CryptoCurrency

Bitcoin Rises 1.5% as Risk Assets Soar on US CPI News

Bitcoin Approaches $93,000 Amid Optimism Spurred by US Inflation Data

Bitcoin has rallied close to the $93,000 mark, buoyed by recent US inflation data that suggests a cooler-than-expected rise in consumer prices. Markets responded positively to the release, with stock indices climbing and traders reassessing risks. The cryptocurrency’s movement reflects a broader investor confidence fueled by the latest economic indicators and the ongoing positioning of Federal Reserve policies.

Key Takeaways

- Bitcoin nears $93,000 following a 1.5% rise, aided by favorable US inflation figures.

- The S&P 500 hits new record highs despite political tensions involving US President Donald Trump and Federal Reserve Chair Jerome Powell.

- Market analysts warn that Bitcoin’s current trading range may be short-lived, with significant resistance levels ahead.

- Bitcoin’s price action is sensitive to macroeconomic developments, especially related to US monetary policy and inflation trends.

Tickers mentioned: Bitcoin, S&P 500

Sentiment: Bullish

Price impact: Positive. The release of lower-than-expected inflation data emboldened investors, positively impacting both equities and cryptocurrencies.

Trading idea (Not Financial Advice): Hold. The recent upward momentum could face resistance at key levels, warranting caution.

Market context: Stabilizing inflation figures are fueling optimism across markets, potentially signaling a continuation of bullish trends in risk assets.

Market reaction to US inflation data and Federal Reserve outlook

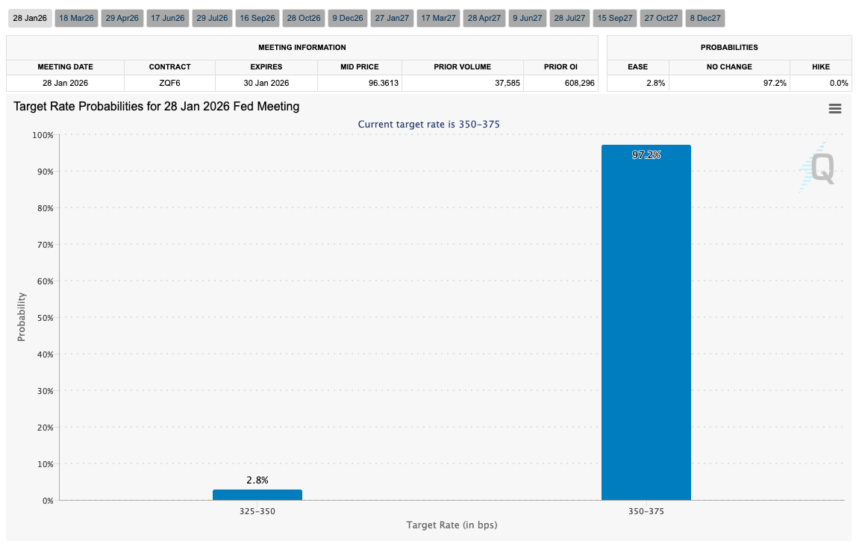

New data from TradingView shows Bitcoin gaining approximately 1.5% as the December Consumer Price Index (CPI) reports a year-over-year increase of 2.7%, matching expert forecasts. Core CPI also came in slightly below expectations at 2.6%, down 0.1% from forecasts, according to the Bureau of Labor Statistics (BLS). This indicates that inflation pressures remain contained, reinforcing expectations of a steady monetary policy stance by the Federal Reserve.

Following the CPI release, stock markets shot upward, with the S&P 500 hitting record highs, reflecting investor optimism. A tweet from The Kobeissi Letter highlighted that both headline and core CPI inflation remained flat in December, reinforcing the narrative that inflationary pressures are easing. However, political tensions continue to simmer. President Donald Trump called for additional rate cuts, and amidst ongoing debates over tariffs and trade policies, some analysts caution that the current trading range may not hold long-term.

As traders eye higher resistance levels around $94,000, some indicate that the current consolidation is likely to break. Voluminous liquidations have surged, with almost $170 million in cross-crypto liquidations over the past 24 hours, reinforcing the view that the recent price stability is due to accumulated liquidity at current levels. Analyst Exitpump pointed out that the resistance zone near the 94,000 mark is formidable, with VWAP (volume-weighted average price) trendlines hinting at potential rejection points. Meanwhile, traders remain cautious, with liquidity metrics suggesting that the recent sideways trading may give way to a decisive move in the near term.

Given the macroeconomic backdrop, Bitcoin’s recent rally remains closely tied to inflation and monetary policy developments, highlighting its role as a hedge amid a complex economic landscape. However, the bounded trading range indicates prudence among traders awaiting clearer directional signals.