Crypto World

BitGo and Figure Execute First Blockchain-Native Equity Trades on Figure’s Alternative Trading System

TLDR:

- BitGo Bank & Trust, N.A. serves as qualified custodian within Figure’s OPEN on-chain public equity network.

- Figure’s OPEN network launched in February 2026, enabling equity issuance and trading on Provenance Blockchain.

- The BitGo–Figure integration separates custody from execution, preserving counterparty risk protections for institutions.

- Real-time on-chain settlement reduces reconciliation layers, lowering operational costs for broker-dealers and asset managers.

Blockchain-native equity trading reached a new milestone as BitGo and Figure completed their first tokenized equity trades.

The trades were executed through Figure’s Alternative Trading System, operating on the Provenance Blockchain. BitGo Bank & Trust, N.A. served as the qualified custodian within Figure’s Onchain Public Equity Network.

The integration brings regulated custody and near real-time settlement to on-chain public equities, offering institutions a more efficient trading framework.

OPEN Network Brings Regulated On-Chain Equity Infrastructure to Market

Figure’s OPEN network launched in February 2026 as a regulated electronic trading venue. It enables companies to issue and trade equity directly on blockchain infrastructure.

Issuance, trading, and settlement are embedded into a single on-chain environment. This removes multiple intermediary layers that traditionally slow down public equity markets.

BitGo Bank & Trust, N.A. operates as a qualified custodian within the OPEN framework. The bank safeguards assets and provides regulated infrastructure for all participants.

Its custodian role ensures compliance with existing financial regulations for institutions. Consequently, regulated participants can access blockchain-native equity within a familiar oversight structure.

The completed trades demonstrate how tokenized equities can function in a continuous on-chain environment. Settlement activity occurs in real time within a regulated framework on Figure’s ATS.

Trade records are also published directly on-chain, adding a layer of market transparency. This approach removes several reconciliation steps found in traditional market infrastructure.

Mike Belshe, CEO of BitGo, spoke directly to the partnership’s broader purpose for market participants.

“At BitGo, our goal is to provide institutions the infrastructure and ability to trade, secure and build on anything on-chain. Our partnership with Figure moves the industry in that direction with BitGo operating as the independent trust layer to reduce risk, increase transparency and instill confidence in continuous markets.”

Custody Separation and Cost Efficiency Support Institutional Participation

BitGo and Figure maintain a clear separation between custody and trade execution throughout their integration. This preserves the counterparty risk protections that traditional market structure depends on.

Institutions can therefore engage with blockchain-native equity without compromising governance standards. The model mirrors core principles from conventional finance while running on blockchain rails.

By cutting reconciliation layers, the integration reduces operational overhead for market participants. Capital efficiency also improves compared to traditional batch-based settlement systems.

Broker-dealers and asset managers can use this as a repeatable integration model. As a result, on-chain equity products become more accessible to a broader range of regulated institutions.

Mike Cagney, Figure’s Executive Chairman, addressed how qualified custody makes institutional engagement more practical.

“Partnering with BitGo brings qualified custody and institutional-grade controls to the OPEN on-chain public equity network. With instant settlement on Provenance and the potential to meaningfully reduce market-structure friction and costs, this is a concrete step toward modernizing how public equities trade and settle.”

Together, BitGo and Figure have established a scalable framework for blockchain-native equity markets. The model combines blockchain efficiency with governance standards that institutions already recognize and trust.

Crypto World

Polymarket acquires prediction market API startup Dome

Polymarket has acquired Dome, a Y Combinator-backed startup that is building a unified API solution for developers to access and build across multiple prediction market platforms.

Summary

- Polymarket has acquired Y Combinator-backed startup Dome.

- Dome offers a unified API for cross-platform prediction market access.

- It has raised $500,000 from Y Combinator and $4.7 million in seed funding.

The acquisition was confirmed by both companies in a Feb. 19 post on X, though neither side shared details about Dome’s future roadmap within Polymarket or how the team will be integrated. The financial terms of the deal were not disclosed.

According to details from Y Combinator, Dome was part of its Fall 2025 cohort and is developing a unified API for prediction markets through a single integration layer, where “developers can access live and historical data.”

“Dome makes it simple to trade, embed market data into products, and deploy strategies across multiple platforms through one interface,” it said.

Dome raised $500,000 from Y Combinator and secured a further $4.7 million in seed funding, according to details shared on the X profile of co-founder Kunal Roy, who, alongside Kurush Dubash, previously served as founding engineers at Alchemy.

“We’re obsessed with prediction markets and want to have the biggest impact in the space. There’s no better place to do that than Polymarket.” Dubash wrote on X.

Besides QCEX, a derivatives exchange and clearinghouse licensed by the U.S. Commodity Futures Trading Commission, which Polymarket acquired in a bid to re-enter the country, Dome marks the company’s first official acquisition focused on developer infrastructure.

Since it was greenlighted by the commission to operate an intermediated trading platform, Polymarket has secured multiple major partnerships with media brands like Yahoo Finance and Google Finance, alongside sports organizations such as Major League Soccer and the National Hockey League.

Last month, the company partnered with Parcl to launch a prediction market tied to real estate trends. It has also expanded onto the Solana blockchain through an integration with Jupiter and was recently added to the MetaMask mobile app, widening its retail distribution.

Crypto World

Bitcoin May See Upside After AI Stocks Become ‘Silly Big’

Bitcoin’s next major leg up could hinge on artificial intelligence stocks becoming excessively overvalued in the eyes of investors, according to macroeconomist Lyn Alden.

“It could be that the AI stocks eventually just peak, they get so silly big that they can’t get realistically much higher,” Alden told Natalie Brunell on the Coin Stories podcast published to YouTube on Thursday.

When an asset’s price rises to a level where further gains are harder to justify, capital often moves into other opportunities with more potential upside.

With Bitcoin (BTC) down almost 46% from its October all-time high of $126,100, Alden suggests it could be a beneficiary of that rotation.

Nvidia may be the “most important stock” in US, says exec

Some financial analysts are questioning whether the largest AI stocks will keep up their momentum in 2026. Albion Financial Group chief investment officer Jason Ware recently told Fox Business that he expects GPU chipmaker Nvidia (NVDA), the largest company on the Nasdaq stock exchange by market capitalization, to have “another great quarter,” but asked whether it will “be good enough.”

“We all know they are the most concentrated, obvious winner in the AI build out. Can that growth continue in a way that supports the stock moving higher?”

Nvidia’s (NVDA) stock price is up 35.48% over the past 12 months, according to Google Finance, and Ware said that it is “probably the most important company and most important stock in America in the market.”

The rise of investor interest in AI means that Bitcoin is now “competing for capital” in a way it never has before, Bitcoin developer Mark Carallo said on Thursday.

Bitcoin only needs a “marginal amount” of new demand

However, Alden said Bitcoin wouldn’t need a significant wave of capital to move higher. “It only takes a marginal amount of new demand to come in,” Alden said, adding that long-term holders essentially “put the floor in” as short-term traders rotate out.

“The coins rotate from fast money hands to strongly held hands; they are really not going to want to part with it unless it goes up like 5X or more, that kind of buyer,” she said.

Bitcoin is trading at $67,849 at the time of publication, down 24.49% over the past 30 days, according to CoinMarketCap.

Related: Bitcoin mining difficulty rebounds 15% as US miners recover from winter outages

Alden said she does not expect a quick, near-term surge in Bitcoin’s price.

“Bitcoin rarely makes V-shape bottoms outside COVID stimulus-type events,” she said, adding that it “normally it hits a low level then goes sideways for quite a while.”

“I think we’re in more of a grind,” Alden said, adding that it may move $10,000 lower or $20,000 lower, and it is still in that “grinding part.”

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Bitcoin Holds Near $67K as Traders Pay Up for Crash Protection in Options Markets

As Bitcoin struggles to hold $67,000, options markets are flashing warning signs as traders aggressively bid up downside protection to hedge against a potential capitulation event.

By early morning, UTC, BTC had climbed 1% over 24 hours to trade near $67,000, recovering from an uneasy dip below the $66,000 handle.

The setup remains precarious. Even as price action steadies, the average U.S. ETF investor is nursing a stinging 20% paper loss, with a cost basis near $84,000. This fragility comes after a brutal 47% drawdown from the October 2025 highs.

- BTC steadies near $67K, but options skew remains bearish.

- Average ETF investor sits on a 20% unrealized loss.

- Private credit stress (Blue Owl) adds macro headwinds.

While recent reports indicate Abu Dhabi government funds bought $1 billion in BTC, while BlackRock doubled down on mining infrastructure, signaling continued institutional appetite, the broader retail market remains skittish. Investors are haunted by the prospect of a complete washout.

Discover: The best crypto to diversify portfolios with

Are We Facing Capitulation?

Jake Ostrovskis of trading firm Wintermute notes that traders are now “paying for insurance,” buying puts to cap downside risk while limiting their upside participation. This defensiveness aligns with harsh statistical realities.

The leverage washout has been severe, with Bitcoin recently hitting -2.88 standard deviations below its 200-day moving average—an anomaly unseen in a decade according to VanEck analysis.

Contagion fears are actively resurfacing. Crypto lender Blockfills froze withdrawals after a $75 million lending loss, echoing the collapses of 2022.

Simultaneously, traditional markets are flashing red: private credit giant Blue Owl fell 6% after curbing redemptions. With Fed minutes recently warning of macro headwinds, risk-off behavior is dominating the narrative.

Despite the gloom, huge divergence exists in equities. Bitcoin miners CleanSpark and MARA rallied 6%, outperforming the tech-heavy Nasdaq 100 which slid 0.6%.

Discover: The best crypto presales on the market

What Happens Next for BTC Price?

From a technical standpoint, Bitcoin is fiercely defending the $66,000-$68,000 zone. If this level fails, the bearish triangle pattern suggests a slide toward $60,000 or even $55k, according to CryptoQuant.

However, alternate scenarios exist. Arthur Hayes points to treasury liquidity as a potential savior for risk assets.

Furthermore, long-term confidence hasn’t evaporated; Trump insiders recently confirmed a $1 million target, suggesting whales may view this dip as a generational accumulation zone.

For now, bulls will be hoping for a swift run back to $84k to give the ETF customers confidence.

The post Bitcoin Holds Near $67K as Traders Pay Up for Crash Protection in Options Markets appeared first on Cryptonews.

Crypto World

Bitcoin Bears Face $600M Liquidation Risk, Sparks $70K Rally

Bitcoin (CRYPTO: BTC) has traded in a narrow corridor, effectively flinging up a question mark over the next directional thrust for the market. The past week has seen the benchmark crypto oscillate between roughly $65,900 and $70,500, a range that has left traders parsing for catalysts amid a broader risk-off climate. While momentum has oscillated, the risk of a sudden liquidation cascade remains a live concern: a modest rally could force a wave of short-covering in futures, squeezing risk assets higher and drawing new buyers back into the market. Against this backdrop, the network’s fundamentals have shown resilience, even as macro data continues to shape sentiment.

Key takeaways

- A 4.3% rise to about $69,600 could trigger more than $600 million in forced liquidations on short BTC futures, according to liquidation heatmaps. This dynamic underscores how quickly sentiment can flip on a price move.

- Hashrate has rebounded toward multi-week highs, with the seven-day average hovering near 1,100 exahashes per second, challenging earlier fears that miners were diverting capacity away from BTC toward other sectors.

- The BIP-360 proposal aims to bolster long-term security by enabling post-quantum protection through a backwards-compatible soft fork, addressing concerns about quantum threats while preserving on-chain privacy until spending.

- Macro data in the United States showed slower growth than expected, with Q4 2025 GDP at an annualized 1.4%, while inflation remained persistent, complicating expectations for near-term rate cuts and potentially nudging traders toward on-chain hedges.

- Futures funding dynamics show continuing pressure from bears, with periods of negative funding and persistent undercurrents that keep the market sensitive to any upside surprise that could trigger a short squeeze.

Tickers mentioned: $BTC, $NVDA

Sentiment: Bearish

Price impact: Positive. A rally toward the $69,600 area could force substantial short liquidations and tilt momentum back toward bulls.

Trading idea (Not Financial Advice): Hold.

Market context: The market sits at a crossroads where macro weakness and on-chain resilience collide: macro data suggests a slower economy and sticky inflation, while the Bitcoin network shows signs of structural strength through rising hashrate and post-quantum security planning, a combination that could set up a short squeeze if price action turns decisively higher.

Why it matters

The immediate price action for Bitcoin is heavily tethered to traders’ expectations about liquidity and leverage in the futures market. When the price nudges, as it did toward the $69,600 region, liquidations—especially on short positions—become a dominant driver of momentum. In recent cycles, a sharp move higher from a tight range has repeatedly triggered a cascade of liquidations, squeezing out speculative bets and luring fresh capital back into the market. This mechanism is particularly potent when the market trades below psychologically important levels and a sudden uptick can trigger a cascade that shifts market psychology from pessimism to renewed risk appetite.

On the fundamental side, the resurgence of network hashrate to around 1,100 exahashes per second signals that participants remain confident enough to invest in BTC mining hardware despite external price pressures. This resilience is notable because it counters early fears that mining capacity might drain away toward other sectors, including AI. The reacceleration in hashrate contributes to a sense of on-chain security and network durability, factors that historically underpin longer-term valuations rather than short-term price skews.

Another dimension of the story is the technical roadmap embodied by BIP-360, a proposal designed to address post-quantum security risks without disrupting current operations. By safeguarding the spend-path and concealing public keys on-chain until spend time, this plan reduces the potential exposure to quantum computing threats while preserving privacy in ordinary conditions. If such a soft fork progresses smoothly, it could restore some bullish confidence by clarifying the long-term security narrative for Bitcoin, helping to offset near-term macro headwinds.

Meanwhile, macro data remains a headwind for many traditional assets. The United States posted GDP growth in the fourth quarter of 2025 at an annualized rate of 1.4%, below expectations, a development that tends to sap risk appetite in equities and dampen immediate expectations for aggressive monetary easing. Coupled with inflation data that showed the PCE price index excluding food and energy rising 0.4% month over month, investors have had to recalibrate their outlooks for rate trajectories. In this environment, on-chain markets can appear attractive to macro traders seeking uncorrelated or counter-cyclical exposure, even as the total market risk remains elevated.

Another layer to consider is the broader risk-off mood evident in traditional markets, including the S&P 500 and gold. As equities waver, gold has emerged as a potential hedge, but the relative stock-bond dynamic remains unsettled. The trading landscape—characterized by muted upside momentum yet persistent volatility—suggests that Bitcoin could act as a catalyst for a broader reallocation if fundamental improvements align with a technical breakout above key levels like $70,000.

In terms of funding dynamics, BTC perpetual futures have shown a mix of negative and neutral readings in recent sessions. This indicates that bears have remained committed to their positions even as price tests important supports. The combination of tighter funding and a risk-off tilt has kept upside momentum in check, even as the network-side improvements create a foundation for possible reversals should liquidity and sentiment align in favor of bulls.

For investors watching the space, the question remains whether this confluence of macro weakness, on-chain resilience, and a clearer security roadmap can coalesce into a sustainable rally or whether the market will continue to drift in a wide range until a new catalyst emerges. In the near term, the path of least resistance may hinge on the balance between fear of macro risks and the lure of a short squeeze driven by liquidations and forced unwindings on the downside bets.

In sum, Bitcoin remains at a pivotal juncture. The combination of a rebuilt hashrate, a tangible post-quantum roadmap, and an expected price re-pricing driven by liquidations could tilt sentiment in favor of bulls, but only if macro catalysts align and the market can sustain buying interest above critical thresholds. As traders monitor the interplay between on-chain fundamentals and macro headlines, the next move could redefine the near-term trajectory for BTC and potentially ripple through the broader crypto complex.

What to watch next

- Watch for a move back above $70,000 and the subsequent response in long vs. short positioning in BTC futures.

- Track the seven-day hashrate trend toward or above 1,100 EH/s and any updates on the deployment or consensus around BIP-360.

- Monitor U.S. macro releases, including GDP and PCE data, for potential shifts in risk appetite and liquidity conditions.

- Observe funding rates on BTC perpetual futures for signs of shifting trader sentiment or emerging short squeezes.

- Follow ETF flows and commentary around the Bitcoin investment vehicle landscape for potential liquidity influx or withdrawal pressures.

Sources & verification

- CoinGlass liquidation heatmap estimates for a move toward $69,600, illustrating potential short BTC futures liquidations exceeding $600 million.

- U.S. GDP growth for Q4 2025 at 1.4% annualized, as reported by Yahoo Finance.

- U.S. personal consumption expenditures price index ex food and energy rising 0.4% month over month, contributing to the inflation backdrop.

- HashrateIndex seven-day hashrate data showing a recovery to around 1,100 EH/s.

- BIP-360 post-quantum security framework and its intended soft-fork approach for hiding public keys on-chain until spending time.

- BTC perpetual futures funding rate observations from market data providers, including notes on recent negative funding periods.

Bitcoin price dynamics and network resilience

Bitcoin (CRYPTO: BTC) is navigating a delicate phase where on-chain security fundamentals converge with macro headwinds to shape the near-term path of least resistance. The range-bound price action has left the market vulnerable to abrupt shifts driven by leveraged positions, but it is precisely this dynamic that can catalyze swift reversals when liquidity returns and short positions are forced to unwind. CoinGlass estimates suggest that a move to around $69,600 could unleash substantial short liquidations, potentially flipping sentiment from fear to momentum if buyers reenter with conviction. This interplay between price, leverage, and liquidity remains a defining feature of the current market backdrop.

Beyond price, the on-chain story has gained clarity. The seven-day average hashrate has climbed back toward the high end of recent ranges, signaling ongoing mining activity and network resilience even in the face of price pressure. While early concerns that miners would pivot away from BTC toward other sectors have cooled, the resilience of hashrate underscores a broader risk-reward calculus: the network’s security and stability continue to be a central factor for long-term investors evaluating BTC’s role in diversified portfolios. The BIP-360 proposal further reinforces this narrative by addressing post-quantum threats through a backwards-compatible mechanism, significantly reducing the risk posed by quantum computing to on-chain security while preserving user privacy until spend moment.

Market participants are also weighing macro data that remains less than supportive of a rapid risk-on rebound. The GDP print and inflation metrics paint a picture of a still-fragile macro environment, where the quest for yield remains tempered and risk assets require a clear catalyst. In such an environment, Bitcoin’s potential for a short squeeze depends on a combination of technical breakouts, improved on-chain fundamentals, and a shift in risk sentiment—a trifecta that could redraw the balance of power between bears and bulls in the months ahead. Traders will be watching for sustained buying pressure above key levels, and the emergence of a decisive narrative that can both reassure existing holders and entice new entrants into the market.

As the market continues to digest these inputs, the path forward will likely hinge on how quickly macro volatility evolves and how effectively the Bitcoin ecosystem communicates its security and scalability roadmap to a broader audience. The balance between fear and opportunity remains delicate, but the confluence of improved network metrics, post-quantum safeguards, and the potential for liquidity-driven reversals means the coming weeks could redefine Bitcoin’s standing in the risk spectrum. For now, observers should remain cautious but attentive to any shift that could unleash a new cycle of momentum in this evolving market.

Crypto World

SBI Ripple Asia Partners With AWAJ to Drive XRPL Adoption Across Asia

TLDR:

- SBI Ripple Asia and AWAJ signed an MOU to provide XRPL technical support to financial startups in Asia.

- AWAJ already holds separate partnership agreements with JETRO and Ripple, expanding its regional influence.

- Support under the deal covers system design, security checks, and connections to existing financial infrastructure.

- The initiative targets globally scalable XRPL use cases, with Japan positioned as the development launchpad.

SBI Ripple Asia has signed a formal memorandum of understanding with Asia Web3 Alliance Japan. The partnership targets startups building financial services on blockchain technology.

Both organizations will work together to provide structured technical support. This marks a key step in expanding XRP Ledger adoption within Asia’s growing web3 sector.

SBI Ripple Asia and AWAJ Formalize Technical Support Framework for Blockchain Startups

The agreement focuses on supporting businesses that want to deploy financial services using XRPL.

SBI Ripple Asia brings deep experience in international remittance and payments infrastructure. AWAJ, meanwhile, operates as a venture studio connecting startups with investors and institutional partners.

According to the announcement, support will cover system configuration, technical design, and security verification. Each engagement will be handled through individual contracts between the parties involved. The scope of support will vary case by case.

SBI Ripple Asia is headquartered in Minato-ku, Tokyo, and is led by Representative Director Masashi Okuyama.

AWAJ is based in Chuo-ku, Tokyo, and is represented by Hinza Asif. The two organizations say this collaboration is premised specifically on the XRP Ledger.

AWAJ recently signed separate agreements with the Japan External Trade Organization and Ripple. Those deals have positioned it as a central node in Japan’s web3 ecosystem. The new MOU with SBI Ripple Asia adds another layer to that growing network.

XRPL Positions as Infrastructure of Choice for Asia’s Financial Innovation Push

The announcement highlights growing interest in blockchain-based financial services across the region.

However, it also acknowledges real barriers: regulatory complexity, security requirements, and business viability concerns. SBI Ripple Asia plans to help startups navigate all of these.

Technical support under this initiative will primarily reach startups in AWAJ’s innovation programs. These programs are designed to take early-stage ideas through proof-of-concept and into commercialization.

AWAJ describes its model as “hands-on,” going beyond simple networking.

The organizations say the goal extends beyond Japan. They aim to develop financial use cases on XRPL that can scale globally. Japan, in their framing, becomes the origin point for these internationally applicable solutions.

Per the official announcement, the partnership also envisions connection with existing financial systems, not just new blockchain infrastructure.

This practical framing sets it apart from more theoretical web3 initiatives. The emphasis stays on whether technology can function as a real financial service.

Crypto World

Will Bitcoin price crash to $60k as bearish double top coincides with 5-week ETF outflows streak?

Bitcoin price has formed a highly bearish pattern that hints at a potential crash to $60K as both institutional and retail confidence continued to erode in the legacy crypto asset.

Summary

- Bitcoin price is at risk of more downside after forming multiple bearish patterns.

- Searches for “Bitcoin going to zero” have hit an all-time high.

- Nearly $4 billion has left spot Bitcoin ETFs over past 5-weeks.

According to data from crypto.news, Bitcoin (BTC) price fell to an intraday low of around $65,700 on Thursday before bouncing back above $67,000 at press time. At this price, it remains 15% below its February high and down over 46% below its all-time high.

On the daily chart, the bellwether asset’s price action appears to have formed multiple bearish patterns.

Notably, Bitcoin price has charted a double top pattern, which is one of the most popular bearish patterns in technical analysis. Such a formation with two rounded tops has typically been marked with a downside equal to the height of the peaks from the neckline.

Bitcoin price has also formed a bearish pennant pattern, which appears like an inverted flagpole and is also another bearish signal indicating further continuation of the trend.

The convergence of both these bearish patterns at the same time significantly increases a bearish outlook for the asset in the coming sessions.

Adding to this, Bitcoin price currently lies below all of the key moving averages with a bearish crossover between the 20-day and 50-day SMA at play. Meanwhile, the Chaikin Money Flow index has also printed a negative reading of -0.06 at press time, suggesting capital outflows away from its market, a metric that suggests selling pressure is building across the board.

Hence, the path of least resistance points to a bearish prediction for Bitcoin, where bears could try to push the token price down towards the $60,000 mark, a level that is calculated by subtracting the height of the double tops formed from the breakout point.

Breaking below this key psychological support could position Bitcoin for a steeper drop towards $50,000.

Market sentiment shows heavy bearish overhang

The bearish narrative gains strength from the fact that retail sentiment already appears to have taken a negative turn.

According to Google Trends data, global searches for “Bitcoin going to zero” have reached a five-year peak, hitting a perfect 100 score on the relative interest scale. This surge in doom-scrolling interest matches levels last seen during the 2022 FTX collapse.

At the same time, the Crypto Fear and Greed Index, a metric that traders use to gauge market psychology, has remained under 10 for the past three days, marking extreme fear levels not seen for nearly two years.

Traders have accordingly positioned themselves with the overall market bias leading bearish, as evidenced by Bitcoin’s long-short ratio slipping below the 1.0 threshold, data from CoinGlass show.

ETF outflows extend into fifth week

Meanwhile, spot Bitcoin ETFs, which have been the primary engine that draws in institutional investment into the space, have also slowed down. Data from SoSoValue show that the 12 spot Bitcoin ETFs have recorded persistent outflows, extending what could become the first five-week outflow streak since last March.

These investment vehicles have lost nearly $4 billion in the period. For context, during the previous cycle, these ETFs had drawn in nearly $20 billion and significantly fueled Bitcoin’s rally towards fresh highs.

However, according to some analysts, a visit to $60k could also mark the bottom for the current cycle. This area coincides with the 200-week EMA, which has historically acted as a strong support level in past bear cycles.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

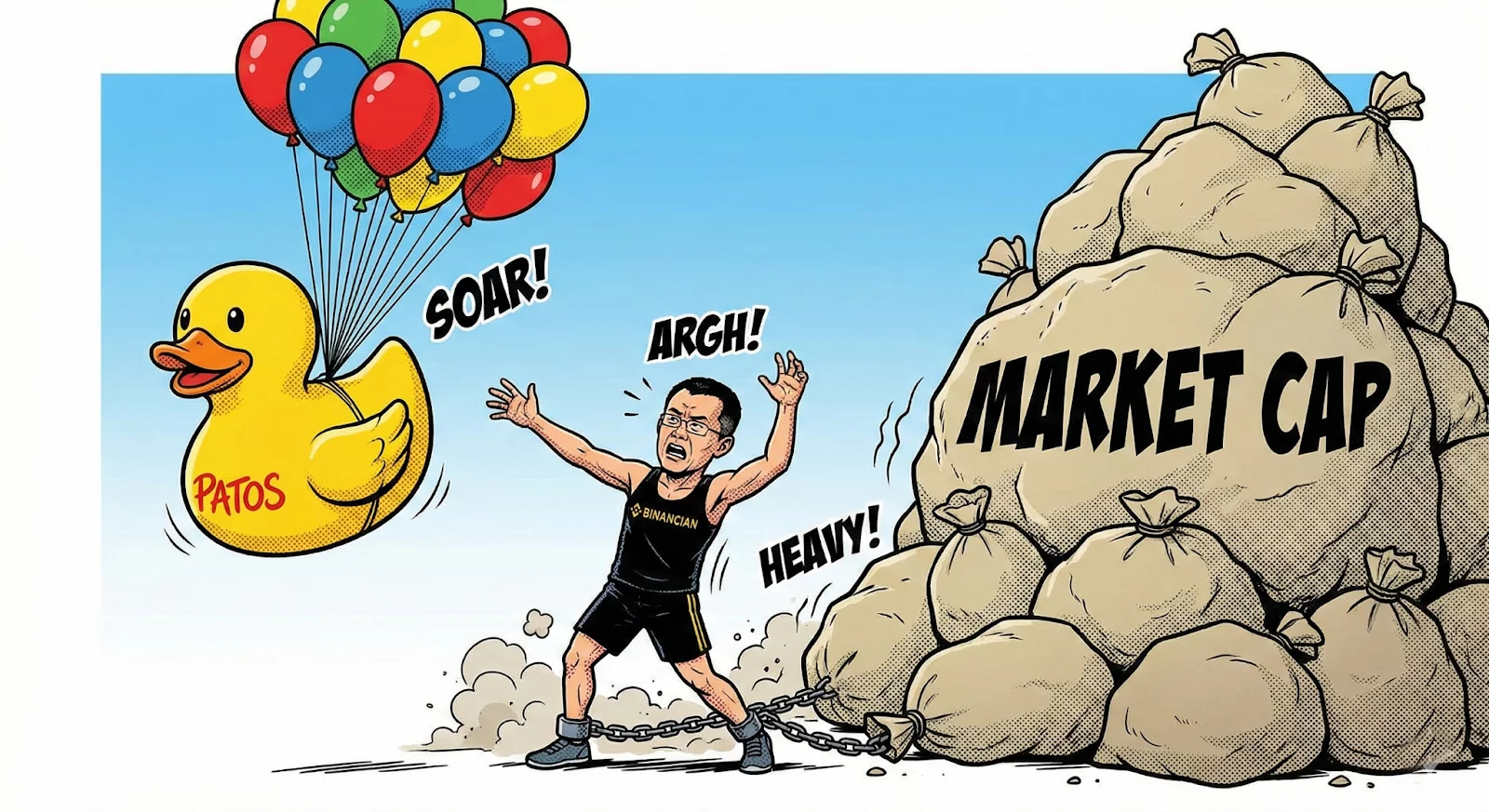

Searching for the next 100x gen, between BNB and Patos on Solana

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Patos Meme Coin token presale launched on December 18th of 2025, and current on-chain data confirms it is rapidly selling out its initial allocation at the foundational floor price of $0.000139999993.

For forward-looking investors seeking to bypass the congestion of legacy secondary markets, researching the mechanics of this high-velocity Solana token at PatosMemeCoin.com has become the defining prerequisite for Q1 2026 portfolio allocation.

The subculture wars: Binancians vs. The Flock

In the modern cryptocurrency ecosystem of 2026, value is dictated as much by communal fervor as it is by underlying cryptography. At the forefront of this tribal financial landscape are two of the most loyal cryptocurrency subculture followings: the “Binancians” and “The Flock.”

Binance Coin holders, proudly referring to themselves as Binancians, represent the old guard of the centralized exchange era. They are the investors who weathered the regulatory storms, the executives who utilize the BNB Chain for decentralized applications, and the traders who rely on BNB for fee discounts across the world’s largest exchange ecosystem. While Binance is much more established with a significantly larger global fanbase, market saturation has tempered their expectations.

In stark contrast, the Patos token holders — known colloquially as “The Flock” — are an insurgency of high-risk, high-reward capital allocators. They are much more fervent for success in February 2026, driven by the viral mechanics of Solana-based wealth generation.

The Flock is not interested in single-digit annual percentage yields; they are hunting for generational wealth. This comparative analysis posits a central thesis: between the entrenched Binancians and the hyper-aggressive Flock, which group is actually likely to see a 100X ROI first?

The anatomy of a Solana gem

Patos is the new Solana memecoin that currently commands a ‘ton of hype’ across decentralized finance (DeFi) message boards, alpha groups, and trading terminal chatrooms. Since ripping onto the scene on December 18th of 2025, it has systematically gained clout with heavy-hitting Solana Whales and most recently, crypto sharks. In less than two months, it has undeniably become Solana’s #1 crypto moon prospect.

The project is garnering more support from centralized crypto exchanges than any other token presale currently active on any blockchain — including the dominant forces of Ethereum, Binance, Solana, and Sui.

As investor FOMO (Fear Of Missing Out) spreads through the crypto degen trenches, the official token presale is moving over 14.5 million tokens daily. These sales averages are compounding weekly with strong upward momentum, creating a feedback loop of scarcity and demand. At this current rate of geometric growth, one prominent on-chain analyst report suggests its floor price offering could sell out completely well before its scheduled June 2026 end.

Smashing the legacy ceiling: The 111-exchange strategy

What elevates Patos Meme Coin from a standard speculative asset to a verified “Solana Gem” is its unprecedented infrastructural roadmap. Patos is aiming to smash crypto records with 111 crypto exchange listings in its first week of public trading. This is an institutional undertaking that is nearly 10x more ambitious than the launch of any noteworthy legacy meme coin in history.

To put this in perspective, one must look at the historical data on the market’s current multi-billion-dollar titans. Tokens like Bonk Inu, Pudgy Penguin, Shiba Inu, and Dogecoin all had fewer than 12 listings during their respective debut weeks, with most launching on under 9 platforms. They relied on slow, organic growth over the years to eventually secure Tier 1 exchange support.

Patos is bypassing this multi-year grind entirely. On its 56th day of presale, less than 2 months in, Patos already has enough confirmed Exchange agreements to show it will top the combined debuts of these billion-dollar brands. Top 30 ranked exchange, Biconomy, became the 8th CEX to confirm it will list PATOS after its initial coin offering concluded just last week. The news triggered a rush of token presale buys, increasing FOMO and hype.

This staggering level of pre-launch market penetration is exactly what has crypto investors repeating their buying, dollar-cost averaging, and watching smart contract activity closely.

The mathematics of a Mars shot

Patos Meme Coin is currently priced at $0.000139999993 per token today. Because this asset is in its incubation phase, a violent price surge is imminent once it officially launches on crypto exchanges in June, during the third quarter of 2026.

For early presale buyers, suggesting a 10x return is more than likely at this point with absolute ease; however, a 70x-80x multiple is considered far more likely according to various decentralized analysts mapping the project’s liquidity constraints. Patos is expected to list with a multi-million dollar liquidity pool and a baseline market cap of just over $11 million.

Centralized exchanges act as floodgates; they expose newly listed tokens to millions of active retail users and billions of dollars of dormant investor funds. An injection of $333 million into the Patos ecosystem upon its coordinated launch is easily plausible in the current macroeconomic climate. Because the starting market cap is tightly compressed, a $333 million liquidity injection represents a 33X multiple on both the market cap and the individual token value.

Table 1: Patos Meme Coin price forecast (post-launch 2026)

The following forecast models Patos Meme Coin’s price growth from its June 26th CEX listing date until the end of 2026. This model bases its figures on only 20 active crypto exchange listings, specifically including the wildcard event in which one Tier 1 exchange is predicted to occur.

| Month (2026) | ‘Bad Market’ Scenario | ‘Good Market’ Scenario | Month’s ATH (All-Time High) |

| June (Debut) | $0.000450 | $0.001800 | $0.003500 |

| July | $0.000380 | $0.002200 | $0.004200 |

| August | $0.000500 | $0.003500 | $0.006800 |

| September | $0.000850 | $0.005100 | $0.009500 |

| October | $0.000700 | $0.004800 | $0.008900 |

| November | $0.001100 | $0.007500 | $0.012500 |

| December | $0.001500 | $0.009800 | $0.015500 (~110X ROI) |

How tokens get their value

To understand why a 100x return is achievable for the Patos Flock and statistically impossible for Binancians in 2026, investors must grasp the fundamental equations of cryptocurrency valuation.

The formula is absolute: Market Capitalization divided by Total Token Supply is the token’s value. Market capitalization is simply the total amount of money currently supporting the asset in the open market. Therefore, whatever percentage of increase a market cap has, that exact percentage is directly responsible for the increase of the token price — provided the token supply remains strictly unaltered. If an asset has a $11 million market cap and receives $11 million in new buying pressure, its market cap doubles (100% increase), and its token price doubles (100% increase).

The fixed supply advantage

This economic reality is where the Patos Flock possesses an insurmountable investment advantage over Binance investors.

The Patos token operates with a strictly fixed, immutable supply of 232,323,232,323 tokens. Because this supply can never increase, every single dollar of new buying pressure is forcefully routed into pushing the token price upward. There is no inflation to dilute the holdings of the early presale adopters.

Binance Coin (BNB) operates with a Total Token Supply of 136.4 million coins. While Binance regularly executes “burns” to manage supply, the core issue is not the supply itself, but the sheer weight of the capital already holding it up.

For those who had the foresight to purchase BNB early, during its floor price days in the ICO of July 2017 (when it traded for cents), investing in BNB would be a no-brainer over 99% of the market.

They would have already achieved 100x, 1000x, or even 10,000x return. However, today is a different reality. The market cap of BNB is the fifth largest of all cryptocurrencies at $85.1 billion. This means it will take an extremely large new audience of retail traders and institutional financial entities to come in and invest just for this token value to marginally increase.

The burden of billions: Imagine this population analogy

To truly conceptualize the immensity of an $85.1 billion market cap, we must use a global analogy. Imagine trying to gather a population of 85.1 billion people. To reach this number, someone would need every single man, woman, and child currently alive on Planet Earth.

If every single citizen of Earth (all ~8 billion of them) collectively logged onto an exchange and bought $10 in BNB Coin, they would inject roughly $80 billion into the ecosystem. This monumental, globally synchronized financial event would only be enough to double the price of BNB (a 2x return).

For a 10x in price to occur, the market cap would need to receive $833 billion from new token buyers. For a 100x return? BNB would require a market cap of over $8.3 trillion — an amount rivaling the gold standard and the GDP of superpowers. Frankly, the market cap is just so bloated that this won’t happen again anytime soon. The mathematical ceiling for hyper-growth has been reached.

Table 2: Binance Coin price forecast (2026)

The following forecast models Binance Coin’s price growth from current valuations until the end of 2026, illustrating the slow, restricted movements of a mega-cap asset.

Month (2026)

‘Bad Market’ Scenario

‘Good Market’ Scenario

Month’s ATH (All-Time High)

March

$580.00

$640.00

$675.00

April

$550.00

$660.00

$710.00

May

$520.00

$645.00

$690.00

June

$560.00

$680.00

$730.00

July

$540.00

$670.00

$715.00

August

$590.00

$710.00

$760.00

September

$570.00

$740.00

$795.00

October

$530.00

$720.00

$780.00

November

$610.00

$780.00

$830.00

December

$630.00

$820.00

$890.00 (< 1.5X ROI)

(Highlight Disclaimer: All data presented in these tables is generated with an AI-assistant, which means massive historical market data was compared to create such algorithmic forecasts. These numbers are only meant to assist research on both Patos Meme Coin and BNB Coin. Each investor should do their own comprehensive due diligence before investing in any cryptocurrency.)

The presale profit multiplier

When comparing these two economic realities, it explains exactly how Patos Flock’s investments will generate much bigger profits for investors who get in during its floor price rounds, before the public market capitalization is generated on centralized exchanges. Buyers of this Solana and Ethereum bridged memecoin are effectively acquiring assets at wholesale valuations.

It is critical to note that securing 111 crypto exchange listings would blow past any predictions seen online to date. The sheer volume of order routing, retail access, and automated arbitrage across 111 platforms will create a perpetual-volume machine.

In the event a Tier 1 crypto exchange like Binance, Coinbase, OKX, BitGet, MexC, KuCoin, or other Top 15 global exchanges list Patos Meme Coin, the crypto mars shot is possible, not just a moon ride. A Tier 1 listing triggers massive institutional liquidity bots and retail FOMO that can easily push a micro-cap coin into the multi-hundred-million-dollar valuation bracket overnight.

A purpose-built wealth generation vehicle

Ultimately, Patos Meme Coin is an unapologetic ‘for-profit’ project looking to create a massive liquidity inflow and market cap explosion in its first week on exchanges by listing on 111 crypto exchanges in a very small window (1 week). This is the development team’s overall, unwavering focus.

The new Solana token was explicitly designed to be a money-making opportunity for crypto newbies, seasoned degens, and institutional crypto savants the same. It is highly reminiscent of the cultural and financial phenomena of Doge and Shiba Inu, but upgraded with the high-speed infrastructure required in 2026. Patos Meme Coin is a calculated crypto degen opportunity aimed at a crypto mars shot that has not yet been seen on the Solana network, and it appears to be exceptionally well-organized from an operational and marketing standpoint.

New Z: The reality of the Trenches

Binance HODLers will undoubtedly see steady, small gains over the coming years. BNB is a vital piece of global exchange infrastructure and should not be ignored within a heavily diversified portfolio designed for wealth preservation. However, for ambitious investors actively looking for a major price pump to become a crypto millionaire fast, they should not be looking at BNB. The math simply prevents it.

The crypto degen lifestyle is defined by high risk and high reward. This is precisely why all the degen trenches are discussing Patos Meme Coin as of February 2026. The Flock understands that finding the next 100x gem requires abandoning the safety of the bloated mega-caps and aping into the ground floor of the next viral ecosystem.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin Price Reacts as US Supreme Court Strikes Down Trump Tariffs

The POTUS also weighed in on the Supreme Court’s decision, calling it a “disgrace.”

After a few delays, the United States Supreme Court finally announced its ruling on the highly debated Trump-tariff case. Unfortunately for the US President, the Court ruled them illegal, rejecting their usage of emergency powers to impose trade duties.

As reported by Walter Bloomberg, the import tariffs from countries like Canada, China, Mexico, and the EU were projected to raise $1.5 trillion over the next decade.

SUPREME COURT STRIKES DOWN TRUMP’S GLOBAL TARIFFS

The Supreme Court ruled Friday that President Trump’s global tariffs are illegal, rejecting his use of emergency powers to impose trade duties.

• The tariffs, covering imports from Canada, China, Mexico, and nearly all… pic.twitter.com/Qu7EVbBCch

— *Walter Bloomberg (@DeItaone) February 20, 2026

Trump was quick to lash out against the Supreme Court’s decision, calling it a “disgrace.” Additionally, he said his administration has a backup plan.

Further reports on the matter, including trade expert Lawrence Herman’s opinion, indicated that the trade tensions won’t end with the Supreme Court’s ruling. He reportedly added that the tariffs are “here to stay in one form or another,” and warned that the US-Canada trade relationship has already been “shattered.”

In the more recent development on the matter as of press time, Trump seemed to have threatened the US legal system, saying he had to do something about the courts.

Bitcoin has had a long and mostly painful history with Trump’s tariff impositions. It plunged last April when the first wave was announced and has reacted negatively to almost all threats from the POTUS to other countries.

You may also like:

After the Supreme Court ruling today, BTC went on a wild micro ride, going down to $66,500, jumping to over $68,000 within minutes, before it repeated the scenario a few times. It has since settled at under $68,000.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ledn Closes $188M Bitcoin-Backed ABS With First-Ever Investment Grade Rating From S&P

TLDR:

- S&P assigned a BBB- rating to Ledn’s ABS senior notes, the first for a digital asset lender.

- The $188M offering was 2x oversubscribed, with institutional demand exceeding the full deal size.

- Ledn’s bitcoin collateral stays ring-fenced in custody and cannot be lent out by any party.

- The ABS creates a rated benchmark for bitcoin-backed loans, a first in crypto credit markets.

Ledn has closed a $188 million asset-backed security offering backed by its portfolio of Bitcoin-collateralized retail loans.

Standard & Poor’s assigned the senior notes a BBB- rating, marking the first investment grade rating ever given to a digital asset lending portfolio.

The deal drew twice the demand it sought, with institutional interest surpassing the full offering size. No crypto-native lender has hit this benchmark before.

Ledn Becomes First Crypto Lender to Earn Investment Grade ABS Rating From S&P

The rating places Ledn in a category previously reserved for traditional asset classes.

Auto loans, mortgages, and similar instruments have long carried these benchmarks. Bitcoin-backed lending has not, until now. S&P’s decision signals a structural shift in how institutions view crypto credit.

Ledn shared details of the transaction via a blog post published alongside the announcement. The company stated that S&P evaluated its loan book using the same analytical frameworks applied to conventional lending assets.

Operational procedures, custody standards, and technology platforms were all reviewed. The outcome confirmed that Ledn’s systems met institutional requirements.

The offering closed oversubscribed by a factor of two.

Demand from institutional buyers exceeded the $188 million target. Ledn did not disclose the specific investors involved. The oversubscription reflects growing appetite for rated crypto credit products among traditional capital allocators.

Ledn noted the ABS structure does not change how client collateral is handled. Bitcoin posted as collateral remains in custody and stays ring-fenced.

Neither Ledn, its funding partners, nor any financing vehicle can lend out that collateral. The company emphasized this in its blog post to address client concerns about counterparty exposure.

Bitcoin-Backed Lending Gets Its First Institutional Benchmark With This ABS Closing

The company has operated since 2018 and has navigated multiple market cycles, including the 2022 credit crisis. Its loan book maintained a clean performance record through those periods.

S&P’s review covered that full history. The rating reflects durability across volatile conditions, not just recent performance.

Ledn described the ABS market access as a new liquidity frontier. The structure creates a direct channel between its bitcoin-backed loan portfolio and institutional credit markets.

This allows funding that operates independently of broader digital asset market conditions. The company framed this as a long-term stability mechanism.

Pension funds and insurance companies typically require investment grade ratings before allocating capital. This deal now meets that threshold for the first time in the digital asset space.

Ledn’s blog post described the milestone as validation of the standards it has worked to establish. The transaction sets a new pricing and risk benchmark for the sector.

Crypto World

XRP Price Prediction February 2026: Why Smart Money Is Rotating From Ripple Into Pepeto for 100X Gains

You know what’s frustrating? Watching a coin you believe in go nowhere for months while something you never heard of quietly crosses $7.2 million in funding. That’s the story playing out right now between XRP and Pepeto.. And once you look at the math, the rotation makes perfect sense.

XRP sits at $1.43 today. Even the most optimistic Ripple forecast puts it at $5 this cycle. That’s roughly 3.5x from here. Solid, sure. But Pepeto is priced at $0.000000185 with a confirmed Binance listing and working products already live. The difference in upside potential isn’t even close.

Senator Elizabeth Warren sent a letter to Fed Chair Jerome Powell and Treasury Secretary Scott Bessent this week demanding they promise no taxpayer money goes toward propping up the crypto market. According to American Banker, Warren called out the Treasury Secretary for dodging questions about government intervention during a February 6 hearing. Bitcoin has lost roughly 50% since its October peak of $126,000. The letter signals that no bailout is coming. Investors who want upside need to find it on their own.

XRP price prediction for February 2026

XRP dipped 4.4% on February 19 to $1.40 before recovering to $1.43. The RSI reads 37, which means bearish pressure is still in control. The MACD keeps falling. If XRP holds above $1.35, a push toward $1.64 is possible. But even if it reaches $2, that’s only 40% from current levels. For investors chasing life changing returns, that math doesn’t excite anyone.

Best crypto presale to buy: Why Pepeto is where the real 100X sits

Pepeto is cutting through this bear cycle without breaking a sweat. Priced at $0.000000185, this project has attracted over $7.2 million from investors who clearly see something special. And they’re not buying hype. They are buying into a working platform you can actually test after joining the presale at pepeto.io.

PepetoSwap handles instant meme token trades. The cross chain bridge moves assets between networks. The upcoming exchange only lists verified projects, cutting scams out completely. Four products. All in demo stage. That is not a roadmap promise. That is real infrastructure built during a downturn.

But here is the part most people miss. The staking at 214% APY is nice. Put in $7,000 and collect $14,980 a year. But don’t confuse the yield with the main play. The main play is the gap between the presale price and what happens after Binance listing. SHIB went from nothing to $40 billion without a single product. PEPE reached $7 billion on memes alone. Pepeto has actual utility at a micro cap valuation. According to The Motley Fool, Wall Street firms predict Bitcoin at $150K this year. When the tide turns, projects like Pepeto benefit first. Founded by a Pepe cofounder, dual audited by SolidProof and Coinsult, zero tax. 70% filled.

Final verdict

The XRP price prediction shows moderate potential, maybe $2 by month end if sentiment shifts. But Pepeto at $0.000000185 with confirmed listing, working products, and $7.2M raised offers something XRP can’t: ground floor access before the world notices.

Click To Visit Official Website To Buy Pepeto: https://pepeto.io

FAQs

How high will XRP go in February 2026?

Technical indicators show XRP could reach $2 if it holds $1.35 support and Bitcoin recovers. But at $1.43, that’s roughly 40% upside. Pepeto at $0.000000184 offers asymmetric returns that XRP’s market cap simply can’t match.

Is Pepeto a better buy than XRP right now?

XRP is established but needs massive capital inflow for modest gains. Pepeto has a confirmed Binance listing, working demo, dual audits, and zero tax at a fraction of XRP’s market cap. For 100X potential, the math favors Pepeto.

Can Pepeto really reach 100X after listing?

SHIB hit $40 billion with no products. Pepeto has swap, bridge, exchange demo, audits, and a Pepe cofounder at a micro cap entry. 100X is conservative when you compare it to what pure hype tokens achieved.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion8 hours ago

Fashion8 hours agoWeekend Open Thread: Boden – Corporette.com

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show

Eric Trump says Bitcoin will reach $1 million.

Eric Trump says Bitcoin will reach $1 million.