Crypto World

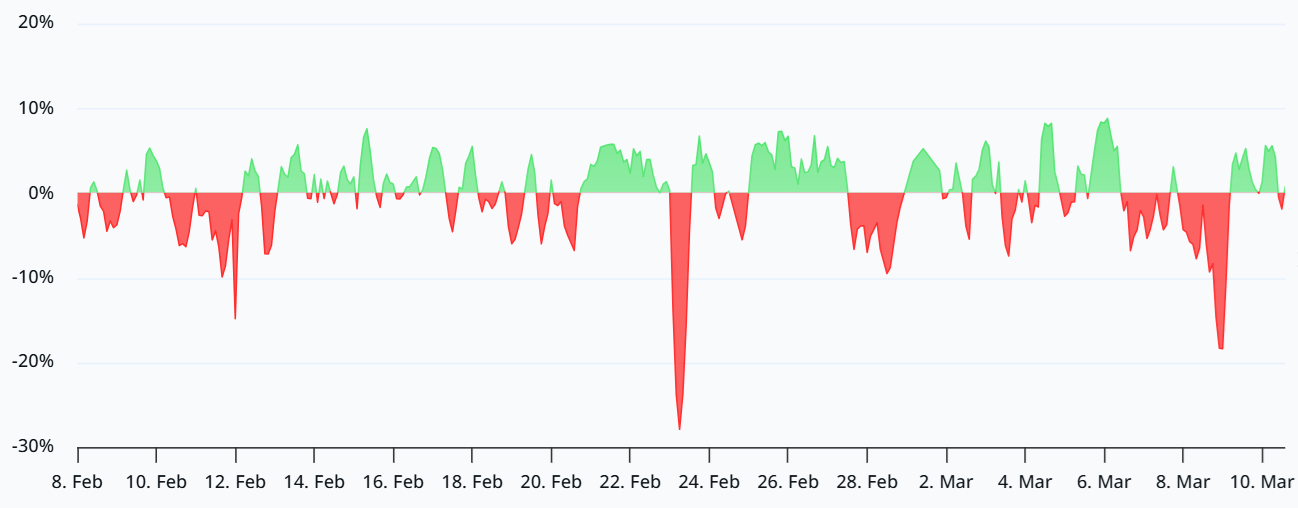

Bitcoin price outlook: buy signals appear amid deep BTC correction

- Bitcoin (BTC) is showing early buy signals amid an ongoing correction near $69,500.

- The key support levels at $65,800 and $60,100 attract dip buyers.

- A break above $74,500 could trigger renewed bullish momentum.

Bitcoin has been in a volatile state over the past month, with prices hovering near $69,500.

The cryptocurrency has faced a 23.2% drop over the last month, signalling a deeper correction in progress.

Despite the decline, recent market activity suggests early buy signals are starting to emerge.

Bitcoin price trapped in a sideways phase

BTC is currently trading in a sideways range between $62,800 and $78,900 over the past seven days.

This range indicates indecision among traders, with neither bulls nor bears fully controlling the market.

Analyst Doctor Profit warn that this sideways phase could be a trap, potentially leading to a deeper drop toward $44,000–$50,000.

However, this view is balanced by macroeconomic developments that may provide temporary support for Bitcoin.

The recent rebound above $70,000 came after a short squeeze pushed BTC higher, liquidating over $245 million in positions.

This shows that buying pressure still exists, particularly from opportunistic traders looking to enter at perceived lows.

Liquidity remains relatively strong, with 24-hour trading volume exceeding $46 billion, suggesting continued investor participation.

Bitcoin technical outlook: the buy signals

From a technical standpoint, Bitcoin remains capped below key resistance at $69,000–$69,500.

Breaking above this level is essential for bulls to regain control of short-term momentum.

On the flip side, the support levels at $65,800 and $60,100 provide clear thresholds where buyers may step in.

Recent dip buying indicates that some traders are accumulating Bitcoin during the correction.

Notably, the reset of leveraged positions in derivatives markets points to reduced short-term selling pressure.

Meanwhile, macro factors such as strong US economic data and Federal Reserve liquidity injections provide additional tailwinds.

Political events like Japan’s election have also lifted global risk appetite, indirectly supporting BTC and other risk assets.

Historical trends show that Bitcoin often experiences deep corrections after major rallies, making the current slump consistent with past market cycles.

The all-time high of $126,080, reached in October 2025, remains distant, but the current consolidation may offer opportunities for medium-term accumulation.

Analysts emphasise that patience is critical, as further volatility is expected before a sustained uptrend emerges.

Bulls should watch these key technical zones carefully, knowing that a breakout above $74,500 could signal renewed upward momentum.

Conversely, a fall below $65,800 could intensify selling and extend the correction phase.

Overall, the market is balancing between lingering bearish pressure and emerging buying interest, creating a cautious but potentially rewarding environment.

Investors with a longer-term perspective may view current prices as an entry point amid market-wide corrections.

Short-term traders should remain alert to both upside breakouts and downside risks in the coming weeks.

Crypto World

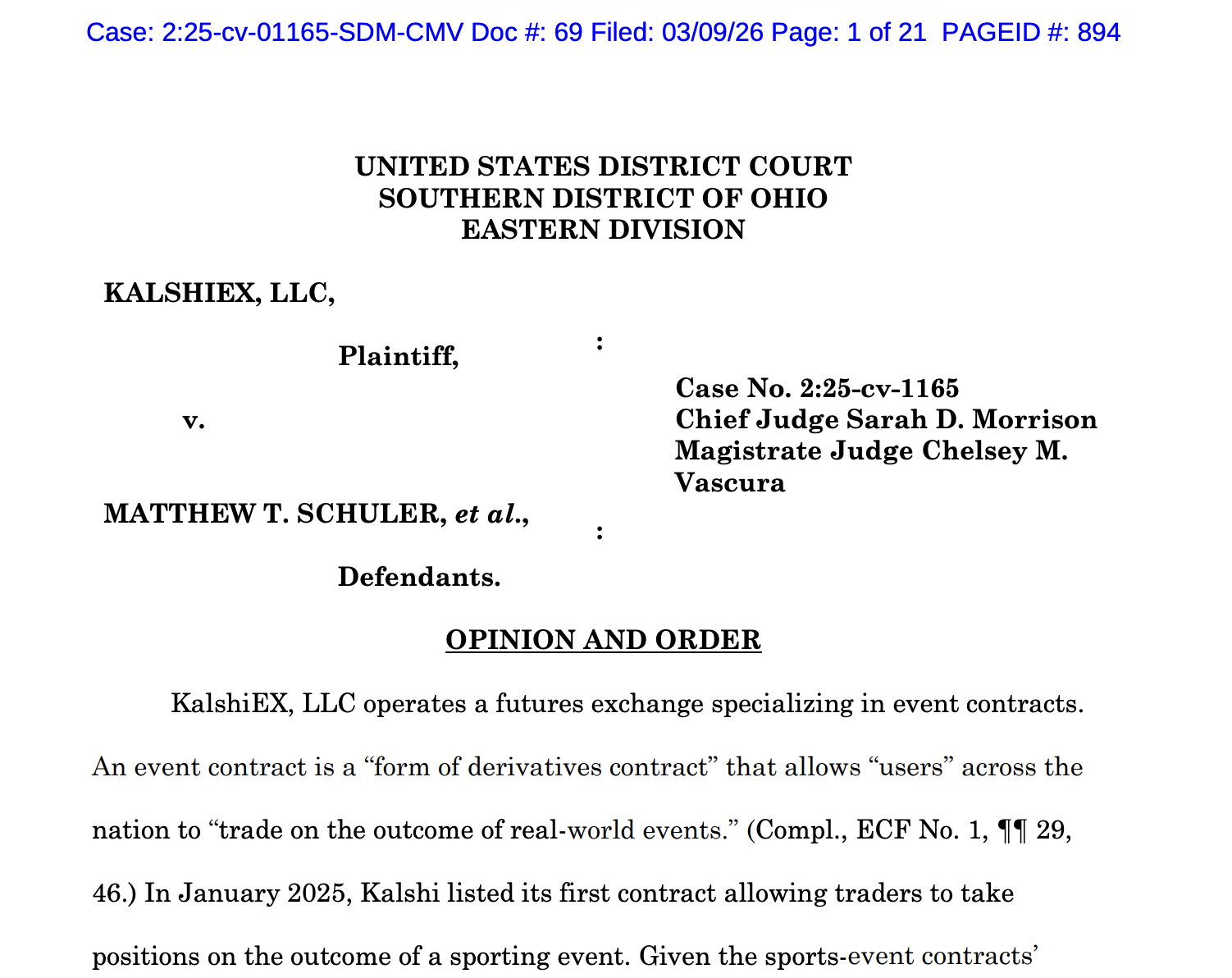

Kalshi Suffers Court Loss in Ohio over Sports Betting Lawsuit

The prediction markets platform argued for an injunction against Ohio authorities, claiming that federal commodities laws superseded state laws on sport event contracts.

An Ohio federal court has denied a motion filed by prediction markets platform Kalshi for a preliminary injunction against Ohio state authorities over allegations that the company was operating in violation of gambling laws.

In an order filed Monday, US District Court for the Southern District of Ohio Chief Judge Sarah Morrison denied Kalshi’s request for an injunction that would have blocked the Ohio Casino Control Commission and state attorney general from regulating contracts on the platform, specifically for sports betting.

According to the judge, Kalshi had failed to show that the sports event contracts available on the platform were subject to the “exclusive jurisdiction” of the Commodity Futures Trading Commission (CFTC).

“Even if this Court were to find that sports-event contracts are swaps subject to the CFTC’s exclusive jurisdiction, Kalshi has not shown that the [Commodity Exchange Act, or CEA] would necessarily preempt Ohio’s sports gambling laws,” said the opinion and order, adding:

“Kalshi argues that Ohio’s sports gambling laws are field and conflict preempted by the CEA when it comes to sports-event contracts traded on its exchange […] Kalshi fails to establish that Congress intended the CEA to preempt state laws on sports gambling.”

The denial pushed back against the narrative from CFTC Chair Michael Selig, who said in February that the federal regulator had “exclusive jurisdiction” over prediction markets and threatened lawsuits against any authority claiming otherwise. Kalshi and prediction platforms face lawsuits in other US states over similar allegations involving unlicensed sports betting.

“This Court does not endeavor to explain why the CFTC has not exercised its authority […] with respect to the sports-event contracts,” said the Monday filing in Ohio. “But the agency’s inaction is not proof that the sports-event contracts are regulated by or permissible under the CEA—and the Court has concluded they are not.”

Related: CFTC chair backs blockchain-based prediction markets as ‘truth machines’

In a statement to Cointelegraph, a Kalshi spokesperson said that the company “respectfully disagree[d] with the Court’s decision, which splits from a decision from a federal court in Tennessee just a few weeks ago, and will promptly seek an appeal.”

CFTC guidance on prediction markets could be looming

Last week, Selig said that the federal regulator was working to provide guidance regarding prediction markets “in the very near future.” The CFTC chair is the sole Senate-confirmed commissioner in a panel normally consisting of five people.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Solana Institutional Adoption Surges with $540M in Spot ETF Investments

TLDR:

- Top 30 institutional investors accumulated $540M worth of Solana spot ETFs during the fourth quarter.

- Electric Capital leads with $137.8M exposure while Goldman Sachs disclosed $107.4M in SOL-linked ETFs.

- Institutional demand remained stable even as the Solana price declined nearly 30% since Q4.

- Spot SOL ETFs are enabling regulated exposure for asset managers unable to custody crypto.

Solana institutional adoption is gaining momentum as investors purchased $540 million in spot SOL ETFs during Q4, showing early multi-quarter conviction in the high-performance blockchain.

Institutional Investors Increase Exposure to Solana

Top institutional investors are positioning heavily in Solana through spot ETFs. In Q4, the 30 largest investors accumulated approximately 4.3 million SOL, worth $540 million.

Electric Capital holds the largest allocation at $137.8 million, followed by Goldman Sachs with $107.4 million.

The presence of traditional financial institutions like Goldman Sachs indicates growing acceptance of Solana beyond Bitcoin and Ethereum. Smaller allocations by Morgan Stanley, Citadel Advisors, and VanEck Associates show diversified participation.

This spread suggests strategic interest across portfolios rather than isolated bets. Unlike earlier cycles where institutions entered altcoins after major retail rallies, Solana is attracting early interest.

The rapid accumulation suggests these investors are viewing SOL as a multi-quarter or multi-year allocation. ETF exposure allows institutions to gain regulated access while maintaining compliance with internal mandates.

Resilient Demand and Structural Appeal

Despite a roughly 30% drop in price since Q4, institutional flows have remained steady. This behavior points to fundamental evaluation, focusing on ecosystem growth, developer activity, and network throughput.

Market corrections have not triggered significant sell-offs, signaling confidence in Solana’s long-term prospects.

Recent price action reinforces this view. SOL dipped to $82 during the past week before quickly recovering to the $88–$89 range.

The strong support indicates steady accumulation by market participants. Technical patterns suggest a short-term uptrend may continue, aligning with institutional positioning strategies.

Solana’s scalability and high-performance blockchain infrastructure are key drivers of interest. Low transaction fees and fast throughput support applications like trading systems, payments, and consumer platforms.

Combined with an expanding ecosystem of decentralized exchanges, NFT platforms, and other applications, Solana presents a compelling option for portfolio diversification.

Spot SOL ETFs further enable access for traditional institutions. These regulated vehicles allow asset managers to gain exposure without direct custody challenges.

The combination of infrastructure, ecosystem momentum, and ETF accessibility explains why institutions are increasingly incorporating Solana into their portfolios.

Crypto World

Stablecoins are starting to reshape payments and banking, Macquarie says

Stablecoins are evolving from a niche crypto trading tool into a potential layer of global financial infrastructure, according to Australian investment bank Macquarie.

While most U.S. dollar-denominated stablecoin activity, mainly in Tether’s USDT and Circle’s USDC, still comes from crypto trading, accounting for about 90% of volume, the bank said adoption is expanding across payments, remittances, treasury operations and tokenized assets, increasingly linking traditional finance with decentralized finance.

“Stablecoin adoption is making strides in cross-border remittances, but adoption as form of payment still has room to grow, presenting an attractive total addressable market (TAM) opportunity,” analysts led by Paul Golding said in the Monday note.

Regulatory progress is helping drive the shift. The analysts pointed to developments such as the U.S. GENIUS Act, Europe’s MiCA framework and emerging Asia-Pacific regulations as factors pushing stablecoins from speculative uses toward institutional settlement tools.

Read more: Stablecoin market expands, bitcoin rallies as Iran war panic cools

Stablecoins are cryptocurrencies designed to maintain a fixed value, typically pegged to the U.S. dollar, and are widely used across digital asset markets for trading, payments and transfers.

Tether’s USDT is the largest stablecoin by market value and trading volume, serving as a key source of liquidity across crypto exchanges, while Circle’s USDC is the second largest and is widely used in institutional and decentralized finance applications. Together, the tokens underpin much of the crypto market’s activity and are increasingly being explored for payments, remittances and settlement.

Stablecoin growth has been rapid. Macquarie estimates the combined market capitalization of major coins at about $312 billion as of March 2026, up roughly 50% year over year and representing about 7%–8% of the total crypto market.

Transaction activity is rising even faster. Adjusted stablecoin transfer volume reached roughly $11 trillion in 2025, the bank said, suggesting onchain dollars are becoming a meaningful economic tool both within crypto markets and in some real-world payment corridors.

Payments networks and fintech firms are beginning to integrate the technology. The report noted that Visa (V) and Mastercard (MA) now support USDC settlement, allowing card obligations to be discharged onchain.

Banks are experimenting with similar systems. Macquarie pointed to initiatives including JPMorgan’s JPMD tokenized deposit product, Citi’s Token Services and tokenized deposit pilots at HSBC as evidence that blockchain-based settlement is gaining traction among large financial institutions.

Read more: Standard Chartered says U.S. regional banks most at risk in $500 billion stablecoin shift

Crypto World

How Bitcoin ETFs Are Changing Crypto Market Structure and Supply How ETFs Reshape Crypto Markets and Bitcoin Supply Flows

Exchange-traded funds have changed how capital reaches crypto markets and how traders find prices. The arrival of spot Bitcoin ETFs opened regulated on-ramps. At the same time, a meaningful share of mined Bitcoin sits outside active markets. This report explains how ETFs alter market structure and why the effective Bitcoin float falls well short of 21 million coins.

ETFs Expand Access to Bitcoin Markets

ETFs let investors buy Bitcoin exposure through standard brokerage accounts. This structure removed custody and private-key management for many buyers. Investors then moved capital into familiar products listed on major exchanges.

Chainalysis observed that spot-ETFs drove trading volumes into the billions per day within months of launch.

Regulators and issuers created prospectuses, oversight, and audit requirements for these funds. The SEC approved multiple spot Bitcoin listings in January 2024.

SEC Chair Gary Gensler noted the agency approved the listing and trading of a number of spot Bitcoin exchange-traded products, marking a procedural turning point for market access.

ETFs Change Liquidity and Price Formation

Authorized participants now exchange ETF shares for underlying Bitcoin. This creation/redemption mechanism links ETF flows with spot markets. Market-making firms increased activity to support arbitrage and large block trades.

Major liquidity providers helped narrow spreads and improve execution quality for institutional trades.

At the same time, ETF flows influence daily price discovery. Large inflows can bid prices upward quickly. Conversely, sustained outflows can remove demand and pressure prices. Market observers now monitor ETF net flows as part of standard price analysis. Chainalysis documented large early inflows that matched high daily trading volumes.

ETFs Drive Institutional Bitcoin Adoption

Asset managers deployed regulated fund structures that appeal to pensions, endowments, and wealth managers. Major issuers launched competing ETFs. Institutions then allocated capital through those products rather than directly holding private keys. This shift created a concentrated pool of institutional demand routed into ETFs. Evidence shows certain ETFs grew to tens of billions in assets in under a year.

Wealth managers and broker-dealers scaled their offering and distribution channels. The result moved sizable blocks of Bitcoin into custodial arrangements under fund sponsors and their partners. This concentration affects how much supply remains available for active trading.

Custody Links Crypto to Traditional Finance

ETF issuers contracted regulated custodians, auditors, and clearing agents. Traditional financial infrastructure now supports large Bitcoin holdings. Institutional custodians apply governance, insurance, and reporting standards that differ from self-custody. These arrangements increase investor confidence and also reduce turnover in those holdings.

Market participants link ETF strategies to futures and options markets. Traders hedge ETF exposure via derivatives, which increases activity on exchanges such as the CME.

The cross-market linkages changed intraday flow patterns and reduced fragmentation between venues.

Why is a substantial portion of Bitcoin effectively unavailable

On-chain analysis shows a nontrivial share of mined Bitcoin never moves again. Independent research finds that between three and four million BTC likely remain permanently inaccessible.

Analysts attribute these losses to forgotten keys, discarded hardware, and unrecoverable custodial accounts. These coins still exist on the ledger, but holders cannot move them.

Some of the largest examples include early-era addresses that remain dormant. Those coins reduce the usable supply relative to the 21 million cap. As a result, market participants must base liquidity assessments on the effective float, not the theoretical total.

Long-Term Holding Shrinks Tradable Supply

Beyond permanently lost coins, many holders keep Bitcoin offline for long periods. Long-term holders now control a large portion of the circulating supply. Funds, corporate treasuries, and strategic reserves hold coins for extended horizons.

Analysts estimate U.S. spot ETFs and institutional treasuries together hold over one million BTC, which removes these coins from daily trading pools.

On-chain metrics show older UTXOs grow as new issuance slows after halving events. When holders prefer storage over trading, available liquidity declines. That scarcity amplifies price response to marginal demand.

What This Means for Bitcoin Markets

Taken together, ETF accumulation, institutional treasuries, and lost coins lower the effective supply. Analysts place the usable circulating supply below the raw mined total. Markets now respond to changes in institutional flows more than in prior cycles. This structural change raises the sensitivity of price to net inflows and outflows.

Regulatory clarity and custody standards helped mainstream ETF adoption. Those same structures increased the proportion of Bitcoin held in long-term, low-turnover accounts. The market, therefore, shows signs of maturing.

Yet price remains sensitive to large fund flows and macro events. Observers should monitor ETF flows, custody reports, and on-chain dormancy metrics to assess liquidity and risk going forward.

Crypto World

Ether Funding Turns Negative, But Bears Remain In Control: Why?

Key takeaways:

-

Ether price struggled as investors pulled $225 million from the spot ETFs, and Ethereum staking rewards underperformed compared to stablecoin yields.

-

Recent Ethereum network upgrades and plans for improved wallet security are positives, but fail to kickstart demand for Ether.

Ether (ETH) price has repeatedly failed to sustain levels above $2,100 over the past month, gradually eroding traders’ confidence in the altcoin. Even with a 7% rise between Monday and Tuesday, ETH derivatives metrics suggest a lack of interest in leveraged bullish positions, potentially signaling that bears remain in control.

ETH perpetual futures dipped into negative territory on Tuesday, signaling increased demand for short (bearish) positions. More importantly, this metric has remained below the neutral 6% to 12% range for the past month. Part of this investor disappointment stems from a 54% price decline over six months, even though cooling onchain activity has also played a significant role.

Weekly base layer fees on the Ethereum network averaged $2.3 million over the past month, down from an $8 million peak in early February. While 7-day transaction counts stabilized near 14 million, the current industry focus on layer-2 rollup scalability has so far failed to generate fresh demand for native Ether.

Contrary to perpetual futures markets, the ETH options risk gauge hovered near the neutral -6% to +6% range on Tuesday. Put (sell) options traded at a 7% premium relative to call (buy) instruments, suggesting confidence is slowly returning among Ether bulls. Furthermore, no competitor has yet challenged Ethereum’s $56 billion in total value locked (TVL).

Ether exchange-traded funds (ETFs) saw $225 million in net outflows between Thursday and Monday, reversing the $169 million in inflows seen on Wednesday. This metric serves as a proxy to institutional demand, which is currently held back by the 2.8% native staking reward rate. By comparison, stablecoin yields on Sky Lending (formerly MakerDAO) sat higher at 3.75%.

Weak spot ETH ETF demand and concerns with Ethereum’s roadmap

Excitement surrounding the ETF staking approval in the US, which occurred in late 2025, has not yet translated into sustainable demand. One could argue that the negative outcome was simply a result of bad luck, as the launch coincided with a broader crypto market downturn that began in early October after total market capitalization neared a $4 trillion all-time high.

Related: Was Ethereum ‘ultrasound money’ a mistake? ETH down 65% vs. BTC since pivot

ETH has underperformed the broader cryptocurrency market since October 2025, and there are no signs that a reversal is underway. Investor sentiment is also impaired by a staggering $735 million net loss from the Ethereum treasury firm Sharplink (SBET US) in 2025. The company, chaired by Ethereum co-founder Joseph Lubin, released these financial results on Monday.

The pace of native chain scalability might have contributed to Ether’s negative performance. For instance, Ethereum co-founder Vitalik Buterin said on Saturday that account abstraction, equivalent to smart accounts, will likely be shipped “within a year,” after more than a decade under development. Transactions will be able to reference each other’s data, enabling quantum-resistant wallets.

Another advantage of the upcoming Ethereum Hegota fork is paying gas fees in non-ETH tokens using special-purpose decentralized exchanges, while adding a “general-purpose public mempool” and removing “public broadcasters” in privacy platforms such as Railgun and Tornado Cash. Buterin also said that he expects “progressive decreases” of slot time and finality time in the long term.

Overall, ETH derivatives and onchain activity point to low conviction in a bullish breakout above $2,200, but at the same time, there is no indication of worsening conditions or domination from bears.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Shiba Inu Price Prediction 2030: Nigel Farage Invests in Stack BTC While DeepSnitch AI Prepares to Outrun DOGE and SHIB With a 300x Launch Target

The institutionalization of crypto took another massive step forward this week in the United Kingdom. Reform UK party leader Nigel Farage has officially deepened his ties to the crypto sector by investing 215,000 pounds, or roughly $286,000, into Stack BTC.

Calculating a reliable Shiba Inu price prediction is nearly impossible when the asset has no real-world utility and is entirely dependent on fleeting internet hype. Smart money is completely abandoning these heavy, outdated tokens. They are putting their money in presales like DeepSnitch AI.

Discover why it’s the next crypto to 300x as the launch approaches.

Nigel Farage secures major stake in Bitcoin Treasury

This London-listed Bitcoin treasury company is chaired by former UK Chancellor Kwasi Kwarteng. Moreover, the new development represents a major bridge between traditional political influence and decentralized finance. Through his media vehicle, Thorn In The Side, Farage’s strategic investment grants him a substantial 6.31% stake in the company.

Stack BTC recently announced it raised a total of $346,000 by issuing 5.2 million new shares in a funding round that also prominently featured Blockchain.com. The involvement of Blockchain.com is critical, as they have entered a partnership to deliver institutional-grade services for Stack’s planned Bitcoin treasury operations.

What is the best crypto to buy now: Shiba Inu price prediction or DeepSnitch AI?

DeepSnitch AI: The ultimate profit edge before the March 31st deadline

You are currently in the final days of the DeepSnitch AI presale. On March 31st, the doors will permanently close, and the opportunity to buy this token at the heavily discounted price of $0.04399 will be gone forever. Immediately after the deadline hits, a strict 7-day claim window opens.

During this single week, early buyers will safely claim their purchased tokens, their massive promotional bonuses, and their staking rewards. Once that brief period closes, DeepSnitch AI officially launches on the UniSwap exchange.

With centralized exchange listings confirmed to follow shortly after, the public demand is going to be astronomical.

DeepSnitch AI has confidently smashed past the $2,000,000 funding milestone because it solves the biggest problem for everyday investors. Instead of guessing which coin to buy or relying on an uninspiring Shiba Inu price prediction, DeepSnitch AI gives you the ultimate profit edge.

It actively tracks “whales”, the massive billionaires and hedge funds moving the market, and tells you exactly what they are buying before the news even breaks. This allows you to follow the smart money and get in early. The launch is approaching, and being part of those who invested should be a top priority for many.

Shiba Inu price prediction

When evaluating the latest Shiba Inu price prediction, it becomes obvious why retail traders are abandoning the token. Despite a massive 275 billion tokens recently being moved off exchanges, the underlying momentum is entirely broken.

The token is flashing a dismal 14-Day RSI of 33.61, sitting just above the oversold territory with absolutely zero buying pressure coming from the retail sector.

Looking at the long-term Shiba Inu forecast, the numbers are actively depressing for current holders. By the end of 2026, the token is forecasted to drop by 9%, and by 2030, the models predict a massive 58% collapse from its current rates.

Anyone hoping for a bullish SHIB future price is completely ignoring the mathematical reality of its huge market capitalization. Searching for a positive Shiba Inu price prediction is a waste of time when you could be putting your capital into a live, functioning artificial intelligence tool that actually tracks market movements for you.

Dogecoin price prediction

Just like a struggling Shiba Inu price prediction, Dogecoin offers an average outlook for investors hoping for life-changing wealth. Currently trading at $0.09088 as of March 9th, the original meme coin is suffocating under an extreme fear market rating. The asset is trapped below its 50-Day SMA of $0.1050 and is miles away from its 200-Day SMA, confirming a strong, sustained bearish trend.

While DOGE is forecasted to hit $0.1139 by the end of 2026, that represents a tiny 25% increase. A small 25% gain by the end of the year is an incredibly inefficient use of capital. DeepSnitch AI is completely positioned to outrun both DOGE and SHIB because it offers something these meme coins never will: real, daily utility that helps you avoid scams and time your trades perfectly.

The bottom line

As political heavyweights like Nigel Farage pour hundreds of thousands of dollars into Bitcoin treasuries, everyday investors must realize that the market is changing. Relying on a stagnant Shiba Inu future price is a proven way to lose money.

While the consensus on the Shiba Inu price prediction remains heavily bearish, DeepSnitch AI is heavily undervalued and completely primed for a 300x explosion upon its UniSwap launch. You only have a few days left to grab this whale-tracking tool before it goes public. And you can earn 30% extra tokens by using the promo code DSNTVIP30.

Visit the official DeepSnitch AI website, join Telegram, and follow on X for more updates.

FAQs

Why is the current Shiba Inu price prediction so negative across the market?

The current Shiba Inu price prediction is deeply negative because the asset has no daily utility, relying entirely on fading social media hype.

How does a bearish Shiba Inu forecast push investors toward DeepSnitch AI?

A highly bearish Shiba Inu forecast forces smart investors to realize that meme coins are dead, pushing them to rotate their funds into DeepSnitch AI.

What prevents an aggressive SHIB price target from happening in 2026?

An aggressive SHIB price target is mathematically impossible because the circulating supply of the token is far too massive.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Crypto Banks Regulation: Wall Street Challenges Federal Trust Charters

TLDR:

- Banks warn crypto companies may act as shadow banks without full oversight.

- National charters allow crypto firms to operate across all U.S. states efficiently.

- Circle and Ripple seek federal trust charters to expand payments and custody services.

- Legal battles could determine the regulatory framework for digital financial services.

Crypto bank regulation is drawing attention as U.S. banks confront regulators over national trust charters for crypto firms.

The discussion revolves around regulatory parity and operational control in the emerging digital finance sector.

Federal Charters Expand Crypto Operations

Federal trust charters enable crypto companies to operate nationwide without separate state approvals. Circle and Ripple are among the firms seeking these licenses to scale their operations efficiently.

Such charters allow crypto companies to hold customer funds, facilitate payments, and manage settlements across all 50 states. This provides capabilities traditionally reserved for regulated banks.

Wall Street banks view these charters as creating an uneven competitive environment. By allowing crypto firms to perform bank-like activities without the same compliance framework, national charters could disrupt traditional banking models.

Banks operate under stringent rules, including capital requirements, liquidity ratios, stress tests, and consumer protection regulations.

These safeguards are designed to reduce systemic risk and protect depositors. Crypto firms could operate outside some of these rules, which raises concerns about regulatory gaps.

The potential national reach of crypto firms could accelerate the adoption of digital financial services. This expansion would allow them to compete directly with banks in custody services, payment processing, and settlement infrastructure.

Legal experts note that federal charters would formalize crypto firms’ roles in the financial system while allowing them operational flexibility not required of traditional banks. This duality lies at the center of current disputes.

Banks Raise Shadow Banking Concerns

The Bank Policy Institute, representing major U.S. banks, warns that crypto companies could act as shadow banks. Shadow banking refers to entities performing banking functions outside traditional oversight.

Historical cases, such as pre-2008 structured investment vehicles, show how lightly regulated institutions can amplify systemic risk.

Banks caution that granting federal charters without full regulatory parity could recreate similar vulnerabilities in digital finance.

Competition is another factor. Crypto firms are building payment infrastructure, issuing stablecoins, and providing asset custody. Federal charters would enable rapid scaling with fewer compliance burdens than traditional banks.

Regulators must balance innovation and stability. Allowing charters can foster blockchain development in the U.S. while providing oversight.

However, hybrid institutions operating under mixed rules could create new regulatory challenges.

Analysts and market watchers have highlighted growing attention on how national charters will reshape the relationship between crypto companies and traditional banks. The legal and regulatory outcomes will determine the future role of crypto firms in the U.S. financial system.

Crypto World

GENIUS Act turns stablecoins into tools of dollar dominance, not crypto rebels

The U.S. Senate is finally treating stablecoins as extensions of the dollar system itself, using the GENIUS Act to pull digital dollars inside the regulatory perimeter.

Summary

- The GENIUS Act passed the Senate 68–30, requiring payment stablecoins to be fully backed by cash and short‑term Treasuries with frequent, public reserve disclosures.

- Built on the Lummis–Gillibrand blueprint, the bill splits oversight between bank regulators and states while explicitly pitching regulated stablecoins as a way to cement U.S. dollar dominance.

- Critics warn the framework could entrench Trump‑linked ventures like World Liberty Financial and cement a two‑tier regime that squeezes offshore “grey‑market” stablecoins in the name of fighting illicit finance.

The U.S. Senate is finally treating stablecoins like part of the dollar system, not a crypto side project. In June 2025, senators passed the GENIUS Act, a landmark bill to create a federal regulatory framework for dollar‑pegged stablecoins, after more than a year of bipartisan trench warfare over Trump‑linked crypto politics, illicit finance, and the future of U.S. monetary power.

What the senator‑backed stablecoin bill actually does

Reuters reports that the GENIUS Act passed the Senate 68–30, with a bloc of Democrats crossing the aisle to join most Republicans in backing rules that would require payment stablecoins to be fully backed by “liquid assets like U.S. dollars and short‑term Treasury securities,” and mandate monthly public disclosure of reserves. Mayer Brown notes that the bill builds directly on the earlier Lummis–Gillibrand Payment Stablecoin Act, which set out a comprehensive regime for dollar‑backed tokens, splitting supervisory roles between federal and state regulators and explicitly positioning regulated U.S. stablecoins as a tool to “promote U.S. dollar dominance.”

Senator Kirsten Gillibrand’s own statement is blunt: “Passing a regulatory framework for stablecoins is absolutely critical to maintaining the U.S. dollar’s dominance, promoting responsible innovation, protecting consumers and cracking down on money laundering and illicit finance.” The bill aims to “fence in” risks around reserves, custody, insolvency and privacy, while giving banks and licensed non‑banks a clear path to issue payment tokens that can move “nearly‑instantly” around the world at lower cost than legacy wires and remittance products.

Politics, risks and macro stakes

The politics are nasty because the stakes are large. Reuters and Politico detail how Democratic support briefly collapsed in May 2025 over concerns that Republican drafters had watered down safeguards on foreign stablecoins and anti‑money‑laundering, just as President Trump’s own stablecoin venture, World Liberty Financial, was tied to a $2 billion Abu Dhabi‑backed investment into Binance. Senator Elizabeth Warren attacked the bill as creating a “super highway” for corruption and warned it could open the door for tech giants like Amazon and Meta to launch their own tokens without sufficient constraints.

Behind the floor drama is a clear macro calculation. The Lummis–Gillibrand materials cite UN estimates that offshore, unregulated stablecoins were used for roughly $17 billion in illicit transactions between 2022 and 2023, ranging from drug trafficking to sanctions evasion, and argue that forcing issuers onshore under tough rules would “cripple” that channel while locking in the dollar as the base currency of a multi‑trillion‑dollar digital economy. U.S. Treasury officials have gone further in speeches and private briefings, floating scenarios where regulated stablecoins generate trillions in incremental demand for Treasuries by 2030, effectively turning crypto rails into a new distribution channel for U.S. public debt.

For crypto markets, the senator‑driven stablecoin push is both a legitimization and a constraint. On one side, a clear federal framework promises mainstream integrations with banks, payments firms and on‑chain finance – a path to scale for the same dollar tokens that today power remittances on BNB Chain and elsewhere. On the other, the combination of reserve rules, licensing and harsh penalties for offshore USD tokens is meant to squeeze the grey‑market coins that made crypto dollarization possible in the first place. The message from Washington’s most aggressive stablecoin hawks is simple: digital dollars are welcome, as long as they stay inside the regulatory perimeter and serve U.S. monetary and security interests first.

Crypto World

BitGo to Custody Digital Assets for StableX’s $100M Stablecoin Plan

BitGo has inked a strategic arrangement to custody and execute trades for StableX Technologies’ digital asset treasury, as StableX targets up to $100 million in crypto acquisitions tied to the stablecoin sector. Under the agreement, BitGo Trust Company will act as custodian for StableX’s holdings, while BitGo’s over-the-counter liquidity desk will facilitate the company’s planned purchases. StableX (EXCHANGE: SBLX) is a Nasdaq-listed company focused on stablecoin infrastructure, and it has already begun building its digital-asset treasury, including token purchases such as FLUID (CRYPTO: FLUID) and LINK (CRYPTO: LINK) in October. The deal signals a broader shift toward institutional-grade custody and execution infrastructure for a wider set of assets beyond Bitcoin-centric treasury strategies (CRYPTO: BTC).

BitGo’s involvement marks a notable step in the maturation of digital-asset treasuries among publicly traded companies. BitGo, which trades on the NYSE under BTGO, has long highlighted its role as an infrastructure provider for institutions seeking secure custody and reliable liquidity. The partnership with StableX comes as BitGo’s leadership emphasizes expanding access to custody and execution for non-Bitcoin assets, underscoring a trend where traditional finance is increasingly engaging with the stablecoin ecosystem and related tokenized assets.

“The partnership underscores BitGo’s expanding role as the go-to infrastructure provider for a new wave of publicly traded companies building digital asset treasury strategies,”

The news follows StableX’s earlier steps to assemble a digital asset treasury. The company has publicly disclosed prior token purchases, including FLUID and LINK, signaling an intentional move toward diversification beyond fiat reserves and pure cash equivalents. The inclusion of LINK signals StableX’s interest inacles within the broader decentralized finance and oracle ecosystems, while FLUID represents exposure to niche protocol tokens that some institutions view as strategic bets within the stablecoin infrastructure space. This aligns with a growing appetite among investors to diversify treasury holdings with crypto assets that could function as liquidity rails or settlement primitives in a rapidly evolving digital economy.

BitGo’s public-market journey also colors the narrative. The company went public in January, pricing its shares at $18 and experiencing a strong first-day move before trading pressure moderated. The stock’s inception-day performance reflected investor interest in crypto infrastructure plays, and the subsequent trading session saw the stock advance and retreat in line with broader market sentiment toward fintech and crypto-enabled businesses. The partnership with StableX is thus positioned as a practical extension of BitGo’s mission to provide institutional-grade custody and liquidity solutions for a new generation of digital-asset treasuries.

In contextual terms, the deal sits within a broader ecosystem of products and products-leaning investor instruments aimed at stablecoins and their supporting infrastructure. The stablecoin universe has seen sustained capital inflows, with total market capitalization rising to substantial levels and attracting attention from asset managers eager to provide related exposure. The sector’s size and ongoing integration into traditional markets have sparked interest from investment products and ETF sponsors seeking to design indices and vehicles that capture the value chain around stablecoins, payments rails, and tokenized real-world assets. The market continues to evolve as an array of financiers and issuers explore how best to combine custody, settlement, and liquidity across these assets.

Beyond StableX’s direct momentum, the broader ETF and tokenization landscape adds another layer to the narrative. In September, Bitwise filed with the U.S. Securities and Exchange Commission to launch a Stablecoin & Tokenization ETF designed to track companies and digital assets tied to stablecoins, tokenization, and related infrastructure. The proposed ETF would follow an index comprising firms involved in stablecoin issuance, infrastructure, payments, and exchanges, alongside widely traded crypto assets such as Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH). This proposed vehicle sits alongside MarketVector Indexes’ benchmarks for stablecoin and tokenization infrastructure and Amplify ETFs’ own issuer products, including the Amplify Tokenization Technology ETF (TKNQ) and the Amplify Stablecoin Technology ETF (STBQ).

Market attention to stablecoins and their infrastructure has intensified as the sector’s scale expands. DefiLlama data show stablecoins collectively approaching a multi-hundred-billion-dollar market cap, underscoring why institutional players are increasingly considering products and services that enable secure custody, efficient liquidity, and reliable settlement for these tokens. The sector’s growth is mirrored in the real-world ecosystem, where large financial players and payment networks are actively exploring how to incorporate stablecoins into settlement rails, cross-border payments, and treasury management. PayPal’s PYUSD and Western Union’s USDPT are among the high-profile examples cited by market observers as signals that traditional finance is integrating digital-dollar tokens into everyday workflows. PYUSD has already seen broad usage in payments and settlement, while USDPT is anticipated to be rolled out in a Solana-based settlement network within the first half of 2026, signaling a broader push toward on-chain settlement capabilities.

In this environment, the BitGo-StableX partnership stands as a practical case study of how custody and liquidity infrastructure can underpin a growing stablecoin treasury. It illustrates how a Nasdaq-listed issuer can pursue a diversified crypto asset strategy with institutional-grade safeguards and execution capabilities, a model that could become more common as more publicly traded firms pursue dynamic crypto-treasury programmes. The emphasis on tokens beyond BTC highlights an expanding universe of crypto assets that institutions want to hold within regulated, custodial frameworks, signaling a maturing market for digital-asset treasury management and a deeper integration of crypto into mainstream corporate finance.

Why it matters

The collaboration between BitGo and StableX marks a tangible step toward legitimizing and scaling digital-asset treasuries for publicly traded entities. By combining custody with an OTC liquidity desk, the partnership aims to reduce operational risk and improve execution efficiency for treasury diversification into stablecoin infrastructure tokens and related assets. This development could accelerate demand for regulated, institutional-grade custody partners as more corporations explore crypto treasury strategies beyond Bitcoin exposure.

From a market structure standpoint, the move supports a broader trend: the emergence of investment vehicles and allocation strategies that reflect an evolving crypto economy. With ETF sponsors pursuing indices that track stablecoin issuers, infrastructure providers, and tokenization plays, the ecosystem is aligning more closely with traditional asset-management practices. The market’s attention to stablecoin infrastructure—backed by data on sector size and new tokenization benchmarks—suggests a growing appetite for vehicles that offer diversified exposure to the stablecoin ecosystem while maintaining compliance and risk controls demanded by institutional buyers.

For builders and investors, the partnership underscores the need for robust, audited custody and settlement layers as digital assets move from speculative instruments to treasury instruments and settlement primitives. The emphasis on tokens such as FLUID and LINK within StableX’s treasury demonstrates a willingness to explore specialized tokens that may offer liquidity and governance utilities in a diversified portfolio. As the market continues to grow, the compatibility of custodial services with trading desks and OTC liquidity will become a key differentiator for infrastructure providers seeking scale in a regulated environment.

What to watch next

- Whether BitGo and StableX close on further terms of the custody and trading arrangement, and the pace at which StableX deploys additional capital into its digital asset treasury.

- Any regulatory or SEC developments related to Bitwise’s Stablecoin & Tokenization ETF filing and related index design, including inclusion criteria for stablecoin issuers and infrastructure firms.

- Updates on the token purchases within StableX’s treasury, including additional positions in FLUID, LINK, or other stablecoin ecosystem assets.

- Progress on the broader ETF/benchmark landscape, including MarketVector’s benchmarks and Amplify ETFs’ TKNQ and STBQ performance and capital inflows.

Sources & verification

- BitGo and StableX strategic partnership press release detailing custody and OTC trading arrangements.

- StableX’s token purchases and treasury-building efforts disclosed in prior communications (including October token acquisitions).

- Bitwise Stablecoin & Tokenization ETF filing with the U.S. SEC and related index construction discussion.

- Amplify ETFs’ product lineup (TKNQ, STBQ) and MarketVector’s stablecoin/tokenization benchmarks.

- Market data on the size of the stablecoin market from DefiLlama and publicly cited examples such as PYUSD (PayPal) and USDPT (Western Union) in relation to stablecoin adoption.

BitGo expands custodial and trading role as StableX scales its digital asset treasury

BitGo’s institutional-grade custody and OTC liquidity capabilities position it as a critical enabler for the Series of moves in the stablecoin infrastructure space. The company’s public market presence, combined with its expanding product suite for institutional clients, provides a foundation for integrating custody with scalable execution as StableX builds its digital asset treasury. The narrative around this partnership is more than a single deal; it reflects a broader alignment between regulated custodians, publicly traded treasury strategies, and the infrastructure required to support a diversified portfolio of stablecoin assets and related tokens. While the market continues to weigh the implications of this agreement, the underlying trend remains clear: mainstream financial actors are embracing crypto-native treasury practices through credible, regulated channels.

For readers and market participants, the development signals ongoing maturation in the space. Treasuries that combine secure custody with efficient liquidity provision may become more common as more firms pursue crypto wealth management strategies that encompass a spectrum of assets—from stablecoins and tokenized assets to specialized protocol tokens. The next steps will hinge on how swiftly institutions can integrate these capabilities with risk controls, regulatory compliance, and governance considerations as they expand the scope of their digital-asset treasury programs.

Crypto World

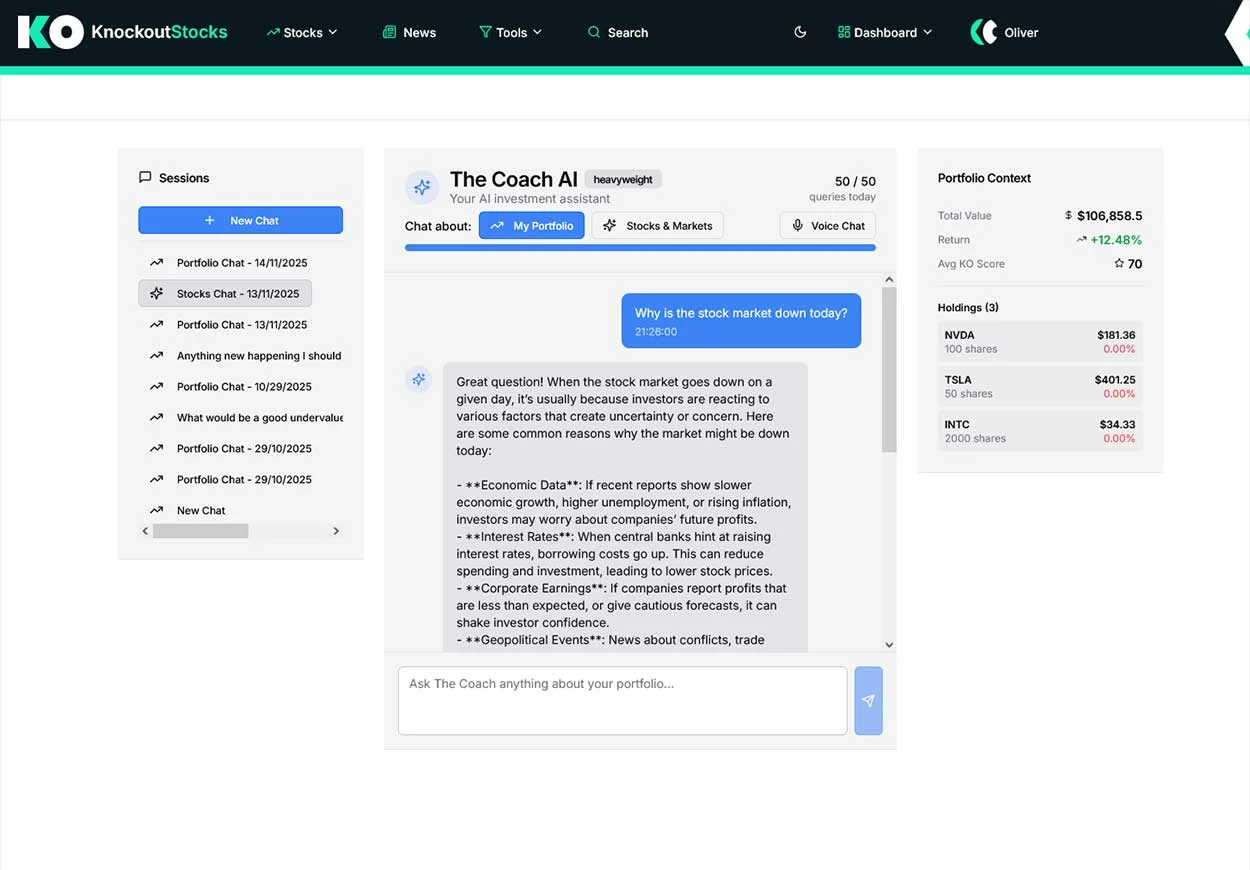

KnockoutStocks vs GuruFocus: Best Stock Research Platform for Value Investors (2026)

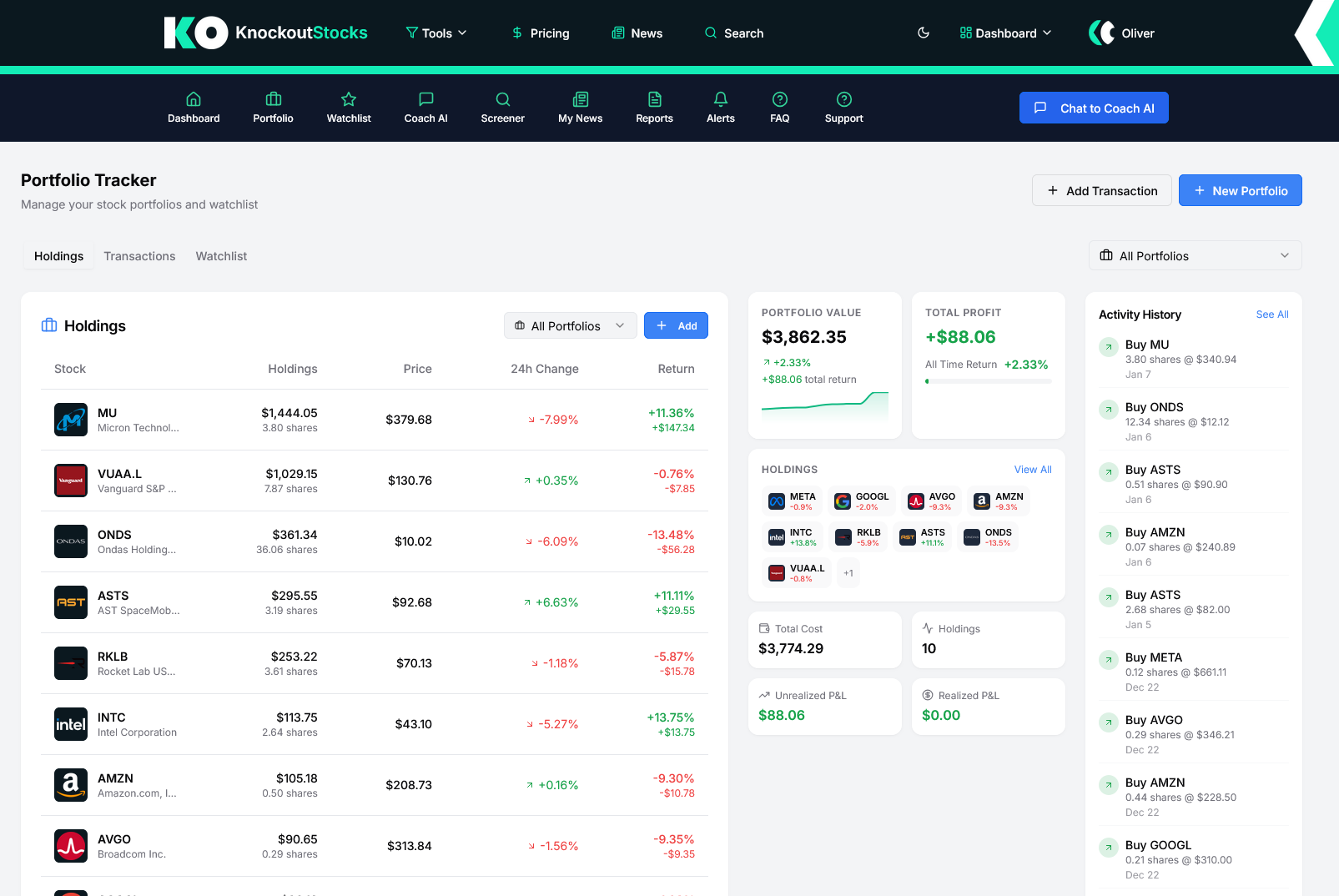

For years, GuruFocus has cultivated a loyal community of value investors through its signature feature: monitoring the investment portfolios of market legends such as Warren Buffett, Charlie Munger, and other prominent fund managers. The platform marries guru portfolio surveillance with comprehensive fundamental analysis capabilities tailored specifically for adherents of value investing principles.

KnockoutStocks pursues a more expansive strategy. It merges AI-driven research capabilities, a unique stock evaluation system, hand-picked stock recommendations, and portfolio management tools into a unified platform designed for contemporary investors. While both platforms deliver serious research capabilities, they cater to distinctly different investment approaches and user priorities.

Platform Overview

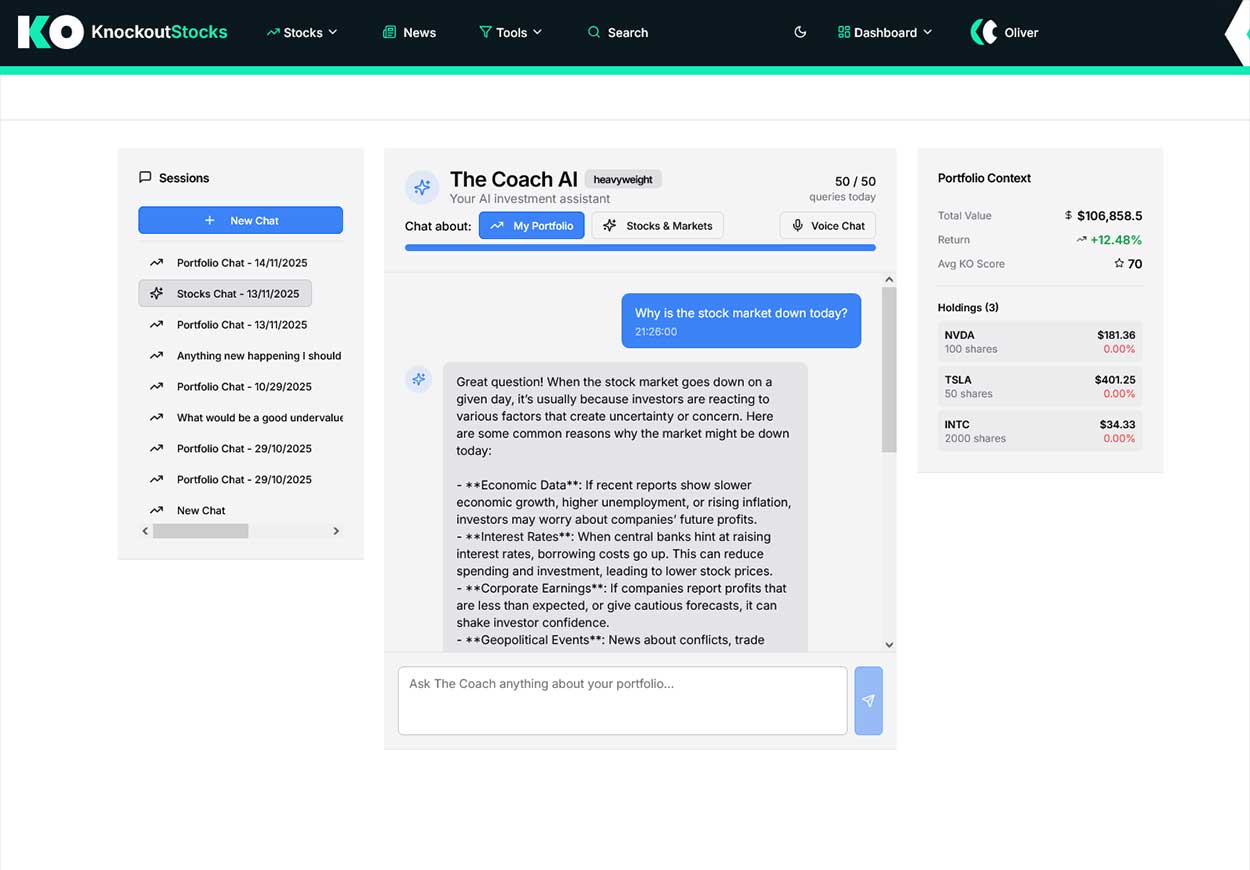

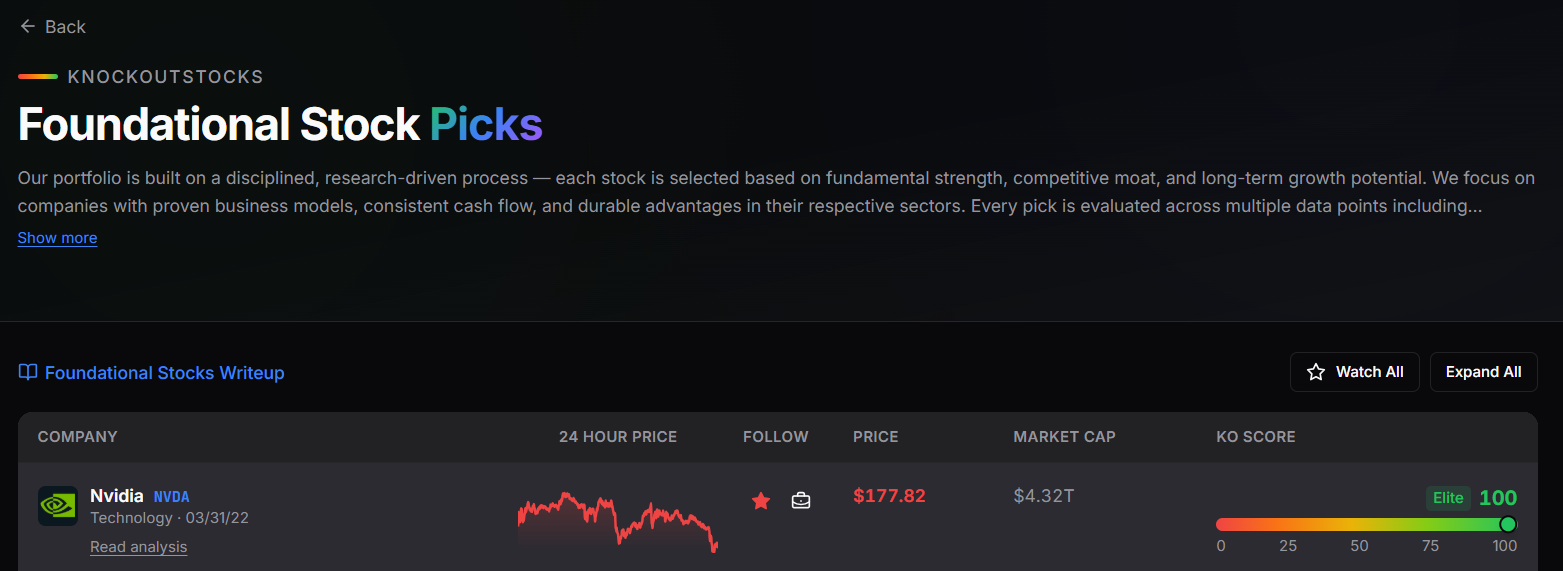

What Is KnockoutStocks?

KnockoutStocks represents an AI-enhanced stock research solution centered on the KO Score — a proprietary evaluation metric that assigns stocks a rating between 0 and 100. This system assesses every company using five fundamental pillars: profitability, financial stability, growth trajectory, market momentum, and analyst sentiment.

The platform features an AI-powered investment advisor, on-demand AI-generated stock analysis reports, a sophisticated stock screening tool, expertly curated investment recommendations, portfolio management functionality, and customized market intelligence. It aims to deliver investors rapid, transparent, evidence-based insights without requiring multiple tools or service subscriptions.

What Is GuruFocus?

GuruFocus is an investment research platform established in 2004. Its foundation rests on monitoring the buying and selling activities of the world’s most successful investors, combining that intelligence with thorough fundamental analysis to identify quality companies at reasonable valuations.

The platform enjoys popularity among value investors who embrace the philosophies of Warren Buffett, Benjamin Graham, and similar investing icons. It delivers guru portfolio monitoring, discounted cash flow analysis tools, financial stability ratings, and an extensive array of fundamental data resources.

Feature Comparison

Stock Research and Scoring

GuruFocus evaluates stocks through its GF Score — a ranking framework that assesses financial robustness, profitability metrics, growth potential, valuation levels, and momentum indicators. The platform also provides a GF Value projection — its proprietary fair value calculation derived from historical valuation ratios, growth forecasts, and business predictability. For value-oriented investors seeking to identify stocks trading beneath intrinsic value, these resources prove genuinely beneficial.

KnockoutStocks employs the KO Score — a unified metric ranging from 0 to 100 that synthesizes five weighted components: profitability, financial stability, growth prospects, market momentum, and analyst consensus. The KO Score emphasizes comprehensive stock quality and market positioning rather than valuation exclusively, creating a more agile and adaptable evaluation tool suitable for diverse investing philosophies — extending beyond traditional value investing.

AI Tools and Insights

KnockoutStocks integrates AI as a foundational element. The platform’s AI advisor enables users to pose questions regarding specific stocks, portfolio holdings, or market dynamics whenever needed. Premium subscription levels provide voice-enabled AI interaction and unrestricted daily query allowances.

GuruFocus lacks a dedicated AI investment advisor. While the platform has started incorporating certain AI-enhanced capabilities for condensing financial information and producing company summaries, AI functionality remains peripheral rather than central to the GuruFocus user experience. Investors seeking immediate AI-powered research assistance and coaching will discover KnockoutStocks substantially more advanced in this domain.

AI-Generated Stock Reports

KnockoutStocks produces immediate AI-powered stock analysis reports for any publicly traded company upon request. Each document encompasses company background, financial condition, critical metrics, market behavior, recent developments, and analyst perspectives — compiled within seconds.

GuruFocus creates thorough stock analysis displays featuring extensive fundamental statistics, financial chronology, and valuation measurements. While the information depth proves impressive, it appears as unprocessed data rather than a polished AI-assembled research document. Investors must interpret the data independently to form conclusions.

Stock Picks

KnockoutStocks delivers a carefully selected, high-conviction stock portfolio personally chosen by its research professionals. Every selection earns inclusion through meticulous research, sector examination, and practical investment rationale grounded in fundamental strength, sustainable competitive advantages, and long-term growth capacity.

The portfolio undergoes continuous monitoring, with position adjustments occurring only when analytical evidence warrants change. Complete access to the Stock Picks section — including current holdings, performance metrics, and comprehensive justification for each position — becomes available to Middleweight and Heavyweight subscribers.

GuruFocus does not provide its own curated investment portfolio. Instead, it furnishes tools for tracking the buying and selling activities of guru investors. While this context proves valuable, it differs fundamentally from an independent, high-conviction portfolio constructed through original research with documented logic supporting every selection.

Guru Portfolio Tracking

This represents GuruFocus’s distinctive and substantial competitive edge. The platform monitors 13F regulatory filings from hundreds of elite fund managers and legendary investors, revealing precisely what they’re purchasing, divesting, and maintaining. For investors who follow Warren Buffett, Bill Ackman, or other prominent figures, accessing near-real-time portfolio activity proves genuinely valuable.

KnockoutStocks presently does not include guru or institutional portfolio surveillance. Its emphasis centers on independent stock investigation and AI-enhanced analysis rather than monitoring other investors’ activities. For value investors utilizing guru behavior as a primary research indicator, GuruFocus maintains a definitive advantage in this particular capability.

Valuation and DCF Tools

GuruFocus offers among the most exhaustive valuation instruments available to individual investors. Its discounted cash flow calculator enables users to construct intrinsic value projections using customizable assumptions. The platform also monitors price-to-GF-Value ratios, Peter Lynch charts, and numerous historical valuation multiples spanning years.

KnockoutStocks integrates valuation indicators within its KO Score through profitability and growth components but doesn’t provide independent DCF calculators or detailed historical valuation modeling capabilities. For investors whose methodology centers on computing precise intrinsic value estimates, GuruFocus extends further in this territory.

Financial Strength and Quality Metrics

GuruFocus monitors an extensive range of financial quality indicators including the Altman Z-Score, Piotroski F-Score, and Beneish M-Score. These represent established quantitative frameworks employed by sophisticated value investors to evaluate financial robustness, earnings integrity, and potential risks of financial distress or accounting manipulation.

KnockoutStocks addresses financial stability as one of five KO Score pillars, incorporating leverage ratios, balance sheet resilience, and financial soundness. While it doesn’t delve as deeply into individual quantitative models like the Piotroski or Altman scores, the KO Score delivers a quicker holistic assessment of financial quality without requiring interpretation of multiple discrete metrics.

Stock Screener

KnockoutStocks includes a sophisticated screening tool with over 20 filtering criteria spanning KO Score, market capitalization, price levels, trading volume, fundamental measurements, and technical signals. Complete screener functionality is accessible on the complimentary plan.

GuruFocus features a robust screening system with hundreds of fundamental filters encompassing GF Score, GF Value, financial strength measurements, valuation ratios, and guru ownership information. For value investors wanting to screen using particular quantitative standards, GuruFocus provides greater fundamental filtering depth. However, most advanced screening capabilities require premium membership.

Portfolio Tracking

KnockoutStocks provides comprehensive portfolio monitoring with real-time performance statistics, profit and loss documentation, and AI-enhanced portfolio evaluation. The Heavyweight subscription supports up to 100 securities per portfolio with unlimited portfolio creation and AI-generated portfolio assessments.

GuruFocus includes a portfolio monitor that overlays its GF Score, GF Value, and financial strength metrics onto user holdings. While useful for tracking fundamental quality and valuation of portfolio positions, it doesn’t deliver real-time profit and loss monitoring or AI-powered portfolio analysis matching KnockoutStocks’ sophistication.

Alerts and Updates

KnockoutStocks transmits customized daily or weekly email notifications covering watchlist activity, leading KO Score changes, earnings releases, analyst rating upgrades, and breaking news aligned with your portfolio.

GuruFocus dispatches alerts for guru transaction activity, GF Score modifications, valuation updates, and dividend announcements. For value investors monitoring guru behavior and valuation signals, these notifications are appropriately focused and authentically helpful.

Pricing

KnockoutStocks provides three subscription levels. The complimentary tier includes complete screener access, one portfolio, five watchlist securities, one AI conversation weekly, and one AI stock report weekly. The Middleweight subscription costs $19.99 monthly with 10 AI queries daily and 10 AI reports weekly. The Heavyweight subscription runs $59.99 monthly with unlimited AI access, voice-enabled coaching, PDF report generation, and CSV data exports.

GuruFocus pricing begins around $49 monthly for the Premium subscription and extends to approximately $109 monthly for the Premium Plus tier with complete feature access including unlimited DCF models and advanced screening capabilities. It ranks among the more costly retail research platforms available, reflecting its comprehensive data offering.

Pros and Cons

KnockoutStocks

Pros

- KO Score provides rapid, comprehensive quality rankings across thousands of securities

- Integrated AI advisor for on-demand stock and portfolio inquiries

- Immediate AI-generated stock reports available for any company anytime

- Expertly curated high-conviction stock portfolio with complete research documentation

- Complete screener access included in free membership

- Robust portfolio tracking with real-time information and AI interpretation

- Voice-enabled AI coach available on premium subscription

- Considerably more affordable across all membership tiers

- Customized news and alerts matching your investment holdings

Cons

- Absence of guru or institutional portfolio surveillance

- No DCF calculator or comprehensive intrinsic value modeling capabilities

- Doesn’t monitor Piotroski, Altman, or Beneish scores separately

- Emerging platform still establishing its long-term performance history

- Less concentrated on pure value investing doctrine

GuruFocus

Pros

- Industry-leading guru and institutional portfolio surveillance

- Comprehensive valuation capabilities including DCF calculators and GF Value projections

- Monitors Piotroski F-Score, Altman Z-Score, and Beneish M-Score

- Exhaustive financial history extending back numerous years

- Powerful screening system with hundreds of fundamental criteria

- Optimal platform for committed value investors

- Well-established with extensive data coverage track record

Cons

- Lacks dedicated AI investment advisor

- No on-demand AI-generated stock analysis reports

- No expertly curated high-conviction stock portfolio

- Premium pricing compared to most retail research solutions

- Platform interface can feel overwhelming due to information density

- Concentrated focus on value investing restricts broader appeal

- Portfolio tracking lacks AI-driven interpretation and real-time performance monitoring

Which Platform Is Best for Different Investors?

Use KnockoutStocks if you:

Desire a comprehensive AI-enhanced research environment encompassing stock evaluation, instant analysis reports, portfolio management, and curated stock recommendations unified in one location. KnockoutStocks functions as your complete research ecosystem regardless of investment methodology.

Value AI-powered capabilities on demand — posing questions about securities, obtaining instant reports, and analyzing your portfolio without dedicating hours to processing raw financial information.

Seek access to a meticulously researched, high-conviction stock portfolio constructed on genuine fundamentals and long-term perspective. Middleweight and Heavyweight members receive complete access including performance monitoring and comprehensive reasoning behind each selection.

Identify as a growth, momentum, or hybrid investor desiring a platform evaluating securities across multiple dimensions beyond simple valuation. The KO Score captures the complete picture.

Want a more economical research solution without compromising analytical sophistication. KnockoutStocks furnishes serious research instruments at a fraction of GuruFocus’s cost.

Use GuruFocus if you:

Identify as a dedicated value investor following Warren Buffett, Benjamin Graham, or similar legendary investors and desire to monitor their portfolio transactions in near-real-time. GuruFocus specializes specifically in this capability and executes it better than any competitor.

Depend heavily on intrinsic value calculations and want the most thorough DCF modeling and valuation instruments available to individual investors. GuruFocus penetrates deeper here than virtually any alternative platform.

Need to screen securities using specific quantitative value measurements like Piotroski F-Score, Altman Z-Score, or Beneish M-Score as components of your research methodology.

Identify as a serious long-term value investor comfortable navigating substantial volumes of financial data and wanting the most comprehensive fundamental research toolkit available.

Final Verdict

GuruFocus and KnockoutStocks both represent serious research platforms, but they’re constructed around fundamentally different investment philosophies and user requirements.

GuruFocus excels in guru portfolio surveillance, comprehensive valuation modeling, and quantitative value investing instruments. If you’re a dedicated value investor studying what legendary investors are purchasing and want the most exhaustive fundamental analysis toolkit available, GuruFocus stands as the superior specialist resource for that particular methodology.

KnockoutStocks dominates in AI functionality, accessibility, curated stock recommendations, portfolio management, and overall cost efficiency. The KO Score evaluates securities more rapidly and comprehensively than the GF Score, the AI advisor delivers immediate insights that GuruFocus cannot replicate, and the curated stock selections provide a high-conviction foundation supported by authentic research. All these advantages come at substantially lower pricing.

For value investors in 2026 seeking deep guru tracking and intrinsic value tools, GuruFocus remains a specialist option worth evaluating. But for investors wanting a more intelligent, faster, AI-powered research platform covering the complete spectrum without a steep learning curve or expensive price point — KnockoutStocks emerges as the superior platform overall.

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos1 day ago

News Videos1 day ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

Crypto World1 day ago

Crypto World1 day agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

Business6 hours ago

Business6 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Business7 days ago

Business7 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat22 hours ago

NewsBeat22 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech1 day ago

Tech1 day agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business1 day ago

Business1 day agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs