CryptoCurrency

Bitcoin On-Chain Data Shows Calm Response to Venezuela Military Intervention Headlines

TLDR:

- Exchange Netflow data shows no mass Bitcoin deposits to exchanges despite Venezuela intervention reports

- Bitcoin holders maintain positions as on-chain metrics reveal measured response to geopolitical tensions

- Historical patterns show crypto markets now separate temporary military headlines from systemic threats

- Structural economic risks generate stronger on-chain signals than geographically limited conflicts

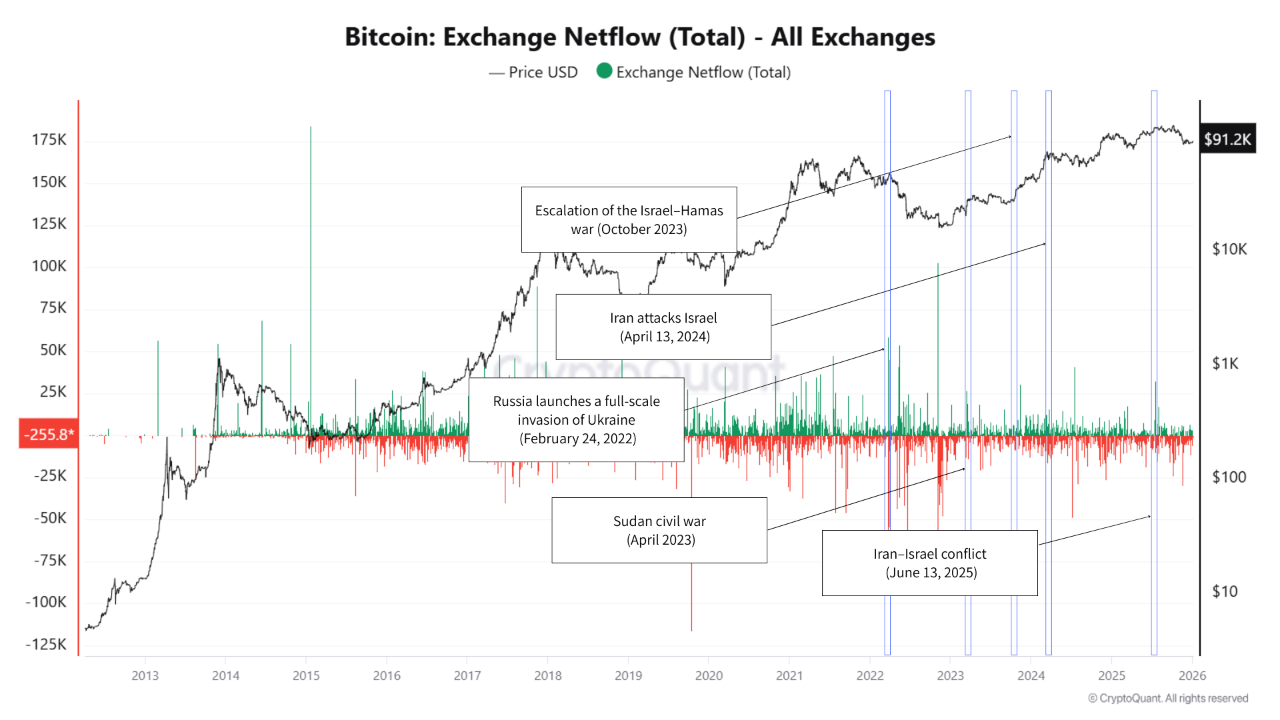

On-chain data reveals Bitcoin’s measured response to escalating Venezuela tensions despite widespread media attention. Exchange Netflow metrics show no significant panic selling as military intervention reports circulate.

Blockchain analytics indicate holders are maintaining positions rather than liquidating amid geopolitical uncertainty. The data contradicts expectations that crypto markets would react sharply to conflict headlines.

Tracking actual coin movements provides clearer insight than price volatility alone. Exchange deposit patterns remain stable, suggesting investors view the situation as manageable rather than threatening.

Exchange Netflow Reveals Holder Confidence

Bitcoin’s on-chain data shows stability through the Venezuela crisis. Exchange Netflow, which measures coins moving to and from trading platforms, remains steady.

Large inflows typically signal preparation to sell, while outflows indicate accumulation behavior. Current patterns show neither extreme, pointing to a wait-and-see approach.

Source: Cryptoquant

Exchanges are not experiencing the deposit spikes associated with genuine market fear. When investors perceive serious threats, blockchain data captures rapid movements toward selling positions.

The Venezuela headlines have not triggered this response. Instead, metrics show business-as-usual activity across major platforms.

This stability mirrors reactions to previous geopolitical events. Russia’s Ukraine invasion and Middle East conflicts generated initial price swings.

However, on-chain data confirmed holders maintained conviction through both episodes. Markets have grown more resilient to localized military actions since 2023.

The pattern suggests experienced traders now separate temporary news from fundamental threats.

Structural Economic Risks Generate Stronger On-Chain Signals

Bitcoin’s on-chain data responds more dramatically to economic confrontations than military operations. U.S.-China trade tensions and regulatory crackdowns produce clear blockchain signatures.

Capital controls and financial system restrictions directly affect cryptocurrency utility and access. These events leave lasting traces in exchange flow patterns.

When governments target crypto infrastructure or impose movement restrictions, on-chain metrics shift noticeably.

Exchange deposits increase as users prepare for regulatory pressure. Conversely, geographically limited conflicts rarely change long-term holding behavior. The distinction helps explain the muted response to Venezuela developments.

Current on-chain data suggests markets are monitoring whether Venezuela escalates beyond military action. Sanctions, trade disruptions, or financial system stress could alter the equation.

Exchange Netflow would likely reflect such changes through increased deposit activity. For now, blockchain metrics indicate calm observation rather than defensive positioning.

The absence of panic signals in on-chain data suggests traders believe current tensions remain contained. Markets continue functioning normally while keeping watch on how the situation develops.