Crypto World

Bitcoin price prediction as Arkham data reveals who controls BTC supply

Bitcoin price is stabilizing after a sharp correction, but on-chain data suggests the real story may lie beneath the surface.

Summary

- Bitcoin consolidates near $68,000 after falling from the mid-$90,000s to $60,000, with the 50-day SMA around $83,000 acting as key resistance.

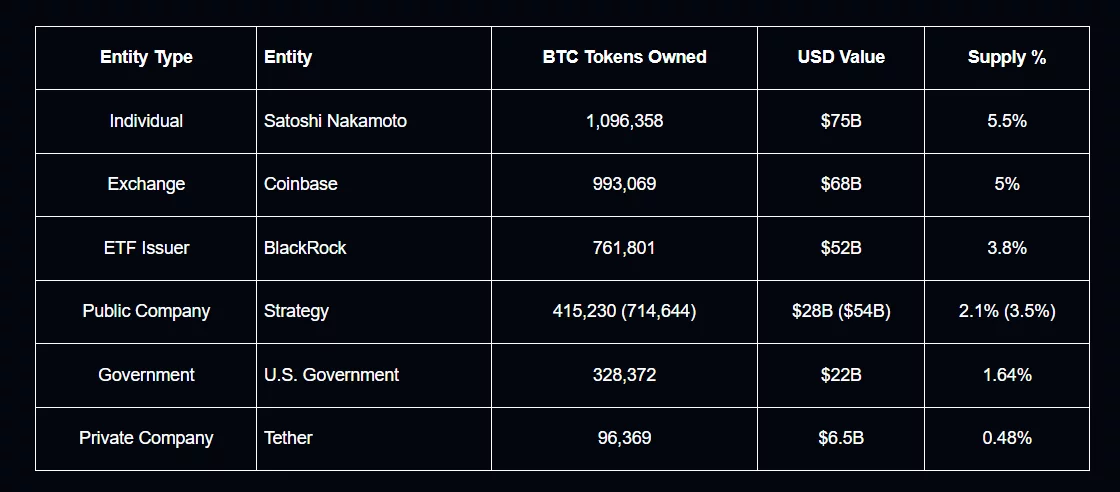

- Arkham data shows heavy supply concentration, with Satoshi, major exchanges, BlackRock’s ETF, Strategy, and the U.S. government controlling a significant share of total BTC.

- Whale inactivity and potential exchange outflows could tighten supply, meaning renewed institutional demand may trigger a sharper upside move.

As Bitcoin (BTC) consolidates near the $68,000 level, Arkham Intelligence’s latest ownership data reveals who controls a large share of supply and that concentration could shape the next breakout or breakdown.

Bitcoin price recently fell from the mid-$90,000 region earlier this year to a local low near $60,000 before rebounding. At press time, price action shows consolidation below the 50-day simple moving average, which sits around $83,000. That level now acts as dynamic resistance.

Until bulls reclaim it, upside momentum remains capped.

The daily chart shows heavy selling through late January and early February. A sharp capitulation candle drove price toward $60,000, followed by a reflex bounce.

However, the Chaikin Money Flow indicator remains slightly negative at around -0.03. This suggests capital inflows are still weak. Momentum has improved, but conviction is not yet strong.

While short-term momentum remains fragile, ownership structure tells a longer-term story.

Bitcoin whale concentration and supply control

Arkham’s 2026 data shows Bitcoin ownership remains highly concentrated. Satoshi Nakamoto’s wallets still hold roughly 1.096 million BTC, representing over 5% of total supply.

Coinbase controls close to 1 million BTC, while Binance holds more than 600,000 BTC. BlackRock’s spot ETF alone holds over 760,000 BTC. Strategy, formerly MicroStrategy, controls more than 400,000 BTC. The U.S. government also holds over 300,000 BTC.

This concentration matters. Large holders reduce effective circulating supply when coins remain dormant. Satoshi’s coins have never moved. Corporate and ETF holdings also tend to be long-term allocations rather than short-term trading inventory. That structurally tightens supply during periods of demand expansion.

However, exchange balances are a different story. When large exchanges hold significant BTC reserves, liquidity remains accessible. If exchange-held Bitcoin begins declining while ETFs continue accumulating, the float could tighten quickly. In that scenario, even modest demand could trigger an outsized upside move.

What it means for Bitcoin price’s next move

Technically, Bitcoin must reclaim the 50-day SMA near $83,000 to confirm a bullish reversal. A break above that level could open a move back toward $90,000. Failure to hold $65,000 may expose $60,000 again.

Structurally, whale dominance suggests long-term supply remains constrained. If institutional demand returns while major holders stay inactive, price pressure could build quickly.

The next decisive move will likely depend on whether capital inflows return and whether the biggest holders continue to sit tight.

Crypto World

Peter Thiel’s Founders Fund Exits ETHZilla as Ether Treasuries Strain

Billionaire tech investor Peter Thiel’s Founders Fund has fully exited Ether treasury company ETHZilla, according to a Tuesday filing with the United States Securities and Exchange Commission (SEC).

Entities linked to Thiel now report owning zero shares in the company in a 13G amendment filed on Tuesday, after disclosing a 7.5% stake on Aug. 4, 2025.

At that time, the group beneficially owned 11,592,241 shares of what was then known as 180 Life Sciences Corp., representing 7.5% of the 154,032,084 shares outstanding and worth about $40 million based on trading at around $3.50 per share in early August.

180 Life Sciences rebrands to ETHZilla

180 Life Sciences raised $425 million in July 2025 to launch an Ether treasury strategy and rebrand as ETHZilla.

The company later moved to raise another $350 million via convertible bonds in September to expand its Ether (ETH) holdings and deploy them across decentralized finance (DeFi) and tokenized assets, at one point holding more than 100,000 Ether.

Related: Bitmine’s staked Ether holdings point to $164M in annual staking revenue

ETHZilla began unloading tokens as markets turned, liquidating 24,291 Ether for $74.5 million in December 2025 at an average price of $3,068.69 per token, to repay debt, leaving about 69,800 ETH on its balance sheet.

Strain on Ether treasury company models

Thiel’s exit is the latest stress signal for public companies with crypto treasuries built around Ether rather than Bitcoin (BTC).

Other large Ether accumulators are taking different approaches. BitMine Immersion Technologies, the largest listed Ethereum holder, acquired a further 40,613 ETH on Feb. 9, lifting its total holdings to more than 4.325 million ETH, worth about $8.8 billion at current prices.

Trend Research, on the other hand, began unwinding its entire Ethereum position this month, selling 651,757 ETH for about $1.34 billion on Feb. 8, locking in an estimated $747 million realized loss.

ETHZilla has since tried to diversify by launching ETHZilla Aerospace, a subsidiary offering tokenized exposure to leased jet engines. However, Thiel’s exit magnifies how volatile Ether‑heavy treasury strategies have become in a market still digesting last year’s peak.

Magazine: Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Unknown Trader Up $7M While Others Lose Millions

A relatively unknown crypto trader gained $7 million from shorting ETH while major investors suffered huge losses.

An anonymous trader known only as 0x58bro has accumulated $7 million in unrealized profits by shorting Ethereum (ETH) and a handful of other cryptocurrencies, according to data from on-chain intelligence platform Arkham.

What’s noteworthy about their success is that it has come at a time when several high-profile crypto personalities have suffered eight-figure losses betting on price increases.

The Quiet Whale Swimming Against the Current

Despite holding a portfolio valued at just under $13 million, 0x58bro maintains a minimal social media presence with just 1,300 followers on X. Arkham’s analysis shows the trader has generated the bulk of his profits from two positions: a $3.7 million gain shorting ETH and $1.45 million from shorting ENA, the governance token of Ethena Labs.

The trader’s wallet composition also revealed a strategic approach to the current market volatility. They hold over $7.5 million in Aave’s interest-bearing ETH token (aETHWETH) and $5 million in Aave’s USDC deposit token (aETHUSDC), suggesting they have positioned capital to earn yield while maintaining the flexibility to deploy it against further downside.

A smaller position of 10 million HANA tokens, currently worth close to $353,000, represents their only significant long exposure.

The timing of these short positions has proven critical, with Ethereum struggling to maintain momentum in recent weeks and prices hovering around the $2,000 psychological support level.

Market Backdrop Shows Leverage Risks and Speculation Cycles

While 0x58bro is profiting from market declines, other traders have faced catastrophic losses attempting to catch a falling knife. On-chain data shows that Machi Big Brother, a well-known crypto personality once worth nearly nine figures, has seen his Hyperliquid account value fall below $1 million. To meet margin calls on his long positions, he was forced to tap into PleasrDAO treasury funds deposited five years ago, with his total losses now standing at $28 million.

You may also like:

The contrast extends to institutional players as well. For instance, Trend Research, the trading firm led by Liquid Capital founder Jack Yi, fully exited its Ethereum positions last week after accumulating about $1.34 billion in ETH at an average entry of $3,180. The exit locked in losses of approximately $869 million, according to Arkham data, coming just days after Yi publicly predicted ETH would reach $10,000.

While Trend Research was forced to unwind what was once Asia’s largest ETH long position, on-chain data from CryptoQuant shows that wallets with no history of outflows holding at least 100 ETH, known as “accumulation addresses,” are still buying through the downturn. These addresses now hold around 23% of Ethereum’s circulating supply and have maintained their accumulation even when prices were trading below their average cost basis.

Whether 0x58bro will maintain his short positions or join the accumulating addresses betting on a rebound remains unknown. But for now, the trader with 1,300 followers has outperformed an industry of influencers with millions watching their every move.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Thai SEC clears BTC, crypto, carbon credits for derivatives

Thai SEC adds BTC and other digital assets plus carbon credits as eligible underlying assets for regulated derivatives, with TFEX to design crypto-linked contracts to attract institutional traders and support ETF-like products.

Summary

- Thai SEC now recognizes BTC and other crypto as underlying assets for futures and options on regulated exchanges.

- Licensed digital asset operators will be allowed to offer derivatives contracts referencing cryptocurrencies under updated licenses.

- TFEX and clearinghouses will revise frameworks and contract specs to support crypto-based derivatives and broader digital finance goals.

Thailand’s Securities and Exchange Commission has expanded the country’s regulated derivatives framework to include digital assets and carbon credits as eligible underlying instruments, according to an announcement from the regulator.

The move, built on an earlier one from Feb. 12, formally recognizes cryptocurrencies, including bitcoin, as investment assets for futures, options, and other derivatives on exchanges such as the Thailand Futures Exchange, the SEC stated. The change follows Cabinet approval to align the derivatives market with international standards while ensuring supervision, risk mitigation, and investor protection.

SEC Secretary-General Pornanong Budsaratragoon said the expansion will promote market growth, diversify products, and improve risk management while broadening investment opportunities, according to the announcement.

The SEC plans to draft supporting regulations, including updates to derivatives business licenses to permit licensed digital asset operators to offer contracts referencing cryptocurrencies, the regulator stated. Exchange and clearinghouse frameworks will also be reviewed to accommodate crypto-based products, while TFEX will finalize contract specifications to ensure practical usage and effective risk oversight.

Thailand has positioned the development as part of a broader effort to establish the country as a regional hub for digital finance, according to the SEC. The regulator previously announced plans to introduce comprehensive rules covering digital asset products, including crypto ETFs, signaling a growing openness to integrating traditional finance and blockchain-based assets.

Market participants indicated the move could attract more international traders and institutional investors seeking regulated crypto derivatives, creating a bridge between local markets and global digital asset liquidity, according to industry observers.

Crypto World

Saudi Arabia Leads the AI Revolution with Global AI Show 2026

Editor’s note: The Global AI Show in Riyadh signals how rapidly AI is moving from labs into everyday business, healthcare, and public life. This editorial looks at why the GAIS Riyadh edition matters for innovators, policymakers, and investors alike, and how responsible AI practices can help societies reap the benefits while mitigating risks. As the AI ecosystem expands across regions, high-profile events shape standards, collaboration, and opportunity. Crypto Breaking News aims to illuminate what this gathering could mean for global AI adoption and the maturation of AI-enabled industries.

Key points

- GAIS 2026 in Riyadh focuses on AI across sectors including business, healthcare, and user-centric applications.

- Ethics, regulation, and responsible AI deployment are central themes with dialogue on data privacy and algorithmic fairness.

- Attendees will engage with AI tools and real-world business applications.

- A distinguished lineup of global leaders and innovators, including Nate Glubish, Shafi Ahmed, John Nosta, Janet Adams, and Jeanie Fang.

Why this matters

GAIS Riyadh positions Saudi Arabia as a hub for AI-driven growth and international collaboration. The event’s blend of strategy discussions, hands-on demonstrations, and policy-focused sessions underscores how responsible, human-centered AI can accelerate innovation while safeguarding privacy and fairness. By convening leaders from tech, governance, and healthcare, GAIS Riyadh could influence global norms, spur partnerships, and accelerate practical AI deployments that benefit businesses and citizens alike.

What to watch next

- Keynote and panel topics on AI applications in healthcare, drug discovery, and personalized medicine.

- Discussions on AGI implementations and AI-driven healthcare advancements.

- The evolving Saudi AI strategy toward 2030 and its global implications.

- The emphasis on networking zones fostering partnerships and investments.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Saudi Arabia Leads the AI Revolution with Global AI Show 2026

The Global AI Show 2026 in Riyadh brings an engaging experience for anyone interested in the future of artificial intelligence. Organized by VAP Group and Powered by the Times of AI, the Global AI Show (GAIS) is planned with a vision to explore AI’s potential across multiple sectors, from business solutions to user-centric applications. GAIS brings to fore the transformation of different human spheres led by AI.

Attendees will be a part of deep discussions on AI strategy, machine learning, natural language processing, and predictive analytics. Participants will also engage directly with AI tools and platforms, which will help them with applications in real-world business issues.

Ethics and regulation are central themes, and hence, there will be sessions dedicated to responsible AI deployment, algorithmic fairness, and data privacy. As AI adoption accelerates globally, understanding these frameworks is necessary for businesses and policymakers alike. The event will encourage dialogue on how innovation and responsibility can coexist to create long-term AI solutions.

Our past speakers were a remarkable mix of global leaders, visionaries, and innovators across technology, governance, healthcare, and cybersecurity. Honourable Nate Glubish, Minister of Technology and Innovation, Government of Alberta, Canada, has shared his insights alongside Pujya Brahmavihari Swami, Head of BAPS Hindu Mandir UAE. Professor Shafi Ahmed, a renowned surgeon, futurist, humanitarian, and CEO of Medical Realities, and John Nosta, leading innovation theorist in technology, AI, and medicine and Founder of NOSTALAB, have also been part of the lineup. Janet Adams, COO and Board Director at SingularityNET/ASI, and Jeanie Fang, Director of Data & AI at Crunchbase, have brought their expertise in artificial intelligence and data innovation.

Networking is a key focus, with interactive zones designed to facilitate partnerships, investments, and collaborations.

The Global AI Show places a strong emphasis on networking and collaboration, creating a dynamic environment where industry leaders, innovators, and investors can connect and explore new partnership opportunities. The sessions are designed to inspire forward-thinking discussions on the evolving role of artificial intelligence in shaping industries and societies worldwide.

The program includes a series of headliners, keynotes, and panels discussing the future of AI, its real-world applications, and its radical impact across critical industries. The topics address Saudi Arabia’s vision of an AI-led future and its implications globally, the vision for AI by 2030, and the changing partnership between humans and smart machines. These conversations will also delve into actual AGI implementations, the AI-driven revolution toward patient-centered healthcare, breakthroughs in drug discovery, the use of AI in personalized medicine, and predictive technologies transforming healthcare outcomes.

Collectively, these sessions highlight how AI is reshaping possibilities, facilitating cross-industry conversations, and propelling the next generation of technological and societal advancement.

By convening global AI experts, innovators, and stakeholders, the Global AI Show reinforces Riyadh’s reputation as a center for technological advancement. Get inspired, informed, and ready to use AI for meaningful impact, and be a part of GAIS Riyadh edition.

Media enquiries :

Press contact :

Crypto World

Ethereum Staking Address Now Holds Over Half ETH Supply For First Time Ever: Santiment

The demand for Ethereum staking has skyrocketed despite the asset price crashing back to bear market lows.

Ethereum’s proof-of-stake contract address now holds over half of the Ether supply “for the first time in the coin’s eleven-year history,” reported on-chain analytics provider Santiment on Wednesday.

This appears somewhat misleading, as approximately 37 million ETH are currently staked, representing approximately 30% of the total supply of 121.4 million tokens. However, Santiment explained that there is often confusion about how the proof-of-stake address works. It described the address as a “one-way vault that temporarily locks ETH to help secure the network.”

“When someone stakes ETH, it gets sent into this contract and is removed from normal circulation, meaning it cannot be spent or traded while it is staked.”

Different Methods Of Counting Supply

When validators leave and withdraw, the Ether is released back into circulation as newly issued coins on Ethereum’s main network, “rather than being pulled back out of the vault itself,” Santiment explained.

“As a result, the existing supply can often differ based on whether only pre-burned or total post-burned coins are being counted.”

So over time, the “vault” accumulates ETH without it easily flowing back out the same way it went in, making the contract’s share of the current supply appear larger. This results in a calculation of 50.18% based on ETH issued historically before burns. Santiment predicted that this figure will increase, especially during bear markets and poor trading conditions.

“As staking continues to increase in popularity, expect that this address will continue its ascension, particularly when trading slows down during bear cycles.”

🤑 BREAKING: Ethereum’s proof-of-stake contract address now holds over half of Ethereum’s supply for the first time in the coin’s 11-year history.

🔐 There is often confusion about how this proof-of-stake address works. Think of it as a one-way vault that temporarily locks $ETH… pic.twitter.com/agj2YG37nu

— Santiment (@santimentfeed) February 17, 2026

Regardless of what figure is taken, the demand for staking has surged, and the percentage of ETH supply staked is at record highs.

Additionally, the validator entry queue is also around record highs, with around 3.9 million ETH waiting to be staked, and the wait time is 67 days.

You may also like:

Meanwhile, the exit queue has dropped to its lowest ever levels with around 11,500 ETH and less than five hours wait.

Ether Price at Bear Market Lows

Panic selling by retail traders has pushed Ether prices to bear market lows below $2,000. ETH touched this psychological level briefly in late Tuesday trading, but again was beaten back by resistance, falling to $1,970 during the Wednesday morning session in Asia.

“Ethereum isn’t expensive right now, it’s boring,” said analyst Merlijn The Trader before adding, “boring is where positions are built.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

CFTC fires back as states target prediction markets

The US Commodity Futures Trading Commission (CFTC) has moved to defend its authority over prediction markets, filing a friend-of-the-court brief as state-level legal challenges against the sector intensify.

Summary

- The U.S. Commodity Futures Trading Commission filed a friend-of-the-court brief to defend its exclusive jurisdiction over prediction markets amid rising state-level legal challenges.

- Chairman Mike Selig said the agency has regulated prediction markets for over two decades and warned challengers: “We will see you in court.”

- The move comes as the U.S. Securities and Exchange Commission signals some event-based contracts may qualify as securities, while states like Nevada attempt to restrict platforms including Coinbase.

CFTC defends control of US prediction markets

In a video posted on X, CFTC Chairman Mike Selig said American prediction markets have faced “an onslaught of state-led litigation” over the past year. In response, the agency is stepping in to assert what it describes as its exclusive jurisdiction over these derivative products.

“Prediction markets aren’t new,” Selig said. “The CFTC has regulated these markets for over two decades.”

He argued that such markets play a valuable role by allowing Americans to hedge commercial risks, including temperature fluctuations and energy price spikes. He also suggested they function as a check on media narratives and broader information flows.

The legal battle comes as regulators debate whether certain prediction market contracts fall under securities or commodities law. The U.S. Securities and Exchange Commission recently warned that some event-based contracts could be classified as securities, potentially subjecting platforms to its oversight.

Meanwhile, states including Nevada have sought to restrict the operations of crypto-linked prediction platforms, though a Nevada court recently declined to block Coinbase from offering certain prediction market services.

The CFTC’s filing underscores escalating jurisdictional tensions between federal and state authorities, as well as between financial regulators. Selig emphasized that the agency intends to protect the “integrity, resilience, and vibrancy” of US derivatives markets.

“To those who seek to challenge our authority in this space, let me be clear,” he said. “We will see you in court.”

The case could have significant implications for the future of US-based prediction markets and their regulatory framework.

Crypto World

Pi Network (PI) Surges 40% Weekly, Bitcoin (BTC) Fights for $68K: Market Watch

Pi Network’s native token is the top performer on a weekly scale, followed by STABLE and MORPHO.

Bitcoin’s rather underwhelming price movements around $68,000 continue as the asset slipped below that level on a couple of occasions in the past 24 hours.

WLFI has soared the most from the larger-cap alts in the past 24 hours, while significantly more modest gains from ETH have pushed the asset to just over $2,000.

BTC Fragile at $68K

The first trading week of the current month resulted in a massive calamity for bitcoin, as the asset plunged to $60,000 for the first time since October 2024. This crash represented a $30,000 decline in the span of just over a week.

The bulls finally intervened at this point and helped BTC recover $12,000 in just a day. However, it faced immediate selling pressure at $72,000 and spent the following several days trading between that upper boundary and the lower one at $68,000.

It lost the support a week ago, but quickly reclaimed it and rocketed to over $70,000 during the weekend. However, that was another fakeout and returned to under $70,000 a day later. It slipped below $67,000 yesterday after the latest rejection, but now stands above $68,000, which is essentially the same level as this time yesterday.

Its market cap has remained calm at $1.365 trillion on CG, while its dominance over the alts is down to 56.2%.

PI’s Weekly Surge

Ethereum is up by 2% in the past day and now sits above $2,000 once more. XRP has neared $1.50 after a minor increase. BNB, DOGE, BCH, and CC are also slightly in the green, while TRX and HYPE are with minor losses. WLFI has stolen the show in the past 24 hours, surging by over 17% to over $0.115.

On a weekly scale, though, Pi Network’s PI token shines. The asset is up by over 40% within this timeframe, as it dumped to a new all-time low of $0.1312 at the time. It now sits close to $0.19 after another 6% daily increase.

The total crypto market cap has added over $25 billion in a day and is up to $2.430 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Why did World Liberty Financial price rally 20%?

WLFI rallied 20% as traders positioned ahead of the World Liberty Forum and large on-chain withdrawals drew attention.

Summary

- World Liberty Financial price surged 20% and approached the top of its weekly range.

- Trading volume more than doubled while derivatives positioning declined.

- Price must clear the $0.12–$0.14 zone to shift short-term structure bullish.

World Liberty Financial (WLFI) was trading at $0.1178 at the time of writing, up about 20% in the past day. The token is currently close to the peak of its seven-day range, which spans from $0.09947 to $0.1183.

Even with the rally, WLFI is still down 27% over the past 30 days and sits roughly 64% below its September 2025 all-time high of $0.3313. The larger trend has been negative, but short-term momentum has picked up.

Spot trading activity surged. Over the past 24 hours, volume reached $224 million, marking a 118% increase from the previous day. Buyers stepped in aggressively during the move higher.

In contrast, derivatives positioning softened. CoinGlass data shows futures volume slipped 0.49% to $11 million, while open interest fell 4.83% to $1.20 million. When price rises as open interest drops, the move is often driven by spot demand or short covering rather than heavy new leverage.

Forum hype and large withdrawals draw attention

Much of the excitement appears tied to the World Liberty Forum, an invitation-only event that will be hosted at Mar-a-Lago on Feb. 18.

According to reports, the event has reached capacity with around 400 attendees. Executives of prominent financial firms like Coinbase CEO Brian Armstrong, NYSE President Lynn Martin, Nasdaq CEO Adena Friedman, and Goldman Sachs CEO David Solomon are among the high-profile attendees.

The forum will focus on digital assets, regulation, and integration between traditional finance and crypto. The project’s political connections have increased visibility, which has fueled speculation ahead of potential announcements.

On-chain data added to the narrative. On Feb. 18, analytics platform Onchain Lens reported that 313.31 million WLFI, worth about $33.76 million, was withdrawn from Binance within 11 hours.

Exchange outflows of that size are often interpreted as tokens moving into longer-term storage, though the intent behind transfers is not always clear.

The recent announcement of an upcoming World Swap forex and remittance platform has also attracted interest. The product targets cross-border payments, a sector with significant global demand.

World Liberty Financial price technical analysis

On the daily chart, WLFI has been in a short-term downtrend since early February. The price is trading below the 20-day moving average, and lower highs and lows are evident.

The downward slope of the moving average indicates that there has been consistent selling pressure in recent weeks.

The Bollinger Bands widened during the most recent decline. Price touched the lower band near $0.086, then bounced sharply. That reaction pushed the relative strength index from below 30 to around 45–46. Momentum has improved, but RSI has not crossed above 50, so buyers have not fully taken control.

The current zone around $0.117–$0.12 acts as immediate resistance. A daily close above $0.12 would be the first technical improvement. If that level breaks with strength, price could test $0.14–$0.15, where the upper Bollinger Band and prior structure align.

Support sits near $0.10–$0.11, with stronger backing at $0.085–$0.090. A drop below $0.085 would expose the token to a move under $0.08.

Crypto World

Peter Thiel Cuts All Ties With Ethereum Treasury Firm

Billionaire venture capitalist and co-founder of PayPal and Palantir Technologies, Peter Thiel’s Founders Fund, has fully divested from ETHZilla, a digital asset treasury firm that holds Ethereum (ETH).

The development comes as digital asset treasury firms face mounting pressure amid the broader crypto market downturn.

Sponsored

Sponsored

Peter Thiel Cuts Ties With ETHZilla During Crypto Market Slump

The digital asset treasury wave gained momentum last year, with several companies adopting Strategy’s (formerly MicroStrategy) 2020 Bitcoin (BTC) playbook. Firms began accumulating cryptocurrencies as reserve assets, attracting heightened investor attention as prices climbed and equity valuations expanded.

BeInCrypto reported in August 2025 that through entities such as The Founders Fund, Thiel controlled a 7.5% stake in ETHZilla. However, the latest SEC filing shows that entities managed by Thiel reported zero ownership in the company by the end of 2025, indicating a complete exit.

“This matters because Thiel is considered smart institutional capital, and a full exit from an ETH treasury firm could signal shifting sentiment, risk reduction, or a strategic rotation away from Ethereum exposure,” Crypto Town Hall posted.

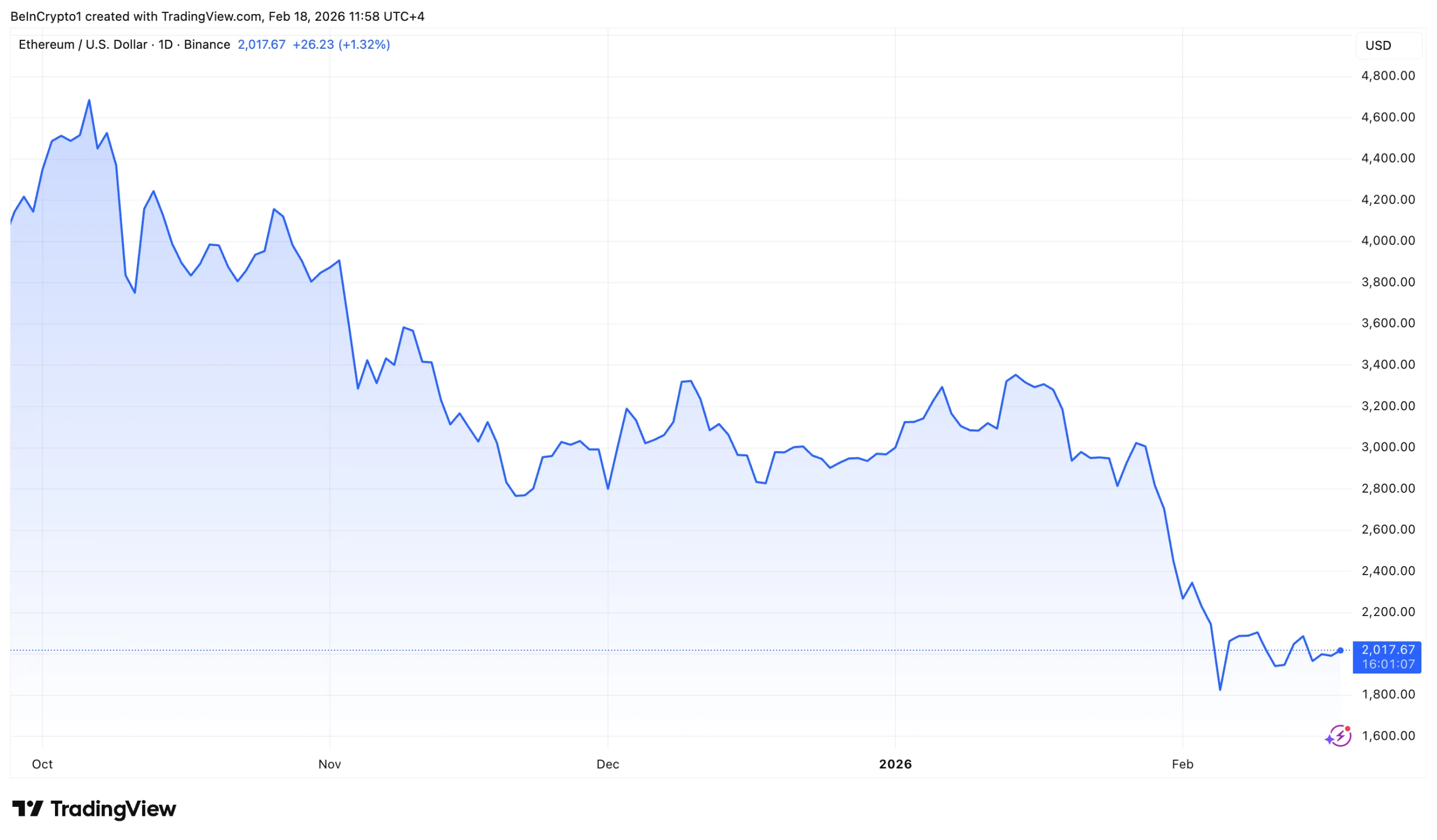

The move comes against the backdrop of a broader market downturn. In October, crypto markets suffered a sharp downturn, often referred to as the “10/10” or “Black Friday” crash. The subsequent months extended the decline.

According to CryptoRank data, Ethereum fell 28.4% in Q4 2025, marking its first negative fourth quarter since 2022. Although 2026 began with a brief recovery, the rebound quickly reversed.

Sponsored

Sponsored

ETH closed January 2026 down 17.7%, and so far in February, its price has declined another 18.1%. At press time, it traded at $2,017.

Treasury Strategy Under Strain as Ethereum Decline Hits Corporate Holders

The sustained price weakness has directly impacted digital asset treasury firms, reducing the value of their crypto holdings and pressuring stock prices. For example, BitMine is currently sitting on unrealized losses exceeding $7 billion. Furthermore, its share price is down 25.7% year-to-date.

ETHZilla, which previously operated as 180 Life Sciences before pivoting toward an Ethereum treasury strategy and rebranding, has faced similar headwinds. At its peak, the company held more than 100,000 ETH.

As market conditions deteriorated in October, the company moved quickly to trim its exposure. Toward the end of that month, ETHZilla offloaded roughly $40 million in Ether, directing the proceeds toward share buybacks.

A second round of sales followed in December, totaling about $74.5 million. The funds were allocated to repay senior secured convertible debt. CoinGecko data shows the company now holds 69,802 ETH, a substantial reduction from its previous peak position.

The company has since outlined yet another strategic shift. According to Bloomberg, ETHZilla’s wholly owned subsidiary, called ETHZilla Aerospace, is seeking to provide tokenized exposure to equity in leased jet engines.

Crypto World

David Bailey’s Nakamoto strikes $107M deal to buy BTC Inc and UTXO

Bitcoin-focused public company Nakamoto Inc., led by chairman and CEO David Bailey, has signed definitive agreements to acquire BTC Inc. and UTXO Management GP, LLC in an all-stock transaction valued at approximately $107.3 million.

Summary

- Nakamoto Inc., led by David Bailey, will acquire BTC Inc. and UTXO Management GP, LLC in a $107.3 million all-stock deal.

- The transaction consolidates Bitcoin media, events, and asset management businesses under one publicly listed entity.

- Nakamoto aims to build a vertically integrated Bitcoin platform spanning publishing, conferences, advisory, and investment strategy.

The deal brings together companies closely tied to Bailey, who co-founded BTC Inc. and later helped launch UTXO Management, under a single publicly listed Bitcoin-focused entity.

Under the terms of the deal, Nakamoto will issue common shares to the sellers at a pre-negotiated price of $1.12 per share. The transaction is expected to close in the first quarter of 2026, subject to customary conditions.

The acquisition brings together media, events, and asset management businesses under a single public holding company. BTC Inc. is best known for publishing Bitcoin Magazine and organizing The Bitcoin Conference, one of the largest Bitcoin-focused gatherings globally. UTXO Management advises Bitcoin-centric investment vehicles and focuses on capital allocation across public and private markets.

Nakamoto said the combination is designed to create a vertically integrated Bitcoin platform with diversified revenue streams.

David Bailey’s expanding Bitcoin platform

The deal further consolidates businesses tied to David Bailey, Nakamoto’s chairman and CEO. Bailey co-founded BTC Inc. in 2013 and later helped launch UTXO Management.

“Bringing BTC Inc and UTXO into Nakamoto has been a part of our vision since day one,” said David Bailey. “We intend to operate a portfolio of companies across media, asset management, and advisory services that can scale with Bitcoin’s long-term growth.

Over the past decade, he has been an active voice in the Bitcoin (BTC) industry and has served on the board of the Bitcoin Policy Institute.

Nakamoto has positioned itself as a Bitcoin-native public vehicle focused on media, advisory services, and treasury strategy. The company’s leadership has signaled interest in further expansion as institutional adoption of Bitcoin grows.

If completed, the transaction would mark a notable consolidation in the Bitcoin sector, combining publishing, large-scale events, and capital management operations within a single listed entity.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business10 hours ago

Business10 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business3 hours ago

Business3 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery