CryptoCurrency

Bitcoin’s Crucial Liquidation Price Targets Eyeing Big Weekly Close

Bitcoin Approaches Year-to-Date Highs Amid Market Volatility

Bitcoin has edged closer to its annual peak, trading near significant resistance levels as traders anticipate potential liquidity-driven moves. The cryptocurrency experienced notable gains over the weekend, with prices climbing as traders react to geopolitical developments and macroeconomic uncertainties. As the weekly close approaches, market participants are closely monitoring order book liquidity and signals of possible breakout scenarios, amid signs of market caution and potential volatility triggers.

Key Market Dynamics and Price Action

- Bitcoin’s weekly close coincides with heightened market uncertainty following US-Venezuela news, which has influenced trader sentiment.

- The asset surged approximately 2% during the weekend, with the next key target around $92,000.

- Crucial levels of liquidity are observed below the yearly open at approximately $88,000, while resistance points above include $92,000 and $94,000 to $95,000.

- Thin order book air above $95,000 presents the possibility of a swift retest of the $100,000 mark, should momentum accelerate.

Market Sentiment and Technical Indicators

Recent weekly candle patterns have exhibited “fakeout” behavior, often signaling false breakouts and market whipsaws, as observed in previous trading cycles. A notable development is Bitcoin’s recent breakout from a symmetrical triangle pattern on the two-hour chart, with the crucial level of $90,000 successfully surpassed, hinting at potential bullish momentum. Traders such as Alan Tardigrade emphasize the importance of this breakout, suggesting that clear movement above this threshold could catalyze further gains.

Broader Macro and Geopolitical Context

As global markets brace for increased volatility, geopolitical tensions in Venezuela have significant implications for both traditional and crypto markets. The situation underscores the potential impact of macroeconomic shifts on asset classes, especially as Venezuela’s gold reserves—among the largest in Latin America—face increased scrutiny. Analysts warn that events in Venezuela could ripple across markets, influencing oil, gold, and cryptocurrency trajectories.

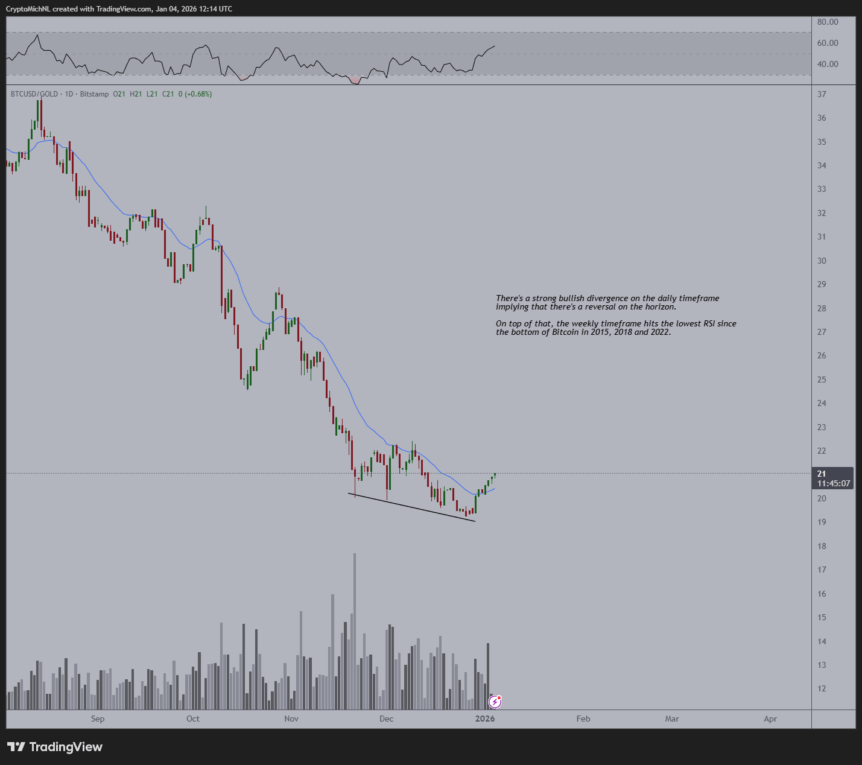

Comparative analysis shows Bitcoin maintaining an upward trend relative to gold, supported by technical indicators and declining weekly RSI levels, which suggest increasing buying momentum. Expert opinions point toward a potential bullish divergence, although confirmation requires higher highs and sustained momentum.

Overall market sentiment remains cautiously optimistic, as traders weigh technical signals against geopolitical risk factors. The convergence of macroeconomic developments, local geopolitical tensions, and technical breakouts paint a complex picture for Bitcoin’s near-term trajectory.

Investors continue to monitor order book depth and liquidity levels to gauge the likelihood of sustained gains versus potential reversals, with some analysts suggesting that the current environment favors a bullish retest of key resistance zones.