Crypto World

Bithumb mistake sent BTC price to $55,000 on that exchange

Bitcoin suffered a flash crash to $55,000 on South Korean exchange Bithumb this week after what appears to have been a major internal accounting error.

Bithumb mistakenly credited users with 2,000 BTC each instead of a small reward worth 2,000 Korean won (about $1.50), according to a blog post on Friday.

The result was tens of millions of dollars’ worth of phantom bitcoin appearing in hundreds of user accounts. No bitcoin was moved onchain, and inflated balances existed only in Bithumb’s internal ledger.

Users who suddenly saw enormous balances wasted little time trying to sell, triggering a sharp selloff on Bithumb’s BTC/KRW pair, sending prices 15.8% below other exchanges. At one point, BTC traded at 81 million won ($55,000) while prices elsewhere remained relatively stable.

Bithumb said it identified the abnormal transactions through internal controls and restricted trading in the affected accounts shortly after the incident.

The exchange said prices on its platform normalized within about five minutes and that its liquidation prevention system operated as intended, preventing any cascading forced liquidations linked to the price movement.

The company added that the incident was not related to an external hack or security breach and that customer assets remain secure.

Crypto World

Market Analysis: AUD/USD and NZD/USD Struggle as Market Jitters Shake Risk Sentiment

AUD/USD failed to stay in a positive zone and declined below 0.7000. NZD/USD is also moving lower and might extend losses below 0.5850.

Important Takeaways for AUD/USD and NZD/USD Analysis Today

· The Aussie Dollar started a fresh decline from well above 0.7100 against the US Dollar.

· There is a bearish trend line forming with resistance at 0.7020 on the hourly chart of AUD/USD at FXOpen.

· NZD/USD declined steadily from 0.6000 and traded below 0.5900.

· There is a key bearish trend line forming with resistance at 0.5900 on the hourly chart of NZD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair struggled to clear 0.7150. The Aussie Dollar started a fresh decline below 0.7050 against the US Dollar.

The pair even settled below 0.7000 and the 50-hour simple moving average. There was a clear move below 0.6980. A low was formed at 0.6956, and the pair is now consolidating losses. There was a minor recovery wave above the 23.6% Fib retracement level of the downward move from the 0.7089 swing high to the 0.6956 low.

On the upside, immediate hurdle is near the 50-hour simple moving average and the 50% Fib retracement at 0.7020. There is also a bearish trend line forming with resistance at 0.7020.

The next major level for the bears could be 7060. The main selling point could be 0.7090, above which the price could rise toward 0.7140. Any more gains might send the pair toward 0.7200. A close above 0.7200 could start another steady increase in the near term. In the stated case, the next key resistance on the AUD/USD chart could be 0.7280.

On the downside, initial support is near 0.6975. The next area of interest might be 0.6955. If there is a downside break below 0.6955, the pair could extend its decline. The next target for the bears might be 0.6920. Any more losses might send the pair toward 0.6900.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair also followed a similar pattern and declined from the 0.6000 zone. The New Zealand Dollar gained bearish momentum and traded below 0.5950 against the US Dollar.

The pair settled below 0.5900 and the 50-hour simple moving average. Finally, it tested 0.5850 and is currently consolidating losses. There was a minor increase above the 23.6% Fib retracement level of the downward move from the 0.5948 swing high to the 0.5848 low.

If the pair recovers, it could face hurdles near 0.5900 and a key bearish trend line. The next major barrier is at 0.5910 since it coincides with the 61.8% Fib retracement.

If there is a move above 0.5910, the pair could rise toward 0.5950. Any more gains might open the doors for a move toward 0.6010 in the coming days. On the downside, immediate support on the NZD/USD chart is 0.5850.

The next major stop for the bears might be 0.5835. If there is a downside break below 0.5835, the pair could extend its decline toward 0.5800. The main target for the bears could be 0.5740.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Banks need Clarity Act more than crypto, former CFTC Chair Christopher Giancarlo says

The banking industry has more to gain from the stalled U.S. Digital Asset Market Clarity Act, a bill aimed at regulating digital assets, than the crypto industry, according to Christopher Giancarlo, a former chairman of the country’s Commodity Futures Trading Commission (CFTC).

“The banks need this more than crypto,” Giancarlo told Scott Melker on Sunday’s Wolf Of All Streets podcast. “Their general counsels are telling their boards: You can’t invest billions of dollars to build these digital rails unless you’ve got regulatory certainty. Banks can’t afford regulatory uncertainty.”

The bill has been deadlocked since January, with crypto companies, including Coinbase CEO Brian Armstrong pushing back against proposals from the Senate Banking Committee to ban crypto firms from paying rewards to stablecoin holders.

Stablecoins, tokens whose values are pegged to an external reference such as the dollar, are central to the blockchain-based payments infrastructure being debated in the legislation: Banks see them as a key building block for a new digital system that could move money faster and more efficiently, while crypto firms are already experimenting with their use in global payments.

The banks, however, are worried that allowing stablecoin rewards could trigger a capital flight from their coffers and want a “level playing field,” as JPMorgan CEO Jamie Dimon put it. Trump administration officials have also criticized banks for holding the legislation “hostage.”

Giancarlo warned that if banks resist this, crypto will continue to build anyway, potentially moving offshore.

“If the banks resist this now, it’s not going to go away. It’s just going to go to Europe. It’s going to go to Asia … and then American banks will say, ‘Whoa.’ Our analog, identity-based, message-based system is no longer working anywhere outside,” he said.

Giancarlo put his odds of the bill passing at about 60-40. “We’ve got a lot of issues to resolve before we’re going to get this done,” he said, noting both sides have already missed the White House’s March 1 deadline.

Crypto World

Will crypto markets react as US oil prices crash $15 in two hours ?

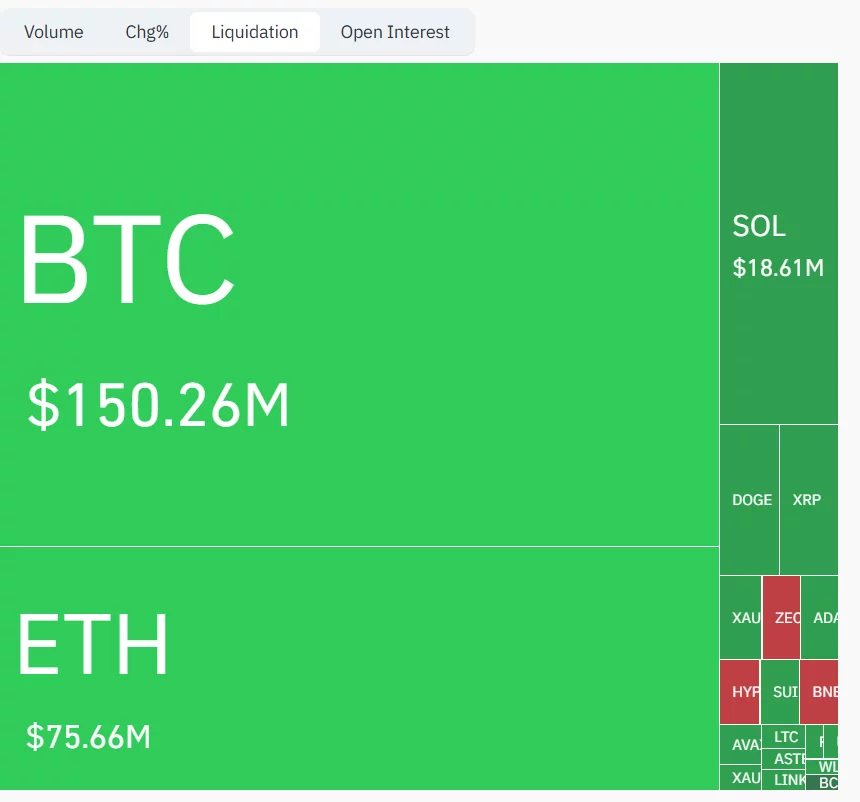

U.S. oil prices plunged $15 per barrel in less than two hours after reports that G7 countries are considering releasing 400 million barrels from strategic reserves, triggering volatility across global markets and over $225 million in liquidations across crypto derivatives.

Summary

- U.S. oil prices fell $15 per barrel in under two hours, dropping below $104.

- Crypto derivatives markets saw over $225 million in liquidations, led by Bitcoin and Ethereum.

- Bitcoin remained largely range-bound near the $67K level despite the macro volatility.

The Kobeissi Letter said oil prices initially surged as much as 30% earlier in the day before the news triggered a rapid reversal.

“US oil prices fall -$15/barrel in under 2 hours, now trading below $104/barrel, on reports that G7 countries are considering releasing 400 million barrels of crude oil reserves,” The Kobeissi Letter wrote in a post on X.

Earlier, the account noted that crude was attempting one of the biggest reversals in history, after the Financial Times reported the potential coordinated reserve release.

Within hours, oil prices had erased more than half of their gains for the day, falling toward the $100 per barrel level.

Crypto market sees liquidations spike

The volatility spilled into digital asset markets, where leveraged traders faced liquidations.

Liquidation data shows more than $225 million wiped out across crypto derivatives, with Bitcoin accounting for roughly $150 million and Ethereum about $75 million.

The majority of liquidations came from long positions, suggesting traders were caught off guard by the sudden macro shift. Altcoins such as Solana, XRP, and Dogecoin also saw smaller liquidation clusters as volatility spread across the market.

Bitcoin remains range-bound

Despite the broader macro turbulence, Bitcoin remained relatively stable.

On the 5-minute chart, Bitcoin briefly dipped toward $67,000 before recovering and trading near $67,500, suggesting limited immediate contagion from the oil market shock.

The muted reaction indicates crypto traders may be viewing the move primarily as a commodity-specific event rather than a broader risk-off signal.

Still, sudden macro developments—particularly those involving energy markets and geopolitical coordination—often ripple into crypto through shifts in liquidity, leverage, and global risk sentiment.

For now, Bitcoin appears to be holding its range, even as traditional markets digest one of the sharpest oil price swings of the year.

Crypto World

Bitcoin trades sideways near $67K as NYDIG pushes back on ‘tech stock’ narrative

NYDIG is pushing back against a common narrative among investors that Bitcoin behaves like a high-growth software stock, arguing that the digital asset operates under a fundamentally different economic model.

Summary

- Research from NYDIG argues that Bitcoin should not be treated like a software stock despite frequent comparisons by investors.

- The report says Bitcoin lacks the revenue, cash flow and valuation metrics that typically define technology equities.

- Bitcoin traded around $67,400 at press time, up roughly 2.2% on the day, while continuing to move within a consolidation range.

Why Bitcoin isn’t a tech stock

In a recent research report, NYDIG said comparisons between Bitcoin (BTC) and software companies are often misleading because the cryptocurrency does not generate revenue, profits or cash flows — the core metrics used to value traditional technology firms.

Software stocks typically trade based on expectations of future earnings growth, subscription revenue and expanding profit margins. Bitcoin, by contrast, functions more like a scarce monetary asset, according to the firm.

The report notes that while investors sometimes group Bitcoin with technology assets because of its digital nature, its economic characteristics align more closely with commodities or monetary goods than with corporate equities.

“The recent price action more plausibly reflects shared exposure to the current macro regime, specifically long-duration, liquidity-sensitive risk assets, rather than evidence of a structural convergence between bitcoin and software equities,” the report said.

NYDIG’s analysis comes as Bitcoin continues to trade in a consolidation range following a volatile start to the year.

Bitcoin price action

According to the daily chart, Bitcoin recently rebounded from early-February lows and is now hovering around the $67,000 level, with the latest candle showing a move toward $67,400, up about 2.2% on the day.

Technical indicators suggest momentum is stabilizing after weeks of choppy trading. The Relative Strength Index (RSI) is currently near the mid-40s, indicating neutral momentum rather than overbought conditions.

Meanwhile, the Chaikin Money Flow (CMF) indicator is hovering around the zero line, suggesting capital flows into the asset remain balanced between buyers and sellers.

The sideways price action reflects a market that is still searching for direction following the earlier correction.

For NYDIG, the key takeaway is that Bitcoin should be analyzed through a different framework than equities. Rather than comparing it to software companies, the firm argues that investors should evaluate Bitcoin based on its fixed supply, decentralized network and role as a digital monetary asset.

As Bitcoin continues to trade near the $67,000 range, the debate over how best to classify the asset — technology play or emerging form of money — remains central to how institutional investors approach the market.

Crypto World

AI at Work Triggers ‘Brain Fry’: Researchers Warn

Enterprise AI promises to streamline workloads, but new research suggests a counterintuitive side effect: fatigue that can erode productivity and raise the risk of errors. A Harvard Business Review analysis, drawing on a study led by Boston Consulting Group and researchers at the University of California, surveyed nearly 1,500 full-time U.S. workers and found that a notable share experience what researchers coined “AI brain fry” — mental fatigue arising from constant interaction with, oversight of, and switching between multiple AI tools. The findings come as corporations across technology and finance push AI deeper into daily operations, from coding to customer support, intensifying the debate over whether productivity gains truly materialize in practice.

The report chronicles workers who described a mental hangover, foggy thinking, headaches, and difficulty concentrating after periods of heavy AI use. In some roles, marketing and human resources reported the highest incidence of these symptoms, underscoring how cognitive load can accumulate when employees juggle prompts, dashboards, and automated workflows. While the promise of AI is to take over repetitive tasks and accelerate decision-making, respondents painted a more nuanced picture: the very act of managing AI systems can become a central, energy-draining task in its own right.

Tech and crypto firms have embraced AI as a key performance lever, measuring AI use as a gauge of output and efficiency. The market’s enthusiasm has been reinforced by high-profile industry moves toward integrating AI to write code, analyze data, and automate routine operations. In parallel, some firms have publicly discussed accelerating AI-led coding initiatives. For example, Coinbase (EXCHANGE: COIN) CEO Brian Armstrong has publicly described pursuing aggressive AI adoption, including efforts to have AI contribute significantly to software development. Such statements highlight a broader industry trend: if AI can generate substantial portions of a platform’s code, the expectations for productivity gains rise, even as organizations grapple with the cognitive demands of multi-tool environments.

As the study authors note, the reality of enterprise AI is complex: enterprises deploy multi-agent systems that require employees to toggle between several tools, prompts, and data sources. That juggling, they argue, can become the defining characteristic of working with AI, rather than a liberating simplification of tasks. The Harvard Business Review piece stresses that without careful governance, AI’s assistive potential can be offset by cognitive overload, leading to mistakes, slower thinking, and declining job satisfaction. The tension is not unique to traditional workplaces; it reverberates through crypto and fintech teams tasked with maintaining rapid development cycles while preserving security and reliability.

AI carries “significant costs,” but can improve burnout

The study’s core finding is that AI-induced mental strain is not a trivial issue; it translates into tangible costs for organizations. Respondents who reported AI brain fry were about 33% more likely to experience decision fatigue than their peers who did not report such fatigue. This elevated decision fatigue can compound errors and slow strategic choices—an outcome with potential financial implications for large enterprises. In fact, researchers estimate that the combination of fatigue and misaligned AI workflows could cost big companies millions annually when scaled across departments and geographies. Moreover, those experiencing brain fry were roughly 40% more likely to express an active intent to quit, signaling higher turnover risk in teams involved in AI-enabled workflows. The data also show that self-reported major errors—defined as mistakes with potentially serious consequences—were nearly 40% higher among those experiencing brain fry.

Yet the research also surfaces a countervailing insight: AI can meaningfully reduce burnout when it is used to automate repetitive, protocol-driven tasks. Respondents who leveraged AI to take on routine work reported burnout levels about 15% lower than peers who did not use AI in that manner. The contrast underscores a central policy implication for leaders: AI should be deployed with clearly defined purposes and measurable outcomes rather than as a blanket productivity booster. When organizations tie AI initiatives to concrete goals—such as reducing time spent on mundane tasks or accelerating critical decision windows—employees can reap real relief from monotony without becoming overwhelmed by tool proliferation.

Industry observers have pointed to a broader set of considerations. As organizations explore multi-agent systems and automated coding pipelines, governance becomes critical to ensure that AI augments human work rather than simply adding to cognitive overhead. Some commentators have argued that incentives around AI usage—such as rewarding mere usage volume—can create waste, erode quality, and intensify mental strain. Instead, leaders should articulate AI’s purpose within the organization, outline how workloads will shift, and emphasize outcomes that can be measured and audited. The practical takeaway is clear: AI initiatives must be paired with transparent expectations and robust change-management practices to avoid simply trading one form of fatigue for another.

For readers seeking a broader perspective on AI deployment dynamics in tech and crypto, related coverage has examined how agents and automation tools are evolving beyond traditional boundaries. A widely cited piece discusses AI agents and their role in crypto workflows, offering context on how automation intersects with decentralized finance and blockchain projects. The evolving discourse around AI in specialized sectors continues to emphasize the need for thoughtful integration and governance, rather than overnight security of a magical productivity boost.

In parallel, industry narratives around AI in software development highlight the bold claims and real-world tensions facing engineering teams. For instance, reporting on Coinbase has illustrated how firms are balancing ambitious AI-coded expectations with practical concerns about reliability, security, and talent retention in a rapidly changing landscape.

What it means for crypto developers and investors

As AI becomes an integral part of software development and operations, crypto platforms face a dual frontier: the potential to accelerate code generation, risk analysis, and customer operations while also contending with cognitive fatigue caused by orchestrating an AI-driven workflow. The study’s findings imply that crypto builders should not assume a straight line from AI implementation to productivity gains. Instead, they should design AI programs with clear scoping, robust oversight, and a focus on reducing repetitive workloads where possible. The evidence points toward a cautious optimist stance: AI can alleviate burnout when applied strategically, but without careful governance and workload redefinition, it risks amplifying errors and fatigue across teams.

For investors and governance teams, the takeaway is to monitor AI outcomes with transparency and to scrutinize metrics beyond raw usage. Firms may want to establish dashboards that track cognitive load indicators, error rates, decision latency, and staff turnover alongside traditional productivity metrics. In a market where automation is increasingly priced into development timelines and security testing, the ability to quantify AI’s impact on human performance will be a differentiator between successful deployments and misaligned programs.

Moreover, the Coinbase case study underscores how public statements and corporate expectations around AI can influence strategic direction. As more crypto firms explore AI-enabled coding and risk tooling, the market will watch not only for performance gains but also for how these initiatives affect engineering culture, retention, and the reliability of codebases. The balance between innovation and human-centered design remains at the core of sustainable AI adoption in high-stakes environments.

Why it matters

First, the research reframes AI adoption as a human-centric issue. While automation offers efficiency, it also introduces a cognitive load that can undermine performance if workers must constantly juggle multiple interfaces and prompts. In sectors where precision matters—such as crypto development and risk analysis—understanding and mitigating AI brain fry could be a prerequisite for scaling AI programs responsibly.

Second, the findings provide a practical roadmap for leaders: set a clear purpose for AI implementations, communicate how workloads will change, and prioritize measurable outcomes over sheer usage. By focusing on quality-of-use rather than quantity of interactions, organizations can curb fatigue while still achieving meaningful productivity gains.

Third, the study reinforces the concept that burnout is not simply a function of workload but of workflow design. AI that targets repetitive tasks can have a tangible, positive effect on well-being, but only if teams are not overwhelmed by a zoo of tools and dashboards. The path forward for crypto platforms and broader tech ecosystems lies in balancing automation with governance, ensuring that AI serves as a partner rather than a source of cognitive overload.

Finally, the broader industry implications extend to policy and employment practices. As AI tooling becomes more embedded in software development, firms should re-evaluate performance metrics, incentives, and training to ensure that adoption supports long-term retention and high-quality outputs. The lessons from this research apply across domains, including crypto engineering, where reliability and security hinge on the clarity of AI-guided processes and the well-being of the teams that implement them.

What to watch next

- Follow-up studies expanding the sample size or exploring industry-specific burnout patterns, with a focus on crypto and fintech teams.

- Company governance updates that define AI’s purpose, workloads, and measurable outcomes, avoiding incentives based solely on usage volume.

- Broader adoption of AI-automation tooling with integrated fatigue monitoring and human-centric design principles.

- Public disclosures from tech and crypto firms on AI-generated code contributions and their impact on reliability and security.

Sources & verification

- Harvard Business Review: When using AI leads to brain fry — findings from the BCG/UC study covering roughly 1,500 U.S. workers and the 14% brain-fry rate.

- Boston Consulting Group and University of California researchers cited in the Harvard Business Review article.

- Links documenting Coinbase AI initiatives and leadership statements about AI-generated code and workforce decisions:

- Coinbase-preferred AI coding tool hijacked by new virus: https://cointelegraph.com/news/coinbase-preferred-ai-coding-tool-hijacked-new-virus

- Coinbase says AI writes nearly half of its code: https://cointelegraph.com/news/coinbase-says-ai-writes-nearly-half-of-its-code

- AI agents and crypto workflows overview: https://cointelegraph.com/explained/what-are-ai-agents-and-how-do-they-work-in-crypto

- Additional context from related tech coverage:

- Anthropic reopens Pentagon talks as tech groups push Trump to drop risk tag: https://cointelegraph.com/news/anthropic-reopens-pentagon-talks-trump-supply-chain-risk

- IronClaw coverage on AI tools in crypto contexts: https://magazine.cointelegraph.com/ironclaw-secure-private-sounds-cooler-openclaw-ai-eye/

What to watch next

Tickers mentioned: $COIN

AI burnout and the enterprise AI mandate: what it means for crypto platforms

Crypto World

Will Ethereum price fall under $1,900 as a bearish crossover forms?

Ethereum price has held above $1,900 against the current crypto market volatility. However, a bearish crossover continues to threaten a drop below this crucial level.

Summary

- Ethereum price approached the $1,900 support as liquidations mounted and investors moved away from risk assets.

- A bearish SMA crossover has been confirmed on the daily chart.

According to data from crypto.news, Ethereum (ETH) price briefly fell 12% to an intraday low of $1,930 on Monday before retracing back part of its loss as it stabilised around $2,000 at press time.

Ethereum has spent the last three sessions oscillating within a tight $1,900 to $2,000 corridor as traders weighed escalating geopolitical risks in the Middle East against a backdrop of persistent macroeconomic uncertainty.

Ethereum price fell after Bitcoin dropped toward $65,000 in response to oil prices climbing past $100 worldwide amid fears of a potential blockade in the Strait of Hormuz as tensions between the U.S. and Iran escalated.

As Ethereum price dipped, it liquidated highly leveraged bets across the derivatives market. Data from CoinGlass shows nearly $75 million was liquidated from ETH futures over the past 24 hours, with long positions accounting for the majority.

A jump in long liquidations can intensify selling pressure and accelerate downside momentum, particularly during periods of heightened market volatility, as experienced over the past 24 hours.

Technical indicators seem to suggest bears could soon gain the upper hand. On the daily chart, the 20-day moving average for ETH price action has confirmed a bearish crossover with the 50-day SMA. As long as these key moving averages continue to move downwards, the asset could struggle to find its footing.

Ethereum price has also moved below the Supertrend line, which confirms that sellers are currently in control. At the same time, the Chaikin Money Flow index showed a negative reading, an indication that capital has been flowing out from the asset.

Hence, Ethereum price remains at high risk of dropping under $1,900, which could trigger bears to retest the Feb. 24 swing low near $1,800.

On the contrary, if price returns above the 50-day SMA at $2,248, traders may view this as a positive change in the current market momentum.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Bitflyer volume surges 200% past Binance, Coinbase as oil spike sends Nikkei sliding

Crypto trading surged on Japan’s Bitflyer on Monday as the Nikkei slid, with the Tokyo-based exchange posting a larger jump in volume than global platforms such as Binance and Coinbase during a sharp selloff in Asian equities.

According to CoinGecko data, Bitflyer’s 24 hour trading volume is up 200% compared to 112% on Coinbase, and 75% on Binance. Activity on Korean exchanges was more muted, with Upbit volumes rising 27.1% and Bithumb up 49.0%.

The surge in Japanese crypto trading coincided with a sharp selloff in regional equities, as Japan’s Nikkei slid alongside declines in Korea and Taiwan amid an unprecedented surge in oil prices. Asian nations, including Japan, are heavily dependent on oil flowing through the Strait of Hormuz, which has seen disruptions due to the ongoing Iran war.

Japanese traders likely leaned into BTC more aggressively during the equity stress, while Korean flows were weaker.

Price action across regional crypto markets reflected a similar pattern. Data from TradingView shows bitcoin rising about 2.05% against the Japanese yen during Asia trading hours, compared with roughly 1.86% gains against the U.S. dollar and about 1.64% against the Korean won.

The stronger performance in yen terms partly reflects currency moves, as the yen weakened against the dollar, but it also aligns with the surge in activity on Japanese exchanges during the regional equity selloff.

This surge in crypto trading came as equity markets across Asia came under heavy pressure.

Damage was not evenly distributed across the region on the Monday open. South Korea’s Kospi led the declines, tumbling about 8% and triggering a circuit breaker, while Japan’s Nikkei 225 fell roughly 6.5%. Taiwan’s Taiex also dropped sharply, losing about 4.9%.

The moves rank among the steepest post-pandemic declines for the three markets, though still smaller than the double-digit plunges seen during the global financial crisis and the March 2020 pandemic selloff.

South Korea’s market tends to react more violently to oil shocks because of the country’s heavy reliance on imported energy.

The country consumes roughly 2.5 million barrels of crude per day and imports nearly all of it, with about 70% sourced from the Middle East. The International Energy Agency has described South Korea as “an ‘energy island’ with no interconnections” and one of the most energy-intensive economies in the OECD.

Taiwan faces similar constraints, relying on imported energy for roughly 97% of its supply and nearly all of its crude oil consumption.

Unlike South Korea, however, Taiwan has diversified its crude sourcing in recent years. Middle Eastern oil now accounts for roughly 35% of Taiwan’s imports, down sharply from more than 70% earlier in the past decade, with the United States emerging as a major supplier.

Japan’s market also fell sharply but proved somewhat more resilient. While the country remains heavily dependent on imported energy, the Nikkei includes a broader mix of industrial, financial, and consumer companies, which can moderate volatility compared with the more concentrated technology-heavy indices in South Korea and Taiwan.

That relative resilience may also help explain why crypto trading activity surged on Japanese exchanges such as Bitflyer even as equities declined, with traders repositioning in digital assets while traditional markets across the region sold off.

All eyes now turn to Tuesday’s open in Tokyo, where traders will be watching whether the surge in crypto volumes on Bitflyer and other Japanese exchanges holds or fades as equity markets attempt to stabilize.

Crypto World

Ethereum price prediction as ETH teeters below $2,000

- Ethereum price remains under pressure below the key $2,150 resistance.

- Exchange outflows hint at continued long-term accumulation.

- The $1,800 support is the key level traders are watching.

The Ethereum price is struggling to hold above the $2,000 mark amid mixed signals from technical indicators, derivatives markets, and on-chain activity.

The ETH price has slipped back toward the mid $1,900 range after briefly attempting a recovery above $2,000.

This highlights how fragile the current rebound remains despite signs of stabilisation following February’s sharp sell-off.

While the latest bounce helped Ethereum avoid deeper losses, the broader trend still leans bearish as long as the price remains trapped below $2,000.

Ethereum price outlook remains fragile

From a technical standpoint, Ethereum continues to trade within a descending channel that has defined the market for several months.

The ETH price also sits well below its major moving averages, which are still pointing downward and reinforcing the broader bearish trend.

This setup suggests that the recent recovery may be nothing more than a temporary relief rally rather than the start of a sustained reversal.

Also, on shorter timeframes, Ethereum recently attempted to break through the $2,150 region but faced immediate rejection.

That rejection created another lower high, confirming that sellers remain active whenever the price approaches resistance.

Momentum indicators also reflect the cautious tone currently dominating the market, with the Relative Strength Index (RSI) sitting below the neutral 50 level, which signals weak bullish momentum.

At the same time, the MACD indicator has begun to soften after a short-lived bullish phase, showing that buying pressure is fading.

Exchange flows and derivatives activity paint a mixed picture

Despite the weak technical structure, some on-chain signals suggest that long-term investors are still accumulating Ethereum.

Exchange flow data shows that more ETH is leaving crypto exchanges than entering them.

The net outflows indicate that investors are moving coins into private wallets rather than preparing them for immediate sale.

This behaviour often appears during accumulation phases when holders expect prices to rise over time.

However, the derivatives market is sending a very different message.

Funding rates across perpetual futures markets have surged sharply into positive values from heavily negative values as traders piled into leveraged positions.

Such a rapid increase in leverage shows that market participants are becoming more aggressive with their directional bets.

High leverage can create unstable conditions because even modest price movements can trigger large liquidation cascades.

Key Ethereum price levels to watch this week

From the technical outlook, the Ethereum price is now approaching a critical moment as it trades just above several important support levels.

The first support that traders should watch sits around $1,900, which marks a recent reaction low.

If the ETH price slips below that level, analysts note that the attention would quickly shift toward the $1,800 zone, which has acted as a strong floor since February and currently represents one of the most important supports on the chart.

A breakdown below $1,900 could open the door for a deeper correction and potentially push Ethereum toward the lower boundary of its broader descending channel near $1,776.

On the upside, the first resistance zone appears between $2,027 and $2,050.

A break above that region would suggest that buyers are regaining some momentum.

Beyond that level, the market will likely focus on the $2,138 to $2,150 area, which represents a major technical barrier within the current channel structure.

A decisive breakout above that ceiling could shift sentiment and allow Ethereum to aim for the next resistance near $2,380.

Until such a breakout occurs, however, the Ethereum price is likely to remain stuck between support near $1,800 and resistance near $2,150 as traders wait for the next decisive move.

Crypto World

Bitcoin gains, oil pulls back from 25% spike as G7 discusses emergency reserve release

Oil’s war rally just hit its first real obstacle.

Tokenized crude futures on Hyperliquid’s CL-USDC contract fell sharply from a high of $118 to $102.83 on Monday after the Financial Times reported that G7 finance ministers would discuss a coordinated release of emergency oil reserves through the International Energy Agency.

Bitcoin rose above $67,300, reversing a move to under $66,900 from earlier in the day.

Three G7 countries, including the U.S., have expressed support for the plan. The ministers and IEA Executive Director Fatih Birol are expected to hold a call to discuss the impact of the Iran war on energy markets.

The reversal was swift. CL-USDC had surged more than 25% earlier Monday as the conflict expanded over the weekend, with Iran appointing a new supreme leader, Israeli strikes escalating into Lebanon, and Iranian missiles hitting Saudi Arabia.

Iraq’s oil output dropped roughly 60% and tanker traffic through the Strait of Hormuz collapsed. The contract hit $118 before the G7 headlines pulled it back to $102, still up 7.2% on the day but well off the highs.

Open interest on the contract sits at $181.9 million with $823 million in 24-hour volume, reflecting the enormous demand for oil exposure on crypto-native venues where traders can react to weekend headlines that traditional commodity markets can’t price until Monday’s open.

The G7 reserve release, if it materializes, would be the most significant coordinated intervention in oil markets since the Russia-Ukraine war in 2022. Whether it’s enough to offset the supply disruption depends on the scale of the release and how long the Strait of Hormuz remains effectively closed.

Crypto World

U.S. Treasury flags crypto ATMs as rising fraud risk in new report

Crypto ATMs are increasingly being exploited by scammers and illicit actors, according to a new report from the U.S. Department of the Treasury submitted to Congress under the GENIUS Act.

Summary

- The US Treasury warned that crypto ATMs are increasingly being used in scams, with reported losses reaching $246.7 million in 2024.

- The agency also flagged mixers, DeFi platforms and cross-chain tools as potential channels for laundering stolen crypto.

- At the same time, the report highlights AI, blockchain analytics and digital identity systems as emerging technologies that could strengthen anti-money-laundering compliance.

Crypto ATMs emerge as key scam tool, U.S. Treasury warns

The report highlights a sharp rise in fraud involving digital asset kiosks — commonly known as crypto ATMs — which allow users to convert cash into cryptocurrency.

Treasury officials warned that these machines have become an attractive tool for criminals who pressure victims into sending funds quickly with limited oversight.

According to data cited in the report, the FBI received more than 10,900 complaints related to crypto ATM scams in 2024, with total reported losses reaching approximately $246.7 million.

Treasury said scammers frequently instruct victims to deposit cash into the machines and send cryptocurrency to wallets controlled by fraudsters, often as part of impersonation schemes or investment scams.

The report noted that older individuals are disproportionately targeted in these schemes, reflecting a broader trend in financial fraud cases involving digital assets.

Beyond crypto ATMs, Treasury also flagged several other areas where digital asset technology could be exploited for illicit finance. These include transaction mixers, decentralized finance protocols and cross-chain bridges, which can be used to obscure the movement of stolen or illicit cryptocurrency across networks.

At the same time, the agency said emerging technologies could help financial institutions improve their ability to detect suspicious activity.

Treasury pointed to tools such as artificial intelligence, blockchain analytics, digital identity solutions and application programming interfaces (APIs) as potential innovations that could strengthen anti-money-laundering and counter-terrorism financing controls.

The agency reviewed more than 220 public comments from industry participants and technology providers while preparing the report.

Treasury emphasized that regulators should maintain a technology-neutral approach to compliance, allowing financial institutions to adopt different tools depending on their risk profiles.

The findings come as US lawmakers continue to debate new frameworks for digital asset oversight under the GENIUS Act, which seeks to encourage financial innovation while strengthening safeguards against illicit finance.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

News Videos7 days ago

News Videos7 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business15 hours ago

Business15 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World4 days ago

Crypto World4 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview