Crypto World

Bitcoin stays volatile while MUFG says stables work better as money

Bitcoin slips ~2% in 7d as MUFG touts stablecoins’ price-stable payments.

Summary

- TC trades near $68k, with a 7d move of about -2.25%, and a 24h range around $66.7k–$69.1k.

- MUFG’s Hardman says stablecoins better meet money’s role via price stability, fast settlement, and low-cost transfers versus BTC’s higher volatility.

- Stablecoins, often fiat-pegged, are gaining attention as digital cash and could see higher adoption in payments while BTC remains mainly a store-of-value asset.

An analyst at Mitsubishi UFJ Financial Group has stated that stablecoins represent a more suitable currency option than Bitcoin for payment purposes, according to recent commentary from the Japanese financial institution.

Lee Hardman, an analyst at MUFG, one of Japan’s three largest banks, said stablecoins have attracted increased attention compared to other digital assets due to their function as digital cash.

Hardman stated that stablecoins better fulfill the requirements of money by offering price stability and fast, low-cost payment services, according to the analyst’s assessment. The analyst noted that Bitcoin’s high price volatility limits its use as a daily payment method.

Stablecoins are pegged to fiat currencies and maintain stable value, making them more likely to be used as a medium of exchange and payment, Hardman said.

The comments come as interest in Bitcoin and cryptocurrencies continues to expand globally, with financial institutions increasingly evaluating various digital asset classes for potential use cases.

Crypto World

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Buys 18,333,334 qONE Tokens

HYLQ Strategy Corp has completed a strategic digital asset investment in qLABS, acquiring qONE tokens in an over-the-counter transaction with the Quantum Labs Foundation.

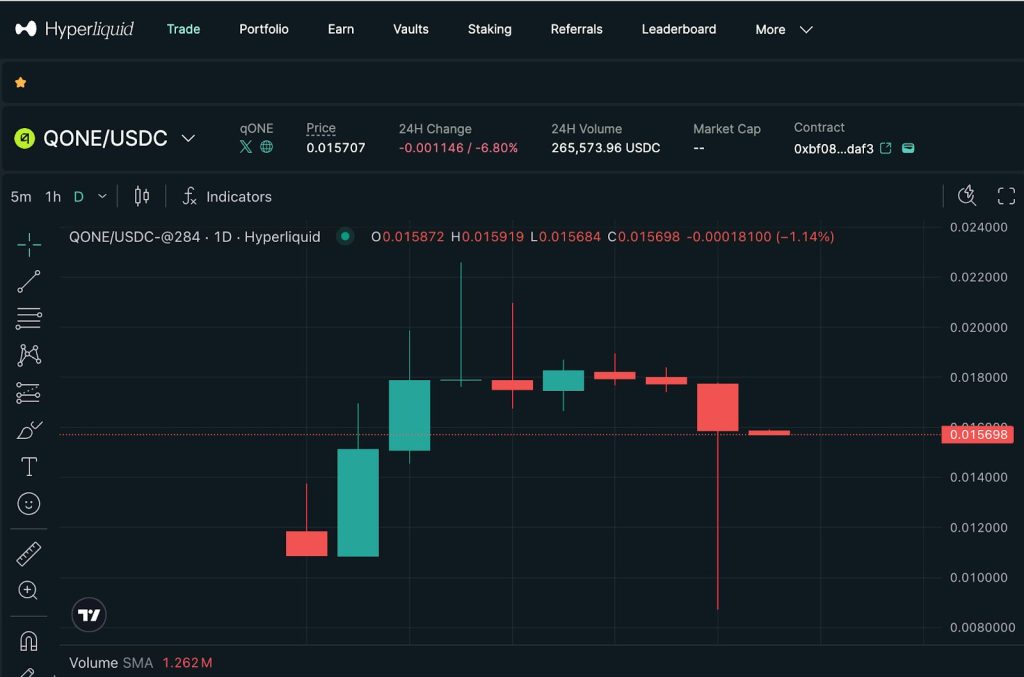

The qONE token trades on the booming Hyperliquid platform and is the native token of the qLABS ecosystem. HYLQ Strategy is the second public company to invest in quantum-safe tokens. qLABS partner 01 Quantum, as a founding member, is also a holder of qONE tokens.

According to the terms of the agreement shared in a company press release, HYLQ purchased 18,333,334 qONE tokens for an aggregate purchase price of $0.006 in an investment totalling $100,000, inclusive of bonus tokens.

The transaction was executed directly with the Quantum Labs Foundation and settled in USDC. This strategic investment represents HYLQ’s commitment to supporting quantum-resistant infrastructure within the Hyperliquid ecosystem, making this the first institutional investment in quantum-safe cryptographic solutions built natively on Hyperliquid.

qLABS is the world’s first quantum-native crypto foundation, developing blockchain solutions resistant to quantum computing threats.

qLABS Launching Quantum-Safe Protection for Digital Assets

The foundation will launch the Quantum-Sig smart contract wallet to provide quantum-safe protection for digital assets at the user and asset level.

A separate L1 Migration Toolkit is in the works. Its design will help Layer-1 blockchains transition their core infrastructure to quantum-resistant cryptography ahead of Q-Day. Q-Day is the anticipated moment when quantum computers become powerful enough to break current cryptographic systems.

The qONE token, launched on Hyperliquid on 6 February 2026, serves as the ecosystem utility token, granting access to quantum-resilient wallet functions, protocol governance, and the broader quantum-safe infrastructure developed by qLABS.

qLABS leverages IronCAP by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

HYLQ Strategy CEO Matt Zahab, commenting on the company’s investment in qLABS’ Quantum Labs Foundation, said:

“As quantum computing advances toward Q-Day, protecting crypto assets from quantum threats is becoming increasingly critical.”

He added: “qLABS is building essential quantum-resistant infrastructure natively on Hyperliquid, addressing a systemic risk that threatens the entire blockchain industry. This investment aligns perfectly with HYLQ’s mandate to support innovative companies within the Hyperliquid ecosystem that are building foundational infrastructure for the future of decentralized finance.”

HYLQ Stock Price is up 28.5% YTD

Year-to-date, HYLQ Strategy (HYLQ:CNSX CA) stock is up 28.5% at CAD0.90. In addition to its primary Canadian listing, the stock also trades over-the-counter in the US (HYLQF: OTCMKTS US). HYLQ is not to be confused with the competing digital asset treasury company, Hyperliquid Strategies (PURR), which trades on the Nasdaq.

How qONE’s staking plans could provide an income stream for HYLQ shareholders

According to Ada Jonuse, Executive Director at qLABS, qONE owners will be able to stake their tokens to earn yield and acquire protocol governance rights.

This means that HYLQ – at some point in the future – may be able to generate yield for its shareholders as a direct result of its $100,000 investment in qONE. An exact date for staking going live is yet to be revealed.

“Staking and governance participation are features to be enabled further down the roadmap when our core products are live and implemented in a full operational environment,” Jonuse explains.

“Because our 100% focus lies on security, in the early stage of the ecosystem, key decisions will be taken by the core team with gradual decentralization envisioned over the years.”

The centralization risk is acknowledged and mitigated through staking-based governance participation, time-weighted and activity-weighted voting, and progressive decentralization as emissions and unlocks occur.

Governance is expected to decentralize meaningfully as protocol usage grows.

Staking rewards will be set dynamically, which means yield is determined by the size of the staking pool, protocol usage, and fee generation, as well as the staker’s proportional contribution.

Jonuse says this approach “aligns incentives with real economic activity rather than fixed inflation.”

The price of the qONE token has been on a bullish run since launch, but the discounted token price offered to HYLQ triggered a sharp pullback, followed by an equally sharp bounceback. qONE was trading at $$0.01569 in the European morning session.

Why launching qONE on Hyperliquid was probably a smart move

Since last year’s 10 October record liquidation event, which wiped out $19 billion in value and marked the start of the current bear market, Hyperliquid and its native HYPE token have decoupled from other crypto assets.

While Bitcoin and Ethereum struggle with institutional outflows, retail investor apathy, and stagnant price action, HYPE surged to new highs, recently trading around $30.05.

YTD Performance Comparison (1 Jan – 17 Feb 2026)

Launching on Hyperliquid is looking increasingly like a very smart move by the qLABS team. As Jonuse points out, “Hyperliquid is a top player in DeFi and soon a venue for trading pretty much all assets on-chain.

“While Quantum-Sig wallet technology will protect any EVM or Solana assets, and our core innovation can be used to upgrade any smart contract-based chain, we are launching on Hyperliquid to highlight the importance of this chain.

“Launching $qONE on Hyperliquid positions us at the intersection of cutting-edge security infrastructure and an actively expanding ecosystem, allowing $qONE to benefit not only from technical alignment but also from narrative-driven adoption and visibility.”

The post HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Buys 18,333,334 qONE Tokens appeared first on Cryptonews.

Crypto World

Grayscale Sui Staking ETF launches on NYSE Arca with staking

Editor’s note: In today’s rapidly evolving digital asset landscape, Grayscale’s new GSUI ETF adds a familiar avenue for investors to access SUI and participate in its staking dynamic. The move signals growing mainstream interest in scalable, real-world blockchain applications and the potential for staking-driven returns within an ETF wrapper. This note provides context on the implications for investors, regulators, and the broader ecosystem.

Key points

- Grayscale Sui Staking ETF (GSUI) begins trading on NYSE Arca.

- Investors gain exposure to SUI and staking rewards through an ETF.

- GSUI is not registered under the Investment Company Act of 1940 and carries higher risk; not suitable for all investors.

- Sui aims to enable real-world, scalable applications with parallel transaction processing.

Why this matters

As blockchain networks mature and institutional interest grows, products like GSUI offer a familiar market-access mechanism for exposure to a high-potential ecosystem. By combining SUI token exposure with staking mechanics inside an ETF wrapper, Grayscale signals continued momentum for real-world digital assets and their use cases in finance, gaming, and beyond.

What to watch next

- Trading liquidity and price performance of GSUI on NYSE Arca.

- Actual staking rewards realized by the fund and their impact on NAV.

- Adoption of the Sui ecosystem and related applications across industries.

- Regulatory and market developments affecting non-40 Act ETFs.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Grayscale® Sui Staking ETF (Ticker: GSUI) Launches on NYSE Arca with Staking

GSUI Delivers Targeted Exposure to Sui, the Next-Generation Smart Contract Platform

STAMFORD, Conn., February 18, 2026 – Grayscale, the world’s largest digital asset- focused investment platform*, today announced Grayscale® Sui Staking ETF (Ticker: GSUI), has begun trading on NYSE Arca, offering investors exposure to SUI while seeking to capture staking rewards generated through participation in the Sui network. Grayscale Sui Staking ETF (“GSUI” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GSUI is subject to significant risk and heightened volatility. GSUI is not suitable for an investor who cannot afford the loss of the entire investment. An investment in GSUI is not a direct investment in SUI.

Built by an industry-renowned team previously responsible for Facebook’s Diem project**, Sui is a fast, low-cost blockchain built to deliver the seamless digital experiences people expect from modern apps, on a network designed for real-world use. By processing multiple transactions in parallel, Sui is intended to offer blockchain applications at internet-level speed. It also has distinct features that allow for ease of use, like simple wallet logins through Gmail and continued functionality even when users are offline***.

Since its launch, Sui has rapidly expanded as a technology stack, rebuilding core infrastructure to allow developers to create sophisticated and highly valued applications.

In addition to providing investors exposure to SUI, GSUI is designed to participate in network staking, a core mechanism that supports the security and operation of the Sui blockchain. Staking rewards, net of applicable fees and expenses, may be reflected in the ETP’s net asset value, offering investors a potential additional source of return beyond price appreciation.

“GSUI’s launch on NYSE Arca marks an important milestone in expanding the range of exchange-traded products tied to the Sui ecosystem, including exposure to potential staking rewards,” said Krista Lynch, Senior Vice President, ETF Capital Markets, at Grayscale. “GSUI is structured to provide investors with exposure to SUI and its staking activity through an ETP, offering a convenient way to gain exposure to a network designed for scalable, real-world applications, and the next generation of digital experiences.”

As adoption expands across finance, gaming, AI, and consumer apps, Grayscale expects Sui to continue positioning itself to power a broad range of real-world digital experiences.

“This milestone further cements Sui’s growing role in the institutional adoption of digital assets, as Sui is backed with both the infrastructure required to support real-world applications at scale and the trust of leading financial partners,” said Adeniyi Abiodun, Chief Product Officer and Co-Founder at Mysten Labs, the original contributors to Sui.

“GSUI provides traditional investors with a streamlined way to access the SUI token and participate in its network activity through a familiar exchange-traded structure.”

Grayscale® Sui Trust ETF first launched as a private placement to eligible accredited investors in August 2024 and received its public quotation in November 2025. For more information about GSUI, please visit: https://etfs.grayscale.com/gsui

About Grayscale

Grayscale is the world’s largest digital asset-focused investment platform* with a mission to make digital asset investing simpler and open to all investors. Founded in 2013, Grayscale has been at the forefront of bringing digital assets into the mainstream. The firm has a long history of firsts, including launching the first Bitcoin and Ethereum exchange traded products in the United States. Grayscale continues to pioneer the asset class by providing investors, advisors, and institutional allocators with exposure to more than 45 digital assets through a suite of over 40 investment products, spanning ETFs, private funds, and diversified strategies. For more information, please follow @Grayscale or visit grayscale.com.

*Largest digital asset-focused investment platform based on asset under management (“AUM”) as of September 30, 2025. For other companies in this category, AUM is considered as of most recent public disclosure.

**Young Platform. (n.d.). Sui: What it is and how it works. Young Platform Academy.

***CoinGecko. (n.d.). What is Sui blockchain?. CoinGecko Learn.

Please read the prospectus carefully before investing in Grayscale Sui Staking ETF

(“GSUI” or the “Fund”). Foreside Fund Services, LLC is the marketing agent for the Fund and Grayscale Investments Sponsors, LLC is the sponsor.

As a non-diversified and single industry fund, the value of the shares may fluctuate more than shares invested in a broader range of securities. There is no guarantee that a market for the shares will be available, which will adversely impact the liquidity of the Fund.

Sui is a delegated proof-of-stake (DPoS) blockchain that relies on a distributed network of validators to confirm transactions and secure the network. Validators’ voting power (and participation in the active set) is determined by the amount of SUI staked to them by token holders through delegation.

Staking Risk. When the Fund stakes SUI, SUI is subject to the risks attendant to staking generally. Staking requires that the Fund lock up SUI for the period of time required by the staking protocol, meaning that the Fund cannot sell or transfer the staked SUI , thereby making it illiquid for the period it is being staked. Staked SUI is also subject to security breaches, network downtime or attacks, smart contract vulnerabilities, and validator or custodian failure or compromise, which can result in a complete loss of the staked SUI or a loss of any rewards. Potential staking rewards are earned by the Fund and not issued directly to investors.

SUI may have concentrated ownership and large sales or distributions by holders of SUI could have an adverse effect on the market price of such digital assets. The value of the Fund relates directly to the value of SUI, the value of which may be highly volatile and subject to fluctuations due to a number of factors. Because the value of the Fund is correlated with the value of SUI, it is important to understand the investment attributes of, and the market for, SUI. Please consult with a financial professional.

Media Contact

press@grayscale.com

Client Contact

866-775-0313

info@grayscale.com

Crypto World

Ethereum price prints bearish pennant as breakdown risk grows

Ethereum price is compressing into a tight bearish pennant, with declining volatility and converging structure signaling that a decisive move is approaching as downside risks continue to build.

Summary

- Bearish pennant structure suggests continuation risk, not reversal

- Volume expansion is required to confirm a valid breakdown

- $1,740 swing low is the key downside target, if support fails

Ethereum (ETH) price action is approaching a critical inflection point as the market compresses into a well-defined pennant structure. Periods of tightening range and declining volatility often precede strong directional moves, and in Ethereum’s case, the broader technical context leans bearish. The prevailing trend remains to the downside, with the market printing consecutive lower highs and lower lows before entering consolidation.

This consolidation phase is not random. Instead, it reflects a pause in momentum as buyers and sellers temporarily reach equilibrium before the next expansion. Given the bearish trend preceding this structure, the current pennant formation increases the likelihood of downside continuation rather than a reversal.

Ethereum price key technical points

- Bearish pennant structure is clearly defined, with converging support and resistance

- Prevailing trend remains bearish, favoring downside resolution

- $1,740 swing low is the key downside target, if breakdown is confirmed

Ethereum’s current structure fits the classic definition of a pennant formation. Support and resistance are converging, forcing price into a tightening range that is approaching an apex. This compression phase reflects declining volatility, which is often visible on both price action and the volume profile.

Historically, pennants tend to resolve in the direction of the prior trend. In Ethereum’s case, the move leading into this consolidation was clearly bearish, marked by sustained selling pressure and weak follow-through on relief rallies. As a result, the probability favors a continuation lower once the structure resolves.

The closer price trades toward the apex, the more likely it is that volatility will return abruptly. Pennant breakouts are often sharp, leaving little room for reaction once the move begins.

Volume behavior is the key confirmation signal

One of the most important factors to monitor during pennant formations is volume. Ethereum’s consolidation has been accompanied by declining volume, which is typical during compression phases. This contraction in volume reflects reduced participation as traders wait for confirmation of direction.

For a bearish breakdown to be considered valid, it must be accompanied by increasing bearish volume. A strong expansion in sell-side volume would confirm that sellers are regaining control and that the breakout is not a false move. Without this confirmation, any break risks being short-lived or reversing back into the range.

Volume, therefore, will be the deciding factor in determining whether Ethereum’s next move develops into a sustained trend or a temporary spike.

$1,740 swing low comes into focus

If Ethereum breaks down from the bearish pennant with volume confirmation, the next major downside target sits at the $1,740 swing low. This level represents the most recent structural low and a natural magnet for price if downside momentum accelerates.

Markets often revisit prior swing lows during corrective or continuation phases to test demand and clear remaining liquidity. A move toward $1,740 would align with the broader bearish structure and reflect a continuation of the prevailing trend.

How price reacts at that level will be critical. A sharp rejection could lead to a short-term bounce, while acceptance below it would expose Ethereum to deeper downside risk.

Market structure remains bearish

From a market structure perspective, Ethereum has not yet shown signs of reversal. Lower highs remain intact, and no meaningful reclaim of resistance has occurred. Until price breaks above the upper boundary of the pennant and holds with volume, rallies should be treated as corrective rather than trend-changing.

This reinforces the idea that the current pennant is more likely a continuation pattern than a base for reversal. Structural confirmation will only come after the market resolves decisively out of compression.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Ethereum is approaching a moment of expansion. The bearish pennant suggests that the market is storing energy for a directional move, with downside continuation favored due to the prevailing trend.

In the near term, traders should expect increased volatility as price reaches the apex of the structure. A breakdown backed by strong bearish volume would legitimize a move toward the $1,740 swing low. Conversely, a lack of volume or a failed breakdown would signal continued consolidation.

Until proven otherwise, Ethereum remains vulnerable to downside continuation, and the next breakout from this pennant is likely to define short-term market direction.

Crypto World

Hyperliquid starts DeFi lobbying group in U.S. with $29 million HYPE token backing

Hyperliquid (HYPE), a blockchain-based exchange that processed more than $250 billion in perpetual futures trading last month, has launched a U.S. lobbying and research arm aimed at shaping how lawmakers regulate decentralized finance (DeFi).

The Hyperliquid Policy Center, a Washington, D.C.-based nonprofit, will focus on regulatory frameworks for decentralized exchanges, perpetual futures and blockchain-based market infrastructure, according to a Wednesday press release.

Jake Chervinsky, a prominent crypto lawyer and former policy head at the Blockchain Association, will serve as founder and CEO.

The launch comes as Congress and federal agencies debate how to oversee crypto trading platforms and derivatives markets. Perpetual futures, which allow traders to hold leveraged positions without an expiration date, are widely used on offshore venues but remain a gray area under U.S. law.

The arrival of a new group also represents just the latest entrant into a Washington crypto-policy scene that’s jammed with similar organizations, including the DeFi Education Fund and Solana Policy Institute, in addition to the broader groups such as the Digital Chamber, Blockchain Association and Crypto Council for Innovation. And the new organization lands as negotiation is well underway on Senate legislation that may set U.S. DeFi policy.

Hyperliquid operates a decentralized exchange that lets users trade perpetual futures directly on blockchain rails without a central intermediary. Instead of routing trades through a traditional broker or clearinghouse, transactions settle onchain.

The platform has emerged as one of the fastest-growing venues in crypto derivatives. It handled more than $250 billion in perpetual trading volume and $6.6 billion spot volume over the past month, DefiLlama data shows.

“Financial markets are migrating onto public blockchains because they offer efficiency, transparency and resilience that legacy systems cannot match,” Chervinsky said in a statement.

“Now the United States must choose: We can either adopt new rules that allow this innovation to flourish here at home, or we can wait and watch as other nations seize the opportunity,” he added.

The new policy group plans to brief lawmakers, publish technical research and advocate for rules tailored to decentralized systems, the press release said.

The Hyper Foundation, which supports the Hyperliquid ecosystem, is contributing 1 million HYPE tokens, worth roughly $29 million, to fund the launch. While that’s less than was committed to the launch last year of the Ripple-backed National Cryptocurrency Association, it’s much more than the $5.6 million the Digital Chamber spent in 2024 or the $8.3 million spent by the Blockchain Association, according to public filings.

Crypto World

BTC will make new records as Fed responds to AI-related credit collapse

BitMEX co-founder Arthur Hayes says bitcoin’s recent 52% crash from its October all-time high is flashing a critical warning signal — but the crypto could ultimately soar to new records once the Federal Reserve responds to an AI-driven banking crisis he believes is imminent.

In his latest essay, “This Is Fine,” Hayes argued that bitcoin’s divergence from traditional tech stocks reveals its role as the “global fiat liquidity fire alarm.” While the Nasdaq has remained relatively flat, bitcoin has plunged from $126,000 to its current $67,000, pricing in what Hayes describes as a massive credit destruction event that equity markets have yet to acknowledge.

“Bitcoin is the most responsive freely traded asset to the fiat credit supply,” Hayes wrote. “The divergence recently between bitcoin and the Nasdaq sounds the alarm that a massive credit destruction event is nigh.”

Hayes models a scenario where artificial intelligence displaces just 20% of America’s 72.1 million knowledge workers, triggering approximately $557 billion in consumer credit and mortgage defaults — about half the severity of the 2008 financial crisis. This AI-driven shock would devastate regional banks and force the Federal Reserve into “the biggest money printing in history,” he predicts.

“Deflation is bad, but ultimately good for fiat credit-sensitive assets like Bitcoin,” said Hayes. “First, the market prices the impact … Then … the monetary mandarins panic and press that Brrrr button harder than I shred pow the morning after a one-meter dump.”

Hayes noted gold’s recent gains, particularly against bitcoin, as another red flag, stating that “a surging gold versus a slumping Bitcoin clearly tells us that a deflationary risk-off credit event within Pax Americana is brewing.”

Hayes said that once the Fed intervenes with emergency liquidity measures — similar to the March 2023 response to regional bank failures — bitcoin will “pump decisively off its lows” and the expectation of sustained money printing will drive it to new all-time highs.

That doesn’t mean there won’t be more pain ahead for the foreseeable future, said Hayes. He warned bitcoin could fall further before the Fed acts, potentially breaking below $60,000 as political dysfunction delays the central bank’s response. Crypto investors, he advised, should stay liquid, avoid leverage, and “wait for the all-clear from the Fed that it’s time to dump filthy fiat and ape into risky assets with wanton abandon.”

Crypto World

Nexus to Launch Revenue-Sharing USDx Stablecoin

The stablecoin is built in collaboration with M0 and returns T-bill yields to ecosystem applications.

Upcoming Layer 1 blockchain Nexus has unveiled its native rewards stablecoin, USDx.

USDx will serve as the Nexus ecosystem’s native dollar and will implement a Global Yield Distribution System (GYDS), under which applications that hold USDx earn a share of protocol revenue based on their users’ USDx holdings.

The design is intended to provide yield as a revenue stream for the ecosystem’s application layer, incentivizing each underlying protocol to integrate USDx.

Through USDx, Nexus aims to unify its ecosystem around a shared currency layer that aligns its applications and incentivizes them to drive conversions of USDT and USDC to USDx.

Nexus focuses on “verifiable finance,” where every layer and transaction in the ecosystem can be independently verified via cryptographic proofs without sacrificing privacy. The design is built on Nexus’ zero-knowledge virtual machine (zkVM), enabling verifiability without disclosing individual users’ sensitive information.

Nexus raised $27.2 million over two investment rounds between December 2022 and June 2024, with a seed round led by Dragonfly, and a Series A led by Pantera and Lightspeed.

CEO Daniel Marin told The Defiant that USDx is fully backed by U.S. Treasuries, but did not disclose an exact formula for how the yield will be distributed. “Applications and users that receive USDX-generated yield will do so according to their contributions to the protocol, such as TVL and volume, and as determined from time-to-time by the protocol’s monetary policy,” Marin said.

Marin did not directly explain why the yield is distributed to the application layer rather than to users who exchange their legacy stablecoins for USDx.

“USDx gives us the opportunity to create a new kind of economic design that allows Nexus to support decentralized governance, onchain activities, as well as yield streaming, all with the goal of building a system that aligns incentives for the protocol, developers, and users,” he said.

Crypto World

Pi Network (PI) News Today: February 18

We will also review the latest price performace of the PI token, which has been rather impressive after last week’s crash.

The Core Team issued an important reminder about a deadline that has now past and the community is expecting updates on the nodes front.

We will also take a look at some of the criticism of the project, as well as the PI’s price resurgance.

Pi Network’s Latest Deadline

Recall that at the end of the previous business week, the team behind the protocol issued an important reminder for Pi Network nodes, describing them as the “fourth role” in the ecosystem. The reason for the February 15 deadline is because the team promised a new series of upgrades to be introduced soon. Nodes had to comply by that date; otherwise, they risked being disconnected from the network.

All nodes were prompted to use laptops or desktops instead of mobile phones. Although the deadline has passed now, the team has yet to publish any additional information about the number of nodes that have completed the necessary step or provide any extensions.

Criticism Grows

On the first Friday of February, the Core Team said they celebrated Pi Network moderators. They published a designated video praising this vital part of the overall ecosystem, indicating that moderators are volunteers not employed or paid by the official Pi Network team, who help moderate chats, answer Pioneers’ questions, monitor Pi apps and products, report bugs, and test new features.

The project’s community, though, was not in a celebratory mood. Many criticized the Core Team for a lack of transparency, clear planning, and failure to implement working KYC solutions. Some urged the team to “speed up the progress” and stop messing around with “all that superficial nonsense.” Others said they had been waiting for over seven years to migrate their Pi coins to no avail.

Separately, one user going by the X handle ‘pinetworkmembers’ addressed the PI token’s massive price calamity and drop to new all-time lows of $0.1312 last week. They blamed the team for failing to introduce a “functioning mainnet after years of promises, no real-world utility beyond ‘keep the app open,’ and a whole lot of mobile mining theater.”

You may also like:

PI’s Revival

As mentioned above, the project’s native token was hit hard during the broader market’s correction last week, plunging to a fresh low. However, while the cards were stacked against it, PI went on an impressive run in the following days and rocketed to over $0.20 during the weekend, prompting other Pioneers to celebrate the revival.

One popular analyst predicted a massive 500% surge, and hinted about buying some PI “for the midterm.” As of press time, PI remains the top performer on a weekly basis, having jumped 40% despite retracing to under $0.19.

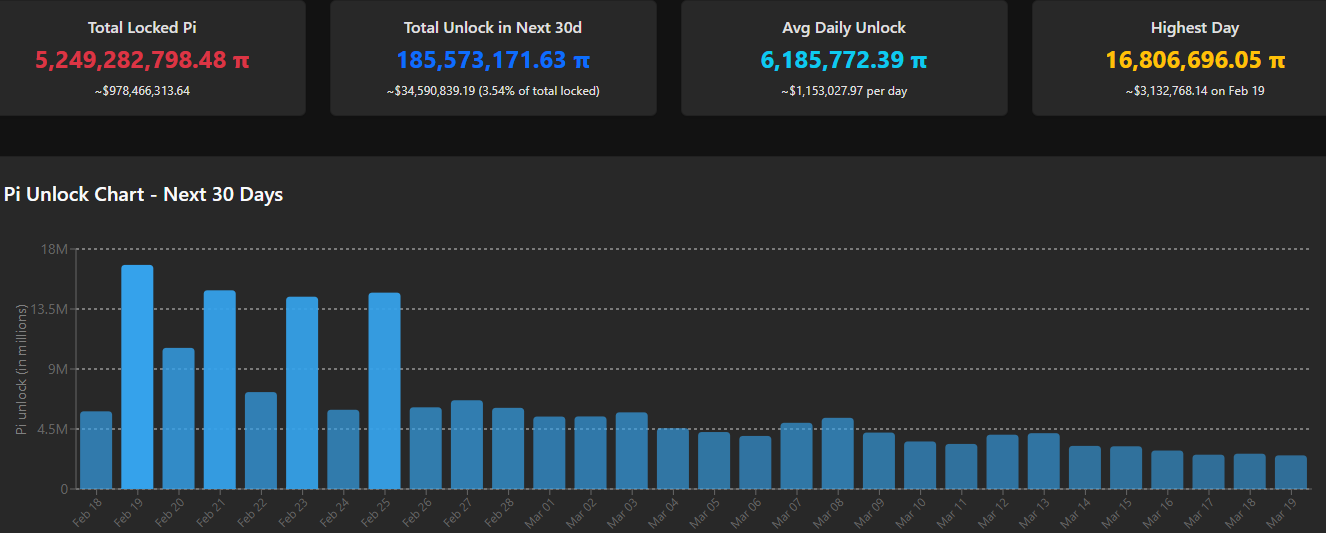

PiScan data shows a sizeable reduction in the number of coins to be unlocked on average in the following month, down to under 6.2 million daily from well over 7.5 million last week. This could further ease the asset’s immediate selling pressure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Brevan Howard’s crypto fund lost 30% in 2025 in worst year since inception: FT

Investment manager Brevan Howard’s cryptocurrency fund fell almost 30% last year as the bitcoin bull run faltered, the Financial Times (FT) reported on Wednesday.

The BH Digital Asset fund lost 29.5% of its value, its worst performance in a calendar year since its inception in 2021, according to the report, which cited people familiar with the fund’s performance. The fund underperformed bitcoin, which lost 6% in the period.

BH Digital Asset, which invests in crypto tokens and digital asset-related companies, enjoyed gains of 43% and 52% in 2023 and 2024, respectively, as the crypto market recovered from the lows of 2022 and the bitcoin price eclipsed $100,000 in December 2024.

“There are a lot of private equity and venture capital type instruments [in BH Digital Asset],” said one hedge fund investor, according to the FT’s report. “They have underperformed bitcoin but to give them credit, last year was terrible for crypto.”

Brevan Howard did not immediately respond to CoinDesk’s request for further comment.

Crypto World

Moonwell’s ‘vibe-coded’ oracle in $1.8M blowup

It was only a matter of time before “vibe-coded” smart contracts led to a significant loss of funds and on Sunday, an oracle misconfiguration led to users of DeFi lending platform Moonwell being liquidated for a total of 1,096 Coinbase Wrapped Staked Ether (cbETH).

The protocol was also saddled with $1.8 million worth of bad debt as a result.

The error was introduced in pull request 578, submitted by Moonwell core contributor “anajuliabit” and co-authored by Claude Opus 4.6.

Including this incident, Moonwell has suffered three oracle malfunctions in the past six months, leading to over $7 million in bad debt.

Read more: Claude AI plugins can now vibe code smart contracts

cbETH = $1.12

Moonwell’s post-mortem report states that, this time, the issue lies in calculating the dollar price of cbETH.

“The oracle used only the raw cbETH/ETH exchange rate. This misconfiguration caused the oracle to report cbETH’s price as approximately $1.12 (reflecting the cbETH/ETH ratio of ~1.12) rather than the intended market value of roughly $2,200,” the report explains.

As a result, the error “wiped out most or all of the cbETH collateral for many borrowers.”

A total of 1,096 cbETH was liquidated. In turn, $1.78 million worth of bad debt was generated for the protocol.

Monitoring systems picked up the discrepancy and strict borrow and supply caps were set to prevent further interaction.

Despite this, liquidation of existing positions continued. Any oracle correction requires “a five-day governance voting and timelock period, which could not be bypassed.”

Trading Strategy’s Mikko Ohtamaa pointed out that “regardless of whether the code is written by an AI or by a human, these kinds of errors are caught in an automated integration test suite.”

He highlights that Claude can even write these tests itself, but that in this case “there was no test case for price sanity.”

Others highlighted the contributor’s GitHub profile which shows an extremely high workrate, over 1,000 commits in the past week.

Read more: Clawdbot creator Peter Steinberger: ‘Crypto folks, stop harassing me’

The dark side of the moon

Moonwell is a lending protocol active on the Base, Optimism, and Moonbeam networks. It holds around $90 million in total value locked (TVL), according to DeFiLlama data, down from a peak of $380 million in August last year.

Since then, the project has suffered a number of hiccups.

DeFi commentary account “Yieldsandmore” details two further incidents in recent months. The first came during last year’s infamous October 10 crash, when a pricing discrepancy between Chainlink feeds and decentralized exchanges on Base led to $12 million in liquidations and $1.7 million of bad debt.

The second came less than a month later, on November 4, when the $129 million Balancer hack had a knock on effect on Moonwell’s market-based wrsETH/ETH oracle, leading to $3.7 million of bad debt.

The two incidents were apparently exploited by the same attacker, who is “clearly constantly scanning Moonwell for extractable value.”

Previously, 2022’s $190 million Nomad Bridge hack devastated the protocol’s Moonbeam deployment, its sole instance at the time.

The incident saw TVL drop 80%, from over $100 million to just $21 million.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Sai Launches Perps Platform Combining CEX Speed with Onchain Settlement

[PRESS RELEASE – Panama City, Republic of Panama, February 18th, 2026]

Sai today launched Sai Perps, a perpetuals trading platform built to be as fast and intuitive as a centralized exchange with the transparency and self-custody of on-chain settlement. The platform features gasless transactions, removing friction for traders while maintaining full on-chain security.

Sai also unveiled Let’s Go Saicho, a one-month on-chain trading competition running from February 18 through March 19, 2026, with $25,000 in total prizes. The campaign is structured in two phases designed to reward both performance and participation: a PNL competition for profitable traders, followed by a first-come, first-serve “Be Early” phase for traders who engage early and hit a minimum volume threshold.

“On-chain markets shouldn’t require traders to compromise between speed and self-custody,” said Matthias Darblade, a Sai contributor. “Sai Perps is designed for active traders who want a clean, CEX-like experience, while still getting the transparency and settlement guarantees that only on-chain infrastructure can provide.”

Why Sai vs. Other Perps DEXs

Sai Perps is built around the premise: trading should be accessible without the usual friction of on-chain perps. Compared to existing perpDEXs, Sai stands out in many ways:

- CEX-like UX, on-chain settlement: A streamlined trading experience designed to be fast and familiar, with trades settling on-chain for transparency and verifiability.

- Infrastructure built for deep, smooth markets: Sai has focused heavily on liquidity, risk systems, and oracle design to support more consistent execution and robust market integrity.

- Accessible to both new and experienced traders: A platform experience optimized for speed and clarity, without sacrificing advanced trading capability.

- Roadmap beyond crypto perps: Sai’s planned expansion includes stocks, commodities, and FX markets, plus user-focused capital efficiency features like Sai Savings (yield on deposits), and cross-chain deposits.

Let’s Go Saicho: $25,000 Trading Competition (Feb 18 – Mar 19, 2026)

Let’s Go Saicho is a one-month competition rewarding trading on Sai across two two-week phases:

- Phase 1 (Feb 18 – Mar 4): PNL Competition | $20,000 prize pool, 50 winners

- Phase 2 (Mar 5 – Mar 19): Be Early (First Come First Serve) | $5,000 prize pool, 50 winners

All markets listed on Sai are eligible in both phases. Traders may go long or short on any listed pair using supported collateral (e.g., USDC and other supported assets such as stNIBI, as available on Sai). For more details on Sai’s Trading Competition, visit here.

About Sai

Sai is a new perpetuals trading platform designed to feel as easy and fast as a centralized exchange, while still settling fully on-chain. Sai’s mission is to make advanced trading accessible without sacrificing transparency or self-custody.

Sai is focused on finalizing its core trading infrastructure and user experience, building liquidity and risk systems for smoother execution, and laying the groundwork for yield features that help users earn on idle collateral. Next on the roadmap: expanded markets (stocks, commodities, FX), Sai Savings, cross-chain deposits, and smart accounts for gasless trading.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business15 hours ago

Business15 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech6 hours ago

Tech6 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business8 hours ago

Business8 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Entertainment2 hours ago

Entertainment2 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal