Crypto World

Bitcoin spirals toward $65,000, headed for worst drawdown since FTX crash

Bitcoin tumbled below $66,000 during early afternoon U.S. hours as this week’s crypto selloff accelerated into a bloodbath on Thursday.

The largest cryptocurrency fell more than 10% over the past 24 hours to a session low of $65,156, according to CoinDesk data, the weakest level since October 2024 and below the 2021 peak.

Feb. 5 could be one of the worst days in bitcoin’s history. BTC is on track to suffer its steepest one-day drawdown — 10.5% since midnight UTC at current prices — since Nov. 8, 2022, when the collapse of crypto exchange FTX sent BTC below $16,000 after a 14.3% drop on the day.

Crypto wasn’t the only asset class under relentless selling pressure. Silver also plunged 15% during the day, and is now almost 40% below its record high just a week ago. Gold also fell more than 2.8% to $4,820, but that selloff wasn’t as bad as silver. The precious metal is now trading about 15% below its record last week.

Software stocks, often moving in lockstep with bitcoin, continued to selloff, with the thematic iShares Expanded Tech-Software ETF (IGV) declining more than 3% and down 24% year to date. The S&P 500 and the tech-heavy Nasdaq were also 1% lower.

Crypto stocks weren’t spared either. Coinbase (COIN), Galaxy (GLXY), Strategy MSTR) and BitMine (BMNR) tumbled more than 10%, while several crypto miners, including Bitfarms (BITF), CleanSpark (CLSK), Hut 8 (HUT), and Mara (MARA), saw similar losses.

“One big factor is just very thin liquidity,” said Adrian Fritz, chief investment strategist at 21shares. “If there is a bit of a sell pressure, it usually triggers a lot of liquidations.”

In a fragile market environment with only a few buy and sell orders to cushion trades, even modest sell-offs can trigger a large price reaction, in turn triggering further liquidations.

While some have said the worst is over for weeks now, Fritz believes otherwise.

“There’s still no signal that we bottomed out. I think it’s too early. There’s no confirmed turnaround,” he said.

He points to the 200-moving-day average — currently around $58,000 to $60,000 — as a key support level to watch. That level also aligns with bitcoin’s “realized price,” or the average cost basis of all bitcoin holders, which he believes could serve as a strong, multi-year support.

Read more: Bitcoin can still fall further. Historical data shows $60,000 will be the bottom

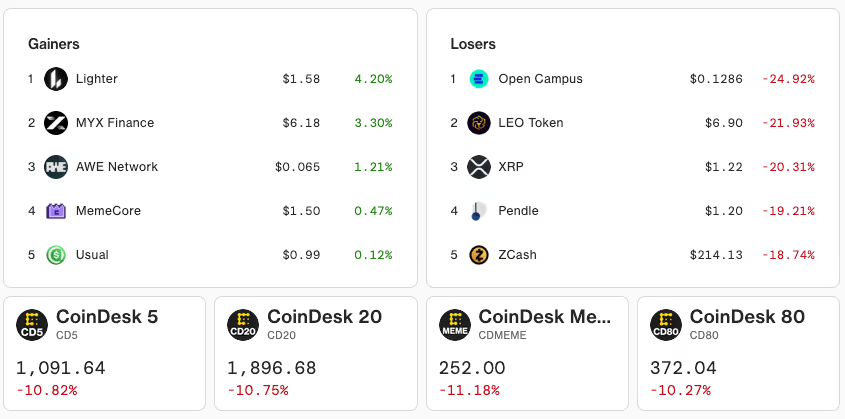

Altcoins decimated

Bitcoin’s performance could seem minor compared to the brutal selloff in altcoins.

Almost all CoinDesk index prices, including major tokens and memecoins, are down by more than 10% over the last 24 hours.

XRP, which fell 19% over the same 24-hour period, underperformed most other large-cap cryptos.

While Fritz said he believes there’s no specific trigger that puts extra pressure on the token, he said that “from a technical point of view, there’s not a lot of support levels for XRP.”

Read more: Here is what industry veterans are saying as bitcoin tumbles below $70,000

Crypto World

Arbitrum Price Under Pressure After 60 Million Whale Selling

Arbitrum price continues to weaken as ARB struggles to attract sustained investor demand. The token has failed to align with broader crypto market recoveries. Instead, it remains under pressure, extending a prolonged decline that has brought it dangerously close to its all-time low.

Investor support appears limited despite occasional short-lived rebounds. Broader market improvements have not translated into lasting gains for ARB. This divergence highlights fading conviction across multiple participant groups within the Arbitrum ecosystem.

Arbitrum Is Dominated By Volatile Holders

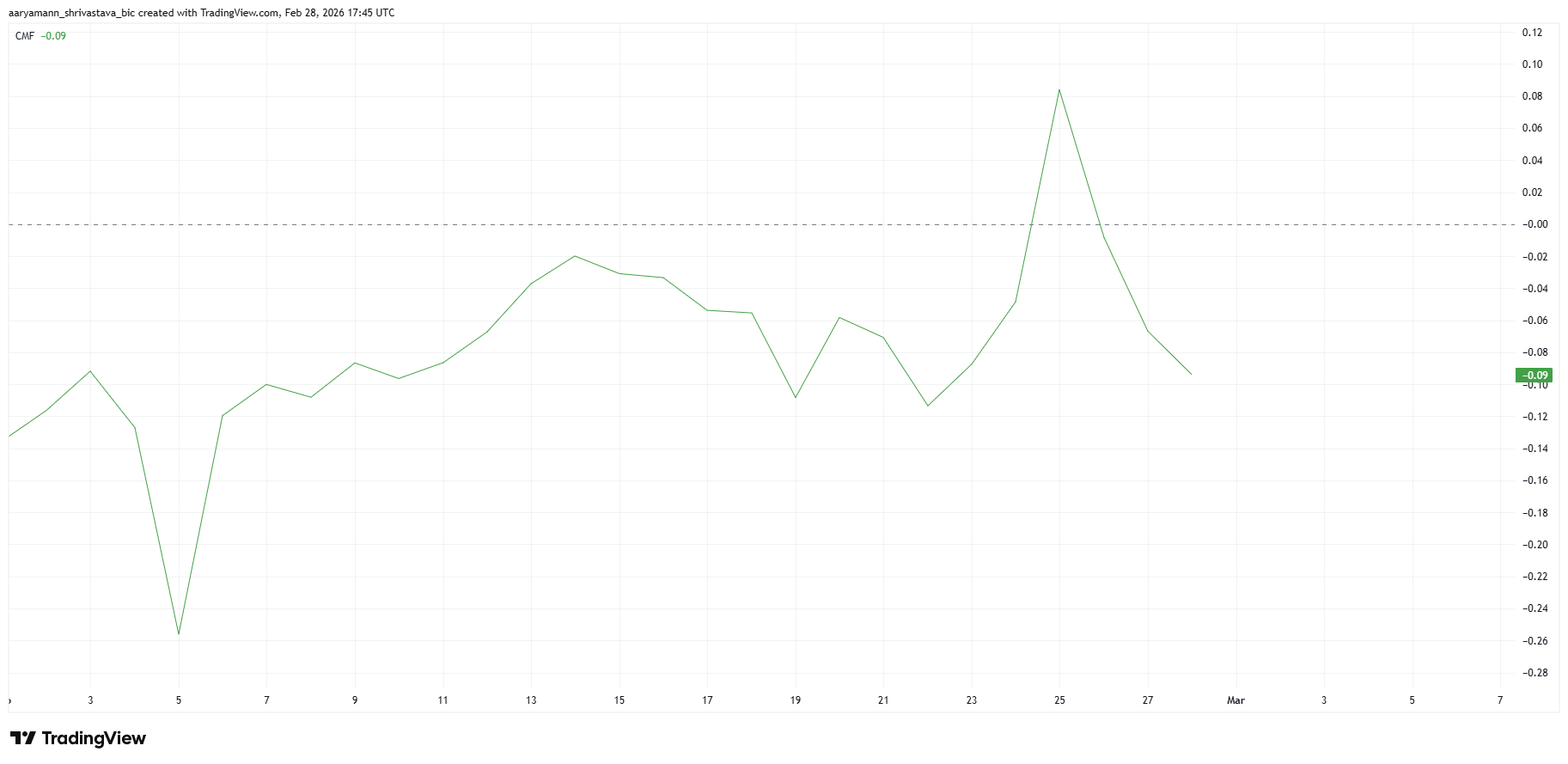

The Chaikin Money Flow indicator has dropped below the zero line, signaling net capital outflows. This reading reflects sustained selling pressure rather than healthy accumulation. Weak inflows suggest buyers lack confidence at current price levels.

ARB briefly spiked after forming a new all-time high earlier in the cycle. That move was largely driven by bottom buying activity. However, short-term holders quickly sold into strength. Their rapid distribution capped upside momentum and reinforced downside volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The MVRV Long/Short Difference metric shows that short-term holders currently dominate realized profits. This imbalance creates vulnerability for Arbitrum’s price stability. Short-term holders often exit positions quickly once profitability appears.

This behavior increases the risk of abrupt corrections. Today’s 8% drop reflects that dynamic. When profit-taking from short-term participants intensifies, the price can fall sharply without warning. Until long-term conviction strengthens, ARB remains exposed to sudden declines.

ARB Whales Aren’t Holding Back Either

Whale activity adds further pressure to the outlook. Addresses holding between 1 million and 10 million ARB have sold more than 60 million tokens over the past three weeks. This distribution has been gradual rather than panic-driven.

Slow and consistent whale selling often signals waning confidence. Unlike emotional capitulation, steady distribution can suppress recovery attempts. Persistent supply entering the market reduces the probability of a strong rebound in the near term.

ARB Price Faces New All-Time Low

Arbitrum price is down 8% today, trading at $0.0921 at the time of writing. ARB failed to defend the $0.0994 support level. The breakdown triggered additional selling, accelerating downside momentum.

The next support lies at $0.0887, just above the all-time low of $0.0883. Given current indicators, a retest appears likely. A decisive break below this threshold could push ARB toward $0.0821, establishing a new cycle low.

Invalidating this bearish thesis requires a structural shift in sentiment. Investors must slow distribution and restore inflows. ARB needs to reclaim $0.0947 to stabilize short-term momentum. Flipping $0.0994 back into support would open a path toward $0.1060, signaling recovery strength.

Crypto World

Anthropic CEO Responds to Pentagon Ban on Military Use

The defense-policy arc surrounding artificial intelligence intensified after the U.S. Department of Defense branded Anthropic as a “supply chain risk,” effectively barring its AI models from defense contracting work. Anthropic’s chief executive, Dario Amodei, pushed back in a CBS News interview on Saturday, saying the company would not support mass domestic surveillance or fully autonomous weapons. He argued that such capabilities undermine core American rights and would cede decision-making on war to machines, a stance that clarifies where the company does and does not intend to operate within the government’s broader AI-use cases.

Key takeaways

- The Defense Department labeled Anthropic a “supply chain risk,” prohibiting its contractors from using Anthropic’s AI models in defense programs, a move Amodei described as unprecedented and punitive.

- Anthropic opposes uses of its AI for mass domestic surveillance and autonomous weapons, stressing that human oversight remains essential for wartime decisions.

- Amodei asserted support for other government use cases for Anthropic’s tech, but drew a firm line around privacy protections and governable warfare capabilities.

- Shortly after the Anthropic designation, rival OpenAI reportedly secured a DoD contract to deploy its AI models across military networks, signaling divergent vendor trajectories in the defense-AI space.

- The development spurred online backlash focused on privacy, civil liberties, and the governance of AI in national security, highlighting a broader debate about responsible AI deployment.

Tickers mentioned:

Sentiment: Neutral

Market context: The episode sits at the intersection of AI governance, defense procurement, and risk appetite among institutional tech providers amid ongoing policy debates.

Market context: National-security policy, privacy considerations, and the reliability of autonomous AI systems continue to shape how tech vendors and defense contractors interact with AI tools in sensitive environments, influencing broader technology and investment sentiment in adjacent sectors.

Why it matters

For the crypto and broader technology communities, the Anthropic episode underscores how policy, governance, and trust shape the adoption of advanced AI tools. If defense agencies tighten controls on specific suppliers, vendors may recalibrate product roadmaps, risk models, and compliance frameworks. The tension between expanding AI capabilities and safeguarding civil liberties resonates beyond defense contracts, influencing how institutional investors weigh exposure to AI-driven platforms, data-processing services, and cloud-native AI workloads used by finance, gaming, and digital-assets sectors.

Amodei’s insistence on guardrails reflects a broader demand for accountability and transparency in AI development. While the industry is racing to deploy more capable models, the conversation about what constitutes acceptable use—especially in surveillance and automated warfare—remains unsettled. This dynamic is not limited to U.S. policy; allied governments are scrutinizing similar questions, which could affect cross-border collaborations, licensing terms, and export controls. In crypto and blockchain ecosystems, where trust, privacy, and governance are already central concerns, any AI policy shift can ripple through on-chain analytics, automated compliance tooling, and decentralized identity applications.

From a market-structuring perspective, the juxtaposition of Anthropic’s stance with OpenAI’s contract win—reported shortly after the DoD announcement—illustrates how different vendors navigate the same regulatory terrain. The public discourse around these developments could influence how investors price risk related to AI-enabled technology providers and the vendors that supply critical infrastructure to government networks. The episode also highlights the role of media narratives in amplifying concerns about mass surveillance and civil liberties, which in turn can affect stakeholder sentiment and regulatory momentum around AI governance.

What to watch next

- Congressional active debate over AI guardrails and privacy protections, with potential legislation affecting domestic surveillance, weapons development, and export controls.

- DoD policy updates or procurement guidelines that clarify how AI suppliers are evaluated for national security risk and how substitutions or risk-mitigation measures are implemented.

- Public responses from Anthropic and OpenAI, detailing how each company plans to address government-use cases, compliance, and risk exposure.

- Moves by other defense contractors and AI vendors to secure or renegotiate DoD contracts, including any shifts in alliance-building with cloud providers and data-handling protocols.

- Broader investor and market reaction to AI governance developments, particularly in sectors reliant on data processing, cloud services, and machine-learning workloads.

Sources & verification

- Anthropic CEO Dario Amodei’s CBS News interview discussing his stance on mass surveillance and autonomous weapons: CBS News interview.

- Official statements around Anthropic being labeled a “Supply-Chain Risk to National Security” by DoD leadership, via public channels linked to DoD policy discussions and contemporaneous coverage: Pete Hegseth X post.

- OpenAI’s defense-contract developments and public discussions about deploying AI models across military networks, as reported by Cointelegraph: OpenAI defense contract coverage.

- Critiques focusing on AI-enabled mass surveillance and civil-liberties concerns referenced in coverage of the broader discourse: Bruce Schneier on AI surveillance.

Policy clash over AI suppliers reverberates through defense tech

Anthropic’s chief executive, Dario Amodei, voiced a clear line during a CBS News interview when asked about the government’s use of the company’s AI models. He described the Defense Department’s decision to deem Anthropic a “supply chain risk” as a historically unprecedented and punitive move, arguing that it reduces a contractor’s operational latitude in a way that could hamper innovation. The core of his objection is straightforward: while the U.S. government seeks to leverage AI across a spectrum of programs, certain applications—particularly mass surveillance and fully autonomous weapons—are off-limits for Anthropic’s technology, at least in its current form.

Amodei was careful to differentiate between acceptable and unacceptable uses. He emphasized that the company supports most government use cases for its AI models, provided those applications do not encroach on civil liberties or place too much decision-making authority in machines. His remarks underscore a crucial distinction in the AI policy debate: the line between enabling powerful automation for defense and preserving human control over potentially lethal outcomes. In his view, the latter principle is fundamental to American values and international norms.

The Defense Department’s labeling of Anthropic has been framed by Amodei as a litmus test for how the U.S. intends to regulate a rapidly evolving technology sector. He argued that current law has not kept pace with AI’s acceleration, calling on Congress to enact guardrails that would constrain the domestic use of AI for surveillance while ensuring that military systems retain a human-in-the-loop design where necessary. The idea of guardrails—intended to provide clear boundaries for developers and users—resonates across tech industries where risk management is a competitive differentiator.

Meanwhile, a contrasting development unfolded in the same week: OpenAI reportedly secured a Department of Defense contract to deploy its AI models across military networks. The timing fueled a broader debate about whether the U.S. government is embracing a multi-vendor approach to AI in defense or whether it’s steering contractors toward a preferred set of suppliers. The OpenAI announcement drew immediate attention, with Sam Altman posting a public statement on X, which added to the scrutiny around how AI tools will be integrated into national-security infrastructure. Critics quickly pointed to privacy and civil-liberties concerns, arguing that expanding surveillance-capable technology in the defense domain risks normalizing intrusive data practices.

Amid the public discourse, industry observers noted that the policy landscape is still unsettled. While some see opportunities for AI to streamline defense operations and improve decision cycles, others worry about overreach, lack of transparency, and the potential for misaligned incentives when commercial AI firms become integral to national-security ecosystems. The juxtaposition of Anthropic’s stance with OpenAI’s contract success serves as a microcosm of broader tensions in AI governance: how to balance innovation, security, and fundamental rights in a world where machine intelligence increasingly underpins critical functions. The story thus far suggests that the path forward will depend not only on technical breakthroughs but also on legislative clarity and regulatory pragmatism that align incentives across the public and private sectors.

As the policy conversation continues, stakeholders in the crypto world—where data privacy, compliance, and trust underpin many ecosystems—will be watching closely. The defense-AI tension reverberates through enterprise technology, cloud services, and analytics pipelines that crypto platforms rely on for risk management, compliance tooling, and real-time data processing. If guardrails emerge with explicit guardrails that constrain surveillance-related uses, the implications could cascade into how AI tools are marketed to regulated sectors, including finance and digital assets, potentially shaping the next wave of AI-enabled infrastructure and governance tools.

Key questions remain: Will Congress deliver concrete legislation that defines acceptable AI use in government programs? How will DoD procurement evolve in response to competing vendor strategies? And how will public sentiment shape corporate risk assessments for AI providers who operate in sensitive domains? The coming months are likely to reveal a more explicit framework for AI policing that could influence both public policy and private innovation, with consequences for developers, contractors, and users across the technology landscape.

Crypto World

How a Wallet Compromise Killed the Solana DeFi Aggregator

After exploring fundraising and acquisition options, the teams concluded that no sustainable recovery path existed following the breach.

Solana-based DeFi aggregator, Step Finance, along with two other affiliate projects, SolanaFloor and Remora Markets, announced plans to shut down all operations with immediate effect.

The decision follows the aftermath of a major security incident earlier this year.

Hack, Halt, Shutdown

In a statement shared on X, the teams said the decision came after exploring multiple paths forward, including fundraising and acquisition discussions. However, none resulted in a viable solution after the hack that occurred in late January.

The incident involved an estimated $30 million in assets being drained from Step Finance’s wallets on the Solana network. Subsequent disclosures indicated that the breach stemmed from compromised devices belonging to members of the project’s executive team.

Access to these devices likely exposed private keys or enabled malware that interfered with internal transaction approval processes, which allowed attackers to initiate and approve malicious on-chain transactions. Once access was obtained, the attackers unstaked roughly 261,854 SOL and transferred the funds out of project-controlled wallets. This triggered an immediate market reaction that saw the STEP token fall by more than 80%.

Following detection of the exploit, the team halted certain components of the platform to limit further damage and later reported that approximately $4.7 million in Remora-related assets and other holdings were recovered. As part of the shutdown process, Step Finance said it is working on a buyback program for STEP token holders based on a snapshot taken prior to the incident, while Remora Markets is preparing a redemption process for rToken holders.

Over 200 Hack Incidents in 2025

The hack involving Step Finance ranked among the most expensive DeFi incidents in January 2026, amidst a broader rise in crypto-related losses over the past year. According to data from blockchain security firm PeckShield, scams and hacks drained more than $4.04 billion from users and platforms in 2025, which is an increase of almost 34% compared to 2024.

You may also like:

Of that total, $2.67 billion was attributed to hacks, while $1.37 billion originated from scams, as scam-related losses rose about 64% year-on-year.

PeckShield found a pivot from purely technical exploits toward targeted social engineering, often aimed at centralized entities and high-value individuals, thereby resulting in higher losses per incident. More than 200 hack cases were recorded during the year, excluding scams.

February stood out as the costliest month, driven by a $1.51 billion breach at Bybit.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

ETH Drops 60% from 2025 High, Yet TradFi Bets on ETH: Here’s Why

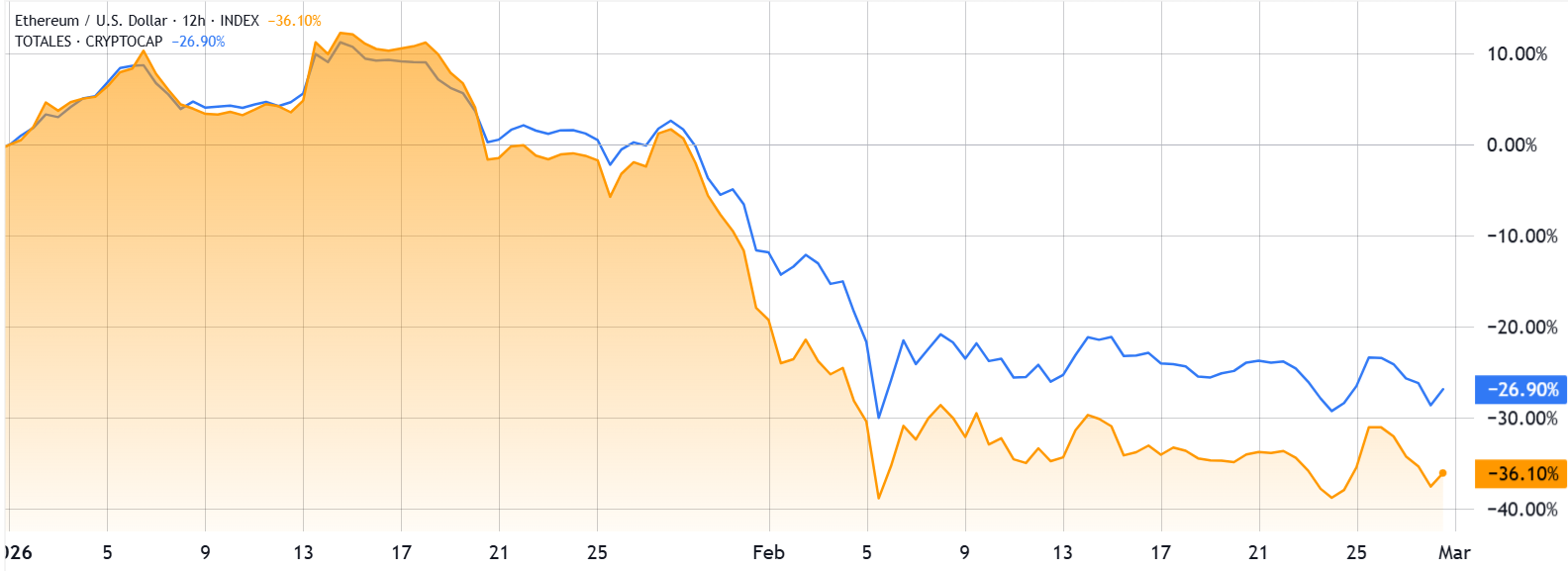

Ethereum remains a focal point for institutional on-chain activity even as price momentum stalls. In 2026, Ether has retreated about 36% for the year, slipping back from the $3,000 milestone toward the $1,900 zone as traders weigh macro headwinds and network dynamics. Yet major financial institutions are pressing ahead with on-chain experiments—spanning tokenized funds, custody solutions, and Layer-2 rollups—underlining a shift in capital toward Ethereum and its expanding ecosystem. On-chain metrics reinforce the narrative: the Ethereum ecosystem, including its Layer-2 solutions, commands a substantial share of total value locked (TVL), while on-chain activity and revenues have cooled from late-2025 peaks. Against this backdrop, Vitalik Buterin has signaled a pivot toward strengthening base-layer scalability and privacy-preserving technologies that could recalibrate the network’s long-run efficiency and security.

Key takeaways

- Structural dominance of Ethereum and its Layer-2s: Ethereum and associated rollups hold about 65% of TVL, underscoring institutional preference for the chain and its scaling stack.

- Price action versus on-chain momentum: Ether is down roughly 36% in 2026, despite ongoing development focused on scalability, privacy, and quantum resistance.

- Activity compression on Ethereum: DEX volumes on the network fell 55% over six months, a sharper pullback than Solana’s 21% decline, signaling a broader slowdown in activity and fee generation.

- Market leadership in liquidity and asset classes: Even with near-term headwinds, Ethereum commands a dominant 57% TVL on-chain, rising to 65% when Layer-2s are included, and maintains a substantial share of Real World Assets (RWA) activity.

- Roadmap and security priorities: The ecosystem’s leadership reiterates a staged approach to base-layer improvements, including parallel block verification, gas-time alignment, and a zero-knowledge EVM, with quantum-resistance considerations on the horizon.

Sentiment: Neutral

Price impact: Negative. Ether’s 2026 decline and softer on-chain activity have pressured asset pricing and network revenue incentives.

Trading idea (Not Financial Advice): Hold. The combination of a robust institutional footprint and a clear, if gradual, roadmap for scalability suggests potential upside if macro conditions improve and on-chain activity stabilizes.

Market context: The Ethereum ecosystem remains a central hub within a broader cycle of liquidity rebalancing, regulatory attention, and shifting risk appetites that influence DeFi flows and cross-chain competition. In this environment, Ethereum’s lead in TVL and DeFi activity—supported by Layer-2 rollups—helps anchor a risk framework that many institutions rely on for on-chain experimentation and asset tokenization.

Why it matters

The sustained institutional engagement with Ethereum signals a broader belief that the network’s core advantages—decentralization, compatibility with a wide array of DeFi protocols, and a proven track record—deliver durable value creation even as price volatility tests investor patience. The data underpinning this case is compelling: Ethereum plus its Layer-2 ecosystem account for a sizable portion of TVL, and even amid a retreat in on-chain volumes, the share remains disproportionately higher than rival chains when L2s are counted. This creates a margin of safety for long-horizon participants who prioritize on-chain liquidity, institutional-grade tooling, and the ability to navigate Real World Asset use cases on-chain.

From a development perspective, the village of researchers and builders around Ethereum has kept pace with a rapidly evolving set of priorities. Vitalik Buterin’s public statements point to a deliberate shift toward strengthening the base layer’s scalability and privacy properties, while preserving the composability that DeFi and tokenized asset markets rely on. The proposed approach includes parallel block verification and real-time gas-cost alignment with actual execution time, paired with the emergence of a zero-knowledge Ethereum Virtual Machine (ZK-EVM). These steps are not only technical milestones; they are foundational bets on how the network sustains security, throughput, and cost efficiency as demand scales. The gradual rollout—starting with a minority of nodes participating before introducing more systemic changes—reflects a measured approach to system-wide upgrades, a stance that has historically helped Ethereum weather upgrade friction and security concerns.

Institutional activity on Ethereum is not merely cosmetic. Large financial players—including names commonly associated with mainstream finance—have launched on-chain initiatives that leverage the Ethereum ecosystem for tokenized funds, stablecoins, and Layer-2 rollups. While critics have highlighted the limits of rollups versus competing blockchains, the real-world economics remain anchored to Ethereum’s first-mover advantage, broad ecosystem support, and established on-chain settlement guarantees. The network’s role in DeFi is underscored by its continued dominance in TVL and the notable share of Real World Assets on-chain. Despite the allure of faster or cheaper blockchains, no clear “Ethereum killer” has emerged capable of matching its breadth of activity and capital efficiency, a gap that keeps Ethereum at the center of many institutional agendas.

On the user-facing side, on-chain fees and DApp revenue have cooled as activity contracted. February 2026 data show Ethereum’s DEX volumes at $56.5 billion, down from an August 2025 peak of $128.5 billion. Meanwhile, Solana’s on-chain activity has fared somewhat better in relative terms, with monthly volumes around $95.5 billion in February, down from $120.6 billion in August. This divergence helps explain why the market remains skeptical about near-term profitability for general-purpose networks, even as the long-run narrative for scalable, privacy-preserving on-chain infrastructure remains intact. For readers following the data, the contrast between Ethereum’s on-chain momentum and its price action is a reminder that fundamental progress does not always translate into immediate price appreciation.

From a strategic perspective, the push toward base-layer scalability—while still embracing rollups—reflects a nuanced consensus about trade-offs between decentralization, security, and efficiency. Buterin’s own remarks acknowledge that quantum-resistant signatures are larger and costlier to verify, a reality that has pushed the team toward fixing protocol-layer recursive signatures and proof aggregation, along with vectorized math precompiles to reduce gas costs. Even with these challenges, the roadmap signals a path toward sustained scalability and resilience in a post-quantum security era, a consideration that matters for institutional investors seeking durability beyond the current market cycle.

Taken together, the evidence suggests that Ethereum’s long-term narrative remains intact even as near-term price action tests the nerves of investors. The combination of a sizable TVL share, an active pipeline of base-layer and L2 innovations, and ongoing institutional experimentation points to a ecosystem that is not merely surviving a period of cooling activity but actively retooling for a more scalable future. The market’s reaction to this mix will likely hinge on the pace of rollup cost reductions, the successful deployment of ZK-EVM features, and the ability of on-chain markets to re-accelerate user and developer activity without compromising security or decentralization.

Related readings on this topic illuminate how institutions weigh Ethereum’s advantages against faster but less proven competitors. For reference, see analyses discussing why institutions still prefer Ethereum despite faster blockchains, and the ongoing work on quantum-resistant and privacy-preserving enhancements in the network’s roadmap. These sources provide context for how market participants view Ethereum’s role in a diversified on-chain ecosystem.

ETH/USD (orange) vs total crypto capitalization (blue). Source: TradingView

Real World Assets active market capitalization, USD. Source: DefiLlama

What to watch next

- Progress on base-layer scalability updates, including any staged rollouts of ZK-EVM features and the transition plan for block confirmation systems.

- Monitoring Vitalik Buterin’s updates on quantum-resistance and signatures—especially any published roadmaps or protocol proposals that affect verification and security costs.

- Institutional on-chain initiatives by major banks and asset managers—tokenized funds, bank-issued stablecoins, and Layer-2 rollup deployments—testing real-world use cases on Ethereum.

- On-chain activity and TVL trends across Ethereum and its Layer-2s, with particular attention to DEX volumes, DApp revenue, and Real World Assets metrics as benchmarks for adoption.

- Regulatory developments that could influence DeFi infrastructure, on-chain asset tokenization, and cross-border settlement within the Ethereum ecosystem.

Sources & verification

- Ether price and on-chain metrics referenced in coverage here: https://cointelegraph.com/ethereum-price

- Vitalik Buterin roadmap discussion for faster quantum-resistant Ethereum: https://cointelegraph.com/news/vitalik-details-roadmap-for-faster-quantum-resistant-ethereum

- Zero-knowledge privacy and AI API discussions for Ethereum devs: https://cointelegraph.com/news/ethereum-devs-propose-zero-knowledge-ai-api-privacy

- Institutional engagement with Ethereum and related technology choices: https://cointelegraph.com/news/institutions-prefer-eth-faster-blockchains

- Further notes on quantum-resistance roadmaps and fixes: https://cointelegraph.com/news/vitalik-proposes-4-fixes-quantum-resistance-roadmap-for-ethereum

Market reaction and key details

In a market where liquidity and risk sentiment oscillate with macro headlines, Ethereum remains a structural anchor for DeFi innovation. The 2026 price trajectory reflects a confluence of broader market cooling and the gnarly economics of scaling, but the on-chain narrative remains anchored in practical progress. The network’s ability to sustain a large share of TVL—65% when counting Layer-2 rollups such as Base, Arbitrum, Polygon, and Optimism—demonstrates that institutions are still monetizing the security, settlement, and composability that Ethereum provides. This is not just about price; it is about a long-run framework in which on-chain finance, tokenized assets, and cross-border settlement can operate with a level of trust and efficiency that is difficult to replicate elsewhere.

From the perspective of on-chain activity, the cooling observed in February 2026—DEX volumes at $56.5 billion and Solana volumes at $95.5 billion in the same period—speaks to a broader cycle where speculative frenzy subsides and real-world usage remains a critical metric. The gap between price and on-chain activity can be misleading; even with lower volumes, the structural advantage of a robust ecosystem—fueled by major financial institutions exploring on-chain product lines—suggests the capacity for renewed growth when conditions improve. The data indicate that Ethereum’s dominance is not merely a function of its native token but of a broader ecosystem that includes Real World Assets and a suite of DeFi primitives that continue to mature.

Buterin’s guidance toward base-layer scalability and ZK-EVMs represents more than a technical pivot. It is a strategic attempt to reduce the friction in moving from experimental rollups to a trusted settlement layer that can scale without compromising security or decentralization. The staged rollout approach—beginning with a minority of participants before expanding to broader deployment—reflects a cautious, methodical upgrade path that has historically helped Ethereum avoid dislocations associated with rapid, sweeping changes. In a market where investors crave clarity, the emphasis on a pragmatic balance between rollups and a strengthened base layer offers a credible framework for sustaining long-term value creation.

Ultimately, the story remains one of resilience and adaptation. While Ethereum’s price action in 2026 has been undeniably negative for momentum traders, the ecosystem’s structural assets—TVL concentration, institutional on-chain programs, and a roadmap oriented toward scalability and quantum-resilience—create a foundation upon which a renewed price cycle could emerge. The critical test will be in translating technical progress into practical improvements in user experience, developer tooling, and DApp economics that can sustain a broader, real-world demand for on-chain services.

Crypto World

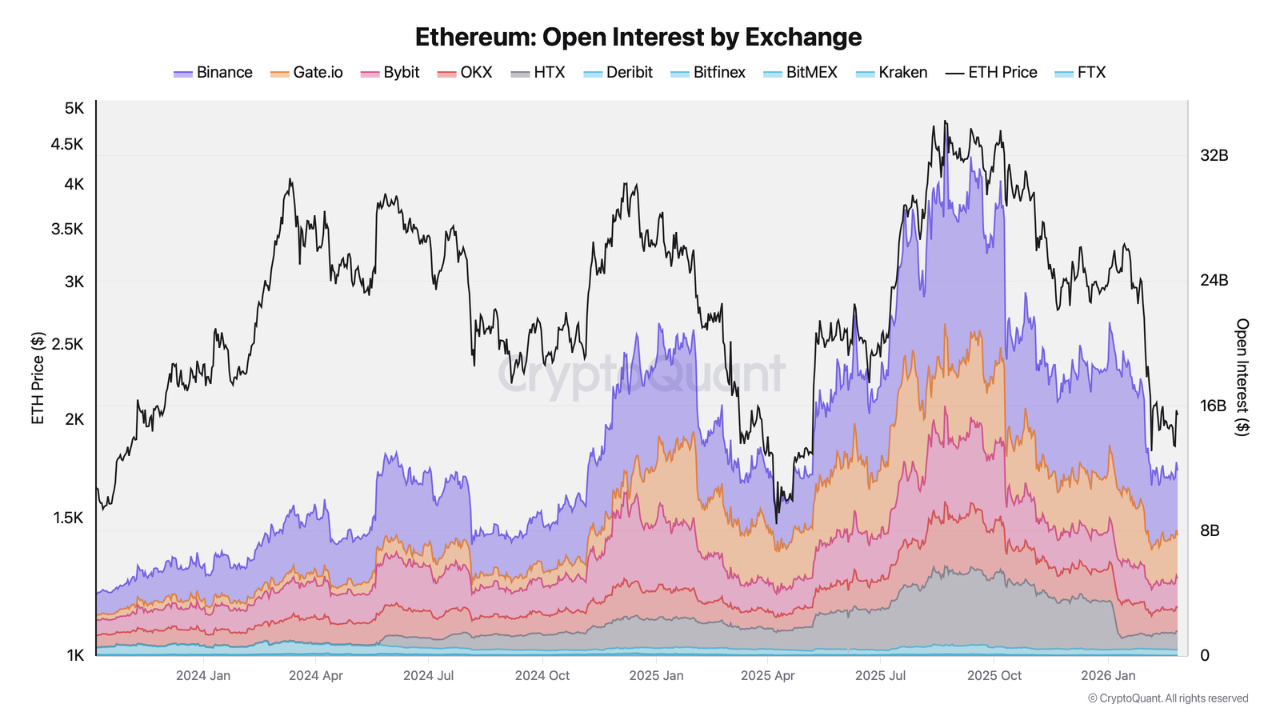

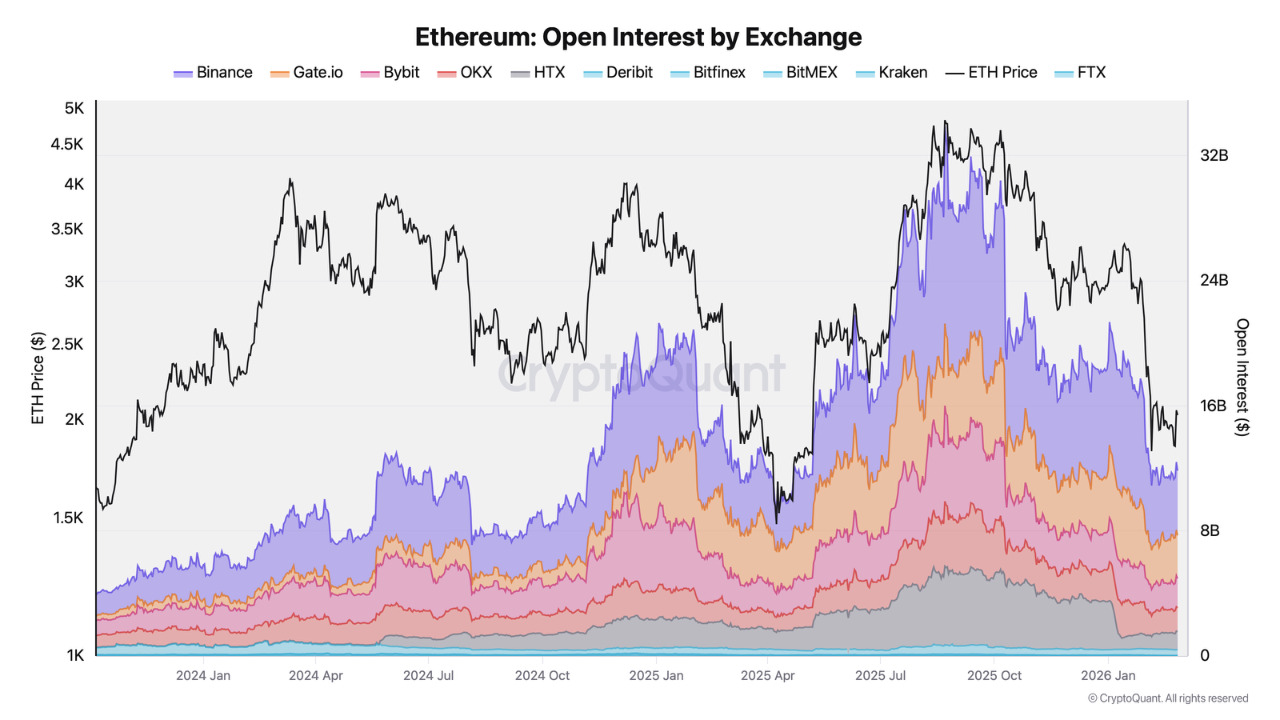

Ethereum Derivatives Market Contracts Sharply as Macro Pressures and Geopolitical Risks Drain Risk Appetite

TLDR:

- Ethereum open interest in ETH terms fell from 7.79M to 5.8M across all major derivatives exchanges.

- Binance notional open interest dropped from $12.6B to $4.1B, yet still holds nearly 35% of total market share.

- Core PPI rose 0.8% month-over-month, reducing Federal Reserve rate cut expectations and pressuring risk assets.

- Bybit and Gate.io both recorded steep open interest declines, confirming a broad market-wide deleveraging phase.

The Ethereum derivatives market is experiencing a sharp contraction as macroeconomic pressures weigh on crypto assets.

Core PPI data rose 0.8% month-over-month, confirming that inflation remains persistent. This reading has reduced expectations for a near-term Federal Reserve rate cut.

Meanwhile, rising U.S.-Iran tensions over the weekend added further uncertainty. Together, these factors pushed traders toward risk aversion, triggering a broad deleveraging across Ethereum’s futures and derivatives segment.

Open Interest Drops Sharply Across Major Exchanges

The Ethereum derivatives market saw open interest in ETH terms fall from 7.79 million to 5.8 million across all exchanges. That represents a reduction of nearly 2 million contracts across the board.

Binance alone concentrated roughly 2 million of the affected positions. The contraction reflects a clear pullback from leveraged exposure across the market.

Binance remains the dominant player despite the notable decline, holding close to 35% of total open interest. Its notional open interest, however, dropped sharply from $12.6 billion to $4.1 billion.

This decline factors in both reduced contract volumes and falling ETH prices. Even after the drop, Binance’s share remains well ahead of all competitors.

Bybit, which holds roughly 15% of total open interest, saw its figures fall to $1.9 billion. That marks approximately a threefold reduction from its prior recorded levels.

Gate.io also declined, dropping from $5.2 billion to $2.75 billion. Gate.io now accounts for approximately 23% of the overall Ethereum derivatives market.

Analyst Darkfost noted the wide scope of this deleveraging phase across platforms. The data reflects active leverage unwinding rather than a routine price correction.

Traders across exchanges are steadily reducing exposure amid unfavorable macro conditions. The speed of this contraction points to deliberate risk management decisions by market participants.

Macro Pressures Drive Risk Aversion Across Crypto Markets

The Federal Reserve’s rate cut prospects have dimmed following the latest inflation data. Core PPI rising 0.8% month-over-month confirmed that price pressures have not eased.

Markets are now pricing in a prolonged period of restrictive monetary policy. This environment tends to reduce appetite for risk assets, including cryptocurrencies.

Altcoins have been among the first to absorb the pressure as risk sentiment shifted. Ethereum led the decline among major digital assets during this period.

The derivatives market responded accordingly, with leveraged positions being quickly reduced. Reduced leverage typically reflects a move by traders toward greater caution.

Geopolitical developments added further pressure on already fragile market conditions. Growing tensions between the United States and Iran surfaced over the weekend.

These events increased uncertainty at a time when investors already lacked clear direction. Risk assets, including crypto, tend to react quickly to such external geopolitical shocks.

The Ethereum derivatives market is now in a clear contraction phase across all major platforms. Traders have broadly pulled back from leveraged positions as conditions tightened.

The combination of macro headwinds and geopolitical risks has created a structurally unfavorable environment. Until conditions stabilize, the derivatives market may continue facing continued downward pressure.

Crypto World

Crypto hacks drop to $37.7M, lowest since March 2025

Crypto hacks and exploits resulted in approximately $37.7 million in losses during February 2026 and were the lowest monthly figure since March 2025 according to Certik data.

Summary

- Crypto hacks totaled $37.7M in February, lowest since March 2025.

- Wallet compromises led losses at $16.6M, ahead of phishing and exploits.

- About 30% of stolen funds were frozen or recovered during February.

Phishing attacks accounted for $8.6 million of the total, while wallet compromise led incident categories with $16.6 million in losses.

YieldBlox topped individual exploits with $10.6 million stolen, followed by IoTeX at $8.9 million and Foom at $2.3 million.

DeFi protocols suffered the largest losses by type at $14.4 million, while AI-related projects recorded $8.9 million in thefts.

Funds returned or frozen reached $11.3 million, representing approximately 30% of total losses.

Wallet compromise and price manipulation drive February losses

Wallet compromise incidents totaled $16.6 million across February and were the largest crypto hacks loss category.

Price manipulation attacks followed with $11.4 million in stolen funds, while phishing schemes drained $8.6 million from victims.

Code vulnerability exploits accounted for $5.1 million, with exit scams adding $2.1 million.

Instadapp posted the largest single incident at $10.5 million, followed by EFX at $8.9 million. Kasm recorded $2.2 million in losses, while Initia saw $2.1 million stolen.

CryptoFarm experienced two separate incidents totaling $2.7 million combined.

Smaller incidents included UCC and Hedgehog at $400,000 each, with Lending and SEI Token both posting $200,000 in losses.

DeFi protocols continued to see the highest exploit activity with $14.4 million in losses across multiple incidents.

AI-related projects emerged as the second-largest target with $8.9 million stolen. Gambling platforms lost $2.3 million, while address poisoning and wallet drainer schemes combined for $2.7 million.

February shows 60% crypto hack drop from January

The $37.7 million February total is a sharp drop from typical monthly figures seen throughout 2025.

Certik data shows January and February 2026 both posted lower losses than most 2025 months.

Total incidents remained relatively stable month-over-month based on the chart. The reduction in total losses comes from fewer high-value exploits rather than decreased attack frequency.

Phishing incidents showed similar patterns across both months, with February’s $8.6 million matching January levels.

Exploit total loss also dropped from January’s elevated levels to February’s $37.7 million.

Crypto World

Cardano Price Tests Bear Market Support

Cardano’s price has entered a tight consolidation phase over the past several days. ADA is trading within a narrowing range as momentum weakens. Repeated attempts to break higher have stalled, reflecting broader caution in the crypto market.

Bearish signals dominate the short-term outlook. However, one key cohort of holders is providing support.

Cardano Is Under Pressure

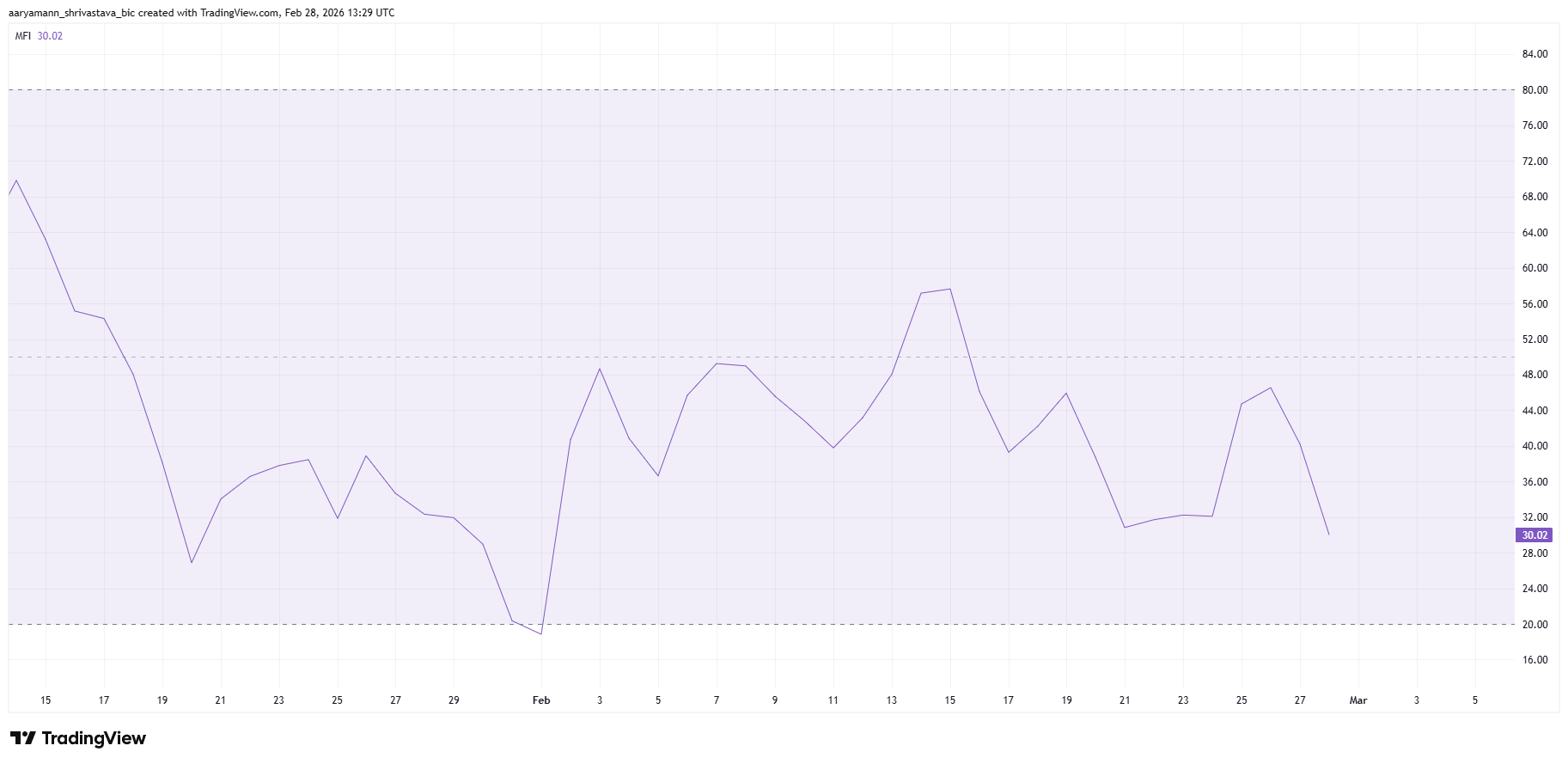

The Money Flow Index shows persistent selling pressure on ADA. The indicator remains below the neutral 50 level, signaling sustained capital outflows. Weak inflows suggest that buyers are hesitant to step in at current prices.

A shift in momentum requires reclaiming the 50 mark or entering oversold territory. At present, ADA is far from both conditions. Without a strong reversal signal, selling pressure may continue to weigh on Cardano price action.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Derivatives data reinforces the bearish narrative. The liquidation map indicates that Cardano futures contracts are skewed toward short positions. Exposure on short contracts stands near $23 million compared with $14 million in potential long liquidations.

This imbalance highlights trader expectations for further downside. Elevated short interest can increase volatility if the price moves sharply. However, current positioning suggests that many traders anticipate continued weakness rather than a breakout.

Sustained bearish positioning may amplify price swings. If ADA attempts a recovery, short liquidations could accelerate upside. Conversely, additional selling could reinforce negative momentum. For now, macro sentiment in futures markets remains defensive.

ADA LTHs Provide Relief

Long-term holders are currently offsetting part of the sell pressure. The Mean Coin Age metric is rising, indicating that older coins are remaining inactive. This trend suggests that LTHs are choosing to hold rather than distribute.

Resilience among long-term investors is crucial. Persistent holding behavior reduces circulating supply pressure. While it does not guarantee recovery, it helps ADA defend critical support levels during periods of uncertainty.

ADA Price Needs To Hold Above This Support

Cardano is trading at $0.264 at the time of writing, rangebound between $0.295 resistance and $0.256 support. The lower boundary aligns with the 13.6% Fibonacci retracement, often referred to as the bear market support floor. ADA has maintained this level for nearly three weeks.

Given current indicators, consolidation appears likely to continue. A successful defense of $0.256 could enable a rebound toward $0.278. Sustained buying may push ADA back to $0.295, testing upper range resistance once again.

However, increased selling pressure would shift the outlook. A decisive breakdown below $0.256 would weaken structural support. In that scenario, Cardano price could decline toward $0.239, invalidating the short-term bullish thesis and reinforcing bearish control.

Crypto World

Anthropic CEO Slams Pentagon Decision As ‘Unprecedented’

The CEO of AI company Anthropic, Dario Amodei, has responded to the United States Department of Defense and the White House, ordering military defense contractors that do business with the Department of Defense to stop using Anthropic’s products.

Anthropic objected to the use of its AI models for mass domestic surveillance and fully autonomous weapons that can fire without any human input, Amodei told CBS on Saturday.

He added that Anthropic was fine with all of the US government’s proposed use cases for its AI models, except for surveillance and fully autonomous weapons platforms. He said:

“These are things that are fundamental to Americans: the right, not to be spied on by the government, the right for our military officers to make decisions about war, themselves, and not turn it over completely to a machine.”

The decision by the Defense Department to label Anthropic as a “supply chain risk,” meaning that military contractors cannot use Anthropic’s products on defense contracting work, is “unprecedented” and “punitive,” he added.

Amodei later clarified that he is not against the development of fully automated weapons if foreign militaries begin using them in the future, but that AI is not yet reliable enough to function autonomously in a military setting.

The law has not caught up to the rapidly developing AI sector, Amodei said, calling on the United States Congress to pass “guardrails” to prevent the use of AI in domestic mass surveillance programs.

Related: Anthropic says it’s been targeted in massive distillation attacks

OpenAI wins a defense contract after US officials label Anthropic a supply chain risk

On Friday, US “Secretary of War” Pete Hegseth announced that Anthropic is a “Supply-Chain Risk to National Security.”

“Effective immediately, no contractor, supplier, or partner that does business with the United States military may conduct any commercial activity with Anthropic,” he said.

Hours later, rival AI company OpenAI accepted a contract with the US Defense Department to deploy its AI models across military networks.

The announcement of the deal from OpenAI CEO Sam Altman drew online backlash from critics, who cited AI being used for mass domestic surveillance and undermining individual privacy as a red line.

Magazine: ‘Slaughterbot’ drones in Ukraine, MechaHitler becomes sexy waifu: AI Eye

Crypto World

Ethereum Holder Retention Rebounds From a 4-Year Low

Ethereum price continues to trade in a sideways structure that reflects a gradual decline rather than stability. ETH has struggled to generate sustained upside momentum. The exit of new participants has weighed on sentiment, even as some long-term metrics show early signs of improvement.

This divergence creates a mixed outlook for Ethereum. While network growth has weakened, improving holder retention offers a counterbalance.

Ethereum New Holders Dip

Ethereum has seen a sharp decline in new addresses over the past several days. Daily new addresses fell nearly 36% within 48 hours, dropping from 298,000 to 191,000. This contraction pushed Ethereum’s Network Growth metric to a two-month low.

The slowdown has persisted since the beginning of the month. Fewer new participants reduce organic demand. Weak onboarding also signals hesitation among retail investors. This trend has added pressure to ETH price performance and contributed to cautious market sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Ethereum Holder Retention Rate provides deeper context that even though new holders are declining, the ones that are staying are staying for good. This metric tracks the percentage of addresses maintaining a balance across consecutive 30-day periods. It measures whether holders continue to retain ETH rather than exit positions.

The retention rate recently fell to 92.4%, marking a 4.5-year low and the weakest reading since September 2021. This decline confirmed wavering conviction among newer holders.

However, the metric has begun to improve modestly, suggesting renewed stability among participants. Rising retention can strengthen structural support if sustained.

ETH Price Shows Potential To Bounce Back

Ethereum is trading at $1,904 at the time of writing, holding above the $1,816 support level. While price action appears flat, a descending resistance line indicates a slow downtrend. Without stronger demand, ETH remains vulnerable to continued weakness.

The Chaikin Money Flow indicator offers cautious optimism. CMF has shifted into positive territory after a gradual uptrend. This movement signals improving capital inflows. Transitioning from outflows to inflows is essential for any sustained Ethereum price recovery.

If inflows continue and support holds, Ethereum could rebound from $1,816 and attempt a move toward $2,165. A breakout above this resistance would invalidate the current downtrend line. Such a shift would likely restore investor confidence and reinforce bullish momentum.

However, failure to maintain positive capital flow would undermine this outlook. A breakdown below $1,816 would invalidate the recovery thesis. In that scenario, Ethereum price could slide toward $1,600, increasing downside risk and reinforcing bearish control across the broader crypto market.

The post Ethereum Holder Retention Rebounds From a 4-Year Low appeared first on BeInCrypto.

Crypto World

Why TradFi Keeps Betting On An ETH Surge

Key takeaways:

-

Institutional adoption of the Ethereum network accelerates despite Ether disappointing price action. Ethereum and its layer-2s hold 65% of TVL market share.

-

Vitalik Buterin is shifting focus toward base layer scalability and ZK-EVM to ensure long-term onchain efficiency and security.

Ether (ETH) has declined 36% in 2026, sparking frustration as the $3,000 level feels increasingly out of reach. Despite a retreat toward $1,900, Ethereum fundamentals appear resilient. Development continues at a rapid pace, specifically targeting base layer scalability, privacy, and quantum resistance.

Critics claiming Ether is poorly positioned may be surprised if the market sentiment shifts back toward cryptocurrencies.

Ether has underperformed the broader crypto market by 9% during the first two months of 2026, challenging the theory that external factors are the sole drivers of this correction. Decentralized exchange (DEX) volumes on the Ethereum network fell 55% over the past six months, while competitor Solana saw a more modest 21% decline during that same timeframe.

Ethereum DEX volumes dropped to $56.5 billion in February 2026, down significantly from a peak of $128.5 billion in August 2025. During the same period, monthly Solana volumes reached $95.5 billion, down from $120.6 billion in August. This contraction in activity has weighed on network fees and decentralized application (DApp) revenue, effectively reducing the immediate incentives for holding Ether.

Institutions choose Ethereum over other blockchains

The narrow focus on volume ignores the fact that Ethereum maintains a 57% market share in total value locked (TVL), totaling $52.4 billion. When including layer-2 solutions such as Base, Arbitrum, Polygon, and Optimism, Ethereum’s dominance rises to 65%. For comparison, Solana’s TVL sits at $6.4 billion, while BNB Chain holds an aggregate $5.5 billion locked in smart contracts.

Major institutions, including JP Morgan Asset Management, Citi, Deutsche Bank, and BlackRock, have recently launched onchain projects using Ethereum. From tokenized funds to dedicated layer-2 rollups and bank-issued stablecoins, Ethereum remains the primary venue for decentralized finance (DeFi) innovation, commanding a 68% market share in Real World Assets (RWA).

Ethereum’s strategic decision to prioritize layer-2 scalability via rollups has been partially labeled a failure, as competing chains like Tron and Solana currently lead in network fees. Regardless of how critics judge the decision to subsidize rollup costs, no “Ethereum killer” has managed to match its monetary value. Even the highly successful Hyperliquid maintains a relatively modest $1.5 billion in TVL.

Vitalik Buterin, Ethereum’s co-founder and lead architect, recently expressed intentions to reduce dependence on rollups by targeting base layer scalability. According to Buterin, the proposed changes include parallel block verification, aligning gas costs with actual execution time, and the implementation of a zero-knowledge Ethereum Virtual Machine (ZK-EVM).

These updates will be implemented gradually. Buterin recommends that a minority of the network participate initially before moving toward mandatory block confirmation systems that rely on ZK-EVM. Additionally, Ethereum maintains a clear roadmap to navigate the quantum computing era, which includes consensus-layer signatures based on privacy-focused proof systems.

Related: Why institutions still prefer Ethereum despite faster blockchains

Buterin has admitted that quantum-resistant signatures are significantly larger and more difficult to verify, noting that lattice-based solutions are currently inefficient. Consequently, the proposed solution involves fixing protocol-layer recursive signature and proof aggregation while developing vectorized math precompiles to reduce gas costs. While the Ethereum network is not yet perfect, a viable path for scalability exists.

Before dismissing ETH as a failure, it is necessary to analyze what has made the network successful relative to competing DApp-focused blockchains. Decentralization and trust require years, if not decades, to establish. ETH maintains a significant first-mover advantage and appears well-positioned to capture a future surge in demand for institutional-grade onchain activity.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Politics7 days ago

Politics7 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World5 days ago

Crypto World5 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports21 hours ago

The Vikings Need a Duck

-

Business7 days ago

Business7 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat8 hours ago

NewsBeat8 hours agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat13 hours ago

NewsBeat13 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat6 days ago

NewsBeat6 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat4 hours ago

NewsBeat4 hours agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.