Crypto World

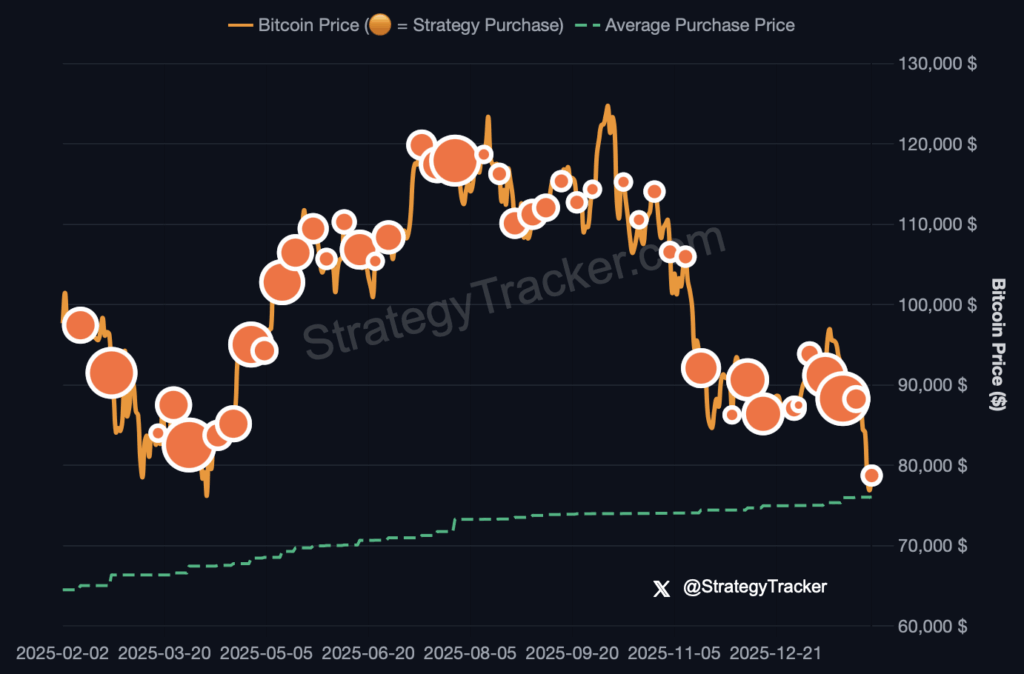

Bitcoin fell below Strategy average buy price overnight

Overnight, bitcoin (BTC) fell to less than $74,600, well below Strategy’s average purchase price.

Since 2010, founder Michael Saylor has used corporate funds to buy 713,502 BTC at a lifetime average of $76,052. However, despite paying $54.2 billion for its so-called BTC treasury, this investment fell to below $53.3 billion.

Monday’s drop, along with similar price dips over the weekend, is the first time in two and a half years that Strategy’s cost basis has been higher than prevailing market prices for BTC.

The last time this happened was October 21, 2023 when the company’s BTC cost basis was $29,581 and BTC was trading at $29,483.

Ever since that date, Strategy has enjoyed owning BTC below its market value.

At his peak, Saylor seemed like a market wizard. On October 6, 2025, Strategy’s BTC holdings peaked above $79 billion and the company’s average buy of $73,982.73 was below the soaring BTC price above $126,000.

That 41% cushion has deflated entirely to less than zero as of last night.

Read more: What is MicroStrategy’s bitcoin liquidation price?

Strategy’s buy price is not a liquidation threshold

Although significant, the price of BTC falling below Strategy’s cost basis won’t automatically trigger any liquidation.

The company has only $8 billion worth of debt — far below its $56 billion worth of BTC holdings. Moreover, the company’s debts don’t mature until 2028 at the earliest.

Still, millions of people saw the decline of BTC below Saylor’s average purchase price on social media. “Been buying BTC for 5+ years with nearly zero profit. Down even worse when adjusted for inflation,” someone reacted.

“If BTC keeps falling like this, MicroStrategy will really become a micro strategy,” wrote another, poking fun at Strategy’s prior business name which originally played on the dot-com name Microsoft.

Investors value Strategy almost entirely based on its BTC holdings. Specifically, relative to its $41 billion market capitalization, the company’s operational activities and legacy software generated less than $500 million in total revenue over its trailing 12-month period.

Over the next few years, Strategy simply needs to service operational expenses and small coupon payments to bondholders.

Its board of directors also voluntarily declares dividends to its preferred shareholders, which it can suspend at any time.

As of October 24, 2025, the company’s annualized dividend and interest expenses were $689 million.

The company’s dividend obligations could actually increase over time — especially if the price of its preferred shares decline.

Saylor just raised the dividend rate on STRC, for example, another 0.25% last week. What started as a 9% dividend rate has become 11.25%.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Binance to drop 19 margin pairs on Feb 26 review date

Binance delists 19 margin pairs on Feb 26, citing liquidity, volume, and risk controls.

Summary

- Binance will remove 10 cross and 9 isolated margin pairs at 02/26 06:00–09:00 UTC after a scheduled review.

- Criteria for removal include low liquidity, thin volume, and elevated risk metrics across affected pairs.

- Users must close or adjust positions before the deadline or face automatic liquidation and order cancellation.

Cryptocurrency exchange Binance announced plans to remove 19 margin trading pairs from its platform, effective February 26 at 09:00 UTC, according to a statement posted on the company’s official website.

The delisting will affect 10 cross margin trading pairs and nine isolated margin trading pairs, the exchange stated.

The decision follows periodic evaluations of criteria including liquidity, trading volume, and risk factors associated with the affected pairs, according to the announcement. Binance conducts regular listing reviews aimed at protecting user security and maintaining market stability in margin markets, the company said.

Users holding open positions in the affected trading pairs must close their positions or make necessary adjustments before the specified deadline, the exchange warned. Failure to do so may result in automatic liquidation processes being activated by the system, according to the announcement.

The statement did not provide information regarding any changes to spot markets. The exchange advised investors to monitor official announcements for updates.

Binance operates as one of the largest cryptocurrency exchanges globally by trading volume.

Crypto World

Crypto Exchange Development MENA: Features & Regulatory Requirements

The Middle East and North Africa (MENA) region is rapidly emerging as one of the world’s most structured environments for regulated digital asset markets. Regulated hubs like the UAE, alongside fast-growing grassroots adoption across North Africa, create a $250B addressible market. According to the World Crypto Rankings 2025 report released by DL and Bybit, the UAE ranks #1 in MENA and 5th globally for crypto adoption. The country recorded $56 billion in crypto inflows between 2024-25, reflecting a 33% YoY growth, with institutional transfers accounting for roughly half of the activity. In December 2024, the MENA-wide digital asset transaction volumes also reached their monthly peak at $60B, indicating a robust regional demand beyond the Gulf hubs.

This rapid expansion of regulated digital asset activity is driving demand for compliant crypto exchange software development tailored to regional licensing, banking integrations, and asset-issuance requirements. Across the Gulf, crypto trading platforms are evolving beyond retail exchanges into regulated financial infrastructure supporting custody, brokerage, tokenized-asset issuance, and cross-border digital-asset settlement within unified venues.

For institutions, fintech operators, and market entrants, launching cryptocurrency exchange software in the MENA region, therefore, requires architecture and features aligned with both market demand and regulatory frameworks. The guide outlines the core architecture, essential features, regulatory requirements, and step-by-step process needed to deploy crypto exchange software across the MENA region.

Why the MENA Region Is Becoming a Global Crypto Exchange Hub?

- Regulatory clarity led by the UAE and Bahrain

VARA (UAE), ADGM (Abu Dhabi), CBB (Bahrain), and emerging Saudi regulatory frameworks provide licensing pathways for crypto exchange software, custodians, and brokers across the region.

- Rapid growth in regulated digital-asset activity

As stated earlier, the UAE processed tens of billions in crypto flows and ranks among the leading global adoption markets.

- Institutional and high-value transaction dominance

According to Chainanalysis, institutional and VIP-sized transfers accounted for a substantial share of regional crypto activity in 2024-2025, reinforcing demand for custody-integrated and OTC-capable exchange infrastructure.

- Expansion of tokenized real-world asset markets

GCC economies are advancing regulated tokenization initiatives, including national real-estate tokenization programs and large-scale asset-issuance pilots.

- High cross-border capital and remittance flows

GCC countries collectively processed over USD 131.5 billion in outbound remittances annually in 2023. Stablecoin settlement and digital-asset transfers have captured more than 10-20% of the remittance market globally over the past year.

- Adoption beyond regulated hubs

MENA crypto exchange development opportunity isn’t limited to the UAE or middle east. North African markets, such as Egypt and Morocco, rank among the world’s top crypto-adoption economies, despite having restrictive regimes, indicating latent exchange demand across the broader region.

- Institutional capital entering digital assets

Several banks, brokers, and investment firms are launching regulated crypto trading services. Over the past few years, the following regional banks and institutions in the UAE have embedded regulated digital asset offerings into their existing services.

| Entity Type | Institution | Service Launched | Year | Key Features |

|---|---|---|---|---|

| Bank | Standard Chartered (UAE) | Institutional Custody | 2024 | DFSA-licensed; services for institutional clients like hedge funds. |

| Bank | Emirates NBD (ENBD) | Partior Blockchain Rails | 2024 | Real-time cross-border settlement using blockchain technology. |

| Invest. Firm | CBB Licensed Firms | Stablecoin Issuance (SIO) | 2026 | First framework for BHD-pegged and USD-pegged stablecoins. |

| Central Bank | Saudi Central Bank (SAMA) | Bitcoin Holding/Sovereign Exposure | 2024/25 | Indirect exposure via micro-strategy style holdings ($68B+). |

| Broker | OKX Middle East | VASP Broker-Dealer | 2024 | Full retail/institutional license for spot, derivatives, and fiat. |

| Broker | Binance FZE | Full VASP License | 2024 | Migrated to a full operational license for trading and custody in Dubai. |

| Bank | Neom/Digital Banks | Blockchain Settlements | 2026 | Exploring CBDC and blockchain-based smart contracts. |

| Broker | IG UAE | Crypto CFDs | 2024/25 | Regulated crypto derivative trading without needing a digital wallet. |

| Bank | RAKBANK | Retail Trading (Bitpanda) | 2025 | First major local bank to offer direct AED-to-crypto in-app trading. |

| Broker | Binance Bahrain | VASP License / Banking Rails | 2024 | Full license to operate in the Kingdom’s “Crypto Hub.” |

| Bank | Liv Bank (ENBD) | Retail “Liv X” Trading | 2025 | Digital-native bank offering trading via Aquanow partnership. |

| Invest. Firm | Mashreq Capital | BITMAC Fund | 2025 | Regulated hybrid fund (BTC + Gold/Equity) with low entry barriers. |

| Invest. Firm | Blockchain Founders Fund | Web3 VC Operations | 2025/26 | Expanded Dubai presence for institutional Web3 equity & token deals. |

| Bank | Sygnum Bank (DIFC) | Crypto-Lending & Staking | 2026 | Lombard loans against crypto assets and 24/7 instant settlement. |

| Invest. Firm | QFC Digital Asset Lab | Tokenized Asset Trading | 2025 | Qatar Financial Centre legalized “Security Tokens.” |

| Bank | Comm. Bank of Dubai | Open Finance APIs | 2026 | First “Open Finance” bank connecting bank accounts to crypto VASPs. |

| Broker | Local VASPs | Regulated Trading License | 2025/26 | Shifted from a ban to licensing under Law No. 14 of 2025. |

| Broker | Bitunix / Deepcoin | Specialized Derivatives | 2026 | High-leverage futures trading for experienced local traders. |

| Bank | BBK (Bank of Bahrain & Kuwait) | Crypto-as-a-Service (MoU) | 2025 | First GCC bank to integrate Binance’s white-label API. |

Core Architecture & Essential Features for MENA-Ready Crypto Exchange Development

Launching crypto exchange software in the MENA region requires an architecture that supports regulated trading, tokenized asset issuance, compliance controls, and financial integration aligned with regional markets. Core infrastructure components and essential features must, therefore, include:

1. Multi-Asset Trading and OTC Execution Engine

As mentioned above, the MENA markets show significant demand for high-value, specific and institutional-size transactions. Cryptocurrency exchange software must therefore support spot, OTC and block-trade execution with configurable spreads, competitive pricing, and broker-assisted workflows.

2. RWA Tokenization and Listing Infrastructure

Observing the pace of regional tokenization initiatives, no crypto exchange software can afford to exclude asset issuance and listing. Crypto trading platforms must build infrastructure to onboard, list and support secondary trading of tokenized RWAs such as real estate, funds, and structured investments within the same venue as crypto assets.

3. Institutional Custody and Settlement Controls

Cryptocurrency exchange development requires custody controls such as segregated wallets, managed accounts, settlement approvals, and reporting suitable for regulated financial entities to support increasing institutional participation in MENA.

4. Stablecoin Transfer and Settlement Capability

Given the region’s massive remittance flows and stablecoin adoption, cryptocurrency exchanges should facilitate deposits, withdrawals, and on-platform cross-border value transfers alongside trading functionality.

5. GCC Banking and Fiat Integration

Cryptocurrency exchange software must connect to regional banking rails for deposits and withdrawals in local currencies and stablecoins redemptions, enabling compliant treasury and settlement operations.

6. Compliance, Surveillance, and Reporting Systems

For MENA-based cryptocurrency exchange development, businesses must integrate AML/KYC onboarding, transaction monitoring and regulatory reporting workflows required by VARA and other frameworks.

7. Sharia-Aligned Asset and Market Configuration

Islamic-finance-alligned markets require configurable screening of assets, trading rules and product structures to support Sharia-compliant digital-asset offerings. Cryptocurrency exchange software targeting middle east markets must integrate such controls to enhance authorities and peoples’ confidence in their platforms.

8. Privacy and Data Governance Controls

Apart from the Sharia regime, various regional data protection and AML frameworks govern crypto activity in the region. Crypto exchange software built for the MENA markets must, therefore, implement user-data governance, permissioned visibility and transaction monitoring controls to comply with such requirements.

Antier recently introduced VARA-ready white label crypto exchange infrastructure for UAE and MENA markets, reflecting growing demand for regulated digital-asset venues capable of supporting both trading and compliant asset issuance within unified exchange environments. For institutions planning early entry into the region, it combines remittance, asset issuance, banking connectivity, robust custody and other region-relevant functionalities.

What are the Regulatory Requirements for Launching a Crypto Exchange in MENA?

| Regulatory Area | What Regulators Require | Operational Impact on Crypto Exchange Software |

|---|---|---|

| VASP / Exchange Licensing | Authorization from VARA (Dubai), ADGM (Abu Dhabi), CBB (Bahrain), or relevant authority | Defines permitted services (trading, brokerage, custody, issuance) and geographic scope |

| Custody & Asset Safeguarding | Segregation of client assets, secure wallet architecture, settlement controls | Requires institutional custody, segregated accounts, approval workflows |

| AML/KYC & Transaction Monitoring | Identity verification, sanctions screening, ongoing transaction surveillance | Onboarding, monitoring, and reporting modules embedded in vcrypto exchange software development |

| Market Surveillance & Reporting | Trade monitoring, abuse detection, regulator reporting | Crypto exchange software must implement surveillance and audit trails |

| Banking & Fiat Integration Approval | Licensed banking partnerships and approved fiat rails | Fiat deposits/withdrawals and stablecoin redemption tied to banking partners |

| Tokenization / Asset Issuance Authorization | Approval for listing or issuing tokenized assets under securities/asset frameworks | Cryptocurrency exchange software must support compliant asset onboarding and lifecycle controls |

| Data Protection & Privacy Compliance | User data storage, consent, and processing rules under regional laws | Data governance, access control, and auditability requirements |

| Sharia Compliance (where applicable) | Asset screening and product structuring aligned with Islamic finance | Cryptocurrency exchange must enable Sharia-aligned asset configuration and trading rules |

Since regulatory requirements differ across MENA jurisdictions, exchange operator must collaborate with legal council at cryptocurrency exchange development company to pursue country-specific licensing strategies while deploying adaptable exchange infrastructure.

How Antier Enables MENA Crypto Exchange Software Launches

It is clear that launching a regulated crypto exchange software in the MENA region requires fool-proof infrastructures embedded with regional-specific architecture and feature components. Those building crypto exchange software must now build crypto exchange superapps with features that resonate with the target region’s demand.

Antier’s VARA-ready white label crypto exchange infrastructure supports the regional evolution by combining regulated trading, RWA tokenization, institutional custody, banking connectivity, and compliance controls aligned with MENA regulatory frameworks. This enables financial institutions, fintech operators, and market entrants to deploy crypto exchange software tailored to regional licensing and market requirements without building from scratch.

For organizations planning entry into MENA digital-asset markets, adopting jurisdiction-aligned exchange architecture early provides a structural advantage in licensing readiness and banking integration. As the region continues to formalize regulated digital-asset ecosystems, cryptocurrency exchange software built on compliant and adaptable infrastructure will be best positioned to scale across multiple MENA jurisdictions.

Talk to our experts to get started with MENA-alligned crypto exchange development.

Crypto World

Cross-Chain Governance Attacks – Smart Liquidity Research

The Governance Exploit Nobody Is Pricing In. Bridges get hacked. That’s old news. We’ve seen the carnage: nine-figure exploits, drained liquidity, emergency shutdowns, Twitter threads filled with “funds are safu” copium.

From Ronin Network to Wormhole, bridge exploits have become a recurring tax on innovation. But here’s the uncomfortable truth. The next systemic risk in crypto probably won’t be a bridge exploit. It’ll be a governance exploit enabled by cross-chain voting power. And almost nobody is pricing it in.

The Shift: From Asset Bridges to Power Bridges

Cross-chain infrastructure has evolved.

We’re no longer just bridging tokens for yield. We’re bridging:

Protocols increasingly allow governance tokens to exist on multiple chains simultaneously — often via wrapped representations or omnichain token standards (like those enabled by LayerZero Labs).

This improves capital efficiency and participation.

But it also introduces a new attack surface:

The separation of voting power from finality.

The Core Problem: Governance Is Local. Voting Power Is Not.

Governance contracts typically live on a single “home” chain.

But voting power can be represented across multiple chains.

This creates a dangerous gap:

-

Tokens are locked on Chain A

-

Voting power is mirrored on Chain B

-

Governance decisions are executed on Chain A

If the system relies on cross-chain messaging to sync voting balances, any delay, exploit, or manipulation in that messaging layer becomes a governance vector.

You don’t need to drain liquidity.

You just need to distort voting power long enough.

And governance proposals often pass with shockingly low turnout.

The Attack Path Nobody Talks About

Let’s walk through a hypothetical.

Step 1: Acquire or Manipulate Voting Power Cross-Chain

An attacker:

-

Borrows governance tokens

-

Bridges them to a secondary chain

-

Exploits a delay in balance updates

-

Or abuses inconsistencies in wrapped token accounting

In poorly designed systems, the same underlying tokens may temporarily influence voting in multiple domains.

Even if briefly.

Even if “just a bug.”

Governance doesn’t need hours. It needs one block.

Step 2: Flash Governance

We’ve already seen governance flash-loan exploits in DeFi.

The most infamous example? The attack on Beanstalk in 2022.

The attacker used flash loans to acquire massive voting power, passed a malicious proposal, and drained ~$182M.

Now imagine that dynamic — but across chains.

Flash-loaned tokens → bridged representation → governance vote → malicious proposal executed → unwind.

All before the watchers even understand what happened.

Step 3: Proposal Payloads as Weapons

Governance proposals can:

If cross-chain voting power is compromised, the proposal payload becomes the exploit.

No bridge drain required.

Just governance “working as designed.”

Why Markets Aren’t Pricing This Risk

Three reasons.

1. Everyone Is Still Fighting the Last War

After major bridge hacks, teams hardened signature validation and multisig thresholds.

But governance-layer risk is subtler.

It doesn’t show up as “TVL at risk” on dashboards.

It shows up as “who controls protocol direction.”

That’s harder to quantify.

2. Voting Participation Is Low

Many DAOs struggle to get 10–20% participation.

Which means:

You don’t need 51%.

You need slightly more than apathy.

Cross-chain voting power distortions don’t need to be massive. They just need to be decisive.

3. Composability Multiplies Complexity

Modern governance stacks combine:

-

Delegation contracts

-

Token wrappers

-

Cross-chain messaging

-

Snapshot systems

-

Execution timelocks

Each layer introduces potential inconsistencies.

And composability means failures cascade.

Where the Real Risk Lives

This isn’t about one protocol.

It’s systemic.

The more governance tokens become:

The more fragile governance assumptions become.

If a governance token is:

You’ve built a multi-dimensional voting derivative.

And derivatives break under stress.

Ask TradFi. They have scars.

The Governance Exploit Nobody Is Pricing In

Markets price:

-

Smart contract risk

-

Bridge exploit risk

-

Oracle manipulation risk

But they do not price:

Cross-domain voting synchronization risk.

No dashboards are tracking:

-

Governance message latency

-

Cross-chain vote desync windows

-

Wrapped-token vote inflation

-

Double-counted delegation

Yet these variables may determine who controls billion-dollar treasuries.

What Builders Should Be Doing (Now)

If you’re designing cross-chain governance:

1. Separate Voting Power from Bridged Liquidity

Avoid naïve 1:1 mirroring without strict finality checks.

2. Introduce Vote Finality Windows

Require:

-

Cross-chain state verification

-

Message settlement delays

-

Proof-of-lock confirmations

Before votes are counted.

3. Use Decay or Cooldowns on Newly Bridged Tokens

Voting power shouldn’t activate instantly after bridging.

If tokens just moved chains 5 seconds ago, maybe they shouldn’t decide protocol destiny.

4. Simulate Governance Stress Scenarios

Run adversarial simulations:

If your governance model breaks under simulation, it will break in production.

What Investors Should Be Asking

Before allocating to a multi-chain DAO:

-

Where does governance live?

-

How is voting power mirrored?

-

Can voting power be double-counted during bridge latency?

-

What happens if the messaging layer stalls?

-

Is there a time lock between the vote and execution?

If the answers are vague, the risk is real.

And it’s not priced in.

The Inevitable Wake-Up Call

Crypto learns through catastrophe.

-

Smart contract exploits → audits became standard.

-

Oracle exploits → TWAP and redundancy

-

Bridge hacks → validator hardening

Governance-layer cross-chain exploits are likely next.

And when it happens, it won’t look like a hack.

It’ll look like a proposal that “passed.”

That’s the scary part.

Final Thought

Cross-chain infrastructure is powerful. It enables capital mobility, global participation, and modular design.

But it also decouples authority from location.

And when authority becomes fluid across chains, attackers don’t need to steal funds.

They just need to win a vote.

That’s the governance exploit nobody is pricing in.

And by the time the market does, it’ll already be too late.

REQUEST AN ARTICLE

Crypto World

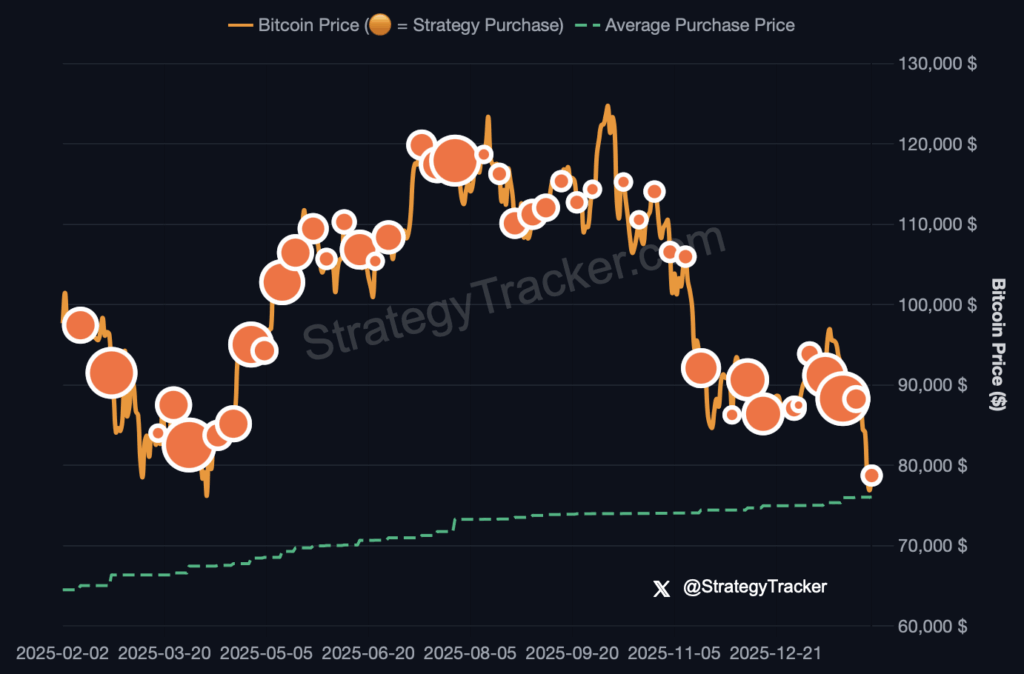

Payoneer Adds to Crypto, Fintech Firms Seeking Bank Charter

Global financial services firm Payoneer is the latest in a growing number of companies that have filed for a national trust banking charter in the US, which could enable it to issue a stablecoin and provide various crypto services.

Payoneer said on Tuesday it filed with the Office of the Comptroller of the Currency to form PAYO Digital Bank, a week after it partnered with stablecoin infrastructure firm Bridge to add stablecoin capabilities to its platform that is mainly focused on cross-border transactions.

Payoneer said that it is seeking to issue a GENIUS Act-compliant stablecoin, PAYO-USD, to serve as the holding currency in Payoneer wallets, in addition to allowing customers to pay and receive stablecoins.

OCC approval would also enable Payoneer to manage PAYO-USD reserves, offer custodial services and enable customers to convert between the stablecoins into their local currency.

“We believe stablecoins will play a meaningful role in the future of global trade,” said Payoneer CEO John Caplan.

The OCC gave conditional approval to Crypto.com for a charter on Monday, adding to the banking charters won by crypto companies Circle, Ripple, Fidelity Digital Assets, BitGo and Paxos in December.

Related: Better, Framework Ventures reach $500M stablecoin mortgage financing deal

The Trump family’s World Liberty Financial also applied for one in January to expand the use of its USD1 (USD1) stablecoin, but is still awaiting a decision.

Crypto trading platform Laser Platform also submitted an application in January, while Coinbase has been awaiting a decision on its application since October.

Stablecoins ideal for business cross-border transfers: Payoneer

Payoneer said OCC approval would allow it to offer its nearly two million customers, which are mostly small and medium-sized businesses, a regulated stablecoin solution to simplify cross-border trade.

“This offering will help advance the use of the USD in global trade, reduce barriers for American companies competing internationally, and expand the dollar’s presence across non-dollar payment corridors,” it said.

In December, Comptroller of the Currency Jonathan Gould said that new entrants to the federal banking sector was “good for consumers, the banking industry and the economy [as] they provide access to new products, services and sources of credit to consumers, and ensure a dynamic, competitive and diverse banking system.”

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

Bitcoin price prediction as Coinbase Premium flips positive

Bitcoin price is attempting a recovery near $65,000 as the Coinbase Premium turns positive despite recent exchange-traded fund outflows.

Summary

- Bitcoin price prediction leans towards trend reversal as the Coinbase Premium flips positive.

- The metric indicates strong U.S. demand returning after recent ETF outflows.

- Price must reclaim key resistance to confirm a stronger recovery.

Bitcoin was trading at $65,907 at press time, up 3.4% in the last 24 hours. The move follows a drop to $62,900 within the past week, where buyers stepped in.

Even with the bounce, Bitcoin (BTC) is still down 24% over the past month and about 50% below its October 2025 all-time high of $126,050.

Trading activity increased during the recovery. Spot volume reached $46 billion, up 22% day over day. In derivatives markets, CoinGlass data shows futures volume up 6.2% to $74.8 billion, while open interest slipped 0.1% to $43.9 billion.

This suggests some traders are closing positions rather than adding aggressive leverage.

Coinbase premium turns positive

On Feb. 25, the Coinbase Premium Index turned positive for the first time in 40 days, hitting 0.0525%, according to CoinGlass.

The index measures the price difference between Coinbase and global exchanges. A positive reading means Bitcoin trades slightly higher on Coinbase, which often reflects stronger U.S. demand.

This shift comes at a time when U.S. spot Bitcoin ETFs have recorded heavy outflows, with roughly $3.8 billion exiting recently. That contrast is important. While ETFs have seen capital leave, the premium suggests some U.S. buyers are stepping back in through exchange flows.

In past cycles, sustained positive premiums have aligned with accumulation phases and relief rallies. However, a single flip does not confirm a trend change. Traders will watch if the premium widens and holds over several sessions.

Bitcoin price prediction: Is the trend reversing?

Bitcoin is attempting to stabilize after a sharp corrective phase. On the daily chart, price is still trading below its short-term trend pivot near the mid-Bollinger band around the high -$67,000 area.

That zone now acts as the line that separates a relief bounce from a stronger recovery attempt.

Momentum indicators show improvement from oversold conditions, with the relative strength index climbing from sub-30 levels earlier in February. Bulls have not yet completely taken back control, though, as the RSI is still below the midpoint.

The recovery might reach the low -$70,000 area if the Coinbase Premium holds positive and Bitcoin breaks through the mid-band resistance with growing spot volume. A move into that zone would shift short-term structure and increase confidence that the trend has reversed.

On the other hand, failure to reclaim resistance would keep the price vulnerable to another pullback toward the mid -$64,000 area. A break below that support would raise the risk of a deeper move toward $60,000.

Crypto World

Binance Revives Tokenized Equities in Ondo Finance Deal

TLDR

- Binance has relaunched tokenized stocks trading through a partnership with Ondo Finance on Binance Alpha.

- The platform lists 10 tokenized U.S. stocks, ETFs, and commodity-linked products.

- Users in the United States cannot access the new tokenized stock offerings.

- Binance previously halted a similar service in 2021 after regulatory scrutiny in Europe.

- Ondo Finance has recorded over $550 million in locked value and $11 billion in cumulative trading volume since September 2025.

Binance has relaunched tokenized stocks trading through a new partnership with Ondo Finance. The exchange will list 10 tokenized U.S. stocks, ETFs, and commodity-linked products on Binance Alpha. The move marks Binance’s return to this market nearly five years after halting a similar service.

Binance and Ondo Finance Launch Tokenized Equities on Alpha

Binance has partnered with Ondo Finance to introduce tokenized versions of major U.S. equities on Binance Alpha. The platform operates within Binance Wallet and targets early-stage digital asset offerings. Users can trade blockchain-based versions of Apple, Google, Tesla, and Nvidia shares.

The lineup also includes the Invesco QQQ ETF, which tracks the Nasdaq index. Binance confirmed that users in the United States cannot access these tokenized stocks. Jeff Li, Binance’s vice president of product, said, “Our users now have even more convenient ways to explore and trade tokenized stocks.”

Binance Alpha allows access to projects before they reach the centralized spot marketplace. The company positions the platform as a gateway for higher-risk digital assets. Through this structure, Binance expands product access while keeping trading within its wallet ecosystem.

Ondo Finance issues the tokenized equities listed on the platform. The company focuses on bridging traditional financial assets with blockchain networks. Binance integrates these tokens directly into its wallet infrastructure.

Binance previously launched tokenized stocks in April 2021, starting with Tesla shares. The exchange later added Coinbase, Strategy, Microsoft, and Apple to the offering. However, regulators in the United Kingdom and Germany raised compliance concerns.

The U.K.’s Financial Conduct Authority and Germany’s BaFin reviewed the product structure. Following regulatory scrutiny, Binance discontinued the service within months. The company has now resumed tokenized equities through its collaboration with Ondo Finance.

Last month, Binance stated that it was considering a renewed push into tokenized equities. The latest listings on Binance Alpha confirm that plan. The rollout follows growing activity in blockchain-based stock trading platforms.

Tokenized Stocks Market Expands Across Exchanges

Tokenized stocks have grown across crypto exchanges and traditional brokerages. The sector’s total value approaches $1 billion, according to recent market data. Ondo Finance reports more than $550 million in locked value.

The company also recorded $11 billion in cumulative trading volume since September 2025. Other exchanges, including Kraken, Bybit, and Gemini, have introduced similar products. Robinhood has also launched tokenized equity trading services.

Traditional exchanges have also outlined plans involving stock tokens. Nasdaq and the New York Stock Exchange have presented proposals tied to blockchain-based trading models. These developments align with Binance’s renewed entry into tokenized equities through Ondo Finance.

Crypto World

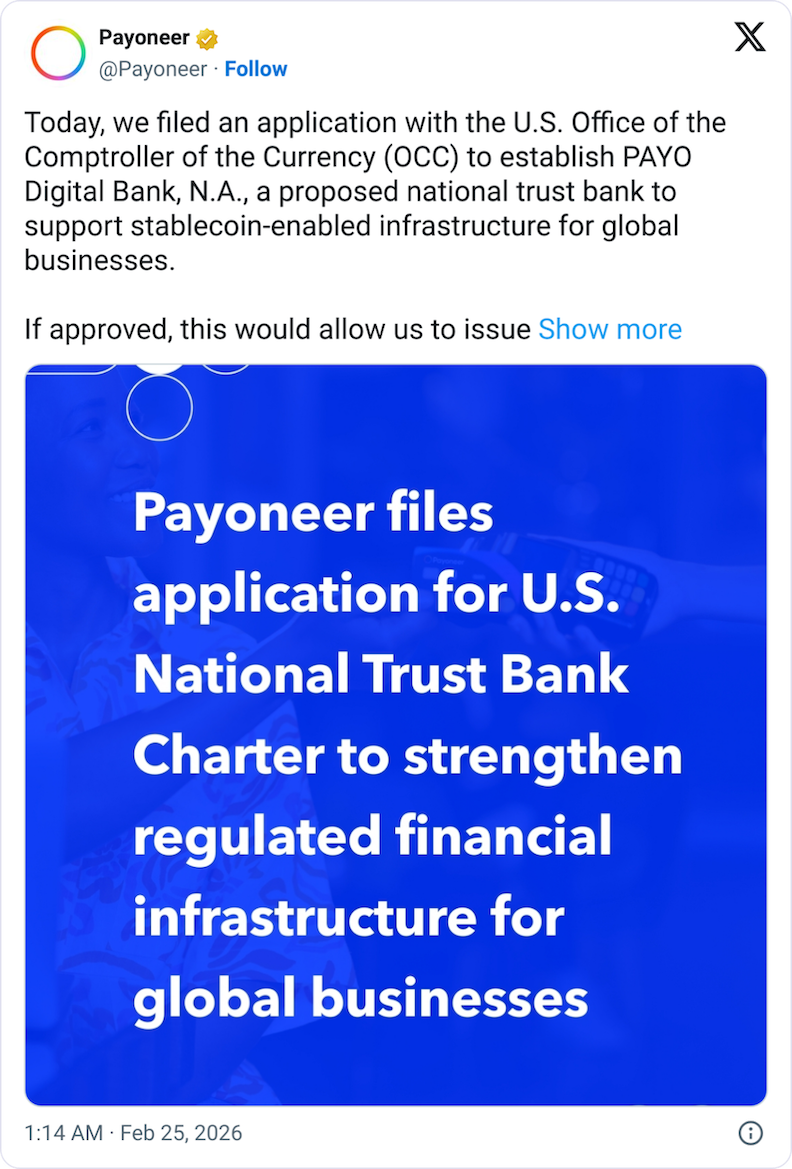

Bitcoin Depot Introduces ID for All Transactions

The biggest Bitcoin ATM operator in the US has begun phasing in a new requirement for users to provide identification for every transaction at its crypto ATMs amid increasing pressure from regulators and lawmakers for operators to curb illicit activity.

Bitcoin Depot said on Tuesday that it began the rollout earlier in February across the company’s US network ATMs, with the goal of helping to detect suspicious activity in real time and eliminate misuse by bad actors, such as account sharing, identity theft, and account takeover.

“Continuous verification allows us to detect suspicious activity based on customers, locations, or transaction amount before a transaction is approved,” Bitcoin Depot CEO Scott Buchanan said in a statement.

Bitcoin Depot implemented ID requirements in October, but only for all new users to its service. Buchanan said that “by requiring identity verification at every transaction, we are taking an additional step to strengthen security, protect customers, and maintain the integrity of our services.”

The US is the largest hub for Bitcoin (BTC) ATMs, with Coin ATM Radar listing 31,360 machines, accounting for 78% of the worldwide total. Bitcoin Depot is the market leader in the country with 9,019 kiosks.

Bitcoin Depot faces state-level lawsuits

Scammers have long used crypto ATMs as a way to receive funds from unwitting victims, as the kiosks are widespread and their transactions are irreversible, leading regulators and lawmakers to crack down on crypto ATM operators.

The advocacy organisation, the American Association of Retired Persons, reported in February that 17 US states have passed laws requiring crypto ATM operators to implement protections, including daily transaction limits, fraud warning signs, and licensing requirements.

Related: Crypto ATM limits and bans sweep across US: Here’s why

Bitcoin Depot has caught the ire of state regulators, as Massachusetts Attorney General Andrea Campbell sued Bitcoin Depot earlier this month, alleging the company has not implemented sufficient safeguards to prevent scams. Campbell is seeking a court order to bar Bitcoin Depot from processing large transactions without additional user protections.

In January, Maine Attorney General Aaron Frey reached a $1.9 million settlement with Bitcoin Depot to reimburse individuals who lost money to scams while using the company’s ATMs.

Last year, Iowa Attorney General Brenna Bird launched a lawsuit against both Bitcoin Depot and its rival Coinflip, alleging the operators failed to implement adequate protections to prevent scams.

Magazine: 6 massive challenges Bitcoin faces on the road to quantum security

Crypto World

Mastercard Hires for Crypto Just as Citrini Warns It Could Be Obsolete

Mastercard is hiring a Director of Crypto Flows to lead stablecoin-linked card issuance, scale DeFi payment flows, and rewrite network rules for Web3 transactions.

The job posting, first surfaced by crypto journalist Frank Chaparro on Feb. 24, signals a structural push beyond the pilot-stage experiments the payments giant has run so far.

The Timing That Writes Itself

Days earlier, Citrini Research published “The 2028 Global Intelligence Crisis,” a doomsday scenario that rapidly went viral on Substack. The report maps a chain reaction in which AI agents progressively dismantle fee-based intermediaries — and payment networks sit squarely in the blast radius. Citrini specifically names Mastercard’s Q1 2027 earnings as a potential inflection point, the moment when agentic commerce begins routing around card interchange via stablecoins.

The logic is straightforward. When AI agents transact on behalf of consumers, a 2-3% card interchange fee becomes an irrational cost. Stablecoin rails settle the same transaction for near zero. In that world, Mastercard doesn’t lose to a competitor. It loses to a protocol.

The gap Mastercard needs to close

The vulnerability is not hypothetical. Stablecoins transferred $18.4 trillion in value in 2024, surpassing both Visa ($15.7 trillion) and Mastercard ($9.8 trillion) in raw volume, according to Artemis Analytics. The comparison is imperfect — much of that is trading, not payments — but the directional signal is clear.

Mastercard’s own CEO, Michael Miebach, told analysts in January that the company is “leaning in” to stablecoins and agentic commerce, calling the latter a trend in which “the train is leaving the station.” Yet he framed stablecoins as “another currency we can support within our network.”

That framing is precisely what Citrini challenges. The doomsday thesis is not that stablecoins replace card payments at today’s checkout counter. It is that a new category of commerce — machine-to-machine, micropayment-dense, 24/7 — will emerge entirely outside the card network’s design envelope.

Building rails or getting routed around

The new role suggests Mastercard is beginning to internalize this risk. Mastercard has laid the groundwork: onboarding multiple stablecoins onto its network in June 2025, expanding Circle’s USDC settlement across the Middle East and Africa, and reportedly pursuing a $2 billion acquisition of crypto infrastructure startup zerohash.

But the gap with Visa persists. Visa’s on-chain stablecoin settlement reached an annual run rate of $3.5 billion by late 2025. Crypto-native issuers like Rain and Reap built their card programs primarily on Visa rails, with Rain scaling to over $3 billion annualized after securing direct Visa membership. Industry analysis suggests Visa’s early crypto-native alignment translated into share, while Mastercard’s exchange-focused approach generated less volume.

Coincidence or confirmation

Regardless of whether Mastercard’s hiring push was triggered by Citrini’s report, the more important reading is that the diagnosis is converging. A research outfit writing from 2028 and a payments giant hiring in 2026 point at the same fault line. Card networks that cannot accommodate stablecoin-native commerce will be bypassed, not disrupted.

The canary, as Citrini wrote, is still alive. The question is whether Mastercard is building a bridge to close the gap—or just hiring someone to watch it widen.

Crypto World

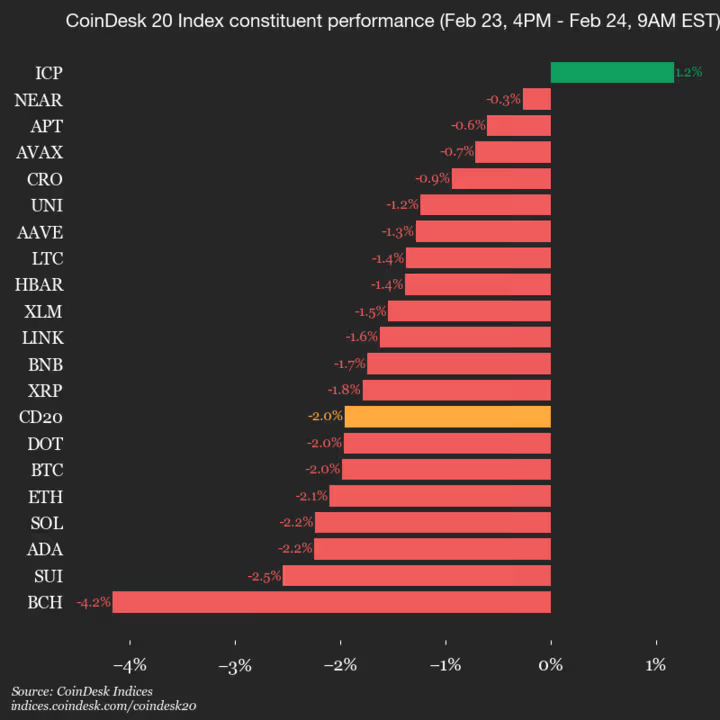

index falls 2% as nearly all constituents decline

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1816.14, down 2.0% (-36.33) since 4 p.m. ET on Monday.

One of the 20 assets is trading higher.

Leaders: ICP (+1.2%) and NEAR (-0.3%).

Laggards: BCH (-4.2%) and SUI (-2.5%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Ethereum Foundation begins staking 70,000 ETH from treasury

The Ethereum Foundation has begun staking a portion of its treasury holdings, marking a significant shift in how the organization manages its ETH reserves.

Summary

- The Ethereum Foundation has begun staking its treasury, starting with a 2,016 ETH deposit and planning to stake approximately 70,000 ETH in total.

- Staking rewards will be directed back to the foundation’s treasury to help fund core operations, including protocol R&D, ecosystem grants and community development.

- The validator setup uses open-source tools from Attestant, including Dirk and Vouch, with a focus on distributed signing, minority clients and multi-jurisdiction infrastructure.

Ethereum Foundation puts treasury to work with 70K ETH staking plan

In a post on X, the foundation said it has made an initial deposit of 2,016 Ethereum (ETH) and plans to stake approximately 70,000 ETH in total, with staking rewards directed back into its treasury. The move follows a Treasury Policy announced last year and is designed to both support network security and help fund the foundation’s core operations.

The staking setup is being implemented using open-source tools developed by Attestant, including Dirk and Vouch.

Dirk functions as a distributed signer, allowing validators to be operated across multiple jurisdictions and reducing the risk of a single point of failure.

Vouch enables the use of multiple consensus and execution client pairings, helping mitigate client diversity risks, a key concern for Ethereum’s decentralization model. The foundation said its validator setup incorporates minority clients and a mix of hosted infrastructure and self-managed hardware spread across several regions.

The announcement comes at a notable moment for Ethereum. Recently co-founder Vitalik Buterin sold roughly $7 million worth of ETH amid a broader price pullback, sparking discussion about treasury management and market signals.

At the same time, the foundation has been expanding ecosystem support through new grant initiatives, including updates to its Ecosystem Support Program aimed at funding protocol research, community development and public goods projects.

By staking a portion of its holdings, the foundation is effectively putting dormant ETH to work, generating yield while reinforcing validator participation. The move aligns the treasury more closely with Ethereum’s proof-of-stake design and provides an additional funding stream for long-term development efforts without relying solely on asset sales.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Crypto World21 hours ago

Crypto World21 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech11 hours ago

Tech11 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat6 hours ago

NewsBeat6 hours agoPolice latest as search for missing woman enters day nine

![Lyn Alden: "This Changes Everything For Bitcoin & Crypto" [New 2026 Bitcoin and Crypto Prediction]](https://wordupnews.com/wp-content/uploads/2026/02/1771993640_maxresdefault-80x80.jpg)