Crypto World

Bitcoin Price Bounce Triggers Crash Risk to $58,000?

BTC’s recent recovery may be hiding a dangerous signal. The Bitcoin price bounced nearly 9% between February 12 and February 15, giving the impression that the worst of the correction was over.

But the rebound is already weakening. Now, leverage data, momentum signals, and on-chain profit trends suggest the bounce may have increased crash risk instead of ending it.

Sponsored

Sponsored

Bitcoin’s 9% Bounce Drew Nearly $2 Billion in Long Bets

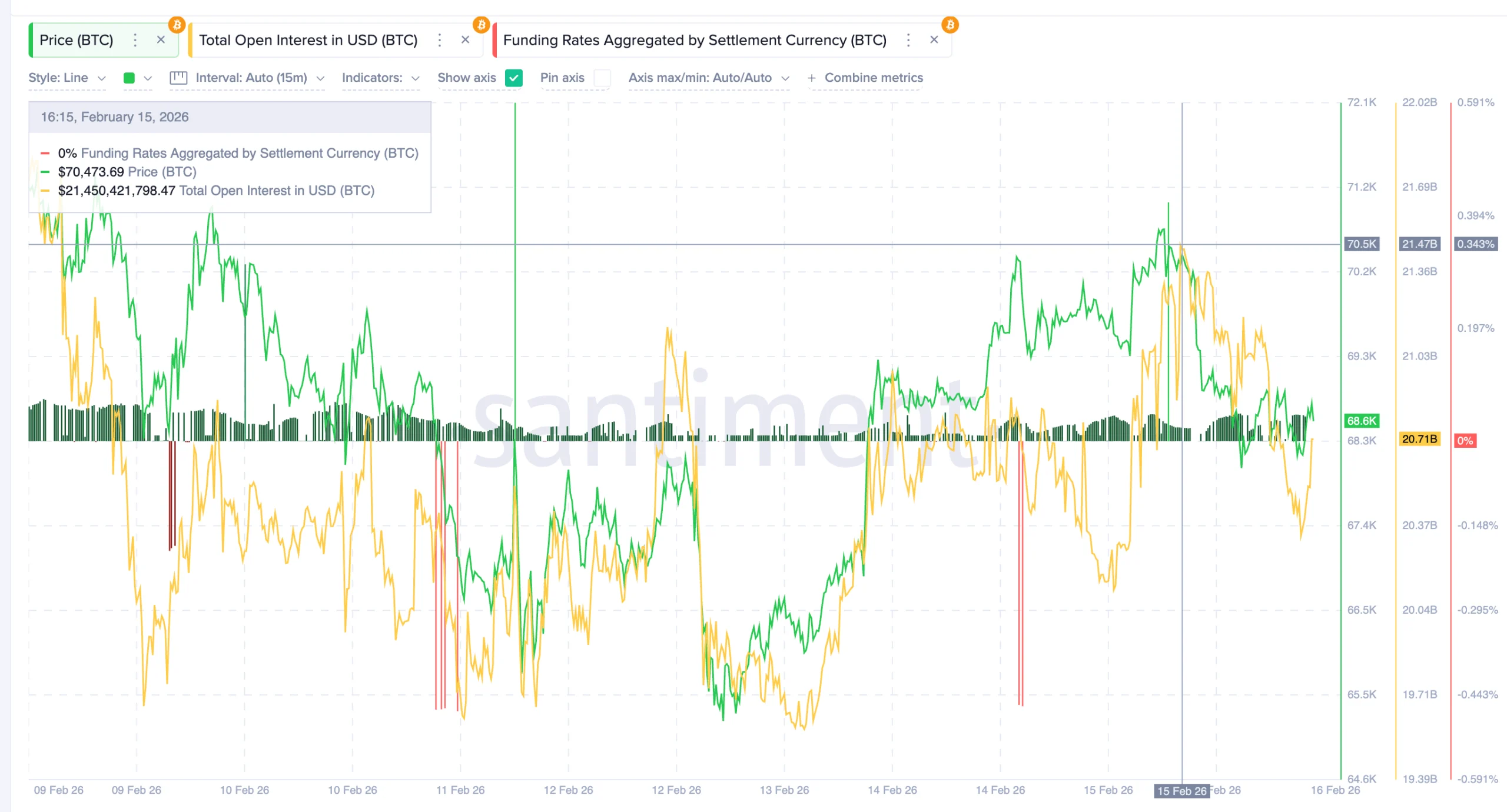

Between February 12 and February 15, Bitcoin climbed roughly 9%. At the same time, futures traders aggressively positioned for further upside. Total open interest, which tracks the total value of active futures contracts, rose from $19.59 billion to $21.47 billion. This was an increase of about $1.88 billion, or roughly 9.6%, between February 13 and February 15.

This increase did not happen in isolation. Funding rates also turned strongly positive, rising toward +0.34%. The funding rate is the fee paid between long and short traders. When it is positive, long traders pay short traders. This shows that most BTC traders were betting on prices rising.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Together, rising open interest and positive funding rates confirmed that the market was positioning for a larger recovery. But the larger chart structure reveals a critical problem.

This entire rebound happened inside a bear flag pattern. A bear flag forms when the price rises slowly after a sharp drop but remains inside a downward continuation structure. It often acts as a pause before another decline.

Sponsored

Sponsored

The recent rejection near the local peak and the ongoing pullback now show that Bitcoin is still trading inside this bearish pattern. Price is already drifting toward the lower boundary of the flag. If this lower support breaks, the next leg of the weakening Bitcoin price prediction could begin.

Hidden Bearish Divergence and 90% Profit Surge Show Sellers Are Returning

Momentum indicators are now starting to confirm this growing weakness. On the 12-hour chart, Bitcoin formed a hidden bearish divergence between February 6 and February 15.

During this period, the price formed a lower high, meaning the recovery was weaker than the previous peak. But the Relative Strength Index, or RSI, formed a higher high. RSI measures the strength of buying and selling momentum.

This combination is called hidden bearish divergence. It usually appears when buying momentum rises temporarily, but the overall trend remains weak. It signals that sellers are quietly regaining control. Shortly after this signal appeared, Bitcoin’s pullback began.

Sponsored

Sponsored

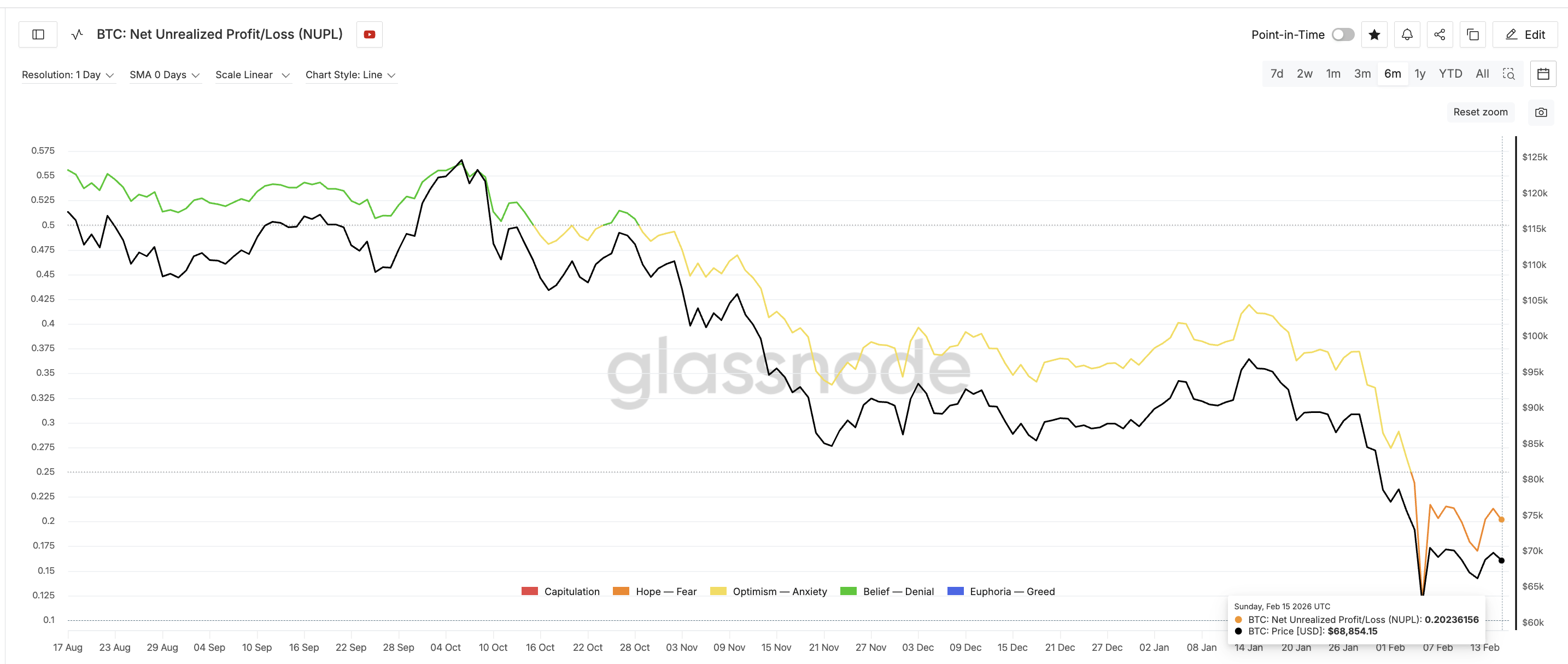

At the same time, on-chain profit data surged sharply, creating another warning sign. Bitcoin’s Net Unrealized Profit/Loss, or NUPL, rose from 0.11 on February 5 to 0.21 on February 14. This was an increase of about 90%. It is currently moving near the same zone, at press time.

NUPL measures the average unrealized profit across all Bitcoin holders. It shows how much profit investors are holding on paper. When NUPL rises sharply, it means many investors are suddenly back in profit, even if it is a small amount. This increases the risk of profit-taking.

The last time NUPL reached similar levels was on February 4. At that time, Bitcoin was trading near $73,000. Within one day, the price collapsed to around $62,800. That was a drop of nearly 14%. Now, the same profit structure has appeared again.

This creates a scary situation. Investors holding fresh profits may sell quickly if prices start falling. That selling can accelerate the correction. This aligns with the hidden bearish divergence already visible on the chart.

Sponsored

Sponsored

Together, these signals show that the recent bounce may have strengthened sellers instead of removing them.

Key Bitcoin Price Levels Show Breakdown Risk Toward $58,800

Bitcoin is now approaching the most important support zone in its current structure. The first critical level is $66,270. This level forms near the lower boundary of the bear flag pattern breaks.

If Bitcoin breaks below this Fib level, the bearish continuation pattern would activate. The next major downside target sits at $58,880 (the $58,000 zone). This level aligns with the 0.618 Fibonacci retracement level ( a structurally strong zone) and represents roughly a 14% decline from current prices.

If selling pressure accelerates further, Bitcoin could fall toward the $55,620 zone, which aligns with the deeper projection of the bear flag structure. On the upside, Bitcoin must reclaim $70,840 to stabilize in the short term.

A stronger breakout above $79,290 would fully invalidate the bearish structure. That would signal that buyers have regained control. Until then, the risk remains tilted to the downside. The recent bounce improved sentiment briefly. But rising leverage, hidden bearish divergence, and a 90% surge in unrealized profits now show that the Bitcoin price recovery may have created the conditions for another drop.

Crypto World

What Does the Latest Rejection at $70K Mean for BTC’s Structure?

Bitcoin’s recent bounce has pushed the market back toward the $70K–$72K area, but the broader structure remains fragile. The key question now is whether this rebound can evolve into a deeper corrective move toward overhead resistance, or if it is merely a temporary reaction within a dominant downtrend.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, BTC remains inside a clear descending channel, preserving the overall bearish structure. The breakdown below the $75K level triggered an accelerated sell-off that extended directly into the $60K demand zone, where buyers finally stepped in.

The recent recovery has brought the price back toward $70K, which also aligns with the channel’s mid-boundary, making it a notable resistance. However, Bitcoin is still trading below the critical $75K resistance. As long as the market remains beneath the $75K-$80K region, the move is technically considered a corrective rebound within a broader bearish trend.

A decisive reclaim of $75K would expose $78,915 and then $81,485 (0.702) as the next upside targets. On the downside, the $60K zone remains the primary structural support.

BTC/USDT 4-Hour Chart

On the 4-hour timeframe, the rebound from $60K appears impulsive, but the price is now approaching the $70K-$72K short-term resistance area, which aligns with the descending structure and previous breakdown region. The market is currently compressing below this level.

A confirmed break and consolidation above $72K would likely trigger continuation toward $75K crucial threshold. However, failure to clear this resistance could result in renewed downside pressure, targeting $65K first and potentially revisiting the $60K demand zone if selling momentum increases.

Sentiment Analysis

The Bitcoin Futures Average Order Size chart reveals a notable shift during the recent decline. As the asset approached the $60,000–$65,000 region, several green dots appeared, representing large whale-sized orders entering the market. This cluster of green dots near the local bottom suggests that larger participants began accumulating during the panic-driven sell-off.

However, red dots has been apeared following the recent rebou, reflecting retail-driven activity. The recent whale participation at lower prices increases the probability that the $60K region attracted strategic accumulation rather than random buying, while the retail-driven rebound hints at a potential consolidation stage followed by bullish retracements.

If this whale activity returns around the $65K-$80K range, it strengthens the case for a sustained rebound. However, for the structure to shift meaningfully bullish, Bitcoin must reclaim $80K. Without that reclaim, the broader daily trend remains corrective within a bearish framework.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

OKX snags European payments license for stablecoin and crypto card expansion

Cryptocurrency exchange OKX has obtained a payment institution (PI) license in Malta, aligning with European Union regulatory requirements that take effect in March.

The license allows OKX to continue offering stablecoin-related payment services across the EU in full compliance with the Markets in Crypto-Assets (MiCA) regulation and the Second Payment Services Directive (PSD2), the company said in a press release on Monday.

Under the updated PSD2 framework, crypto-asset service providers engaging in payment activities involving stablecoins, legally classified as electronic money tokens (EMTs), must hold a PI or electronic money institution (EMI) authorization.

“We have recently launched real-world payment products, including OKX Pay and our OKX Card, that bring stablecoins into everyday use. Securing a Payment Institution license ensures that these products operate on a fully compliant footing,” said Erald Ghoos, CEO of OKX Europe.

At the end of last month, OKX introduced a crypto payment card in Europe in association with Mastercard. The exchange is enthusiastic about stablecoins entering mainstream finance. OKX Ventures, the firm’s innovation investment arm, recently backed stablecoin issuance platform STBL.

Crypto World

Bitcoin price confirms bullish divergence as liquidations spike, eyes $71k resistance

Bitcoin price has confirmed a bullish divergence on the daily chart as liquidation levels shot up on Monday.

Summary

- Bitcoin’s Relative Strength Index has formed a bullish divergence.

- Several key economic data points, including FOMC minutes from January, could decide Bitcoin’s trajectory this week.

- Over $75 million of positions were liquidated from Bitcoin’s futures market.

The daily chart for Bitcoin shows that its Relative Strength Index has formed a bullish divergence with its price, which has been in a prolonged downtrend since mid-January.

A bullish RSI divergence occurs when the RSI records higher lows while the related asset’s price continues to set lower lows. Such a technical formation has often been a precursor to a significant trend reversal or a relief rally.

Besides the bullish RSI, another positive indicator came from the MACD histogram and moving averages, which showed the MACD line had just crossed over the signal line, a telltale sign of an incoming bullish trend. Together, these indicators suggest that bullish momentum seems to be building, with bulls starting to assert dominance over the market.

The shift comes after Bitcoin bulls attempted a rebound after the bellwether fell near the $65k support zone on Thursday. The asset rose sharply over the following days but faced resistance around $71k for the second time in the past 7 days, as investors remained on the sidelines awaiting key economic data expected to be released this week.

First, Federal Reserve Governor Michael S. Barr’s speech on Wednesday, Feb. 18, is expected to focus on the intersection of Artificial Intelligence and the labor market. On the same day, the Federal Reserve will release the minutes from its January meeting, offering further clarity on the central bank’s stance on monetary policy. Finally, on Friday, the U.S. will release Q4 GDP and core PCE inflation data, which will also act as a major market catalyst.

Upcoming macro data should illuminate the Fed’s stance on monetary easing for the remainder of 2026, offering the structural clarity necessary for Bitcoin to establish its next trend.

Key levels to watch

For now, the path of least resistance for Bitcoin (BTC) appears to be higher, with the $71K resistance line acting as the next key resistance level that traders will keep an eye on this week.

A decisive break above it could lead to a reclaim of $75,000, which has previously served as a key support area in past cycles. On the contrary, a drop under $65,000 could validate the downtrend towards a likely retrenchment towards the $60K low observed on Feb. 6.

In the meantime, massive liquidations have been sweeping through the broader crypto market. In the past 24 hours alone, the crypto market saw nearly $300 million liquidated, with Bitcoin alone accounting for over $75 million worth of positions being liquidated. Persistent liquidations may keep Bitcoin price under pressure throughout the upcoming sessions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Michael Saylor’s Strategy to convert bond debt to equity over the next 3-6 years

Strategy plans to reduce the debt on its balance sheet by converting its $6 billion in convertible bonds into equity over the coming years, according to founder Michael Saylor.

In a Sunday X post, Saylor confirmed the plan in response to a statement from the company’s account, reiterating that the firm can “withstand a drawdown in BTC price to $8,000” before facing any shortfall in covering its debt.

What this essentially means is the world’s largest corporate Bitcoin holder plans to systematically turn the company’s lenders into shareholders by converting outstanding convertible bonds into common equity. This is expected to transpire over the next “3-6 years,” Saylor said.

Currently, the company has a convertible debt load of roughly $6 billion and Bitcoin holdings that amount to approximately $49 billion based on current prices, with more than 714,000 BTC on its balance sheet.

Although the move may be able to shield its aggressive Bitcoin accumulation strategy from refinancing pressure, the conversion could also dilute existing shareholders once the debt is exchanged for newly issued stock.

On Feb. 12, Strategy CEO Phong Le said the company will increasingly rely on perpetual preferred shares such as Stretch (STRC) to fund future Bitcoin purchases while reducing reliance on common stock sales.

Strategy shares have struggled over the past few months due to Bitcoin’s latest downturn, but rallied over 8% to close at $133.88 on Friday, rallying another 0.24% in after-hours trading, as Bitcoin briefly reclaimed the $70k mark.

The rally was short-lived, and Bitcoin has receded back towards $68,700 at press time, down roughly 2% in the past 24 hours.

According to data from Bitcoin Treasuries, Strategy is now down over 9.7% on its investment, with an average buying price of $76,052. Meanwhile, the company’s shares are down 70% from their all-time high reached last year.

Crypto World

Can Ethereum price defend $1,900 as bearish pressure builds?

Ethereum’s correction appears to be accelerating, with price sliding toward the critical $1,900 support level and futures sentiment hitting its most bearish reading in three months.

Summary

- Ethereum price is under pressure across all major timeframes, with structure still tilted to the downside.

- Futures traders are increasingly defensive, as aggressive selling begins to dominate derivatives flows.

- The $1,900 level now stands as a pivotal support; holding it could stabilize price, while a break may accelerate losses.

At press time, Ethereum was changing hands at $1,958, marking a 6.4% drop in the last 24 hours as continued selling dragged prices lower. Over the past week, the coin has fluctuated between $1,907 and $2,129, but it has stayed under pressure across every major timeframe.

In the last seven days, Ethereum (ETH) has slipped 6.3%. The losses deepen when you zoom out. It is down 40% over the past month and 27% compared with a year ago, showing how strong and persistent this correction has been.

Trading activity in the spot market picked up as prices fell. During the sell-off, 24-hour volume jumped 34% to reach $31 billion, suggesting that more traders stepped in while the price tested important support levels.

Derivatives, on the other hand, tells a more cautious story, pointing to a market that remains on edge. As per CoinGlass data, derivatives volume rose 18% to $40 billion while open interest dropped 7% to $23 billion. This combination suggests that traders are closing positions into volatility rather than adding fresh leverage.

Futures sentiment flips extremely bearish

Additional pressure is coming from longer-term derivatives sentiment. A Feb. 15 analysis by CryptoQuant contributor CryptoOnchain revealed a notable shift in futures behavior on Binance. The Ethereum Taker Buy/Sell Ratio (30-day moving average) has dropped to 0.97, its lowest reading since November 2025.

When this ratio drops below 1.00, it shows that aggressive sell orders are outpacing aggressive buys. Using a 30-day average helps filter out daily fluctuations, turning this into a structural signal rather than a short-term reaction.

At the current levels, the data indicate that futures traders have been leaning on the sell side for several weeks, either hedging their exposure or taking a defensive stance as prices weaken.

If spot market demand is unable to absorb the supply close to support, this ongoing imbalance raises the possibility of prolonged consolidation or additional losses, but it does not guarantee that prices will continue to decline right away.

Ethereum price technical analysis

Ethereum is still clearly in a downward trend. Since late December, there have been consistently lower highs and lower lows, suggesting that the correction is still ongoing. Sellers continue to dominate the market, as shown by the price remaining below the 20-day moving average.

Volatility has spiked sharply. The recent downturn pushed ETH close to the lower Bollinger Band around $1,600, with the bands widening, a classic sign of a strong directional move. Despite a minor recovery from that extreme, the price is still trading close to the lower half of the range, suggesting that selling pressure has lessened but not reversed.

A crucial psychological and technical level is now the $1,900 mark. It lines up with a previous consolidation zone where buyers once tried to stabilize prices. If Ethereum breaks below this level decisively, it could drop toward $1,600–$1,650, near the lower edge of the recent volatility range.

Momentum readings remain weak. The relative strength index sits around 32–33, recently brushing near oversold territory. Such levels sometimes trigger short-term rallies, but no bullish divergence has appeared. Throughout the correction, RSI has failed to climb back above 50, keeping overall momentum firmly in the bearish camp.

For bulls to regain control, a daily close holding above $1,900 and RSI pushing back into the 40–45 range would be necessary. If $1,900 fails, downside risk remains elevated.

A move toward $1,600, and potentially lower, would be consistent with both the current technical structure and further bearish tilt in futures sentiment.

Crypto World

3 Things That Could Influence Crypto and Bitcoin Prices This Week

A short but busy week lies ahead on the United States economic calendar as spot crypto markets lose recent gains again.

All eyes will be on the PCE inflation report this week, following last week’s CPI, and the Federal Reserve minutes on Wednesday.

January’s CPI came in slightly below expectations, with headline inflation at 2.38% year-on-year and core CPI at 2.5%, the lowest since early 2021. This boosted the stock and crypto markets on Friday, but gains in the latter were soon eroded over the weekend.

“Meanwhile, geopolitical tensions remain, and macroeconomic uncertainty is elevated,” said the Kobeissi Letter, cautioning of “more volatility this week.”

Economic Events Feb. 16 to 20

Traditional markets are closed in the US on Monday for the President’s Day holiday.

There is an ADP employment update on Tuesday, followed by the January Retail Sales report. Wednesday sees more consumer spending data with the delayed December Durable Goods Orders numbers.

The Fed meeting minutes are also released on Wednesday, and there will be 10 central bank speaker events, which could shed light on future monetary policy decisions.

Investors will also get an early look at economic growth for the fourth quarter with the Thursday release of the GDP report.

However, the big data of the week is the December Personal Consumption Expenditures (PCE) inflation report.

You may also like:

Based on the January CPI data, Goldman Sachs raised its PCE outlook, according to reports.

“We estimate that the core PCE price index rose 0.40% in January,” said economists.

The growth projections were due to rising consumer electronics and IT prices, which are more heavily weighted in PCE than CPI. A global RAM and storage shortage due to AI data center demand has caused computer and component prices to surge.

“So far, data doesn’t offer much reason for the Fed to cut rates at its next meeting in March,” wrote The Street.

The CME Fed Watch Tool has a 90% probability that rates will remain unchanged.

Crypto Market Outlook

Crypto markets have lost last week’s late gains, with total capitalization dropping 2.5% over the past 24 hours in a fall back to $2.41 trillion.

Bitcoin failed to hold above $70,000 for long and retreated to $68,300 in early Asian trading on Monday. The asset has remained rangebound for the past ten days.

Ether prices have tanked hard, shedding 5% from almost $2,100 back to $1,950 at the time of writing, while the altcoins continue to bleed out.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Animoca Brands Secures VARA VASP License in Dubai to Serve Institutions

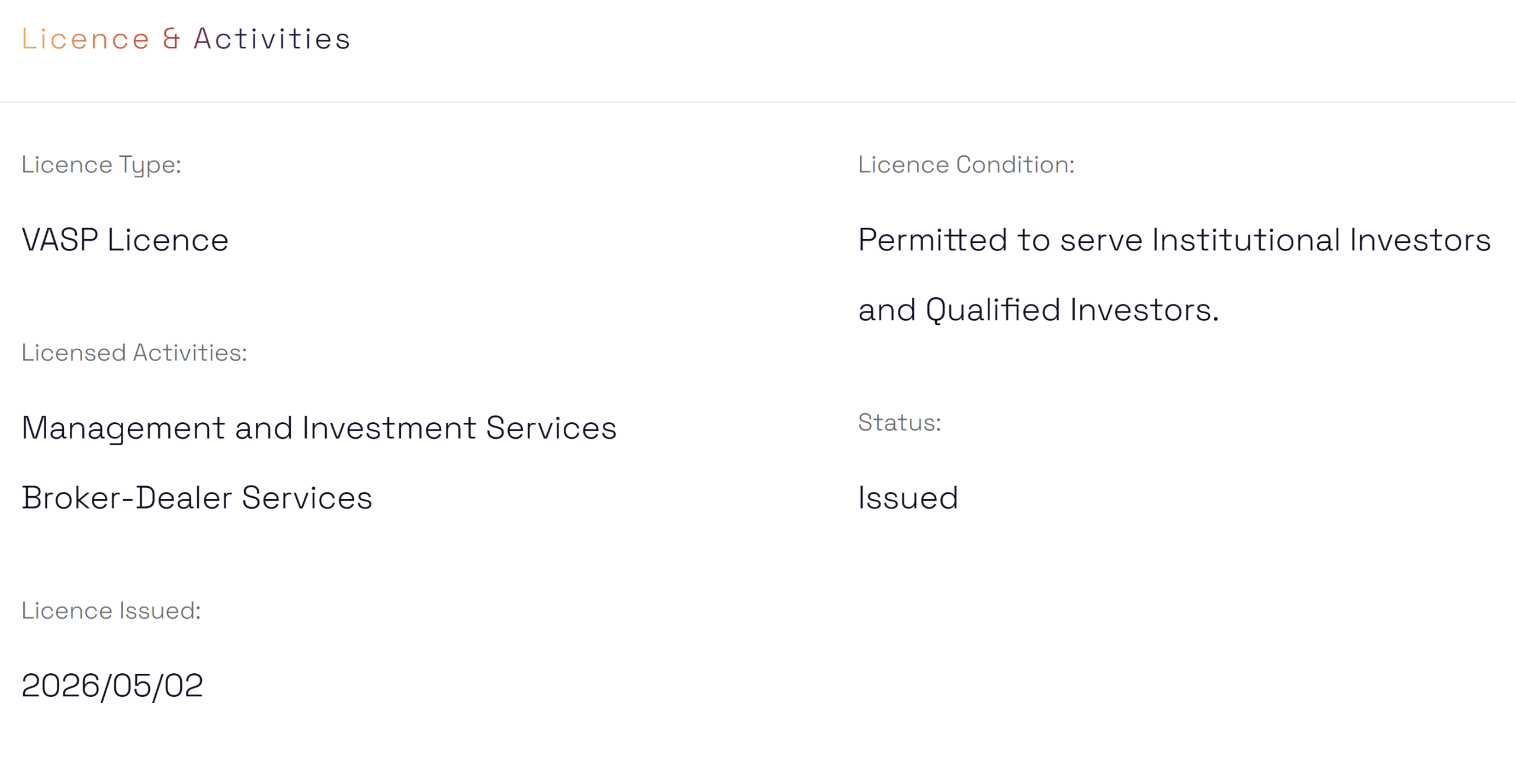

Animoca Brands has secured a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA), clearing the way for the company to broaden its crypto operations across the Middle East.

The license allows the Hong Kong-founded Web3 investor and platform developer to offer broker-dealer services and investment management related to virtual assets in and from Dubai, excluding the Dubai International Financial Centre, according to a Monday announcement. The services are aimed primarily at institutional and qualified investors worldwide.

“This licence enhances our ability to engage with Web3 foundations as well as global institutional and qualified investors within a well-regulated framework,” Omar Elassar, managing director for the Middle East and head of global strategic partnerships at Animoca Brands, said.

VARA, established in March 2022, is responsible for regulating and overseeing the provision, use, and exchange of digital assets across Dubai’s mainland and free zones.

Related: Dubai and UAE move to align crypto frameworks under new partnership

Animoca to serve institutional investors in Dubai

VARA’s public register shows that the license was issued on Feb. 5. It permits the firm to serve institutional and qualified investors under the oversight of Dubai’s VARA.

Animoca Brands develops blockchain platforms and supports Web3 ecosystems, including The Sandbox, Open Campus and Moca Network, while also backing early-stage projects. The company says its investment portfolio spans more than 600 companies and digital-asset initiatives.

In January, Animoca Brands acquired gaming and digital collectibles company Somo, adding Somo’s playable and tradable collectibles to its broader portfolio of blockchain-based projects.

Related: What Dubai’s ban on Monero and Zcash signals for regulated crypto

Crypto firms expand crypto operations in Dubai

The move adds to a growing list of crypto firms establishing regulated operations in Dubai. In October 2025, digital asset infrastructure firm BitGo also obtained a broker-dealer license from Dubai’s VARA, allowing its Middle East and North Africa unit to provide regulated digital-asset trading and intermediation services to institutional clients in the emirate.

The approval came after VARA said it had issued financial penalties against 19 companies for “unlicensed” Virtual Asset activities and “breaches of VARA’s Marketing Regulations.”

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Kevin O’Leary Wins $2.8M Defamation Suit Against ‘Bitboy’

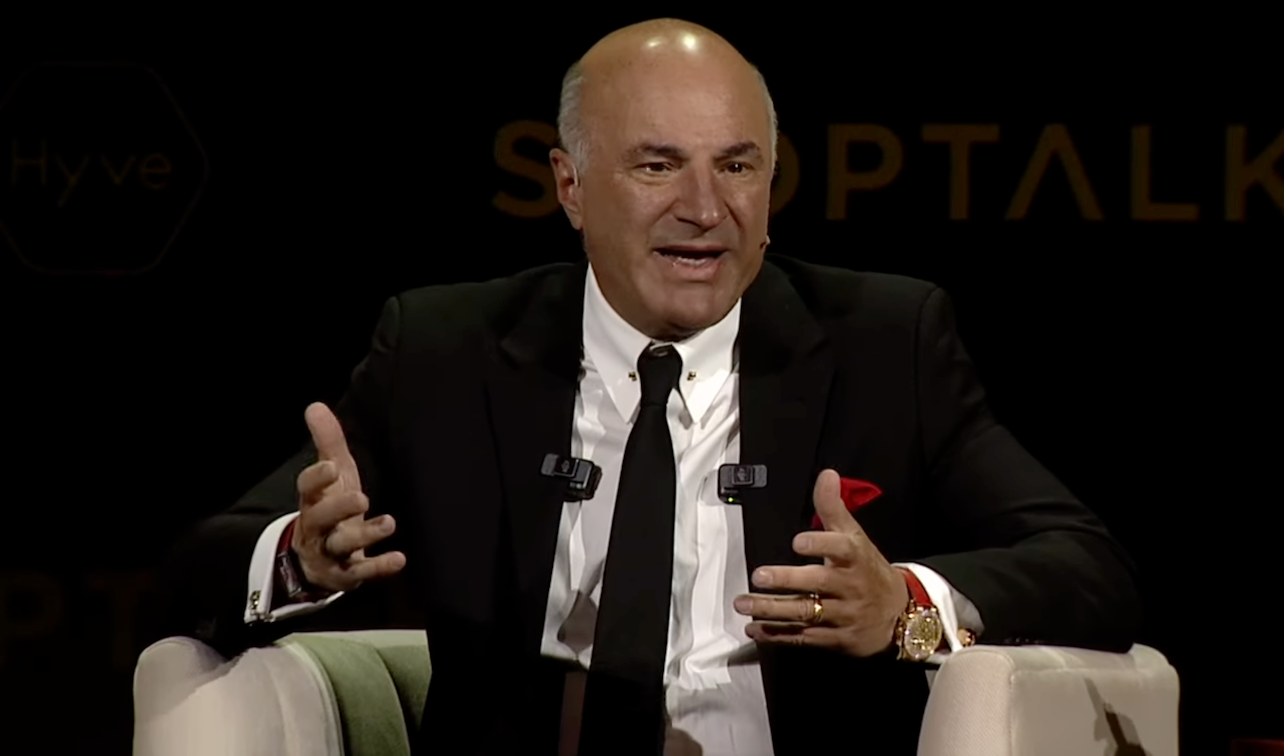

Businessman and TV personality Kevin O’Leary has won a multi-million-dollar defamation lawsuit against crypto influencer Ben Armstrong, also known as “Bitboy.”

Miami federal judge Beth Bloom on Friday ordered Armstrong to pay almost $2.83 million in damages to O’Leary over a series of social media posts accusing the Shark Tank star of being a murderer.

O’Leary and his wife, Linda, were in a boating accident in 2019 that resulted in two deaths when their boat struck another. Armstrong accused O’Leary of murder in multiple X posts in March 2025, claiming that he paid millions to cover up the incident.

In her order, Judge Bloom said that O’Leary wasn’t operating the boat at the time and was never charged. While Linda O’Leary was charged with careless operation of a vehicle, she was exonerated after a 13-day trial that found the other boat was operating without its lights on.

Armstrong posted O’Leary’s phone number in X outburst

Judge Bloom said Armstrong had “escalated his harassment campaign” by sharing O’Leary’s private phone number and “urging his followers to ‘call a real life murderer,’” which saw him suspended from X for 12 hours.

O’Leary had said his phone was “lighting up” after the post, and the sharing of his number “significantly affected him, both in his professional and personal life,” according to the order.

Judge Bloom made a default judgment in the case after Armstrong failed to respond to the complaint and did not appear in court. The judge ordered Armstrong to pay $750,000 in mental anguish damages, $78,000 in reputational damages, and $2 million in punitive damages.

Related: Uniswap scores early win as US judge dismisses Bancor patent suit

The decision is the latest legal blow to Armstrong, who has been embroiled in public legal controversies over the past few years after being removed from the Bitboy Crypto brand in 2023, once one of the most-watched crypto-related YouTube channels.

He was arrested in March in Florida over emails he had sent to Georgia Superior Court Judge Kimberly Childs while acting as his own attorney. He was also arrested again in July in Georgia on charges of making harassing phone calls.

Armstrong was also arrested years earlier, in 2023, while livestreaming outside a former associate’s house, whom he had alleged was in possession of his Lamborghini.

Magazine: Kevin O’Leary says quantum attacking Bitcoin would be a waste of time

Crypto World

Could Q1 Be the Worst Since 2018?

Bitcoin (CRYPTO: BTC) started 2026 with a steep slide and is on track for a challenging first quarter, echoing patterns seen in prior bear markets. The largest cryptocurrency by market cap has fallen about 22% since January, slipping from roughly $87,700 to the mid-$60k range, with recent prints near $68,000. If that pace holds, Q1 could mark the worst start to a year since the 2018 bear market, when BTC tumbled almost 50%, according to data tracked by CoinGlass. Ether (CRYPTO: ETH), the second-largest asset, has also pushed lower in the year’s early weeks, though its losses have been comparatively milder, aligning with a broader risk-off mood across crypto markets.

Key takeaways

- Bitcoin is down roughly 22% year-to-date, trading around $68.6k after opening near $87.7k, signaling entrenched near-term softness.

- The first quarter could become the worst since 2018 for BTC, with 2018 data showing a 49.7% quarterly decline according to CoinGlass.

- Ether has fared similarly in its own context, with about 34.3% losses in the current Q1—the third-worst start among nine observed first quarters historically.

- BTC has posted five straight weeks of losses, including a January drop of around 10.2% and a February trend that remains negative, needing a reversal above $80k to avert further red printing in February.

- Analysts describe the move as a routine correction within a longer-term backdrop of rising institutional interest and halving-cycle dynamics, rather than a structural breakdown.

Tickers mentioned: $BTC, $ETH

Sentiment: Bearish

Price impact: Negative. The price has declined to about $68,670, indicating ongoing downside pressure in the near term.

Market context: The sector remains sensitive to macro headwinds and liquidity conditions, with a focus on how institutional adoption and supply-side cycles could shape a potential rebound later in the year.

Why it matters

From a market structure perspective, the current pullback highlights how crypto assets are trading in a risk-off environment even as macro narratives evolve. Bitcoin’s retreat from the high-70s and into the 60k territory reflects a mix of profit-taking, cautious positioning by retail participants, and a broader test of support levels after a period of elevated volatility. The context matters because BTC’s price level often informs broader risk appetite in the sector, influencing altcoins and the trajectory of liquidity in the ecosystem.

Historically, the first quarter has displayed pronounced volatility for crypto. In 2018, during a brutal bear market, BTC shed almost half of its value within three months, a benchmark often cited by traders and analysts when assessing risk. In 2025 and 2020, Q1 saw notable declines as well, though the magnitude varied. The current quarter’s descent—paired with ETH’s sharp, yet comparatively less severe, slide—appears to align with a broader pattern: macro uncertainties tend to weigh on risk assets early in the year, even as final-year catalysts or structural developments remain in view.

One factor driving the current mood is the perpetual tug-of-war between risk-off sentiment and the long-run thesis for crypto assets. On one hand, institutions have continued to explore exposure and on-chain activity has shown resilience in certain metrics. On the other hand, macro headwinds—rising rates expectations, liquidity considerations, and geopolitical dynamics—can confine upside moves in the near term. In this context, market participants are watching crucial levels to gauge whether the pullback is a temporary correction or the onset of a more protracted downturn.

Within the price action, BTC’s five-week losing streak underscores a persistent near-term weakness. A slide of around 2.3% in the preceding 24 hours, with prices hovering around $68,670 at press time, suggests a market that remains sensitive to any fresh negative catalysts. CoinGecko tracks Bitcoin’s price and confirms the current trading range, reinforcing the view that a meaningful rebound would require catalysts beyond mere technical bounce—potentially including improved macro clarity or a renewed wave of institutional buying interest.

What to watch next

- Price level to watch: Whether BTC can reclaim the $80,000 threshold to halt or reverse the February red trend.

- Near-term performance: The next weekly closes to determine if the five-week streak of losses ends or extends.

- ETH trajectory: Whether Ether’s decline moderates alongside BTC or diverges due to sector-specific catalysts.

- Macro and on-chain signals: Monitoring shifts in liquidity conditions, risk sentiment, and any halving-cycle-related dynamics that could bolster a longer-term recovery.

- Institutional flow indicators: Any uptick in demand from well-funded participants that could support a sustained move higher once macro conditions stabilize.

Sources & verification

- CoinGlass data on Bitcoin’s quarterly performance and historical comparisons to 2018 (bear market) data.

- CoinGecko price data confirming BTC around $68k–$69k and daily movement metrics.

- LVRG Research commentary from Nick Ruck on BTC’s correctional phase and long-term resilience.

- Twitter/X reference to DaanCrypto’s assessment of Q1 volatility and its historical context.

Bitcoin’s Q1 trajectory amid macro headwinds and halving dynamics

Bitcoin (CRYPTO: BTC) is navigating a challenging start to 2026, with a renewed sense of caution across markets. After opening the year near $87,700, the benchmark asset has ceded roughly a quarter of its value, slipping into the mid-60k zone as headlines about liquidity and policy remain in focus. The decline mirrors patterns seen at the outset of prior downturns, where quarterly losses in the double-digit range have not always translated into a permanent downturn but instead have persisted until a new phase of accumulation takes hold. CoinGlass data help frame the severity: the first quarter of 2018, for example, remains the gold standard for a severe quarterly drawdown in the BTC bear era. The current slide has revived debates about whether the market is entering a longer-term correction or simply testing support before a potential resumption of upside.

Ether (CRYPTO: ETH) is not immune to the broader risk-off tone, though its drawdown has followed a somewhat different cadence. The leading altcoin has faced substantial selling pressure in Q1, with losses that stand at roughly 34% so far this quarter. Historically, ETH has shown red in a minority of its first quarters, but the current figure places it among its harsher starts. The divergence between BTC and ETH’s path underscores the nuanced dynamics within the crypto market, where Bitcoin often drives overall market psychology while the altcoin complex trails in response to sector-specific catalysts and cross-asset risk metrics.

Market observers have pointed to a recurring theme: the first quarter has a reputation for volatility in crypto markets, a fact that traders reference when calibrating risk and exposure. Daan Trades Crypto, an analyst cited in recent commentary, notes that quarterly fluctuations tend to be self-contained at the outset of a given year, and that early-year losses do not always predict how the rest of the year will unfold. Such commentary is supported by a broader body of historical data indicating that while Q1 performance can be harsh, it does not invariably preface a structural market decline, particularly when halving cycles and institutional adoption offer longer-term catalysts.

Current price action places BTC at a crossroads. When prices last crossed into the $70k range, buyers often argued for a swift rebound on improved macro sentiment or renewed liquidity. That level has since yielded to selling pressure, and a sustained breach of price levels around $68k–$69k raises the question of whether the market is undergoing a deeper retracement or simply pausing before the next leg up. For traders and investors, the key remains whether macro signals align with on-chain activity and whether the next set of data points—be it inflation prints, rate expectations, or regulatory developments—could tilt the balance in favor of buyers or sellers over the coming weeks.

https://platform.twitter.com/widgets.js

Crypto World

$100K Prize, Transparent Contract Trading

As the cryptocurrency market enters a new phase of volatile expansion, one of the leading global digital asset trading platforms Zoomex officially announced the launch of its annual flagship initiative — “February Sprint: Growth Season.”

Featuring a total prize pool of up to $100,000, the campaign is designed not only to empower users to achieve step-by-step asset growth but also to further embody Zoomex’s unwavering commitment to “asset sovereignty” and “rule transparency,” creating a fair, competitive arena where assets move seamlessly, and reward pathways remain clear for traders worldwide.

In today’s trading environment, user expectations surrounding platform integrity and asset liquidity have risen to core strategic priorities. Zoomex’s Brand Director stated: “We believe the foundation of fairness lies in users having absolute sovereignty over their assets and the ability to access them at any time. The market’s trust threshold for trading platforms is at a pivotal turning point.

That is why Zoomex continues to optimize a frictionless asset circulation system, ensuring that every participant’s assets are safeguarded within a highly transparent framework while maintaining maximum liquidity. This is not only a demonstration of technological strength, but also our brand commitment to protecting users’ asset sovereignty.”

To ensure users can execute trades at optimal cost throughout the Rapid Sprint, Zoomex leverages its proprietary Dual Liquidity Pool architecture to deliver a highly liquid, ultra-low slippage trading environment. Compared to a single liquidity source, the dual-pool mechanism significantly enhances order book depth.

Whether users are accelerating toward high-volume trading rewards or hedging risk during extreme market volatility, every order is executed at precise pricing. This transparent pricing and execution model eliminates hidden market costs, ensuring that every reward earned during Growth Season delivers tangible value.

The campaign, running from February 12 to February 28, is designed entirely around the principle of rule transparency, with all participants competing under a unified and fair algorithm:

Equal Starting Line: Exclusive New User Benefit

- New users who register and complete verification will receive a $10 bonus. This initiative encourages participants to experience Zoomex’s efficient asset mobility and impartial matching engine firsthand.

Accelerated Advancement: $1,000 Deposit Growth Reward

- In recognition of capital efficiency, Zoomex offers tiered incentives based on cumulative deposits. From $50 to $1,000 in total deposits, users can unlock rewards of up to $300 in bonus funds and $700 in Position Vouchers. All data is synchronized in real time, ensuring full visibility into each user’s asset growth trajectory.

Professional Recognition: Trading Days Rewards & XAUT Gold Airdrop

- The campaign honors disciplined traders by rewarding cumulative trading days, offering up to $110 in bonus incentives. For advanced participants seeking greater challenges, Zoomex also introduces the XAUT airdrop rewards — backed by physical gold — of up to $300 in XAUT. This structure guides users toward diversified and stable asset allocation within a transparent and fair trading environment.

Zoomex’s February “Rapid Sprint” Growth Season represents a resonance of integrity between the platform and its users. Here, every asset flow is transparent, and every trade execution is fair and reliable. We do not participate in market gamesmanship — we focus solely on safeguarding your asset sovereignty and empowering your journey toward sustainable growth.

Register now and begin your asset growth sprint with Zoomex today.

About ZOOMEX

Founded in 2021, Zoomex is a global cryptocurrency trading platform with over 3 million users across more than 35 countries and regions, offering 700+ trading pairs. Guided by its core values of “Simple × User-Friendly × Fast,” Zoomex is also committed to the principles of fairness, integrity, and transparency, delivering a high-performance, low-barrier, and trustworthy trading experience.

Powered by a high-performance matching engine and transparent asset and order displays, Zoomex ensures consistent trade execution and fully traceable results. This approach reduces information asymmetry and allows users to clearly understand their asset status and every trading outcome. While prioritizing speed and efficiency, the platform continues to optimize product structure and overall user experience with robust risk management in place.

As an official partner of the Haas F1 Team, Zoomex brings the same focus on speed, precision, and reliable rule execution from the racetrack to trading. In addition, Zoomex has established a global exclusive brand ambassador partnership with world-class goalkeeper Emiliano Martínez. His professionalism, discipline, and consistency further reinforce Zoomex’s commitment to fair trading and long-term user trust.

In terms of security and compliance, Zoomex holds regulatory licenses including Canada MSB, U.S. MSB, U.S. NFA, and Australia AUSTRAC, and has successfully passed security audits conducted by blockchain security firm Hacken. Operating within a compliant framework while offering flexible identity verification options and an open trading system, Zoomex is building a trading environment that is simpler, more transparent, more secure, and more accessible for users worldwide.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat15 hours ago

NewsBeat15 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics5 days ago

Politics5 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat17 hours ago

NewsBeat17 hours agoMan dies after entering floodwater during police pursuit