Crypto World

Bitcoin improvement proposal to block spam draws heat from heavyweights

By Omkar Godbole (All times ET unless indicated otherwise)

A new Bitcoin Improvement Proposal, BIP-110, which seeks to curb spam-like data clogging the blockchain, is facing backlash from some industry leaders who argue it risks damaging the network’s reputation more than the spam itself.

BIP-110 is a “soft fork,” a type of upgrade that works smoothly with existing Bitcoin setups without breaking the blockchain. It seeks to set strict temporary limits on non-money data in transactions, particularly Ordinals inscriptions that jam images, videos or tokens into Bitcoin blocks.

Implementing the same could help fight “spam” and unclog the network, making it cheaper for regular people to use, keeping the blockchain focused on payments. The onchain activity has been close to negligible in recent months.

However, Blockstream’s CEO, Adam Back, disagrees, calling the proposal an attack on Bitcoin’s reputation as reliable money.

“It’s worse as it is an attack on bitcoin’s credibility as a store of value, it’s security credibility, and a lynch mob attempt to push changes there is not consensus for. spam is just an annoyance, it all definitionally fits within the block-size. the op returns are 4x smaller,” Back said on X.

Several others echoed this, arguing the fix might hurt trust more than spam does.

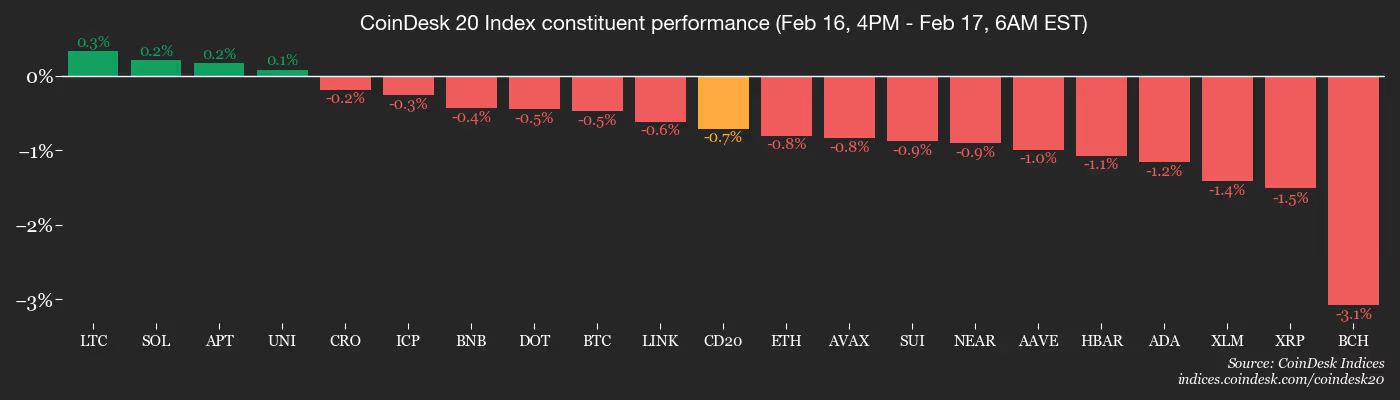

In the meantime, markets offer little excitement, as bitcoin continues to trade back and forth between $67,000 and $70,000, with prices approaching the lower end of the range as of writing. The CoinDesk Memecoin Index (CDMEME) is down 3% over 24 hours alongside 1% declines in other major tokens such as ether and BNB.

“The decline of the largest coins is an ominous sign for smaller ones, as it may soon pull them down with it at an accelerated pace,” Alex Kuptsikevich, senior market analyst at The FxPro, said in an email.

He added that the market has entered a “stress zone” but has not yet reached the final capitulation stage. “To form a ‘true bottom,’ a peak in loss-taking and a complete exhaustion of selling pressure are necessary,” he noted.

In traditional markets, dollar shorts hit their highest level in over a decade, while the recent decline in the inflation-adjusted yield on the U.S. 10-year note offered hope to battered bitcoin bulls. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 17, 7 p.m.: Rocket Pool to launch its Saturn One upgrade.

- Macro

- Feb. 17, 8:30 a.m.: Canada inflation rate YoY for January (Prev. 2.4%); Core rate YoY (Prev. 2.8%)

- Feb. 17, 8:30 a.m.: NY Empire State manufacturing index for February est. 7.1 (Prev. 7.7)

- Feb. 17, 6:50 p.m.: Japan balance of trade for January est.-2.142bn yen (Prev.105.7bn yen)

- Earnings (Estimates based on FactSet data)

- Feb. 17: HIVE Digital Technologies (HIVE), pre-market, -$0.07

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 17: Jito to host an X Spaces session with Hush Protocol.

- Feb. 17: Basic Attention Token to host a Brave Talk session on X Spaces.

- Balancer is voting to swap a signer on the Emergency subDAO multisigs to improve operational responsiveness and security coverage. Voting ends Feb. 17.

- Unlocks

- Feb. 17: YZY (YZY) to unlock 17.24% of its circulating supply worth $20.84 million.

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 1.03% from 4 p.m. ET Monday at $68,131.79 (24hrs: -1.28%)

- ETH is down 1.11% at $1,976.32 (24hrs: -0.57%)

- CoinDesk 20 is down 1.28% at 1,978.56 (24hrs: -1.03%)

- Ether CESR Composite Staking Rate is up 6 bps at 2.84%

- BTC funding rate is at 0.002% (2.2119% annualized) on Binance

- DXY is up 0.21% at 97.12

- Gold futures are down 1.87% at $4,952.10

- Silver futures are down 4.19% at $74.70

- Nikkei 225 closed down 0.42% at 56,566.49

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 0.37% at 10,512.50

- Euro Stoxx 50 is up 0.15% at 5,987.94

- DJIA closed on Friday up 0.10% at 49,500.93

- S&P 500 closed up 0.05% at 6,836.17

- Nasdaq Composite closed down 0.22% at 22,546.67

- S&P/TSX Composite closed up 1.87% at 33,073.71

- S&P 40 Latin America closed on Monday down 0.64% at 3,717.23

- U.S. 10-Year Treasury rate is down 2.7 bps at 4.029%

- E-mini S&P 500 futures are down 0.20% at 6,836.50

- E-mini Nasdaq-100 futures are down 0.58% at 24,658.75

- E-mini Dow Jones Industrial Average Index futures are down 0.02% at 49,560.00

Bitcoin Stats

- BTC Dominance: 58.81% (-0.16%)

- Ether-bitcoin ratio: 0.02897 (-0.14%)

- Hashrate (seven-day moving average): 1,043 EH/s

- Hashprice (spot): $34.08

- Total fees: 2.22 BTC / $151,829

- CME Futures Open Interest: 118,450 BTC

- BTC priced in gold: 13.8 oz.

- BTC vs gold market cap: 4.53%

Technical Analysis

- The chart shows swings in bitcoin’s 30-day implied volatility index in candlestick format.

- Volatility has cooled significantly, reversing the early month pop to nearly 100%.

- The reversal indicates that panic has ebbed and traders are no longer frantically chasing options or hedging bets as in the first six days of the month.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $164.32 (+16.46%), -0.94% at $162.78 in pre-market

- Circle Internet (CRCL): closed at $60.04 (+6.02%), -0.35% at $59.83

- Galaxy Digital (GLXY): closed at $21.66 (+7.49%), -1.66% at $21.30

- Bullish (BLSH): closed at $31.73 (+0.06%), -0.66% at $31.52

- MARA Holdings (MARA): closed at $7.92 (+9.24%), -1.14% at $7.83

- Riot Platforms (RIOT): closed at $15.22 (+7.18%), -1.18% at $15.04

- Core Scientific (CORZ): closed at $17.84 (+2.06%)

- CleanSpark (CLSK): closed at $9.85 (+5.80%), -0.81% at $9.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $41.34 (+3.09%)

- Exodus Movement (EXOD): closed at $11.27 (+10.60%), -3.02% at $10.93

Crypto Treasury Companies

- Strategy (MSTR): closed at $133.88 (+8.85%), -1.60% at $131.74

- Strive (ASST): closed at $8.33 (+8.18%), -0.12% at $8.32

- SharpLink Gaming (SBET): closed at $6.85 (+4.74%), -2.34% at $6.69

- Upexi (UPXI): closed at $0.77 (+3.36%), +5.76% at $0.81

- Lite Strategy (LITS): closed at $1.12 (+8.74%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $15.1 million

- Cumulative net flows: $54.31 billion

- Total BTC holdings ~ 1.26 million

Spot ETH ETFs

- Daily net flow: $10.2 million

- Cumulative net flows: $11.67 billion

- Total ETH holdings ~ 5.71 million

Source: Farside Investors

While You Were Sleeping

Bitcoin remains under pressure near $68,000 even as panic ebbs (CoinDesk): Bitcoin is struggling to build any upward momentum, even as the key panic gauge pulls back from its early-month high and hints at renewed stability.

BofA survey flags dollar bearish bets at over a decade high. Here’s what it means for bitcoin (CoinDesk): Investors are most bearish on the dollar in over a decade, per Bank of America’s latest survey and that extreme bet could breed bitcoin volatility, just not the way crypto bulls have become used to.

Pound and bond yields Fall as weak data Cements rate-cut bets (Bloomberg): The pound is falling below $1.36 after data showed wage growth slowed more than expected to 4.2% in December, while unemployment ticked up.

US and Iran begin nuclear talks in Geneva as threat of war looms (Reuters): Iran’s supreme leader warned that U.S. attempts to depose his government would fail, as Washington and Tehran began nuclear talks amid a U.S. military buildup in the Middle East.

Crypto World

Gemini executive depart amid cost-cutting push

Cryptocurrency exchange Gemini disclosed plans for a leadership restructuring that will see three senior executives depart as the company narrows its geographic focus and implements cost reductions, according to a regulatory filing released Tuesday.

Summary

- Gemini operates in more than 60 countries, but demand in certain regions proved insufficient to support continued growth.

- The firm plans to execute separation agreements with three executives that may allow them to remain temporarily to assist with transitions.

- The board appointed Chief Accounting Officer Danijela Stojanovic as interim CFO.

Chief Operating Officer Marshall Beard, Chief Financial Officer Dan Chen, and Chief Legal Officer Tyler Meade will leave their positions effective Feb. 17, the company stated in a Form 8-K filing. Gemini plans to execute separation agreements with each executive that may allow them to remain temporarily to assist with transitions, during which they would receive base salary and benefits without additional bonuses or incentive compensation.

Beard also resigned from Gemini’s board of directors on the same date. The filing indicated his departure was not related to disagreements over operations, policies, or practices.

Gemini announced a round of layoffs earlier this month.

The company will not fill the chief operating officer position. Co-founder Cameron Winklevoss will assume many of Beard’s responsibilities, including revenue-related duties, according to the filing. The board appointed Chief Accounting Officer Danijela Stojanovic as interim CFO, while Kate Freedman, currently associate general counsel and corporate secretary, will serve as interim general counsel.

ETF analyst James Seyffart characterized the changes as a “big shakeup” in a post on social media platform X following the filing’s publication.

The leadership changes accompany broader operational restructuring announced earlier this month. Gemini Space Station Inc. will cease operations in the United Kingdom, the European Union, and Australia, the company stated. Gemini also announced workforce reductions of approximately 25% to decrease costs and concentrate on core priorities.

Company management indicated that expansion into multiple countries created operational complexity and elevated expenses. While Gemini operates in more than 60 countries, demand in certain regions proved insufficient to support continued growth, executives stated. Future operations will focus primarily on the U.S, which management identified as the company’s strongest market.

Unaudited financial results for the previous year reflected mixed performance. Monthly transacting users increased approximately 17% year-over-year to roughly 600,000, according to company data. Net revenue is projected between $165 million and $175 million, compared with $141 million in 2024.

Operating costs, however, outpaced revenue growth significantly. The company estimated operating expenses may reach $530 million, with adjusted EBITDA losses of approximately $260 million. Total net losses for the year could approach $600 million, according to the projections.

Market participants responded negatively to the disclosed losses, according to reports.

Crypto World

Wall Street Bets on Prediction Markets With New ETF Wave

Institutional investors are entering prediction markets, following a strategy seen earlier in the crypto space.

Asset managers are filing for prediction-market tied exchange-traded funds as the space continues to gain traction.

Sponsored

Sponsored

Institutional Capital Moves Into Prediction Markets as ETF Race Begins

On February 17, 2026, Bitwise Asset Management submitted a post-effective amendment to register six ETFs under a new brand called “PredictionShares.” The proposed funds, tied to event contracts on the outcome of US elections, would be listed and primarily traded on NYSE Arca.

“PredictionShares will serve as a new Bitwise platform focused on providing exposure to prediction markets. Bitwise’s CIO Matt Hougan says prediction markets are accelerating in both scale and importance, making client exposure an opportunity the firm couldn’t pass up,” Crypto In America host Eleanor Terrett wrote.

The six proposed funds are:

- PredictionShares Democratic President Wins 2028 Election

- PredictionShares Republican President Wins 2028 Election

- PredictionShares Democrats Win Senate 2026 Election

- PredictionShares Republicans Win Senate 2026 Election

- PredictionShares Democrats Win House 2026 Election

- PredictionShares Republicans Win House 2026 Election

Each ETF seeks capital appreciation tied to a specific US election outcome. It follows an 80% investment policy under which it will invest at least 80% of its net assets, plus any borrowings for investment purposes, in derivative instruments whose value is linked to that defined political event.

The funds gain exposure primarily through swap agreements that reference CFTC-regulated event contracts listed on designated contract markets, although they may also invest directly in those event contracts. The event contracts follow a binary payout structure, typically settling at $1 if the specified outcome occurs and at $0 if it does not.

“This makes an investment in the Fund highly risky. An investment in the Fund is not appropriate for investors who do not wish to invest in a highly risky investment product or who do not fully understand the Fund’s investment strategy. Such investors are urged not to purchase Fund Shares,” the filing reads.

Sponsored

Sponsored

Moreover, GraniteShares, an independent ETF issuer, also filed a Form 485APOS on February 17 for six similar funds. These two filings followed shortly after Roundhill made the same move.

Bloomberg Intelligence Senior Research Analyst James Seyffart indicated that more filings are likely to continue.

“The financialization and ETF-ization of everything continues,” he added.

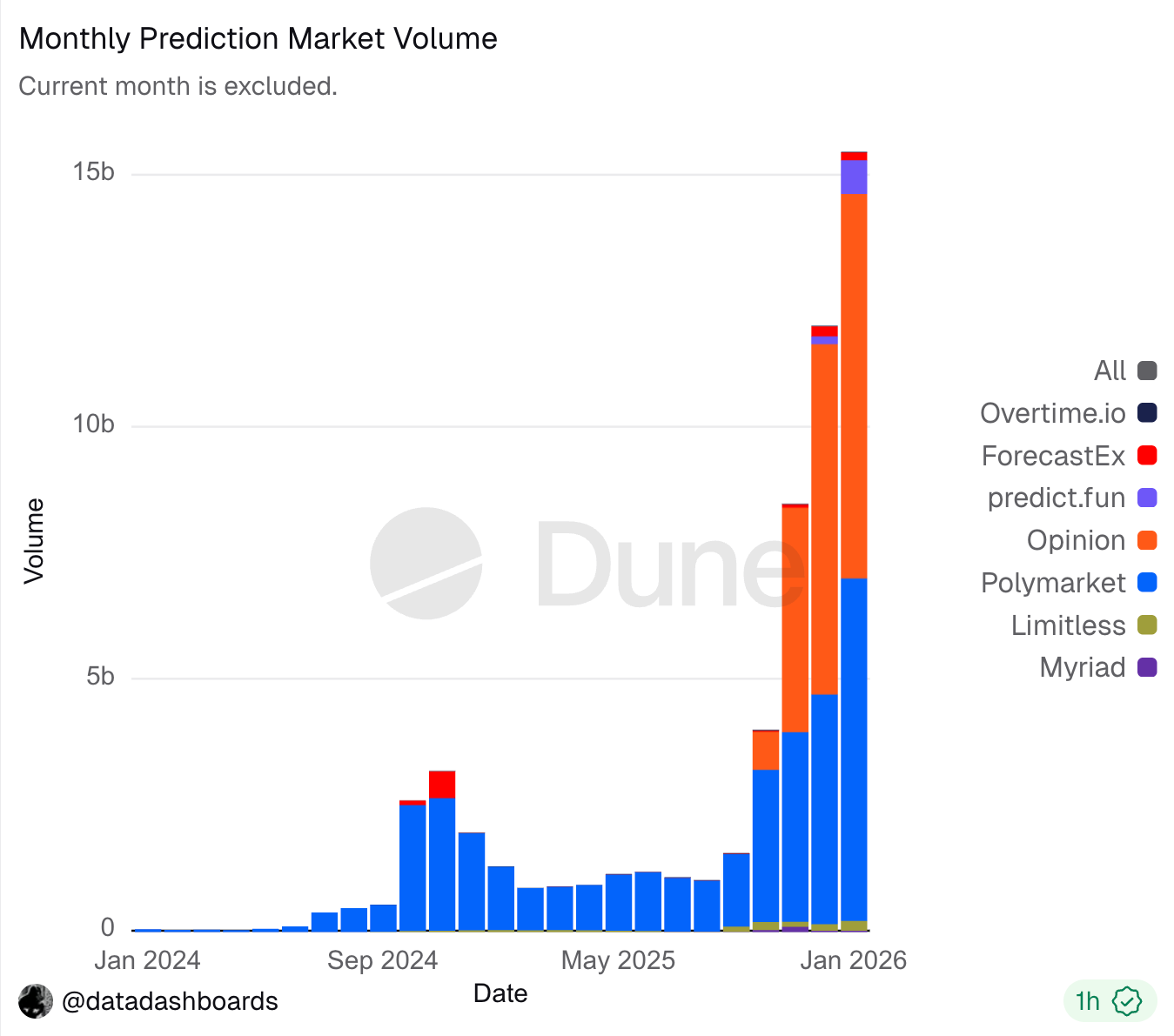

The ETF filings arrive as the prediction market sector posts record-breaking growth. The move mirrors the surge of ETF applications tied to digital assets, when asset managers rushed to capitalize on renewed momentum in the sector following the election of a pro-crypto administration.

While demand for Bitcoin and Ethereum ETFs appears to have slowed, evidenced by significant outflows from the spot products, institutions may be looking to broaden their exposure to the growing prediction market space.

Data from Dune Analytics highlights the sector’s momentum. Monthly trading volume climbed to $15.4 billion in January, setting a new all-time high.

Transaction count also reached a record, surpassing 122 million, while monthly users rose to 830,520. Taken together, these suggest sustained growth across the prediction market sector, alongside increasing product development and institutional interest.

Crypto World

Dragonfly Raises $650M for New Fund to Back DeFi, Prediction Markets and Stablecoins

Dragonfly Capital has announced the closing of its $650 million Fund IV, focusing on stablecoins, decentralized finance, and prediction markets.

Dragonfly Capital, a crypto venture capital firm, has closed its Fund IV at $650 million, to focus on DeFi, stablecoins and prediction markets, despite stagnant prices and a mildly down market.

Haseeb Qureshi, managing partner at Dragonfly Capital, announced in an X post today, Feb. 17, that Fund IV is the firm’s “biggest bet yet that the crypto revolution is still early in its exponential.” Qureshi added:

“If you look at our recent bets — Polymarket, Ethena, Rain, Mesh — the growth speaks for itself. Agentic payments, on-chain privacy, the tokenization of everything — crypto’s surface area is about to explode, and we want to be backing the founders at the center of it.”

Dragonfly Capital’s approach during market downturns is not new. The firm has raised capital during previous challenging periods, such as the 2018 ICO winter and prior to the Luna collapse, Qureshi added.

The firm’s first fund in 2018 closed at roughly $100 million during the ICO downturn, followed by a $225 million Fund II in 2021, and a $650 million Fund III in 2022 — overshooting an initial $500 million target — just before the market’s prolonged downturn.

This article was generated with the assistance of AI workflows.

Crypto World

BlackRock, Coinbase to keep 18% of ETH ETF staking revenue

BlackRock and Coinbase plan to take an 18% share of staking rewards from BlackRock’s proposed Ethereum staking exchange-traded fund, according to an updated regulatory filing.

Summary

- BlackRock and Coinbase will take 18% of ETH ETF staking rewards.

- Between 70% and 95% of the fund’s Ethereum would be staked, with Coinbase serving as custodian and execution agent.

- Supporters see institutional yield access as positive, while critics warn about fees and centralization risks.

The firms disclosed the fee structure in an amended S-1 filing with the U.S. Securities and Exchange Commission on Feb. 17. According to the filing, investors will receive 82% of gross staking rewards, with the fund sponsor and its execution partner receiving 18%.

A sponsor fee that ranges from 0.12% to 0.25% of the investment value will be paid by shareholders each year in addition to the staking fee.

How the staking model will work

Under the proposed structure, most of the fund’s Ethereum (ETH) holdings will be used for staking. The filing says between 70% and 95% of assets may be staked under normal conditions, with the rest kept available for liquidity and redemptions.

Coinbase will act as the prime execution agent and custodian through its institutional services unit. The company may also pass part of its share to third-party validators and infrastructure providers involved in the staking process.

BlackRock has already seeded the trust with $100,000, equal to 4,000 shares priced at $25 each. The firm is also building its Ethereum position ahead of a potential launch.

Based on early 2026 network data, Ethereum staking yields have averaged close to 3% annually. After the 18% cut and other fees, the effective return for investors is expected to be lower, depending on market conditions and network participation.

Market reaction and centralization concerns

The fund is a yield-generating variant of BlackRock’s current Ethereum spot ETF, which has garnered significant institutional interest since its inception. After the success of its Bitcoin (BTC) and Ethereum products, the company has established itself as a significant player in digital asset ETFs over the last two years.

Nasdaq has already applied to list the staked, indicating growing support for regulated crypto yield products in traditional markets.

Some analysts say the structure could appeal to investors seeking exposure to blockchain rewards without managing wallets or validators. Others have questioned whether an 18% share of staking income is too high, especially as competition in the ETF space increases.

Concerns have also been raised about the concentration of influence. In the same week as BlackRock’s filing, Vitalik Buterin warned that growing Wall Street involvement in Ethereum could increase centralization risks over time.

Supporters argue that institutional products help bring liquidity and legitimacy to the market. Critics say they may shift too much control toward large financial firms.

Crypto World

Ether Bulls Eye $2.5K as Staking ETF Debuts; RWA Market Cap Grows

Ether has not reclaimed the $2,500 level since late January, and traders are awaiting catalysts to spark a fresh run. The latest signals from institutions point to a shift in appetite: some of the industry’s biggest players are reallocating from BTC-centric exposure toward Ethereum-focused ETFs. Harvard’s endowment disclosed an $87 million stake in BlackRock’s iShares Ethereum Trust during Q4 2025, while trimming holdings in the iShares Bitcoin Trust. Separately, the market for real-world assets tokenized on Ethereum surpassed $20 billion in aggregate value, reflecting a growing blend of traditional finance with blockchain rails. With the bear market bottom noted around $1,744 on February 6, analysts are watching for decisive momentum that could sustain a rebound.

Key takeaways

- Institutional sentiment is shifting toward Ether as elite funds reallocate capital from Bitcoin to Ether ETFs.

- BlackRock’s Staked Ethereum ETF features a 0.25% expense ratio and an 18% retention of staking rewards as service fees to intermediaries, balancing incentives in the staking flow.

- Real-world asset tokenization on Ethereum has surpassed $20 billion in aggregate value, with broad participation from BlackRock, JPMorgan Chase, Fidelity and Franklin Templeton.

- Harvard’s SEC filings show an $87 million addition to BlackRock’s iShares Ethereum Trust during Q4 2025, alongside a reduction in its iShares Bitcoin Trust.

- Dragonfly Capital’s $650 million funding round signals sustained appetite for tokenized stocks and private credit offerings on-chain, reinforcing the momentum toward RWAs and custody infrastructure.

Tickers mentioned: (omitted as per guidance to avoid introducing tickers not clearly provided in the source)

Sentiment: Neutral

Price impact: Positive. The combination of renewed institutional interest and expanding RWA activity on Ethereum could support a constructive price bias for ETH over the medium term.

Trading idea (Not Financial Advice): Hold. The emerging mix of ETF activity and RWA infrastructure suggests potential for a delay-driven rebound, pending clearer price confirmations.

Market context: The ETH narrative sits at the intersection of regulated access to staking, continued ETF experimentation, and a broadening roster of on-chain real-world asset use cases. While spot flows have been modest in the near term, the participation of major asset managers in ETH-focused vehicles points to growing demand for regulated exposure and secure custody solutions within the crypto ecosystem. The sector remains sensitive to overall risk appetite, macro cues, and regulatory developments that could influence institutional allocations to crypto assets.

Why it matters

The trajectory for Ether as a mainstream financial instrument hinges on the alignment between traditional finance’s risk controls and the evolving capabilities of on-chain infrastructure. The ongoing expansion of RWAs on Ethereum demonstrates that large-scale capital is looking beyond pure speculative bets toward assets that can be tokenized, securitized, and traded within regulated frameworks. A 0.25% expense ratio on a Staked Ethereum ETF, paired with an 18% retention of staking rewards as fees, signals an industry attempt to balance competitive pricing with sustainable staking incentives. The underlying staking ecosystem—where custodians like Coinbase play a key role in facilitating services—highlights a path for institutions to access ETH staking without shouldering daily operational risk directly.

Moreover, the $20+ billion RWA market on Ethereum reflects a concerted effort to bring real assets onto the blockchain, blending gold, Treasuries and bonds with programmable settlement and liquidity access. The involvement of BlackRock, JPMorgan Chase, Fidelity and Franklin Templeton underscores how the line between traditional custody and digital asset infrastructure is blurring. In parallel, venture funding from players like Dragonfly Capital reinforces confidence in the long-run viability of tokenized stocks and private credit offerings, suggesting a maturation phase for the sector that could underpin sustained demand for ETH as a settlement and collateral layer.

Price catalysts remain tied to the broader risk environment. While a near-term move to $2,500 is discussed in market chatter, the path will likely depend on regulatory clarity, ETF inflows, and the pace at which RWAs scale from pilot projects to widely adopted products. The bear market bottom observed in early February may prove to be a reference point if new catalysts emerge, but investors will want to see consistent demand signals, improved liquidity, and clear governance for staking yield structures before committing meaningful capital.

What to watch next

- Regulatory milestones for ETH-focused ETFs and any SEC updates on product approvals or adjustments.

- Upcoming quarterly ETF flow data to gauge whether institutional inflows into Ether-based products accelerate.

- New RWAs issuances and partnerships on Ethereum, including any large-scale tokenizations of traditional assets.

- Price action around the $2,000–$2,500 zone and whether macro risk sentiment supports a durable breakout for ETH.

Sources & verification

- Harvard’s 2025 Q4 Form 13F filings showing an $87 million stake in BlackRock’s iShares Ethereum Trust and adjustments to its iShares Bitcoin Trust.

- MarketBeat data detailing changes in notable iShares Ethereum Trust holdings.

- DefiLlama data on the RWAs aggregate on Ethereum exceeding $20 billion in value.

- Dragonfly Capital’s $650 million fundraise focused on tokenized RWAs and related on-chain infrastructure.

Institutional bets build as ETH ETFs mature and RWAs expand

Ether (CRYPTO: ETH) has begun to demonstrate a degree of resilience that could be the prelude to a broader regime shift in active institutional exposure. The most meaningful signal to date is the combination of major asset managers embracing Ethereum-based products and the rapid expansion of real-world asset tokenization that sits atop the Ethereum chain. The Harvard disclosures, which show an $87 million addition to BlackRock’s iShares Ethereum Trust in Q4 2025, and a concurrent trimming of iShares Bitcoin Trust holdings, exemplify a nuanced preference for ETH-driven exposure over BTC-focused routes. This bifurcation in appetite suggests institutions are seeking regulated, scalable access to staking and on-chain liquidity, rather than relying solely on the volatility of the broader crypto market.

BlackRock’s Staked Ethereum ETF adds another dimension to the narrative. With a 0.25% expense ratio and an 18% retention of staking rewards as service fees, the vehicle aims to strike a pragmatic balance between cost efficiency and the revenue necessary to compensate the intermediaries that enable staking. The arrangement underscores a broader trend in the industry: in order to scale, staking products must align the incentives of custodians, exchanges, and fund managers with the long-term interests of investors seeking yield-bearing crypto exposure. Coinbase’s involvement as a staking service intermediary is cited as a notable practical factor in ensuring smooth on-ramp and on-chain execution for such portfolios.

Beyond the ETF mechanics, the size and scope of RWAs on Ethereum point to a maturation of the ecosystem. The aggregate RWAs on Ethereum now surpass $20 billion, a milestone that includes tokenized gold and a growing slice of US Treasuries, bonds, and money market funds. The involvement of major financial institutions—BlackRock, JPMorgan Chase, Fidelity, and Franklin Templeton—signals a coordinated push to bring more traditional assets under a tokenized, on-chain framework. When measured alongside other blockchain ecosystems, Ethereum’s RWAs stand out as a bridge between regulated finance and decentralized technologies, reinforcing the case for ETH as a robust platform for both settlement and collateral.

The venture funding environment is also shifting in this space. Dragonfly Capital’s recent $650 million round, aimed at real-world assets and tokenized financial instruments, illustrates persistent appetite from crypto-focused investors to back asset-backed models that operate in concert with established market infrastructure. In practice, this means more pilot programs, more credible custodial arrangements, and more sophisticated deals that link asset origination with tokenized issuance and on-chain trading. The result could be a multi-year trajectory in which RWAs contribute to sustained demand for ETH, even as the broader crypto market experiences sideways or choppy price action.

From a price perspective, the catalysts discussed—ETF inflows, deeper RWA adoption, and regulatory clarity—could provide the conditions for a rebound toward the $2,500 level noted in market discussions. The bear cycle that bottomed near $1,744 on February 6 has left a price floor that investors are watching closely, with the possibility of a renewed risk-on environment driving ETH higher as institutional confidence grows. While no single event guarantees a sustained rally, the confluence of regulated access, staking economics, and tangible on-chain assets tied to ETH strengthens the case for a constructive, though cautious, upside path in the medium term. The landscape suggests that the next phase of ETH’s price narrative will be driven less by frothy retail speculation and more by disciplined, asset-backed finance and regulated market access. Harvard’s stake in BlackRock’s ETH Trust and the evolving real-world asset framework remain central reference points as this story develops. For additional context on RWAs’ market dynamics, see Tokenized RWAs climb despite market rout, and for coverage of Dragonfly Capital’s funding round, visit Dragonfly’s $650M fund. The price-angle discussion around a potential move to $2,500 is also explored in ETH chart patterns and rally scenarios as noted in market analysis. Investors should monitor price action, ETF flow data, and regulatory developments to gauge how these structural shifts translate into tangible market movements.

Crypto World

Grayscale Says XRP Is Second Most Talked-About Asset After Bitcoin

The positive sentiment reflects strong and meaningful activity from the XRP community, despite the bears dominating the broader market.

The crypto market may be in a bear season now, but some assets are in the spotlight, thanks to their strong communities. One such cryptocurrency is XRP, the native asset of the XRP Ledger (XRPL), otherwise known as the Ripple Network.

Recent data from the asset management giant Grayscale ranked XRP as the second-most-discussed asset in the platform’s community, after bitcoin (BTC). This reflects strong and meaningful activity from the XRP community.

The Second Most Talked-About Asset

According to a voiceover from Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary, during the Ripple Community Day, XRP has a broad, vibrant community with “diehard fans.”

Grayscale advisors have reported that their clients are constantly asking about XRP. The asset is even considered the second-most discussed asset, behind BTC in some cases. Sharif-Askary revealed that a huge part of the excitement surrounding XRP is from persistent demand for products linked to the asset. Investors see the XRPL as a “battle-tested blockchain that has a real opportunity to capture market share” and are looking to tap into the ecosystem.

Additionally, the Grayscale product and research head believes the narrative and price sentiment surrounding XRP will change. The asset’s growth may have been delayed so far by lagging product-market fit and regulatory challenges. However, positive sentiment from the community is likely to change the narrative for the asset.

Bullish Predictions For XRP

Sharif-Askary’s remarks about positive community sentiment are echoed by weekly inflows into crypto investment products. CryptoPotato reported that most crypto funds just recorded a fourth consecutive week of outflows, but only products tied to assets like XRP saw positive flows.

Bitcoin and Ethereum have continued to lag in sentiment, with their investment products losing $133 million and $85 million, respectively, last week. XRP, on the other hand, attracted over $33.4 million, with relatively steady demand.

You may also like:

Interestingly, analysts are making bullish price calls for XRP. Last weekend, XRP emerged as one of the top gainers in the market, rallying over 16%, amid predictions that the Ripple asset may have begun to decouple from other larger-cap cryptocurrencies. At the time of writing, data from CoinMarketCap showed XRP trading around $1.45, with a slight decline over the last 24 hours. Regardless of the downturn, market experts foresee a bullish breakout in the asset’s price trajectory over the coming weeks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitwise files for prediction market-backed ETFs

Bitwise Asset Management has filed with regulators to launch a new line of exchange-traded funds tied to political prediction markets, marking its latest push into alternative investment products.

Summary

- Bitwise has filed with regulators to launch a new line of ETFs focused on U.S. election outcomes.

- The proposed funds would give investors regulated access to political prediction contracts through traditional brokerage accounts.

- Approval is still pending, and regulators continue to review how these products fit within existing securities rules.

The filing was disclosed by Bloomberg ETF analyst James Seyffart, who shared details on social media. According to the preliminary prospectus dated Feb. 17, the proposed funds would operate under the “PredictionShares” brand and remain subject to regulatory approval.

The document states that the offering is incomplete and that the securities cannot be sold until the registration statement becomes effective.

Election-focused contracts at the core

The filings outline several proposed ETFs linked to U.S. political outcomes. These include separate funds tracking whether Democrats or Republicans win the 2028 presidential election, as well as products tied to control of the House and Senate in the 2026 mid-term elections.

Rather than investing in companies connected to prediction markets, the funds are designed to hold event-based contracts sourced from regulated trading venues. These contracts pay out based on specific real-world outcomes, such as election results.

Bitwise said PredictionShares will serve as a dedicated platform for clients seeking regulated exposure to prediction markets through traditional brokerage accounts. No launch date has been set, and approval from the U.S. Securities and Exchange Commission has not yet been granted.

Seyffart noted that similar filings have appeared in recent months and said more are likely to follow as interest in the sector grows.

Growing competition and market interest

Bitwise’s chief investment officer, Matt Hougan, said prediction markets are expanding in both size and relevance, making them difficult for asset managers to ignore. He added that client demand played a key role in the decision to pursue the products.

Other firms have also moved into the space. Roundhill Investments previously filed for similar election-based ETFs, while GraniteShares has submitted competing proposals. None has yet received regulatory clearance.

With platforms like Polymarket reporting heavy trading volume during significant political events, prediction markets have drawn increased attention in recent election cycles. Supporters say these markets often reflect public opinion more quickly than traditional polls.

Critics, like Vitalik Buterin, warn that they are extremely risky and can behave like speculative bets. Industry analysts caution that funds associated with particular outcomes could lose most of their value if forecasts prove to be wrong.

Additionally, regulators are examining how these products align with current derivatives and securities regulations.

Crypto World

Trading Platform eToro Q4 Earnings Sends Stock Surging

Trading platform eToro jumped more than 20% after reporting better-than-expected fourth-quarter earnings, with revenue coming mainly from its crypto services.

The company reported on Tuesday that its Q4 net income increased 16% from a year ago to $68.7 million, with earnings per share of 71 cents, compared with analyst expectations of 60 cents.

Fourth-quarter revenue came in at $3.87 billion, down 40% from the prior-year period, with crypto revenue accounting for the bulk of earnings at $3.59 billion.

The earnings beat bucked eToro’s main crypto rivals, Coinbase and Robinhood, whose Q4 earnings both missed expectations as their revenues took a hit amid a crypto market crash late last year.

Meanwhile, eToro’s full-year 2025 revenue rose more than 9% from 2024 to $13.84 billion, while its net income jumped 12% year-on-year to $215.7 million. Its full-year crypto revenue was $13 billion, up nearly 7% from 2024.

Shares climb on Q4 beat, CEO says it will catch crypto wave

Shares in eToro (ETOR) ended trading on Tuesday up 20.4% to $33.07 on the company’s earnings beat, making it one of the best-performing crypto stocks for the day. The stock fell slightly after-hours to $33.

EToro CEO Yoni Assia said it is “a pivotal moment for financial services” as artificial intelligence and the increasing use of blockchain infrastructure are “reshaping how people invest and interact with markets.”

“EToro is uniquely positioned to capture this opportunity,” he said. “We are positioning eToro for a financial system that is increasingly moving on-chain. With our long-standing leadership in crypto and tokenization, we are well placed to help shape this transition.”

Related: Gemini post-IPO shakeup sees exit of three top executives

Assia told investors on an earnings call that eToro was seeing some of its crypto-focused customers “suddenly trading commodities” for the first time.

“There’s somewhat of a convergence or a shift from crypto, which now has lower volatility, to now basically gold, silver, and other commodities that have higher volatility,” he said.

Meanwhile, the company said its crypto trading volume in January was down 50% from last year, with 4 million crypto trades over the month, and that the average investment per trade also dropped 34% to $182.

However, the total number of trades last month was up 55% year over year to 74 million, while the average investment per trade rose 8% to $252.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling — Joseph Chalom

Crypto World

Pumpfun Rolls Out ‘Cashback Coins’

The Solana memecoin launchpad’s new ‘Cashback Coins’ offer creators a choice between trader cashback and creator fees.

Solana-based token launchpad pumpfun has introduced a new feature called “Cashback Coins.”

Cashback Coins provide a choice for creators: they can decide to direct all creator fees towards traders or opt for traditional creator fees, but this choice must be made before launch and cannot be altered later. The introduction of these coins is part of pumpfun’s strategy to address ongoing concerns in the crypto space about the distribution of rewards and incentives.

“Creator Fees are undeniably a net positive for helping teams, creators & founders grow & succeed. However, many tokens achieve success without a team or project lead, thereby disproportionately rewarding token deployers who don’t deserve the fees,” the team wrote on X.

“Now, traders can choose to engage with tokens they feel the most aligned with, ultimately letting the market decide who gets rewarded and where the bar is set.”

The platform’s native PUMP token is up 11% over the past week.

This article was generated with the assistance of AI workflows.

Crypto World

Zora Launches Attention Markets on Solana

The activation enables users to trade “attention markets” that reflect real-life trends.

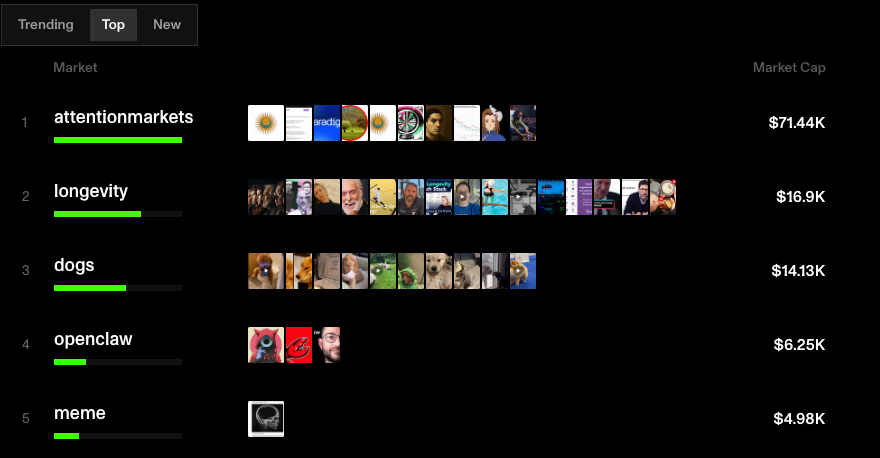

Zora launched a new token market on Solana today, dubbed “attention markets,” where users can tokenize and speculate on real-world trends.

The platform is off to a slow start, with its flagship token, $attentionmarkets, trading at only a $70,000 market capitalization with just $170,000 in total trading volume 30 minutes after its launch. Meanwhile, only three of its tokens have market capitalizations above $10,000, indicating little immediate demand for the product.

Zora is likely aiming to be first to market with the launch, after it was reported just last week that Polymarket is partnering with Kaito to launch its own variation of attention markets.

The launch also comes less than two months after the crypto community tried to rally behind the idea of Zora’s tokenized content coins after viral political journalist Nick Shirley launched his own creator coin that quickly burned out.

After a brief 24-hour surge that saw the $thenickshirley token reach as high as a $16 million valuation, the token now changes hands at just a $470,000 market capitalization, leaving Zora bulls defeated yet again.

Jesse Pollak, the creator of Ethereum Layer 2 Base, which is closely integrated with Zora, took to X to share the launch, where he said, “Excited to see zora continue to experiment to grow the onchain pie. zora creator tools remain fully operational on zora.co and in the zora app, all running on base.”

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 hours ago

Business5 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video20 hours ago

Video20 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World20 hours ago

Crypto World20 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

![I AM SHAKING!!!! [insane Bitcoin Signal]](https://wordupnews.com/wp-content/uploads/2026/02/1771392411_maxresdefault-80x80.jpg)