still point to a fragile recovery rather than a confirmed bullish reversal.

Options Market Shows Fragile Conditions, Not Strong Support

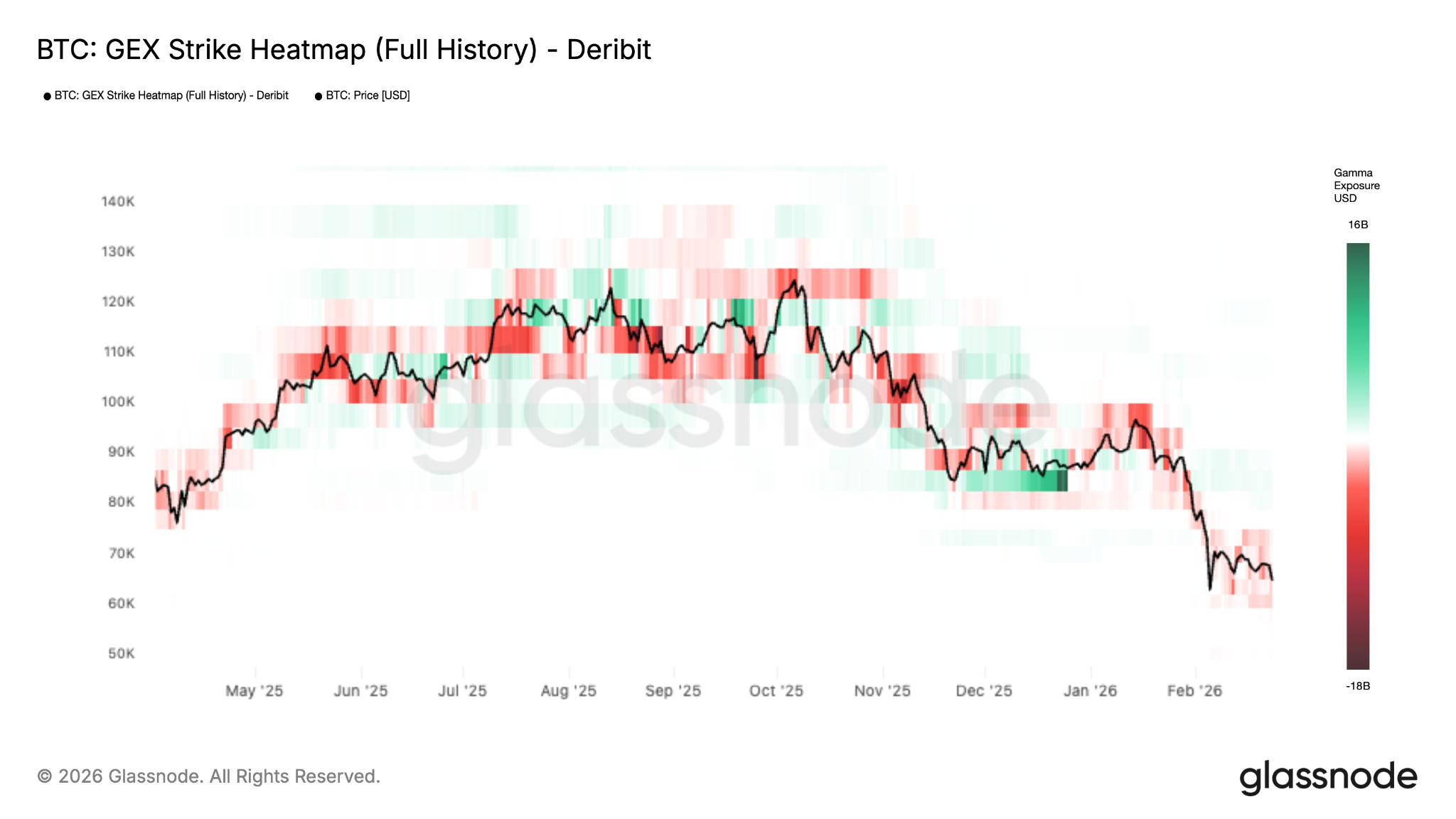

Bitcoin’s options positioning recently shifted into what traders call a negative gamma regime, according to Glassnode’s GEX heatmap.

In simple terms, gamma measures how options market makers hedge risk. When Bitcoin sits in a negative gamma zone, dealer hedging tends to amplify price moves.

That means rallies can accelerate quickly—but so can selloffs.

The heatmap also shows fewer strong resistance “gamma walls” above current prices. This creates less friction for upward moves, which helps explain Bitcoin’s sudden surge.

However, it also means the market lacks structural stability.

Without strong hedging support, price moves remain fragile and prone to reversal.

Bitcoin Spot Demand Is Improving for the First Time in Months

CryptoQuant data shows Bitcoin’s apparent demand, which measures net accumulation versus new supply, has turned positive for the first time since November.

This is an important early signal. When demand exceeds supply, it suggests buyers are stepping in and absorbing coins from sellers.

However, one positive shift does not confirm a full reversal. During past bear markets, temporary demand increases often occurred before further consolidation.

A sustained trend of rising demand over several weeks would provide stronger confirmation.

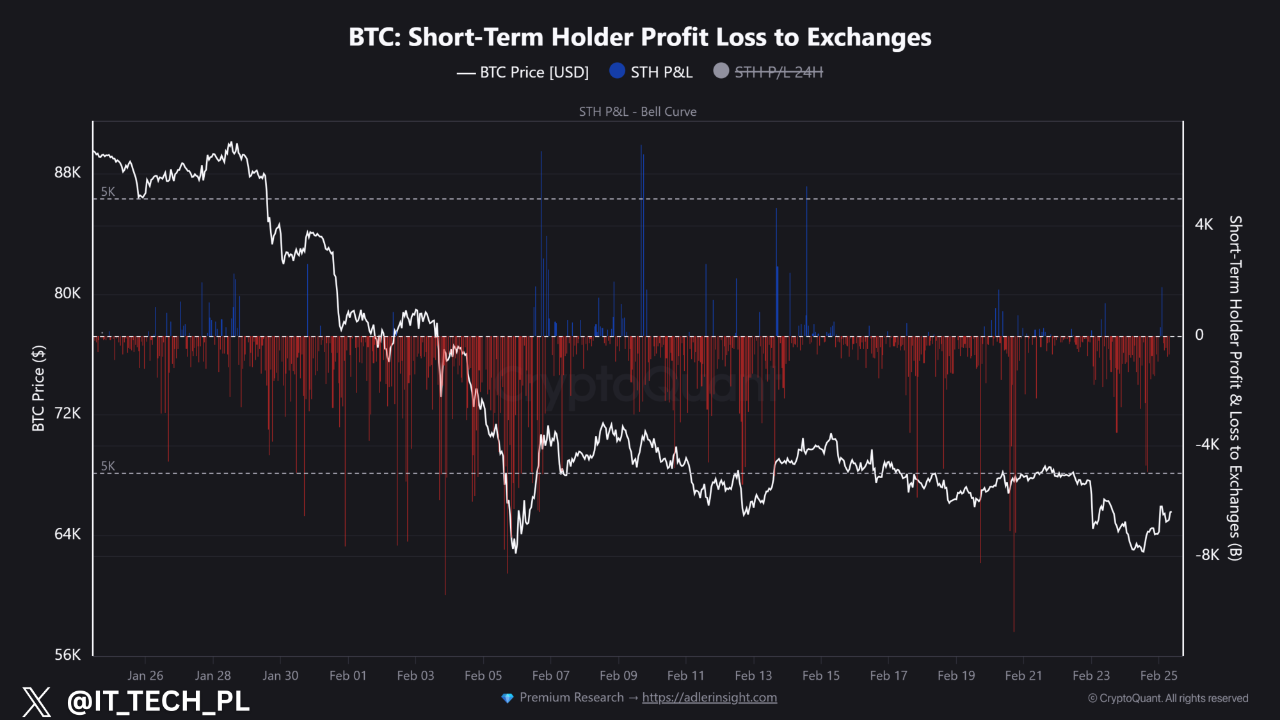

Short-Term Holders Are Still Selling at Losses

Another key indicator comes from CryptoQuant’s short-term holder profit and loss data, which tracks whether newer investors are selling at gains or losses.

The data shows short-term holders have been selling at losses consistently since late January. Several major loss spikes occurred in early February and again recently.

This pattern is known as capitulation, where weaker investors exit the market. Capitulation is common near market bottoms, because stronger buyers absorb those losses.

However, the signal has not fully reversed.

Until short-term holders begin selling at profits again, analysts warn that rallies can become “exit liquidity,” where trapped investors sell into strength rather than holding.

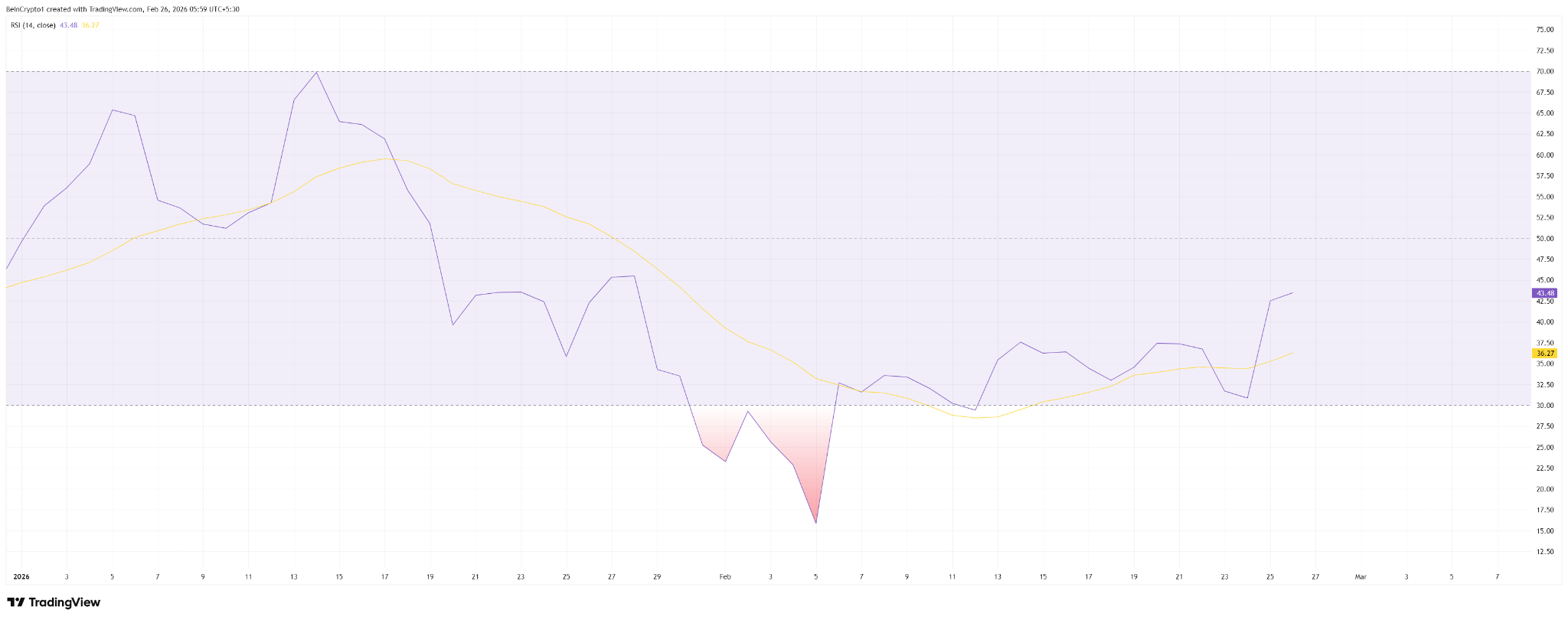

Technical and Historical Data Suggest Selling Pressure Is Easing

Bitcoin’s relative strength index (RSI), a momentum indicator, recently recovered after reaching extremely oversold levels in early February. This suggests selling pressure has weakened.

Historically, such RSI recoveries often lead to short-term rebounds.

Quarterly performance data also shows Bitcoin rarely experiences multiple consecutive quarters of heavy losses.

While this pattern does not guarantee a bottom, it supports the view that the market may be entering a stabilization phase.

Institutional Flows Still Show Weakness

Institutional positioning remains a key concern. Earlier data showed Bitcoin ETFs experienced sustained outflows, and SEC filings revealed large investment advisors and hedge funds reduced exposure significantly in late 2025.

This suggests institutional demand has not fully returned. Strong bull markets typically require consistent inflows from large investors.

Early Bottoming Signs, But Bull Market Not Confirmed

Bitcoin is showing several early bottoming signals. Spot demand is improving, capitulation appears to be getting absorbed, and technical indicators suggest selling pressure is fading.

However, key confirmation signals are still missing.

Short-term holders remain in loss territory, institutional flows remain weak, and options market structure shows fragile conditions.

For now, Bitcoin’s rally appears more consistent with a relief bounce than a confirmed bull reversal.

A sustained recovery will likely require stronger demand, renewed institutional inflows, and price stability above key resistance levels.

-

Video6 days ago

Video6 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Politics4 days ago

Politics4 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports7 days ago

Sports7 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World2 days ago

Crypto World2 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business4 days ago

Business4 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech1 day ago

Tech1 day agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 hours ago

NewsBeat4 hours agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business1 day ago

Business1 day agoTrue Citrus debuts functional drink mix collection

-

NewsBeat1 day ago

NewsBeat1 day agoPolice latest as search for missing woman enters day nine

-

Crypto World1 day ago

Crypto World1 day agoEntering new markets without increasing payment costs

-

Sports3 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market